Summary

Table of Content

Gas Fired Construction Generator Sets Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Gas Fired Construction Generator Sets Market Size

The global gas fired construction generator sets market was valued at USD 874.3 million in 2024 and is expected to reach USD 2.3 billion in 2034, growing at a CAGR of 10% from 2025 to 2034. Increasing infrastructure and urbanization development projects coupled with growing demand for efficient & reliable power generation units will bolster the industry landscape.

To get key market trends

Stringent measures and standards pertaining to reduce carbon emissions along with integration of advanced technology systems comprising of automatic load management to enhance fuel consumption will drive product deployment. Substantial investment in large commercial, residential, and industrial projects across key geographies will positively influence the gas fired construction generator sets market trend.

Gas-fired construction generator sets utilize natural gas or propane as fuel to produce electricity on construction sites. Increasing integration of remote monitoring capabilities and IoT technologies in gensets enables fuel levels, real-time tracking of performance, and maintenance requirements, thereby enhancing product adoption.

Gas Fired Construction Generator Sets Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 874.3 Million |

| Forecast Period 2025 - 2034 CAGR | 10% |

| Market Size in 2034 | USD 2.3 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Additionally, the rising emphasis on cleaner fuel combined with expansion of commercial and industrial establishments will fuel the demand for construction generator sets across emerging economies. Increasing demand for uninterrupted power supply sources in line with rapid growth in construction activities will complement the product deployment.

Growing shift to reduce carbon emission and adoption of cleaner energy systems will drive the business landscape. Continuous innovation in gas based energy solutions, which are lower emissions generate as compared to other alternatives will accelerate the industry growth. In addition, rising availability of natural gas in emerging economies coupled with increasing expansion of their supply infrastructure will boost the business scenario.

Gas Fired Construction Generator Sets Market Trends

The industry is poised for significant growth on account of stringent government regulations and rapid expansion of infrastructure developments. Continuous construction activities including of bridges, roads, airports, dams, and essential facilities coupled with growing need for reliable power backup sources to maintain operations will complement the demand for these units.

Moreover, construction sites are susceptible to power outages caused by natural disasters comprising of hurricanes, storms, and earthquakes, thereby propelling the demand for generator sets. Ongoing improvement in these gensets by introducing improved durability, enhanced energy efficiency along with incorporation of advanced fuel management systems will amplify the gas fired construction generator sets market penetration.

Rapid integration of these systems with sustainable energy sources coupled with increasing focus on reducing operational cost and optimizing fuel consumption will bolster the business growth. Ongoing supply chain constraints, fluctuating diesel prices, and geopolitical scenarios are the key parameter factors impacting the overall industry.

Rapid adoption of these units across off-grid locations where grid connectivity is not available, particularly in offshore construction projects, which in turn will drive the industry landscape. Surging need for scalable and cost-effective power sources for temporary and short-term construction projects will encourage the product deployment.

Growing incorporation of AI enable technology systems including IoT, remote monitoring systems, and predictive maintenance will foster the business growth. Continuous innovation in gas gensets with optimizing fuel usage and track performance enabling operational efficiency & maximum uptime will create favorable industry opportunities.

