Summary

Table of Content

Food Traceability Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Food Traceability Market size

The global food traceability market was valued at USD 13 billion in 2024. The market is projected to grow from USD 15 billion in 2025 to USD 45 billion by 2034, representing a 13% CAGR from 2025 to 2034, according to latest report published by Global Market Insights Inc.

To get key market trends

- The food traceability market has been recording very good growth, which has been boosted mainly by the increased demand for consumers on the safety and transparency of the food. The consumers are increasingly becoming aware and concerned regarding the source, quality and safety of the food they make. This increasing awareness has made food manufacturers and retailers embrace the use of highly developed traceability solutions that can give visibility the entire line of supply. Consequently, the adoption of technologies such as blockchain, RFID, and IoT is on the rise to guarantee real-time technology and authenticity of food products.

- Market growth has also been fueled by regulatory compulsions which are evident in the various food supply chains all over the world. Government and other international organizations have come up with strict laws to ensure that food products are carefully documented and traced to the point of consumption. As an example, the Food Safety Modernization Act (FSMA) of the U.S. FDA and the European Union General Food Law attach importance to the adherence to the traceability standards. These plans have forced food corporations to invest in modernized tracking systems and data handling which have further boosted the food traceability market.

- The increasing food recalls and contamination cases across the world is another major growth driver. The outbreaks of foodborne diseases, adulteration, and contamination have increased the necessity to have an effective traceability system that reduces the time to find the origin of contamination and reduces the recalls of products. A company should have effective traceability systems that can enable them to offer consumer safety, brand protection and also ensure they remain compliant with regulations. Therefore, the meat industry, seafood, dairy, and processed food are some of the industries that are adopting elaborate traceability systems to address the risks and improve operational efficiency

- The combination of consumer-based demand, regulatory compliance, and food safety issues is hastening the use of traceability technologies in the world. It has caused an increase in the digital solutions of supply chains and the development of new traceability platforms. This trend implies that the food traceability market is going to grow continuously due to the desire of the stakeholders to create a more transparent, reliable, and safe world food ecosystem.

Food Traceability Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 13 Billion |

| Market Size in 2025 | USD 15 Billion |

| Forecast Period 2025 - 2034 CAGR | 13% |

| Market Size in 2034 | USD 45 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising consumer demand for food safety and transparency | Accelerated adoption of traceability systems to meet consumer expectations |

| Regulatory mandates for traceability across food supply chains | Drives compliance-led investments in traceability technologies |

| Increasing food recalls and contamination incidents | Highlights the need for robust traceability to minimize risk and response time |

| Pitfalls & Challenges | Impact |

| High implementation and maintenance costs | Limits adoption among small and mid-sized food producers |

| Lack of standardization across global supply chains | Creates fragmentation and inefficiencies in traceability efforts |

| Data interoperability and integration issues among stakeholders | Hampers seamless tracking across diverse systems and platforms |

| Opportunities: | Impact |

| Adoption of blockchain, IoT, and AI for real-time tracking | Enhances precision, speed, and trust in traceability data |

| Expansion of digital infrastructure in emerging markets | Opens new avenues for traceability system deployment |

| Growing interest in sustainable and ethical sourcing | Positions traceability as a key enabler of responsible supply chains |

| Market Leaders (2024) | |

| Market Leaders |

13.5% market share |

| Top Players |

Collective market share in 2024 is 42.2% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, India |

| Future Outlook |

|

What are the growth opportunities in this market?

Food Traceability Market Trends

- The increased uptake of digital and cloud-based traceability solutions is one of the current trends in the food traceability industry. Food organizations are moving towards cloud and SaaS solutions to traceability information management systems at an increasing rate as opposed to paper-based networks or systems which are hardware intensive. Such digital transformation is more scalable, allows real-time data exchange between several stakeholders, and lowers operational expenses. It can also enable the smaller and mid-sized enterprises to establish traceability systems in an effective geographical manner.

- The other important trend is the adoption of new technologies like blockchain, IoT sensors, RFID tags, and analytics that use AI into traceability systems. The technologies used allow the collection of data accurately and without tampering and enhance visibility along the supply chain. Blockchain guarantees the records immutability, IoT ensures continuous monitoring, and AI may increase predictive analysis to detect risks. Janet, these tools are turning traceability into an obligation-based process into an active and information-based supply chain management practice.

