Summary

Table of Content

Gout Therapeutics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Gout Therapeutics Market Size

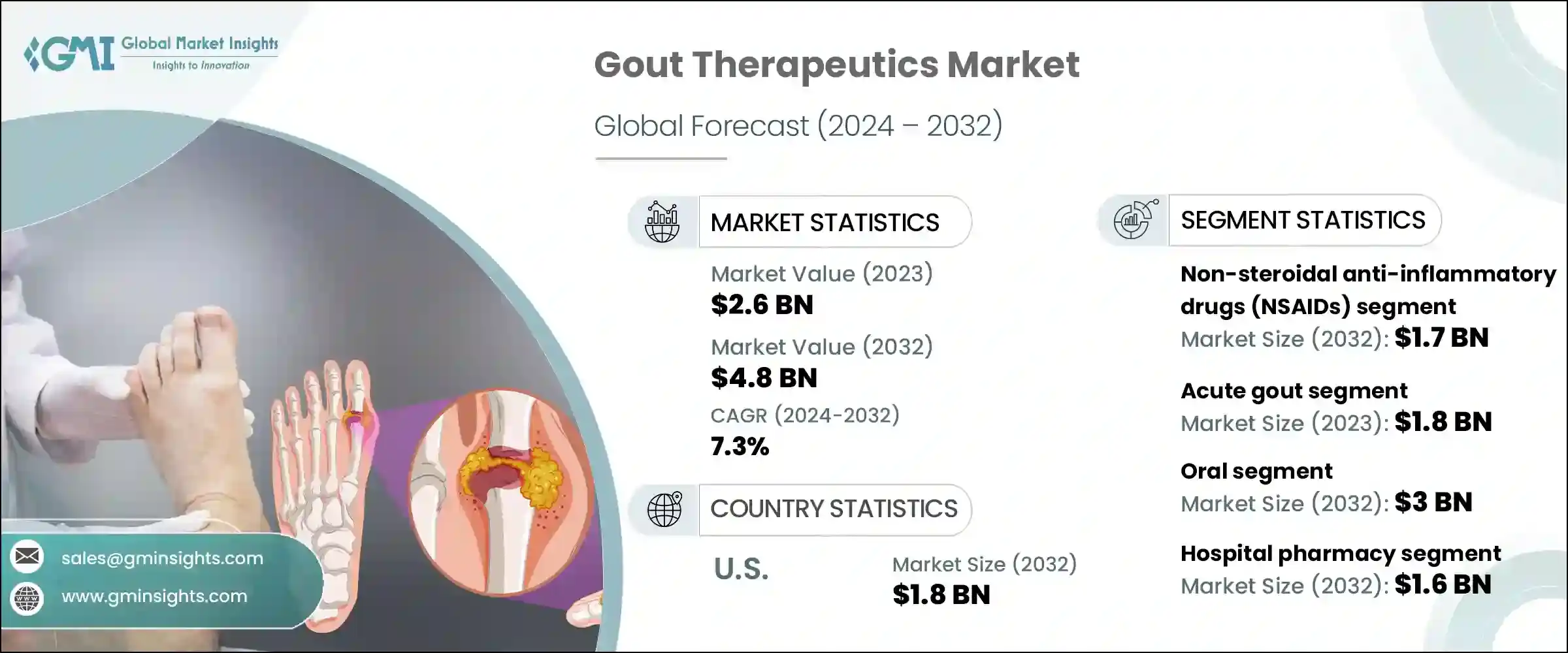

Gout Theapeutics Market size was valued at around USD 2.6 billion in 2023 and is estimated to grow at 7.3% CAGR from 2024 to 2032. Gout therapeutics involves medications and treatments used to manage and treat gout, a type of inflammatory arthritis characterized by sudden, severe attacks of pain, redness, and tenderness in the joints, often affecting the big toe. The condition is caused by the accumulation of urate crystals in the joint, due to high levels of uric acid in the blood.

To get key market trends

The rising incidence of gout is a significant driver for the market. For instance, according to a study published by National Center for Biotechnology Information in March 2024, the global incidence of gout in individuals aged 15–39 years was 145.19 per 100,000 population in 2019, that doubled in comparison to 1990. This underscores the growing demand for effective treatment options in the gout therapeutics market.

Furthermore, advancements in treatment options, rising awareness towards early gout diagnosis, rising geriatric population, and changes in diet and lifestyle are the promoting factors advancing the growth of the market.

Gout Therapeutics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 2.6 Billion |

| Forecast Period 2024 – 2032 CAGR | 7.3% |

| Market Size in 2032 | USD 4.8 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Gout Therapeutics Market Trends

The field of gout therapeutics has experienced significant advancements driven by a deeper understanding of the disease's pathophysiology and the development of innovative treatment modalities. These advancements encompass novel urate-lowering therapies, biologic agents targeting specific inflammatory pathways, improved novel drug delivery systems, personalized medicine approaches, combination therapies, and comprehensive dietary and lifestyle interventions.

