Summary

Table of Content

Generator Sets Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Generator Sets Market Size

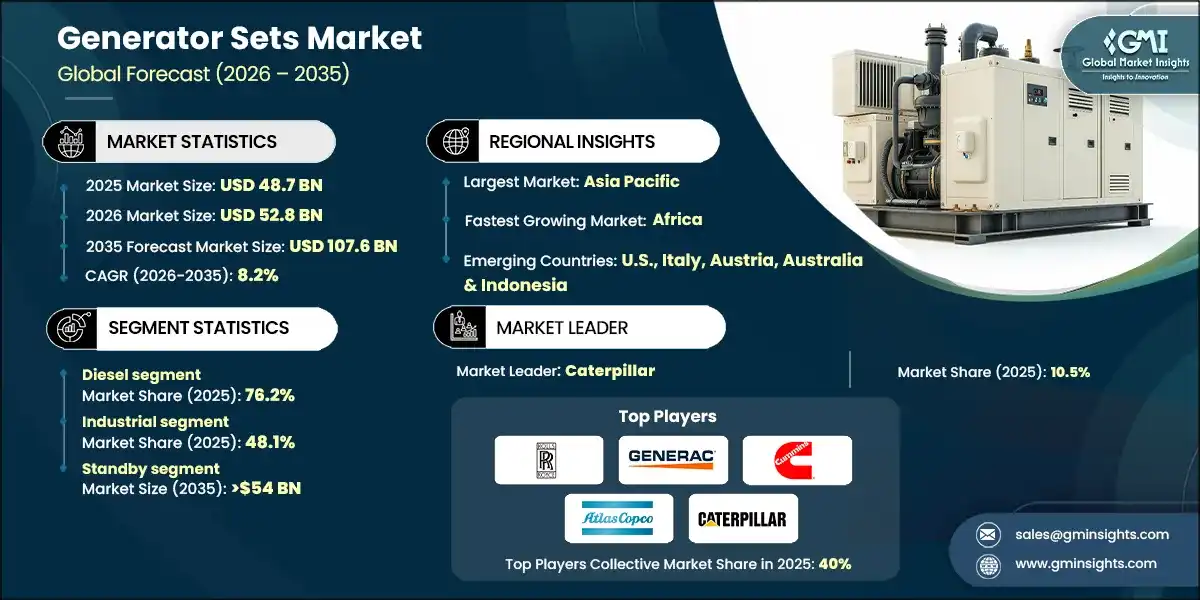

According to a recent study by Global Market Insights Inc., the generator sets market was estimated at USD 48.7 billion in 2025. The market is expected to grow from USD 52.8 billion in 2026 to USD 107.6 billion by 2035, at a CAGR of 8.2%.

To get key market trends

- Rising global electricity demand, driven by rapid industrialization and increased commercial activities, continues to strengthen the adoption of generator sets across multiple sectors. Growing dependence on uninterrupted power for data centers, telecom towers, healthcare facilities, and manufacturing plants is significantly elevating the demand for these units.

- A generator set is an integrated system that combines an engine typically diesel or natural gas with an alternator to produce electrical power. It serves as a reliable source of backup or primary electricity in locations where grid supply is unavailable, unstable, or insufficient. Gensets are widely used across industries, commercial facilities, and remote sites to ensure continuous and uninterrupted power.

- For reference, in April 2024, Aggreko was contracted by the Guam Power Authority (GPA) to deliver a 20 MW temporary power package for a period of 24 months. The deployment of these high-efficiency, ultra-low-emission generators formed a key part of GPA’s strategy to reinforce grid reliability in the island’s remote setting.

- Increasing frequency of grid failures and outage events in developing economies is accelerating the installation of diesel gensets units for emergency preparedness. Expansion of urban infrastructure, including high-rise buildings, commercial complexes, and smart-city developments, is fostering large-scale deployment of backup power solutions.

- Technological advancements enabling higher fuel efficiency, reduced emissions, and improved noise control are reshaping product development strategies in the genset industry. Integration of digital monitoring systems, IoT based performance analytics, and predictive maintenance capabilities is becoming a standard expectation among end-users.

- Shift toward hybrid generator systems that combine diesel or gas gensets with solar or battery storage is gaining traction owing to rising sustainability priorities. Growing acceptance of natural-gas-powered generators, owing to lower emissions and operational cost benefits, is influencing long-term investment decisions.