- The trend in the industry that is expanding is the development of traceability systems and sustainability and ethical sourcing verification. The traceability platforms are becoming more popular by companies as a means to confirm their claims like sustainably sourced ingredients, lower carbon footprints, and fair labor practices. This trend indicates the move towards non-safety traceability to holistic transparency that is in line with the corporate environmental and social sustainability objectives as well as consumer concerns regarding environmentally and socially responsible food products.

- The traceability environment is increasingly segmented in the market and regionally specialized. The various food segments like fresh produce, seafood, meat, processed foods are moving towards more specific traceability solutions to their own distinct risks and handling needs. Moreover, new markets such as the Asian-pacific and the Latin American are heavily investing in national traceability infrastructure enhancing market penetration and standardization throughout their food supply chain.

Food Traceability Market Analysis

Learn more about the key segments shaping this market

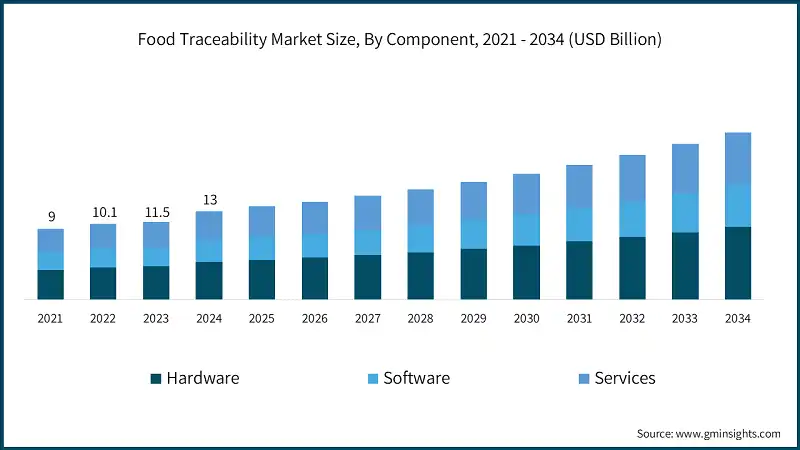

Based on component, the market is segmented into hardware, software, and services. The hardware segment was valued at USD 5.4 billion in 2024 and is anticipated to register at 10.7% CAGR during 2025 to 2034.

- Hardware part of the food traceability market is growing with food corporations integrating modern tracking devices including RFID tags, barcode and IoT-enabled sensors in their attempts to increase supply chain visibility. The gadgets assist in recording real-time information about product movement, storage and shelf life enhancing food safety and quality management. The increasing focus on automation and the management of intensive logistics is increasing the need to find stable and scalable hardware infrastructure in the production and distribution phases.

- The software segment is expanding at a high rate because of the rise in the adoption of cloud-based and blockchain-integrated traceability systems. These solutions offer centralized data management, predictive analytics, and real-time monitoring features that can enable food producers and retailers to establish solutions promptly and make operations easier. The rise of software platforms as an important resource to streamline supply chain visibility and performance can be explained by the fact that companies are more focused on the transparency of their data and their adherence to regulatory requirements.

- The services segment is becoming stronger with organizations making special requests to receive specialized assistance in setting up systems, integrating and maintaining traceability structures. Service providers also possess knowledge in tailoring traceability solutions, interoperability between hardware and software and in keeping up with the changing food safety rules. This increasing dependence on expert and administered services is enhancing operational effectiveness and assisting corporations to accomplish perfect end-to-end traceability.

Based on mode of deployment, the food traceability market is segmented into on-premises, cloud-based, and hybrid. The on-premises segment was valued at USD 5.8 billion in 2024 and is anticipated to register at 8.8% CAGR during 2025 to 2034.

- The on-premises segment is expanding because food industry companies have become more concerned with data security and control of the system in their own infrastructure. It allows custom traceability operations and maintains sensitive supply chain data. Complicated systems with large manufacturers still need on-premises systems in order to ensure complete compliance and customized workflow management.

- Cloud based segment is growing at a high rate because of its scalability, flexibility and cost-effectiveness. It enables real-time exchange of data amongst suppliers, retailers, and regulators and cuts down on the cost of infrastructure. This is shifting towards cloud-based traceability solutions because of the growing use of digital supply chain systems and remote monitoring systems.

