Summary

Table of Content

Filter Bag Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Filter Bag Market Size

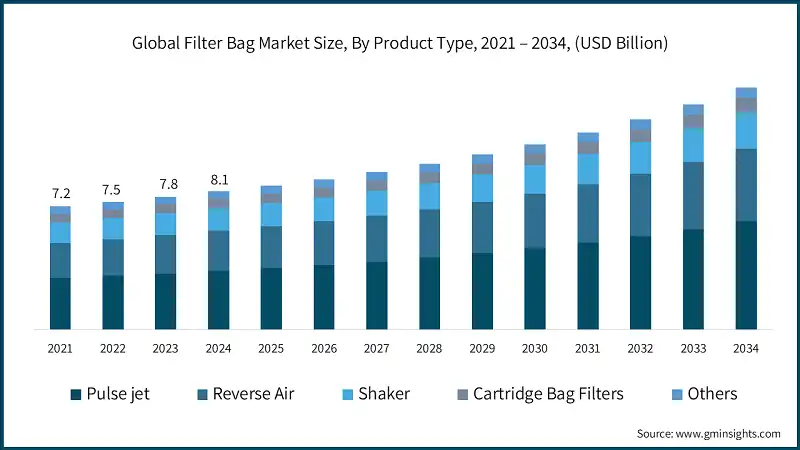

According to a recent study by Global Market Insights Inc., the global filter bag market was estimated at USD 8.1 billion in 2024. The market is expected to grow from USD 8.5 billion in 2025 to USD 14.2 billion in 2034, at a CAGR of 6%.

To get key market trends

- The worldwide market for filter bags increases because industries are facing more stringent air pollution control regulations. Governments and regulatory bodies are implementing more stringent environmental regulations to minimize the health and environmental hazards due to particulate emissions.

- For instance, the U.S. Environmental Protection Agency (EPA) revealed that its programs under the Clean Air Act reduced particle pollution by 41% between 2000 and 2020. Similarly, on the European continent, the European Commission executes strict emission limits under its Industrial Emissions Directive.

- In the Asian continent, India, for example, is launching the National Clean Air Program (NCAP) to reduce particulate pollution by 20-30% by 2024 compared with 2017 levels. These are laws calling for industries such as cement, power plant, chemicals, metals, and pharmaceuticals to employ high-efficiency filtration equipment. Filter bags are an economical and practical way of meeting these demands. Increasing awareness of clean air and government monitoring in rapidly growing nations also provide a boost.

- Pulse jet filter bags are the most widely used product line in the market due to their efficiency and high-technology cleaning usage. In contrast to shakers or reverse air systems, pulse jet systems clean dust away from the filter surface using compressed air bursts while the filtration continues.

- This minimizes downtime, optimizes filter life, and reduces maintenance costs. Their great cleaning capability and compact design make them ideal for application in small space industries. Applications of such pulse jet systems are in cement, metallurgy, and thermal power generation as they can efficiently clean fine dust and comply with strict environmental protection requirements without productivity loss.

- Coal plants produced 36% of the world's electricity in 2022, as reported by the International Energy Agency (IEA), illustrating the critical need for effective dust control within this industry.

- The Asia Pacific is the biggest and fastest-growing segment of the international market for filter bags. Unchecked industrialization in Vietnam, Indonesia, India, and China is spearheading demand. For example, China's National Bureau of Statistics revealed that China manufactured 2.6 billion metric tons of cement only in 2022, which significantly contributed to air dust emissions.

- Governments in the region also implemented more stringent air pollution control regulations and made investments in efforts to improve air quality. India's NCAP and China's Three-Year Action Plan for Winning the Blue Sky Defense Battle are a couple of examples. All these efforts in combination with a robust base of local manufacturers providing economic solutions have made the industries shift towards filter bags more easily.

- Increased urbanization and awareness among people regarding the health hazards of air pollution are also compelling industries to employ better filtering technologies. Thus, the Asia-Pacific region will be at the top of the market for the coming few years.

