Summary

Table of Content

Heat Exchanger Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Heat Exchanger Market Size

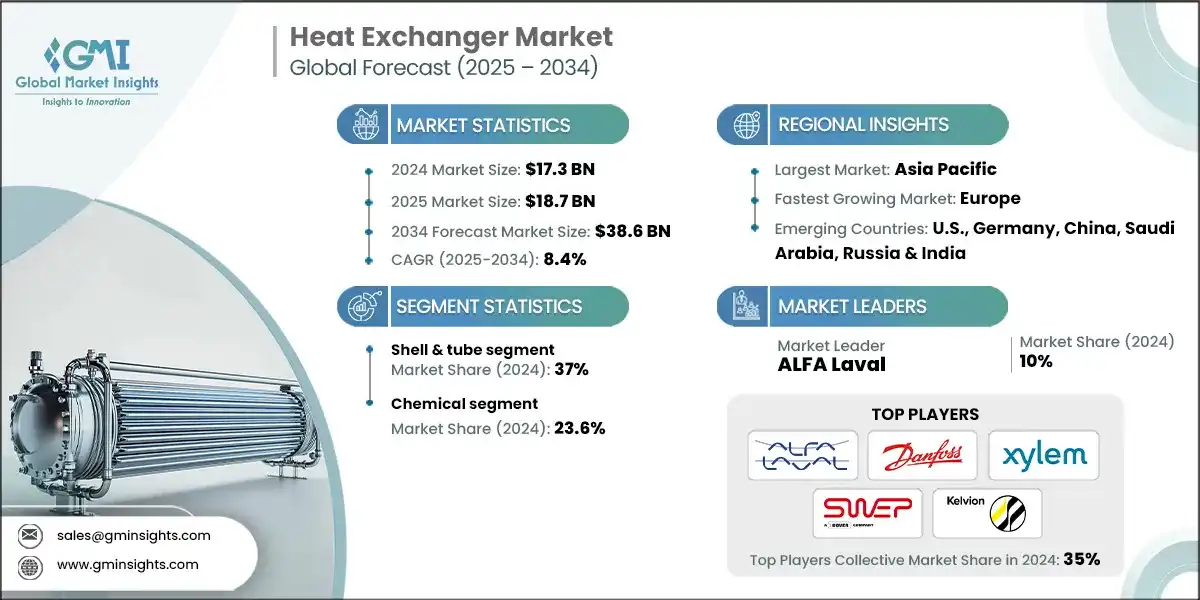

According to a recent study by Global Market Insights Inc., the global heat exchanger market size was estimated at USD 17.3 billion in 2024. The market is expected to grow from USD 18.7 billion in 2025 to USD 38.6 billion in 2034, at a CAGR of 8.4%.

To get key market trends

- Rising investments in heavy-duty industrial operations and the growing energy demand for heating and cooling systems in building infrastructures will complement the business landscape. These devices are essential for transferring heat between two or more fluids, ensuring energy efficiency and cost savings across various applications.

- Increasing focus on energy efficiency, along with continuous development of industrial and building infrastructure to prioritize energy optimization, is accelerating the demand for advanced heat exchanger technologies.

- For instance, in January 2024, SPX FLOW, with its brands Gerstenberg Schröder, APV, and Waukesha Cherry-Burrell, introduced the Origin Series Scraped Surface Heat Exchanger (SSHE). This innovation enhances cost efficiency, simplifies maintenance, and supports diverse applications.

- The Asia Pacific region leads the heat exchanger market, supported by significant investments by manufacturing and power generation sectors to improve thermal efficiency and reduce emissions. These heat exchangers are essential for optimizing processes in industries reliant on high-temperature operations and energy recovery.

- For instance, in October 2024, KRN HVAC Products, a wholly owned subsidiary, signed a USD 115.7 million MoU with the Rajasthan government to develop a heat exchanger manufacturing facility. The primary focus is on data center cooling, with increasing demand for cold storage solutions.

- The Middle East & Africa region is the fastest-growing market owing to increasing demand from oil & gas, power, and industrial sectors for reliable heat exchange solutions. The need for compact, efficient, and high-performance heat exchangers in off-grid and remote facilities is fueling growth. OEMs are also incorporating advanced materials and smart monitoring technologies to improve performance, detect faults early, and extend equipment lifespan, further strengthening industry prospects.

