Summary

Table of Content

Flat Panel Antenna Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Flat Panel Antenna Market Size

The global flat panel antenna market was valued at USD 558.7 million in 2024 and is estimated to grow at a CAGR of 32.1% to reach USD 8.8 billion by 2034. The growth of the market is driven by the key factors including the increasing demand for high-speed connectivity, as well as widespread use in point-to-point communication systems.

To get key market trends

The demand for flat antennas is on the rise because of the growing demand for high-speed connections. Traditional cellular networks and GEO satellites are geographically constrained because their infrastructure is static. This is exacerbated by the lack of bandwidth and high latency for remote rural areas. Companies like OneWeb and Starlink are using these limitations of conventional networks to market flat panel antennas. These antennas are designed to enable interfacing with LEO satellites which flat panel antennas improve upon.

Flat Panel Antenna Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 558.7 Million |

| Forecast Period 2025 – 2034 CAGR | 32.1% |

| Market Size in 2034 | USD 8.8 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

FPAs support substantially wireless point-to-point communication systems where signals are shot back and forth between 2 locations. FPAs, for example, are used in wireless backhaul links in FPAs for long distance networks. Besides this, FPAs are being adopted more and more in wireless communication systems such as Wi-Fi, cellular, or CCTV systems because of the benefits that FLPs like range, accuracy, and performance.

Flat Panel Antenna Market Trends

- The rapid adoption of FPA in commercial and residential sectors in applications such as precision agriculture, maritime connectivity, mobility for military and government, SAR (search and rescue), remote facilities, aviation, and many more is a key trend for the market growth. The major potential for exponential growth areas includes mobility, government, and military with the low-cost price of the terminal. FPA also offers several benefits such as lightweight and versatility, seamless integration, broader beam, ultra-high frequencies, IoT connectivity, and electronically controlled array that are rapidly driving the demand for FPAs in industries.

- Additionally, satellite flat panel antennas are a novel development in the rapidly developing fields of telecommunications and satellite technology. The antennas are well-known for their ability to work as a broadband communication tool for both consumers and businesses, and for their small and elegant form. The need for satellite flat panel antennas has significantly increased as a result of recent technical breakthroughs and the growing need for high-speed broadband internet access. One of the most important trends for market expansion is the growth of the market.

- Moreover, flat panel antennas are utilized by businesses to create safe, fast communication in industrial settings, temporary work sites, and distant offices. These antennas provide consistent communication and teamwork across remote sites by facilitating private LTE deployments, enterprise-grade Wi-Fi networks, and cellular backhaul. Hence, the increasing focus on enterprise connectivity solutions is another important factor that is leading to the growth of the market during the estimated period.

Flat Panel Antenna Market Analysis

Learn more about the key segments shaping this market

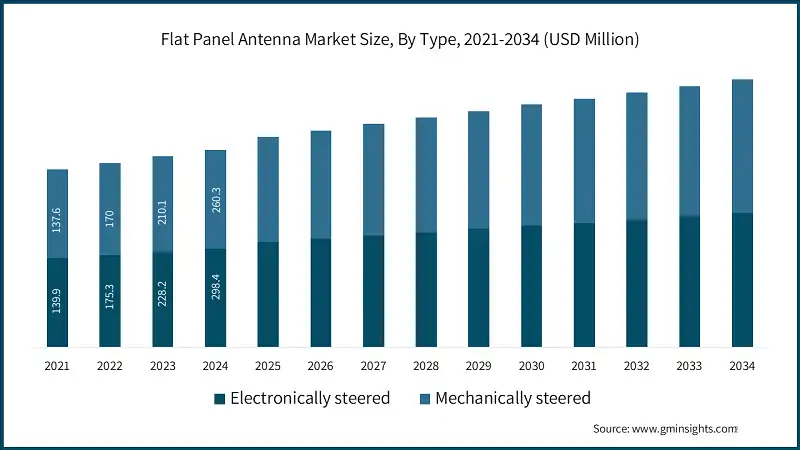

Based on type, the market is divided into electronically steered and mechanically steered.

- The mechanically steered is expected to account for 46.59% of the global flat panel antenna industry in 2024. Mechanically steered antennas currently maintain a competitive edge due to their early market presence and ability to meet the strict performance standards unique to the aerospace industry. Accordingly, the stringent performance requirements is primarily driving the segment growth during the estimated period.

- In 2034, the electronically steered segment is expected to account for USD 2.9 billion. Electronically steered flat panel antennas are essential for optimizing satellite bandwidth efficiency and resolving weight concerns for mobility applications. These antennas are anticipated to take the lead in the land-mobile and maritime industries because of their lightweight construction and easy installation processes, which is accelerating the segment growth at a substantial rate.

Learn more about the key segments shaping this market

Based on operating frequency, the flat panel antenna market is segmented into C and X band and Ku K and Ka band.

