Summary

Table of Content

Family Entertainment Center (FEC) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Family Entertainment Center Market Size

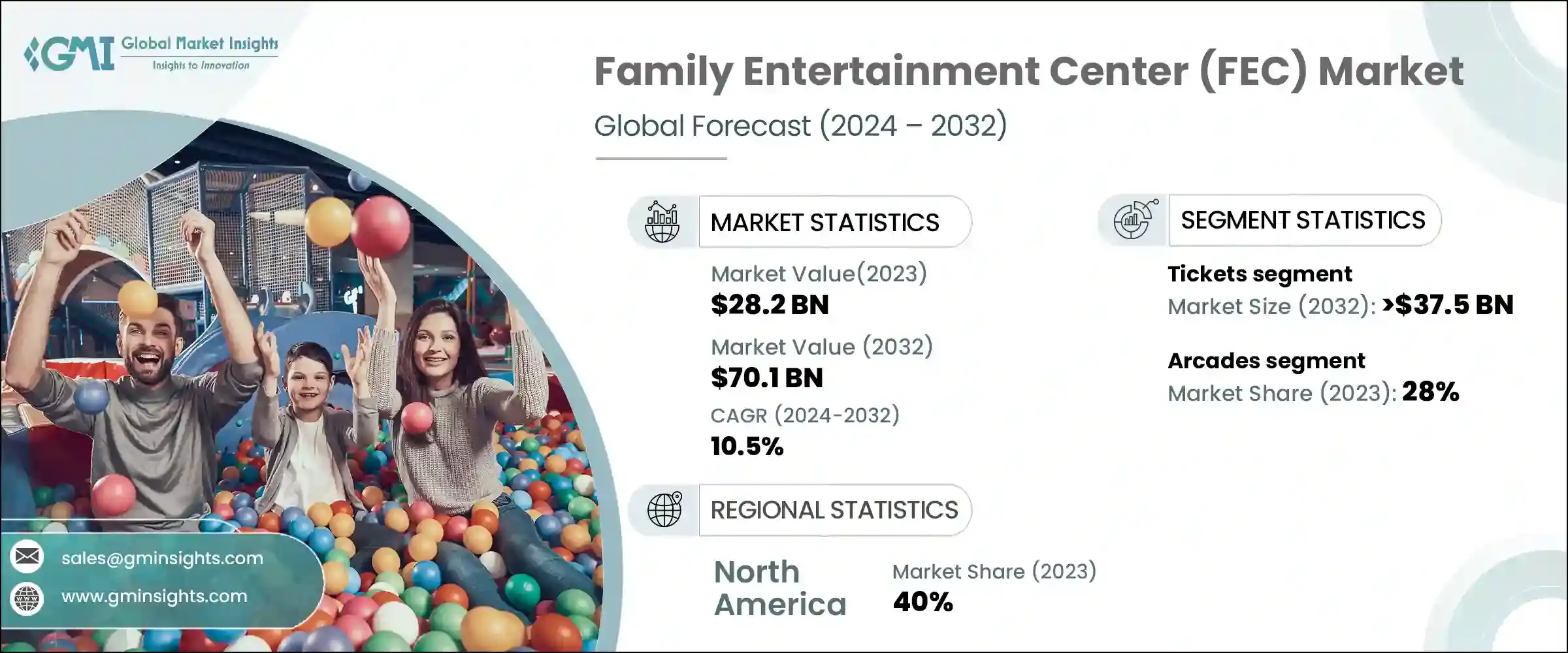

Family Entertainment Center Market size was valued at USD 28.2 billion in 2023 and is estimated to register a CAGR of over 10.5% between 2024 and 2032. The market growth is propelled by the growing number of new sites established by large corporations. This increase is driven by growing consumer demand for entertainment activities spanning all age groups, offering a mix of entertainment, dining, and interactive experiences. For instance, in February 2022, NEOM and MBC signed an agreement to establish AAA games studios and arcades in Saudi Arabia. This joint venture facilitated gaming and digital publishing in the region.

