Summary

Table of Content

Generative AI Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Generative AI Market Size

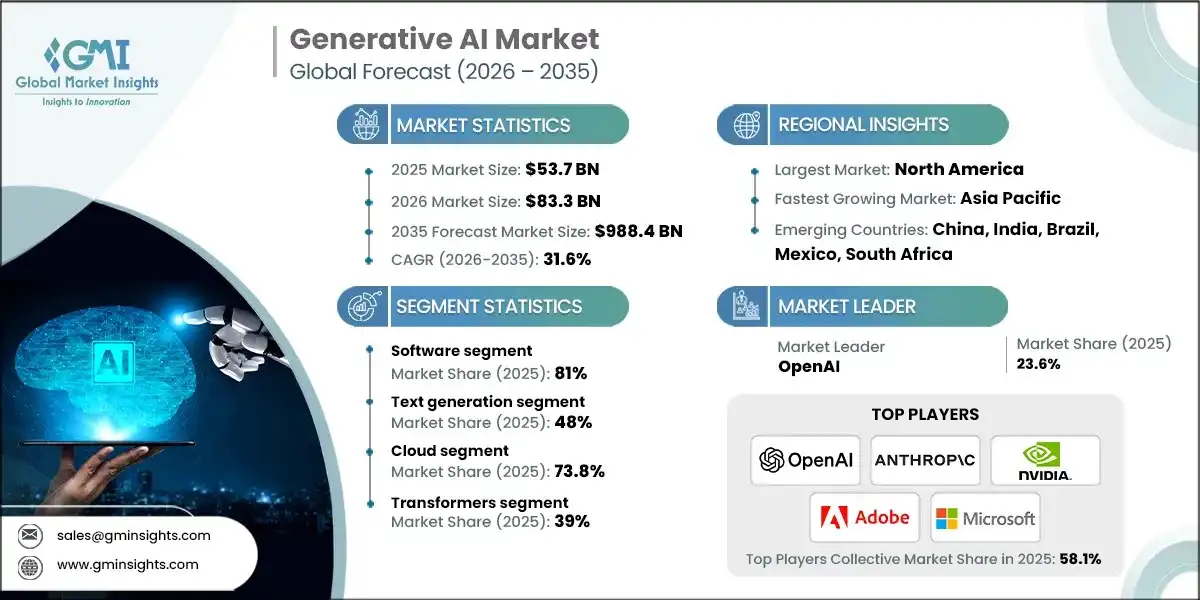

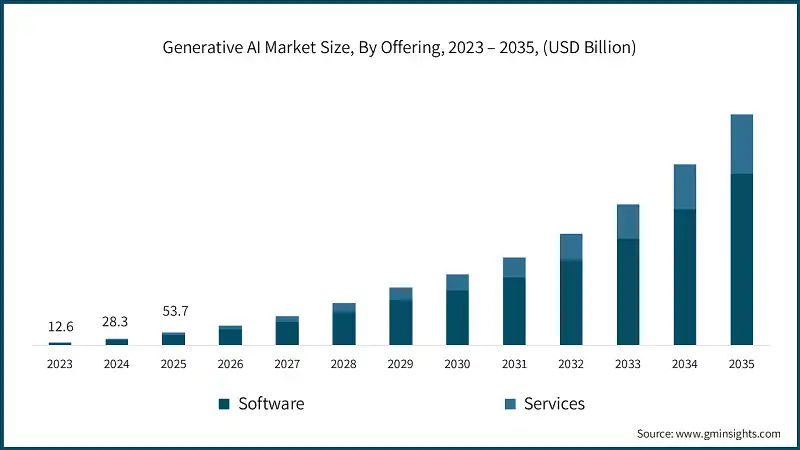

The global generative AI market was valued at USD 53.7 billion in 2025. The market is expected to grow from USD 83.3 billion in 2026 to USD 988.4 billion in 2035 at a CAGR of 31.6%, according to latest report published by Global Market Insights Inc.

To get key market trends

Enterprises everywhere are turning to generative AI’s unique capability to help streamline workflows, accelerate time-to-decision and eliminate manual work across business segments. For instance, in December 2025, Cognizant, TCS, Infosys and Wipro undertook to deploy more than 200,000 Microsoft Copilot licenses combined illustrating the significant enterprise market demand for AI-enabled automation work at scale.

Continued progress in computation infrastructures, dedicated AI chips and model structures lead generative AI to a higher level of performance and scale. “With faster processing times, increased efficiency and more sophisticated algorithms, businesses can run increasingly complex AI applications, manipulate larger data sets and develop new products across sectors fastening adoption rates and widening the generative AI market.”