Filter Bag Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.1 Billion |

| Forecast Period 2025 - 2034 CAGR | 6% |

| Market Size in 2034 | USD 14.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing enforcement of air pollution control standards | Increasing enforcement of air pollution control standards (such as EPA, EU directives, and local emission norms) is driving industries to adopt filter bags in dust collection and air filtration systems. |

| Growth of Industrialization | Expanding industries such as cement, power generation, chemicals, metals & mining, and pharmaceuticals create strong demand for efficient dust and particulate filtration solutions. |

| Rising Awareness of Workplace Safety | Employers are prioritizing clean air in manufacturing facilities to protect workers from hazardous dust exposure, boosting the adoption of industrial filtration bags. |

| Urbanization and Infrastructure Growth | Rapid construction and cement production, especially in emerging economies, increases particulate emissions, driving higher use of filter bags. |

| Pitfalls & Challenges | Impact |

| High initial costs of advanced filter bags | Specialized materials (PTFE, aramid, PPS) and advanced coating increase upfront costs, which can discourage adoption in cost-sensitive industries. |

| Competition from alternative filtration technologies | Cartridge filters, electrostatic precipitators, and membrane filters often compete with filter bags, especially in applications needing finer particle capture. |

| Opportunities: | Impact |

| Technological advancements | Development of high-efficiency, long-life, high-temperature, and nano-fiber coated filter bags is expanding application potential. |

| Growth of sustainable manufacturing | Industries are investing in eco-friendly production systems, where high-performance filter bags help reduce emissions and energy costs. |

| Market Leaders (2024) | |

| Market Leaders |

Market share 12.3% |

| Top Players |

Collective market share in 2024 is 26.8% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | U.S., France, Germany, China |

| Future Outlook |

|

What are the growth opportunities in this market?

Filter Bag Market Trends

- In the past decade, filter bag production industries have employed more advanced materials such as aramid, PPS (polyphenylene sulfide), and PTFE (polytetrafluoroethylene) in filter bags. Polyester and polypropylene bags were satisfactory for medium dust collection in the past. Cement, metallurgy, and chemical processing are corrosive conditions and high-temperature environments, and industry operators considered ordinary bags to be unreliable.

o From 2015 to 2020, industries began implementing high-temperature-resistant material. Aramid-type filter bags withstanding 200°C temperatures were the norm. PTFE-coated and PTFE-membrane bags became popular in 2021 due to improved filtration, chemical resistance, and longevity. This change enabled industries to comply with stricter environmental regulations as well as reduce replacement expenses.

o From 2024 to 2034, the trend is likely to increase with industries prioritizing efficiency and sustainability. PTFE-coated filter bags will become the standards of high-demand sectors such as cement kilns, power plants, and waste burning in the near future. Technologies such as nanofiber layering and hybrid fabrics will enhance filtration without restricting airflow. Once these next-generation materials become available at decreasing prices, their application will be extended to food & beverage and pharma industries. This technology will change the future of filter bags.

- New economies of the Asia-Pacific, Latin American, and African regions are spearheading demand for filter bags. Industrialization of China, India, Vietnam, Brazil, and South Africa since 2015 has boosted demand for dust collection equipment. Filter bags are being used because they are affordable and easy to replace.

o From 2015 to 2023, China and India became the biggest consumers of filter bags because of their huge steel, power, and cement industries. Their respective governments also implemented more stringent emissions control to combat pollution in the air. For instance, India's National Clean Air Programme (NCAP) helps in decreasing the level of PM2.5 and PM10 by 40% by 2026, which will raise the demand for filter bags. Likewise, China's Three-Year Action Plan for Winning the Blue Sky Defense Battle (2018-2020) was aimed at curbing industrial emissions, again stimulating the demand for filtration products.

o Between 2024 and up to 2035, emerging markets will see demand increasing at a higher rate than in the developed world. Urbanization and infrastructure expansion in Asia and Africa will increase demand for cement and construction. Mining and energy production will also see growth in markets. Asia-Pacific regional producers are enhancing quality while lessening prices, thus facilitating the adoption of filter bags by industries. Such growth makes emerging economies the key driving forces in the world's filter bags market.

o By 2050, Asian urbanization is expected to reach 64%, driving the expansion of infrastructure and industrial filtration demand. In addition, the International Finance Corporation (IFC) identifies that investment in emerging market infrastructure can exceed USD 2 trillion per year by 2030, further driving the demand for filter bags.

Filter Bag Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is segmented into pulse jet, reverse air, shaker, cartridge bag filters, and others. The pulse jet segment accounted for revenue of around USD 3.4 billion in 2024 and is estimated to grow at a CAGR of around 6.5% from 2025 to 2034.

- Pulse jet filter bags are utilized globally in the filter bag market because they are of high efficiency, flexibility, and low operating cost compared to any other technology. Dust is not continuously blown off in reverse air or shaker cleaning systems from the surface of the filter without ever closing the system by compressed air pulses.

