Summary

Table of Content

GCC Industrial Gas Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

GCC Industrial Gas Market Size

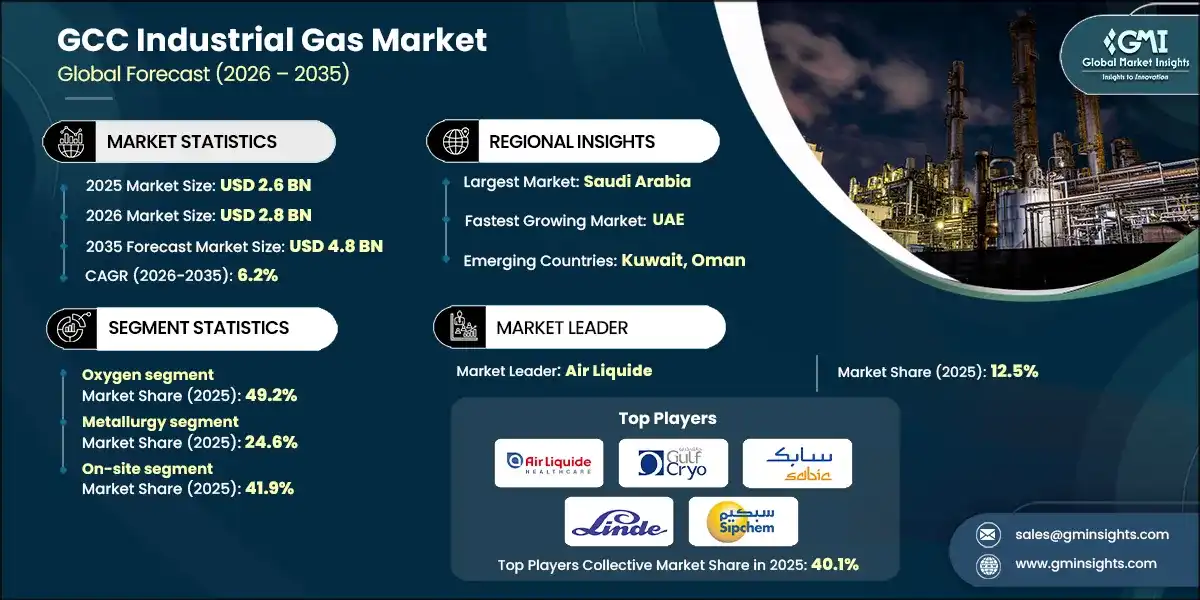

The GCC industrial gas market was estimated at USD 2.6 billion in 2025. The market is expected to grow from USD 2.8 billion in 2026 to USD 4.8 billion in 2035, at a CAGR of 6.2% according to latest report published by Global Market Insights Inc.

To get key market trends

- The GCC industrial gas market is experiencing robust growth driven by the region's massive infrastructure development, renewable energy expansion, and regulatory initiatives promoting energy efficiency and localization. Industrial gases including oxygen, nitrogen, hydrogen, argon, carbon dioxide, helium, krypton, and xenon serve critical applications across metallurgy, manufacturing, chemicals, energy, and healthcare sectors throughout the six Gulf Cooperation Council member states.

- The GCC industrial gas market is witnessing three transformative trends reshaping the industry landscape. First, the adoption of energy-efficient and advanced gas production technologies is accelerating across the region as companies respond to rising operational costs and sustainability mandates.

- The International Energy Agency projects that electricity demand in the Middle East and North Africa will increase by more than 50% by 2035, requiring substantial investment in energy-efficient industrial infrastructure. Second, the rise in customized, value-added gas products tailored to specific industrial applications is gaining momentum, particularly in high-purity gases for electronics and medical applications. Air Liquide's expansion of ultra-high purity gas facilities and specialty gas portfolios demonstrates this trend toward application-specific solutions.

- The integration of solar and smart technologies into industrial gas production is emerging as a strategic priority, with renewable-powered electrolysis for green hydrogen production representing a major growth vector. The Middle East Institute reports that MENA countries including GCC states are projected to become global leaders in renewable energy-based supply chains within 25 years, with the UAE targeting 1 million tons of green hydrogen and derivatives by 2030.

