Summary

Table of Content

Geofencing Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Geofencing Market Size

Geofencing Market size was estimated at over USD 200 million in 2016 with a CAGR of over 28% from 2017 to 2024.

To get key market trends

The rising demand for location-based services (LBS) and increasing penetration of mobile devices are expected to support the growth of the geofencing market over the forecasted timeline. There has been a notable increase in the demand for LBS over the past five years for real-time, location-based navigation and tracking and for gathering market intelligence. A steady growth of the mobility trend among enterprises operating in a diverse range of industries will also facilitate favorable adoption of geofencing market technology over the forecast period. As businesses are becoming increasingly aware about the benefits of location-based monitoring and management of mobile resources for increasing process and workforce productivity, geofencing solutions are poised to witness rapid acceptance.

Geofencing Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2016 |

| Market Size in 2016 | 200 Million (USD) |

| Forecast Period 2017 - 2024 CAGR | 28% |

| Market Size in 2024 | 1.7 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The rising adoption of the technology in the transport and logistics sector along with increasing demand from the retail industry for proximity-based promotion and marketing will also accelerate the geofencing market growth between 2017 and 2024.

Geofencing Market Analysis

Fixed geofencing held a major share of the overall market in 2016 owing to widespread implementation of static geofences for multiple applications including advertisements, recreational activities, and asset monitoring. However, mobile geofencing allows enterprises to turn the collected situational data into actionable insights. This gives them the ability to effectively run retargeting campaigns. Dynamic geofences send out alerts to the users when certain situations of their personal interest are met. Due to these capabilities, the mobile geofencing market is expected to show promising growth over the forecast period.

The product segment dominated the geofencing market in 2016 owing to significant adoption of these solutions by different industries such as transport and logistics, retail, automotive and public sector. With companies expanding the solution capabilities in terms of analytics functions and integration with other similar location-based services, the product market holds a significant share of the overall market. However, the geofencing services market is projected to exhibit fastest growth between 2017 and 2024 owing to the consistent need for professional and managed services to efficiently operate and manage the sophisticated systems.

The promotion and advertising solutions industry held a dominant position with a market share of over 30% in 2016. This significant market share can be attributed to rising awareness among enterprises about the utility of proximity-based marketing campaigns in increasing the effectiveness of advertising functions. The technology helps in targeting customers with real-time promotional messages, once they enter the proximity of a business establishment. This enhances the ROI on marketing for these enterprises.

Within the service market, API management services held the largest market share in 2016 owing to large scale installation of geofencing solutions over the past five years. As these solutions need to be integrated with several existing systems for different business processes, the adoption of API management services has been significant since the inception of the technology. However, with rapid advancement and adoption of cloud computing, managed services are expected to witness high adoption over the forecast period. These services enable efficient management of cloud-based deployment and maintenance of geofencing solutions.

GPS technology will play a significant role in the widespread adoption of geofencing systems over the next five years. With favorable proliferation of GPS enabled mobile devices and the excellent accuracy of GPS tracking systems, they are being increasingly modernized to deliver highly accurate location-based data for an array of applications such as fleet management and asset management.

By installing GPS vehicle tracking systems, the technology helps in protecting the most valuable assets and vehicles. Using mobile device such as a smartphone or a tablet, fleet managers can monitor the location of vehicles in real-time. This enables them to take immediate action when a particular vehicle deflects from a pre-defined route. Such advanced capabilities are boosting the adoption in the transport and logistics industry.

