Summary

Table of Content

Health Insurance Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Health Insurance Market Size

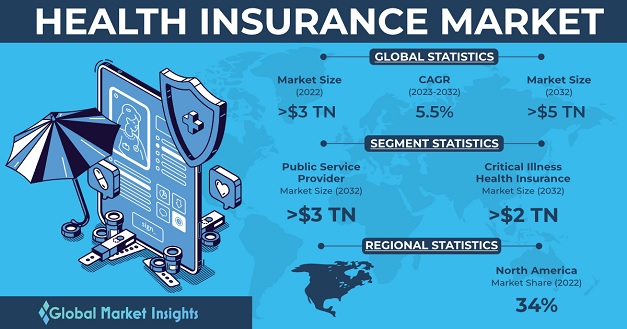

Health Insurance Market size crossed USD 3 trillion in 2022 and will see a 5.5% CAGR from 2023-2032. Growing healthcare expenditure and the rising GDP worldwide will have a positive impact on industry outlook.

To get key market trends

Expanding geriatric population is responsible for the rising disease burden worldwide with an expanding patient pool suffering from chronic illnesses. The elderly community falls under the underproductive section of the population, making it more difficult to afford extensive medical care. As a result, insurers are introducing supportive policies to cater to the geriatrics, which may create lucrative growth opportunities.

Health Insurance Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2022 |

| Market Size in 2022 | USD 3 Trillion |

| Forecast Period 2023 to 2032 CAGR | 5.5% |

| Market Size in 2032 | USD 5.4 Trillion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Stringent regulations and longer claim reimbursement times are some of the major roadblocks to health insurance industry development. In addition, insurance companies delay or reject applications that are raised too late by patients. For instance, certain health policies offered by some insurance firms require the payer to inform 3 days prior to any surgery or hospitalization in order to claim a reimbursement in time. Such strict regulations are posing a challenge for both insurance providers as well as payers.

Health Insurance Market Analysis

Learn more about the key segments shaping this market

Critical illness health insurance market size is poised to surpass USD 2 trillion by 2032. Critical illness insurance is very beneficial as they provide coverage for an array of life-threatening diseases such as cancer, stroke, heart attack, and renal failure. As per the Nation Cancer Registry Program of ICMR, cancer incidences in India surged from more than 1.3 million in 2020 to over 1.4 million in 2022. Critical illnesses require extensive care with multiple hospital visits and hefty expenditure on treatment services. Insurance programs for such ailments not only cover hospitalization expenses, but also help patients pay for doctor visits, medical bills, and more, which may create a favorable environment for market progress.

Learn more about the key segments shaping this market

Health insurance market valuation from public service providers is set to reach over USD 3 trillion by 2032. Public insurance supports patients that fall under low- and middle-income groups to cater to a demographic with unmet medical needs. These policies help minimize out-of-pocket expenditure on healthcare services. Several governments worldwide across Germany, the U.S., and India are introducing extensive health insurance programs to provide the geriatric population and groups with low disposable income access to healthcare services.

Health insurance market from the senior citizens age group will register over 3.5% CAGR from 2023-2032. Senior citizens are more prone to chronic illnesses and aging-related disorders, resulting in significant healthcare expenditures. However, since they cannot afford out-of-pocket expenses, the geriatric population relies on health insurance policies to cover their medical bills. These policies provides them access to free annual check-ups along with benefits such as coverage inclusive of outpatient services, and no medical screening before buying insurance plans.

Looking for region specific data?

North America held a 34% share of the health insurance market in 2022. North America is set to emerge as a key hub for health insurance due to the massive healthcare expenditure in countries such as the U.S., and Canada. Additionally, hefty investments in healthcare infrastructure and government-backed initiatives focusing on the development of more inclusive insurance programs are aiding industry expansion across the region.

Health Insurance Market Share

Some of the key companies include:

- Aetna

- Anthem Health Insurance

- Centene

- Cigna Corporation

- HCSC

- Highmark Inc

- Jubliee Holding Limited

- Kaiser Permanente

- Ottonova,

- United Healthcare.

Recent Developments:

- February 2023: Cigna Worldwide Insurance Company became the first international insurance provider to get a branch license from the Saudi Central Bank (SAMA), allowing the firm to operate in the Kingdom of Saudi Araba.

The health insurance market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue in USD from 2018 to 2032, for the following segments:

By Service Provider

- Private

- Public

By Type

- Hospitalization Insurance

- Critical Illness Insurance

- Income Protection Insurance

- Medical Insurance

By Network Provider

- Health Maintenance Organization [HMO]

- Preferred Provider Organization [PPO]

- Exclusive Provider Organization [EPO]

- Others

By Age-group

- Minors

- Adults

- Senior Citizens

By Time Period

- Life Insurance

- Term Insurance

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Poland

- Netherlands

- Switzerland

- Rest of Europe

- Asia Pacific

- Japan

- India

- China

- Australia

- South Korea

- Indonesia

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Columbia

- Peru

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Iran

- Egypt

- Israel

- Rest of MEA

Frequently Asked Question(FAQ) :

What is the health insurance market worth?

Global market for health insurance crossed USD 3 trillion in 2022 and will register a 5.5% CAGR from 2023-2032, owing to the rise in GDP and healthcare expenditure worldwide.

Why is the demand for critical illness health insurance policies on the rise?

Critical illness health insurance market size is poised to surpass USD 2 trillion by 2032, due to the rising prevalence of cancer and other life-threatening diseases.

What is driving the demand for health insurance in North America?

Senior citizens segment will register more than 3.5% CAGR through 2023-2032, driven by the growing geriatric population and healthcare spending in the region.

Who are the leading health insurance providers?

Aetna, Centene, Cigna Corporation, HCSC, Highmark Inc., Kaiser Permanente, Ottonova, and United Healthcare are some of the leading firms in the market.

Health Insurance Market Scope

Related Reports