Summary

Table of Content

Fluoropolymer Films Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Fluoropolymer Films Market Size

Fluoropolymer Films Market size was USD 2.22 billion in 2018 and will grow at a CAGR of 4.9% from 2020 to 2026. Proliferating electronics industry in developing nations coupled with increasing demand for medical & healthcare facilities across the globe will escalate the revenue generation.

To get key market trends

To get key market trends

Fluoropolymer films are high-performance state of the art materials with exceptional characteristics such as chemical resistance, low coefficient of friction, transparency, weather resistance, heat resistance, water absorption, etc. Fluoropolymer films are widely used across a number of end-user industries such as transportation, electrical and electronics, construction, industrial processing, etc. They provide a significantly long shelf life for critical components utilized in emission control, performance enhancement, and safety of automotive and aerospace industries.

Fluoropolymer films market share is gaining a higher visibility in the medical sector owing to their application in various medical packaging materials. Pharmaceutical packaging requires to restrict chemical, biological, climatic and mechanical hazards that may lead to the product deterioration.

Fluoropolymer Films Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 2.22 Billion (USD) |

| Forecast Period 2020 to 2026 CAGR | 4.9% |

| Market Size in 2026 | 3.11 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Development of next generation drug containers for enhancing the barrier resistance in cap liners, drug delivery systems and plunger laminates will significantly augment the fluoropolymer films market application in pharmaceutical packaging. In addition, cryogenic preservation, coated surgical instruments and cell culture bags utilized in healthcare sector require high performance materials with optimum biocompatibility.

Fluoropolymer films provide enhanced capabilities of chemical resistance and higher purity of medical and pharmaceutical devices. These trends depict that the product will gain substantial revenue in coming years from pharmaceutical industry.

Technological advancements, automation and rapidly growing consumer electronics sector are propelling the electrical & electronics industry. The industry is witnessing remarkable changes in recent years owing to rapidly changing technologies. Increasing sales of semiconductors, flexible printed circuits, cables and wires will escalate the fluoropolymer films market value.

Growing exports of electronics components from the U.S. is positively influencing the fluoropolymer films market demand. For instance, in 2017, the U.S. exports of electronic products increased to over $268 billion with an increase of 3% as compared with 2016.

Fluoropolymer films are manufactured from fluoropolymer compound/resins which comprises monomers such as ethylene, tetrafluoroethylene, chlorotrifluoroethylene, vinyl fluoride, propene, and hexafluoro propene. The production and selling price of ethylene is dependent on petroleum prices and changing economic conditions.

Crude oil, which is one of the key raw materials in the manufacture of fluoropolymers, also experienced oscillating price dynamics. In addition, complex manufacturing process of fluoropolymer due to involvement of several stage of chemical fusion increases the cost of production. Thus, rise in production cost of fluoropolymer film will hamper the fluoropolymer films market to some extent over the forecast timeframe.

Fluoropolymer Films Market Analysis

Learn more about the key segments shaping this market

The product segment consists of major types of fluoropolymer films such as PVDF, FEP, PTFE, PFA, ECTFE, PVF, ETFE etc. PTFE films held over 50% volume share in 2019. These films are strong, tough, waxy, nonflammable synthetic film produced by the polymerization of tetrafluoroethylene. Increasing application of PTFE in insulations for electrical and electronic wires & cables will significantly drive the fluoropolymer films market segment.

China is the largest market regarding consumption of PTFE in the construction, automobile and electrical and electronic industries. According to OICA, more than 29 million automobiles were sold in 2018 and a tremendous growth was witnessed in automobile sector which will further boost the fluoropolymer films market in the projected period of time.

On the other hand, polyvinylidene fluoride is a chemically inert non-reactive thermoplastic fluoropolymer. It offers excellent properties such as low coefficient of friction, fire resistance, and resistance over a wide range of temperatures, which makes PVDF films an attractive product for many outdoor protective coverings.

It provides efficient ability for thermoforming, resistance to UV radiations etc. Due to these properties it has immense value to manufacturers in various industries such as chemical processing, construction, electrical & electronics, oil & gas, etc. will drive the global fluoropolymer films market.

Learn more about the key segments shaping this market

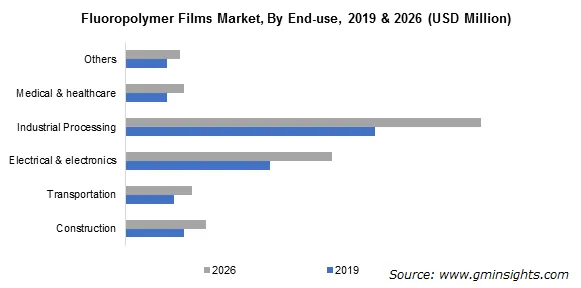

End-use segment consists of construction, transportation, electrical & electronics, industrial processing, medical & healthcare. Industrial processing segment accounted for over 40% revenue share in 2019 and is anticipated to grow at 5.2% CAGR through 2026. Food processing sector is on the rise in Asia Pacific region due to growing population in the region.

