Summary

Table of Content

Gate-All-Around (GAA) Transistor Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Gate-All-Around Transistor Market Size

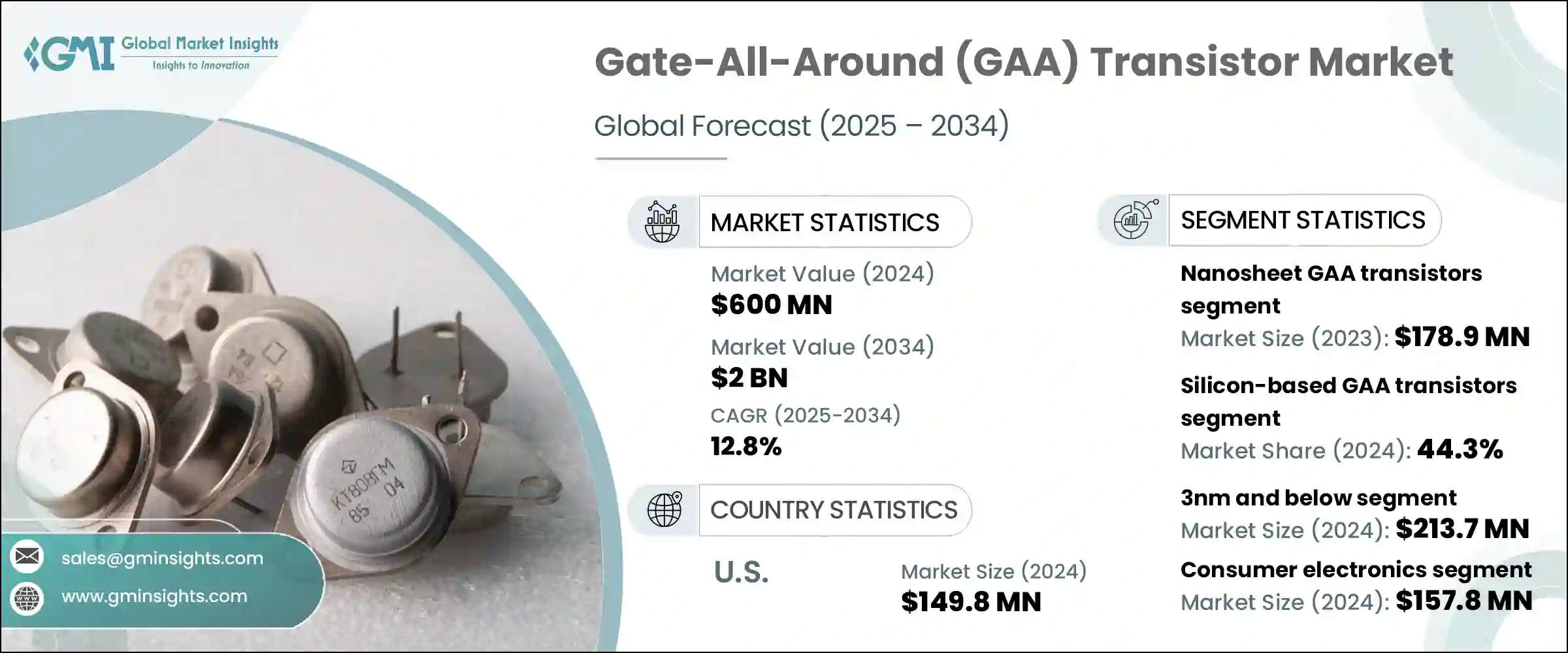

The global Gate-All-Around transistor market was valued at USD 600 million in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 2 billion by 2034.

To get key market trends

The growth and development of 5G infrastructure, along with edge computing, is expected to drive considerable growth within the GAA transistor industry as these technologies require even greater processing efficiency, power saving, and signal integration. Nanosheet GAA transistors are high speed and low power semiconductor components that are Integrated into mobile processors, 5G base stations, network infrastructure, and many other technology devices. Nanosheet GAA transistors possess greatly enhanced electrostatic control and lower leakage current which enables them to outperform other designs in HSDPA applications.