GCC Industrial Gas Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 2.6 Billion |

| Market Size in 2026 | USD 2.8 Billion |

| Forecast Period 2026 - 2035 CAGR | 6.2% |

| Market Size in 2035 | USD 4.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Massive infrastructure and real estate development | Large-scale construction projects and urban expansion in GCC countries are driving demand for industrial gases used in welding, cutting, and building material processing |

| Renewable energy expansion and solar installations | The region’s push toward clean energy, especially solar projects, requires industrial gases for photovoltaic manufacturing and maintenance, boosting market growth. |

| Regulatory push for energy efficiency & localization | Government initiatives promoting energy-efficient technologies and local production are increasing industrial gas consumption in manufacturing and energy sectors. |

| Pitfalls & Challenges | Impact |

| Volatility in raw material and energy costs | Fluctuating prices of feedstock and energy sources impact production costs, creating uncertainty for industrial gas suppliers. |

| Supply chain disruptions and logistic constraints | Global and regional transportation bottlenecks, along with geopolitical tensions, can delay deliveries and raise operational costs. |

| Opportunities: | Impact |

| Integration of Solar and Smart Technologies into Industrial Gas Production | Adopting smart systems and renewable-powered production facilities can reduce costs, improve sustainability, and align with GCC’s green energy goals. |

| Market Leaders (2025) | |

| Market Leaders |

12.5% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Saudi Arabia |

| Fastest growing market | UAE |

| Emerging country | Kuwait, Oman |

| Future outlook |

|

What are the growth opportunities in this market?

GCC Industrial Gas Market Trends

- Energy efficiency has emerged as a strategic priority for industrial gas producers in the GCC as companies respond to rising operational costs, sustainability mandates, and competitive pressures. The International Energy Agency projects that electricity demand in the Middle East and North Africa will increase by more than 50% by 2035, requiring substantial investment in energy-efficient industrial infrastructure to manage costs and environmental impacts. Industrial gas production, particularly air separation and liquefaction processes, ranks among the most electricity-intensive industrial operations, making energy efficiency critical to competitiveness.

- The second major trend reshaping the GCC industrial gas market is the shift from commodity bulk gases to customized, value-added products tailored to specific industrial applications. This trend is driven by the increasing sophistication of end-user industries, particularly electronics, healthcare, and advanced manufacturing sectors requiring ultra-high purity gases and application-specific formulations.

- Air Liquide's business model exemplifies this trend, with distinct segments for Large Industries (pipeline and onsite supply), Industrial Merchant (bulk and cylinder delivery), Electronics (ultra-high purity gases), and Healthcare (medical gases treated as regulated medicaments).

- The third transformative trend is the integration of renewable energy, particularly solar power, and smart technologies into industrial gas production and distribution systems. This trend is driven by the GCC's exceptional solar resources, national commitments to renewable energy and hydrogen economy development, and the economic competitiveness of solar-powered electrolysis for green hydrogen production.

- The Middle East Institute reports that MENA countries including GCC states are projected to become global leaders in renewable energy-based supply chains within 25 years, with Saudi Arabia, UAE, Oman, Qatar, Kuwait, Jordan, Morocco, and Egypt leading major projects [MEI.EDU]. The UAE aims for 1 million tons combined green hydrogen and derivatives by 2030, with 300,000 tons locally and 700,000 tons regionally or abroad under Emirati operations, targeting approximately 25% market share in European and Asian markets. By 2050, MENA could earn USD 130 billion annually from clean hydrogen exports, indicating large-scale green hydrogen and ammonia production and export infrastructure expansion over 2025-2050, with strong growth expected in the 2025-2035 decade as foundation projects roll out.

GCC Industrial Gas Market Analysis

Learn more about the key segments shaping this market

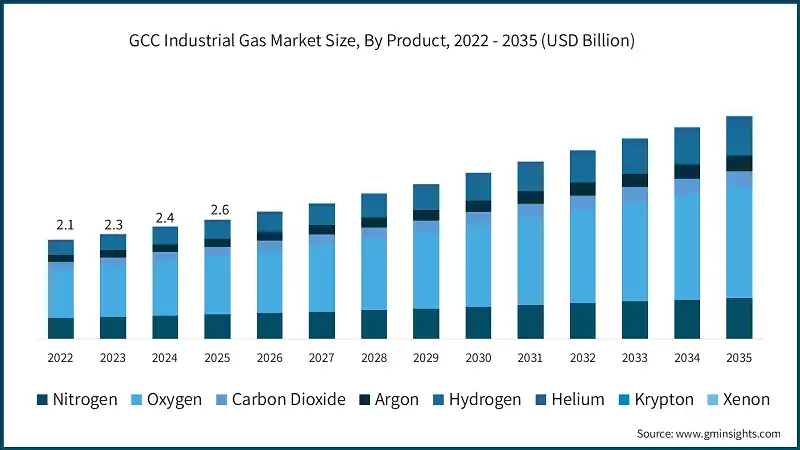

Based on Product the market is segmented as nitrogen, oxygen, carbon dioxide, argon, hydrogen, helium, krypton, xenon.

