Summary

Table of Content

Ferroelectric Random Access Memory (FeRAM) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Ferroelectric Random Access Memory Market Size

The global ferroelectric random access memory market was valued at USD 474 million in 2024. The market is expected to grow from USD 499.3 million in 2025 to USD 852.4 million in 2034, at a CAGR of 6.1% during the forecast period, according to the latest report published by Global Market Insights Inc. The increasing need for energy-efficient, high-performance memory in modern electronics is a key driver for the FeRAM market. As devices such as wearables, IoT sensors, and portable medical equipment become smaller and more power-constrained, traditional memory technologies like Flash and EEPROM struggle to deliver both speed and efficiency. FeRAM offers a unique combination of fast read/write capabilities, low power consumption, and non-volatility, making it ideal for such applications. Its ability to instantly write data without requiring refresh cycles enables faster data processing and longer battery life. Consequently, FeRAM is gaining traction among designers seeking memory solutions that balance performance, reliability, and energy efficiency in compact, embedded systems.

To get key market trends

The automotive and industrial sectors are increasingly adopting FeRAM due to its robustness, endurance, and reliability under harsh conditions. In modern vehicles, FeRAM is used for event data recorders, advanced driver-assistance systems (ADAS), and sensor data storage, where consistent performance and instant data capture are critical. Similarly, in industrial automation and factory equipment, FeRAM’s high endurance and fast write speed support continuous logging and real-time control functions. Unlike conventional memory types, FeRAM can retain data even after power loss, ensuring system reliability in mission-critical environments. As vehicles and industrial systems become more connected and data-driven, the integration of FeRAM offers enhanced durability, efficiency, and operational stability for next-generation embedded applications.

Ferroelectric Random Access Memory (FeRAM) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 474 Million |

| Market Size in 2025 | USD 499.3 Million |

| Forecast Period 2025 - 2034 CAGR | 6.1% |

| Market Size in 2034 | USD 852.4 Million |

| Key Market Trends | |

| Drivers | Impact |

| Growing demand for low-power, high-speed memory solutions | Drives FeRAM adoption by approximately 35%, particularly in wearable electronics and IoT edge devices. |

| Rising integration of FeRAM in automotive and industrial systems | Boosts market expansion by nearly 30% through applications in data logging, sensing, and energy-efficient embedded systems. |

| Advancements in ferroelectric material engineering and fabrication processes | Enables 25–28% improvement in device density and endurance, accelerating next-generation FeRAM deployment. |

| Increasing adoption of non-volatile memory in smart cards and security applications | Spurs about 32% growth in secure, tamper-resistant FeRAM-based storage solutions. |

| Supportive government policies and funding for energy-efficient semiconductor technologies | Encourages 20–25% uplift in R&D investments and pilot-scale production capacity. |

| Pitfalls & Challenges | Impact |

| High manufacturing and material costs (ferroelectric thin films, deposition precision) | Restrains large-scale adoption and raises per-bit cost compared to flash memory. |

| Limited storage density compared to emerging NVM (MRAM, ReRAM) | Hampers competitiveness in high-capacity memory markets |

| Opportunities: | Impact |

| Expansion in IoT and edge computing devices | Offers strong potential for FeRAM adoption due to its low-power operation and fast data retention in always-on, connected devices. |

| Growth of automotive electronics and ADAS systems | Creates opportunities for FeRAM in real-time data logging and event recording under extreme temperature and reliability conditions. |

| Market Leaders (2024) | |

| Market Leaders |

~28% market share. |

| Top Players |

Collective market share in 2024 is ~74% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Emerging Country | China, India, Brazil, Mexico, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Ferroelectric Random Access Memory Market Trends

Since 2021, manufacturers have increasingly focused on integrating FeRAM directly into microcontrollers and SoCs. This trend supports compact system design and enables faster data exchange, especially in automotive electronics and industrial automation applications requiring real-time responsiveness.

Beginning in 2022, the FeRAM industry has seen a technological shift toward hafnium oxide (HfO2)-based ferroelectric materials. This transition enhances CMOS compatibility, reduces manufacturing costs, and allows scaling to smaller process nodes for advanced semiconductor devices.

Since 2023, FeRAM has gained popularity in IoT applications due to its ultra-low power consumption and fast write capability. This trend aligns with the rising need for efficient, non-volatile memory in edge devices and smart sensors.