- For instance, in February 2025, Jafza has partnered with German firm Allied Heat Exchange (A-HEAT) to build GCC’s largest heat exchanger plant within DP World’s free zone, spanning 1.2 million sq ft. Operated by Güntner, it aims to boost supply chain efficiency for energy-efficient cooling solutions, especially for data centers, across Asia, Africa, and beyond.

Heat Exchanger Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 17.3 Billion |

| Market Size in 2025 | USD 18.7 Billion |

| Forecast Period 2025 - 2034 CAGR | 8.4% |

| Market Size in 2034 | USD 38.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Influx of new investments across industrial infrastructure | Creates higher demand for advanced heat transfer solutions, encourages innovation and expansion in manufacturing capabilities to meet the rising need for efficient thermal management systems. |

| Stringent emission norms by respective administrations | Prompting industries to adopt more efficient thermal management systems to reduce environmental impact. |

| Initiatives to keep a check on the rising carbon footprint | Creating demand for more energy-efficient and sustainable heat exchange solutions, encourages innovation and adoption of eco-friendly technologies |

| Pitfalls & Challenges | Impact |

| High maintenance requirements and associated operational expenses | Poses a threat to potential buyers, by increasing overall ownership costs and deterring potential customers. |

| Opportunities: | Impact |

| Growing Industrial Automation and Manufacturing | Increased demand for efficient heat transfer solutions, especially in sectors like petrochemicals, pharmaceuticals, and food processing |

| Expansion in Renewable Energy Sector | Adoption of heat exchangers in solar thermal and waste heat recovery systems presents new revenue streams and technological advancements. |

| Emerging Markets with Rapid Industrialization | Increased infrastructure development and industrial activities boost demand for reliable heat transfer equipment, opening new regional markets. |

| Rising Environmental Regulations and Energy Efficiency Standards | Emphasizes the need for innovative, energy-efficient heat exchange solutions, driving R&D investments and market expansion. |

| Market Leaders (2024) | |

| Market Leaders |

10% market share |

| Top Players |

Collective market share in 2024 is 35% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Emerging Country | U.S., Germany, China, Saudi Arabia, Russia & India |

| Future outlook |

|

What are the growth opportunities in this market?

Heat Exchanger Market Trends

- Heat exchangers play a critical role in various industries, including chemical, petrochemical, oil and gas, power generation, and HVAC systems. Rising demand for energy-efficient solutions and the need to comply with stringent environmental regulations are pushing manufacturers to develop advanced heat exchanger technologies.

- For instance, in July 2025, The European Climate Law formalizes the goal for Europe to become climate-neutral by 2050, with an interim target of reducing GHG emissions by at least 55% by 2030 compared to 1990. It guides policies for sustainable, fair progress, promotes clean technologies, and establishes monitoring to ensure an irreversible transition to a low-carbon economy.

- Ongoing innovations cater to diverse requirements, offering improved performance, durability, and adaptability to various operational environments will positively influence the business dynamics.

- For instance, in June 2023, Alfa Laval introduced the AC900, a brazed plate heat exchanger designed for 300-600 kW applications, including chillers, industrial cooling, and heat pumps. It features an oversized gas outlet port for efficient performance under varying load conditions.

- These devices are essential for transferring heat between fluids, ensuring optimal energy utilization and operational efficiency. Moreover, increased investments in research and development activities to cater to diverse applications and improve product reliability further augmenting the product deployment.

- Growing adoption of renewable energy systems and the expansion of industrial infrastructure in emerging economies are further fueling demand. Innovations such as compact designs, improved thermal performance, and corrosion-resistant materials are complementing the industry landscape.

- For instance, by July 2025, the government of India approved 806 applications across 14 sectors under the USD 22.8 billion PLI scheme launched in 2021. Investments reached USD 20.3 billion, generating over USD 190.9 billion in production and sales, boosting India’s industrial growth and reducing import dependence

.

