Summary

Table of Content

Glyphosate Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Glyphosate Market Size

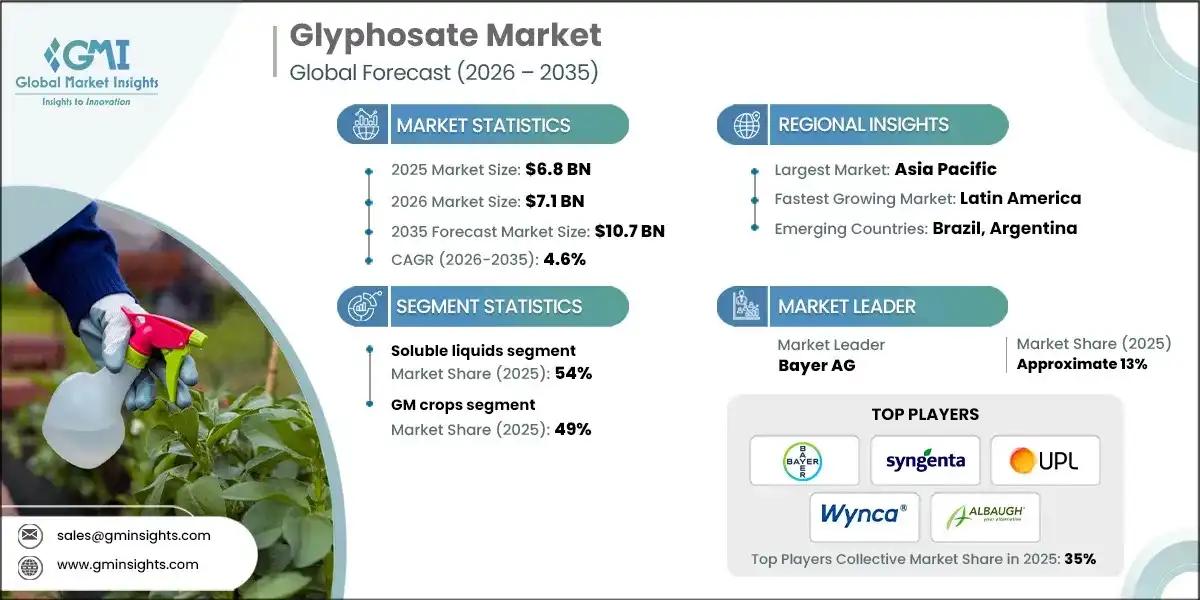

The global glyphosate market was valued at USD 6.8 billion in 2025 and is projected to expand from USD 7.1 billion in 2026 to USD 10.7 billion by 2035 at a 4.6% CAGR, according to latest report published by Global Market Insights Inc.

To get key market trends

- Glyphosate’s broad spectrum, systemic action continues to anchor pre plant burndown, in crop use on traited systems, and post-harvest stubble management, even as stewardship expectations rise. The glyphosate market benefits from conservation/no till adoption, multi cropping intensification, and cost per hectare advantages in price sensitive regions. At the same time, resistance evolution and regulatory tightening in parts of Europe are reshaping use patterns toward precision application and diversified tank mixes.

- Additionally, conservation/no till practices cover roughly 180 million hectares today and are on a growth path, which locks glyphosate into foundational roles for burndown and residue transitions in many rotations. Furthermore, diversified mixtures and mode of action rotations are now norm rather than exception across much of the U.S. Corn Belt, Brazil’s MATOPIBA, and Australian grain belts.

- In Europe, renewal through 2033 arrived with tighter conditions, including desiccation limits and buffer/drift requirements, which is steering investment into drift mitigation, recordkeeping, and alternative mechanisms where agronomically viable. Furthermore, In the U.S., regulatory materials continue to affirm approved status within label directions, while endangered species protections increase the emphasis on application timing, buffers, and documentation.