- The hybrid sector is also trending because it offers a mix of security offered by on-premises solutions with the flexibility of cloud solutions. This strategy helps firms to keep vital information in their location but utilize cloud analytics and real-time collaboration solution. Hybrid deployment provides a perfect compromise in control, scalability, and free exchange of information throughout the food supply chain.

Based on technology, the food traceability market is segmented into RFID (Radio Frequency Identification), barcode, infrared sensors, biometrics, GPS, blockchain, and others (e.g., QR codes, NFC). The RFID (Radio Frequency Identification) segment held 28% share with USD 3.6 billion in 2024.

- Food traceability market is improving at a very high pace with RFID and barcodes technology that facilitate effective product identification and tracking. RFID has automatic and real-time data capture and is extensively implemented in logistics and cold-chain management, whereas barcodes have cost-effective and reliable labeling and compliance. Collectively, these technologies provide digital tracking systems, which are accurate and transparent throughout the production and distribution process.

- The new technologies such as infrared sensors, biometrics and GPS are making supply chain more precise and controlled. IR serves to track freshness and temperature of goods and biometrics is a security measure that allows identification of workers and GPS can be used to track the position of a shipment in real time in order to keep delivery intact. The technologies are assisting the food companies in enhancing quality control, spoilage, and accountability throughout the operations.

- The concept of traceability is being transformed using blockchain and other digital technologies like QR codes and NFC to provide transparency of data and consumer interaction. The blockchain will enable secure, tamper-free record-keeping, whereas QR and NFC technologies will enable the consumer to check the product origin and authenticity in real-time. This is digital integration which promotes increased trust, regulatory adherence and consistency of the brand in the planetary food ecosystem.

Based on software solution, the food traceability market is segmented into enterprise resource planning (ERP), laboratory information management systems (LIMS), warehouse management systems (WMS), cloud-based traceability platforms, others (e.g., friction welding, supply chain management (SCM)). The enterprise resource planning (ERP) segment was valued at USD 4.5 billion in 2024 and having a market share of 35%.

- High growth rate of software segment in food traceability is with the integration of Enterprise Resource Planning (ERP), Laboratory Information Management System (LIMS), Warehouse Management Systems (WMS) and cloud-based traceability systems. ERP and WMS systems optimize the production planning process, inventory management and logistics, which enables companies to have full visibility and control of the movement of the products. LIMS has a significant part to play in quality assurance through monitoring the test data as well as the sample results and food safety compliance.

- Digital transformation in the food industry is underway with the help of cloud traceability systems. These platforms facilitate smooth data exchange, real time tracking and co-ordination of various stakeholders in global supply chains. Large enterprises and small food producers will be interested in them because of their scalability and cost efficiency. There are also some innovative solution variants in the category Others, e.g. advanced Supply Chain Management (SCM) tools, that are combining analytics and automation to enhance decision-making and reduction of risk exposure.

Based on application, the food traceability market is segmented into meat & livestock, dairy products, fruits & vegetables, seafood, beverages, grains & cereals, processed foods, and others (e.g., bakery, confectionery). The meat & livestock segment was valued at USD 3.1 billion in 2024 and is anticipated to register at a 12.9% CAGR through 2034.

Traceability is currently becoming larger in a variety of food items and meat, seafood, and dairy are the most adopted categories, as all are prone to high spoilage rates and have strict safety regulations. In meat and livestock industry, traceability systems are able to monitor the path of animals, both in the farm and at the processing plants, to ensure the control of disease as well as compliance with regulations. On the same note, traceability of seafoods assists in ensuring the origin of catch, avoidance of unlawful fishing and preservation of freshness in extended product transportation processes. Applications in dairy are in temperature monitoring and quality control of production and distribution.

- Traceability systems are increasingly employed in fruits, vegetables, grains as well as processed foods to provide transparency and prevent food waste. As the demand of consumers to know more about the farm to table grows, the traceability will be used to verify the organic products, control the storage factors and monitor the expiry dates. Baked goods and beverages are also incorporating traceability to check the sourcing and consistency of production of ingredients. This broad usage in the categories demonstrates that traceability has become a critical part of quality management in the food sector.