- Oxygen captured roughly 49.2% of the market share in 2025. Oxygen's dominant market share reflects its critical role across multiple high-volume applications including steel and aluminum production, petrochemical oxidation processes, combustion enhancement in power generation, and medical applications. The market for oxygen is driven by metallurgy sector expansion, particularly steel production supporting infrastructure development, and healthcare sector growth requiring medical-grade oxygen. Air Liquide's Kuwait operations include an air separation unit producing 1,500 tons per day of oxygen, described as one of the largest plants in the Middle East, demonstrating the scale of oxygen production infrastructure in the GCC.

Learn more about the key segments shaping this market

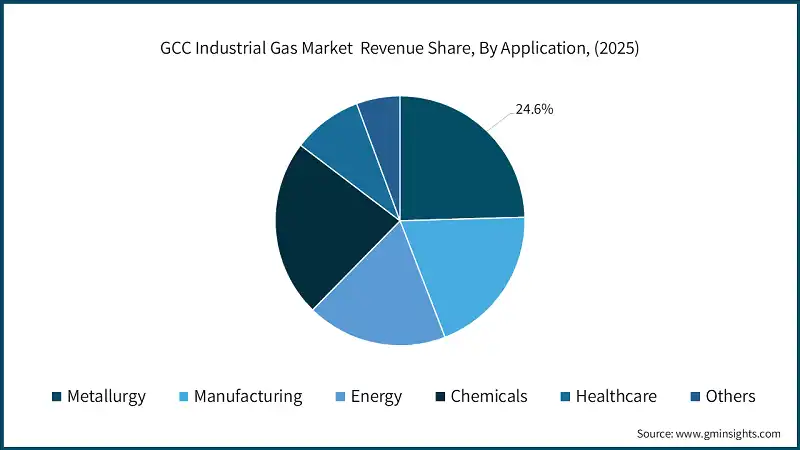

Based on application, the market is segmented as manufacturing, metallurgy, energy, chemicals, healthcare, and others.

- Metallurgy represented about 24.6% of the GCC Industrial Gas market in 2025. Metallurgy's market share reflects the GCC's substantial steel, aluminum, and metal fabrication industries supporting infrastructure development and industrial diversification. The sector's 6.0% CAGR is driven by massive infrastructure and real estate development accounting for approximately 50% of market growth drivers. Industry leaders at the Middle East Gas Conference in Dubai reported that the region requires approximately USD 200 billion in natural gas investment over the next four years to boost production by 30% by 2030 and meet surging power demand driven by rising populations, air conditioning needs, desalination requirements, and rapid expansion of AI data centers in the UAE and Saudi Arabia. Metallurgy applications consume oxygen for steel production and combustion, argon for welding and inert atmospheres, nitrogen for heat treating and inerting, and hydrogen for direct reduction of iron in emerging green steel processes. Air Liquide's Shuaiba Oxygen plant distributes liquid argon across the Arabian Peninsula to supply steel and welding industries, demonstrating the regional logistics supporting metallurgy applications.

Based on supply mode the market is segmented as packaged, bulk, on-site.

- On-site represented about 41.9% of the GCC Industrial Gas market in 2025. Metallurgy's market. On-site generation's market share reflect the economics and operational advantages of dedicated production facilities for large-volume consumers. Air Liquide's Large Industries segment provides large-scale supply via pipeline networks or on-site production units located in industrial basins, characterized by long-term contracts of 15 to 20 years and mutualization of production assets to enhance supply reliability and optimize operating costs.

Looking for region specific data?

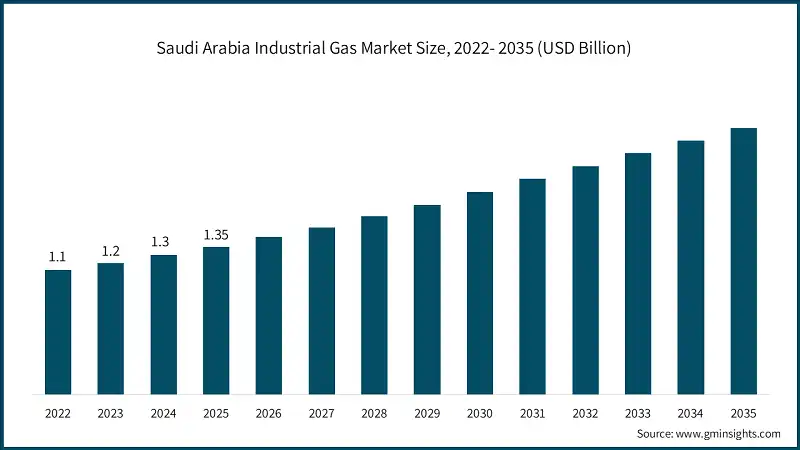

The Saudi Arabia Industrial Gas market valued at USD 1.3 billion in 2025 and estimated to grow to almost USD 2.4 billion by 2035.