Heat Exchanger Market Analysis

Learn more about the key segments shaping this market

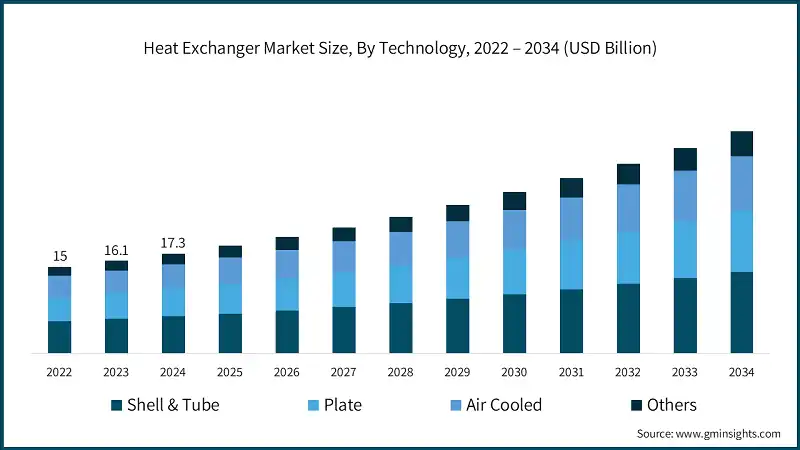

- Based on technology, the industry is segmented into shell & tube, plate, air cooled and others. The shell & tube segment dominated the heat exchanger market, accounting for 37% share in 2024 and is expected to grow at a CAGR of 8.3% through 2034.

- The rising demand for these units across industries such as chemicals, oil & gas, and food & beverages, along with a growing focus on energy efficiency, is driving the shell & tube heat exchanger industry growth. Increased investments in manufacturing and industrial projects, coupled with the expanding role of specialty chemical operations, are further influencing the business dynamics.

- For instance, in January 2025, Alleima will supply heat exchanger tubes to Preem for converting the Lysekil refinery from fossil fuels to renewable fuels, a key step in Sweden’s green energy efforts. The upgrade, beginning in late 2024, will enable the refinery to produce 1.2 million cubic meters of renewable fuels annually and cut fossil CO2 emissions by 2-3 million tons each year, while decreasing fossil fuel output accordingly.

- The plate heat exchanger segment will project at a CAGR of 8.4% till 2034. Plate heat exchangers known for their high heat transfer efficiency, compact structure, and ease of maintenance, are expected to witness growing adoption across multiple industries. To meet evolving industrial needs, manufacturers are expanding production capacities and integrating advanced technologies into these systems.

- For instance, at Chillventa 2024, Alfa Laval unveiled three new heat exchangers for propane (R290), CO2 (R744), and ammonia (R717) systems. These innovative products, including the SE series, AC900, and semi-welded plates, cater to residential, commercial, and industrial applications across various industries.

- Air cooled heat exchanger industry is set to grow at a CAGR of 8.7% through 2024. Rising need for advanced heating and cooling systems in buildings, along with tightening energy regulations and a push to harness waste heat, is anticipated to propel the growth of the heating and cooling sector.

- For instance, the European Union introduced a new climate legislation in April 2023, aiming to cut emissions by 55% by 2030. These technologies are also extensively employed in refineries, natural gas facilities, power generation plants, and petrochemical operations to efficiently capture and repurpose waste heat generated during industrial processes.

Learn more about the key segments shaping this market

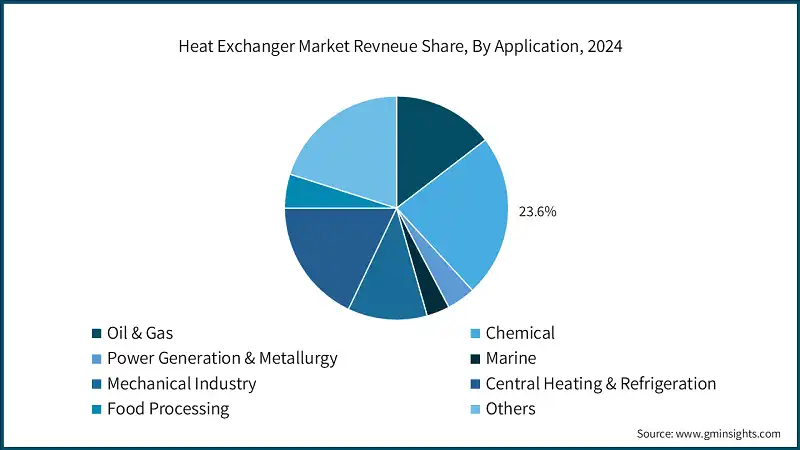

- Based on application, the application is segmented into oil & gas, power generation & metallurgy, chemical, central heating & refrigeration, mechanical industry, food processing, marine, and others. The chemical segment dominates the market with 23.6% share in 2024 and is expected to grow at a CAGR of 9.2% from 2025 to 2034.

- The rising demand for chemical products, combined with a focus on energy efficiency and sustainability, is driving the adoption of advanced heat exchanger technologies in the chemical sector. Additionally, compliance with strict safety regulations and the use of digital tools like sensors and data analytics are enhancing real-time monitoring, predictive maintenance, and operational control in customized chemical facilities.