From 2024 onward, companies have focused on developing high-endurance FeRAM tailored for next-generation automotive systems. These products deliver reliable data storage under extreme temperatures, supporting ADAS, electric vehicles, and real-time event recording functions in connected mobility platforms.

Ferroelectric Random Access Memory Market Analysis

Learn more about the key segments shaping this market

The global ferroelectric RAM market was valued at USD 405.6 million and USD 426.6 million in 2021 and 2022, respectively. The market size reached USD 474 million in 2024, growing from USD 449.3 million in 2023.

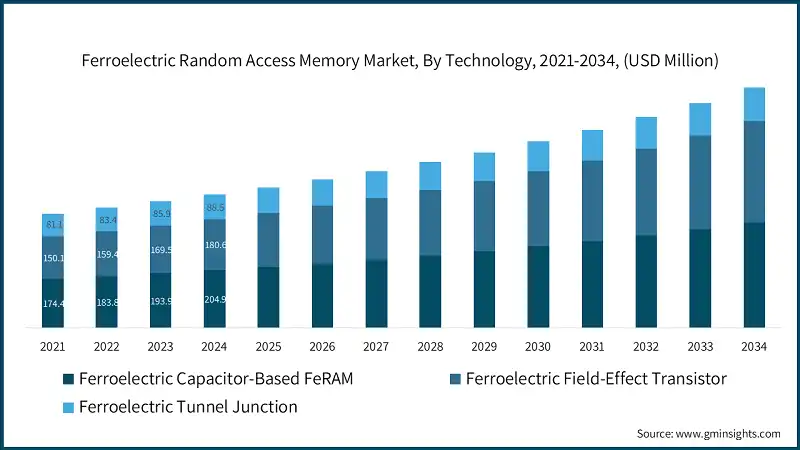

Based on the technology type, the market is divided into ferroelectric capacitor-based FeRAM, ferroelectric field-effect transistor, and ferroelectric tunnel junction. The ferroelectric capacitor-based FeRAM segment accounted for 43.2% of the market in 2024.

- Ferroelectric Capacitor-Based FeRAM drives market growth through its proven reliability, fast read/write capability, and low-power operation. Its maturity and widespread adoption in embedded systems, industrial automation, and automotive electronics ensure continued relevance in energy-efficient and mission-critical memory applications.

- Manufacturers should focus on enhancing endurance, data retention, and scalability of Capacitor-Based FeRAM. Investing in advanced fabrication techniques and hybrid integration with CMOS processes can help maintain competitiveness while catering to growing demand in industrial and automotive sectors.

- The ferroelectric field-effect transistor segment was valued at USD 180.6 million in 2024 and is anticipated to grow at a CAGR of 7.2% over the forecast years. Ferroelectric Field-Effect Transistor (FeFET) technology is gaining traction due to its superior scalability, faster switching speeds, and compatibility with advanced CMOS nodes. Its ability to achieve higher density and lower power consumption supports next-generation computing and AI-driven applications.

- Manufacturers should prioritize R&D collaborations to refine material properties and device stability of FeFET technology. Strategic partnerships with semiconductor foundries can accelerate commercialization, enabling integration into advanced logic-memory architectures for future high-performance computing systems.

Based on the material type, the ferroelectric random access memory market is segmented into traditional perovskite materials, doped hafnium oxide, and aluminum scandium nitride. The traditional perovskite materials segment dominated the market in 2024 with a revenue of USD 186.8 million.

- Traditional Perovskite Materials drive FeRAM market growth through their proven reliability, strong ferroelectric properties, and extensive use in established memory architectures. Their stability and performance consistency make them suitable for industrial, automotive, and consumer electronics requiring durable non-volatile memory solutions.

- Manufacturers should focus on improving scalability and process integration of perovskite-based FeRAM to enhance competitiveness. Optimizing thin-film deposition techniques and exploring lead-free compositions will ensure better environmental compliance and long-term adoption in modern semiconductor manufacturing environments.

- The doped hafnium oxide is anticipated to witness growth at a CAGR of 7.2% over the analysis period, reaching USD 312.8 million by 2034.

- Doped Hafnium Oxide is driving FeRAM market growth due to its excellent CMOS compatibility, scalability, and low power consumption. Its ability to enable smaller node fabrication and high-density integration positions it as a preferred material for next-generation memory applications.

