Summary

Table of Content

Eyewear Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Eyewear Market Size

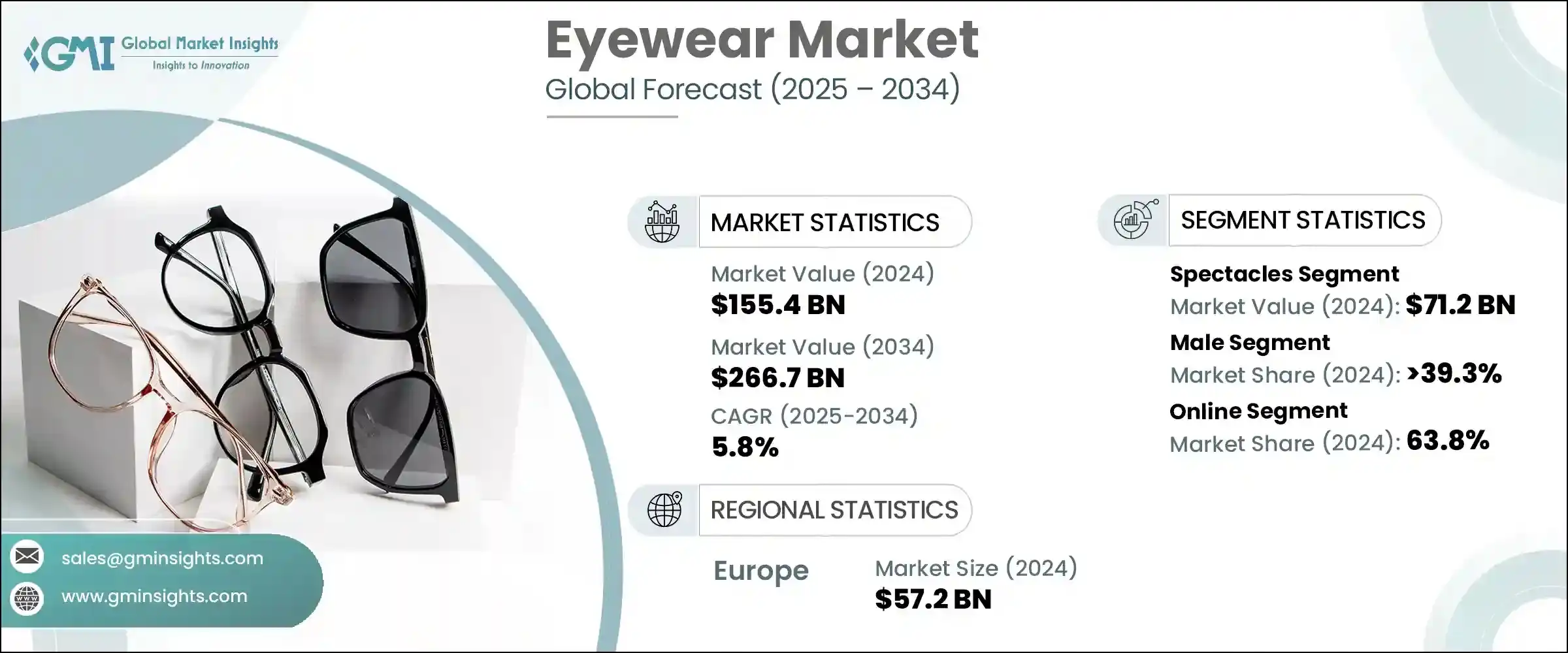

The global eyewear market size was estimated at USD 155.4 billion in 2024. The market is expected to grow from USD 161 billion in 2025 to USD 266.7 billion in 2034 at a CAGR of 5.8%. The growing luxury eyewear demand is driving the growth of the global market. Individual customers now view how well they can see it solely as an issue that can supply a functional tool for vision correction but also as an accessory or status symbol.

To get key market trends

In response to the growing demand for quality eyewear, popular brands, such as Ray-Ban, Prada, Gucci, Cartier, Dior, and Persol, are supplying frames made from high-quality materials, which attract affluent buyers; frames that are only worn by a few_STYLE_ shoppers.

Eyewear Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 155.4 Billion |

| Forecast Period 2025 – 2034 CAGR | 5.8% |

| Market Size in 2034 | USD 266.7 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The trend for premium eyewear is one of the most important growth drivers. Customers are willing to pay a higher price for products consisting of durable materials such as titanium and acetate, as well as advanced lens technologies. Sponsorships by celebrities, social media influencers, and fashion marketing have increased the attractiveness of luxury eyewear. Limited-edition collections and brand collaborations, for example, have also contributed to a sense of exclusivity and fanned ever greater demand.