- EU renewal through 2033 came with tightened conditions, including a prohibition on desiccation for harvest management and stricter buffer/drift rules, prompting faster adoption of precision tools and alternative mixes across several member states. APAC regulators continue to affirm registered uses when labels are followed, while North American stewardship is shaped by endangered-species mitigations and ongoing litigation narratives that reorient portfolios toward professional channels.

Glyphosate Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 6.8 Billion |

| Market Size in 2026 | USD 7.1 Billion |

| Forecast Period 2026-2035 CAGR | 4.6% |

| Market Size in 2035 | USD 10.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing Global Food Demand | Necessitates high-efficiency crop protection tools like glyphosate. |

| Labor Shortages in Agriculture | Boosts adoption of chemical weed control as a labor-saving alternative. |

| Dominant Supply Chain from China | Ensures cost leadership and large-volume global availability. |

| Pitfalls & Challenges | Impact |

| Mounting Legal and Health Allegations | Threatens long-term brand reputation and regulatory acceptance. |

| EU and Regional Regulatory Uncertainty | Introduces compliance risks and labeling obligations for manufacturers. |

| Opportunities: | Impact |

| Penetration into Emerging Agricultural Markets | Unlocks new demand in Asia-Pacific and Sub-Saharan Africa. |

| Development of Next-Gen Bioformulations | Offers premium growth through safer, targeted, and environment-friendly products. |

| Market Leaders (2025) | |

| Market Leaders |

Approximate market share of 13% in 2025 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Latin America |

| Emerging Country | Brazil, Argentina |

| Future Outlook |

|

What are the growth opportunities in this market?

Glyphosate Market Trends

- Biotechnology-driven demand and next-gen trait systems: U.S. adoption of genetically engineered soybeans, corn, and cotton has remained above 90% for years, keeping glyphosate central to traited programs that still rely on it as a foundation chemistry even as stacks diversify. Brazil’s crop agency continues to report sustained double-cropping intensity and rising soybean/corn area, which lifts total treated hectares where glyphosate underpins burndown and in-crop passes. China’s stepwise expansion of domestic GM corn supports gradual demand growth for herbicide-tolerant systems while the country remains pivotal on the supply side for technical concentrate. Stacked traits such as XtendFlex and Enlist keep glyphosate in the mix but enable rotation/mixtures to slow resistance evolution, changing how the glyphosate market grows rather than whether it grows.

- Generic consolidation and Chinese manufacturing modernization: Chinese technical suppliers rationalized capacity and upgraded environmental compliance, improving purity specs and stabilizing pricing bands for global formulators that depend on long-term offtake. The numbers tell us supply reliability improved after wastewater and emissions investments elevated compliance and helped reduce the boom–bust swings seen in past years. For formulators in the Americas and Europe, that means fewer stockouts and more predictable cost curves, which matters because downstream programs increasingly tie glyphosate to residual partners and precision application hardware.

- Precision application and digital stewardship: Growers are adopting pulse-width modulation, section control, and UAV spot-spraying to cut overlap and drift while maintaining control, a shift reinforced by endangered-species mitigations and recordkeeping expectations in the U.S. Additionally, digital platforms (FieldView, xarvio, Granular) pulling application data into compliance-ready logs and variable-rate prescriptions that trim per-acre volumes without sacrificing outcomes.

- Resistance management and integrated weed management: The international survey continues to track new glyphosate-resistant biotypes, pushing growers from glyphosate-only to diverse stacks that include auxins, PPO/HPPD inhibitors, and residuals. Per-acre glyphosate intensity eases in some geographies, yet glyphosate remains the anchor in most programs because of cost-to-control and spectrum, particularly in HT soybean, corn, and cotton systems.