To get key market trends

The companies are strategically expanding their footprint to capture a larger market, using advanced technology and innovative attractions to increase customer engagement. The proliferation of these areas is supported by increased urbanization and disposable income, allowing families to spend more on leisure activities. There is a global shift towards experiential spending, and consumers are prioritizing experience over material goods, driving the market. The fusion of virtual reality, augmented reality, and immersive gaming environments has further increased the appeal of FECs, making them popular options for family outings and social gatherings. As a result, the family entertainment center market is poised for continued growth.

Family Entertainment Center (FEC) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 28.2 Billion |

| Forecast Period 2024 - 2032 CAGR | 10.5% |

| Market Size in 2032 | USD 70.1 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The family entertainment center market faces several restraints, including high operating costs and the high initial investment required for advanced equipment and technology. Additionally, the fierce competition from ample markets for entertainment in urban areas may hinder market growth. Economic downturns and changing consumer preferences could also affect visitor numbers. Moreover, safety and liability concerns pose greater challenges, necessitating stricter regulation and rising insurance costs, which may hamper market growth.

Family Entertainment Center Market Trends

The family entertainment center (FEC) industry is experiencing significant growth due to increasing investments in the construction of new centers. The driver behind this investment is the increasing demand for multi-faceted entertainment options that cater to different age groups and tastes. Leading brands are capitalizing on this trend by creating innovative spaces to enhance customer experience. Key trends include the incorporation of virtual reality (VR) and augmented reality (AR) experiences, which provide immersive and interactive entertainment.

In addition, the FEC has featured a great mix of traditional arcade games, contemporary simulation experiences, trampoline parks, and fun activities such as obstacle courses. This mix of offerings is popular with many and enjoyed by children and adults. Moreover, the trend toward creating multifunctional spaces that can accommodate events such as birthday parties, corporate meetings, and school visits is also gaining momentum. This versatility not only increases foot traffic but also increases revenue potential.

As a result, investment in new FECs is poised to drive continued market expansion and innovation. For instance, in May 2024, a new USD 70 million indoor sports and family entertainment complex was proposed for the growing West Henderson neighborhood. The City of Henderson announced the project, dubbed the West Henderson Fieldhouse, and will go before the City Council for final approval.

Family Entertainment Center Market Analysis

Learn more about the key segments shaping this market

Based on revenue stream, the market is divided into tickets, food & beverage, and merchandise. The tickets segment is expected to hold over USD 37.5 billion market revenue by 2032. Tickets give access to a wide range of attractions, from rides and arcade games to immersive virtual reality experiences and live performances. The attractiveness of the packaged tickets, with discounts on many attractions, increases the value proposition for families and groups.

In addition, ticketing games, where visitors earn and redeem tickets for prizes, help increase and repeat participation. Seasonal promotions and special events, such as holiday-themed activities or celebrity appearances, drive big-ticket sales. This dynamic approach to ticketing not only increases foot traffic but also generates steady revenue, underscoring its crucial role in market demand.

Learn more about the key segments shaping this market

Based on center, the FEC market is categorized into arcades, kids play areas, VR parks, and others. The Arcades segment hold around 28% of the market share in 2023. Modern FECs combine classic arcade games with modern entertainment catering to a wide range of tastes. This blend of nostalgia and novelty appeals to millennials seeking childhood memories and younger generations seeking interactive entertainment.

Additionally, the arcade provides a social environment where families and friends can engage in friendly competition, enhancing their overall entertainment experience. The ever-popular arcade games, as well as technological advancements, ensure that they play a significant role in increasing the demand of the market.

Looking for region specific data?

North America dominate the family entertainment center market with around 40% of the market share in 2023. Rising disposable incomes and an increasing emphasis on family-oriented leisure activities are driving many families to seek entertainment options like FECs, which offer a variety of arcade games, virtual reality experiences, and a mixture of attractions. Furthermore, the trend toward experiential spending, where consumers prioritize unique experiences over tangible features, makes FEC more popular.

