Home > Chemicals & Materials > Specialty Chemicals > Custom Synthesis > Global Glycidol Market

Global Glycidol Market Analysis

- Report ID: GMI4818

- Published Date: Sep 2020

- Report Format: PDF

Global Glycidol Market Analysis

The market is segmented by grade into Glycidol below 95%, Glycidol 96%, Glycidol 97% and Glycidol above 97%. Glycidol 96% dominate the market and is expected to reach USD 67.63 million by 2026 owing to its increasing applications in preparation of surface-active compounds such as laundry detergents, disinfectants and cosmetic preparations. The increasing applications in skin creams, moisturizing lotions and shampoos may raise the glycidol market demand in the next few years.

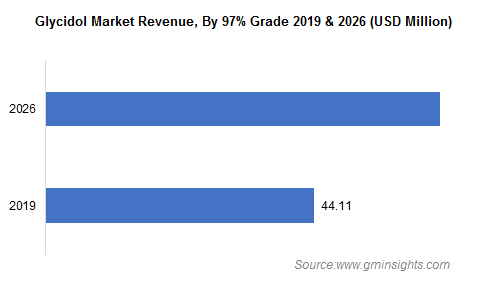

The demand for Glycidol 97% is expected to rise significantly during the assessment period owing to its increasing applications as an additive in plastic manufacturing and solvent in paint manufacturing. Furthermore, the increasing use of Glycidol 97% as a stabilizer in manufacturing vinyl polymers is likely to further raise the glycidol market share.

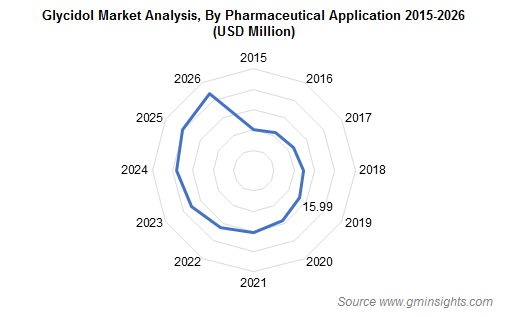

On the basis of application, it is bifurcated into production of surface-active compounds, additives in plastics, paints, photographic chemicals, pharmaceuticals, biocides, others. The increasing use of glycidol as a sterilant in the pharmaceutical industry is expected to boost the growth of the market. Furthermore, increasing applications of the product in the production of cardiac agents, antibiotics, biochemical probes, pharmaceutics with different applications may propel the glycidol market growth.

The pharmaceutical application is expected to reach USD 21.87 million by 2026 growing at a CAGR of 4.7% over the forecast period. The increasing demand for production of cardiac drugs which lower high blood pressure, restore the heart rhythm (anti-arrhythmitic) and improve the overall work of the heart muscle is likely to further raise the glycidol market demand. The increasing cases of chronic health disorders such as diabetes, blood pressure, heart diseases and obesity may raise the demand for the product in pharmaceutical drugs.

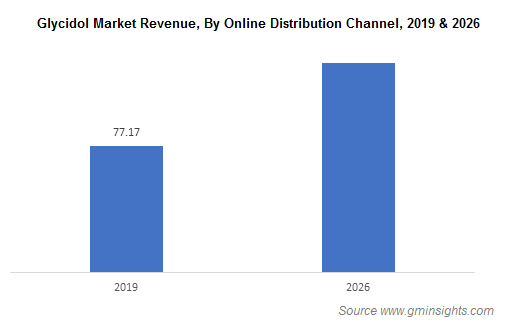

The glycidol market growth is attributed towards choice from a wide variety of different brands by comparing their prices online. Moreover, online sites also provide discounts on the purchase of these products, which is likely to attract customers. Moreover, distributors of the product such as Sigma Aldrich have started their own online portal for ease of purchase of customers.

Furthermore, many distributors of the product register themselves on online selling sites such as Molbase to enhance their reach of customers, thus boosting the growth of online distribution channel. Online distribution channel is expected to reach USD 109.29 Million by 2026 growing at a CAGR of 5.3% over the forecast period.

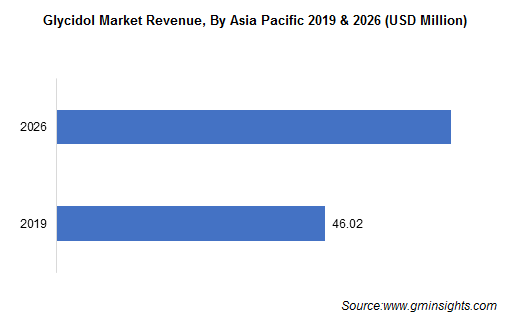

Glycidol market in Asia Pacific is expected to witness a strong growth during the forecast period owing to increasing application of the product as an additive in manufacture of vinyl polymers and as a stabilizer in manufacture of epoxy resins. The increasing production and consumption of vinyl compounds in the Asia Pacific is justified by the fact that Northeast Asia was the largest consumer of vinyl chloride monomer, accounting for over half of the world’s vinyl chloride monomer demand in 2018.

The increasing construction activities coupled with the changing consumer preference towards the purchase of cars with more vibrant colors in Asia Pacific is expected to raise the glycidol market demand from the paint industry in the region.