- Manufacturers should invest in refining dopant compositions and process uniformity to improve device performance and endurance. Collaborating with foundries and research institutions can accelerate commercial deployment, ensuring doped hafnium oxide-based FeRAM meets mass-production and advanced node requirements.

Based on the interface type, the ferroelectric random access memory market is segmented into serial I2C interface, serial SPI interface, and parallel interface. The serial I2C interface segment dominated the market in 2024 with a revenue of USD 190.7 million.

- Serial I2C Interface drives ferroelectric RAM market growth through its simplicity, low power consumption, and suitability for compact embedded systems. Its wide adoption in IoT devices, sensors, and industrial equipment enhances reliable data communication while minimizing hardware complexity and design cost.

- Manufacturers should focus on improving data transfer rates and ensuring compatibility with evolving microcontroller standards. Developing multi-protocol FeRAM modules that integrate I2C functionality can expand market reach across consumer, industrial, and low-power embedded device applications.

- On the other hand, the parallel interface segment is anticipated to witness growth at a CAGR of 7%.

- Parallel Interface fuels FeRAM market growth by enabling faster data access and higher bandwidth for memory-intensive operations. It is increasingly adopted in advanced automotive and industrial systems where quick data exchange and low latency are critical to system reliability.

- Manufacturers should invest in optimizing interface architecture and reducing pin count to simplify integration. Collaborating with OEMs to develop standardized parallel interface modules can enhance interoperability and broaden FeRAM’s adoption in high-performance embedded computing environments.

Based on the density range, the ferroelectric random access memory market is segmented into low density, medium density, and high density. The medium density segment dominated the market with a market share of 17.3% in 2024 and is anticipated to grow at a CAGR of 2.7% between 2025 – 2034.

- Medium density FeRAM supports market growth by balancing storage capacity, speed, and power consumption. This segment finds strong demand in automotive, industrial automation, and medical devices where moderate memory size and high endurance are essential for real-time operations.

- Manufacturers should focus on enhancing scalability and endurance of Medium Density FeRAM solutions. Collaborating with system designers to optimize memory configurations for automotive and industrial use will ensure broader adoption and longer product lifecycles.

- The medium density segment held the second-largest market share in 2024, with a revenue of USD 6.8 million.

- High density FeRAM propels market expansion by catering to data-intensive applications such as advanced computing, networking, and AI-enabled systems. Its capability to store larger data volumes with non-volatility and low latency makes it a strategic alternative to traditional memory technologies.

- Manufacturers should invest in advanced fabrication processes and material innovation to improve scalability of High Density FeRAM. Focusing on 3D integration and CMOS compatibility will position FeRAM competitively against emerging non-volatile memory solutions in high-performance computing markets.

Learn more about the key segments shaping this market

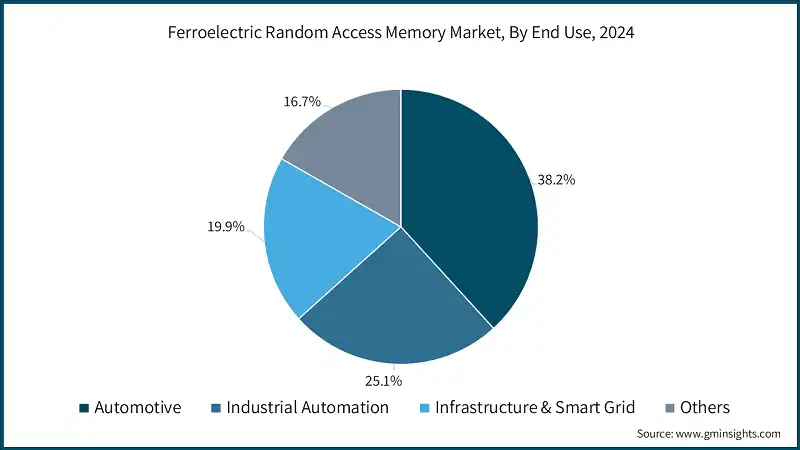

Based on the end use industry, ferroelectric random access memory market is classified into automotive, industrial automation, infrastructure & smart grid, medical & healthcare, consumer electronics, networking & communications, and others. The automotive segment dominated the market in 2024 with a market share of 38.2%.