- Central heating & refrigeration segments holds 17.9% market share in 2024 with 7.8% CAGR through 2034. The segment is set to witness significant growth owing to the adoption of advanced heat exchanger technologies using low-global warming potential refrigerants, driven by strict environmental mandates. Implementation of regulatory obligations for energy-efficient heating and cooling, along with digital technology integration for improved climate control, are influencing industry growth.

- Rising demand for heat exchangers in refineries and gas plants for energy efficiency and cost savings is driving growth in the oil and gas sector. Additionally, the popularity of compact, versatile devices suitable for tight or challenging spaces will further boost product adoption and industry expansion.

- The mechanical industry employs heat exchangers across several industrial processes to manage heating and cooling needs across mechanical applications. Increasing demand for efficient thermal management solutions to improve energy efficiency and operational performance. The expansion of manufacturing facilities, infrastructure development, and the adoption of automation and modern machinery also contribute to higher utilization of heat exchangers.

Looking for region specific data?

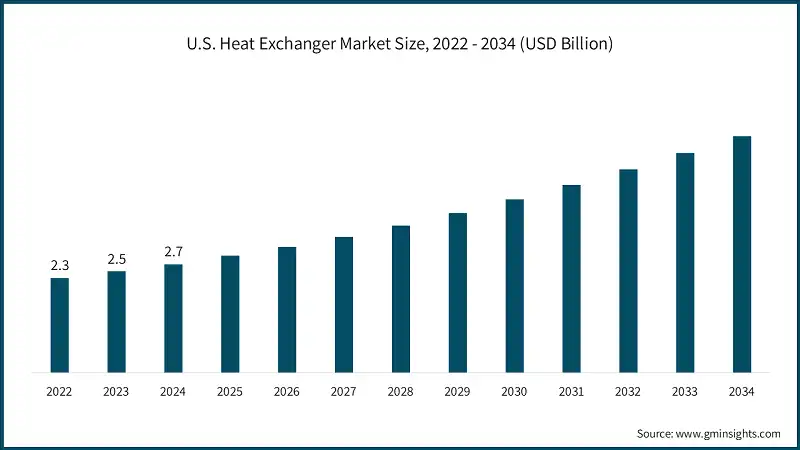

- The U.S. dominated the heat exchanger market held around 83.8% share in 2024 and generated USD 2.7 billion in revenue. Industries are adopting energy-efficient heating and cooling solutions driven by net-zero targets, strict environmental regulations, infrastructure upgrades, and advancements in heat exchanger technologies are positively influencing industry growth.

- For instance, in October 2024, Tranter and Hexxcell have partnered to enhance industrial heat exchanger maintenance. By integrating Tranter's expertise with Hexxcell's hybrid-AI digital twin models, the collaboration offers advanced monitoring, predictive analytics, and actionable insights to improve efficiency, reduce downtime, and support sustainable operations

- The North America heat exchanger market is projected to reach over USD 5.9 billion by 2034. Stringent mandates for limiting carbon emissions across industrial applications, along with increasing R&D initiatives for development of efficient and reliable heat exchange solutions for variety of industries will create favorable business scenario.

- For instance, in July 2025, Southwest Research Institute enhanced its heat exchanger testing facilities to accommodate megawatt-scale performance evaluations. This expansion allows for customized testing of high-capacity heat exchangers used in heating, cooling, and high-temperature applications across various industries.

- The Europe heat exchanger market was evaluated at USD 6.1 billion in 2024. The industry is set to grow owing to increasing energy demands for heating and cooling in buildings, along with rising investments in heavy-duty industrial operations. The focus on efficient climate control and expanding industrial activities further boosts the need for reliable systems, augmenting the Europe heat exchanger industry outlook.

- For instance, the European Green Deal requires an investment of about EUR 520 billion or USD 563 billion per annum from 2021 to 2030, along with EUR 92 billion from 2023 to 2030 to expand the EU's net-zero technology production capacity. Moreover, the positive targets & initiatives by the regional authorities are set to propel the product demand across a wide range of industry verticals.

- The Asia Pacific heat exchange market is set to surpass USD 14 billion by 2034 backed by the expanding manufacturing facilities across emerging economies and rising investments in energy-intensive infrastructure including in petrochemicals, chemicals, energy, and manufacturing industries are complementing the industry outlook.