- For illustration, in November 2025, Amazon announced up to USD 50 billion to expand secure AI/HPC infrastructure for U.S. government customers including classified workloads in regions serving defense, healthcare, and public-safety agencies.

- Increasing construction of data centers worldwide, supported by cloud adoption and AI workloads, is emerging as a major demand driver for high-capacity generators. Telecommunication network expansion, especially with 5G rollout, is boosting requirements for reliable onsite power backup at distributed tower locations.

- Surging mining and oil & gas field activities in various regions are strengthening the uptake of heavy-duty generators for remote operations. Industrial modernization initiatives across emerging economies are stimulating demand for gensets for both operational continuity and peak-load management.

- Growing reliance on automation and robotics in factories requires consistent power quality, fostering wider genset deployment. Increasing adoption of microgrid supporting generators in remote and off-grid locations is creating new avenues for industry scenario. Rising focus on decarbonization is increasing interest in hydrogen ready generators and dual-fuel technologies.

- For citation, in November 2024, NVIDIA has unveiled a new set of partnerships with SoftBank Corp., aimed at advancing Japan’s sovereign AI strategy, strengthening the country’s global technology position, and opening significant AI-driven revenue opportunities for telecom operators worldwide.

- Surging demand for low-noise, environmentally compliant gensets is strengthening in urban centers where regulatory restrictions on noise and particulate matter are tightening. In addition, infrastructure development megaprojects including railways, highways, ports, and industrial parks continue to create large-volume rental and purchase demand.

- The generator sets market was valued at USD 38.9 billion in 2022 and grew at a CAGR of approximately 7.0% through 2025. Seasonal needs including monsoon-driven grid instability or peak-summer consumption spikes, are boosting the temporary power segment.

- Growing agricultural mechanization in developing countries is driving rural adoption of small to medium capacity gensets for irrigation, storage, and processing activities. Moreover, rural electrification programs across several nations are creating strong demand for standby generators during grid expansion phases.

Generator Sets Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 48.7 Billion |

| Market Size in 2026 | USD 52.8 Billion |

| Forecast Period 2026 - 2035 CAGR | 8.2% |

| Market Size in 2035 | USD 107.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing intensity & frequency of weather-related disasters | Rising climate-driven storms, floods, and outages are elevating the need for reliable backup power, thereby strengthening demand for generator sets. |

| Flourishing real estate sector & automotive industry | Expanding construction activity and the growth of automotive manufacturing hubs are increasing onsite power requirements, driving genset adoption across industrial and commercial projects. |

| Rapid industrialization & increasing infrastructural investments | Accelerating industrial growth and large-scale infrastructure development are boosting the need for high-capacity generator sets to ensure uninterrupted operations. |

| Pitfalls & Challenges | Impact |

| High capital, installation & maintenance costs | Significant upfront investment and ongoing servicing requirements remain major obstacles limiting broader deployment of generator sets. |

| Opportunities: | Impact |

| Growing shift toward hybrid & renewable‑integrated gensets | Rising sustainability goals are creating demand for gensets that pair with solar, battery storage, and smart‑energy systems, opening opportunities for cleaner, fuel‑efficient power solutions. |

| Expansion of data centers & digital infrastructure | Rapid growth in hyperscale and edge data centers is increasing the need for high‑reliability standby power, driving strong opportunities for advanced, large‑capacity generator systems. |

| Rural electrification & off‑grid power demand | Extensive electrification programs in emerging economies are boosting the requirement for dependable off‑grid power, creating a sizable market for medium‑ and high‑capacity gensets. |

| Increasing adoption in healthcare & critical facilities | Hospitals, labs, and emergency care centers are prioritizing uninterrupted power for critical operations, expanding opportunities for premium, high‑reliability diesel and gas gensets. |

| Market Leaders (2025) | |

| Market Leaders |

10.5% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Africa |

| Emerging Country | U.S., Italy, Austria, Australia & Indonesia |

| Future outlook |

|

What are the growth opportunities in this market?

Generator Sets Market Trends

- The rising occurrence of weather-related disasters including hurricanes, floods, heatwaves, cyclones, and severe storms is significantly reshaping the demand landscape for generator sets across key geographies. As climate instability escalates, power grids are increasingly exposed to physical damage and operational disruptions, resulting in prolonged outages that affect residential, commercial, and industrial activities.