Gas Fired Construction Generator Sets Market Analysis

Learn more about the key segments shaping this market

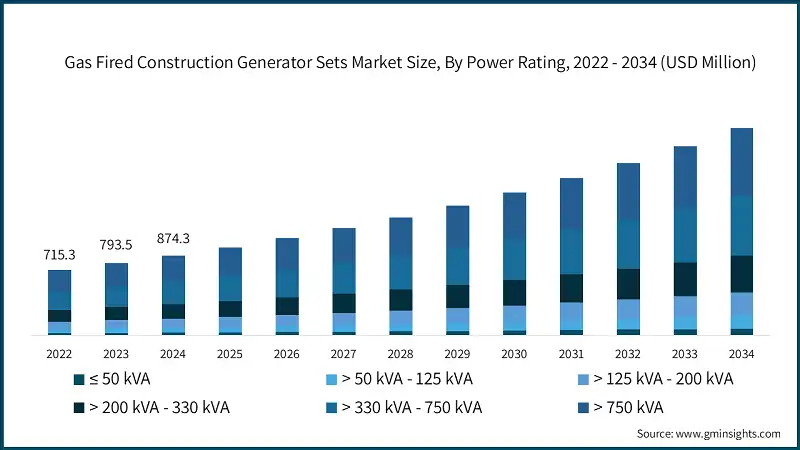

- The gas fired construction generator sets industry was estimated at USD 715.3, 793.5, 874.3 million in 2022, 2023 and 2024, respectively. Robust demand for these units in small to large construction projects across key geographies will drive product adoption. Increasing expansion of industrial sector, commercial buildings, and transportation networks will spur product deployment.

- Based on power rating, the industry is segmented into ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA. The ≤ 50 kVA rated gas fired construction generator sets market will be projected to hit USD 70 million by 2034. The Increasing economic growth and construction activities in line with surging demand for efficient and reliable power solutions to ensure uninterrupted operations will sway the business growth.

- For instance, in April 2024, The U.S. General Services Administration has allocated USD 23.8 million toward 13 federal building projects across 10 states as part of GSA's Good Neighbor Program. This is part of President’s investing in America initiative sponsored by IRA.

- The > 50 kVA - 125 kVA rated gas fired construction generator sets market will witness a growth rate of over 9.5% till 2034. Continuous innovation to enhance generator performance, reliability, and efficiency will enhance the industry landscape. Increasing construction activities in remote & urban areas in association with rising demand for reliable units to drive tools and lighting will energize the business growth.

- The > 125 kVA - 200 kVA rated gas fired construction generator sets dominated a market share of over 10% in 2024. Key construction companies are shifting their focus from diesel to gas based systems owing to strict regulations imposed by the regulatory authorities will encourage the industry trend.

- For instance, in February 2025, Apple unveiled a USD 500 billion spending commitment to be disbursed over the next four years in the U.S. This pledge builds on the company’s investing in American innovation and advanced high-skilled manufacturing, directed towards A.I, silicon engineering, and skills development for people throughout the nation.

- The > 200 kVA - 330 kVA rated gas fired construction generator sets market was evaluated over USD 150 million in 2024. These units ensure high power supply for large construction activities comprising of commercial real estate development, construction of road transportation, and expansion of complexes, thereby stimulating the business expansion.

- The > 330 kVA - 750 kVA rated gas fired construction generator sets is likely to exceed USD 650 million in 2034. These high rated power source are highly required in various activities to support operations including site offices, batching plants, and heavy machinery will boost the industry landscape.

- For instance, in October 2024, BioMADE announced to invest accounted USD 26.9 million in 17 new projects that aim to improve American bio industrial manufacturing technologies and foster a competent workforce.

- The > 750 kVA rated gas fired construction generator sets market will observe a growth rate of over 10% through 2034. Increasing expansion of industrial complexes and large-scale developments to deliver efficient, stable, and continuous power will positively sway the business growth. These gensets offer low-emission and support construction firms to achieve their carbon emission targets, which in turn will propel the industry momentum.

Learn more about the key segments shaping this market

- Based on application, the industry is segmented into peak shaving, standby, and prime/continuous. The standby gas fired construction generator sets hold a market share of 51.7% in 2024. The industry is poised to grow owing to an ease of operation and higher fuel efficiency. Major public and private players are investing in smart engine technologies comprising of turbocharging and electronic fuel injection to optimize fuel consumption in conjunction with growing focus to curb GHG emissions will stimulate the business landscape.

- The peak shaving gas fired construction generator sets market was valued at USD 150 million in 2024. These gensets are preferred across high demand areas particularly where the construction activities are facing grid instability and power shortages. Stringent emissions regulations implemented by regulatory agencies worldwide to address environmental concerns and reduce air pollution will accelerate the industry outlook.

- For instance, in March 2025, the Ministry of Road Transport and Highways has announced the construction of bridge over the Lohit River systems and Dibang worth USD 87.6 million. This would be executed on DBFOT annuity basis under Arunachal Pradesh Package of SARDP-NE.