- They offer smooth operation, less maintenance time, and greater productivity, suitable for continuous processing applications like cement, steel, power generation, and chemicals.

- These pulse jet filter bags are widely applied due to their high cleaning capacity and low volume. They have better capacities to carry higher air-to-cloth ratios, meaning that they can carry more air in less cloth. This allows for smaller baghouses to be applied with space economy without compromising filtration efficiency.

- They are self-supporting at high temperatures and dusty environments as well, so they are suitable for heavy-industry use where emission standards are high.

- Pulse jet systems also last longer and require less manual maintenance. Their self-cleaning system maintains airflow rates uniform and performance constant, reducing energy and operating expenses. New developments in filter media like PTFE-coated, Aramid, and nanofiber composites have improved the durability and efficiency of these bags and helped industries to comply with increasingly demanding environmental regulations.

- The U.S. Environmental Protection Agency (EPA), the organizations utilizing high-technology filtration equipment, i.e., pulse jet filter bags, have cut particulate emissions by an extremely high percentage, resulting in improved air quality.

- With governments across the globe setting tighter emissions standards and businesses wanting to cut costs, pulse jet filter bags provide just the right balance of efficiency, reliability, and cost.

- The European Union's Industrial Emissions Directive (IED), for example, and the U.S. Clean Air Act have compelled businesses to turn to more advanced filtration systems, further fueling demand for pulse jet filter bags and cementing their place at industry forefront.

Learn more about the key segments shaping this market

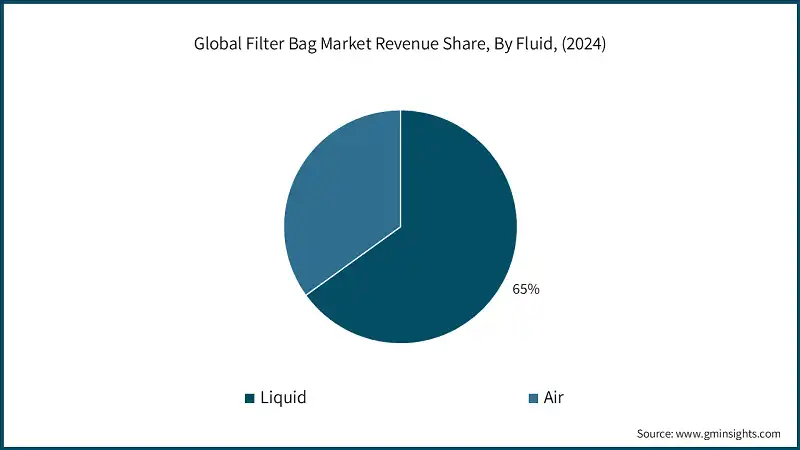

Based on the fluid, the global filter bag market is categorized into liquid and air. The liquid segment held around 65% of the total market share in 2024 and is anticipated to grow at a CAGR of 6.4% from 2025 to 2034.

- Liquid filter bags are dominating the filter bags market because they find extensive applications across industries, are less expensive, and are extremely effective in liquid filtration. While dry filter bags find applications in dust collection as well as air pollution control, liquid filter bags are applied in food & beverages, pharmaceuticals, water treatment, chemicals, paint & coatings, and oil & gas.

- Their expanded application is necessitated by worldwide interest in water treatment, wastewater treatment, and liquid filtration, prompting large demand. The United Nations has consistently. estimated that there are 2.2 billion individuals across the world with no access to safely drink water, necessitating effective water treatment.

- Liquid filter bags are applied because they have the ability to filter various liquids. They are applied in usage from the filtration of minute particles from pharmaceuticals to municipal and industrial water treatment plants.

- They are simple to operate, can carry lots of dirt, and cost less to operate than other methods of filtration such as cartridge filters or membrane systems. For treatment of large amounts of fluids in industries, liquid filter bags prove a cost-effective and efficient solution without compromising on quality.

- Water quality policies also do not lose their strength in marketplaces such as North America, Europe, and Asia-Pacific and are driving market growth. For instance, the U.S. Environmental Protection Agency (EPA) regulates the Clean Water Act, which mandates that industries meet stringent levels of discharge of wastewater.

- Governments and businesses are increasing investment in sustainable water management, and this is driving the demand for liquid filter bags used in industrial and municipal wastewater treatment.

