Summary

Table of Content

Hematology Diagnostics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Hematology Diagnostics Market Size

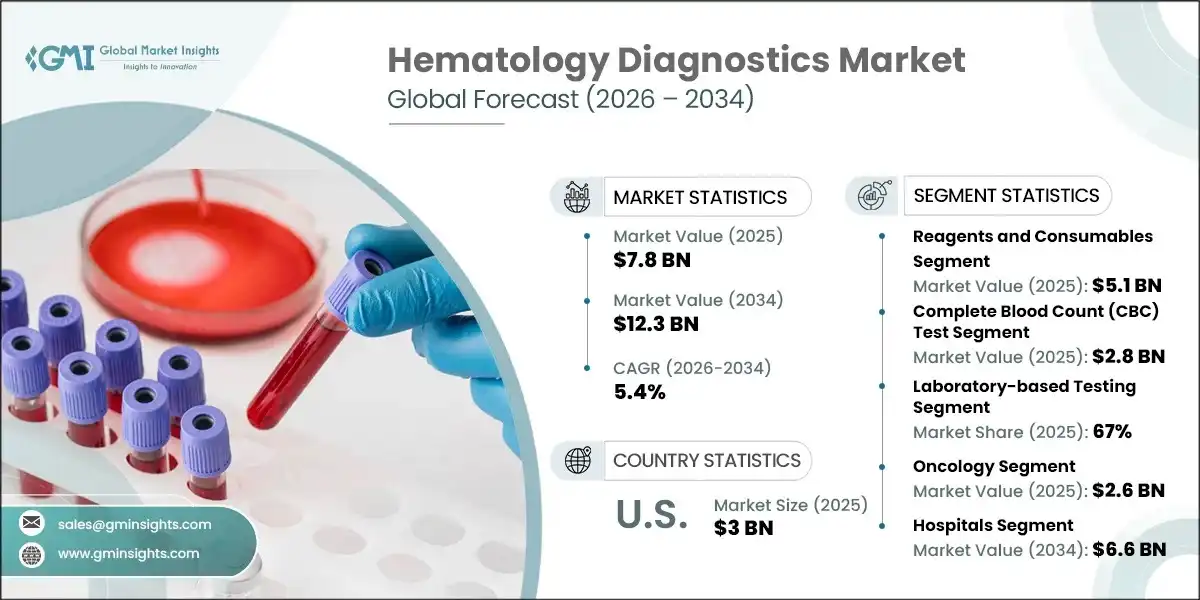

The global hematology diagnostics market size surpassed USD 7.8 billion in 2025 and is anticipated to witness over 5.4% CAGR between 2026 and 2034.

The market is experiencing strong growth due to the rising prevalence of blood disorders, expanding elderly population, and continuous innovation in diagnostic technologies. Conditions such as anemia, leukemia, lymphoma, and sickle cell disease are increasing globally, creating sustained demand for early, accurate, and scalable blood testing solutions. According to the World Health Organization, anemia affected over 1.28 billion people worldwide in 2022, while U.S. health authorities estimate that sickle cell disease impacts around 100,000 individuals. These trends directly contribute to the expanding hematology market size, especially across hospitals, diagnostic laboratories, and specialty clinics.

To get key market trends

Technological progress is a major catalyst shaping the market trends. Automated hematology analyzers, flow cytometry systems, and AI-assisted cell imaging platforms are improving diagnostic precision, turnaround time, and workflow efficiency. At the same time, decentralized testing is gaining traction. The point-of-care hematology diagnostics market size is growing steadily as portable analyzers enable rapid testing in emergency departments, outpatient centers, and resource-limited settings, supporting faster clinical decisions and improved patient outcomes.

Hematology diagnostics focuses on evaluating blood cells, hemoglobin levels, platelets, and coagulation parameters using advanced instruments, reagents, and software. As healthcare systems prioritize early disease detection and personalized treatment pathways, investment in modern hematology testing infrastructure is expected to remain a strategic priority for providers and medical device manufacturers alike.

Hematology Diagnostics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 7.5 Billion |

| Forecast Period 2026 – 2034 CAGR | 55% |

| Market Size in 2034 | USD 7.8 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Market Dynamics

Drivers

Increasing Prevalence of Blood and Related Disorders

The rising global burden of blood and related disorders is a primary growth driver for the hematology diagnostics market. Conditions such as anemia, leukemia, lymphoma, thrombocytopenia, and inherited blood disorders are being diagnosed at higher rates due to aging populations, lifestyle-related chronic diseases, and improved awareness. This trend is significantly expanding demand for routine and advanced hematology lab tests, including complete blood counts (CBC), hematocrit testing, and differential cell analysis across hospitals and diagnostic laboratories.