- The prime/continuous gas fired construction generator sets market will observe at a faster rate of over 9.5% till 2034. Growing expansion of natural gas pipeline networks to support critical infrastructure in tandem with escalating construction projects comprising of data centers, industrial plants, highways, tunnels, and bridges will encourage the installation of these gensets.

Looking for region specific data?

- The U.S. gas fired construction generator sets market was valued at USD 117.1, 130.6, 144.6 million in 2022, 2023 and 2024, respectively. The country is estimated to reach USD 350 million by 2034. The industry is poised for robust growth propelled by the ongoing expansion of utilities and airports. Increasing concern over emissions and environmental impact along with paradigm shift toward cleaner energy source will complement the business growth.

- The North America gas fired construction generator sets hold a market share of over 15% in 2024. Supportive government policies, tax credits, and incentives programs aimed at promoting energy efficiency, clean energy, and resilience are the key factors are driving the product adoption across the region.

- For instance, in January 2025, the Department of National Defence through the Canadian Forces Housing Agency (CFHA) has announced to build 668 new RHUs and refurbish over 600 RHUs that are spread out throughout the country.

- The Europe gas fired construction generator sets market will witness at a CAGR of over 10% till 2034. Key industry players are incorporating digitalization technologies to optimize performance, enhance equipment visibility, and streamline maintenance operations, which in turn will boost the product penetration.

- The Asia Pacific market for gas fired construction generator sets will exceed USD 1 billion by 2034. The region is experiencing significant growth owing to rapid population growth and substantial investment in construction activities including bridges, roads, and industrial facilities.

- For instance, in August 2024, India has approved twelve new smart industrial cities alongside other infrastructure projects expected to enhance the country’s manufacturing base. The smart city developments under the National Industrial Corridor Development Programme will require investment of USD 3.41 billion, while three railway initiatives in four states will attempt to maximize the logistics network.

- The Middle East gas fired construction generator sets market was reached over USD 30 million in 2024. Rising environmental concerns and regulatory pressure are augmenting the adoption of low-emission and high-efficiency generator sets across region. Increasing government activities in industrial zones, transportation networks, and smart city development projects will boost the demand for these units.

- The Africa gas fired construction generator sets market will witness a growth rate of over 12% up to 2034. The region is facing several power outages, inadequate energy infrastructure and inefficient grid network will bolster the adoption of these units. In addition, ongoing construction boom fueled by government led programs, rapid urbanization, and infrastructure projects.

- For citation, in February 2025, UNIDO has commissioned funding for eight different projects toward sustainable development within Africa and the Middle East. This marks the adoption of an economic focus approach within Japan's supplementary budget.

- The Latin America gas fired construction generator sets market will exceed USD 120 million in 2034. The abundant availability of natural gas reserves in the region, key industry players are heavily investing in exploration, LNG infrastructure, and pipelines networks will drive the business growth.

Gas Fired Construction Generator Sets Market Share

- The top 5 players including Cummins, Caterpillar, Atlas Copco, HIMOINSA, and Mahindra Powerol together holds share of about 44% in the gas fired construction generator sets industry. The market is highly competitive in nature with key industry manufacturers are focusing on durability, advanced digital controls, and emissions compliance.

- Generac Power System is leveraging its expertise in gas based generator sets to fortify its market share in power solutions. The company is expanding its aftersales service network along with incorporating advanced technology solutions comprising of predictive maintenance, remote monitoring capabilities, and IoT enables systems.

- Cummins has been enhancing its brand value for services, reliability, advanced engineering solutions, and continuous improvement of power solutions. The company is continuously improving their efficiency and fuel emissions systems which offer its gensets to more economical for construction activities.

Gas Fired Construction Generator Sets Market Companies

- Cummins has valued USD 34.1 billion net sales in 2024. The sales of its power system segment evaluated USD 1.7 billion, which has grown 22% up from the last year. Its distribution segment has reported USD 3.1 billion, which has grown by 13% as compared to previous year.