Glyphosate Market Analysis

Learn more about the key segments shaping this market

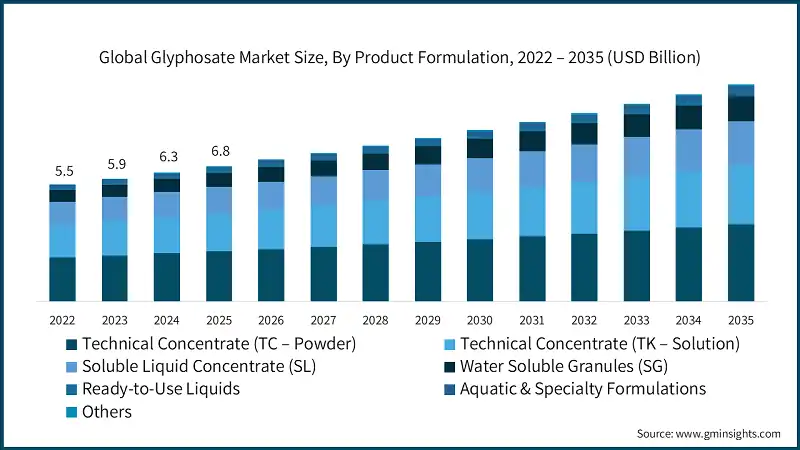

Based on product formulation, the market is segmented into technical concentrate (tc – powder), technical concentrate (tk – solution), soluble liquid concentrate (sl), water soluble granules (sg), ready-to-use liquids, aquatic & specialty formulations, others. Soluble liquids dominated the market with an approximate market share of 54% in 2025 and is expected to grow with a CAGR of 4.7% by 2035.

- Soluble liquids dominate field-scale programs because handling is simple, tank-mix breadth is wide, and premium surfactant systems improve uptake and rain fastness; aquatic-approved labels address canal and shoreline work where surfactant selection is constrained.

- Technical concentrates remain the upstream backbone, with Chinese suppliers providing consistent 95–96% specs that feed global formulation networks. Water-soluble granules serve dust-free small-pack needs, while RTU formats skew to professional landscaping and municipal contexts where convenience and stewardship outweigh lowest $/acre. The numbers in our model show SLs holding the largest share with steady upgrades in adjuvant chemistry, while TC/TK grows more slowly as vertical integration and long-term contracts reduce spot trade. This matters because precision application and documentation tilt demand toward premium SLs and aquatic/specialty SKUs in regulated settings.

- Premiumization is the throughline. Branded suppliers defend pricing via surfactant packages, drift-reduction features, and salt choices that align with stewardship and sensitive-area rules. Meanwhile, combination offers—glyphosate with dicamba, 2,4 D choline, or PPO partners—expand, giving growers single-pass convenience and resistance management in one jug. In short, the glyphosate market keeps its commodity roots upstream, but at the nozzle it’s a formulation game.

Learn more about the key segments shaping this market

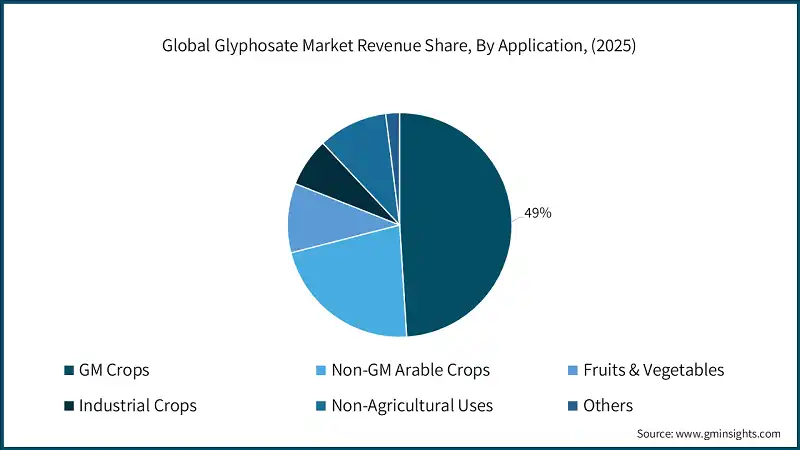

Based on application, the glyphosate market is segmented into gm crops, non-gm arable crops, fruits & vegetables, industrial crops, non-agricultural uses, others. GM crops held the largest market share of 49% in 2025 and is expected to grow at a CAGR of 5% during 2026-2035.