Increased volumes of structured and unstructured digital data increase the training and affordances of generative AI which can produce richer outputs and industry-specific solutions. For example, global companies increasingly employ AI to produce personalized content, marketing insights and data-driven recommendations at various points across customer engagements and operational analytics to drive more profound value from AI.

Strategic investments and partnerships between AI leaders and enterprise software providers are accelerating market growth. These collaborations enable enterprises to integrate generative AI into core business workflows, improve productivity, and unlock new use cases across analytics, customer service, and software development, thereby expanding adoption and driving sustained market momentum.

For instance, on October 14, 2025, Salesforce expanded its partnerships with OpenAI and Anthropic, integrating advanced models like GPT-5 and Claude into its Agent force 360 platform to enhance enterprise workflows, analytics, and AI-powered automation.

Generative AI Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 53.7 Billion |

| Market Size in 2026 | USD 83.3 Billion |

| Forecast Period 2026 to 2035 CAGR | 31.6% |

| Market Size in 2035 | USD 988.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increased Demand for Automation and Efficiency | Drives adoption of generative AI across enterprises to reduce costs, improve efficiency, and scale operations faster. |

| Advancements in Computation Power and Algorithms | Enhances model performance and lowers deployment barriers, accelerating commercialization and market growth. |

| Explosion of digital data availability | Enables training of more accurate and capable generative models, expanding use cases across industries. |

| Growing enterprise investment & adoption | Sustains long-term market expansion through widespread implementation in marketing, software development, healthcare, and customer service. |

| Pitfalls & Challenges | Impact |

| Data privacy, security & regulatory concerns | Constrains deployment in regulated industries and increases compliance costs, slowing market penetration. |

| High infrastructure & compute costs | Limits profitability and slows adoption among smaller enterprises, increasing reliance on hyperscale cloud providers. |

| Opportunities: | Impact |

| Integration with existing enterprise software & workflows | Enhances productivity and stickiness of AI platforms, increasing customer lifetime value. |

| Expansion into new industry verticals | Opens large, untapped markets for tailored AI solutions, driving incremental revenue growth. |

| Development of multimodal AI capabilities | Enables innovative applications and differentiated offerings, creating competitive advantage. |

| SME adoption and democratization of AI tools | Broadens market reach beyond large enterprises, accelerating overall market size and platform adoption. |

| Market Leaders (2025) | |

| Market Leaders |

23.6% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Generative AI Market Trends

Generative AI is evolving from text-only systems to multimodal models which can understand and generate text, image and audio in a unified workflow. This advancement will enable richer content creation and improve analytical capabilities. Generative AI will move beyond just simple chat bots, and expand to being used for content creation, marketing and decision-support applications in enterprises.

For instance, Google released Gemini 2.5 flash image in august 2025. This release introduced advanced multimodal capabilities for creating and editing images within the Gemini generative AI family of models. The Gemini 2.5 flash image model will create detailed images based on user's natural language prompts and include more rich visual workflows. This will open up greater enterprise and creative applications of the Gemini 2.5 flash image model.

Enterprises are growing to invest in customized generative AI models that are tailored to their industry data and workflows, and these models provide more accurate, compliant solutions for vertical-usage cases, such as legal, medical and industrial contexts. This strong trend allows enterprises to differentiate themselves from one another and provide a specialized value to their customers, this will increase demand for customized generative AI solutions in all sectors.

Autonomous AI agents that can plan, reason, and execute complex tasks are becoming a key trend, replacing simple retrieval-augmented systems with proactive workflows that help complete business processes. This is transforming service-oriented software into intelligent task executors capable of acting on insights rather than just presenting them.

More companies are integrating generative AI directly into core business processes rather than just testing pilots, embedding “AI-first” capabilities into productivity stacks and decision support tools. This shift is reshaping software development, automation, and operational strategies, signaling that businesses see generative AI as essential infrastructure for innovation and competitive advantage rather than a one-off experiment.

Generative AI Market Analysis

Learn more about the key segments shaping this market

Based on offering, the market is divided into software and services. The software segment dominated the market, accounting for 81% in 2025 and is expected to grow at a CAGR of 30.5% through 2026 to 2035.

- Generative AI software encompasses development platforms, pre-trained models, APIs, and application tools that enable enterprises to build, deploy, and scale AI capabilities across functions. In 2025, software dominated the market, reflecting its essential role in enabling automation, content generation, language processing, and analytics across industries. Software’s scalability and integration edge make it the better of GenAI adoption.