- New urate-lowering drugs such as febuxostat and pegloticase have emerged as pivotal advancements in gout treatment, particularly for patients resistant to or intolerant of conventional therapies such as allopurinol. Febuxostat inhibits xanthine oxidase effectively and is administered orally once daily, offering an alternative for those needing dose adjustments.

- The introduction of biologic agents targeting specific inflammatory pathways such as IL-1 inhibitors, has provided effective options for managing acute gout flares and chronic tophaceous gout.

- Additionally, advances in pharmacogenetics have facilitated a more personalized approach to gout management, allowing for tailored treatment plans based on individual genetic profiles and response patterns. Thus, propelling the growth of the market.

Gout Therapeutics Market Analysis

Learn more about the key segments shaping this market

Based on drug class, the market is divided into non-steroidal anti-inflammatory drugs (NSAIDs), corticosteroids, colchicine, urate-lowering agents, and other drug classes. The non-steroidal anti-inflammatory drugs (NSAIDs) segment of the market is forecasted to reach USD 1.7 billion by 2032.

- NSAIDs exert their anti-inflammatory effects by inhibiting cyclooxygenase (COX) enzymes, particularly COX-2, are responsible for converting arachidonic acid into prostaglandins. These prostaglandins contribute to inflammation, swelling, and pain. By blocking COX-2, NSAIDs decrease the production of prostaglandins, thereby reducing inflammation and alleviating the symptoms of acute gout attacks.

- NSAIDs offer quick onset of action, often providing significant pain relief and reduction in inflammation within hours of administration, which is crucial for managing acute gouty arthritis.

- Further, NSAIDs are effective for managing mild to moderate gout attacks and are often recommended as first-line therapy for symptomatic relief before considering more aggressive treatment options, thus driving the market growth.

Learn more about the key segments shaping this market

Based on condition, the gout therapeutics market is segmented acute gout and chronic gout. The acute gout segment accounted for USD 1.8 billion in 2023.

- Medications such as non-steroidal anti-inflammatory drugs (NSAIDs), corticosteroids, and colchicine provide quick relief from severe pain associated with acute gout attacks, enhancing patient comfort and mobility.

- By dampening the inflammatory cascade, these treatments effectively reduce swelling and redness in the affected joints. This not only provides immediate relief from discomfort but also improves the aesthetic appearance of the joint.

- Additionally, these therapies indicated for acute goat can be administered orally, intravenously or intra-articularly, allowing healthcare providers to tailor treatments based on the severity of symptoms and patient preferences. Thus, adding to the revenue growth of the acute goat segment.

Based on route of administration, the gout therapeutics market is divided into oral, parenteral, and other routes of administration. The oral segment of the market is forecasted to reach USD 3 billion by 2032.

- Oral medications for gout such as non-steroidal anti-inflammatory drugs (NSAIDs), colchicine, and some urate-lowering therapies are widely available and familiar to healthcare providers. This accessibility ensures prompt access to medications when needed.

- They are easy to administer and generally more convenient for patients compared to injectable or intravenous routes. This convenience can improve patient compliance with treatment regimens, leading to better outcomes.

- Further, oral medications often offer flexible dosing options, allowing healthcare providers to tailor treatments based on individual patient factors such as severity of symptoms, comorbidities, and response to therapy. This personalized approach can optimize therapeutic outcomes. Thus, escalating the growth of the market.

Based on distribution channel, the gout therapeutics market is bifurcated into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment is forecasted to reach USD 1.6 billion by 2032.

- Hospital pharmacies often provide specialized compounding services, allowing for customized formulations of medications when standard preparations are not suitable for specific patient needs. This capability is particularly beneficial for patients with allergies, intolerances, or unique dosing requirements.

- They stock a wide range of medications used in the treatment of gout. This ensures immediate access to medications needed for both acute management of gout flares and long-term maintenance therapy.

- Further, hospital pharmacies play a critical role in monitoring patients receiving gout medications, including assessing therapeutic responses, monitoring for adverse effects, and providing timely interventions or adjustments as needed. This proactive approach helps minimize medication-related complications and optimize therapeutic outcomes. Thus, driving the growth of the market.

Looking for region specific data?

The growth of the gout therapeutics market in the U.S. is projected to reach USD 1.8 billion by 2032.

- The U.S. boasts a robust healthcare infrastructure with advanced medical facilities, including specialized clinics and hospitals equipped to handle complex cases of gout. This infrastructure supports timely diagnosis, treatment, and management of gout, ensuring high-quality care for patients.