Gate-All-Around (GAA) Transistor Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 600 Million |

| Forecast Period 2025 - 2034 CAGR | 12.8% |

| Market Size in 2034 | USD 2 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

As 5G networks are rapidly deployed, there is an increased need for energy efficient RF and digital processors, which has caused a surge in the need for advancements in semiconductors in relation to bandwidth and latency. Furthermore, edge computing that requires the high speed, low latency processing of chips to enable analytics, AI inference, and Internet of Things connectivity at the edge, also needs augmentation. TSMC, Samsung, and Intel are the foremost GAA specialists who are adopting this technology to fab 5G modems, networking hardware and edge AI processors for superior performance and energy efficiency in next generation connectivity devices.

GAA's implementation in the next-gen HPC systems is accelerated by AI-related tasks, big data handling, quantum simulation, and funding from the government. The need for increased investment within HPC is due to the use of cloud computing alongside artificial intelligence services, and data analytics. Samsung, Intel, and TSMC have increased the performance of their processors while also addressing the problem of overheating. These leading businesses have incorporated GAA blades due to their increased electric control and power efficiency along with lower leakage inductance. Other big players on the semi-conductor market are also switching to GAA technologies to stay competitive on the market.

Gate-All-Around Transistor Market Trends

- The industry is focusing on Gate-All-Around (GAA) transistors is undergoing innovation almost daily with nanosheet transistors or the so called ‘nanosheet’ devices dominating the architecture for sub 3nm semiconductor nodes. Major foundries such as TSMC, Samsung, and Intel are shifting from the FinFET to the GAA technology to improve the efficiency in power consumption and the density of the transistor. Moreover, the next generation of AI processors, HPC chipsets, and mobile devices rely on enhanced power efficiency, which increases research into forksheet and complementary FET CFET architectures.

- Companies are adopting next-generation fabrication methods such as EUV lithography and 3D stacking to improve the scalability of GAA Transistors. The foundries are shifting their efforts towards innovation friendly materials and researching new channel elements like germanium and indium gallium arsenide (InGaAs) to supersede silicon confines. At the same time, the semiconductor equipment manufacturers opt to implement specialized deposition and etching processes for higher yield and cost effectiveness of GAA technology so it can be commercially viable for mass production.

Gate-All-Around Transistor Market Analysis

Learn more about the key segments shaping this market

Based on the type, the market is segmented into nanosheet GAA transistors, nanowire GAA transistors, forksheet GAA transistors, and others.

- Nanosheet GAA transistors segment accounted for USD 178.9 million in 2023. GAA nanosheet transistors is commonly used type due to their superior electrostatic control and relative ease in scaling for nodes below 3nm. Top semiconductor foundries like TSMC and Samsung are incorporating nanosheets into logic processors to improve performance, power, and transistor density for AI, HPC, and mobile computing applications.

- Nanosheet GAA transistors accounted for USD 130.7 million in 2022. The control and leakage current characteristics of the gate for Nanowire GAA transistors are outstanding, hence their applicability in ultra low power systems. While they are not as prevalent as nanosheets, they are investigated for use in IoT and sophisticated RF designs where power optimization and performance enhancement are critical challenges.

Learn more about the key segments shaping this market

Based on material, the Gate-All-Around transistor market is divided into silicon-based GAA transistors, germanium-based GAA transistors, and III-V compound semiconductor GAA transistors.

- The silicon-based GAA transistors segment is expected to account for 44.3% of the global market in 2024. Silicon-based GAA transistors are predominant owing to an economical and matured process as well as incorporation into the existing semiconductor manufacturing ecosystem. Major foundries such as TSMC and Intel are applying silicon nanosheets to improve scalability, efficiency, and power performance along with transistor density in <3nm nodes.

- The germanium-based GAA transistors segment is expected to account for 33.4% of the global GAA transistors market in 2024. germanium sport GAA transistors, which feature improved carrier mobility that translates bullish switching performance and speed growth in HPC and AI processors. Regardless of manufacturing limitations, semiconductor companies are pouring resources into material engineering to make it economical for newer generations of logic and RF devices.

Based on node size, the Gate-All-Around transistor market is segmented into 3nm and below, and above 3nm.

- The 3nm and below segment dominated the market accounting for USD 213.7 million in 2024. Leading innovation in the 3nm and below sectors are TSMC, Samsung, and Intel, who are utilizing nanosheet GAA transistors for AI, HPC, and mobile processors. Their adoption of Advanced Computing Applications Technology adds significant value without sustainably increasing costs to performance, power efficiency, or transistor density.

