Summary

Table of Content

Formaldehyde Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Formaldehyde Market Size

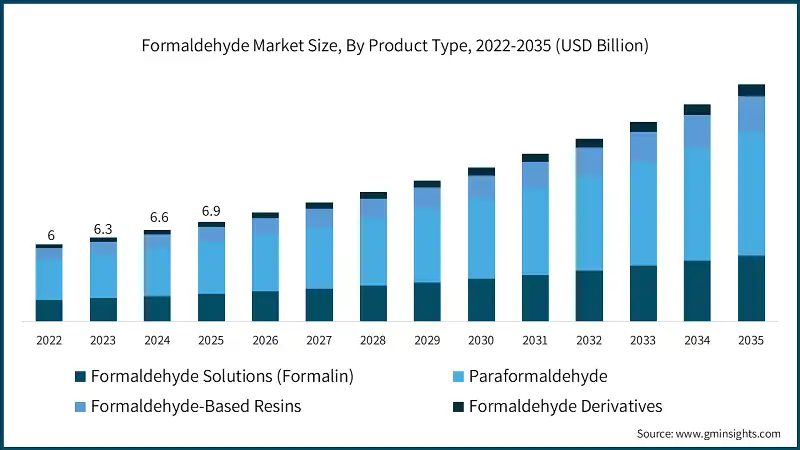

The global formaldehyde market was valued at USD 6.9 billion in 2025. The market is expected to grow from USD 7.3 billion in 2026 to USD 11.4 billion in 2035, at a CAGR of 5.1% according to latest report published by Global Market Insights Inc.

To get key market trends

- The global formaldehyde industry will continue the trend of gradual growth from a broad use within the construction, automotive, health care, agriculture, industrial manufacturing, and others. The formaldehyde industry currently has many regulatory influences driving the changes and continues to shift toward the production of lower-emission and ultra-low-free formaldehyde products.

- Currently, around 46.4% of the market is composed of formaldehyde-based resins. This market is primarily driven by products like engineered wood, laminates, and adhesive-based products. Also, derivative products are the fastest-growing segment within the market as they are being used in automotive, electronics, and industrial applications.

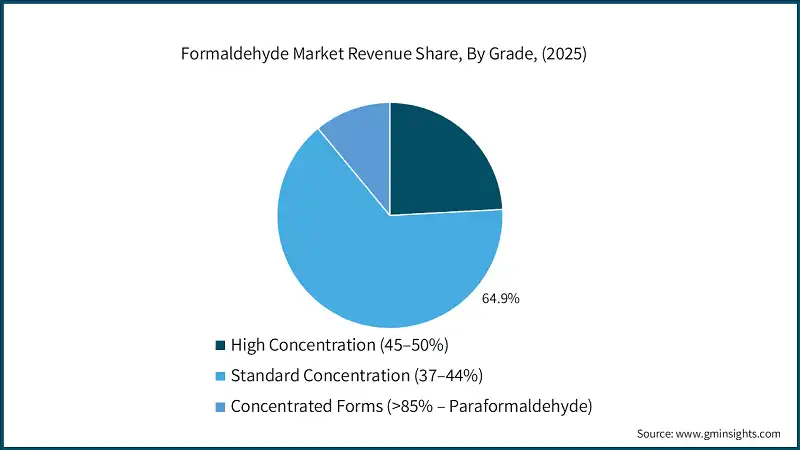

- Based on Formaldehyde's different grades, it can be broken into standard concentrations (37-44%). Approximately 64.9% of the market is made up of standard concentrations because it is extremely versatile across many different categories, including adhesives, coatings, and the treatment of water. In terms of the end-use application, adhesive and resin production account for approximately 45.5% of the overall formaldehyde demand across the entire formaldehyde supply chain.

- The largest consumers of formaldehyde commercially, ranked according to total consumption, are the following building and construction, automotive, and medical applications. In terms of market revenue by region, North America is leading due to a well-developed manufacturing sector and a well-established regulatory framework for the production and use of formaldehyde. Europe is focusing on sustainability and the development of products with low-emission potential.

