Summary

Table of Content

Food & Beverages Air Filters Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Food & Beverages Air Filters Market Size

Food & Beverage Air Filters Market size exceeded USD 980 million in 2019 and is estimated to register over 6.6% CAGR between 2020 and 2026. Increasing cases of food borne infections due to consumption of food products manufactured in unhealthy conditions to promote food & beverage air filters industry growth.

To get key market trends

Increasing awareness regarding the need to prevent chronic health issues such as diabetes, heart problems, cholesterol and obesity is attracting consumer attention towards the consumption of food and beverage products manufactured under health environmental conditions. Increasing adoption of modern agricultural techniques involving the use of fertilizers and pesticides coupled with the increasing trend of organic farming is likely to raise concerns over safety and hygiene of food products manufactured, thus raising the demand for more efficient filtration solutions in the food & beverage industry.

The spread of food borne infections caused due to the consumption of contaminated food products manufactured in unhygienic conditions without the use of proper filtration systems may boost the growth of food & beverage air filters market. Increasing consumer preference towards the consumption of packaged healthy food products is likely to drive market share. The increasing awareness regarding the consumption of non-alcoholic beverages and organic fruit juices may escalate the product adoption.

Food & Beverages Air Filters Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 980.38 Million (USD) |

| Forecast Period 2020 to 2026 CAGR | 6.6% |

| Market Size in 2026 | 1.5 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Increased acceptance of advanced technologies such as high-pressure processing for manufacturing food products demand the use of highly effective equipment for filtration of bacteria, fungi and other particles being released in the food processing area, raising the product demand. Favorable regulations such as clean label and packaging requirements laid down by the Food and Drug Administration are encouraging food manufacturers to install air filters in their production facilities.

However, high cost of installation of few types of air filters and the high maintenance cost associated with it may restrict the growth of food and beverages air filters market to some extent during the forecast period. Moreover, installation of some air filters such as HEPA air filters may turn out to be an expensive affair for small and medium sized food and beverage manufacturers, which may reduce its adoption rate to some extent among food and beverage manufacturers.

Food & Beverages Air Filters Market Analysis

Learn more about the key segments shaping this market

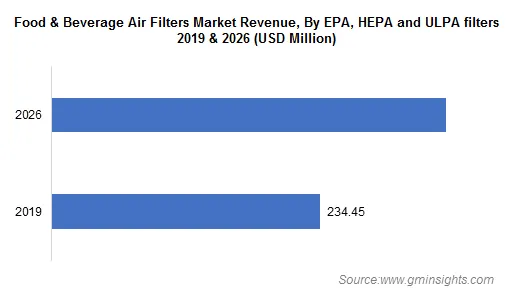

The food & beverage air filters market based on the product spectrum is segmented into dust collector, mist collector, cartridge collector, EPA, HEPA and ULPA filter and baghouse filter. EPA, HEPA and ULPA filter segment was valued at over USD 230 Million in 2019 and is expected to witness remarkable 7.3% CAGR over the assessment period. This is mainly attributed to the high filtration efficiency offered by these filters.

HEPA filters can eliminate 99.97% of contaminant particulate matter of diameter of 0.3 μm. The laminar airflow ensured by these filters are likely to raise the product demand in the coming years. ULPA filters are capable of removing 99.9% of contaminants which are 0.12 μm or larger in diameter.

The ability of HEPA and ULPA filters to function efficiently in adverse, sensitive and moisture-prone areas is likely to raise product demand. The numerous attributes offered by ULPA filters such as larger media area, longer service life, ability to operate in a low pressure drop and lower energy consumption make it a cost-effective option for food processors. Increased consumer awareness regarding food safety and purity may foster food & beverage air filters market statistics.

Learn more about the key segments shaping this market

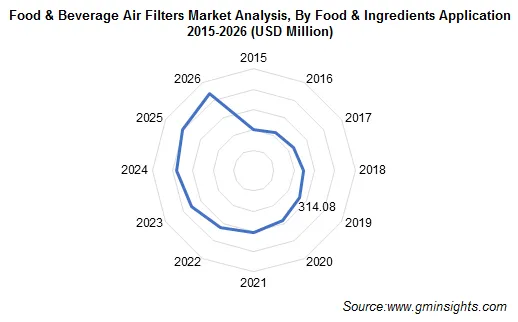

Based on application, the food & beverage air filters market is divided into food & ingredients, dairy, bottled water, brewery and non-alcoholic beverages. The food and ingredients segment dominated the global food & beverage air filters market in 2019 with a market value of USD 310 Million. The high use of air filters in food & ingredient manufacturing is ascribed by the high rate of dust particle emission from spices and flavors used in its manufacturing.