- Meanwhile, innovative technologies in filter media, including multilayer felt, polypropylene, nylon, and polyester, are enhancing filtration performance, chemical resistance, and durability, and therefore these bags are becoming increasingly desirable.

- Retail segments such as food & beverages and pharmaceuticals are the ones that favor liquid filter bags because they assure the product purity, as well as compliance with safety standards. The fact that they offer cost-effective reliable filtration makes them the industry's first choice in the area of filter bags.

Based on the distribution channel, the global filter bag market is categorized as direct, and indirect. The indirect segment held around 59% of the total market share in 2024.

- Indirect sales channel is leading because it is more convenient, less expensive, and local assistance is available. A greater part of demand arises in the aftermarket segment where cement, power generation, steel, chemical, and food and beverages industries are prone to replacing filter bags to comply with environmental regulations. For example, the United States Environmental Protection Agency (EPA) describes that the Clean Air Act compels industries to regulate emissions, making it necessary to replace filter bags more often.

- Distributors, dealers, and EPC contractors are an important part of this industry. They provide quick-replacement bags, perform on-site inspections, suggest proper materials, and provide installation assistance. These manufacturers, including Donaldson, Camfil, and Parker Hannifin, are dependent on their channels to penetrate markets abroad, particularly the Asia-Pacific and African markets where they have negligible direct presence. Industrial e-commerce websites have also made it easier for buyers to source, compare, and acquire filter bags in an effective manner.

Looking for region specific data?

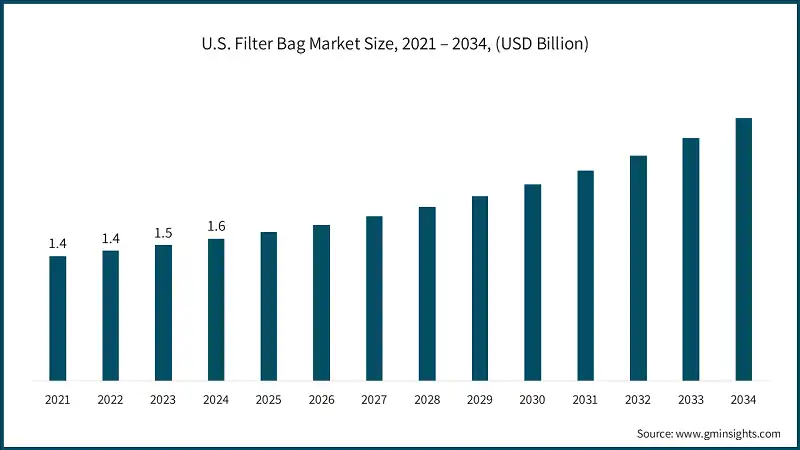

The U.S. dominated the filter bag market with around 72.8% market share and generating USD 1.6 billion in revenue in 2024.

- The United States dominates the North American market for filter bags because of its robust manufacturing and industrial bases. Cement, power generation plants, chemical, and metal processing industries release massive amounts of particulate material, and hence, there is high demand for dust collection and filtration machinery.

- The United States Environmental Protection Agency (EPA) has extremely stringent regulations for emission control, which force industry to install high-technology filtering equipment like pulse jet and high-performance filter bags. Industrial emissions in the U.S. reduced by 77% since 1970 according to the EPA, because of such regulations. American producers also spend significant amounts of capital on research and development to produce state-of-the-art filters like PTFE-coated and aramid-based filter bags.

- The increased application of automation and digital surveillance in industries also contributes to the application of smart filtration systems. All these, along with technological advances and regulatory demands, contribute to making the U.S. the biggest market for North American filter bags.

The European filter bag market in Germany is expected to experience significant and promising growth from 2025 to 2034.

- Germany's most powerful industrial base and technological leadership propel it as the leading market in Europe for filter bags. Energy-based industries such as the automobile, steel, cement, and chemical industries rely on effective dust control technology.

- Germany is also abiding by strict European Union environment standards that require industries to use state-of-the-art filtration technologies. Germany achieved a 40% decrease in industrial particulate emissions from 2000 to 2020, according to the European Environment Agency.

- German local industries produce high-efficiency filter bags using durable materials such as PTFE and aramid cloth. Germany also has efficient distribution networks, together with technically competent support, which allows industries to install and service filtration systems.

