Summary

Table of Content

Floriculture Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Floriculture Market Size

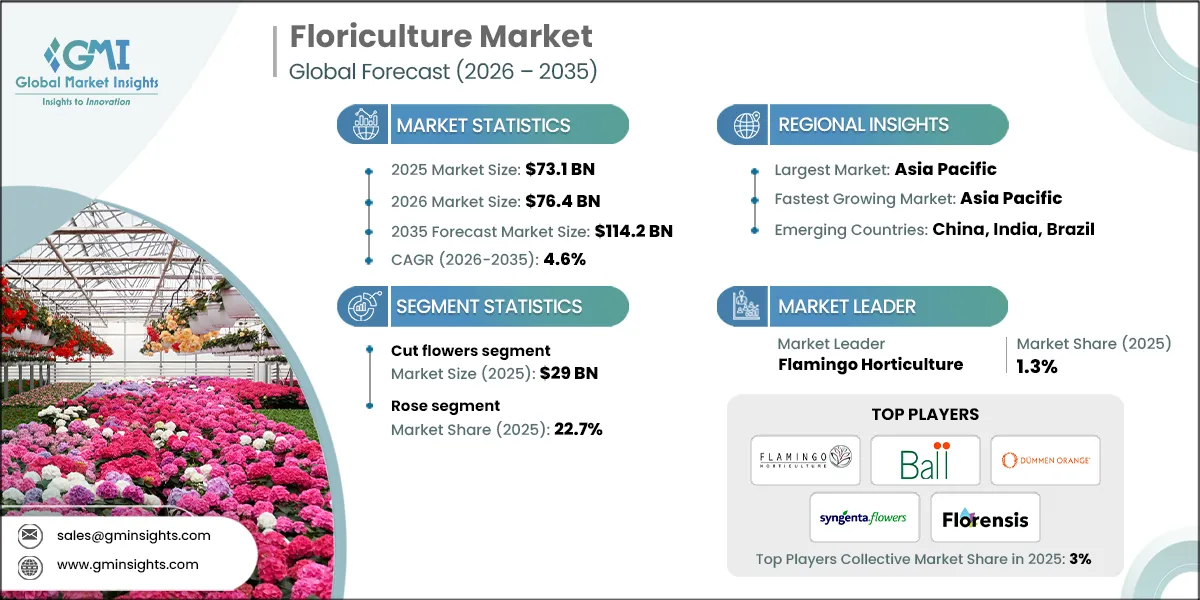

The floriculture market was estimated at USD 73.1 billion in 2025. The market is expected to grow from USD 76.4 billion in 2026 to USD 114.2 billion in 2035, at a CAGR of 4.6% according to latest report published by Global Market Insights Inc.

To get key market trends

The floriculture industry is an important area within horticulture because it involves the production and distribution of flowers and ornamental plants, both for consumers in the United States and around the world. The floriculture industry is growing due to increased consumer interest in decorative plant products, flower/garden landscape design and flowers as gifts. The floriculture market consists of cut flower products, potted plant products, bedding plant products and foliage plant products

Cut flowers, because of their use at special events and other celebrations, makes up the largest portion of the floriculture market. Regions of the world with favorable growing conditions and advanced greenhouse technology will continue to be major contributors to the global supply of high-quality flowers. Urbanization, increasing disposable income and changing lifestyles are the primary drivers of the growth of the floriculture industry.

As urban areas grow, there is an increased focus on creating attractive spaces that use floral and ornamental plants. E-commerce has changed how flowers are purchased because customers can now buy flowers directly and set up subscriptions for repeat purchases, making it much easier for customers to access floral products no matter where they live.

Advances in greenhouse technology, hydroponics and cold chain logistics have also resulted in better production efficiency, longer shelf life and better quality of floral products during transportation, resulting in growth potential for growers and exporters during seasonal peaks. Going forward, innovation and sustainability will continue to transform the floriculture industry as eco-friendly practices such as biodegradable packaging, organic farming methods and water-efficient irrigation practices become the norm.