- GM crops still account for the largest slice of the glyphosate market, with soybean, corn, and cotton systems using glyphosate as the base layer and alternates to address resistant biotypes. Additionally, conventional arable uses rely on pre-plant burndown in conservation/no-till, while permanent crops use directed strips to suppress competition in orchards and vineyards; aquatic/industrial segments depend on aquatic-approved and long-interval labels for canals, rights-of-way, and utilities.

- Resistance pushes diversification everywhere, but conservation/no till acreage keeps glyphosate embedded in rotations, and emerging markets add hectares as mechanization rises, netting a steady climb in total demand even if per acre intensity edges lower in mature region.

Looking for region specific data?

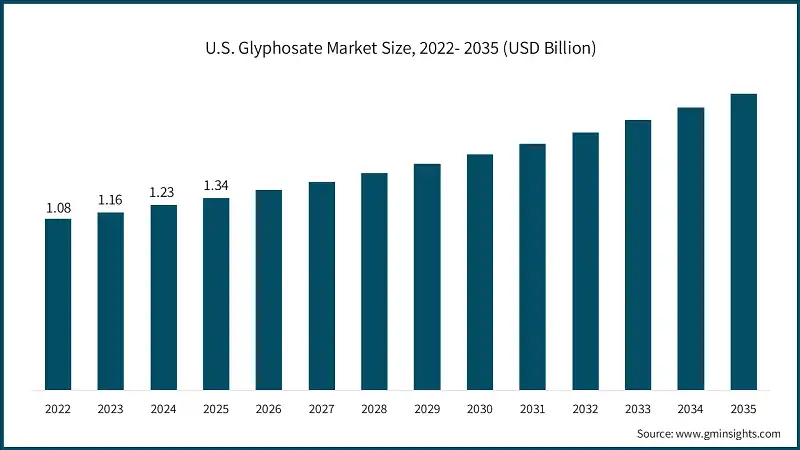

The North America glyphosate industry is growing rapidly on the global level with a market share of 23.9% in 2025.

- The North America glyphosate market is mature and highly professionalized; the U.S. glyphosate market continues to operate under EPA approvals within label directions, with endangered-species mitigations reinforcing timing, buffers, and documentation expectations.

U.S. dominates the North America glyphosate market, showcasing strong growth potential.

- The U.S. glyphosate market relies on diversified stacks in soybeans, corn, and cotton, with precision tools widely adopted to manage drift and overlaps, while the Canada glyphosate market uses burndown and harvest management in canola within evolving stewardship norms.

Europe glyphosate market leads the industry with revenue of USD 1.2 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- The Europe glyphosate market runs under a 10 year renewal through 2033, but desiccation limits and tighter buffers/drift rules have immediate program effects; several member states have layered national restrictions that push precision adoption and alternative mixes. Germany, France, and others maintain stricter local conditions, so suppliers that pair glyphosate with recordkeeping and compliant nozzles/adjuvants are better placed.

The Asia Pacific glyphosate market is anticipated to grow at a CAGR of 5.1% during the analysis timeframe.

- The Asia Pacific glyphosate market is the largest by value thanks to vast cropped area and multi cropping intensity; conservation/no till is expanding in pockets, while UAV adoption accelerates spot spray and hard to reach work (paddy margins, plantation intergrows). The China glyphosate market links demand to domestic GM corn approvals and supply to technical exports; the India glyphosate market benefits from mechanization and HT cotton adoption, with stewardship frameworks shaping growth paths.

Latin America glyphosate accounted for 5.9% market share in 2025 and is anticipated to show highest growth over the forecast period.

- Latin America remains among the most important and fastest growing regions in terms of glyphosate demand. The reason for the increasing glyphosate use is primarily due to the large amount of large scale cultivation of glyphosate resistant genetically modified (GM) crops in this region. Brazil and Argentina together represent nearly 45% of all GM soybean and corn planted in the world.