- For instance, in July 2024, Nexson Group opened its Beijing factory, a 5,000-square-meter facility in Huairou Science City near the Yanqi River. This factory will act as the Asia Pacific production hub, incorporating advanced technologies from Germany and France to meet regional demands.

- The Middle East & Africa heat exchanger market is set to observe significant expansion on account of the rising demand from the oil & gas, power, and industrial sectors, particularly in off-grid and remote facilities, accelerating the product demand. The increasing need for efficient, reliable, and compact heat exchange solutions across industries is driven by the expansion of energy infrastructure and industrialization efforts.

- Additionally, rapid industrialization and urbanization are increasing construction activities, boosting demand for energy-efficient heating and cooling systems in buildings further augmenting the business landscape.

Heat Exchanger Market Share

The top 5 companies in the heat exchanger industry are ALFA LAVAL, Danfoss, Xylem, Kelvion Holding, and SWEP International contributing around 35% of the market in 2024.

- Danfoss maintains a major foothold across the heat exchanger industry through its global presence across key emerging economies. The company provides a range of heat exchangers, including brazed plate, gasketed and semi-welded types, designed for refrigeration and heat transfer purposes. The company also introduces innovative solutions featuring micro-channel and micro-plate heat exchanger condensers, leveraging advanced technology for improved efficiency.

- Xylem offers Bell and Gossett offers efficient plate heat exchangers, steam/water models, tank heaters, and gas coolers, providing compact, high-capacity solutions for thermal transfer and heating applications. The company also provides shell & tube, plate and frame and brazed plate heat exchangers for variety of industrial applications.

- Over the past three years, the heat exchanger industry has experienced moderate market concentration, with regional OEMs and independent service providers gaining market share, especially in areas with aging equipment and cost-focused customers. Leading companies leverage extensive engineering expertise and service networks to support high-performance heat exchangers, deploy advanced diagnostics, modular upgrades, and smart maintenance platforms to enhance lifecycle management and operational efficiency.

- SWEP International provides a broad selection of brazed plate heat exchangers, emphasizing efficient performance with minimal material use. Their units, available in various sizes and materials like copper and stainless steel, are designed for single-phase heat transfer applications, ensuring reliable and optimized solutions across diverse industrial and commercial uses.

- Companies in the heat exchanger market are actively innovating, forming strategic partnerships, and expanding their operations to secure market share. They also provide lifecycle services, long-term agreements, and leveraging digitalization to enhance their presence in emerging regions.

- The heat exchanger industry faces intense competition driven by technological advancements, growth strategies, and product innovation. Companies are prioritizing R&D to enhance efficiency, reduce energy usage, and improve performance, aiming to strengthen their market position with diverse offerings.

Heat Exchanger Market Companies

Major players operating across the industry include:

- Accessen Group

- Alfa Laval

- AMI Exchangers

- API Heat Transfer

- Bronswerk

- Danfoss

- Euro-Apex

- Funke Warmeaustauscher Apparatebau

- Hisaka Works

- HRS Heat Exchangers

- Kelvion Holding

- Koch Heat Transfer

- Mersen

- Nexson

- SPX Flow

- SWEP International

- Thermofin

- Thermowave

- Wessels Company

- Xylem

- Danfoss one of the prominent players in the engineering industry, reported USD 11.37 billion in sales for the year 2024. The company’s advanced heat exchangers are meticulously designed to maximize thermal efficiency across HVAC systems and diverse industrial operations. It provides dependable, high-performance solutions built to withstand the toughest operating conditions whether it is gasketed, brazed plate, or welded configurations.

- Xylem secured total revenue of USD 4.3 billion for 6 months of 2025. Total Revenue for the year 2024 reached USD 8.6 billion, which is a 16% increase on a reported basis and a 6% rise. The company’s Bell & Gossett’s plate heat exchangers are engineered for high efficiency in compact designs. Its brazed plate and gasketed plate heat exchanger models come in various sizes to ensure optimal thermal performance, delivering powerful and efficient heating solutions.

- ALFA LAVAL recorded net sales of USD 3.5 billion for 6 months of 2025. With nearly nine decades of expertise, the company delivers advanced plate heat exchanger solutions tailored to diverse applications. Their shell and tube heat exchangers featuring either plain or enhanced tubes are widely used for efficient fluid heating and cooling in both industrial and comfort systems.