- Ku K and Ka band segment accounted for USD 346.1 million in 2024. The demand of the Ku, Ka, and K band operating frequencies in flat panel antennas is significantly influenced by several factors wide availability, strong demand, cost-effectiveness, high performance capabilities, and potential for usage in new technologies like 5G and IoT, which is exhibiting a positive influence on the segment growth globally.

- C and X band accounted as the significantly growing segment that is likely to reach USD 1.6 billion in 2034. The C band is used in many different fields, including wireless networking, radar, and satellite communication. Due to its numerous applications and capacity for high-speed data transport, the C band is in great demand. Imaging systems that need extremely high resolutions, such as different radar and sensor systems, employ the X band. The X band is a popular option for industries that need real-time communication because of its low latency. The soaring demand for satellite communications, rise in use of radar and sensing systems, and growing government investments in C and X band technologies are the key factors, which is accelerating the segment growth over the forecast period.

Based on the network connectivity, the market is bifurcated into multi-network devices and dedicated network devices.

- The dedicated network devices segment is expected to account for 52.5% of the global flat panel antenna market in 2024. The growing need for secure and reliable connectivity, high emphasis on high-speed and low-latency connectivity, and an increase in demand for mobile and remote works is boosting the market for network connectivity solutions.

- The multi-network devices segment accounted for CAGR of 36.4% during 2025-2034. The increasing need for unified networks, IoT, edge computing, and the expansion of 5G and wireless technologies are fueling the need for network connectivity solutions which have low-latency and high-speed access to wireless networks.

Based on orbit type, the flat panel antenna market is segmented into Geostationary Earth Orbit (GEO) and Non-GEO.

- is lower than that of GEO satellites, which is important for real-time communication. Satellite resources are more effectively allocated as a result of increased flexibility in satellite placement and movement. Non-GEO satellites are increasingly used particularly by the land mobility, maritime, and aviation sectors.

- Geostationary Earth Orbit (GEO) segment will grow at a CAGR of 28.9% during the forecast period because GEO satellites are stationary in relation to Earth as they provide a consistent and dependable signal. GEO satellites offer high coverage as a result, which is advantageous for worldwide applications or areas that need international attention. The proliferation of satellite-based broadband, particularly for internet and data services, has increased the demand for GEO satellites.

Based on end use, the flat panel antenna market is bifurcated into aviation, telecommunications, military, commercial, and others.

- Telecommunications dominated the market, accounting for USD 338.2 million in 2024. Faster transfer rates are required due to the growing demand for mobile data, and flat panel antennas can help with this. Flat panel antennas can be used to meet the growing demands for high-speed data transfer conveyed on by the Internet of Things and M2M communication, which is driving the segment growth during the estimated period.

- Military segment is expected to register highest growth during the forecast period, growing at a CAGR of 34.4% for 2025 to 2034. The requirement for secure and dependable communications, which flat panel antennas may provide, is driving the need for improved communication systems. Situational awareness has increased the demand for sophisticated communication systems, which flat panel antennas can provide. The use of flat panel antennas in military applications has grown due to the necessity for small, light antennas.

Looking for region specific data?

In 2024, the U.S. flat panel antenna market accounted for USD 3.1 billion. United States market is likely to be driven by the growing investment in the space exploration, soaring demand for compact antenna systems, increasing number of satellite launches, coupled with the rising demand for electronically steered phased array flat panel antennas. According to Statista, U.S. firms launched the most commercial space rockets this century in 2023, with 117 launches. Due to the decline in launch prices and the rise of new commercial providers such as SpaceX, Blue Origin, and Rocket Lab, the number of space launches has significantly increased during the past ten years.

Germany flat panel antenna market is expected to grow at a CAGR of 8.2% during the forecast period. The soaring demand for multi-orbit antennas, rising emphasis for high-speed wireless connectivity, as well as the increase in adoption of connected vehicles, which is further supporting the market expansion across the region.

China flat panel antenna market is expected to grow at a CAGR of 10% during the forecast period. The rising government's initiatives supporting the development of 5G, and growing research and development investment in IoT technologies are primarily attributed to the regional market growth during the estimated period. Also, the market is also benefiting from the Chinese government’s plans such as ‘Made in China 2025’ and ‘Internet Plus’ which focus on digitalization and reduce reliance on foreign technology. Thereby, these aforementioned factors is resulting into the high demand of flat panel antenna in China.

In 2024, Japan is expected to account for a share of 15.4% of the flat panel antenna market in Asia Pacific. The rising investments related satellite deployments, rapid expansion of high-speed wireless connectivity, increasingly adopting flat panel antennas in military & defense application, and rising technological developments across the region is acting as a major catalyst for the demand of flat panel antenna.

South Korea flat panel antenna market accounted for USD 454.6 million in 2024. The increasing rollout of 5G technology, rapid growth of the telecommunication industry, and proliferation of IoT devices are the key factors leads to an increased demand for flat panel antenna across the region.