Rising demand for point-of-care testing in developing countries

The hematology diagnostics market is gaining strong momentum in developing countries due to the rising demand for point-of-care (POC) testing solutions that enable rapid, reliable, and cost-effective diagnosis. Limited access to centralized laboratories, shortages of skilled laboratory professionals, and increasing patient volumes are pushing healthcare providers toward decentralized testing models. As a result, compact and portable POC devices are becoming an essential part of routine hematology lab tests, particularly in primary care centers, emergency departments, and rural healthcare facilities.

Opportunities

AI-Driven Innovation and Advanced Analytics

The hematology diagnostics market offers strong growth opportunities, particularly through the development of next generation hematology analyzers powered by artificial intelligence (AI) and machine learning (ML). As healthcare systems face increasing testing volumes and demand for precision diagnostics, AI-enabled platforms are emerging as a strategic differentiator across hospitals, diagnostic laboratories, and specialty clinics. These advanced systems enhance pattern recognition, automate abnormal cell detection, and support predictive analytics, improving diagnostic accuracy while reducing manual review and operational burden.

Challenges

High Cost of Advanced Hematology Diagnostics

The hematology diagnostics market faces a significant challenge due to the high cost associated with advanced diagnostic technologies, which can limit adoption, particularly in cost-sensitive healthcare settings. Sophisticated hematology analyzers, flow cytometry systems, and molecular testing platforms require substantial upfront capital investment, along with ongoing expenses for reagents, consumables, calibration, and system maintenance. These cost factors directly impact purchasing decisions across small- and mid-sized laboratories, slowing penetration within the broader hematology tests market.

Lack of reimbursement and inadequate insurance coverage

A key challenge restraining the market is the lack of comprehensive reimbursement frameworks and inconsistent insurance coverage across regions. Despite the growing clinical importance of early disease detection, many hematology lab tests and advanced diagnostic procedures are only partially reimbursed or excluded from insurance plans, particularly in emerging healthcare systems. This creates financial pressure on hospitals, diagnostic laboratories, and patients, limiting the adoption of high-cost technologies such as automated analyzers, flow cytometry systems, and molecular-based assays.

Hematology Diagnostics Market Trends

The hematology diagnostics industry is expanding rapidly, driven by continuous innovation in diagnostic technologies, the integration of artificial intelligence (AI) and machine learning in clinical workflows, and the growing use of advanced cell analysis techniques such as flow cytometry. The shift toward automation, as laboratories prioritize speed, consistency, and operational efficiency to manage rising test volumes and staffing constraints, is driving market trends.

The availability of automated hematology analyzers has increased significantly across hospitals and large diagnostic centers, supported by improved affordability, modular system designs, and cloud-enabled data management. These systems deliver faster turnaround times, higher diagnostic accuracy, and strong result reproducibility while reducing manual intervention and human error. As a result, automation is becoming a standard requirement for high-throughput laboratories and centralized testing facilities.

Moreover, evolving hematocrit test market trends highlight growing demand for rapid and reliable red blood cell assessment in anemia screening, surgical monitoring, and chronic disease management. This demand is accelerating the adoption of compact point-of-care hematology devices, which provide near-instant results at the patient site. Such solutions are increasingly used in emergency departments, rural clinics, and home-care settings, enabling timely clinical decisions and improving care delivery outside traditional laboratory environments.

Together, AI-enabled analytics, automated analyzers, and decentralized testing models are reshaping hematology diagnostics into a faster, more scalable, and data-driven segment of the global in-vitro diagnostics industry.

Hematology Diagnostics Market Analysis

Learn more about the key segments shaping this market

Based on product, the market is classified into reagents and consumables and instruments. The instruments segment is further bifurcated into hematology analyzers, flow cytometers, and other instruments. The reagents and consumables segment generated the highest revenue of USD 5.1 billion in 2025.

- Advancements in automated hematology analyzers have increased the demand for high-quality reagents and consumables. These reagents are crucial for maintaining optimal functionality and ensuring accurate test results, especially in high-throughput clinical settings, driving consistent demand.

- Furthermore, reagents and consumables are recurring purchases, as they need to be replenished after each set of diagnostic tests. Hospitals, laboratories, and diagnostic centers require continuous supplies to maintain operations, ensuring a stable market for these products.

Based on test type, the hematology diagnostics market is classified into complete blood count (CBC) test, platelet function test, hemoglobin test, hematocrit test, and other test types. The complete blood count (CBC) test segment accounted for USD 2.8 billion revenue in 2025 and is anticipated to grow at a CAGR of 4.7% between 2026 to 2034.