Floriculture Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 73.1 Billion |

| Market Size in 2026 | USD 76.4 Billion |

| Forecast Period 2026-2035 CAGR | 4.6% |

| Market Size in 2035 | USD 114.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising consumer demand for ornamental plants | Fuels market growth through increased home and garden beautification trends |

| Increasing popularity of gifting culture | Boosts seasonal and event-driven flower sales globally |

| Growing wellness and health awareness | Encourages demand for indoor plants linked to stress relief and air quality |

| Expansion of e-commerce and digital platforms | Broadens market reach and simplifies direct-to-consumer sales |

| Pitfalls & Challenges | Impact |

| Increasing competition from artificial flowers | Reduces demand for natural flowers and pressures pricing |

| Opportunities: | Impact |

| Commercialization of sustainability and eco-innovation | Create premium segments and strengthens brand positioning |

| Adoption of precision agriculture and AI-driven logistics | Enhances efficiency, reduces waste, and improves supply chain reliability |

| Market Leaders (2025) | |

| Market Leader |

1.3% market share |

| Top Players |

Collective market share in 2024 is 3% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Floriculture Market Trends

The global floriculture industry, encompassing the cultivation of flowering and ornamental plants, is experiencing dynamic shifts driven by evolving consumer preferences, technological advancements, and a heightened focus on sustainability.

- E-commerce is Leading to New Retail Opportunities in The Floriculture Industry. The rise of digital technology has significantly changed the way that people buy flowers and plants. Consumers can now easily order flowers and plants via the internet for home delivery. This creates new opportunities for industry to reach more consumers, as well as provide more selection and convenience. This shift has fundamentally changed how flowers are purchased compared to traditional retail systems.

- Growing Interest in Sustainable and Ethically Sourced Flowers. As consumers are increasingly aware of their purchases' impact on the environment and society, they seek to purchase flowers that have been grown with minimal pesticide application, effective water management, the use of ethical labor practices, and the existence of transparent supply chains. This interest has caused growers to pursue certification programs and eco-friendly production methods.

- Increasing Popularity of Indoor Plants and Green Spaces. In addition to cutting flowers, there has been an explosion in demand for potted plants (house plants) and other forms of foliage as people move to smaller, more urban areas, making it possible for them to bring the outdoors inside. Indoor plants improve wellness and aesthetics and have given rise to the phenomenon often referred to as "Green Living."

- Customization and Experience Enhancement in the Floral Industry. The floral market has seen a growing number of consumers willing to spend more to have unique, exotic, or specialty-grown flowers and/or personalized arrangements. This trend illustrates consumers' desire for exclusive experiences and customized products beyond the traditional holiday, grocery, and retail bouquet experience.