Learn more about the key segments shaping this market

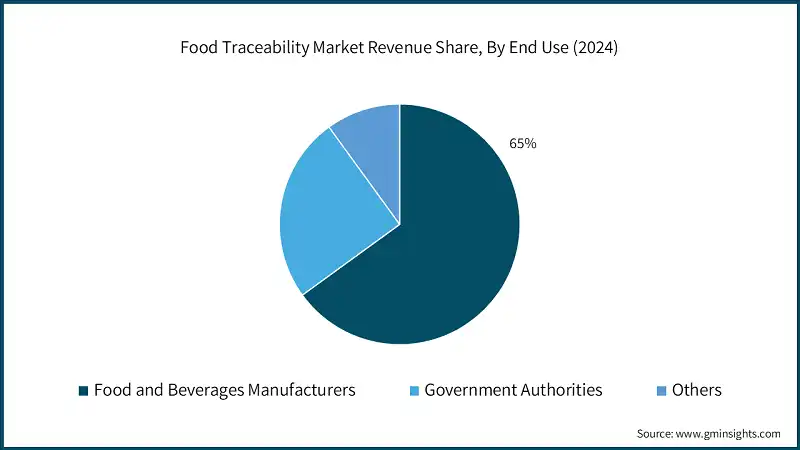

Food and beverages manufacturers end use segment was valued at USD 8.4 billion in 2024 is anticipated to expand with a CAGR of 13.4% in the forecasted period and holds a revenue share of 65% in 2024.

- Manufacturers of food and beverages are leading traceability use because they aim at offering assurance that their food safety standards are adhered to and they are able to retain customer loyalty. These systems allow producers to track the ingredients, recalls being effective and responsibility that is proven at each level of production. Process optimization and reduction of costs in terms of the improved supply chain coordination and real-time monitoring are also beneficial to manufacturers.

- Governments are considering the traceability systems to improve the health, safety and regulatory standards of the population. The frameworks assist in the monitoring of imports and exports, source of contamination and adherence to national and international food legislation. In addition to these, other end users like the logistics providers, retailers, and distributors are investing in traceability to enhance product tracking, increase transparency and address the demands of consumers to have verified, safe, and ethical food products.

Looking for region specific data?

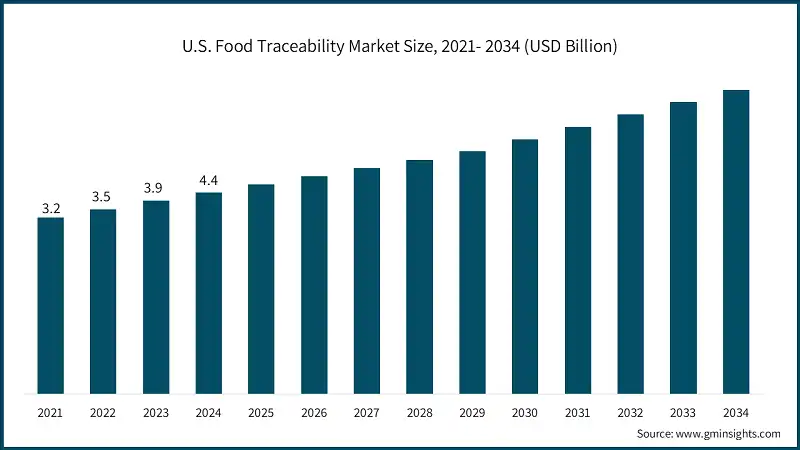

The North America food traceability market accounted for USD 4.9 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

Stringent food safety laws and the rise in consumer focus on transparency are steadily growing the market in North America. The U.S. Food Safety Modernization Act (FSMA) provides a strong tracking system, which pushes manufacturers and retailers to implement the innovative traceability system. Market digitization is also being fueled by the existence of large food processors and technology innovators. End-to-end visibility across supply chains has also been promoted by the increasing demand of clean-label and sustainably sourced food. Combination of blockchain, IoT and AI-based solutions is becoming an important facilitator of efficiency and compliance in the regional food ecosystem.

U.S. dominates the North America food traceability market, showcasing strong growth potential.

Growth is especially good in the U.S. where food companies are laying emphasis on traceability in an attempt to handle recalls and avoid chances of contamination. The use of cloud-based systems and RFID made systems is improving the visibility of data between farm and retail shelf. Traceability solutions are becoming more popular with retail giants and e-commerce grocery platforms as a way to assure customers about the authenticity of the product. Also, government-based digital programs are driving interoperability among various tracking systems, which guarantee complete supply chain traceable. This has been a long-standing regulatory and technological wave that makes the U.S. a key institution in food traceability innovation.