- The above 3nm segment accounted for USD 343.9 million in 2023. The above 3nm section encompasses initial GAA implementations and obsolete FinFET transitions which service IoT, automotive, and mid-level computing. Corporations concentrate on economical manufacturing while enhancing scalability and efficiency functionality for widespread microchip technologies.

Based on application, the Gate-All-Around transistor market is segmented into High-Performance Computing (HPC), Internet of Things (IoT) devices, AI & machine learning processors, 5G & communication infrastructure, and others.

- The High-Performance Computing (HPC) segment will grow at a CAGR of 13.2% during the forecast period. Due to increased transistor density, power leakage mitigation, and enhanced performance, GAA transistors improve the efficiency of HPC systems. Intel and AMD, for example, incorporate sub-3nm GAA architectures to best serve AI workload, data center, and cloud computing optimization.

- The AI & machine learning processors segment will grow at a CAGR of 14.6% during the forecast period. The adoption of GAA in AI accelerators and neural processing units (NPUs) is being spurred by the need for power-efficient and high speed architectures in AI and Machine Learning applications. The industry leaders are now more concerned with the optimization of the deep learning and real time AI inferencing using scaling of GAA transistors.

Based on end-use, the Gate-All-Around transistor market is segmented into consumer electronics, automotive, data centers & cloud computing, industrial electronics, healthcare & medical devices, and others.

- The consumer electronics segment dominated the market, accounting for USD 157.8 million in 2024. GAA transistors increase the efficiency, performance, and power management of leakage in smartphones, laptops, and wearables. Apple and Samsung use their sub-3nm GAA technology for ultra premium devices.

- In 2024, the automotive segment accounted for USD 143.1 million. GAA transistors ensure effective processing and heat management for advanced driver assistance systems, electric vehicle (EV) power management, and autonomous driving (AD) systems. The integration of high-performance GAA transistors improves sensor fusion data processing, as well as connectivity and computing on board the vehicle.

- In 2024, the U.S. Gate-All-Around transistors market accounted for USD 149.8 million. The development of transistors GAA within the US is spearheaded by Intel, AMD and NVIDIA in the spheres of cloud and AI computing and HPC. Government policies in conjunction with semiconductor spending further aid local manufacturing and capacity building, which improves the country’s position as a leader in advanced chip production, as well as fortifies the supply chain in the US.

- The Germany Gate-All-Around transistors market is expected to reach USD 112.6 million by 2034. Germany’s semiconductor industry specializes in automotive and industrial verticals with the use of GAA transistors for EVs, automation, and smart factories. Infineon and other companies invest in next-gen semiconductor research and development while also complying with the EU’s geopolitical objectives geared towards self-sufficient chip manufacture and sovereignty over technologies.

- The China Gate-All-Around transistors market is expected to grow at a CAGR of 16.1% during the forecast period. Through government supported semiconductor investments and regional foundries, China is expediting the use of GAA transistors. Firms such as SMIC are concentrating on advanced sub 5nm circuitry in abidance to enhance self-sufficiency in the domestic production of AI, IoT, and 5G chips.

- Japan is expected to account for a share of 12.3% of the market in Asia Pacific. Japan pushes investment in GAA transistors R&D alongside the relatively new TSMC and Rapidus corporations. The country’s emphasis on HPC and consumer electronics activity enables innovative positioning of AI-enabled mobile processors and automation chips.

- South Korea Gate-All-Around transistors market is expected to grow at a CAGR of 16.3% during the forecast period. South Korea excels in sophisticated semiconductor fabrication, specifically with Samsung and SK Hynix spearheading sub-3nm GAA transistor development. Massive spending in next generation memory and logic chips consolidate South Korea’s advantage in artificial intelligence, high performance computing, and mobile technology.

Gate-All-Around Transistor Market Share

The market is competitive and highly fragmented with the presence of established global players as well as local players and startups. The top 3 companies in the global ambient light market are Samsung Electronics, Taiwan Semiconductor Manufacturing Company (TSMC), and Intel Corporation, collectively accounting for a share of 35%. The GAA transistor market has intense rivalry, since primary Intel, Samsung and TSMC continue to pursue innovation in sub 3nm transistor architecture.

