Summary

Table of Content

Fluorinated Ethylene Propylene (FEP) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Fluorinated Ethylene Propylene Market Size

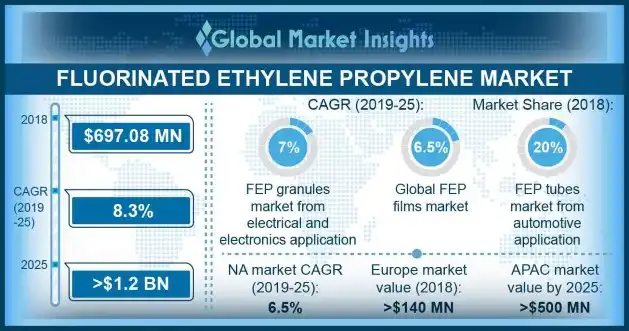

Fluorinated Ethylene Propylene (FEP) Market size valued at USD 695 million in 2018 and will expect consumption of over 40 kilo tons by 2025.

To get key market trends

Growing power demand, awareness of renewable energy and decreasing solar energy price should stimulate fluorinated ethylene propylene market share on account of growing adoption of solar photovoltaic panels. Global solar photovoltaic manufacturing sector surpassed USD 90 billion in 2018 which indicates tremendous growth opportunities.

Fluorinated Ethylene Propylene Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 695 Million (USD) |

| Forecast Period 2019 - 2025 CAGR | 8.3% |

| Market Size in 2025 | 1.2 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

These materials improve processability, moisture barrier, temperature resistance, UV resistance and transparency of energy generating devices. Favorable government initiatives, rising diesel & electricity prices and rising demand for energy self-sufficiency should further promote the market growth.

Significant population growth, and increasing urbanization are likely to increase product adoption pertaining to the rise in power demand for commercial & residential property construction. Global construction sector may surpass USD 15 trillion by 2030 which is an indicator of heathy growth potential.

These materials find extensive usage in architectural coatings owing to their beneficial impact on insulation, durability, chemical & water resistance, resistance to UV radiation and gas impermeability. Increased availability of lending, economic development and expansion of tourism sector are likely to accelerate the fluorinated ethylene propylene market growth.

This substance has significantly higher cost, low stiffness and strength as compared to other types of fluoroplastics such as PTFE which is likely to hinder the fluorinated ethylene propylene market growth. Moreover, this material releases perfluorooctanoic acid (PFOA) and perfluorinated compounds upon degradation which presents the risk of contaminating drinking water, groundwater, surface water and air. Various manufacturers are eliminating the use of PFOA to comply with industry and environmental requirements.

Fluorinated Ethylene Propylene Market Analysis

Fluorinated ethylene propylene powder segment exceeded USD 74 million in 2018 owing to favorable government policies, and growing demand from automotive and shipbuilding industries. These powders offer excellent melt fluidity, chemical resistant & smooth finish in the final product and imparts high weather resistance. Growing product demand for manufacturing various appliances such as washers & dryers, vending machines, refrigerators and microwaves should further promote fluorinated ethylene propylene market.

Granules segment from aerospace applications should surpass USD 35 million by 2025 pertaining to growing fleet replacement initiatives and growing adoption of fuel-efficient & lightweight aircraft. These materials are lighter than their substitutes which improves the speed of aircraft and enhances the fuel efficiency. Rising trend of military modernization and booming commercial airplane industry owing to increasing passenger volume should stimulate the fluorinated ethylene propylene (FEP) market trends.

Learn more about the key segments shaping this market

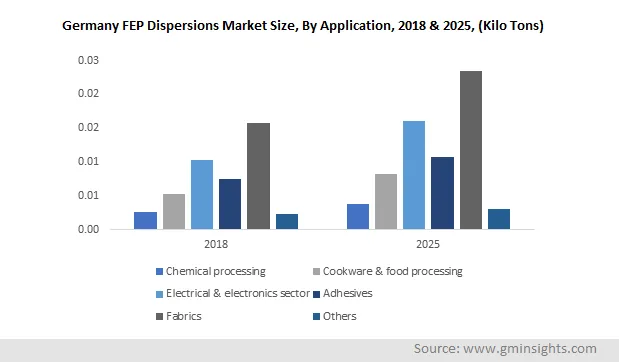

ispersions segment was valued at about USD 16.5 million in 2018 owing to rising demand for non-stick and heat resistant products. These products provide high chemical resistance, adhesion and non-stick properties, making them suitable for architectural fabrics & gaskets, industrial fabric, high performance cookware and glass cloth coating. Growing demand for industrial fabrics in flame resistant clothing and automotive carpets should further boost fluorinated ethylene propylene market.