- Saudi Arabia's downstream and chemicals sector includes integrated refining and petrochemicals including Sadara joint venture with Dow, with Aramco acquiring 70% of SABIC in 2020 for USD 69.1 billion to expand petrochemicals. SABIC operates a CO2 utilization plant valued at approximately USD 175 million with 25 kilometers of pipelines via Jubail United Petrochemical Company. Aramco–SLB–Linde joint development for a Jubail CO2 storage hub targets capacity of 9 million tons of CO2 per year by 2027, with the existing Uthmaniyah Gas-Oil Separation Plant carbon capture, utilization, and storage in operation since 2015 in the Ghawar region.

GCC Industrial Gas Market Share

The GCC Industrial Gas industry is moderately concentrated, with the top five players (Air Liquide, Gulf Cryo, SABIC, Linde, SIPCHEM) holding 40% combined share in 2025. Air Liquide commands market leadership with 12.5% share, leveraging its global scale, technological capabilities, and long-term customer relationships across GCC’s industrial basins. Air Liquide's market leadership position is supported by strategic assets including the Shuaiba Oxygen joint venture in Kuwait, a 50-50 partnership with Kuwait Cryo established in 2006. The joint venture operates an air separation unit producing 1,500 tonnes per day of oxygen, described as one of the largest plants in the Middle East, under a long-term agreement with Equate Petrochemical Company [AIRLIQUIDE.COM]. Shuaiba Oxygen is one of the largest private liquid argon producers in the Gulf Cooperation Council, with argon distributed across the Arabian Peninsula to supply steel and welding industries, demonstrating Air Liquide's regional distribution capabilities.

- Air Liquide

- The company's basin strategy focuses on key industrial basins supporting mutualized production and pipeline networks, with long-term contracts of 15 to 20 years and mutualization of production assets to enhance supply reliability and optimize operating costs. Air Liquide inaugurated the world's largest proton exchange membrane electrolyzer at Bécancour and opened a proton exchange membrane gigafactory in Berlin targeting 3 gigawatts by 2025, indicating capability to supply low-carbon hydrogen at scale relevant to GCC hydrogen ambitions.

- The company's basin strategy focuses on key industrial basins supporting mutualized production and pipeline networks, with long-term contracts of 15 to 20 years and mutualization of production assets to enhance supply reliability and optimize operating costs. Air Liquide inaugurated the world's largest proton exchange membrane electrolyzer at Bécancour and opened a proton exchange membrane gigafactory in Berlin targeting 3 gigawatts by 2025, indicating capability to supply low-carbon hydrogen at scale relevant to GCC hydrogen ambitions.

- Linde

- Linde represents the second major global player in the GCC market, having significantly strengthened its position through the acquisition of Airtec in September 2025. Linde completed acquisition of Airtec, previously holding 49% stake, increasing shareholding to more than 90% and expanding presence across Kuwait, UAE, Qatar, Bahrain, and Saudi Arabia. Airtec was described as one of the largest industrial gas companies in the Middle East, supplying industrial gases to energy, healthcare, and manufacturing end markets.

- Linde represents the second major global player in the GCC market, having significantly strengthened its position through the acquisition of Airtec in September 2025. Linde completed acquisition of Airtec, previously holding 49% stake, increasing shareholding to more than 90% and expanding presence across Kuwait, UAE, Qatar, Bahrain, and Saudi Arabia. Airtec was described as one of the largest industrial gas companies in the Middle East, supplying industrial gases to energy, healthcare, and manufacturing end markets.

- Gulf Cyro

- Gulf Cryo represents a leading regional specialist with more than 30 production and distribution sites across the region, demonstrating the logistics network required to support packaged and bulk gas distribution. Regional players including Gulf Cryo, ADNOC Industrial Gas (ADNOC subsidiary), Abdullah Hashim Industrial Gases (longstanding Saudi supplier with regional expansion via acquisitions), Buzwair Industrial Gases, Dubai Industrial Gases, Gulf Industrial Gases Company, Jordan Gases Company, Naga Gases, National Industrial Gas Plants, and Yateem Oxygen compete with global majors by leveraging local market knowledge, customer relationships, and distribution density.