Like other industry leaders, these companies invest in advanced WiFi, AI, HPC, and 5G fabricated power devices and their power performance. Dominance in next-generation semiconductor technology has imposed fierce rivalry among other manufacturers due to strategic investment that exploit the EUV lithographic capabilities with material engineering and nanosheet designs. To contain the ever-increasing demand for energy efficient and high-performing semiconductor GAA solutions, alliances between technology contractors, chip manufacturers, and foundries are forming to deliver low-cost solutions such as soc platforms.

The Chinese, Japanese, and European market participants are strengthening their market positions by exploiting state funded semiconductor schemes, joint ventures, and R&D expenditure initiatives. The firms SMIC and Rapidus are working on the advanced node development projects in efforts to catch-up with the technology leaders.

Gate-All-Around Transistor Market Companies

The top 3 companies operating in the GAA transistor industry are:

- Samsung Electronics

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Intel Corporation

- Samsung Electronics is strategically advancing semiconductor innovation by pioneering GAA-based 3nm technology, enhancing power efficiency and performance, while strengthening industry collaborations to accelerate HPC, AI, and mobile chip development. In June 2022, Samsung Electronics begun 3nm chip production using Gate-All-Around (GAA) transistor architecture, improving power efficiency by 45% and performance by 23% over 5nm. Its Multi-Bridge-Channel FET (MBCFET™) technology enhances transistor performance. Collaborating with SAFE™ partners, Samsung aims to streamline design, verification, and production, accelerating GAA-based semiconductor advancements for HPC, mobile, and AI applications.

- TSMC is focusing on the primary research and development (R&D) focus of advanced GAA transistor technologies which increase semiconductor performance, efficiency, and scalability. These efforts are aimed at consolidating their leadership position in high-performance computing and AI applications.

- Intel continues investing in GAA transistors and RibbonFET implementation to improve chip efficiency and push for advances below 3-nanometer, as well as improve foundry integration.

Gate-All-Around Transistor Industry News

- In February 2024, Samsung and Arm collaborated to develop the next-generation Cortex-X CPU using Samsung’s advanced Gate-All-Around (GAA) transistor technology, scaling up to the 2nm node. GAA transistors improved power efficiency, performance, and scalability, surpassing FinFET technology. This partnership aims to drive innovation in high-performance mobile computing.

- In June 2023, Samsung launched its 3nm Gate-All-Around (GAA) Multi-Bridge-Channel FET (MBCFET) technology at ChipEx2023, showcasing its superior SRAM design flexibility. Unlike FinFETs, GAA transistors enabled independent nanosheet width tuning, optimizing power, performance, and area (PPA). This breakthrough improved SRAM efficiency, stability, and scalability, overcoming traditional transistor limitations.

This Gate-All-Around transistor market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) from 2021 to 2034, for the following segments:

Market, By Type

- Nanosheet GAA transistors

- Nanowire GAA transistors

- Forksheet GAA transistorss

- Others

Market, By Material

- Silicon-based GAA Transistors

- Germanium-based GAA transistors

- III-V compound semiconductor GAA transistors

Market, By Node Size

- 3nm and below

- Above 3nm

Market, By Application

- High-Performance Computing (HPC)

- Internet of Things (IoT) devices

- AI & machine learning processors

- 5G & communication infrastructure

- Others

Market, By End Use

- Consumer electronics

- Automotive

- Data centers & cloud computing

- Industrial electronics

- Healthcare & medical devices

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Latin America

- Brazil

- Mexico

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

How much is the U.S. Gate-All-Around transistor industry worth?

The U.S. Gate-All-Around transistor market recorded USD 149.8 million in 2024.

Who are some of the prominent players in the Gate-All-Around transistor industry?

Key players in the market include Samsung Electronics, Taiwan Semiconductor Manufacturing Company (TSMC), and Intel Corporation.

How big is the Gate-All-Around transistor market?

The Gate-All-Around transistor industry was valued at USD 600 million in 2024 and is estimated to grow at a 12.8% CAGR to reach USD 2 billion by 2034.

What is the market share of silicon-based GAA transistors?

The silicon-based GAA transistors segment is expected to hold 44.3% of the global market in 2024.

Gate-All-Around (GAA) Transistor Market Scope

Related Reports