- Automotive applications drive FeRAM market growth through increasing demand for reliable, non-volatile memory in electric vehicles, ADAS, and infotainment systems. FeRAM’s fast write speed, durability, and ability to retain data under extreme conditions make it essential for modern automotive electronics.

- Manufacturers should focus on enhancing temperature tolerance, data retention, and endurance of automotive-grade FeRAM. Collaborating with automotive OEMs for customized memory modules and adhering to automotive safety standards can strengthen long-term partnerships and increase market penetration.

- Industrial Automation boosts FeRAM market expansion by requiring high-endurance memory for real-time control, data logging, and process monitoring. FeRAM’s reliability and low power consumption support continuous operation in harsh environments, ensuring stable performance for industrial equipment and factory systems.

- Manufacturers should develop ruggedized FeRAM solutions optimized for industrial-grade temperatures and long write cycles. Offering tailored memory configurations for PLCs, sensors, and controllers can enhance compatibility with automation systems and attract large-scale industrial clients.

Looking for region specific data?

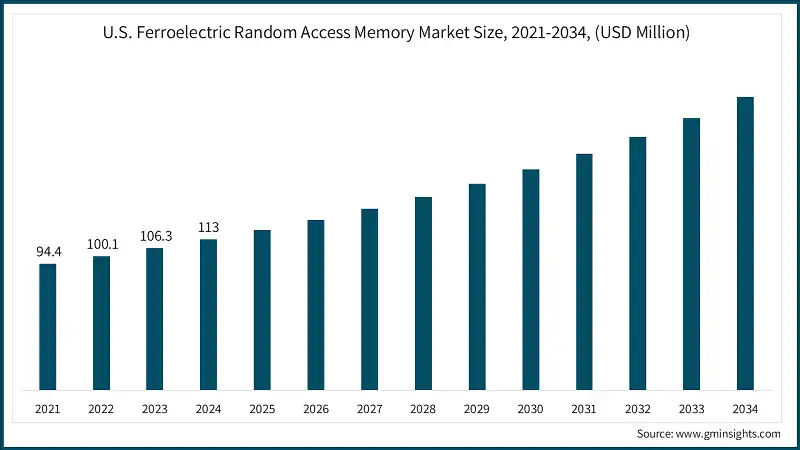

North America Ferroelectric Random Access Memory Market The North America market dominated the global ferroelectric RAM market with a industry share of 29.4% in 2024. The U.S. Ferroelectric Random Access Memory (FeRAM) market was valued at USD 94.4 million and USD 100.1 million in 2021 and 2022, respectively. The market size reached USD 113 million in 2024, growing from USD 106.3 million in 2023. Europe market accounted for USD 97 million in 2024 and is anticipated to show lucrative growth over the forecast period. UK dominates the Europe ferroelectric random access memory market, showcasing strong growth potential. The Asia Pacific market is anticipated to grow at the highest CAGR of 6.3% during the analysis timeframe. China ferroelectric random access memory (FeRAM) market is estimated to grow with a significant CAGR, in the Asia Pacific Ferroelectric Random Access Memory (FeRAM) market. Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period. UAE ferroelectric random access memory (FeRAM) market to experience substantial growth in the Middle East and Africa market in 2024. The competitive landscape of the ferroelectric random access memory (FeRAM) market is characterized by intense innovation and collaboration among established pharmaceutical giants, emerging biotech startups, and academic institutions. Top players such as Infineon Technologies AG (Cypress FeRAM Division), Fujitsu Semiconductor Limited, LAPIS Semiconductor Co., Ltd. (ROHM Group), Texas Instruments Incorporated, and STMicroelectronics N.V. hold a combined market share of ~74% in the global Ferroelectric Random Access Memory (FeRAM) market. These players focus on continuous innovation, product miniaturization, and improved energy efficiency to strengthen their market presence. Through strategic partnerships, R&D investments, and expansion into automotive, industrial, and IoT sectors, they aim to enhance performance, reliability, and scalability of FeRAM technology, ensuring sustained competitiveness in the global memory market. Additionally, smaller players and emerging semiconductor firms contribute by focusing on specialized FeRAM solutions and advanced memory architectures tailored for specific applications such as IoT devices, automotive electronics, and industrial automation. This dynamic environment fosters continuous innovation, improved data retention, and miniaturization, driving the overall growth and technological diversification of the market. Prominent players operating in the ferroelectric random access memory (FeRAM) market are as mentioned below: Infineon Technologies AG (Cypress FeRAM Division) is a leading player in the Ferroelectric Random Access Memory (FeRAM) market with a significant share of around 28%. The company focuses on delivering high-speed, low-power, and reliable memory solutions. Its robust manufacturing infrastructure, advanced R&D capabilities, and wide product portfolio enable it to meet growing demand across automotive, industrial, and IoT applications. Fujitsu Semiconductor Limited is a pioneer in FeRAM technology, recognized for developing energy-efficient, non-volatile memory products with fast write speeds and excellent endurance. The company’s commitment to innovation, strong partnerships, and extensive application coverage—from smart cards to embedded systems—strengthens its competitive position and contributes to sustained market leadership.Europe Ferroelectric Random Access Memory Market