Dispersions demand from fabrics applications is likely to register over 5% gains by the end of the predicted timeframe on account of growing demand from food processing & packing and architectural fabrics industries. These products offer various benefits such as high chemical resistance, superior wear & impact resistance, and reduced sliding friction. Growing apparel demand from China, India, Bangladesh and Mexico, increasing disposable income and urbanisation should further boost the growth of fluorinated ethylene propylene market.

North America driven by the U.S., Canada and Mexico surpassed USD 175 million in 2018 pertaining to growing demand from oil & gas industry. This product finds widespread use in various oil & gas equipment such as pumps, valves or pumps which are subjected to extreme temperature and chemicals. Growing prevalence of horizontal drilling & hydraulic fracturing, discovery of new oilfields and innovation in fracking techniques should boost the fluorinated ethylene propylene market.

Europe driven by France, UK, and Germany should surpass USD 240 million by 2025 owing to growing demand for premium lightweight vehicles. This product finds extensive usage in automotive O-rings, wire insulators, seals, diaphragms, and tank filler necks pertaining to its high resistance to fuels & high temperature. Rising government initiatives to promote electric mobility, smart traffic management and emission reduction should further boost lightweight automotive sector and stimulate product demand.

Asia Pacific driven by India, Japan, and China will register over 6.5% gains in the forecast period on account of rising demand for high-speed transmission cables from the booming 5G services industry. This material finds widespread usage in coating wires & cables for insulation and protecting the remaining structure from electric current owing to the product’s insulating & flame-resistant properties. Significant economic growth, government investment, evolving telecom industry and growing smart city initiatives are likely to accelerate the fluorinated ethylene propylene market growth.

Fluorinated Ethylene Propylene Market Share

Global FEP market share is highly consolidated with the presence of various prominent manufacturers such as

- The Chemours Company

- AMETEK

- BASF

- Daikin Industries

- Inoflon Fluoropolymers

Certain market participants are engaging in strategic acquisitions to satisfy rising product demand from electrical power, automotive & construction industries and ensure market expansion.

Industry Background

This product is a melt-processable copolymer of tetrafluoroethylene and hexafluoropropylene that allows efficient thermoforming and extrusion. It offers easy formability, chemical & friction resistance, non-toxicity, non-stick features and weatherability. Growing demand from photovoltaic, automotive, aerospace and electric wire & cable industries should fuel the fluorinated ethylene propylene industry growth.

The fluorinated ethylene propylene (FEP) market research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in Tons and revenue in USD from 2014 to 2025, for the following segments:

By Product

- Granules

- By application

- Electrical & electronics sector

- Automotive

- Aerospace

- Chemical processing

- Others

- By application

- Dispersions

- By application

- Chemical processing

- Cookware & food processing

- Electrical & electronics sector

- Adhesives

- Fabrics

- Others

- By application

- Film

- By application

- Chemicals & life science equipment

- Electrical & electronics sector

- Hot melt adhesives

- Composite molding

- Solar panels

- Others

- By application

- Powder

- By application

- Chemical processing

- Cookware

- By application

- Tubes

- By application

- Chemical processing

- Food processing

- Automotive

- Medical

- By application

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Poland

- Asia Pacific

- Japan

- India

- China

- South Korea

- Indonesia

- Australia

- Latin America (LATAM)

- Brazil

- Argentina

- Middle East & Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Which are the top companies in the fluorinated ethylene propylene industry?

3M, DowDuPont, Daikin Industries, Ltd., Shanghai , F New Materials Co. Ltd., Saint-Gobain, Merck Millipore, The Chemours Company, Juhua Group Corporation, AMETEK, Inc., Polyfluor Plastics B.V., BASF, ITAFLON, Shandong Hengyi New Material Technology, are the top contributors in the industry.

Which product segment is expected to lead the market during the forecast period?

Based on product, the FEP powder segment held the highest share in 2018 and is anticipated to exhibit a remarkable growth rate during the forecast period.

What is the key factor driving FEP market?

Growing demand from oil & gas industry, rising usage of Fluorinated Ethylene Propylene for the manufacture of lining and parts in Automotive Industry, and growing demand from optical fiber and electrical & electronics industries are the key factors expected to drive the growth of global market.

How much is the fluorinated ethylene propylene market expected to record by the year 2025?

The worth of fluorinated ethylene propylene market is expected to reach a valuation of USD 1.2 billion by 2025.

What will be the worth of global FEP market by the end of 2025?

According to the report published by Global Market Insights Inc., the metal injection molding parts business is expected to hit at $1.2 Billion (USD) by 2025.

What was the estimated global fluorinated ethylene propylene industry size in 2018?

Fluorinated ethylene propylene market was valued at $ 697 million in 2018.

Fluorinated Ethylene Propylene Market Scope

Related Reports