A major factor keeping this market afloat is the growth in disposable income from countries such as China, India, and the Middle East. As cities expand and more consumers join the middle class, luxury eyewear is seen as part of a lifestyle upgrade for more customers. By 2030, 1.2 billion users are expected to enter the global middle-class population, with the majority coming from Asia, according to the World Bank. Moreover, the rise of e-commerce has provided brands with luxury eyewear selling it to customers globally.

Luxury eyewear brands are focusing on customization too. To differentiate their products and appeal to customers desiring something special, they provide features such as personalized fitments, engraved initials, and advanced lens coatings. Smart eyewear such as Ray-Ban Meta smart glasses with AR-enabled lenses will take the market even further and combine mint with innovative technology.

Eyewear Market Trends

Regulatory concerns and government authorities have adhered to strict policies concerning safety measures in the workplace. The provision of safety glasses in the workplace is one of the policies adopted. Employers are increasing their efforts to enhance eye safety in workplaces to avert injuries.

Schools, community organizations, and employers make a major contribution to how programs are conducted to teach users about eye safety. Special emphasis is given to ensure that users know how to protect their eyes and factors that can be harmful to them, which include wearing protective glasses. Also, the wide adoption of advanced technology in society has resulted in the emergence of new and improved comfortable protective eyewear. Safety glasses are now made and sold by manufacturers who focus their finances on R&D. These glasses are light, long-lasting, good-looking, and will be worn by many users. Innovative designs of safety glasses that serve both protection and novelty by integrating prescription and sun/UV, are what these manufacturers focus on.

The market for eyeglasses is being put under greater scrutiny as well. The Administration of Food and Drugs in the United States (FDA) and The European Medicines Agency (EMA) set policies and regulations about the manufacture, distribution, and marketing of eyeglasses, contact lenses, and sunglasses. The US FDA mandates that contact lenses are designated as safe and effective medical devices prior to being sold to the general population. The EMA also mandates that contact lenses are issued with particular quality and safety precautions before they are sold in the European Union.

Eyewear Market Analysis

Learn more about the key segments shaping this market

Based on product, the market is segmented as spectacles, contact lenses, and sunglasses. In 2024, the spectacles segment generated a revenue of USD 71.2 billion and is expected to grow at a CAGR of around 5.3% during the forecast period.

- This growth in the segment is due to the increased demand for the product owing to the high number of users suffering from computer vision syndrome (CVS). CVS is an eye strain condition seen increasingly amongst users on account of the rising usage of mobile phones and digital screens.

- The rise of online education and the use of smart glasses, more so during the pandemic, has increased the number of CVS cases among children and resulted in greater use of anti-glare and anti-fatigue glasses. In 2020, Essilor documents a 39% growth in the consumption of children’s AR and AF lenses in the documents because of the increase of e-learning in their main market.

- The pandemic led to the protection glasses for children being sold more often due to increased exposure to screens during remote learning. Further, the rising demand for spectacles had been due to the general trend of increasing usage of clear and tinted lens spectacles.

Learn more about the key segments shaping this market

Based on end-users, the eyewear market is segmented as male, female, unisex, and kids. In 2024, the male segment accounted for over 39.3% and is expected to grow at the rate of 5.4% till 2034.

- The growth of the market is driven by increasing demand for prescription glasses for men, preference for premium-grade eyewear, high preference for smart glasses, and growing fashion consciousness. Studies suggest men have a higher predisposition to vision-related problems such as myopia and presbyopia; both of which can worsen with extended periods of screen time at the workplace or age-related deterioration.

- Such trends add to the demand for high-end prescription eyeglasses and progressive lenses. Plus, men prefer to spend their money on durable, high-end eyewear rather than on frequently changing fashions. This helps brands at the high end of the spectrum — like Ray-Ban, Oakley, and Prada, all of which focus on utility and endurance — to thrive.

- Smart and sports eyewear are catching on, with brands such as Ray-Ban Meta and Oakley forking the appetites of men who value tech and performance. The spike in blue light-blocking glasses suggests increasing screen time for both professionals and gamers. Men in business environments are drawn to stylish but professional eyewear, boosting sales of premium frames and high-end lenses.

- Although trends in men’s eyewear historically changed at a more glacial pace, a new fashion-consciousness has led to a wider adoption of designer sunglasses and oversized accents. As they have more disposable income at their disposal and a willingness to spend on the best quality, men are leading the expansion of the premium eyewear industry.

Based on the distribution channel, the eyewear market is segmented as online and offline. The online segment is expected to hold a major share of 63.8% in 2024.

- While constantly shopping online for anything and everything during the pandemic, donning a mask while waiting for users to pass by me became a breeze. That aside, the sharp growth of e-commerce shops as well as smart devices being adopted at an astounding rate, has made it super easy for users to sit at home and shop.