The Europe food traceability market size exceeded USD 4.1 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

The traceability market of food is growing in Europe because of the stringent regulatory controls and a culture of consumer consciousness. The General Food Law of the European Union mandates that companies keep detailed tracking records, which will assist in tracing the route of production to distribution. Market growth is also being influenced by sustainability issues and increasing demand of food products that are ethical products. The current trend is large-scale digital transformation initiatives that result in the implementation of smart labeling, blockchain, and IoT-based tracking systems in various food industries.

Germany dominates the Europe food traceability market, showcasing strong growth potential.

Germany is experiencing a rapid uptake of traceability because food manufacturing and food logistics chain in Germany is very orderly. The transparency of the food supply chains in the country has been improved by the focus of the country on automation and Industry 4.0 technologies. RFID and digital twins are the two technologies that are actively used by German companies to track the quality of products, sustainability indicators, and the authenticity of their origins. Additionally, the partnership between technology vendors and regulators is leading to the creation of standard data platform, which enhances traceability facilities on the national level.

The Asia Pacific food traceability market is anticipated to grow at 19.1% CAGR during the analysis timeframe.

In Asia-Pacific, due to the high growth rates in terms of industrialization, urbanization, and growing food exportation activities, the market is high growth region. There is increased stringent food safety regulations in governments within the region as a result of a number of contamination incidents that have occurred in the past years. The rise in the number of middle-class people and the increase in awareness of the origin of food is forcing manufacturers towards clean and highly enabled tracking systems. Food authenticity and safety are being centralized around technological integration through IoT sensors, QR codes and blockchain platforms.

In China, Asia Pacific food traceability market is estimated to grow with a significant CAGR.

China is the most rapidly developing regional market that is fueled by regulatory pressure and digital innovation. Government efforts like the initiatives like the National Food Safety Standard and Smart Agriculture Program are hastening the uptake of traceability in the food industry. Livestock, seafood and packaged food traceability renewable solutions using blockchain and AI are increasingly implemented in Chinese companies. Moreover, the e-commerce is also employing QR-based authentication to establish a sense of consumer trust and counterfeit goods, enhancing even more the role of China in the worldwide food traceability arena.

The Latin America food traceability market accounted for 5% revenue share in 2024 and is anticipated to show lucrative growth over the forecast period.

Latin America market is expanding because of the rising food exports, escalating food safety issues and pressure on the food safety standards by international trade. High-level export base in beef, fruits and processed foods, as well as agricultural diversity in the region is favorable to the adoption of digital traceability. The governments are also implementing new systems of traceability to enhance the tracking of products and to meet the importation standards of the North American and European regions. The most important factors facilitating this growth are technological modernization and cooperation between the private sector.

Brazil leads the Latin America food traceability market, exhibiting remarkable growth during the analysis period.

Brazil is also the fastest developing nation in Latin America due to the increasing agribusiness industry and the world meat export leadership. Traceability is becoming a common practice in livestock and poultry industries to maintain international certification requirements. RFID tags, GPS tracking, and blockchain platforms are the areas in which the Brazilian companies invest in order to make the supply chain more transparent. Moreover, the Brazilian food industry is becoming innovative and competitive in the world through the government initiative to promote national traceability standards and data-driven agriculture

Middle East & Africa food traceability market is expected to grow at a CAGR of 13% during the analysis timeframe.

The Middle East & Africa region is also experiencing gradual yet continuous increase in food traceability due to increasing food imports and the safety assurance requirement. Traceability is gaining momentum in governments to enhance food security and minimize challenges related to contamination and fraud. There is an increase in investments in digital infrastructure and smart logistics, which allows increased visibility of supply chains. The increased consumption of packaged and processed food is also producing the pressure on the availability of the use of trustful product tracking mechanisms.

Saudi Arabia food traceability market to experience substantial growth in the Middle East and Africa in 2024.

Saudi Arabia is making significant improvements and one of the aspects of that progress is the Vision 2030 initiative through which the food and agriculture industry is being modernized. It is also investing in digital supply chain solutions and smart labelling technologies so that all imported and locally produced foods can be guaranteed quality and traceability. Food manufacturers are incorporating the IoT sensors, blockchain, and cloud-based traceability systems to comply with regulatory measures and consumer demands. These developments are making Saudi Arabia a regional food safety and traceability innovation leader.