- These units are becoming essential assets for ensuring energy resilience during and after such events, as they offer rapid, dependable, and self sufficient power restoration capabilities. The unpredictability of extreme weather drives households, businesses, and critical service providers to prioritize the acquisition of reliable standby systems that can sustain essential loads in emergencies.

- For illustration, in November 2025, AT&T activated newly acquired mid-band spectrum at approximately 23,000 cell sites over 5,300 U.S. cities, boosting 5G download speeds up to 80% and expanding converged mobility-plus-home-internet service coverage

- The expansion of the real estate sector across residential complexes, commercial buildings, industrial parks, and mixed-use developments is emerging as a powerful catalyst for growth in the generator sets industry. Rising urbanization growth and the proliferation of high-density structures along with the requirement for uninterrupted, stable, and high-quality power supply will foster business landscape.

- Modern buildings rely extensively on sensitive electrical systems, smart automation technologies, HVAC units, lighting frameworks, and security networks that necessitate dependable backup power solutions. In addition, these units have become integral to building designs, mandated in many regions as part of safety and operational standards.

- For citation, in August 2025, JMG Limited commissioned a 9 MW critical power ecosystem (six 1,800 kVA Mitsubishi gensets, 1,400 kVA UPS and synchronized LV panels) for the African Medical Centre of Excellence in Abuja to guarantee round-the-clock clinical operations.

- Rapid industrialization across developing and emerging economies is creating a robust and enduring demand trajectory for generator sets. Manufacturing facilities, processing plants, mining operations, and heavy-engineering units rely heavily on consistent energy availability to support machinery, automation systems, and critical production lines.

- Gensets ensure uninterrupted progress in remote or developing project sites where grid availability is limited or non-existent. As governments and private sector players continue to invest in economic-development projects, the reliance on gensets for both temporary and long-term power support increases proportionally.

Generator Sets Market Analysis

Learn more about the key segments shaping this market

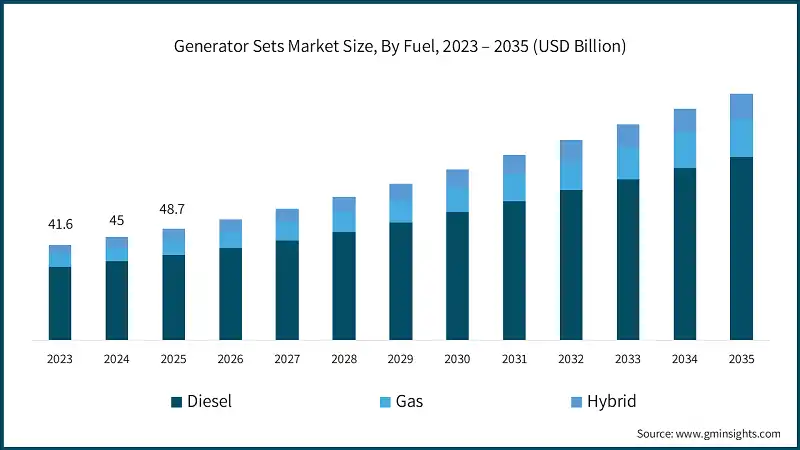

- Based on fuel, the industry is segmented into diesel, gas, and hybrid. The diesel generator sets market holds a share of 76.2% in 2025. Rising global dependence on reliable backup power in regions with unstable grid conditions continues to reinforce the demand for these gensets across industrial, commercial, and infrastructure applications.

- Technological improvements targeting lower emissions, reduced fuel consumption, and enhanced noise suppression are reshaping diesel genset design priorities. Rising demand for rapid-response power systems for disaster recovery, emergency shelters, and public-safety infrastructure is improving uptake of these units.

- The gas generator sets market is set to exceed USD 16 billion by 2035. Growing emphasis on cleaner power generation is increasing the adoption of natural-gas-based generator sets across commercial, industrial, and urban infrastructure segments.

- For reference, in December 2025, the State of Indiana and Google confirmed a USD 2 billion data center campus in Fort Wayne that is now operational, with filings noting a multi-building, 700+ acre plan and a custom demand-response program with Indiana Michigan Power.

