Summary

Table of Content

Explosives & Pyrotechnics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Explosives & Pyrotechnics Market Size

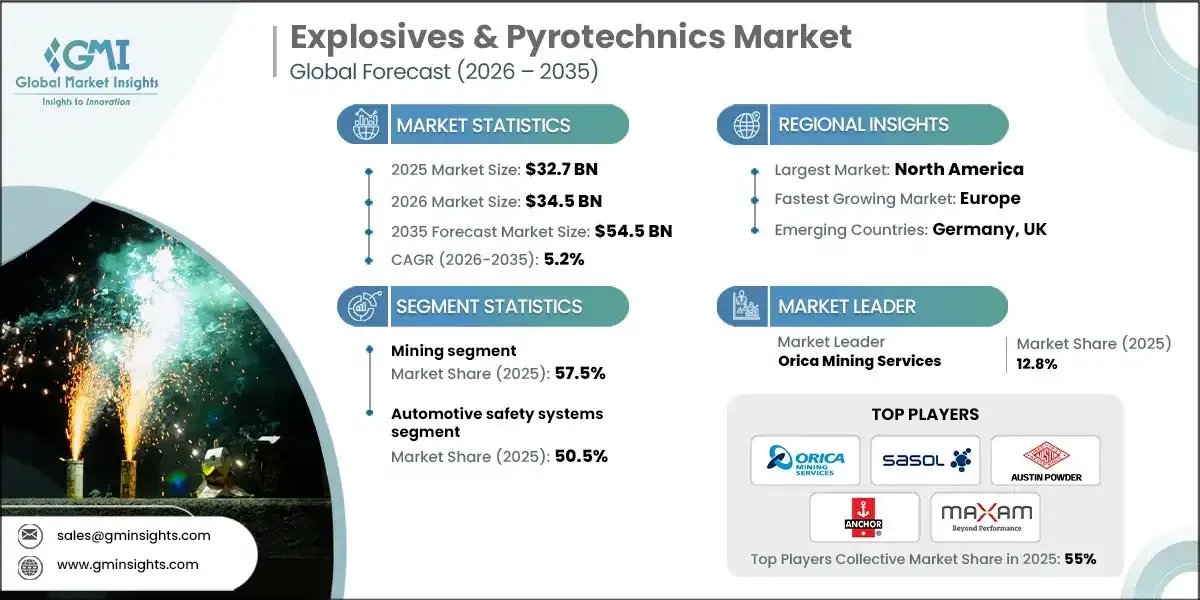

The global Explosives & Pyrotechnics market was valued at USD 32.7 billion in 2025. The market is expected to grow from USD 34.5 Billion in 2026 to USD 54.5 billion by 2035, expanding at a 5.2% CAGR during 2026–2035 according to latest report published by Global Market Insights Inc.

To get key market trends

- The sector spans commercial explosives for mining and construction, energetic materials for defense and aerospace, and pyrotechnic devices for automotive safety and entertainment. Commercial ammonium-nitrate-based products dominate volumes, with roughly 20 million tons consumed annually in mining and quarrying. Pyrotechnic devices used in airbag inflators and seat-belt pretensioners are regulated as UN 3268 Class 9 materials, with typical activation thresholds above 130°C for auto ignition and around 0.15 amperes for electrical initiation.

- Defense and aerospace remain durable end markets. The FY2025 U.S. weapons procurement budget earmarks USD 29.8 billion for missiles and munitions, covering conventional ammunition, tactical missiles, and strategic systems each with explosive fills and propellants. Government owned contractor operated (GOCO) facilities such as Holston and Radford (propellants) underscore resilient domestic capacity for energetics. Automotive pyrotechnics are another high volume driver inflators and pretensioners are sealed UN 3268 Class 9 devices with defined activation thresholds and qualification regimes.

Explosives & Pyrotechnics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 32.7 Billion |

| Market Size in 2026 | USD 34.5 Billion |

| Forecast Period 2026-2035 CAGR | 5.2% |

| Market Size in 2035 | USD 54.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Infrastructure build-out accelerates tunneling and site prep | Significantly increases demand for explosives and pyrotechnics to facilitate tunneling, excavation, and site preparation activities. |

| Transition-metal mining expansion drives premium products and EBS adoption | Expands the need for advanced explosive products and Electronic Blasting Systems (EBS) to improve efficiency, safety, and precision in mining operations. |

| Safety regulation spurs innovation in insensitive, lead-free, and containment systems | Encourages the development of safer, environmentally friendly explosive materials that comply with strict safety standards, reducing accidents and environmental impact. |

| Pitfalls & Challenges | Impact |

| Complex multi-agency approvals elongate product cycles | Creates delays in product development and deployment, hindering quick market response and increasing time-to-market for new explosive technologies. |

| Opportunities: | Impact |

| Wireless initiation improves safety and productivity in underground mines | Enhances operational safety and efficiency by enabling remote initiation. |

| Market Leaders (2025) | |

| Market Leaders |

12.8 % market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Europe |

| Emerging Country | Germany, UK |

| Future Outlook |

|

What are the growth opportunities in this market?