Food Traceability Market Share

- SGS SA, Honeywell International Inc, Zebra Technologies, C.H. Robinson, and Cognex are a significant part of the global market and with the further standing of being moderately concentrated with the top five players steadily holding market share of 42.2% in the year 2024.

- The nature of the competitive environment among food traceability market can be described as a combination of global certification organizations, testing laboratories, inspection service providers, and technology companies that constantly innovate to tighten their grip on the market.

- The companies are oriented towards providing a combination of testing, auditing, and data analysis to achieve compliance and transparency in food supply chains. With their power in food safety coupled with international contacts and hi-tech facilities, they are able to deliver their services to many segments of the industries including primary farming to the processed food product manufacturing.

- These players make huge investments in digital transformation and technology-driven service models to maintain their position in the market. They are also adding new powerful technologies like blockchain, RFID, IoT, and AI to allow the tracking of products in real time and predictive analytics.

- Strategic action promotes visibility of the supply chain of the company and also ensures food producers trace the products back to their origin within a few seconds. Also, a large number of companies have built their own traceability solutions or cloud solutions, which allow their clients to have customizable dashboards to trace the compliance, quality management, and efficiency of their logistics.

- Mergers, acquisitions, and partnerships are now major tools in the expansion of these market leaders in global frontiers and technical capability strengthening. They are establishing new industry standards of traceability through partnerships with food manufacturers, logistics providers and regulatory bodies.

- These alliances enable firms to cut across geographies and industries with their services and be consistent and reliable in data reporting. They also increase their credibility and control over the global traceability standards by the alignment to governmental initiatives and sustainability objectives.

- Company’s overall strength in terms of service portfolios and quality standards of a global scale is another key factor in their competitiveness. These businesses provide end to end traceability solutions, such as certification and testing, online tracking and risk evaluation.

- Companies are reliable partners to food producers and retailers due to their adherence to regulatory requirements as well as adhering to constant innovation. They innovate their products all time in order to be in tandem with the dynamic consumer demands in food safety, transparency and sustainability.

- In general, the leading companies of the food traceability industry have played an important role in the industry reformation by creating a data-based, technology-enabled ecosystem. Their aggressive attitude towards innovation, teamwork, and compliance have not only made them have better competitive advantage but have hastened the worldwide shift to safer and more accountable food supply chains.

Food Traceability Market Companies

The major players operating in food traceability industry include:

- SGS SA

- Honeywell International Inc

- Zebra Technologies

- C.H. Robinson

- Cognex

- Others

- SGS SA aims to enhance its market dominance in terms of food traceability by incorporating highly tested, inspected and certified services. The company keeps investing in digital traceability systems, auditing systems that utilize blockchain, and verification systems that focus on sustainability. The extensive network of its laboratories worldwide and regulatory experience aid its clients to be compliant and establish confidence within global food supply chains.

- Honeywell International Inc. works on the creation of real-time food tracing through the development of advanced automation, IoT and sensor-based monitoring systems. The combination of software and hardware solutions of the company allows end-to-end visibility to enhance safety and efficiency of logistics and cold-chain operations. Honeywell has been on the leading edge of traceability infrastructure because of constant innovation in related technologies.

- Zebra Technologies continues to maintain its position in the market due to the availability of barcode, RFID and data capture technologies which underline the current food traceability systems. Its solutions improve inventory precision, product recognition and logistics visibility. The direction that Zebra takes towards the digitalization of automation and smart labeling helps companies to optimize and align their operations and meet international traceability standards.

- C.H. Robinson supports its spirit through its logistics management and digital supply chain experiences. Advanced data analytics, temperature monitoring, and cloud-based platforms are used by the company to make sure that the transparency is ensured, and timely delivery is delivered by food transport. Through combining the tools of sustainability and visibility, it assists the clients in attaining traceable and efficient networks in distribution.

- Cognex Corporation is also still a major player having provided machine vision and barcode reader technology that uses images based on the reading of barcodes that are important in food traceability. It has high-precision systems that enhance the identification of the products, quality control, and verification of the packaging in the food production lines. Ongoing development of AI-based visual inspection can assist manufacturers in having error-free, automated processes of traceability.

Food Traceability Market News

- In August 2025, Zebra acquired Elo Touch Solutions, at USD 1.3 billion, to enhance connected frontline and kiosk operations; in the food-traceability sector this is an indication of increased interactive and data-capture touchpoints in the retail/distribution phases.