- Germany's focus on the environment and energy-saving processes also supports the necessity for energy-saving filter bags in order to meet environmental requirements. They all contribute to making Germany the top filter bags market in Europe.

The Asia Pacific filter bag market, China holds a market share of around 33% in 2024 and is anticipated to grow with a CAGR of around 7.3% from 2025 to 2034.

- The largest Asia-Pacific filter bags market is China due to fast industrialization, urbanization, and infrastructure development. Cement production, electricity generation using coal, steel production, chemical factories, and mining all produce considerable dust and thus will have high filtration system requirements.

- The Chinese government has imposed stringent air pollution regulations, such as the "Blue Sky Policy," to reduce particulate discharge by 18% from 2021 to 2025, according to the Ministry of Ecology and Environment. Local Chinese manufacturers make affordable filter bags to local standards and ship them to regional neighboring countries in the APAC region.

- Advanced products like pulse jet filter bags and PTFE-coated ones are extensively utilized for reasons of efficiency. Greenway spending and ecological concern drive high-tech filtration solution demand. These together bestow China with the market-leading position as filter bags market in APAC.

The MEA filter bag market in Saudi Arabia is expected to experience significant and promising growth from 2025 to 2034.

- The UAE is the biggest filter bags market in the Middle East and Africa, driven by industrialization, infrastructure growth, and regional hub status. Cement, construction, petrochemicals, and oil & gas industries generate high particulate emissions that increase the demand for filtration systems. The government of the UAE emphasizes air quality and sustainability through initiatives such as the UAE Vision 2021, targeting a rise in air quality to 90% by 2024, as per the UAE Ministry of Climate Change and Environment.

- The logistics and distribution infrastructure of the country is robust and facilitates the supply of filter bags throughout the Gulf Cooperation Council (GCC) region. Industrial operators in the UAE are embracing recent technologies such as pulse jet filter bags and PTFE-coated textiles to enhance performance and lower maintenance costs.

Filter Bag Market Share

Eaton Corporation is leading with a 12.3% market share. Donaldson Company, Inc, Pall Corporation, Eaton Corporation, Camil AB, and Parker Hannifin Corporation collectively hold 26.8%, indicating moderately fragmented market concentration.

- The market is dominated by Eaton Corporation with 12.3% market share because of product variety, worldwide presence, and technological focus. The firm supplies high-performance filter bags applicable for use in cement, power generation, chemicals, and metal industries using the most recent materials such as PTFE-coated and heat-resistant textiles.

- This makes Eaton's products very dependable for applications in environments where there are stringent emission regulations. Its extensive distribution channel and after-sales services also contribute to the basis for its leadership in providing effective delivery of new installations and replacement components. Other notable firms, such as Donaldson Company, Inc., Pall Corporation, Camfil AB, and Parker Hannifin Corporation, hold 26.8% of the market, yet portray a moderately fragmented market with multiple mid-to-large suppliers that maintain a strong competitive presence without dominating the market.

- These firms stay ahead through ongoing product innovation, solutions-oriented by industry, and strong worldwide penetration. Alliance tactics with industrial buyers and distributors, service-focused in the aftermarket, and investment in energy-efficient and sustainable products allow them to narrow customer loyalty and respond to changing regulatory demands.

- Overall, the diversified market permits a series of operators to thrive by segmenting on capabilities in technology, strengths in services, and local presence, with Eaton prevailing given its best fit among innovation, service, and market access.

Filter Bag Market Companies

Major players operating in the filter bag industry are:

- Babcock and Wilcox

- BWF Envirotec

- Camfil Farr

- Clarcor

- Donaldson

- Eaton

- Filter Concept

- General Electric

- Lenntech

- Mitsubishi Hitachi Power Systems

- Pall

- Parker Hannifin

- Rosedale Products

- Thermax

- W. L. Gore and Associates

Camfil Farr (Camfil AB) provides numerous dust and liquid filter bags, cartridge filters, and HEPA bags for use in cleanroom, HVAC, and industrial emission control applications. Clarcor, owned by Parker Hannifin, provides dust collector bags, liquid filter bags, and cartridge filters for cement, metal, chemical, and food & beverage applications, utilizing frequently PTFE-coated felt and woven substrates.

Donaldson Company, Inc. offers pulse jet and shaker filter bags, liquid filter bags, and cartridge filters of aramid, PTFE, polyester, and polypropylene for cement, power, metals, and chemicals applications.