- In contrast to North America and Europe, Asia Pacific continues to be the fastest-growing region based on the rapid emergence of urban areas, industrialization and the continued growth of the industrial supply chain in the region. The region of Latin America and the Middle East and Africa will be seeing rapid growth in terms of formaldehyde usage as they are both supporting vast industrial base infrastructure development projects.

Formaldehyde Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 6.9 Billion |

| Market Size in 2026 | USD 7.3 Billion |

| Forecast Period 2026-2035 CAGR | 5.1% |

| Market Size in 2035 | USD 11.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for engineered wood products in global construction and housing markets | Boosts formaldehyde resin consumption significantly, especially UF and PF resins, supporting volume growth across emerging and developed regions. |

| Expanding automotive and transportation manufacturing increasing use of lightweight durable formaldehyde-based materials | Drives steady demand for POM and phenolic resins used in fuel systems, interiors, and under-the-hood applications. |

| Growing chemical intermediates production for downstream plastics, coatings, and specialty chemical industries | Strengthens formaldehyde consumption as a feedstock for MDI, BDO, and other high-value derivative manufacturing globally. |

| Pitfalls & Challenges | Impact |

| Stringent environmental regulations and health concerns related to formaldehyde emissions and exposure limits | Restricts usage in building materials increases compliance costs and accelerates shift toward low-emission and alternative products. |

| Volatility in methanol feedstock prices impacting formaldehyde production costs and profitability | Creates margin pressure for manufacturers, complicates long-term contracts, and increases pricing uncertainty across regional markets. |

| Opportunities: | Impact |

| Development of low-emission and ultra-low formaldehyde resins meeting stringent global regulations | Enables continued use in construction and furniture, protecting market share while improving environmental and health compliance. |

| Rapid infrastructure growth in Asia Pacific boosting demand for construction chemicals and resins | Creates high-volume consumption opportunities for UF and PF resins, driven by urbanization and housing expansion. |

| Market Leaders (2025) | |

| Market Leaders |

8.2 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, Japan, India |

| Future outlook |

|

What are the growth opportunities in this market?

Formaldehyde Market Trends

- The formaldehyde industry is seeing a significant shift towards Low & ULTRA Low Emission (ULEF) formaldehyde resins because of increased global regulatory pressures related to environmental issues and indoor quality management. Therefore, manufacturers are currently committing to the development of innovative resin formulations and proprietary emission control technologies to comply with E0, CARB and European regulatory standards. Furthermore, the continued evolution of the market is driving sustained demand within the construction industry, as well as within the furniture and interior markets.

- s also gradually transitioning into High Value Derivatives; Polyoxymethylene (POM), MDI, and Specialty Intermediates are being developed for automotive, electronic, and industrial applications. As a result of this shift away from commoditized formaldehyde products to value-added derivatives, producers are benefitting from vertical integration and expanding their derivative production capacity; thus, increasing their overall profitability and reducing the effect of price volatility.

Formaldehyde Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is segmented into formaldehyde solutions (formalin), paraformaldehyde, formaldehyde-based resins, and formaldehyde derivatives. Formaldehyde-based resins dominated the market with an approximate market share of 46.4% in 2025 and is expected to grow with a CAGR of 5% by 2035.

- The use of formaldehyde solutions (formalin) is considered a major market segment that includes the use of formaldehyde for disinfectants, preservatives, and as a chemical intermediate in many industries, especially textiles, leather, and water treatment; the market value for formaldehyde solutions is projected to reach USD 1.8 billion by 2025 and will experience a 5% annual growth rate.

- Paraformaldehyde is projected to deliver approximately 8% of market share in 2025, based on its ability to provide stability and have higher purities, thus driving its applications in the areas of agrochemicals, pharmaceuticals, and other specialty chemicals, which have a forecast of 5.2% CAGR.

- Resin made from formaldehyde constitutes the greatest volume of consumption and continues to provide engineered wood, adhesive products and laminate products while being manufactured with increasingly reduced formaldehyde emissions.