The high level of particulate matter and spores released into the air while manufacturing bakery and confectionary products poses the need for better quality filtration systems for consumer safety, thus boosting the market share. Moreover, grain factories involve grain separation and sieving stages, which releases a lot of dust into the air, raising the demand for high efficiency filters.

Looking for region specific data?

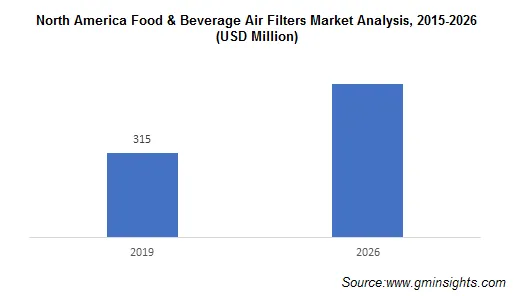

North America food & beverage air filters market is expected to witness considerable growth owing to changing consumption patterns of consumers and their inclination towards the consumption of healthy, convenience foods. Rising health consciousness coupled with increased prevalence of illnesses such as diabetes, obesity, heart problems and cholesterol in North America are compelling food and beverage manufacturers in the region to adopt hygienic manufacturing practices and clean label requirements.

Extremely cold temperatures in the region together with the increasing disposable income of people are expected to encourage the consumption of wine and other brewery products, thus raising product demand from the beverage industry. Favorable regulatory scenario by the U.S. Food & Drug Administration to promote the manufacturing of food products in a hygienic environment may fuel the market outlook.

Food & Beverages Air Filters Market Share

Key players operating in the food & beverage air filters market are

- 3M Group

- Pall Corporation

- Porvair Filtration Group Ltd.

- Camfil Group

- Nano Purification Solution Ltd.

- APC Filtration, Inc.

- Air Filters, Inc.

- Parker-Hannifin Corporation

- Donaldson Company, Inc

- Spirax - Sarco Engineering Plc

Key players are adopting strategies such as contract acquisition and capacity expansions to enhance their product portfolio and client reach and meet the increasing client requirements.

In January 2020, Parker-Hannifin Corporation began the construction of Parker Filtration Innovation Center, a new filter membrane application research and development center in Columbia, Tennesse. This capacity expansion would enable the company to conduct extensive research to improve filtration systems in the food & beverage industry.

In October 2020, Camfil Group acquired a contract from Tönnies Group for fitting the CC 6000 and CC 2000 and its ProSafe HEPA H14 filter in the company’s meat processing facility. This contract acquisition would enable the company to improve its brand name in the market and increase its sales.

The Global Food & Beverage Air Filters market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in Thousand units & revenue in USD Million from 2015 to 2026 for the following segments:

By Product

- Dust Filter

- Mist Filter

- Cartridge Filter

- EPA, HEPA and ULPA Filter

- Baghouse Filter

By Application

- Food & Ingredients

- Dairy

- Bottled water

- Brewery

- Non-alcoholic beverages

The above information has been provided for the following countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- Malaysia

- Thailand

- Australia

- South Korea

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

How will North America prove to be a lucrative region for global food & beverage air filters market revenue growth?

The changing consumption patterns of consumers coupled with inclination towards healthy, convenience foods and rising health consciousness will favor the growth of North American food & beverage air filters industry size.

Why will food and ingredients applications play a key role in the expansion of global food & beverage air filters industry share?

The food and ingredients segment was valued at USD 310 million in 2019 and is poised to flourish in the coming years owing to its rising usage of air filters attributed to the high rate of dust particle emission from spices and flavors used in its manufacturing.

What factors will fuel the demand for EPA, HEPA, and ULPA filters in the global food & beverage air filters industry?

EPA, HEPA, and ULPA filter segment was accounted for over USD 230 million in 2019 and is likely to flourish at 7.3% CAGR through 2026, favored by their high filtration efficiency in adverse, sensitive, and moisture-prone areas.

How will increasing cases of foodborne infections impact the global food & beverage air filters market size?

In 2019, the global food & beverage air filters industry revenue crossed USD 980 million. Due to the mounting cases of food-borne infections due to consumption of food products manufactured in unhealthy conditions, the market size is set to expand at 6.6% CAGR through 2026.

Food & Beverages Air Filters Market Scope

Related Reports