- In June 2025, Cognex launched OneVision, an AI-driven machine vision automation platform based on the cloud. The product can also work with scalable vision applications, which is in line with the requirement of quality and flexible, real-time traceability of food operations.

- In March 2025, Photoneo, a 3D machine-vision supplier, was purchased by the Zebra Technologies Corporation. This further introduces high vision and automation to the Zebra brand, improving the functions of product tracking, identification, and logistics- direct facilitation of food-traceability systems.

- In March 2025, SGS announced FSMA 204 Food Traceability Solutions which consists of audits, training, and the TRAKKEY platform , which is notable due to its bespoke solution to food traceability needs, makes the firm more relatable to food manufacturers and supply chains.

- In January 2025, Cognex Corporation introduced new AI-powered barcode readers DataMan 290 and 390 to achieve better decoding performance in the manufacturing and logistics environment. They enhance traceability features because proper high-speed barcode reading is the golden key to monitoring food products and supply-chain events.

- In December 2024, SGS SA collaborated with ENSESO4Food to incorporate the TRAKKEY4Food digital platform into its FSMA 204 traceability platform. This alliance continues their food-traceability compliance services stack, allowing customers to satisfy US regulatory mandates and enhance the supply-chain transparency.

- In July 2024, C.H. Robinson sold its European Surface Transportation division to sennder Technologies GmbH. This sale enabled C.H. Robinson to concentrate on its core logistics and supply-chain visibility services, which are part of the food-traceability companies void of more end-to-end transport visibility.

The food traceability market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) from 2021 to 2034, for the following segments:

Market, By Component

- Hardware

- Software

- Services

Market, By Mode of Deployment

- On-Premises

- Cloud-Based

- Hybrid

Market, By Technology

- RFID (Radio Frequency Identification)

- Barcode

- Infrared Sensors

- Biometrics

- GPS

- Blockchain

- Others (e.g., QR codes, NFC)

Market, By Software Solution

- Enterprise Resource Planning (ERP)

- Laboratory Information Management Systems (LIMS)

- Warehouse Management Systems (WMS)

- Cloud-based Traceability Platforms

- Others (e.g., Friction welding, Supply Chain Management (SCM))

Market, By Application

- Meat & Livestock

- Dairy Products

- Fruits & Vegetables

- Seafood

- Beverages

- Grains & Cereals

- Processed Foods

- Others (e.g., bakery, confectionery)

Market, By End Use

- Food and Beverages Manufacturers

- Government Authorities

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the food traceability market?

Key trends include adoption of digital and cloud-based traceability solutions, integration of blockchain, IoT sensors, RFID tags and AI analytics, and growing focus on sustainability and ethical sourcing verification.

Who are the key players in the food traceability market?

Key players include SGS SA, Honeywell International Inc, Zebra Technologies, C.H. Robinson, Cognex, Carlisle Technology, Merit-Trax Technologies, Trustwell, Safe Traces, Bext360, rfxcel, Covectra, and Bar Code Integrators.

What was the valuation of the on-premises deployment segment in 2024?

On-premises deployment segment was valued at USD 5.8 billion in 2024 and is anticipated to register at 8.8% CAGR during 2025 to 2034.

Which region leads the food traceability market?

North America held the largest market share with USD 4.9 billion in 2024. Stringent food safety laws like FSMA and high consumer focus on transparency fuel the region's dominance.

What is the growth outlook for Asia Pacific food traceability market from 2025 to 2034?

Asia Pacific is the fastest-growing market, projected to grow at a CAGR of 19.1% through 2034, due to industrialization, urbanization, and stringent food safety regulations.

How much revenue did the hardware segment generate in 2024?

Hardware segment generated USD 5.4 billion in 2024, supported by integration of RFID tags, barcodes, and IoT-enabled sensors for supply chain visibility.

What is the current food traceability market size in 2025?

The market size is projected to reach USD 15 billion in 2025.

What is the market size of the food traceability in 2024?

The market size was USD 13 billion in 2024, with a CAGR of 13% expected through 2034 driven by rising consumer demand for food safety and transparency.

What is the projected value of the food traceability market by 2034?

The food traceability market is expected to reach USD 45 billion by 2034, propelled by regulatory mandates, increasing food recalls, and adoption of blockchain, IoT, and AI technologies.

Food Traceability Market Scope

Related Reports