Middle East & Africa glyphosate accounted for 7% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

- Middle East and Africa (MEA) are growing steadily but more moderately than the other regions; therefore, many countries in these regions are trying to modernize their agriculture with the assistance of their governments. The countries leading this initiative are Egypt, South Africa, Kenya, and Saudi Arabia. Since the introduction of agriculture modernization programs in these countries, glyphosate markets have steadily increased.

Glyphosate Market Share, 2025

The glyphosate market is moderately concentrated, the top five suppliers hold roughly one third of global value, led by Bayer AG, with BASF, Corteva Agriscience, Syngenta Group, and FMC rounding out the group. Furthermore, originators defend price points through premium formulations, trait system integration, and stewardship programs, while Chinese technical concentrate suppliers stabilize upstream supply quality and cost after environmental upgrades.

- Bayer AG: Bayer AG continues to lead on the strength of Roundup branding, premium SLs, and trait system integration, while prioritizing professional channels in the U.S. and documenting stewardship through its digital platforms as it manages ongoing litigation provisions in 2025.

- Syngenta Group: Syngenta Group blends originator formulations with ADAMA’s value tier portfolio, creating coverage from premium to cost competitive SKUs across regions; system selling and local agronomy teams remain central to its glyphosate market strategy. FMC treats glyphosate as a foundation chemistry layered with proprietary actives (e.g., flumioxazin, pyroxasulfone, dicamba) to address resistant biotypes in the Corn Belt, Brazil’s MATOPIBA, and Australia.

- UPL: UPL leverages broad dealer networks and Arysta integration to scale cost effective generics and premixes in India, Latin America, and Africa, where smallholder affordability and access shape product design (small packs, co pack adjuvants). Nufarm’s Australasian and Americas footprint emphasizes regional formulation and service, competing on cost and local fit in the glyphosate market’s price sensitive channels.

- Zhejiang Xinan Chemical Group: Zhejiang Xinan Chemical Group is a manufacturer of bulk glyphosate and PMIDA in China with leading upstream integration capabilities and competes aggressively on price while also expanding its export markets to South America and Africa. The company is enhancing its environmental compliance capabilities in response to increasing domestic regulatory pressure.

- Albaugh, LLC: The company has a competitive advantage by providing generic formulation manufacturing services for both North America and Latin America. Its acquisition of Corteva's glyphosate facility in 2023 has increased Albaugh's economies of scale and allows them to offer a wide range of glyphosate products tailored for each respective market's individual regulations, as well as work with retail and cooperative partners to expand their market share.

Glyphosate Market Companies

Major players operating in the glyphosate market include:

- ADAMA Agricultural Solutions Ltd.

- Albaugh, LLC

- Anhui Huaxing Chemical Industry Co., Ltd.

- Arysta LifeScience

- Bayer AG

- Excel Crop Care Limited

- FMC Corporation

- Gharda Chemicals Limited

- Helm AG

- Heranba Industries Limited

- Hubei Xingfa Chemicals Group

- Jiangsu Good Harvest-Weien Agrochemical Co., Ltd.

- Jiangsu Yangnong Chemical Co., Ltd.

- Nufarm Limited

- Nutrien Ag Solutions

- Rainbow Agro

- Sinon Corporation (Taiwan)

- Syngenta Group (ChemChina)

- UPL Limited

- Zhejiang Xinan Chemical Industrial Group Co., Ltd.

Glyphosate Industry News

- In October 2024, Bayer unveiled a new formulation in the Roundup portfolio with improved Rainfastness and Drift Reduction Technology specifically tailored for Latin American countries.

- In September 2024, Albaugh LLC integrated Corteva's glyphosate business assets into its operations in both Argentina and Mexico, which will further strengthen ALBAUGH's Regional Presence in the generic glyphosate market.

- In July 2024, Syngenta Group announced they would be investing in the upgrades to their manufacturing facility located in Brazil to increase production of Touchdown formulations used for both domestic and export sales.