- Lower emissions, reduced operating noise, and improved combustion efficiency are strengthening the appeal of gas generators for environmentally regulated zones. Moreover, increasing installation of these backup power units in data centers, healthcare facilities, and corporate campuses is driven by the demand for reliable, eco-friendly backup systems.

- The hybrid generator sets market was valued at USD 4.8 billion in 2025. Declining battery costs and improved storage lifecycles are making hybrid solutions economically attractive for both prime power and backup power applications. Hybrid gensets are gaining prominence in commercial and residential settings as they offer sustainable, low-noise, and low-emission alternatives to conventional power systems.

Learn more about the key segments shaping this market

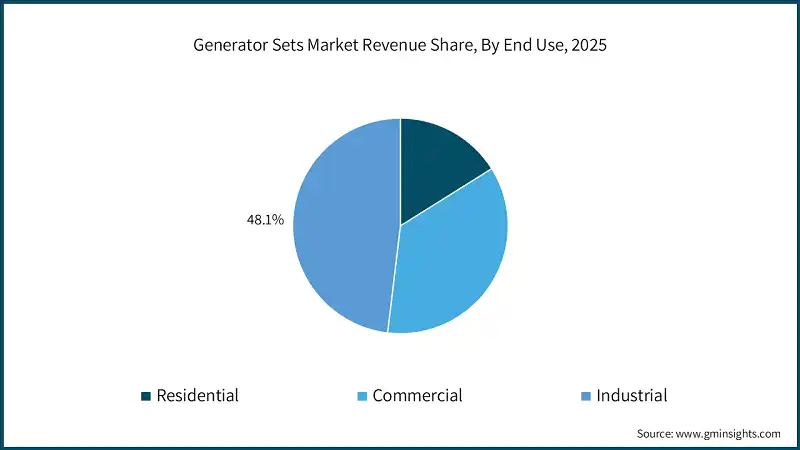

- Based on end use, the industry is divided into residential, commercial, and industrial. The industrial generator sets hold a share of 48.1% in 2025 and is set to exceed USD 50 billion by 2035. Increasing industrial automation and adoption of high-precision machinery are elevating the need for continuous, stable power, driving significant demand for high-capacity industrial generator sets.

- The commercial generator sets market was valued at USD 17.4 billion in 2025. Growing number of commercial construction projects and business parks is driving new installations of permanent standby power systems. Increasing emphasis on customer experience and service continuity is encouraging hospitality, healthcare, and entertainment sectors to use advanced, low-noise generator sets.

- For instance, in February 2025, Apple announced a USD 500 billion U.S. investment over four years explicitly including expanded data-center capacity and AI infrastructure, spanning sites in Texas, North Carolina, Arizona, Iowa and more.

- The residential generator sets market will witness a CAGR of over 8% by 2035. Increasing dependence on uninterrupted electricity for household appliances, lighting, cooling systems, and home-office setups is accelerating the adoption of compact generator sets. Increasing preference for user-friendly, low-maintenance, and automatic-start gensets is shaping product development strategies for residential applications.

- Based on application, the industry is divided into standby, peak shaving, and prime/continuous. The standby segment holds a share of 51.2% in 2025 and is set to exceed USD 54 billion by 2035. Expanding digital dependency in homes and workplaces is increasing the demand for standby units capable of delivering stable power for sensitive electronics and automated systems.

- The peak shaving generator sets market will witness a CAGR of over 8% by 2035. Growing adoption of energy-intensive manufacturing processes and heavy-load equipment is increasing the need for supplementary power sources that can balance load during consumption spikes. Growing focus on operational flexibility is driving demand for generators capable of supporting mixed load profiles and dynamic energy demands.

- For citation, in May 2025, the U.S. EPA revised its guidance on emergency-backup generator operations, allowing data-center operators to utilize generators more flexibly in grid-stability programs.

- The prime/continuous generator sets market was valued at USD 14.9 billion in 2025. Mining, oil & gas, construction, and large-scale agricultural operations increasingly rely on robust gensets that can withstand long duty cycles and high mechanical loads. Growing requirement for consistent voltage and frequency stability in precision-driven industrial processes is strengthening demand for high-quality prime-power generators.

Looking for region specific data?