- For instance, in 2025, Microsoft significantly expanded Copilot product across multiple platforms like Microsoft 365, GitHub, and Dynamics to include generative AI in different business and software development workflows. In 2025 AWS developed the Bedrock platform, which allowed businesses to use many different foundational models of generative AI through one software platform further demonstrating that software is the main aspect of the generative AI Software Industry.

- Generative AI services include consulting, system integration, customization, training, governance, and ongoing model optimization. As enterprises move from pilots to production, services play a critical role in aligning AI models with proprietary data, regulatory requirements, and operational processes, making them essential for large-scale and responsible AI adoption.

- The services segment is expected to grow steadily as enterprises demand ongoing optimization, AI lifecycle management, and responsible AI frameworks. Management services, advisory support and continuous process improvements around generative AI will remain in long-term demand because AI systems are becoming complicated approaching regulation scrutiny and also since they need customization to specific fields.

Learn more about the key segments shaping this market

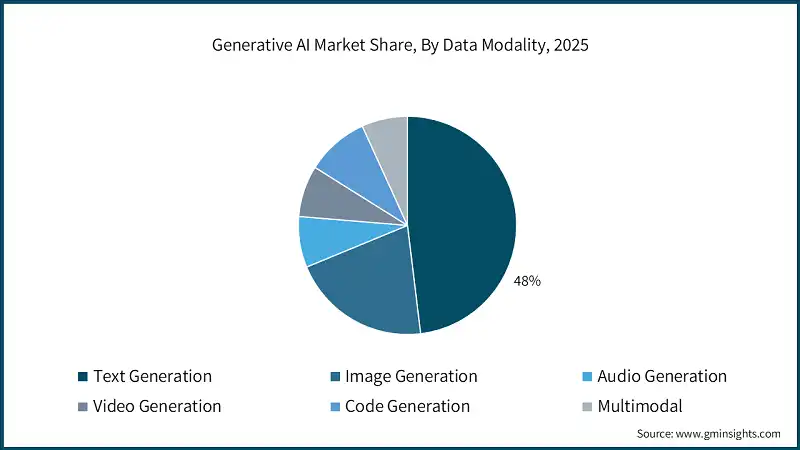

Based on data modality, the generative AI market is segmented into text generation, image generation, audio generation, video generation, code generation, and multimodal models. Text generation segment dominates the market with 48% share in 2025 and is expected to grow at a CAGR of 28% from 2026 to 2035.

- Text generation is driven by widespread use in chatbots, content creation, search, customer support, and enterprise productivity tools. Its maturity, scalability, and immediate ROI make it the most adopted modality across industries such as BFSI, retail, healthcare, and IT services.

- Image generation enables the creation of visuals, illustrations, marketing assets, and design prototypes using text prompts, significantly improving creative efficiency. This modality is widely adopted in advertising, media, e-commerce, and product design, allowing brands to reduce production costs while accelerating content turnaround and personalization.

- Video generation is expected to record the highest CAGR from 2026 to 2035, driven by rising demand for automated video content in marketing, training, entertainment, and social media. Advances in model quality, realism, and motion consistency are enabling scalable video creation without traditional production complexity.

- Code generation focuses on automating software development tasks such as code writing, debugging, testing, and documentation. It enables developers to be more productive in their work, shortens development cycles and supports corporate modernization efforts-all valuable effects for both IT teams which should increasingly find their way into digital transformation initiatives as well.

Based on deployment, the generative AI market is segmented into cloud and on premises. The cloud segment dominates the market with 73.8% share in 2025 and is expected to grow at a CAGR of 32.5% from 2026 to 2035.

- Cloud-based deployment dominates the generative AI industry, due to the properties of Cloud (Scalability, Flexibility, and less upfront requirement for infrastructure), the rapid deployment of generative AI applications to enterprises is a main driver of Cloud usage. The availability of advanced foundation models from many Cloud providers and the ability to integrate seamlessly into existing digital ecosystems is significant in the adoption of Cloud technology for generative AI applications. As a result, Cloud technology will be the default choice for both startups and larger enterprises when deploying generative AI applications.

- The demand for real-time AI processing and continuous model updates, as well as the increasing global presence of cloud infrastructure like Hyperscale will result in strong growth in cloud deployment in the years to come. As more organizations begin using AI-as-a-Service (AIaaS), the growth of their Hyperscale Cloud Infrastructure will reinforce Cloud Deployment as the primary platform for deploying generative AI solutions.