Learn more about the key segments shaping this market

Based on grade, the formaldehyde market is segmented into High Concentration (45–50%), Standard Concentration (37–44%), and Concentrated Forms (>85% – Paraformaldehyde). Standard Concentration (37–44%) held the largest market share of 64.9% in 2025 and is expected to grow at a CAGR of 5% during 2025-2034.

- The largest segment share of the formaldehyde-based resin market is represented by the number of formaldehyde derivatives that exist today, i.e. POM, MDI, and BDO, which illustrate opportunities for the downstream, high-value integration of formaldehyde derivatives at a CAGR of 5.6%, due to their uses in the automotive, electronics, and industrial markets.

- In addition, high-concentration formaldehyde products are a significant segment of the market and account for a substantial proportion of resin use, chemicals produced as a result of chemical reactions between other chemicals (intermediates), and disinfectants used in the industrial industry; projected market value for high-concentration formaldehyde will reach USD 1.6 billion by 2025 with a CAGR of 5.3%.

- Concentrated forms of formaldehyde will represent niche markets and account for the fastest-growing segment of high-value applications of formaldehyde in pharmaceuticals, agrochemicals and other specialty intermediates.

- As the market continues to expand with new innovative uses for high-concentration formaldehyde in controlled-release formulations of pharmaceutical agents, high-purity derivatives produced world-wide from the use of high-concentration formaldehyde are projected to reach a combined value of USD 0.7 billion in 2025 with a CAGR of 5.2%.

Based on application, the formaldehyde market is segmented into adhesives & resins production, chemical intermediates, coatings & paints, disinfectants & preservatives, textiles & leather treatment, industrial process aids, and others. Adhesives & resins production segment dominated the market with an approximate market share of 45.5% in 2025 and is expected to grow with the CAGR of 4.7% by 2035.

- Adhesives and resins will be the largest overall application segments by revenue USD 3.1 billion comprised of engineered wood, laminated products, and construction materials; driven largely by the use of UF, PF, and MF resin systems for their increasing demand as a result of growing Urbanization and Infrastructure expansion at a CAGR of 4.7% globally through 2025.

- Chemical Intermediates will be among the largest segments with high value-added products including MDI, POM and BDO, used extensively in automotive, electronics and specialty chemicals furthermore, through the performance, antimicrobial and durability characteristics of formaldehyde, coatings and paints, disinfectants and preservatives and treatments will all benefit from the incorporation of formaldehyde.

- industrial process aids can be found in almost every manufacturing sector; "other" segments account only for those niche markets such as pharmaceutical and research chemical applications that are experiencing the highest growth rates 10.4% during the same time period.

Based on end use, the formaldehyde market is segmented into building & construction, automotive, medical & healthcare, agriculture, oil & gas, textiles, apparel & leather, aerospace & defense, semiconductors & electronics, personal care & hygiene, and others. Building & construction segment dominated the market with an approximate market share of 34.5% in 2025 and is expected to grow with the CAGR of 4.6% by 2035.

- The construction and building industries are the largest users of formaldehyde in adhesives, resins, laminates, and insulations, with an estimated value of USD 2.4 Billion in 2025, and a CAGR of 4.6%. Continued urbanization, infrastructure improvements, and an ever-increasing demand for housing all contribute to growth in this segment.

- The automotive industry uses formaldehyde-based resins and derivatives to create lightweight components, interiors, and under-the-hood applications. This segment is currently projected to reach USD 0.9 billion by 2025 and will have a CAGR of 5.4%. The automotive segment benefits from the increasing production of vehicles and the trend towards electrification.

- In addition to the automotive sector, the medical and healthcare industries also utilize formaldehyde for a variety of purposes including sterilizing instruments, preserving specimens, and developing laboratory chemicals. The medical/healthcare segment is projected to reach USD 0.5 Billion in 2025, experiencing a CAGR of 5.7%.