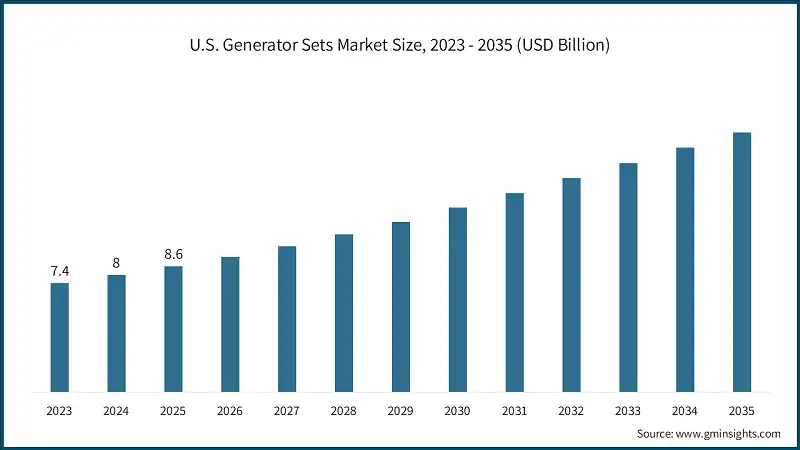

- The U.S. dominated the generator sets market in North America with around 85.8% share in 2025 and generated USD 8.6 billion in revenue. Growing frequency of extreme weather events including wildfires, hurricanes, ice storms, and heatwaves is accelerating demand for emergency backup power systems nationwide.

- The North America generator sets market is projected to surge over USD 20 billion by 2035. Expansion of mining, oil sands, and remote industrial operations in Canada continues to strengthen demand for rugged diesel and gas-powered gensets. Rising deployment of clean energy systems across the region is prompting adoption of hybrid gensets to balance renewable intermittency.

- For illustration, in July 2025, the U.S. federal government issued Executive Order 14318, accelerating the permitting and development of AI-grade data-center infrastructure. As part of this mandate, federal agencies cleared pathways for installing dispatchable, on-site backup power systems explicitly including generator-based emergency supply to support over 100 MW hyperscale campuses.

- The Europe generator sets market is set to grow at a rate of over 7.5% by 2035. Rising construction of advanced data-processing facilities and digital infrastructure is boosting demand for high-quality standby generators with superior efficiency. Expanding healthcare, transportation, and municipal infrastructure projects are incorporating gensets as part of mandatory emergency-power standards.

- The Asia Pacific generator sets market holds a share of 50.4% in 2025. Rapid industrialization, expanding manufacturing hubs, and rising commercial development are major drivers supporting high-capacity genset installations across the region. Growing electricity demand and periodic grid instabilities in densely populated nations are accelerating reliance on diesel and gas-powered backup systems.

- For reference, in January 2026, Samsung announced plans to invest USD 300 million in constructing a new data center in eastern South Korea. The project will be led by Samsung SDS, the company’s IT services arm, which will develop the facility in Gumi, North Gyeongsang Province.

- The Middle East generator sets market is set to grow at a rate of over 9.5% by 2035. Increasing focus on energy diversification is encouraging deployment of gas-powered and hybrid generator systems in both urban and industrial settings. High temperatures and harsh environmental conditions drive the need for robust gensets with enhanced cooling and endurance capabilities.

- The Africa generator sets industry was valued at USD 3.2 billion in 2025. Frequent grid instability, limited electrification in rural areas, and periodic supply shortages are driving strong demand for standby and prime-power generator sets. Rapid urban development, expansion of commercial centers, and growth of small- to medium-scale industries are elevating genset adoption.

- For instance, in July 2025, MTN South Africa committed USD 18.31 million to upgrade Gauteng’s telecom infrastructure adding base stations, battery and generator capacity, and site security within a national USD 270 million program to harden the network against power disruptions.

- The Latin America generator sets market will exceed USD 4.5 billion by 2035. Increasing commercial development in retail, hospitality, and logistics sectors is enhancing the need for reliable auxiliary power solutions. Greater emphasis on reducing operational costs is promoting adoption of gas-based and hybrid generator options in high-fuel-price regions.