- The on-premises deployment model provides a secure and compliant environment for companies that require high levels of data governance, security, and industry regulatory compliance (e.g., Banking, Financial Services, and Insurance (BFSI), Healthcare, Government, and Defense). Companies with sensitive or proprietary information will favor an on-premises. Generative AI product due to the ability to maintain privacy, reduce exposure to data breaches, and adhere to strict compliance regulations.

- The on-premises deployment model has an anticipated growth pattern based on the advancements in AI hardware, edge computing, and hybrid platform technology. Therefore, businesses that want more customization, more predictable pricing, and to lessen the amount of dependence on external cloud resources will continue to invest their capital on deploying on-premises and hybrid generative AI.

Based on technology, the market is segmented into generative adversarial networks (GANs), transformers, variational auto-encoders, diffusion networks, and others. The transformers segment is expected to dominate the market with a share of 39% in 2025.

- Generative adversarial networks (GANs) are used for generating realistic images, creating synthetic datasets, and as a basis for many simulation technologies. Many different industries use GANs for generating synthetic data and visually realistic images in the media, video game and medical imaging industries, as well as design workflows where visual realism and data augmentation are important. Through the use of GANs, companies have supported the training of models and creative experimentation in their business practices using these technologies.

- Transformers represent the majority of the generative AI industry because they have a significant advantage over other AI technologies when it comes to the ability to process large-scale sequential data quickly and efficiently. This makes transformers a leading technology when it comes to how businesses generate text as well as develop conversational AI, generate code and create multi-modal systems. Companies can use generative transformers to deploy scalable, high-performance AI in their productivity, analysis, and customer engagement platforms.

- variational auto-encoders require a stable representation learning, they can be used for anomaly detection and for probabilistic data modelling. Since they create structured output, they may be used in applications such as healthcare diagnostic systems, recommendation systems, compression of large datasets, and support enterprise use cases that require a high level of interpretability and reliability.

- Due to their superior output quality, stability and consistency when compared to the previously established generative methods, diffusion networks are rapidly becoming a popular choice for generating HD images and videos. With the ability to control detail levels, they create highly realistic visuals, making them perfect for creative design, advertising, digital media production, gaming and simulations. Additionally, as companies' quality expectations continue to increase, the iterative refinement of produced outputs enabling more creative flexibility and increasing adoption in enterprises.

Looking for region specific data?

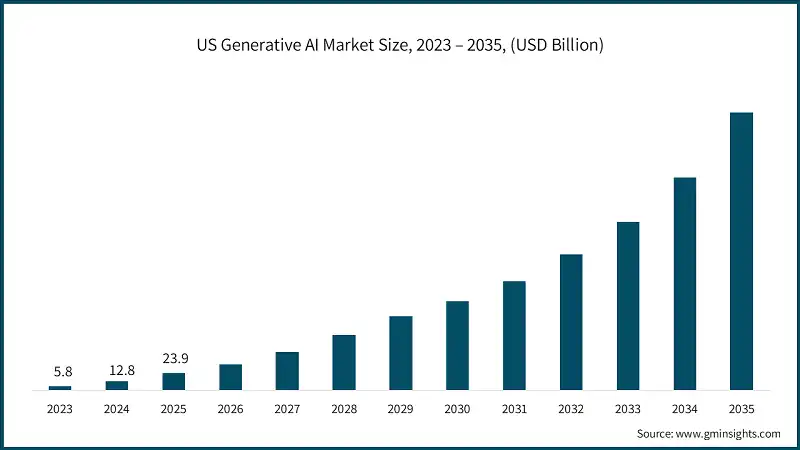

The U.S. generative AI market reached USD 23.9 billion in 2025, growing from USD 12.8 billion in 2024.

- The U.S. market is rapidly transitioning toward widespread adoption of generative AI across enterprises, startups, and digital services. Organizations are increasingly embedding AI into core workflows to enhance productivity, automate repetitive tasks, and accelerate innovation across sectors such as healthcare, retail, BFSI, and media.

- Enterprises are leveraging generative AI to enhance productivity, automate repetitive tasks, and accelerate innovation. Industries such as BFSI, healthcare, media, and retail are implementing AI-powered tools for customer support, data analysis, and creative solutions, making AI a critical component of digital transformation initiatives and strategic business operations in the US market.

- The rise of multimodal and video-focused generative AI models is enabling richer and more immersive applications, from interactive marketing campaigns to AI-assisted media production.Organizations are adopting these tools to generate realistic images, videos, and simulations, supporting faster content development cycles and personalized experiences for consumers and business clients.