Heat Exchanger Industry News

- In May 2025, Standard Group introduced its latest offering: Glass Lined Shell and Tube Heat Exchangers. This new product has been developed in partnership with the AGI Group of Japan, leveraging their cutting-edge technology. The design aims to address the challenges faced by traditional graphite heat exchangers, delivering improved durability, superior corrosion resistance, and increased operational safety for demanding process applications.

- In April 2025, Alfa Laval introduces the T25 semi-welded plate heat exchanger, a compact and efficient solution for modern energy needs. It supports clean energy expansion, such as green hydrogen, while benefiting sectors like building heating and cooling, heavy industries, and power production. The T25, part of Alfa Laval's new series, features durable plate and gasket materials for demanding applications. Designed for high performance, these units enhance gasket lifespan, ensure reliable sealing under pressure, and improve thermal efficiency.

- In March 2025, HRS Heat Exchangers has successfully shipped its largest order to date from its Murcia facility to North America, valued at USD 3.8 million. The order includes 384 corrugated tube modules weighing around 126 tonnes, designed for heating, cooling, and heat recovery in a renewable energy project. The shipment, consisting of 18 containers, was dispatched in stages between September and December.

- In July 2024, SWEP has introduced the SWEP 190 series of brazed plate heat exchangers, designed for low-GWP and natural refrigerants. Developed in response to new regulations on fluorinated gases, these compact and versatile units come in single- and dual-circuit options, with capacities from 60kW to 150kW. They are suitable for HVACR applications using refrigerants like R32, R454B, and R290, featuring integrated distribution for stable operation and improved efficiency.

- In March 2024, HRS Heat Exchangers secured its largest order to date, worth USD 3.8 million, for a North American environmental project. Scheduled for delivery in late 2024, the order includes 384 heat exchanger modules (6m and 10m lengths) featuring nearly 10 km of tubing and HRS's corrugated tube technology. Manufactured in Murcia, Spain, the 126-ton equipment will ship in 18 containers and support heating, cooling, and heat recovery operations for a renewable energy initiative.

The heat exchanger market research report includes in-depth coverage of the industry with estimates & forecast in terms of “USD Million” from 2021 to 2034, for the following segments:

Market, By Technology

- Shell & Tube

- Plate

- Air Cooled

- Others

Market, By Application

- Oil & Gas

- Chemical

- Power Generation & Metallurgy

- Marine

- Mechanical Industry

- Central Heating & Refrigeration

- Food Processing

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Poland

- Turkey

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Philippines

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Nigeria

- Latin America

- Brazil

- Argentina

- Colombia

- Chile

Frequently Asked Question(FAQ) :

Who are the key players in the heat exchanger market?

Key players include ALFA LAVAL (market leader with 10% share), Danfoss, Xylem, SWEP International, Kelvion Holding, SPX Flow, API Heat Transfer, Bronswerk, Hisaka Works, HRS Heat Exchangers, Koch Heat Transfer, Mersen, Nexson, Thermofin, Thermowave, and Wessels Company.

What is the growth outlook for plate heat exchangers from 2025 to 2034?

Plate heat exchangers are projected to grow at a CAGR of 8.4% till 2034, due to their high heat transfer efficiency, compact structure, and ease of maintenance.

Which region leads the heat exchanger market?

The U.S. region dominated with 83.8% share generating USD 2.7 billion in revenue in 2024. The region benefits from significant manufacturing and power generation investments.

What are the upcoming trends in the heat exchanger market?

Key trends include rising demand for energy-efficient solutions, integration of IoT and AI for monitoring and predictive maintenance, and development of advanced materials with enhanced corrosion resistance.

What is the current heat exchanger market size in 2025?

The market size is projected to reach USD 18.7 billion in 2025.

How much market share did the shell & tube segment hold in 2024?

Shell & tube technology dominated the market with 37% share in 2024 and is expected to grow at a CAGR of 8.3% through 2034.

What is the market size of the heat exchanger in 2024?

The market size was USD 17.3 billion in 2024, with a CAGR of 8.4% expected through 2034 driven by rising industrial investments and increasing energy demand for heating and cooling in building infrastructure.

What was the market share of the chemical application segment in 2024?

The chemical segment held 23.6% market share in 2024 and is expected to grow at a CAGR of 9.2% from 2025 to 2034.

What is the projected value of the heat exchanger market by 2034?

The heat exchanger market is expected to reach USD 38.6 billion by 2034, propelled by energy efficiency focus, industrial automation, and expansion in renewable energy sectors.

Heat Exchanger Market Scope

Related Reports