Floriculture Market Analysis

Learn more about the key segments shaping this market

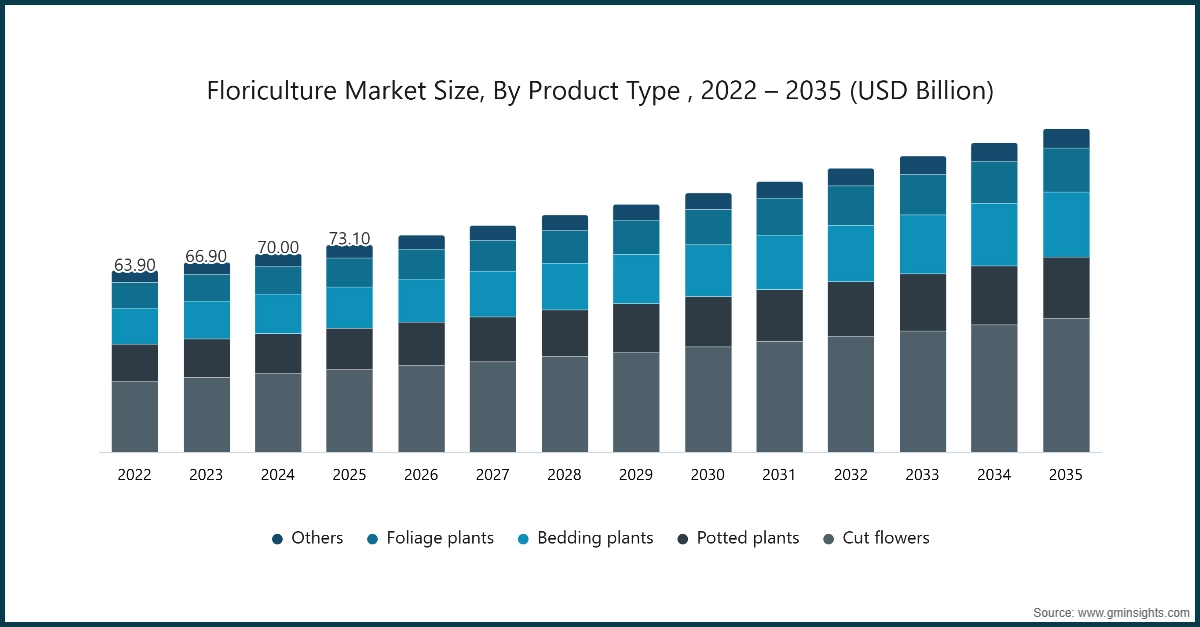

Based on product type, the market is divided into cut flowers, potted plants, bedding plants, foliage plants, and others. In 2025, cut flowers held the major market share, generating a revenue of USD 29 billion.

- Among all categories of floriculture globally, cut flowers make up the highest proportion of the total floriculture marketplace. Cut flowers are typically used for decorative purposes and have come to symbolize the joy associated with giving gifts to one's family and friends. In addition to being used to create aesthetically pleasing arrangements, cut flowers are also a popular choice for wedding ceremonies, holiday celebrations, and for corporate functions where the visual appeal of flowers is important to the success of the event.

- Cut flowers represent the largest imported and exported flower crop globally. Roses, carnations, lilacs (lilies), and orchids make up the majority of the cut flower market; these flowers are not only sold in large quantities in domestic markets, but they can also be exported to countries like Europe and North America. In addition to seasonality, price and production cycle fluctuations are greatly affected by seasonal demands. In many cases, flowers are sold for a much higher price during peak seasons and require additional production effort to meet increased demand.

- Sales growth in the cut flower segment is attributed to the rapid advancement of cold-chain logistics that help maintain flower freshness during transportation and online shopping platforms that have enabled worldwide distribution of cut flowers. The cut flower segment, however, continues to face challenges due to the short shelf life of the product and the difficulties associated with the changing nature of international trade laws and regulations. Continuous innovations and strategic planning will be necessary for businesses to continue competing in a global marketplace for cut flowers.

- The potted plant industry is growing rapidly, because it has become popular with consumers who value sustainability and durability in their home and office decor. Potted plants cover a broad range of types such as flowering plants, succulents and indoor foliage.

- Each of these products provides prospective buyers with the benefit of both beautifying their homes or offices, as well as providing clean air through purification. Urbanization and interest in inside gardening has greatly increased the demand for potted plants in urban areas where people don't have outdoor space for gardening.

- As businesses providing potted plants adapt to the changing needs of buyers by expanding their online sales and implementing a subscription-based sales approach, they continue to grow in popularity. Potted plants are less perishable than cut flowers, which makes them a better option for international and domestic sales. Due to this longevity of life in addition to being able to purify the air, these secures potted plants as an emerging area of growth for the market.