- Consumer and enterprise adoption of generative AI tools continues to expand, with nearly 46% of US internet adults used at least one AI tool in late 2025, including ChatGPT, Gemini AI, and Copilot, highlighting both individual and corporate uptake of AI technologies. As usage widens, demand for tailored, high-quality generative solutions will further drive growth and innovation in the US market.

North America dominated the generative AI market with USD 25.05 billion in 2025.

- The generative AI industry is primarily driven by North America. In 2025, the fastest-growing markets for Artificial Intelligence (AI) will be those where both established technology companies and numerous startups are present along with a large number of organizations that have adopted AI into their workflows (i.e., the use of Machines Learning/Machine Intelligence). All businesses within various sectors of the economy are starting to adopt AI as part of the standard operation for their ongoing business operations to become more efficient through increased productivity, enhanced analytics, generated creative content and automated processes.

- Generative AI enables enterprises to create innovative solutions in healthcare, banking, financial services and insurance (BFSI), retail, media and software development. AI adoption is moving beyond pilot projects, with businesses embedding AI-first capabilities into decision-making, operational processes, and customer engagement platforms to create measurable business impact.

- Partnerships between AI developers and cloud service providers with North American businesses are driving the acceleration of Advanced AI Deployment today. Section 2 provides an overview of the factors driving the growth of advanced AI technologies. A scalable cloud infrastructure provides faster and ongoing access to APIs (application programming interfaces) and offers set of services that form partnerships with North American businesses to rapidly deploy, continuously update and develop customized AI solutions specific to their industries on demand.

Europe generative AI market accounted for a share of 18.69% and generated revenue of USD 10.04 billion in 2025.

- Enterprises in Europe are deploying generative AI for content creation, analytics, software development, and marketing automation. The adoption is influenced by a combination of digital transformation initiatives and competitive pressures, prompting companies to embed AI-first capabilities into decision-making, operational workflows, and customer-facing applications.

- Regulatory frameworks across Europe are shaping responsible AI deployment, with a focus on ethical use, data privacy, and algorithmic transparency. Enterprises are implementing bias mitigation, governance, and compliance strategies to align with EU AI regulations, including the AI Act, ensuring trustworthy AI adoption while supporting innovation.

- European organizations are increasingly collaborating with AI solution providers, cloud vendors, and startups to customize generative AI models for regional languages, industry-specific use cases, and multi-modal applications. This trend is driving advanced model deployment in sectors such as finance, healthcare, manufacturing, and media, while expanding overall AI market penetration across the region.

Germany dominates the generative AI market, showcasing strong growth potential, with a CAGR of 31.8% from 2026 to 2035.

- Enterprises in Germany are adopting generative AI for advanced content creation, software development, and analytics, leveraging AI models to optimize workflows and support decision-making. The growing interest in AI-driven solutions is fueled by competitive pressures, research collaborations, and government initiatives supporting AI innovation and adoption.

- German organizations are placing strong emphasis on AI tools that support multi-lingual and industry-specific applications, including engineering simulations, predictive analytics, and automated customer support. These solutions are designed to meet high standards of reliability, precision, and performance, aligning with Germany’s reputation for quality and efficiency in technology deployment.

- Digital platforms and AI-as-a-service offerings are increasingly being used by German enterprises to integrate advanced models without heavy upfront infrastructure costs. This enables faster deployment, real-time model updates, and flexible customization of AI solutions, strengthening business operations and fostering greater adoption of generative AI across sectors.

The Asia Pacific generative AI market is anticipated to grow at the highest CAGR of 35.3% from 2026 to 2035 and generated revenue of USD 13.9 billion in 2025.

- Across the Asia pacific, organizations in sectors such as BFSI, healthcare, retail, and media are increasingly deploying generative AI for content creation, predictive analytics, customer support automation, and process optimization. Governments and private enterprises are investing in AI research, infrastructure, and pilot programs, leading to an expanding ecosystem of AI developers, solution providers, and cloud service collaborators.

- Many companies in Asia Pacific are integrating multimodal and domain-specific generative AI models tailored to local languages, cultural context, and industry requirements. These AI systems support text, image, video, and code generation, enabling more personalized solutions for users and facilitating localized use cases in e-commerce, digital entertainment, and enterprise software.

- The rapid evolution of cloud infrastructure and regional data centers is enabling faster deployment and scaling of generative AI solutions without heavy upfront investment in computing resources. This trend is supported by partnerships between global cloud providers and local technology firms, making advanced models more accessible to mid-sized and large enterprises throughout Asia Pacific.