Flat Panel Antenna Market Share

Flat panel antenna industry is a significant level of fragmented owing to the many players offering a wide range of products. Companies such as Kymeta Corporation, Hanwha Phasor and ThinKom Solutions, Inc. are holding highest numbers of market shares of nearly 14%. The market for Flat Panel Antenna is continuously developing with new product innovations that are tailored for advancing flat panel antenna capabilities, along with entered a strategic alliance. For instance, in November 2024, Kymeta unveiled the introduction of the Goshawk u8, a hybrid geostationary/low Earth orbit (GEO/LEO/Cellular) terminal. The Goshawk u8 is a highly adaptable system that seamlessly interfaces with a variety of vehicles and vessels in order to meet the mission-critical needs of international forces. It provides dependable, network-redundant connectivity while on the move.

Flat Panel Antenna Market Companies

Leading companies in the flat panel antenna industry comprise:

- Kymeta Corporation

- Hanwha Phasor

- ThinKom Solutions, Inc.:

- TTI Norte

- L3Harris Technologies

Kymeta uses Intelligent Communications Platforms (ICPs) to transform satellite communications. Kymeta engineers, manufactures, and delivers robust connectivity and improved situational awareness for essential, mobile applications by utilizing advanced metamaterial-based research. The electronically guided flat panel antennas, which are supported by both international and U.S. patents, allow for flawless communications when on the go. The company combine satellite and cellular networks with software-defined solutions, edge processing, and hybrid multi-network capabilities to guarantee constant connectivity in demanding situations. Kymeta products offer continuous connectivity and spatial information wherever, at any time, to clients in the public safety, transportation, military, maritime, and government sectors globally. Kymeta is influencing the direction of international communications and is committed to providing dependable, effective, and intelligent connectivity solutions for a world that is becoming more mobile and interconnected.

Hanwha Phasor is aiming for the development of enterprise-grade Active Electronically Steered Array (AESA) antennas for satellite communications to facilitate seamless connectivity across air, land, and sea. Both military and commercial customers are served by the sophisticated technological capabilities. In addition to offering high performance interoperability and keeping an ultra-low profile, the distinctive flat panel design and cutting-edge technological capabilities enable continuous multi-orbit connection.

Flat Panel Antenna Industry News

- In March 2024, Hanwha Phasor has declared that the introduction of the Phasor L3300B land antenna for mobile communications. The active electronically steered antenna (AESA) Phasor L3300B was developed for both military and commercial use. Hanwha Phasor's land antenna solution provides customers with constant communications in any location. The antenna can establish connections with new satellites before severing its existing one due to its twin simultaneous reception channels.

- In April 2024, Micro-Ant, a producer and developer of custom antennas developed many flat panel antennas for L-band using Ka-band applications. These antennas are inexpensive, very effective, incredibly durable, and useful in a wide range of military and commercial applications. Vehicle monitoring, high-gain satcom links, and field deployable nodes for both passive and active operation are a few examples of applications. They have fielded thousands of flat panels and have created over 15 distinct configurations to meet the needs of their clients. Applications include high-gain satcom communications, vehicle tracking, and field deployable nodes for both passive and active operation.

- In November 2024, Intellian Technologies unveiled three new small flat panel antennas for satellite broadband service on the OneWeb constellation from Eutelsat Group. Fixed, land mobility, and maritime services are served by these active electronically scanned arrays (ESA) user terminals. These terminals are the smallest in the Eutelsat OneWeb portfolio and are intended for usage on the OneWeb LEO network.

This flat panel antenna market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) and Volume (Units) from 2021 to 2034, for the following segments:

Market, By Type

- Electronically steered

- AESA (Active Electronically Scanned Array)

- PESA (Passive Electronically Scanned Array)

- Mechanically steered

Market, By Operating Frequency

- C and X band

- Ku K and Ka band

Market, By Network Connectivity

- Multi-Network Devices

- Dedicated Network Devices

Market, By Orbit Type

- Geostationary Earth Orbit (GEO)

- Non-GEO

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- High Elliptical Orbit (HEO)

Market, By End use

- Aviation

- Telecommunications

- Military

- Commercial

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Latin America

- Brazil

- Mexico

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

How much is the U.S. flat panel antenna market worth in 2024?

The U.S. market was worth over USD 3.1 billion in 2024.

What will be the size of electronically steered segment in the flat panel antenna industry?

The electronically steered segment is anticipated to cross USD 2.9 billion by 2034.

How big is the flat panel antenna market?

The market size for flat panel antenna was valued at USD 558.7 million in 2024 and is expected to reach around USD 8.8 billion by 2034, growing at 32.1% CAGR through 2034.

Who are the key players in flat panel antenna industry?

Some of the major players in the industry include Kymeta Corporation, Hanwha Phasor, ThinKom Solutions Inc., TTI Norte, L3Harris Technologies.

Flat Panel Antenna Market Scope

Related Reports