Learn more about the key segments shaping this market

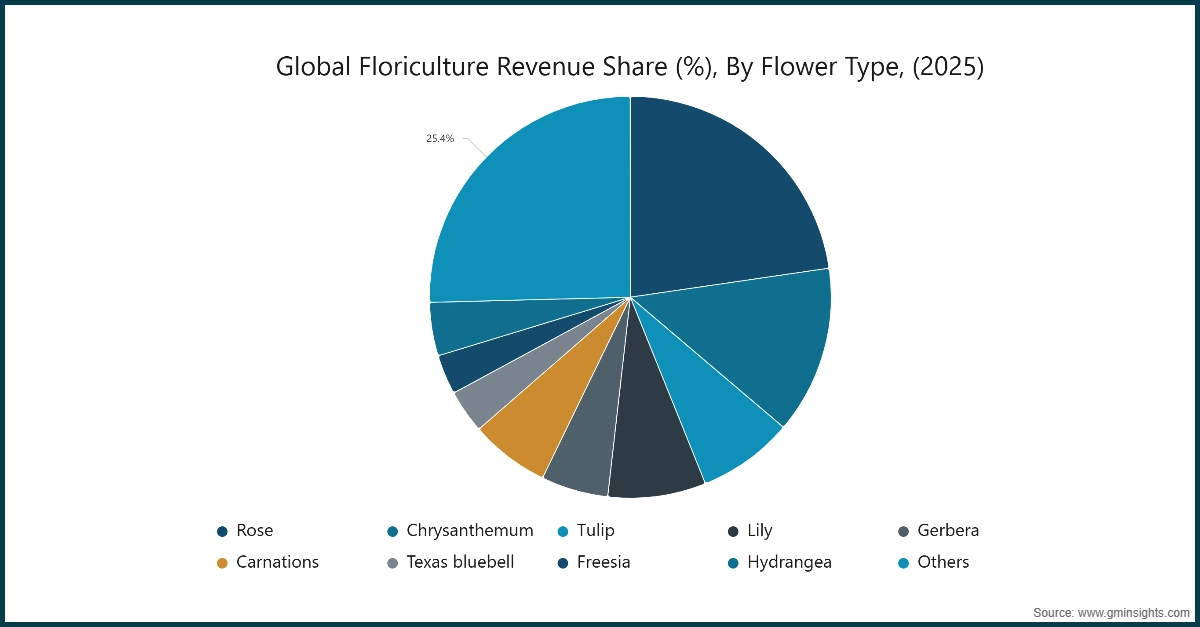

Based on flower type, the floriculture market is segmented into rose, chrysanthemum, tulip, lily, gerbera, carnations, texas bluebell, freesia, hydrangea, and others. The rose segment held the largest share, accounting for 22.7% of the global floriculture industry in 2025.

- Roses are the most sought-after cut flower in the world. The demand for roses is greatest during the Valentine's Day holiday and anniversaries when flowers are typically purchased as gifts or used as decoration for the event. Seasonal price variation exists because of the increased demand for roses during these special event days.

- The major producers of roses include India, Kenya, and Ecuador with most of their exports going to Europe and North America. Establishing greenhouses for growing roses in a controlled environment and maintaining a cold chain of logistics for moving roses have led to higher quality and longer shelf life products. The introduction of more premium and unique varieties of roses as well as custom colored roses has stimulated growth in the luxury market for roses.

- Chrysanthemums have a large market share in the floriculture industry due to their vibrant colors, long-lasting vase life, and suitability for use in bouquets and decorative arrangements. Along with their use in bouquets and decorative arrangements, Chrysanthemums are used extensively in cultural and religious ceremonies throughout Asia with a primary emphasis on China and Japan. The market segment for Chrysanthemums benefits from the ability to produce them year around using a controlled environment. However, like all floral business segments, Chrysanthemum's face challenges due to pest management issues and seasonal fluctuations of demand. As more gardeners become interested in ornamental gardening, Chrysanthemum's sales will continue to increase around the globe.

- Tulips are one of the premium flower segments and are primarily cultivated in Europe with the Netherlands being the leading producer and exporter of Tulips in the world. Tulip's popularity typically occurs in the spring and during the holidays, making them a crop that is considered highly valuable, in addition to being used extensively for Luxury Gifts and Landscaping. Tulips are heavily reliant on greenhouse production to grow and subsequently market Tulips.

Based on distribution channel, the floriculture market is segmented into B to B and B to C. In 2025, B to B dominate the market with highest market share.

- The floriculture industry's B2B category is characterized by transactions primarily between growers, wholesalers, exporters, and retailers. Specifically, B2B serves as the backbone for large-volume distribution in cut flower and ornamental plant markets. Corporations, including hotels and event planners, are the largest consumers of these types of products, as well as the primary customers of B2B transactions.

- Export-oriented businesses located in countries, such as The Netherlands, Kenya, and India, utilize B2B networks to assist with conducting international trade; therefore, these three locations have established an important role in the global floricultural industry as well.

- Due to the extensive production capacity and established trade routes, export-oriented companies based in these countries leverage B2B transactions to establish long-term contracts that allow them to secure large volume orders, which creates stability and predictability in their income stream. Unfortunately, like many other industries utilizing a B2B transaction model, there are numerous challenges within the B2B segment that directly affect the operational efficiency and overall profitability of companies within the B2B sector.