China generative AI market is estimated to grow with a CAGR of 36.8% from 2026 to 2035.

- In China, the generative AI industry has experienced an exponential surge in adoption, driven by domestic foundational models such as DeepSeek-R1 and Alibaba’s Qwen, which have achieved technical parity with global leaders through advances in reasoning efficiency and model architecture. Enterprises are increasingly integrating AI into workflows for content creation, automation, and decision-making across finance, manufacturing, and healthcare sectors.

- Furthermore, as the need for enterprise-grade AI products continues to grow, the government has begun to promote the use of such technologies through its “AI Plus” initiative, as well as providing funding for the creation of specialized models that address areas like coding and bilingual communications, thereby helping narrow the gap between the performance of Western companies and their Asian counterparts. These efforts support the expansion of AI into robotics, manufacturing, and healthcare where low-latency processing and high security are critical.

- For instance, Baidu’s ERNIE 4.5 and X1 Models were introduced in 2025 to provide enterprise and consumer applications with multimodal, reasoning-enhanced capabilities. Similarly, ByteDance’s AI assistant Doubao reached over 157 million monthly active users, demonstrating the rapid consumer adoption of generative AI across China’s mobile ecosystem.

Latin America generative AI market shows lucrative growth over the forecast period.

- The Latin America market is gaining momentum as enterprises and public sector organizations adopt AI to enhance productivity, digital services, and customer engagement. Countries such as Brazil, Mexico, and Argentina are seeing increasing deployment of language, content, and analytics-driven AI solutions tailored to local languages and business needs, reflecting broader digital transformation efforts across the region.

- Regional businesses are leveraging generative AI for marketing automation, customer support, e-commerce personalization, and process optimization to compete more effectively in both domestic and global markets. Cloud adoption is supporting faster implementation of scalable AI models without heavy upfront infrastructure investment, enabling mid-sized and enterprise organizations to accelerate their digital agendas.

- The rapid integration of AI across Brazil, Mexico, and Chile has created an urgent need for specialized industry models. These systems require specific design considerations, such as cross-border regulatory compliance, low-bandwidth optimization for rural connectivity, and localized data residency to meet evolving privacy standards.

Brazil generative AI market is estimated to grow with a CAGR of 35.1% from 2026 to 2035 and is expected to reach USD 11.35 billion by 2035.

- Brazil’s market is witnessing rapid growth, driven by strong government support and enterprise adoption across multiple industries. The increasing demand for digital sovereignty and localized AI solutions has led to the launch of the Brazilian Artificial Intelligence Plan (PBIA) 2024–2028, a R$23 billion (~$4 billion) national strategy aimed at developing sovereign large language models (LLMs) in Portuguese and upgrading national data center infrastructure.

- The rapid adoption of generative AI across Brazil’s key sectors has created a pressing need for industry-specific applications. In agribusiness, AI is being used to optimize crop yields through predictive modeling, while in energy, Petrobras has deployed generative AI assistants to over 110,000 employees to streamline technical documentation, operational workflows, and knowledge management.

- Local enterprises are increasingly collaborating with cloud providers and AI startups to accelerate AI adoption. These partnerships enable faster deployment of customized generative AI solutions, strengthen data infrastructure, and support scalable workflows across sectors such as finance, healthcare, and telecommunications, reinforcing Brazil’s position as a regional AI leader.

The Middle East and Africa generative AI market accounted for USD 3.41 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- The Middle East and Africa market is rapidly emerging as a vibrant frontier for digital innovation, supported by strong government initiatives, expanding infrastructure, and growing enterprise adoption. Countries across the Gulf Cooperation Council (GCC), North Africa, and sub-Saharan Africa are leveraging AI to accelerate digital transformation, strengthen competitiveness, and foster economic diversification beyond traditional sectors.

- Adoption of generative AI in MEA is accelerating across use cases including automated customer support, content generation, predictive analytics, and workflow automation, enabling organizations to improve productivity and enhance service delivery. Countries such as the United Arab Emirates, Saudi Arabia, South Africa, and Egypt are leading the charge, with enterprises leveraging AI to support digital government platforms, e-commerce personalization, and localized language solutions that reflect diverse linguistic and cultural needs.

- Cloud adoption and expanding digital infrastructure are enabling scalable deployment of generative AI solutions throughout the MEA region. By leveraging partnerships with global cloud providers and regional tech companies, enterprises can access advanced AI models and computing resources without heavy upfront investment, accelerating implementation and supporting long-term market growth.