Regional government bodies are striving to improve the food processing sector to drive the economic growth. For instance, the Government of India leverages reforms such as 100% FDI in marketing of food products and various incentives on supply chain infrastructure. Furthermore, fluorine-based polymer films are used as release sheets during compression molding of components along with phenolic and epoxy resins.

They are also employed as liners; for instance, to avoid corrosion in the chemical industry. They are used as a roll cover to protect metal rolls from rusting owing to their unique characteristics such as weatherability, flame retardancy, thermal stability, etc. This is likely to have a subsequent positive impact on the fluoropolymer films market.

Looking for region specific data?

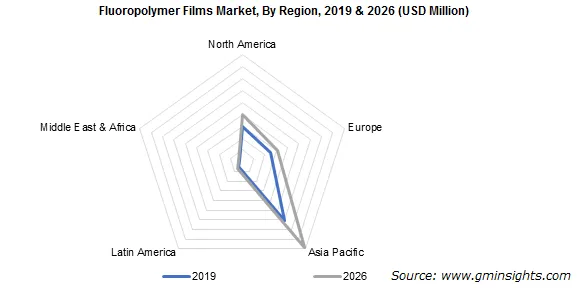

Asia Pacific fluoropolymer films market generated over USD 1 billion in 2019. The massive regional share can be attributed to the presence of key end-user industries such as construction, manufacturing and transportation sector across the region. This is mainly due to growing population, urbanization, and increasing demand for advanced thermoplastics across the region.

Strong presence of automobile manufactures along with rising demand for commercial and regional aircrafts is positively influencing the product requirements. Increasing infrastructural projects involving green buildings and smart homes will supplement product demand. In addition, expansion of manufacturing plants and capacities will result in increased demand for fluoropolymer films.

Fluoropolymer Films Market Share

Companies are increasingly investing in development of new formulations of fluoropolymer films. Expansion of facilities and sales network are among the major strategies adopted by companies for strengthening their foothold in the industry. For instance, in August 2017, a new subsidiary was set-up by Daikin Industries namely Daikin Chemical Southeast Asia in Thailand. This will enable the company to expand its presence in Southeast Asia and improve their cooperation with processing manufacturers, leading to increased fluoropolymer films market sales revenue.

Furthermore, In May 2019, Daikin Industries announced that the company will invest USD 896 million to double its manufacturing output of fluoropolymers, which is extensively used in semiconductor production equipment, in conjunction with the spread of 5G communication.

Other key players in the fluoropolymer films industry ecosystem includes

- The 3M Company

- Arkema Group

- Kureha Corporation

- Saint-Gobain

- Honeywell Corporation

- AGC Inc.

- Polyflon Technology

- Fluortek

- Dunmore

- SKC Corporation

- Solvay

The fluoropolymer films market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in tons & revenue in USD million from 2016 to 2026, for the following segments:

By Polymer

- PVDF (Polyvinylidenefluoride)

- FEP (Fluorinated Ethylene Propylene)

- PTFE (Polytetrafluoroethylene)

- PFA (Perfluoroalkoxy)

- ETFE (Ethylene Tetrafluoroethylene)

- ECTFE (Ethylene ChloroTriFluoroEthylene)

- PCTFE (Polychlorotrifluoroethylene)

- PVF (Polyvinyl Fluoride)

- THV (Terpolymer Of Tetrafluoroethylene, Hexafluoropropylene And Vinylidene Fluoride)

By End-user

- Construction

- Transportation

- Electrical & electronics

- Industrial Processing

- Medical & healthcare

- Others

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- Indonesia

- Malaysia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which polymer segment is expected to drive the market during the forecast period?

The PTFE films segment registered a significant market share in 2019 and is projected to record a remarkable growth rate throughout the forecast period.

Which are the top companies in the fluoropolymer films industry?

3M Company, The Chemours Company, DAIKIN INDUSTRIES, Arkema Group, Kureha Corporation, Saint-Gobain, Honeywell Corporation, AGC Inc., Polyflon Technology, Fluortek, Dunmore, SKC Corporation, Rogers Corporation, Solvay are some of the top contributors in the industry.

What will be the worth of global fluoropolymer films market by the end of 2026?

According to the report published by Global Market Insights Inc., the fluoropolymer films business is likely to attain $3.11 billion (USD) by 2026.

What are the key factors driving the market?

Growing pharmaceutical industry coupled with expansion of construction sector, supportive initiatives by Indian Government for expanding solar installation capacities and proliferating electrical and electronics industry are the major factors expected to drive the growth of global market.

How much valuation will the fluoropolymer films industry register in the year 2026?

The fluoropolymer films market is expected to witness a remuneration of 3.11 Billion (USD) in 2026.

What is the anticipated growth for the fluoropolymer films market over the forecast duration?

As per estimates, fluoropolymer films industry would account a crcr of 4.9% through 2026.

Fluoropolymer Films Market Scope

Related Reports