- Generac Power Systems registered revenue of USD 4.3 billion in 2024 which has marked growth from the previous year. The domestic segment grew from USD 891 million to USD 1.07 billion which has secured an overall growth of 20%, of which 1% came from acquisitions.

- In 2024, Caterpillar revenue recorded USD 64.8 billion. The company’s Power Generation division reported sales for the last quarter of 2024 was USD 2.24 billion while for the last quarter of 2023 the sales were USD 1.83 billion from all important areas.

Major players operating in the gas fired construction generator sets market are:

- Aggreko

- Atlas Copco

- Caterpillar

- Cooper

- Cummins

- Generac Power Systems

- Greaves Cotton

- HIMOINSA

- J C Bamford Excavators

- Kirloskar

- Mahindra Powerol

- Mitsubishi Heavy Industries

- Rehlko

- Sterling Generators

- Wartsila

Gas Fired Construction Generator Sets Industry News

- In December 2024, Caterpillar launched Cat G3500K series of generator sets which is designed for high-efficiency, reliable, quick response power. This gas series are capable of operating in severe conditions and in many environments including primary and continuous power.

- In June 2024, Cooper Corporation together with Sinfonia Technology, launched India’s first 10 KVA LPG CPCBIV+ certified genset. It is designed to comply with the stringent emission standards mandated by the CPCBIV+ legislation in India which is a significant milestone in the clean engine emission and power generation landscape.

- In March 2024, Caterpillar introduced the Cat DG450 natural gas genset, a low NOx power solution specifically designed for non-emergency applications in areas designated as non-attainment by the U.S. Environmental Protection Agency. This gensets is compatible with the Cat Active Management Platform, a reliable distributed energy resource management system that allows customers to monetize, monitor, and manage these natural gas gensets and other power solutions.

- In February 2023, Cummins launched two new natural gas powered gensets C200N6B and C175N6B. These models are built on the same reliable QSJ8.9G engine platform as the widely used C150N6 and C125N6 natural gas generators, which have gained popularity in various industrial applications. In addition, this launch has made significant market share of the company’s gas gensets portfolio.

The gas fired construction generator sets market research report includes in-depth coverage of the industry with estimates & forecast in terms of “Units” & “USD Million” from 2021 to 2034, for the following segments:

Market, By Power Rating

- ≤ 50 kVA

- > 50 kVA - 125 kVA

- > 125 kVA - 200 kVA

- > 200 kVA - 330 kVA

- > 330 kVA - 750 kVA

- > 750 kVA

Market, By Application

- Standby

- Peak Shaving

- Prime/Continuous

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Russia

- UK

- Germany

- France

- Spain

- Austria

- Italy

- Asia Pacific

- China

- Australia

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Philippines

- Myanmar

- Middle East

- Saudi Arabia

- UAE

- Qatar

- Turkey

- Iran

- Oman

- Africa

- Egypt

- Nigeria

- Algeria

- South Africa

- Angola

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

Frequently Asked Question(FAQ) :

What will be the size of ≤ 50 kVA rated segment in the gas fired air cooled home standby gensets industry?

The ≤ 50 kVA rated segment is anticipated to cross 70 million by 2034.

How much market size is expected from U.S. gas fired air cooled home standby gensets market by 2034?

The U.S. gas fired air cooled home standby gensets market is likely to reach 350 million by 2034.

Who are the key players in gas fired air cooled home standby gensets market?

Some of the major players in the gas fired air cooled home standby gensets industry include Aggreko, Atlas Copco, Caterpillar, Cooper, Cummins, Generac Power Systems, Greaves Cotton, HIMOINSA, J C Bamford Excavators, Kirloskar, Mahindra Powerol, Mitsubishi Heavy Industries, Rehlko, Sterling Generators, Wärtsilä.

How big is the gas fired air cooled home standby gensets market?

The gas fired air cooled home standby gensets market was valued at USD 874.3 million in 2024 and is expected to reach around 2.3 billion by 2034, growing at 10% CAGR through 2034.

Gas Fired Construction Generator Sets Market Scope

Related Reports