Forecasts suggest that the e-commerce sector will undergo an extraordinary boom and is likely to grow significantly faster than other markets. This is due to numerous major companies that already partnered with top e-commerce sites since such collaborations enable businesses to widen their reach and target audiences more effectively. - Offering dedicated online glasses shops has transformed the eyewear business. Multiple different eyewear brands can now showcase their catalogs to every differentiated customer group, including men, women, boys, girls, and even unisex. Moreover, shop customers can easily and freely buy glasses online through a seamless shopping experience. Furthermore, online shops give customers the chance to review the products. This not only enhances the overall shopping experience but also gives companies insight into the needs and wants of the consumers, which in turn, further paves the way for business growth.

Looking for region specific data?

- In 2024, Europe dominated the eyewear market, accounting for around 36.8% of the global market share, and generated around USD 57.2 billion in revenue in the same year. The global market is also dominated by Europe, due to a strong history of luxury eyewear in Europe along with advanced optical technology and an aging population that requires vision correction. Luxottica, Safilo, De Rigo, Rodenstock, and Zeiss are some of the producers of high-quality frames for the loves of the Italian and other European manufacturers countries including Germany and France. This drives luxury market growth as European brands lead global fashion trends.

- Sustainability is becoming increasingly important, with brands turning to organic materials and processes. As per Eurostat, the share of the population aged 65 or over in the EU reached 21.1% in 2023, leading to an increased demand for vision correction products. Eye care services are advanced and insurance coverage is good in Europe, thereby ensuring users get their prescription glasses and lenses more easily.

- In North America, an increasing demand for high-quality offerings, and a growing prevalence of online purchasing. More screen time from smartphones, computers, and gaming has increased demand for blue light-blocking glasses from brands such as JINS, Hoya, and Warby Parker. The demand for luxury and smart eyewear is also growing, and companies are investing in augmented reality (AR) glasses (like the Ray-Ban Meta Smart Glasses and Amazon Echo Frames).

- For prescription glasses and sunglasses, direct-to-consumer (DTC) brands such as Warby Parker and Zenni Optical are making them more affordable with online shopping and virtual try-on tools. The growth trend for e-commerce sales in the U.S. is also evident in the eyewear industry as the sales of e-commerce in the U.S. were up by 8.1% for the year 2023 as per the U.S. Census Bureau. Additionally, vision insurance plans like VSP and EyeMed boost sales of prescription eyewear.

- China, Japan, India, and South Korea are leading the Asia-Pacific region, the fastest-growing eyewear market. Soaring myopia rates, particularly in children in China, Japan, and South Korea, have been powering sales of prescription glasses but also of myopia control lenses such as Hoya’s MyoSmart. The World Health Organization (WHO) predicted that almost half (49.8%) of the world's population would be myopic by 2050, with the highest percentage in Asia. Demand for branded and fashionable eyewear is increasing, owing to rising incomes and urbanization.

- Companies like Lenskart in India and Owndays in Japan, along with online shopping, are making stylish, technical eyewear more accessible. The demand for trendy sunglasses and frames is also being boosted by global fashion developers South Korea and Japan through K-Pop culture and celebrity endorsements. The need is huge and government programs, such as those for the National Program for Control of Blindness and Visual Impairment in India, are helping raise awareness and facilitate access to eye care. This program has helped reduce the percentage of blindness in India from 1.1% in 2001 to 0.36% in 2023 according to India’s Ministry of Health and Family Welfare.

Eyewear Market Share

- The top 7 companies in the home improvement market include Carl Zeiss AG, Luxottica Group SpA, Safilo, Hoya Corporation, The Cooper Companies, Johnson & Johnson Vision Care, and Bausch & Lomb and they collectively held a share of 11% in the market.

Carl Zeiss AG dominates the market due to its premium substantial lens. Zeiss is a foremost name in optoelectronic engineering and specializes in produce engineering, as well as prescription and blue light specialty lenses. Despite being predominantly known for its lenses, Zeiss’s partnerships with many eyeglass brands increase his market penetration. Zeiss tends to meet its customers’ demands through an impeccable optics reputation and a shift to high-end innovative lenses. - Luxottica Group SpA is one of the key competitors in the online and offline donning spectacles industry. They hold a broad market share from activewear to spectacles and even retail. Owning brands such as Ray-Ban, Oakley, Persol, Oliver Users, Vogue Eyewear, and many more places Luxottica in a markedly different position. This allows them to be one of the leaders in the eyeglass industry. This is further strengthened by the company's enduring partnerships with luxury brands, solidifying their dominance within the premium footwear market.

Eyewear Market Companies

Major players operating in the eyewear industry are:

- Carl Zeiss AG

- Luxottica Group SpA

- Safilo

- Hoya Corporation

- The Cooper Companies

- Johnson & Johnson Vision Care, Inc.