North America’s complex infrastructure and urbanization make it easy to establish new locations, to meet growing demand. Seasonal events, loyalty programs, and new marketing strategies continue to appeal to many consumers, ensuring continued demand and growth in the market.

The family entertainment center (FEC) market in the U.S. is becoming increasingly demanding with increasing disposable income and a cultural emphasis on family-oriented activities. Americans prioritize experiential spending, seeking indulgent entertainment, which FECs provide with features such as arcades, virtual reality experiences, and interactive games. The market is further strengthened with new attractions and themed programs targeting a wide range of demographics ranging from children to adults.

Furthermore, the growing urban and suburban development in several European and Asia Pacific counties make it easier to install new FECs, making these areas more vulnerable. Enhanced marketing strategies and seasonal promotions will play a critical role in attracting tourists and ensuring strong demand in the FEC marketplace.

Family Entertainment Center Market Share

Dave & Buster's and Legoland Discovery Center (Merlin Entertainments) dominate the market with around 8% market share. These major players employ a variety of strategies to gain market share and maintain a competitive edge in the market. Differentiation is a key strategy, with leading FEC operators focusing on offering unique and innovative attractions and experiences that set them apart from competitors. Robust marketing and promotional efforts, including targeted advertising campaigns, social media engagement, and loyalty programs, help drive customer acquisition and retention.

Additionally, strategic partnerships and collaborations with local businesses, schools, and community organizations expand reach and enhance brand awareness. Continuous investment in facility upgrades, technological enhancements, and guest experience improvements ensures that FECs remain relevant and appealing to families seeking memorable and enjoyable entertainment experiences.

Family Entertainment Center Market Companies

Major companies operating in the family entertainment center (FEC) industry are:

- Altitude Trampoline Park

- Bowlero Corp.

- Dave & Buster's

- KidZania

- Legoland Discovery Center (Merlin Entertainments)

- Majid Al Futtaim Leisure and Entertainment

- Punch Bowl Social

- Round1 Bowling & Amusement

- Scene75 Entertainment Centers

- Sky Zone, LLC

Family Entertainment Center Industry News

- In September 2023, Timezone, a renowned family entertainment brand from Australia, launched its latest outlet in India. Facilities include bowling, a Dark Mars VR experience, and more than 60 arcade games.

- In September 2022, Dreamscape launched a VR attraction at Riyadh Park mall. Technology is the center of attraction for visitors to Riyadh and has also increased the interactive activities in the region.

The family entertainment center (FEC) market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) and Number of Visitors from 2021 to 2032, for the following segments:

Market, By Center

- Arcades

- Kids play areas

- VR parks

- Others

Market, By Revenue Stream

- Ticket

- Food & beverage

- Merchandise

Market, By Age Group

- Up to 12 years

- 13-19 years

- 20-35 years

- 36-65 years

- Above 65 years

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- South Africa

- Saudi Arabia

- Rest of MEA

Frequently Asked Question(FAQ) :

Who are the major family entertainment center market players?

Altitude Trampoline Park, Bowlero Corp., Dave & Buster's, KidZania, Legoland Discovery Center (Merlin Entertainments), Majid Al Futtaim Leisure and Entertainment, and Punch Bowl Social, among others.

Why is the family entertainment center industry booming in North America?

North America family entertainment center (FEC) industry held 40% revenue share in 2023, driven by rising disposable incomes and a preference for family-oriented leisure activities, bolstered by experiential spending trends.

Why is the number of tickets rising for family entertainment center?

The tickets segment is expected to record USD 37.5 billion by 2032, as they offer access to various attractions, including virtual reality experiences and live performances with packaged deals and engaging games.

How big is the family entertainment center market?

The market size of family entertainment center (FEC) reached USD 28.2 billion in 2023 and is set to witness 10.5% CAGR between 2024 and 2032, due to the increasing consumer spending on recreational activities and rising consumer participation in VR park.

Family Entertainment Center (FEC) Market Scope

Related Reports