- Moreover, the U.S. is a global leader in biomedical research and development (R&D), fostering innovation in gout therapeutics. Pharmaceutical companies and academic institutions conduct extensive research to develop new drugs, biologics, and treatment modalities aimed at improving outcomes for patients with gout.

The gout therapeutics market in UK is expected to experience significant and promising growth from 2024 to 2032.

- The UK's National Health Service (NHS) provides universal healthcare coverage, ensuring equitable access to gout diagnosis, treatment, and management for all residents. This integrated system supports coordinated care and patient outcomes across different healthcare settings.

- Additionally, increasing prevalence of gout in the country is also contributing to a high demand for treatment therapies. According to NHS, gout cases have increased during 2019-2022 by about 20% in the country, contributing to the market growth.

Japan gout therapeutics market is anticipated to witness lucrative growth between 2024 – 2032.

- Japan has a highly advanced healthcare system known for its efficiency, universal coverage, and access to high-quality medical care. This system ensures that patients with gout receive timely diagnosis, treatment, and ongoing management.

- Japan emphasizes precision medicine, which is globally estimated to reach USD 157.1 billion by 2032. Precision medicine approaches that are tailored to individual patient characteristics, including genetic factors, is also influencing the gout susceptibility and response to treatments. This personalized approach is enhancing the treatment efficacy and patient outcomes in the country, thereby raising the demand for novel gout therapies in Japan.

The gout therapeutics market in Saudi Arabia is expected to experience significant and promising growth from 2024 to 2032.

- Saudi Arabia collaborates with international partners in healthcare and medical research, fostering knowledge exchange and technology transfer. This collaboration enhances access to global best practices, innovative therapies, and research findings in gout management.

- Saudi Arabia has been increasing its investment in biomedical research and development, including studies focused on rheumatic diseases such as gout. This investment supports local research initiatives, clinical trials, and the development of new therapeutic interventions tailored to the country's healthcare needs.

Gout Therapeutics Market Share

The gout therapeutics sector is competitive in nature, with a mix of major global and smaller to medium-sized companies competing for market share. A pivotal aspect of market strategy involves the continual introduction of innovative gout therapies leveraging diverse technologies. Notably, prominent industry players command considerable influence in this dynamic landscape, often driving forward advancements through substantial investments in research and development. Smaller players are focusing on specific gout therapies to gain significant expertise and compete with established players.

Gout Therapeutics Market Companies

Some of the eminent market participants operating in the gout therapeutics industry include:

- Astrazeneca Plc

- Addex Therapeutics

- Abbvie Inc.

- Amgen Inc.

- Boehringer Ingelheim International GmbH

- GSK plc

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc

- Regeneron Pharmaceuticals, Inc.

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Ltd.

- Teva Pharmaceuticals Industries Ltd.

- Teijin Limited

- Zydus Lifesciences Limited

Gout Therapeutics Industry News:

- In June 2024, AbbVie announced the acquisition of Celsius Therapeutics, Inc., a biotechnology company pioneering new therapies for patients. This acquisition expands AbbVie's portfolio in innovative treatments and reinforces its commitment to advancing healthcare through biotechnological innovation.

- In October 2023, Amgen acquired Horizon Therapeutics, a company specializing in researching, developing, and commercializing medicines for rare and rheumatic diseases. This acquisition bolstered Amgen's portfolio by integrating Horizon's innovative therapies, expanding its capabilities in addressing unmet medical needs within the specialized disease areas.

The gout therapeutics market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD Million from 2021 – 2032 for the following segments:

Market, By Drug Class

- Non-steroidal anti-inflammatory drugs (NSAIDs)

- Corticosteroids

- Colchicine

- Urate-lowering agents

- Other drug classes

Market, By Condition

- Acute gout

- Chronic gout

Market, By Route of Administration

- Oral

- Parenteral

- Other routes of administration

Market, By Distribution Channel

- Hospital pharmacy

- Retail pharmacy

- Online pharmacy

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

How much is the gout therapeutics industry worth?

The gout therapeutics market size was valued at USD 2.6 billion in 2023 and is estimated to grow at 7.3% CAGR from 2024 to 2032, driven by the rising incidence of gout.

Who are the major gout therapeutics industry players?

Abbvie Inc, Amgen Inc, Boehringer Ingelheim International GmbH, GSK plc, Merck & Co., Inc, Novartis AG, and Pfizer Inc. among others.

Why is the gout therapeutics industry growing in the U.S?

U.S. gout therapeutics market size is projected to reach USD 1.8 billion by 2032, owing to the robust healthcare infrastructure.

Why is the demand for non-steroidal anti-inflammatory gout therapeutics drugs rising?

The non-steroidal anti-inflammatory drugs segment of the gout therapeutics is forecasted to reach USD 1.7 billion by 2032, as they offer quick onset of action, often providing significant pain relief

Gout Therapeutics Market Scope

Related Reports