- In May 2024, Zhejiang Xinan Chemical Company established a new PMIDA Plant located in Anhui Province to enhance the efficiency of their backward integration of glyphosate intermediates.

This glyphosate market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2026 to 2035, for the following segments:

Market, By Product Formulation

- Technical Concentrate (TC – Powder)

- Technical Concentrate (TK – Solution)

- Soluble Liquid Concentrate (SL)

- Water Soluble Granules (SG)

- Ready-to-Use Liquids

- Aquatic & Specialty Formulations

- Others

Market, By Application

- GM Crops

- GM Corn

- GM Cotton

- GM Canola

- GM Soybean

- GM Sugar Beet

- GM Alfalfa

- Non-GM Arable Crops

- Cereal Grains

- Oilseed Crops

- Fruits & Vegetables

- Vegetables

- Fruits

- Industrial Crops

- Sugarcane

- Other Industrial Crops

- Non-Agricultural Uses

- Forestry Management

- Turf & Ornamentals

- Aquatic Areas

- Rights-of-Way (ROW)

- Commercial & Industrial Sites

- Others

Market, By End Use

- Large-Scale Commercial Farmers

- Small & Medium Farmers

- Government & Public Agencies

- Commercial Landscapers

- Industrial Vegetation Management Companies

- Residential Consumers

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the glyphosate market?

Key players include Bayer AG, Syngenta Group, UPL Limited, Zhejiang Xinan Chemical Group, Albaugh LLC, ADAMA Agricultural Solutions, Anhui Huaxing Chemical Industry, Arysta LifeScience, Excel Crop Care Limited, FMC Corporation, Gharda Chemicals Limited, Helm AG, Heranba Industries Limited, Hubei Xingfa Chemicals Group, Jiangsu Good Harvest-Weien Agrochemical, Jiangsu Yangnong Chemical, Nufarm Limited, Nutrien Ag Solutions, Rainbow Agro, and Sinon Corporation.

Which region leads the glyphosate market?

Asia Pacific is the largest market by value, while Europe generated USD 1.2 billion in revenue in 2025. North America held 23.9% market share in 2025, with the U.S. dominating through diversified stacks in soybeans, corn, and cotton.

What are the upcoming trends in the glyphosate market?

Key trends include rising biotech-driven demand from next-gen trait systems and improved supply reliability driven by consolidation and modernization in Chinese generic manufacturing.

What is the growth outlook for the Asia Pacific glyphosate market from 2026 to 2035?

The Asia Pacific glyphosate market is anticipated to grow at a 5.1% CAGR through 2035, driven by vast cropped area, multi-cropping intensity, expanding conservation/no-till practices, accelerating UAV adoption, and mechanization in countries like China and India.

What was the market share of the GM crops application segment in 2025?

The GM crops segment held 49% market share in 2025 and is expected to grow at a 5% CAGR during 2026-2035, with soybean, corn, and cotton systems using glyphosate as the base layer for weed management.

How much market share did soluble liquid concentrate formulations hold in 2025?

Soluble liquid concentrate (SL) formulations held approximately 54% market share in 2025 and are expected to grow at a CAGR of 4.7% through 2035, driven by simple handling, wide tank-mix compatibility, and premium surfactant systems improving uptake.

What is the current glyphosate market size in 2026?

The market size is projected to reach USD 7.1 billion in 2026.

What is the market size of the glyphosate in 2025?

The market size was USD 6.8 billion in 2025, with a CAGR of 4.6% expected through 2035 driven by broad-spectrum systemic performance in pre-plant burndown, in-crop applications, conservation/no-till adoption, and multi-cropping intensification.

What is the projected value of the glyphosate market by 2035?

The glyphosate market is expected to reach USD 10.7 billion by 2035, propelled by growing global food demand, GM crop expansion, penetration into emerging agricultural markets, and development of next-generation bioformulations.

Glyphosate Market Scope

Related Reports