UAE market is expected to experience substantial growth in the Middle East and Africa transportation management system market, with a CAGR of 29.6% from 2026 to 2035.

- The rapidly growing generative AI industry in the UAE is expected to make the region and the world a leader and a center of excellence for generative AI technology due to the vision of the government combined with investments in digital infrastructures and strong uptake of generative AI technology by both the public and private sectors. The UAE’s proactive approach toward developing generative AI policies and creating a tech ecosystem and developing talent has resulted in some of the highest generative AI usage rates globally, putting the UAE at the leading edge of digital transformation.

- The incorporation of generative AI technology into core workflows is enhancing productivity, automating complex processes, and advancing decision-making in numerous industries, including the financial services sector, the government sector, the healthcare sector, and the logistics sector. A survey conducted in 2025 by the Dubai Financial Services Authority (DFSA) indicated that 52% of the firms in the UAE currently utilize AI, and the adoption of generative AI has seen nearly threefold growth over the last 12 months, indicating the effectiveness of the integration of technology into operations.

- With a digitally savvy workforce and high levels of adoption by consumers, the UAE is well-positioned to develop its generative AI capabilities further. Continued investment in developing talent, building South-East Asian generative AI models, and growing the number of enterprises utilizing generative AI technology is anticipated to help support growth over the years to come and solidify the UAE’s status as a regional hub for AI and sustain leadership in the generative AI space.

generative AI Market Share

- The top 7 companies in the generative AI industry are OpenAI, Anthropic, NVIDIA, Adobe, Microsoft, Accenture, Google contributing 62% of the market in 2025.

- OpenAI develops cutting-edge generative AI models, including the GPT and DALL·E series, that power applications in text, image, and multimodal content creation. OpenAI’s cloud-based API platform enables enterprises to integrate AI into workflows, software, and analytics, while its ongoing R&D in reasoning, safety, and alignment strengthens its leadership in both commercial and research-driven AI applications globally.

- Anthropic focuses on building safe and reliable AI systems, with models like Claude designed for scalable enterprise deployment. By emphasizing interpretability, alignment, and ethical safeguards, Anthropic is positioning its AI solutions for use in business productivity, content generation, and customer support while expanding partnerships with large tech providers and cloud platforms to accelerate adoption.

- NVIDIA adopts generative AI through its GPU hardware and AI software stack, including the NVIDIA AI Enterprise platform. By optimizing training and inference for large models, NVIDIA supports AI developers, enterprises, and cloud providers in deploying high-performance generative AI applications across industries, including healthcare, media, and autonomous systems.

- Adobe leverages generative AI capabilities within its Creative Cloud and Experience Cloud products, such as Firefly for content creation. Adobe enables creative professionals and marketers to generate images, text, and video efficiently while integrating AI into workflows, enhancing productivity, personalization, and brand storytelling across global enterprises.

- Microsoft integrates advanced generative AI models into its productivity and cloud solutions, including Azure AI Service, Copilot in Microsoft 365, and developer tools. This integration enables businesses to scale AI-powered document generation, coding, and data analysis while enhancing enterprise adoption through robust security, compliance, and cloud infrastructure.

- Accenture provides consulting and managed services for generative AI adoption, helping enterprises implement AI strategies, optimize workflows, and ensure ethical governance. By combining AI expertise with industry knowledge, Accenture enables organizations to scale AI applications in finance, healthcare, retail, and energy while accelerating ROI and digital transformation initiatives.

- Google develops advanced AI models like Gemini and Bard, integrating them into enterprise services, cloud infrastructure, and productivity tools. Google focuses on multimodal and large-scale AI capabilities, enabling businesses to automate content generation, analytics, and decision-making while leveraging its global cloud ecosystem to accelerate deployment and adoption.

Generative AI Market Companies

Major players operating in the generative AI industry are:

- Accenture

- Adobe

- Amazon (AWS)

- Anthropic

- Autodesk

- Capgemini

- Microsoft

- NVIDIA

- OpenAI

The generative AI market is intensely competitive, featuring a mix of global AI platform leaders, cloud infrastructure providers, and specialist model developers catering to diverse enterprise needs. Large technology companies invest heavily in R&D, high performance computing, and foundational model development, enabling them to secure strategic partnerships with enterprises and governments. These players continuously innovate in areas such as large language models, multimodal AI, and robust enterprise tooling to sustain leadership.