- One challenge includes the logistical issues associated with transporting cut flowers and plants, which are perishable, and therefore must be handled and stored properly while in transit, so they arrive at their destination in the desired condition.

- For exporters, it is important to comply with international quality standards and phyto-sanitary regulations, which create additional complexity within the B2B supply chain. In addition, the rise of digital platforms has changed the way people view the B2B transaction model, and many suppliers are creating their own e-commerce solutions for their respective customers.

Looking for region specific data?

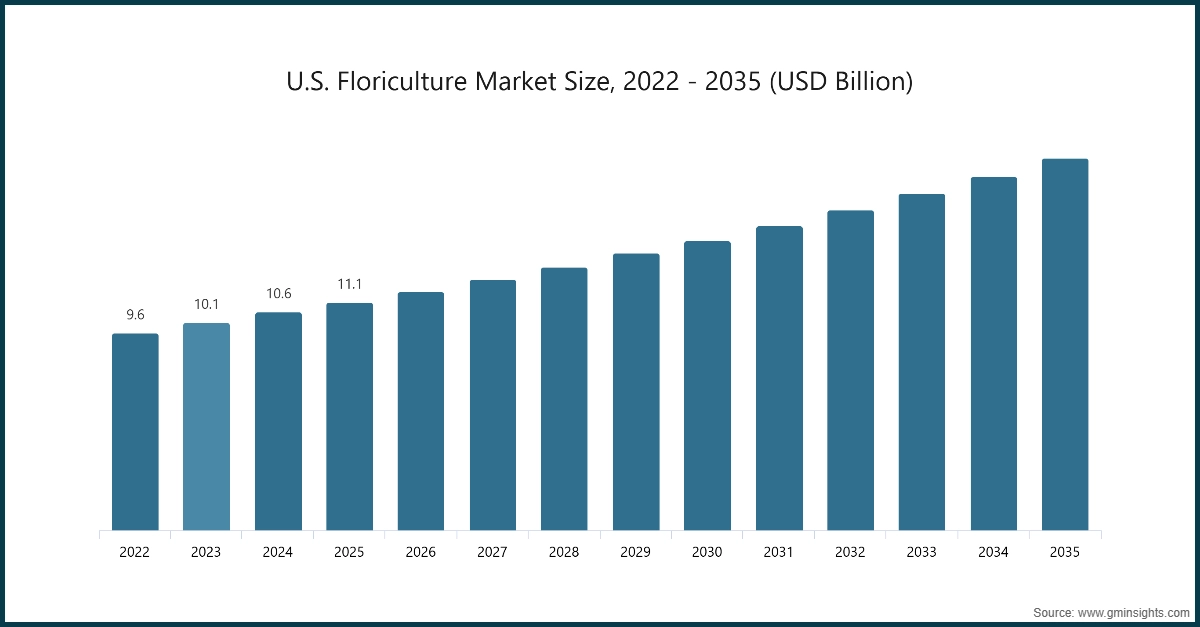

North America Floriculture Market

In 2025, the U.S. dominated the North America market, accounting for around 80% and generating around USD 11.1 billion revenue in the same year.

- The North American Market for Floriculturists is buoyed by strong consumer demand from both the U.S. & Canada for Ornamental Plants, as well as cut flowers, during seasonal holidays such as Valentine's Day and Mother's Day. Due to their continued popularity for gift giving and decor during these occasions, most Floral Sales in North America take place during these events.

- Advanced Greenhouse Technology allows the North American Market to produce flowers and plants throughout the year with superior quality; therefore, North American Margins (price received by retail and online florists) are significantly higher than International Margins for these products.

- The North American Region also has developed an extensive and reliable Distribution Network for Floral Products, allowing for smooth transitions of products from producer to wholesaler to retailer and the ability to deliver products to end users timely.

- The combination of E-Commerce and Subscription Service Businesses has also expanded the North American Market, providing consumers access to Floral Products through multiple resources.

- In addition to E-Commerce and the growth of Subscription Services Businesses, growing environmental sustainability initiatives have created a growing preference for the use of Certified Organic Certification, Eco-Friendly Packaging, and to a lesser extent Environmental Sustainability Certifications by consumers.