Explosives & Pyrotechnics Market Trends

- Environmental sustainability and lower carbon formulations- Conventional AN based explosives carry embedded nitrous oxide heavy footprints in nitric acid production, and nitrate residues can elevate water treatment burdens. Pilot programs show that hydrogen peroxide emulsion (HPE) explosives can cut production emissions by ~90% versus typical AN emulsion (0.23 kg CO2/kg vs. ~2.3 kg CO2/kg oxidizer phase), while removing nitrate related fume pathways.

- Boliden’s Kankberg pilot with Hypex Bio is projected to reduce ~400 tonnes of CO2 per year and trim nitrogen water treatment requirements, a proof point that’s turning heads. On legacy assets, tertiary N2O abatement on nitric acid plants is achieving up to 95% reductions at sites like Carseland, while companies raise Scope 1/2 targets and begin addressing Scope 3 from purchased goods and blasting use.

- Digital transformation and precision blasting- Electronic blasting systems (EBS) with millisecond control reduce vibration, sharpen fragmentation curves, and lift downstream recovery. Wireless systems (e.g., WebGen) remove the wire constraint, enabling complex underground designs and higher utilization in geologies that challenge signal propagation. Over 125,000 WebGen units have been fired in 4,000+ blasts globally, and EBS conversion contributed a quarter of Orica’s volume uplift to EBIT with digital solutions revenue up 44% YoY to USD 133.3 million.

- Regulatory intensification and safety innovation- Manufacturing of any quantity of explosives or pyrotechnics triggers OSHA Process Safety Management requirements, forcing robust PHAs, MOCs, MI programs, and written procedures. Historical incident analyses show recurring gaps where strong PSM prevents repeat failures. Transport rules continue to evolve, PHMSA’s alternative pathway via DOT approved Firework Certification Agencies and a new portal speed 1.4G approvals and improve applicant visibility. Defense customers keep pushing insensitive munitions and environmental improvements; GOCO plants like Holston (IMX, RDX, HMX) and Radford (propellants) remain central. Commercial players are rolling out lead free detonators (e.g., Exel Neo) and containment upgrades.

Explosives & Pyrotechnics Market Analysis

Learn more about the key segments shaping this market

Based on end user the market is segmented as mining, construction & infrastructure, military & defence and other.

- Mining accounted for 57.5% of the explosives & pyrotechnics market in 2025, reflecting copper, nickel, lithium and other transition metal projects coming online. IFC and World Bank analyses indicate nickel supply must more than triple from 2020 levels by mid century and copper must grow by over half, while >3 billion tons of minerals will be needed for clean energy systems signals that translate directly into higher explosives throughput. Surface mines draw bulk emulsions at scale; underground mines skew to packaged explosives and EBS to navigate ventilation and confinement. North America and APAC volume prints from major suppliers align with this demand picture.

- Construction and infrastructure represented 19.6% in 2025, with tunneling, foundations, controlled demolition, and earthworks. World Bank programs and corridor projects (e.g., Lobito) underscore the sustained need for drill and blast in road, rail, and energy infrastructure build outs. Defense captured 15.4% with outlook across explosive fills, propellants, demolition charges, and training explosives, supported by GOCO capacity and FY2025 procurement priorities.

Learn more about the key segments shaping this market

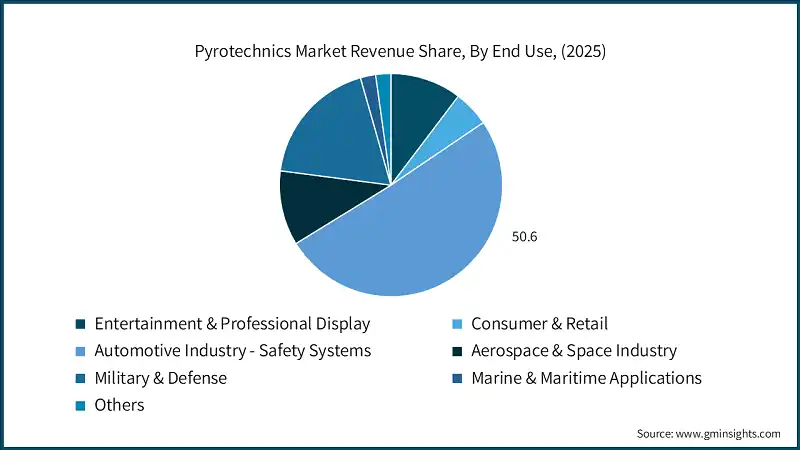

Based on end user the explosives & pyrotechnics market is segmented as entertainment & professional display, consumer & retail, automotive industry - safety systems, aerospace & space industry, military & defense, marine & maritime applications, and others.