- Complete blood count (CBC) is a standard and widely used test in routine health check-ups and preventive healthcare. Its ability to provide a comprehensive snapshot of a patient's overall health including red and white blood cell counts, hemoglobin levels, and platelet counts contributes to its frequent use in early disease detection.

- Moreover, the test is relatively low cost and widely accessible, making it a preferred diagnostic tool for healthcare providers. Its affordability and simplicity make it a first-line test for diagnosing various conditions, from infections to blood cancers, driving its demand in hospitals and clinics. These advantages are expected to fuel growth in this segment of the market.

Based on modality, the hematology diagnostics market is classified into laboratory-based testing and point-of-care (POC) testing. The laboratory-based testing segment dominated the market in 2025 with a market share of 67%.

- Laboratory-based testing offers higher accuracy and reliability compared to other diagnostic methods. Advanced equipment, such as automated analyzers, ensures precise results, making laboratory testing the preferred choice for diagnosing complex blood disorders like anemia, leukemia, and other hematological conditions.

- Furthermore, it has the capability to conduct a wide range of hematology tests, including complete blood count, blood smears, and specialized tests for detecting blood cancers and other hematological abnormalities. The ability to perform detailed and comprehensive testing drives the demand for laboratory-based diagnostics.

Based on application, the hematology diagnostics market is classified into oncology, anemia, infectious diseases, cardiovascular disorders, and other applications. The oncology segment accounted for USD 2.6 billion in market revenue in 2025 and is anticipated to grow at a CAGR of 5% between 2026 to 2034.

- The increasing incidence of hematological cancers, including leukemia, lymphoma, and myeloma, drives growth in the oncology segment of hematology diagnostics. According to the American Cancer Society, in 2024, approximately 70,135 new cases of non-Hodgkin lymphoma, 24,810 cases of multiple myeloma, and 62,270 new cases of leukemia are expected in the U.S. Blood tests enable early detection of these cancers, which is essential for treatment effectiveness, thus increasing the demand for advanced diagnostic tools.

- Moreover, the growing trend of personalized medicine in oncology, which tailors treatment based on the genetic profile of tumors, relies heavily on hematology diagnostic tests. Techniques like genetic sequencing and biomarker testing are essential for identifying specific mutations and predicting responses to targeted therapies, thereby fueling the demand for sophisticated diagnostic technologies in oncology.

Learn more about the key segments shaping this market

Based on end use, the hematology diagnostics market is segmented into hospitals, diagnostic laboratories, and other end users. The hospitals segment is anticipated to reach USD 6.6 billion by the end of the forecast period.

- Hospitals are seeing a growing number of patients with hematological disorders, including anemia, leukemia, and other blood-related conditions. This rise in patient volume creates a higher demand for efficient and accurate hematology diagnostic tools to handle a large number of tests and diagnoses.

- Moreover, with the growing trend toward personalized medicine, hospitals are investing in hematology diagnostic tools that can provide more precise, individualized results. Personalized treatment plans based on comprehensive diagnostic data require hospitals to adopt advanced hematology diagnostic instruments.

Looking for region specific data?

U.S. hematology diagnostics market accounted for USD 3 billion revenue in 2025 and is anticipated to grow at a CAGR of 5% between 2026 to 2034.

- The market continues to expand strongly across major healthcare economies, supported by rising disease burden, advanced infrastructure, and sustained investment in diagnostic technologies. In the United States, the high prevalence of hematological disorders such as anemia, leukemia, and sickle cell disease is a primary growth driver.

- The National Cancer Institute reported over 60,600 new leukemia cases in 2022 alone, reinforcing demand for high-precision hematology lab tests and automated systems. As a result, hospitals and reference laboratories are increasing adoption within the hematology analyzers market to improve turnaround times, accuracy, and testing capacity. Strong healthcare spending and rapid commercialization of innovations from the hematological disorders medical devices pipeline further strengthen market expansion.

- Germany represents one of Europe’s fastest-growing markets due to its modern clinical infrastructure and strict diagnostic standards. Broad access to advanced hematology platforms and favorable reimbursement for hematology tests market services enable providers to adopt next-generation analyzers and digital diagnostics with lower financial risk, accelerating technology penetration across public and private laboratories.

- In Asia Pacific, Japan holds a dominant position as rising leukemia and lymphoma incidence continues to drive the blood cancer diagnostic market. National health data indicates sustained growth in blood cancer cases, increasing the need for specialized testing, disease monitoring, and therapy guidance. Together, these structural factors position the U.S., Germany, and Japan as strategic revenue hubs for global hematology diagnostics suppliers.