Asia Pacific Ferroelectric Random Access Memory Market

Latin American Ferroelectric Random Access Memory Market

Middle East and Africa Ferroelectric Random Access Memory Market

Ferroelectric Random Access Memory Market Share

Ferroelectric Random Access Memory Market Companies

LAPIS Semiconductor Co., Ltd. (ROHM Group) plays a key role in advancing FeRAM by leveraging its expertise in semiconductor design and power management. The company focuses on producing durable, low-energy memory solutions for harsh environments such as automotive, factory automation, and metering applications, enhancing reliability and long-term data stability.Ferroelectric Random Access Memory Industry News

The ferroelectric random access memory market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Technology Type

- Ferroelectric capacitor-based FeRAM

- Ferroelectric field-effect transistor

- Ferroelectric tunnel junction

Market, By Material Type

- Traditional perovskite materials

- Doped hafnium oxide

- Aluminum scandium nitride

Market, By Interface Type

- Serial I2C interface

- Serial SPI interface

- Parallel interface

Market, By Density Range

- Low density

- Medium density

- High density

Market, By End Use

- Automotive

- Industrial automation

- Infrastructure & smart grid

- Medical & healthcare

- Consumer electronics

- Networking & communications

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the ferroelectric random access memory (FeRAM) market?

Key players include Infineon Technologies AG (Cypress FeRAM Division), Fujitsu Semiconductor Limited, LAPIS Semiconductor Co., Ltd. (ROHM Group), Texas Instruments Incorporated, and STMicroelectronics N.V. — collectively holding about 74% market share.

What are the upcoming trends in the ferroelectric random access memory (FeRAM) industry?

Key trends include integration of FeRAM into SoCs and microcontrollers, the shift toward hafnium oxide-based materials, and the rise of ultra-low-power FeRAM in IoT, automotive, and smart sensor applications.

What is the growth outlook for doped hafnium oxide material in FeRAM from 2025 to 2034?

The doped hafnium oxide material segment is projected to grow at a CAGR of 7.2% till 2034.

Which region leads the ferroelectric random access memory (FeRAM) market?

North America held 29.4% share in 2024, leading the global market. Growth is fueled by strong semiconductor R&D and rising adoption of FeRAM in automotive and industrial electronics.

What was the valuation of the ferroelectric field-effect transistor (FeFET) segment in 2024?

The FeFET segment was valued at USD 180.6 million in 2024 and is anticipated to grow at a CAGR of 7.2% through 2034.

How much revenue did the ferroelectric capacitor-based FeRAM segment generate in 2024?

The ferroelectric capacitor-based FeRAM segment accounted for 43.2% of the market in 2024, leading adoption due to its proven reliability, fast read/write capability, and low-power performance in embedded and industrial applications.

What is the current ferroelectric random access memory (FeRAM) market size in 2025?

The market size is projected to reach USD 499.3 million in 2025.

What is the projected value of the ferroelectric random access memory market by 2034?

The FeRAM market is expected to reach USD 852.4 million by 2034, supported by advancements in ferroelectric material engineering and the rising integration of FeRAM in automotive, IoT, and industrial devices.

What is the market size of the ferroelectric random access memory (FeRAM) market in 2024?

The market size was USD 474 million in 2024, with a CAGR of 6.1% expected through 2034, driven by growing demand for low-power, high-speed, and non-volatile memory in electronics and industrial systems.

Ferroelectric Random Access Memory (FeRAM) Market Scope

Related Reports