- Automotive safety systems led the pyrotechnics segment with 50.5% share in 2025, spanning airbag inflators, pretensioners, and quick acting pyromechanical actuators. These devices are UN 3268 Class 9 with established ignition thresholds and current sensitivity specs that underpin qualification and shipment. Military and defense followed at 18.6% across illumination, signaling, smoke, countermeasures, and training devices, Air Force FY2026 procurement includes fuzes, flares, CAD/PAD, and bombs, while SOCOM budgets for demolition and breaching replenishment.

- Aerospace held 10.9% for stage separations, deployment mechanisms, and fire suppression, entertainment displays captured 10.4% under ATF licensing and DOT hazard classes, consumer fireworks represented 5.3% with CPSC performance and PHMSA classifications, marine uses accounted for 2.2% under maritime safety regimes.

Looking for region specific data?

The U.S. explosives & pyrotechnics market valued at USD 7.9 billion in 2025 and estimated to grow to almost USD 12.7 billion by 2035. North America holds around 32.1% of the market share in 2025, as robust mining and quarrying, intensive infrastructure, and deep defense/aerospace footprints converge.

- U.S. FY2025 munitions budgets and GOCO assets such as Holston, Lake City, Radford, Iowa, and Scranton anchor domestic energetics capacity. Electronic blasting and digital adoption are well advanced, and suppliers reported 1.1 million tonnes of AN/emulsion volumes in the region in FY2023. Canada contributes via gold, base metals, and potash, with underground activity favoring packaged explosives and EBS.

Europe’s Explosives & Pyrotechnics market shows the fastest projected growth, helped by stringent environmental standards driving low emission formulations and advanced underground operations in Scandinavia and Eastern Europe.

- Early wireless deployments include Sweden’s Kiruna magnetite site, where WebGen addressed magnetic ore signal challenges before moving to broader commercial use. Supplier EMEA volumes eased in FY2023 as Russia operations were exited, yet technology penetration remains high in the EU core. Germany’s automotive hub boosts pyrotechnic safety demand, while the UK strengthens quarrying and construction explosives needs.

Asia Pacific accounted for 26.1% of the Explosives & Pyrotechnics market in 2025, propelled by China and India’s infrastructure programs, Australia’s metals and battery commodity mining, and regional defense modernization.

- Supplier APAC volumes reached 1.8 million tonnes in FY2023, up 4% YoY, highlighting sustained pull from mining customers. Indonesia’s nickel build out for EV batteries and India’s domestic explosives manufacturing policies support additional demand. The China automotive ecosystem underpins large scale pyrotechnic safety device production, with export linkages across Asia.

In Latin America, the explosive and pyrotechnic market is driven by strong momentum in mining, infrastructure developments of large scale, and construction activity on the rise. The region shows a clear preference for blasting agents that continue to be in vogue because of their effectiveness and being able to cater to different geological conditions.

- The other factors that encourage growth include rising investments in tunnels, transport corridors, hydro projects, and groundwork that require controlled blasting. Meanwhile, there is an increasing focus on operational safety and environmental responsibility by regulators across Latin America, thereby encouraging companies to embrace safer formulations and improved detonation technologies.

In the Middle East & Africa, extensive construction programs, major government-backed infrastructure projects, and sustained growth in mining and quarrying propel the market.

- Blasting agents remain central to demand, particularly in modern civil-engineering projects, which apply precision blasting for land preparation, tunnelling, foundation, and demolition. Advances in emulsion and other industrial explosive technologies are now allowing for safer and more efficient blasting operations that align with a regionally growing emphasis on stricter safety frameworks. The defense sector further weighs impactfully, as certain countries are currently seeking to modernize their military capabilities and need specialized explosive materials.

Explosives & Pyrotechnics Market Share

The market exhibits moderate concentration. The top five suppliers controlled about 41% in 2025, with Orica at 12.8%, a lead supported by continuous AN plants emulsion capacity, electronic blasting systems, and an expanding digital portfolio.

- Orica Mining Services

- Orica Mining Services combines continuous AN plants with emulsion manufacturing, electronic blasting systems, and digital solutions spanning fragmentation analytics and orebody intelligence. The company’s initiatives include WebGen wireless blasting, 4D bulk explosives commercialization, and Exel Neo lead free detonators, alongside tertiary N2O abatement delivering ~95% reductions at Carseland and accelerated Scope 1/2 targets (≥45% by 2030) with Scope 3 in boundary.