Hematology Diagnostics Market Share

The market is highly competitive, with several key players dominating the landscape. Major companies, such as Abbott, Roche, Siemens Healthineers, Beckman Coulter, and Sysmex, lead the market with innovative hematology analyzers and diagnostic solutions. These players focus on technological advancements, such as automation and integration with AI, to enhance diagnostic accuracy and speed. Additionally, competition is fueled by continuous product development, mergers, acquisitions, and partnerships to expand market reach and improve clinical outcomes in hematology diagnostics.

Hematology Diagnostics Market Companies

Prominent players operating in the industry include:

- Abbott

- BAG DIAGNOSTICS

- BECKMAN COULTER

- BIO-RAD

- BioSystems

- Boule

- diatron

- HemoCue

- HORIBA Medical

- mindray

- NIHON KOHDEN

- Roche

- SIEMENS Healthineers

- sysmex

- Thermo Fisher Scientific

Hematology Diagnostics Industry News:

- Reported Q3 2025 revenue of $188M, up 12% year-over-year; clinical revenue grew 18% YoY, with NGS revenue up 24% and now ~33% of clinical revenue.

- Agreed to a $17.5B Reverse Morris Trust deal to combine BD’s Biosciences & Diagnostic Solutions business with Waters; expected pro-forma 2025 revenue of ~$6.5B and adjusted EBITDA ~$2.0B, and total addressable market ~ $40B.

The hematology diagnostics market research report includes in-depth coverage of the industry with estimates and forecasts in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Product

- Reagents and consumables

- Instruments

- Hematology analyzers

- Flow cytometers

- Other instruments

Market, By Test Type

- Complete blood count (CBC) test

- Platelet function test

- Hemoglobin test

- Hematocrit test

- Other test types

Market, By Modality

- Laboratory-based testing

- Point-of-care (POC) testing

Market, By Application

- Oncology

- Anemia

- Infectious diseases

- Cardiovascular disorders

- Other applications

Market, By End Use

- Hospitals

- Diagnostic laboratories

- Other end users

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the hematology diagnostics industry?

Prominent players include Abbott, BAG DIAGNOSTICS, BECKMAN COULTER, BIO-RAD, BioSystems, Boule, diatron, HemoCue, HORIBA Medical, mindray, SIEMENS Healthineers, sysmex, and Thermo Fisher Scientific.

Who are the key players in the hematology diagnostics industry?

Prominent players include Abbott, BAG DIAGNOSTICS, BECKMAN COULTER, BIO-RAD, BioSystems, Boule, diatron, HemoCue, HORIBA Medical, mindray, SIEMENS Healthineers, sysmex, and Thermo Fisher Scientific.

What is the growth outlook for the oncology segment from 2026 to 2034?

The oncology segment, which generated USD 2.6 billion in 2025, is set to expand at a CAGR of 5% up to 2034.

Which region leads the hematology diagnostics sector?

The U.S. leads the market, accounting for USD 3 billion in revenue in 2025, with a projected CAGR of 5% through 2034.

What are the upcoming trends in the hematology diagnostics market?

Key trends include the adoption of AI-enabled analytics, automation in hematology analyzers, decentralized testing models, compact point-of-care devices, and cloud-enabled data management systems.

What was the valuation of the complete blood count (CBC) test segment in 2025?

The CBC test segment accounted for USD 2.8 billion in revenue in 2025 and is expected to grow at a CAGR of 4.7% till 2034.

What is the growth outlook for the oncology segment from 2026 to 2034?

The oncology segment, which generated USD 2.6 billion in 2025, is set to expand at a CAGR of 5% up to 2034.

Which region leads the hematology diagnostics sector?

The U.S. leads the market, accounting for USD 3 billion in revenue in 2025, with a projected CAGR of 5% through 2034.

What is the market size of the hematology diagnostics in 2025?

The market size was over USD 7.8 billion in 2025, with a CAGR of more than 5.4% expected between 2026 and 2034. The growth is driven by the rising prevalence of blood disorders, an aging population, and advancements in diagnostic technologies.

How much revenue did the reagents and consumables segment generate in 2025?

The reagents and consumables segment generated USD 5.1 billion in 2025, propelled by the demand for high-quality reagents in automated hematology analyzers.

What is the projected value of the hematology diagnostics market by 2034?

The market is poised to cross USD 12.3 billion by 2034, led by automation, AI integration, and decentralized testing models, reaching a substantial value by 2034.

What are the upcoming trends in the hematology diagnostics market?

Key trends include the adoption of AI-enabled analytics, automation in hematology analyzers, decentralized testing models, compact point-of-care devices, and cloud-enabled data management systems.

Hematology Diagnostics Market Scope

Related Reports