Generator Sets Market Share

- The top 5 players in generator sets market are Rolls-Royce, Generac Power Systems, Cummins, Atlas Copco, and Caterpillar contribute around 40% of the market share in 2025. The market is highly competitive, with global players focusing on fuel efficiency, durability, and advanced engine technologies to differentiate their offerings.

- Rolls Royce, through its MTU division, maintains a strong competitive position in the generator sets market by offering high-capacity diesel and gas power solutions engineered for demanding applications. The company is recognized for its advanced engine technology, delivering high efficiency, low emissions, and superior long duration performance.

- Generac Power Systems stands out as a market leader in residential and light-commercial generator solutions, supported by strong brand recognition and an expansive dealer and service network. The company’s focus on automatic home standby generators has made it a preferred choice for households seeking dependable backup power.

- Cummins holds a powerful global presence in the generator sets market, driven by its vertically integrated approach in designing both engines and generator systems. Known for fuel efficiency, durability, and reliable performance, Cummins serves a wide customer base ranging from residential users to large industrial facilities and critical infrastructure.

- Atlas Copco maintains a strong competitive edge in portable, mobile, and temporary generator solutions, offering compact, rugged, and highly fuel-efficient units suitable for construction, mining, events, and rental applications. The company’s designs emphasize mobility, ease of operation, and reduced maintenance requirements, making its products highly attractive in dynamic work environments.

- Caterpillar is regarded as one of the most influential players in the generator sets market, particularly in high-capacity industrial and commercial applications requiring exceptional reliability. The company’s gensets are known for their rugged construction, long operational life, and strong performance under extreme environmental and load conditions.

Generator Sets Market Companies

- In the first nine months of 2025, Caterpillar reported total revenue of USD 48.5 billion. Based on the figures you provided, the company allocated about USD 1.6 billion to research and development during this period. Its operating profit reached approximately USD 8.5 billion, with profit before tax also reported at around USD 8.5 billion. Together, these metrics reflect strong operational performance and sustained investment in innovation throughout the year.

- In the first nine months of 2025, Cummins generated revenue of USD 25.1 billion, reflecting solid operational activity during the period. The company recorded a gross margin of USD 6.6 billion, supported by steady demand across its engine and power-generation businesses. Its research and development spending amounted to USD 1 billion, highlighting an ongoing commitment to technological advancement. Additionally, Cummins achieved an operating income of USD 3.2 billion, demonstrating healthy profitability across its core operations.

- In the first nine months of 2025, Atlas Copco reported USD 13.7 billion in revenue, reflecting steady performance across its business segments. During this period, the company achieved EBITA of USD 3 billion, supported by strong operational efficiency. Its operating profit reached USD 2.8 billion, indicating solid profitability across core activities. The firm also recorded profit before tax of USD 2.8 billion, highlighting consistent financial strength throughout the year.

Major players operating in the generator sets market are:

- Aggreko

- American Honda Motor

- ASHOK LEYLAND

- Atlas Copco

- Briggs & Stratton

- Caterpillar

- Cummins

- Deere & Company

- FG Wilson

- Generac Power Systems

- Greaves Cotton

- HIMOINSA

- HUU TOÀN GROUP

- J C Bamford Excavators

- Kirloskar

- MAHINDRA POWEROL

- Mitsubishi Heavy Industries

- Rehlko

- Rolls-Royce

- Sterling and Wilson

- Sudhir Power

- Supernova Genset

- Wärtsilä

- Yamaha Motor

- YANMAR HOLDINGS

Generator Sets Industry News

- In November 2025, Briggs & Stratton has unveiled EnergyTrak, its next-generation monitoring platform for standby generators, marking a significant upgrade in how dealers oversee and maintain power systems. The platform has been completely rebuilt to streamline fleet management and enhance service operations, offering a more reliable architecture and delivering advanced, data-driven insights that technicians previously could not access in the field.

- In October 2025, Atlas Copco has unveiled its EPH series of modular hybrid power generators, introducing a modern alternative to conventional diesel units. Engineered to significantly lower fuel use and operational expenses, these intelligent systems deliver reliable, on-demand power for off-grid operations while meeting stricter energy and sustainability expectations. The EPH lineup marks a major advancement in off-grid energy, combining the strengths of a traditional diesel generator with a battery energy storage system (BESS) and optional integration with renewable sources such as solar.