- Gulf Cryo represents a leading regional specialist with more than 30 production and distribution sites across the region, demonstrating the logistics network required to support packaged and bulk gas distribution. Regional players including Gulf Cryo, ADNOC Industrial Gas (ADNOC subsidiary), Abdullah Hashim Industrial Gases (longstanding Saudi supplier with regional expansion via acquisitions), Buzwair Industrial Gases, Dubai Industrial Gases, Gulf Industrial Gases Company, Jordan Gases Company, Naga Gases, National Industrial Gas Plants, and Yateem Oxygen compete with global majors by leveraging local market knowledge, customer relationships, and distribution density.

GCC Industrial Gas Market Companies

Major players operating in the GCC industrial gas industry are:

- Gulf Cryo

- SABIC (Saudi Basic Industries Corporation)

- Linde

- SIPCHEM (Sahara International Petrochemical Company)

- Brothers Gas Bottling & Distribution Co LLC

- Abdullah Hashim Industrial Gases & Equipment (AHG)

- Dubai Industrial Gases

- Gaschem Kuwait

- Air Liquide

- Buzwair Industrial Gases Factories

- Air Products and Chemicals, Inc.

- Yateem Oxygen

- ADNOC Linde

- Nizwa Gas Industries

GCC Industrial Gas Industry News

- In July 2024, Saudi Aramco signed an agreement to acquire a 50% stake in the Blue Hydrogen Industrial Gases Company (BHIG), a subsidiary of Air Products Qudra, which operates in Jubail. The deal includes hydrogen and nitrogen offtake options, aiming to enhance Aramco’s position in low-carbon hydrogen production in Saudi Arabia’s Eastern Province.

- In September 2025, Linde completed the acquisition of over 90% of Airtec (previously at 49%), one of the largest Middle Eastern industrial gas suppliers. This strengthens Linde’s presence across Kuwait, UAE, Qatar, Bahrain, and Saudi Arabia—adding air separation units, CO? plants, and turnkey gas generation infrastructure.

- In December 2025, Air Products announced their plans with Yara International to develop low-emission ammonia projects.

The GCC Industrial Gas market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Product

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Helium

- Krypton

- Xenon

Market, By Application

- Manufacturing

- Metallurgy

- Energy

- Chemicals

- Healthcare

- Others

Market, By Supply Mode

- Packaged

- Bulk

- On-Site

The above information is provided for the following countries:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Frequently Asked Question(FAQ) :

What is the growth outlook for the GCC industrial gas market from 2026 to 2035?

The GCC industrial gas industry is projected to grow at a CAGR of 6.2% through 2035, driven by mega infrastructure projects, clean energy investments, and increasing demand for customized industrial gas solutions.

What are the key trends shaping the GCC industrial gas industry?

Major trends include energy-efficient gas production technologies, growing demand for high-purity and customized industrial gases, and integration of renewable energy and solar-powered hydrogen production facilities across the GCC market.

Which country leads the GCC industrial gas market?

Saudi Arabia led the market with a valuation of USD 1.3 billion in 2025. Growth is driven by large-scale petrochemical investments, carbon capture projects, and expanding downstream industrial infrastructure under Vision 2030.

Who are the key players in the GCC industrial gas market?

Key players in the GCC industrial gas industry include Air Liquide, Gulf Cryo, SABIC, Linde, SIPCHEM, Air Products and Chemicals, ADNOC Linde, and regional suppliers with strong distribution networks.

What was the valuation of the on-site supply mode segment in 2025?

On-site supply mode held a 41.9% share of the market in 2025, supported by long-term contracts and cost efficiencies for large-volume industrial gas consumers in metallurgy and chemicals.

How much revenue did the oxygen segment generate in 2025?

The oxygen segment accounted for 49.2% of the market in 2025, reflecting strong consumption across steel production, petrochemicals, power generation, and medical oxygen applications.

What is the projected value of the GCC industrial gas industry by 2035?

The market is expected to reach USD 4.8 billion by 2035, growing at a CAGR of 6.2% due to increasing adoption of energy-efficient gas production technologies and expansion of hydrogen and renewable energy projects in the market.

What is the current GCC industrial gas market size in 2026?

The market is projected to reach USD 2.8 billion in 2026, supported by rising demand from metallurgy, manufacturing, energy, and healthcare applications across the GCC region.

What is the market size of the GCC industrial gas industry in 2025?

The market size was USD 2.6 billion in 2025 and is expected to grow at a CAGR of 6.2% from 2026 to 2035, driven by massive infrastructure development, renewable energy expansion, and localization initiatives across the GCC industrial gas industry.

GCC Industrial Gas Market Scope

Related Reports