The market also presents growing opportunities for niche and specialized players focusing on safety oriented, domain specific, or ethical AI solutions. These firms differentiate by delivering tailored models, compliance frameworks, and custom trained systems for sectors like healthcare, finance, legal, and manufacturing. Competition is further intensified as organizations offer managed AI services such as deployment, fine tuning, governance, and optimization, helping customers integrate generative AI into existing workflows and improve long term value.

Generative AI Industry News

- In December 2025, Google launched Gemini 3 Flash, a cost-optimized enterprise model in the Gemini 3 family designed for text, image, video, and audio processing. Gemini 3 Flash delivers comparable reasoning and coding capabilities to Gemini 3 Pro but uses fewer tokens for daily tasks, enabling enterprises to adopt multimodal AI with lower latency and reduced operational costs.

- In November 2025, Adobe announced a global strategic partnership with HUMAIN at the U.S.-Saudi Investment Forum to build AI models and AI-powered applications tuned for the Arab world, combining Adobe’s creative AI leadership with HUMAIN’s regional model development and advanced infrastructure for local and global AI deployment.

- In October 2025, OpenAI released the gpt-oss-safeguard models, a family of open-weight reasoning models designed for safety classification tasks. The models, available in 120B and 20B parameter sizes under the Apache 2.0 license, allow enterprises to evaluate inputs and enforce policy rules in a chain-of-thought reasoning framework, providing explainable AI outputs with minimal latency.

- In October 2025, Adobe launched Adobe AI Foundry, a new enterprise service that enables businesses to build custom generative AI models trained on their own branding and intellectual property. The Foundry models, built on Adobe’s Firefly family, can generate text, images, video, and 3D content and are fine-tuned for each customer to maintain brand consistency across campaigns.

The generative AI market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) from 2022 to 2035, for the following segments:

Market, By Data Modality

- Text generation

- Image generation

- Audio generation

- Video generation

- Code generation

- Multimodal

Market, By Offering

- Software

- Services

Market, By Deployment

- Cloud

- On-premises

Market, By Technology

- Generative adversarial networks (GANs)

- Transformers

- Variational Auto-encoders

- Diffusion Networks

- Others

Market, By Application

- Content generation & creative design

- Conversational ai & virtual assistants

- Code generation & software development

- Data augmentation & synthetic data generation

- Predictive analytics & decision support

- Design, simulation & prototyping

- Knowledge management & enterprise search

Market, By End-Use

- Media & entertainment

- BFSI

- It & telecom

- Healthcare & life sciences

- Automotive & transportation

- Retail & e-commerce

- Legal and professional services

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Norway

- Denmark

- Netherlands

- Belgium

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Vietnam

- Indonesia

- Singapore

- Malaysia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the generative AI market?

Key players include OpenAI, Anthropic, NVIDIA, Adobe, Microsoft, Accenture, Google, Amazon (AWS), Autodesk, Capgemini, IBM, Salesforce, Meta, Hewlett Packard Enterprise, Baidu, Alibaba Cloud, Tencent, Naver, Mistral AI, Aleph Alpha, G42, Cohere, Midjourney, Perplexity AI, Hugging Face, Grok (xAI), Runway ML, and Synthesia.

Which region leads the generative AI market?

North America held the largest share with USD 25.05 billion in 2025, driven by strong presence of technology companies, startups, and widespread AI adoption across various sectors.

What are the upcoming trends in the generative AI market?

Key trends include evolution of multimodal models combining text, image, and audio; development of autonomous AI agents; integration with enterprise software workflows; and customized industry-specific AI models for vertical use cases.

What was the valuation of cloud deployment segment in 2025?

Cloud deployment segment held 73.8% market share in 2025, driven by scalability, flexibility, and seamless integration into existing digital ecosystems.

What is the growth outlook for video generation modality from 2026 to 2035?

Video generation is expected to record the highest CAGR from 2026 to 2035, driven by rising demand for automated video content in marketing, training, entertainment, and social media.

What is the market size of the generative AI in 2025?

The market size was USD 53.7 billion in 2025, with a CAGR of 31.6% expected through 2035 driven by increased demand for automation and efficiency across enterprises.

What is the projected value of the generative AI market by 2035?

The generative AI market is expected to reach USD 988.4 billion by 2035, propelled by advancements in computation power, growing enterprise investment, and expansion of digital data availability.

What is the current generative AI market size in 2026?

The market size is projected to reach USD 83.3 billion in 2026.

How much revenue did the software segment generate in 2025?

Software segment accounted for 81% of the market in 2025, dominating due to its essential role in enabling automation, content generation, and analytics across industries.

Generative AI Market Scope

Related Reports