Lenntech specializes in liquid filtration solutions for wastewater, chemicals, and pharmaceuticals using polypropylene, polyester, and multi-layer felt media. Mitsubishi Hitachi Power Systems is a high-temperature industrial filter bag expert for coal-fired power stations. Pall Corporation provides liquid and gas filtration, such as filter bags and cartridge filters, for food & beverage, chemicals, and pharmaceuticals.

Parker Hannifin provides dust and liquid filter bags made from polyester, aramid, and PTFE-coated materials for cement, metals, chemical, and food industry.

Rosedale Products exports proprietary shaker system and pulse jet bags made of PTFE, polyester, and high-temperature resistant media, while Thermax is a specialist in needle felt and PTFE-coated power and cement industry dust collector bags.

Lastly, W. L. Gore and Associates is a world leader in PTFE membrane and high-performance filtration fabrics, exporting liquid filter and pulse jet bags for cement, metals, chemicals, and high-temperature industrial applications. C

Filter Bag Industry News

- In 2024, Eaton launched new filter bags in its SENTINEL MAXPO and DURAGAF MAXPOXL ranges. These filter bags include an internal pre-filter to efficiently separate particles and oil. Made from fully welded polypropylene (PP) with thicker filter material, the SENTINEL MAXPO and DURAGAF MAXPOXL bags can remove particles with retention rates ranging from 1 to 200 μm. Their design makes them easy to handle, and the inner core, made of a porous fiber matrix from meltblown PP, improves filtration and absorbs oil effectively.

- In June 2023, Donaldson Company, Inc. acquired Univercells Technologies, a global producer of innovative biomanufacturing solutions for cell and gene therapy research, development, and commercial manufacturing. The acquisition represents an important next step in Donaldson’s life sciences strategy.

- In January 2023, Freudenberg Performance Materials launched Filtura, its product brand for filter media solutions. Filtura is a comprehensive portfolio of innovative high-performance filter media products and customized solutions for air and liquid filtration.

The filter bag market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Bn/Mn) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Pulse jet

- Reverse air

- Shaker

- Cartridge bag filters

- Others

Market, By Media

- Woven

- Non-woven

Market, By Technology

- Pulse-jet cleaned filter bags.

- Reverse-air cleaned filter bags

- Mechanical shaker filter bags

- Cartridge filter systems

Market, By Fluid

- Air

- Liquid

Market, By Material

- Polyester

- Polypropylene

- Nomex

- Acrylic fibers

- Teflon

- Fiberglass

- Polyimide/ P84

- Others

Market, By Application

- Cement

- Pharmaceuticals

- Power generation

- Metals

- Chemicals

- Others

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Question(FAQ) :

Who are the key players in the filter bag market?

Key players include Babcock and Wilcox, BWF Envirotech, Camfil Farr, Clarcor, Donaldson, Eaton, Filter Concept, General Electric, Lenntech, Mitsubishi Hitachi Power Systems, Pall, Parker Hannifin, Rosedale Products, Thermax, W. L. Gore and Associates.

Which region leads the filter bag market?

U.S. dominated the 72.8% share of the filter bag market share with USD 1.6 billion in 2024.

What are the upcoming trends in the filter bag market?

Key trends include adoption of advanced materials like PTFE-coated and aramid filter bags, nano-fiber composite technologies, increased focus on high-temperature resistance, and growth in sustainable manufacturing processes.

What is the growth outlook for China's filter bag market from 2025 to 2034?

China holds 33% market share in Asia Pacific region and is projected to grow at 7.3% CAGR through 2034.

What was the valuation of the liquid fluid segment in 2024?

The liquid segment held 65% market share in 2024, dominating due to extensive applications across water treatment, pharmaceuticals, food & beverages, and chemical industries.

How much revenue did the pulse jet segment generate in 2024?

Pulse jet filter bags generated USD 3.4 billion in 2024, leading the market due to their high efficiency and low operating costs.

What is the current filter bag market size in 2025?

The market size is projected to reach USD 8.5 billion in 2025.

What is the market size of the filter bag market in 2024?

The market size was USD 8.1 billion in 2024, with a CAGR of 6% expected through 2034 driven by stringent air pollution control regulations and increasing industrialization across sectors.

What is the projected value of the filter bag market by 2034?

The filter bag market is expected to reach USD 14.2 billion by 2034, propelled by environmental regulations, industrial growth, and technological advancements in filtration materials.

Filter Bag Market Scope

Related Reports