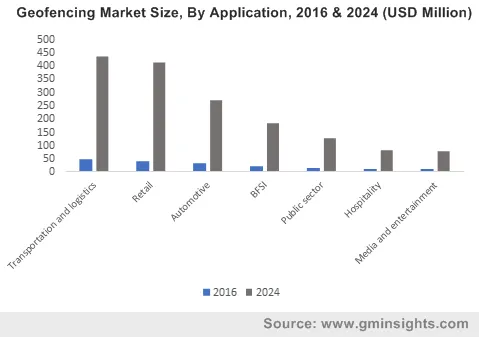

Transportation and logistics segment hold a dominant share in the geofencing market on account of large scale implementation managing large fleets across different geographic areas. With the use of geofencing, event-based triggers can be incorporated in the supply chain processes. Such triggers can be used to inform the forward supply chain for processing incoming shipments. Due to the associated benefits such as real-time coordination, higher security, and improved planning of carrier movement and deliveries, the systems are being increasingly adopted by the transportation and logistics industry.

The retail market is expected to exhibit fastest growth between 2017 and 2024 due to increasing application of the technology for strengthening proximity marketing campaigns by retailers. With the advent of the technology, retailers are increasingly using digitization to retain and increase their loyal customer base. Especially for short-term initiatives such as promotional events, retailer’s set-up geofences to enhance their customer engagement and attract more customers towards their stores.

On-premise geofencing solutions dominated the market in 2016 owing to large scale adoption of geofencing systems integrated with business process systems present on-premise. Different legacy systems for various business processes are traditionally deployed on-premise; therefore, on-premise solutions will hold a major share of the overall market by 2024. However, due to increasing popularity of cloud computing technology, cloud-based geofencing systems are expected to exhibit accelerated adoption over the forecast period.

North America is expected to dominate the geofencing market between 2017 and 2024 owing to the availability of excellent GPS infrastructure in the region and high penetration of mobile devices. As most of the brick-and-mortar retailers in the region are aggressively implementing proximity marketing strategies to compete against e-commerce business models, the adoption will grow significantly over the forecast period.

Asia Pacific, on the other hand, is expected to witness fast growth over the timeline due to increasing awareness regarding the advantages of location-based services to increase the efficiency of fleet management systems and marketing campaigns.

Geofencing Market Share

Companies operating in the business are involved in expanding the capabilities of their solutions with enhanced accuracy and integration functionalities. With aggressive promotion and marketing strategies, these players are developing solutions for a diverse set of customer segments for promotion, asset tracking, workforce management and fleet monitoring applications.

Some of the players operating in the geofencing market are:

- Apple

- Bluedot innovation

- Thumbvista

- Esri

- Embitel

- Simplifi.fi

- Gimbal

- Mapcite

- UpSnap

- Placecast

- Swirl Networks

- GeoMoby

- Localytics

- Urban Airship

- Pulsate

- PlotProjects

- Radar Labs

- DreamOrbit.

Industry Background

Geofencing has revolutionized location-based marketing and fleet management functions by allowing enterprises to define perimeters around specific locations. The technology is being used independently and also in conjunction with other similar technologies such as beacons to enhance the effectiveness of location-based services. With consistent technological advancements, geofencing market is projected to exhibit robust growth over the forecasted timeline.

Frequently Asked Question(FAQ) :

What was the geofencing market size in 2016?

The market size of geofencing was USD 200 million in 2016.

What is the anticipated growth for the geofencing industry share during the forecast period?

The industry share of geofencing is projected to witness more than 28% growth rate during 2017 to 2024.

Which type of services offered by geofencing market players will witness increased demand?

Managed services offered by geofencing providers will record significant demand owing to fast adoption of cloud computing and the need for efficient management of cloud-based deployment.

How are GPS technologies emerging as a critical part of the global geofencing industry?

GPS vehicle tracking strengthens the safety of the vehicles and other valuable assets, while allowing fleet managers to monitor real-time locations using portable devices like smartphones.

Where are geofencing technology and components expected to gain significant traction?

Geofencing will witness considerable adoption across the transport and logistics applications, as well as in the retail sector for taking advantage of proximity-based marketing and promotional activities.

What is the key benefit impacting the demand for mobile geofencing services?

Mobile geofencing is gaining momentum among enterprises as the technology enables the collection of situational data which can be converted into actionable insights for effective retargeting campaigns.

Geofencing Market Scope

Related Reports