- Several other industries utilize formaldehyde including agriculture, textiles, aerospace, semiconductors, and personal care. Although aerospace and semiconductors account for a smaller market share than the other sectors mentioned, they are experiencing faster growth than the other segments with CAGRs above 6%.

Looking for region specific data?

North America formaldehyde market leads the industry with revenue of USD 950.4 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Formulations of Formaldehyde in North America are being shaped from the steady construction activity, engineered wood products, and automotive applications. The US is the largest consumer regionally and has benefitted through better technology in manufacturing/resin technology. In addition, stricter regulations regarding emissions have spurred the use of low/formaldehyde resins and compliant resin products. Furthermore, stable demand continues for the housing, furniture, and industrial markets.

The Europe formaldehyde industry is growing rapidly on the global level with a market share of 20.7% in 2025.

- The European market for formaldehyde is dictated by a heavy emphasis on environmental regulation, as well as a commitment to sustainable design and production processes. The demand for engineered wood products, automotive components, and specialty chemicals drives demand. The largest portion of the market for formaldehyde continues to remain in Western Europe, although Eastern Europe has seen the growth of the market over time. Current competitive positions in the market continue to define themselves by the implementation of low-emissions and compliant-regulatory technology.

The Asia Pacific formaldehyde market is anticipated to grow at a CAGR of 5.6% during the analysis timeframe.

- Growth in Asia Pacific is being driven by China and India from their building materials, furniture, and chemical industries. Growth in urbanization and infrastructure development in these areas as well as a growing base of manufacturers have created increased demand for these products at an unprecedented level. This increased demand, coupled with setting continuing downstream and capacity expansions to further serve these markets will likely create increased competitive advantages in the Asia Pacific region as government regulations begin to tighten.

Latin America formaldehyde accounted for 10.1% market share in 2025 and is anticipated to show highest growth over the forecast period.

- In Latin America, the growing construction, manufacturing of furniture, and agriculture industries have led to an increase in formaldehyde demand. Brazil has the largest share of this regional increase, followed closely by Mexico and Argentina. Urbanization and infrastructure investment will help continue to grow these markets. However, economically volatile conditions and reliance on imported methanol to make formaldehyde will limit future growth.

Middle East & Africa formaldehyde accounted for 4.9% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

- The Middle East/Africa (MEA) Region continues to see robust growth in the market, primarily due to the construction sector, oil and gas-related chemicals, and growth in the industrial sector. The majority of the consumption of formaldehyde will continue to occur in the Gulf Cooperation Council (GCC) Countries, with continued support from both private and government-supported infrastructure development efforts and investments in petrochemicals.

Formaldehyde Market Share

The top 5 companies in formaldehyde industry include BASF SE, Dynea Oy (Metsa Group), Hexion Inc., Georgia-Pacific Chemicals LLC, and Formacare (European Association). These are prominent companies operating in their respective regions covering approximately 31.3% of the market share in 2025. These companies hold strong positions due to their extensive experience in formaldehyde industry. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- BASF SE a global chemical leader with extensive formaldehyde and resin portfolios, driving innovation, sustainability, and production capacity expansions to serve construction, automotive, and industrial sectors worldwide.

- Dynea Oy (Metsa Group) European specialty chemicals producer focusing on high-quality formaldehyde-based resins and wood adhesives, leveraging strong R&D and customer solutions for engineered wood and industrial markets.

- Hexion Inc. major supplier of formalin and formaldehyde derivatives with broad product range in resins and specialty chemicals, emphasizing product quality and sustainability with global manufacturing footprint.

- Georgia-Pacific Chemicals LLC U.S. resin and chemical producer offering formaldehyde-based adhesives and specialty products for wood, construction, and industrial applications, focusing on performance and compliance.

- Formacare (European Association) sector group under Cefic representing European formaldehyde producers, advocating safe, compliant manufacturing and use of formaldehyde and related resins under strict health and environmental standards.