- In August 2025, Aggreko introduced its new 400 kW Tier 4 Final diesel generator to the North American market, extending its Greener Upgrades portfolio aimed at advancing cleaner energy solutions. The unit is engineered to deliver dependable industrial-grade power while cutting emissions, enhancing operational efficiency, and lowering overall operating costs all in alignment with stringent environmental standards. This launch reinforces Aggreko’s commitment to supporting customers through a more sustainable energy transition with modern, compliant, and cost-efficient power-generation technology.

- In August 2025, Caterpillar introduced the Cat D1500 DG set, a high-power, compact solution delivering 1.5 MW of standby output from its 32.1 liter C32B engine. Engineered for space-restricted environments, the unit provides exceptional power density while occupying up to 13% less floor space and weighing as much as 32% less than its predecessor, making installation more flexible and cost-efficient. The lighter design not only eases transport and handling but also reduces structural and setup requirements, offering customers meaningful savings across logistics and deployment.

The generator sets market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) and volume (‘000 Units) from 2022 to 2035, for the following segments:

Market, By Power Rating

- ≤ 50 kVA

- > 50 kVA - 125 kVA

- > 125 kVA - 200 kVA

- > 200 kVA - 330 kVA

- > 330 kVA - 750 kVA

- > 750 kVA

Market, By Fuel

- Diesel

- Gas

- Hybrid

Market, By End Use

- Residential

- Single family

- Multi family

- Commercial

- Telecom

- Healthcare

- Data centers

- Educational institutions

- Government centers

- Hospitality

- Retail sales

- Real estate

- Commercial complex

- Infrastructure

- Others

- Industrial

- Oil & gas

- Manufacturing

- Construction

- Electric utilities

- Mining

- Transportation & logistics

- Others

Market, By Application

- Standby

- Peak shaving

- Prime/continuous

Market, By Sales Channel

- Online

- Dealer

- Retail

The above information has been provided for the following regions & countries:

- North America

- U.S.

- Canada

- Europe

- Russia

- UK

- Germany

- France

- Spain

- Austria

- Italy

- Asia Pacific

- China

- Australia

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Philippines

- Myanmar

- Middle East

- Saudi Arabia

- UAE

- Qatar

- Turkey

- Iran

- Oman

- Africa

- Egypt

- Nigeria

- Algeria

- South Africa

- Angola

- Kenya

- Mozambique

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

Frequently Asked Question(FAQ) :

Who are the key players in the generator sets market?

Key players include Aggreko, American Honda Motor, ASHOK LEYLAND, Atlas Copco, Briggs & Stratton, Caterpillar, Cummins, Deere & Company, FG Wilson, Generac Power Systems, Greaves Cotton, HIMOINSA, HỮU TOÀN GROUP, J C Bamford Excavators, Kirloskar.

Which region leads the generator sets market?

The U.S. dominated the generator sets market in North America with around 85.8% share in 2025 and generated USD 8.6 billion in revenue.

What are the upcoming trends in the generator sets market?

Key trends include shift toward hybrid systems combining diesel/gas with solar or battery storage, IoT-enabled monitoring and predictive maintenance, adoption of natural gas-powered generators, hydrogen-ready technologies, and integration with renewable energy systems.

What is the growth outlook for standby application from 2025 to 2035?

Standby segment held 51.2% share in 2025 and is set to exceed USD 54 billion by 2035, driven by expanding digital dependency and demand for stable power for sensitive electronics.

What was the valuation of industrial end-use segment in 2025?

Industrial generator sets held 48.1% market share in 2025 and is set to exceed USD 50 billion by 2035.

How much market share did the diesel segment hold in 2025?

Diesel generator sets held 76.2% market share in 2025, driven by rising global dependence on reliable backup power in regions with unstable grid conditions.

What is the current generator sets market size in 2026?

The market size is projected to reach USD 52.8 billion in 2026.

What is the market size of the generator sets in 2025?

The market size was USD 48.7 billion in 2025, with a CAGR of 8.2% expected through 2035 driven by rising global electricity demand from rapid industrialization and expanding commercial activities.

What is the projected value of the generator sets market by 2035?

The generator sets market is expected to reach USD 107.6 billion by 2035, propelled by increasing frequency of weather-related disasters, data center expansion, and growing need for reliable backup power systems.

Generator Sets Market Scope

Related Reports