- Bausch & Lomb Inc.

- Charmant Group

- CIBA VISION

- De Rigo Vision S.p.A

- Fielmann AG

- JINS, Inc.

- Marchon Eyewear, Inc.

- QSpex Technologies

- Rodenstock GmbH

Some of the leading players in this market include Carl Zeiss AG, Hoya Corporation, and Rodenstock GmbH, which are some of the top names in producing high-quality ophthalmic lenses. They provide advanced coatings and custom progressive lenses for better vision. Luxottica Group SpA — now merged with EssilorLuxottica — Safilo Group, De Rigo Vision S.p.A and Marchon Eyewear, Inc., concentrates on luxury and designer eyewear. They manufacture frames and sunglasses for such big brands as Ray-Ban, Prada, Nike, and Dior.

Johnson & Johnson Vision Care, Inc., Bausch & Lomb Inc., The Cooper Companies, and CIBA VISION (now a part of Alcon) are the leaders in the contact lens market, focusing primarily on soft, toric, and multifocal brands. They also produce specialty lenses for other conditions, such as astigmatism and myopia. Fielmann AG and JINS, Inc. have cheaper prescription eyewear. JINS also has blue light-blocking eyewear and smart eyewear capable of AI features. The Charmant Group: Lightweight and durable titanium eyewear QSpex Technologies delivers custom lenses on-demand with the speed and quality needed to meet the most demanding prescription eyewear solutions.

Eyewear Industry News

- In February 2024, Carl ZEISS AG acquired an IP portfolio for electronic glasses from Mitsui Chemicals. This move should reinforce the company's commitment to remain at the forefront of technological development in the market.

- In October 2023, Bausch and Lomb released SeeNa, an ophthalmic diagnostic system for patients who have had a refractive cataract. Seena takes key measurements required for eye evaluation as well as cataract lens (IOL) power calculations, in a single step. Above all, ResultsMind provides a user-friendly interface that enables the doctors and staff to acquire operations to manage them and get results within a short time.

- September 2023 a cooperation between Ray-Ban (Luxottica brand) and Meta has launched smart sunglasses with built-in audio, microphone, camera, and charging case. These glasses enable users to stream and share content in real time and are set to change the game of digital content creation.

- In July 2023, Luxottica announced a collaboration with Eastman Kodak that would result in the inclusion of Kodak products under the Luxottica brand as of January 2024. Dial my digital barn, and they dig up optical products for Kodak and maintain them. Kodak is a heritage brand and has good brand equity which will help Luxottica leverage its brand positioning. Sunglasses would become a must-have for the fashion world

The eyewear market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) and Volume in Thousand Units from 2021 to 2034, for the following segments:

Market, By Product

- Spectacles

- Single vision

- Multifocal

- Bifocal

- Progressive

- Reading glasses

- Safety glasses

- Others (blue light glasses, etc)

- Contact lens

- Soft contact lens

- Rigid contact lens

- Others (toric contact lens)

- Sunglasses

- Polarized

- Non-polarized

Market, By Type

- Prescription

- Non-prescription

Market, By Frame Material

- Metal

- Plastic

- Polycarbonate

- Rubbers

- Others (wooden, nylon, etc.)

Market, By Shape

- Oval & aviator

- Rectangular

- Round

- Square

- Others (oversized, shield, etc.)

Market, By Price

- Low

- Medium

- High

Market, By End Use

- Male

- Female

- Unisex

- Kids

Market, By Distribution Channel

- Online

- E-commerce

- Company site

- Offline

- Specialty stores

- Mega retail stores

- Others (optical camps, ophthalmic centers, etc.)

The above information is provided for the following regions:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Question(FAQ) :

How much is the European eyewear industry worth?

In 2024, Europe dominated the market, accounting for around 36.8% of the global market share and generating around USD 57.2 billion in revenue.

Who are some of the prominent players in the eyewear market?

Major players in the eyewear industry include Carl Zeiss AG, Luxottica Group SpA, Safilo, Hoya Corporation, The Cooper Companies, Johnson & Johnson Vision Care, Inc., Bausch & Lomb Inc., Charmant Group, CIBA VISION, De Rigo Vision S.p.A, Fielmann AG, JINS, Inc., Marchon Eyewear, Inc., QSpex Technologies, and Rodenstock GmbH.

What is the size of the spectacles segment in the eyewear industry?

In 2024, the spectacles segment generated a revenue of USD 71.2 billion and is expected to grow at a CAGR of around 5.3% during the forecast period.

How big is the global eyewear market?

The global market size for eyewear was estimated at USD 155.4 billion in 2024 and is expected to grow to USD 266.7 billion by 2034, at a CAGR of 5.8%.

Eyewear Market Scope

Related Reports