- As indicated previously, the consumer demand trends in North America demonstrate a commitment to Innovation and Environmental Responsibility which has allowed for the continued growth of the North American Floriculture Industry as a Leader in the global floriculture industry.

Europe Floriculture Market

In Europe market, Germany leads the market 22.3% share in 2025 and is expected to grow at 3.6% during the forecast period.

- Europe maintains its status as the largest marketplace for floriculture in the world today. Amsterdam, situated in the Netherlands, is considered the "centre of the universe" for flower production and exports. The dominant position of Europe in the floricultural marketplace results from using highly efficient commercial greenhouses and innovative production techniques supported by modern technology to produce high-quality products at a fast pace.

- Europe's logistics network also supports Europe-based exporters by providing a highly developed global supply chain that allows them to export their products easily. The importance of quality and sustainability is reflected in the popularity of European consumers who purchase organic, fair trade-certified flowers. European festivals, holidays, and other special events create the same consumption patterns that occur during all quarters of the year.

- The increasing cost of energy has created challenges for the floriculture industry regarding energy costs for greenhouse production. The floriculture industry in Europe is now working to implement renewable energy sources such as solar energy, geothermal heating and wind energy to address these problems and maintain its competitive position.

Asia Pacific Floriculture Market

The Asia Pacific holds significant share in the floriculture industry. China holds a market share of around 39% in 2025 and is anticipated to grow with a CAGR of around 5.0% from 2026 to 2035.

- Many economies across the Asia Pacific region have seen a surge in flower farming not only due to the large population numbers, but because of rapid urban growth. Increased urbanization and disposable income have changed consumers' priorities and purchasing decisions concerning the purchase of flowers. Many people are willing to spend more money on purchasing flowers for their homes (life), for giving gifts to family or friends, and for entertainment and decorating their homes/places of business.

- Cultural activities such as giving flowers to others are commonplace and often required during holidays, weddings, graduations and other special occasions. India has become one of the two largest exporters of flowers in Asia and has developed a growing reputation for exporting roses and lilys (an orchid) as well. India's ability to produce abundant quantities of flowers is largely due to the favorable climate, the ability to produce large amounts of flowers in greenhouses and increased government investment into developing and supporting specialized horticulture products and services.

- The development of specialized techniques (e.g., hydroponics) has increased flower production in India; additionally, there are many government programs supporting programs focused on enhancing horticulture businesses and increasing the production and supply of flowers, including increased collaboration with overseas growers.

- There are some challenges in producing flowers in Asia including challenges related to cold chain distribution networks, which limit the extent to which flowers are preserved for transit and limitations in the variability of climatic conditions affecting a consistent supply of flowers. Other than these limitations, the growth potential for flowers and the floriculture industry in Asia is considerable and very promising for years to come.

Floriculture Market Share

Flamingo Horticulture is leading with 3% market share. Flamingo Horticulture, Ball Horticultural, Dummen Orange, Syngenta Flowers and Florensis collectively hold around 97%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

Flamingo Horticulture is a major grower and exporter of cut flowers and plants primarily from Africa and supplies them to the many global markets. To be vertically integrated, they run large farms and own their entire supply chain from breeding to packing. Because they produce on a large scale and maintain a consistent supply chain, as well as having a wide variety of products, Flamingo Horticulture is a major supplier for both retailers and wholesale customers in Europe. Ball Horticultural is the leading company globally in floriculture, specializing in breeding flower seeds, producing young plants, and distributing horticultural products. They are known for introducing unique and popular new varieties of annuals, perennials, and pot plants. They have a broad network of operations worldwide and continue to expand and develop new genetics, making them a major player in the ornamental plant industry on a global scale. Dummen Orange is a leading breeder and propagator of flowers and plants, offering a wide range ofcut flowers, pot plants, bedding plants, and perennials. They are one of the most well-known companies for their commitment to innovation and R&D regarding the genetics of plants. They have a significant global presence and continuously introduce new, high-demand varieties, ensuring that they influence how products are offered within the floriculture industry.