Formaldehyde Market Companies

Major players operating in the formaldehyde industry include:

- Acron Group (PJSC Akron)

- Bakelite Synthetics

- Balaji Formalin Private Limited

- BASF SE

- Celanese Corporation

- Chemanol (National Methanol Company)

- Dynea AS

- Ercros S.A.

- Foremark Performance Chemicals

- Gulf Formaldehyde Company Q.S.C.

- Hexion Inc.

- Huntsman Corporation

- LCY Chemical Corp.

- Metafrax Chemicals PJSC (Metafrax Group)

- Yuntianhua Group Co., Ltd.

Formaldehyde Industry News

- In 2025, Korean scientists developed a breakthrough process converting toxic formaldehyde into a valuable pharmaceutical building block, enabling safer drug synthesis, higher chemical utilization efficiency, and opening opportunities for formaldehyde recycling in pharmaceutical and fine chemical research, strengthening sustainability perceptions.

- In 2025, formaldehyde prices in India surged over thirty percent following U.S. sanctions disrupting methanol imports from Iran, causing feedstock shortages, raising resin production costs, and triggering panic across plywood, MDF, particleboard, and laminate manufacturers, with stabilization expected after months.

This formaldehyde market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2025 to 2035, for the following segments:

Market, By Product Type

- Formaldehyde Solutions (Formalin)

- Paraformaldehyde

- Formaldehyde-Based Resins

- Formaldehyde Derivatives

Market, By Grade

- High Concentration (45–50%)

- Standard Concentration (37–44%)

- Concentrated Forms (>85% – Paraformaldehyde)

Market, By Application

- Adhesives & Resins Production

- Chemical Intermediates

- Coatings & Paints

- Disinfectants & Preservatives

- Textiles & Leather Treatment

- Industrial Process Aids

- Others

Market, By End Use

- Building & Construction

- Automotive

- Medical & Healthcare

- Agriculture

- Oil & Gas

- Textiles, Apparel & Leather

- Aerospace & Defense

- Semiconductors & Electronics

- Personal Care & Hygiene

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What are the key trends shaping the formaldehyde industry?

Major trends include a shift toward low- and ultra-low-emission formaldehyde resins, rising adoption of high-value derivatives, and increased regulatory compliance across construction and furniture markets.

Who are the key players in the formaldehyde market?

Key formaldehyde industry players include BASF SE, Dynea Oy (Metsa Group), Hexion Inc., Georgia-Pacific Chemicals LLC, and Formacare.

What is the growth outlook for formaldehyde derivatives during the forecast period?

Formaldehyde derivatives are projected to grow at a CAGR of 5.6% through 2035, driven by expanding applications in automotive, electronics, and high-value industrial materials such as POM and MDI.

Which region leads the formaldehyde market?

The U.S. industry generated USD 950.4 million in 2025. Growth is driven by strong construction activity, engineered wood manufacturing, and adoption of low-emission resin technologies.

What was the valuation of the standard concentration (37–44%) grade segment in 2025?

The standard concentration grade held 64.9% of the market, owing to its widespread use across coatings, adhesives, water treatment, and industrial applications.

How much revenue did the formaldehyde-based resins segment generate in 2025?

Formaldehyde-based resins accounted for approximately 46.4% market share in 2025, led by strong consumption in engineered wood, adhesives, and laminate applications.

What is the projected value of the formaldehyde market by 2035?

The formaldehyde industry is expected to reach USD 11.4 billion by 2035, growing at a CAGR of 5.1% due to sustained demand from construction materials, automotive components, and downstream chemical derivatives.

What is the current formaldehyde market size in 2026?

The formaldehyde industry is projected to reach USD 7.3 billion in 2026, supported by increasing use of formaldehyde-based resins in adhesives, laminates, and industrial manufacturing.U

What is the market size of the formaldehyde industry in 2025?

The market size exceeded USD 6.9 billion in 2025 and is expected to grow at a CAGR of 5.1% during 2026–2035, driven by rising demand from construction, engineered wood, and chemical intermediates industries.

Formaldehyde Market Scope

Related Reports