Floriculture Market Companies

Major players operating in the floriculture industry are:

- Beekenkamp Group

- Danziger

- Dummen Orange

- Esmeralda Farms

- Flamingo Horticulture

- Florance Flora

- Florensis Flower Seeds

- Forest Produce

- Marginpar

- Native Floral Group

- Bohemian Flowers

- Proven Winners

- Selecta Cut Flowers

- Syngenta

- Ball Horticultural Company

- Anthura

- Deliflor Chrysanten B.V.

- Schreurs

- Könst Alstroemeria B.V

- Könst Alstroemeria B.V

Syngenta Flowers,, which exists as a subsidiary of Syngenta Group, engages in the genetics and production of both flower seeds as well as young plants with a focus on professional horticulturalists. The company has invested heavily in R&D processes to develop the best-performing sustainable varieties of annuals, perennials and potted plants. Due to their global reach, dedication to plant health and advanced genetic technologies, Syngenta Flowers plays a crucial role within the entire commercial flower industry.

Florensis is an international breeding company that propagates high quality young plants for professional growers around the world. The company provides growers with a full selection of annuals, perennials and potted plants, and are recognized for their strong emphasis on the health, colour and vigour of their plant varieties. They have a large position within the industry based upon their vast and reliable plant material supply chain and established distribution network.

Floriculture Industry News

- In July 2025, Beekenkamp Group launched three new customer-focused websites for its corporate and divisional brands (Ornamentals and Vegetables), enhancing global accessibility and digital engagement.

- In November 2025, Danziger initiated its 2027 breeding season campaign with the InnovationFest rollout highlighting new genetics, expanded petunia and perennial collections to growers worldwide

- In April 2025, Dümmen Orange hosted the FlowerTrials demonstration event at its De Kwakel location in the Netherlands, centralizing product showcases to improve customer access to its diverse ornamental plant portfolio.

- In March 2024, Danziger launched a new showroom and greenhouse facility in Ecuador to enhance customer engagement, showcase premium rose varieties and strengthen its market presence in South America.

The floriculture market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Tons) from 2022 to 2035, for the following segments:

Market, By Product Type

- Cut flowers

- Potted plants

- Bedding plants

- Foliage plants

- Others

Market, By Flower Type

- Rose

- Chrysanthemum

- Tulip

- Lily

- Gerbera

- Carnations

- Texas bluebell

- Freesia

- Hydrangea

- Others

Market, By Operating Speed

- B to B

- B to C

- Online

- Offline

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Indonesia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the floriculture market?

Major players include Flamingo Horticulture, Ball Horticultural, Dummen Orange, Syngenta Flowers, Florensis, Beekenkamp Group, Danziger, Esmeralda Farms, Florance Flora, and Selecta Cut Flowers.

Which country dominated the North America floriculture market in 2025?

The United States dominated the North America market in 2025, accounting for approximately 80% of the regional revenue and generating USD 11.1 billion. Its leadership is supported by strong consumer demand and advanced distribution networks.

What is the market size of the floriculture industry in 2026?

The market size for floriculture reached USD 76.4 billion in 2026, reflecting steady growth supported by increased e-commerce adoption and wellness trends.

What are the upcoming trends in the floriculture industry?

Key trends include the adoption of AI-driven logistics, precision agriculture, and e-commerce platforms. Sustainability and eco-friendly practices are also gaining traction, creating premium market segments and enhancing brand positioning.

What was the market share of the rose segment in 2025?

The rose segment accounted for 22.7% of the global floriculture market in 2025, driven by its popularity in gifting and decorative applications.

How much revenue did the cut flowers segment generate in 2025?

The cut flowers segment generated USD 29 billion in revenue in 2025, making it the largest product category. Its dominance is attributed to high demand for roses, chrysanthemums, and tulips.

What is the projected value of the floriculture market by 2035?

The floriculture industry is expected to reach USD 114.2 billion by 2035, growing at a CAGR of 4.6%. This growth is driven by eco-innovation, precision agriculture, and expanding digital sales channels.

What is the floriculture market size in 2025?

The market size for floriculture was valued at USD 73.1 billion in 2025. Rising consumer demand for ornamental plants and the growing popularity of gifting culture are key factors driving market growth.

Floriculture Market Scope

Related Reports