- Sasol Limited

- Sasol Limited leverages integrated chemical value chains to produce AN and explosives for African mining markets. The portfolio serves gold, PGM, and coal operations, with priorities around operational reliability, cost competitiveness, and environmental performance. As African jurisdictions emphasize local content and safety, Sasol’s established footprint supports resilient share.

- Austin Powder

- Austin Powder Company operates across North America, South America, and Africa with bulk explosives, packaged products, initiation systems, and blasting services. Differentiators include technical service depth, safety compliance, and flexible deployment across mining, quarrying, and construction. Longstanding customer relationships in aggregates and metals reinforce route density and service economics.

- ENAEX anchors

- ENAEX anchors Latin American share, particularly in Chilean copper, with AN manufacturing, emulsions, and field service models adapted to high altitude and complex geology. Growth vectors include Peru and the broader Andean region, with technology upgrades in electronic blasting and digital monitoring.

- MAXAM Corp

- MAXAM Corp sustains a diversified footprint across Europe, Latin America, Africa, and Asia with commercial explosives and initiating systems, plus defense exposure. Competitive focus spans safety, environmental compliance, electronic initiation, and selective expansion in growth corridors.

Explosives & Pyrotechnics Market Companies

Major players operating in the Explosives & pyrotechnics industry are:

- Orica Mining Services

- Incitec Pivot Limited

- Sasol Limited

- Austin Powder Company

- ENAEX

- MAXAM Corp

- AECI Group

- EPC Group

- Chemring Group

- Titanobel SAS

- Hanwha Corporation

- LSB Industries Inc

- Solar Industries India

- Zambelli Fireworks

- Howard & Sons

- Angelfire Pyrotechnics

- Pyro Company Fireworks

- Melrose Pyrotechnics

- Skyburst The Firework

- Entertainment Fireworks

- Supreme Fireworks UK

- Celebration Fireworks

- Impact Pyro

Explosives & Pyrotechnics Industry News

- In September 2025, Nagpur based Special Blast Limited has planned explosive facility expansion and production of ammunition owing to rising demand in response.

- In December 2023, Economic Explosives Ltd has developed new explosive formulation SEBEX 2 which provide much greater blast effect and any current available solid explosive.

- The Explosives & pyrotechnics market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By End Use

- Mining

- Coal mining

- Metal mining

- Others

- Construction & infrastructure

- Tunneling & underground construction

- Road & highway construction

- Dam, reservoir & hydroelectric projects

- Others

- Military & defense

- Military training & simulation

- Military engineering & construction

- Naval & maritime operations

- Others

- Others

- Oil & gas industry

- Avalanche control & snow safety

- Agriculture & land clearing

- Geotechnical & scientific applications

- Emergency services & disaster response

- Forestry & logging

Market, By End Use

- Entertainment & Professional Display

- Consumer & retail

- Household consumers

- Retail distribution channels

- Others

- Automotive industry - safety systems

- Aerospace & space industry

- Military & defense

- Marine & maritime applications

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the key players in the explosives & pyrotechnics market?

Key players include Orica Mining Services, Incitec Pivot Limited, Sasol Limited, Austin Powder Company, ENAEX, MAXAM Corp, AECI Group, EPC Group, Chemring Group, Titanobel SAS, and Hanwha Corporation.

What are the key trends in the explosives & pyrotechnics industry?

Key trends include the adoption of hydrogen peroxide emulsion (HPE) explosives for reduced emissions, increased demand for bulk emulsions in surface mining, and the growing use of packaged explosives and EBS in underground mining.

Which region held the largest share of the explosives & pyrotechnics market in 2025?

North America held 32.1% of the market share in 2025, supported by robust mining activities, infrastructure development, and a strong defense and aerospace presence.

What was the market share of the automotive safety systems segment in the pyrotechnics market in 2025?

Automotive safety systems led the pyrotechnics segment with a 50.5% share in 2025, encompassing airbag inflators, pretensioners, and pyromechanical actuators.

What was the market size of the explosives & pyrotechnics market in 2025?

The market size was valued at USD 32.7 billion in 2025, with a CAGR of 5.2% expected during the forecast period of 2026–2035.

What is the projected value of the explosives & pyrotechnics market by 2035?

The market is projected to reach USD 54.5 billion by 2035, driven by increasing demand from mining, infrastructure, and defense sectors.

What was the size of the U.S. explosives & pyrotechnics market in 2025?

The U.S. market was valued at USD 7.9 billion in 2025 and is expected to grow to nearly USD 12.7 billion by 2035.

What was the market share of the mining segment in 2025?

The mining segment accounted for 57.5% of the market in 2025, driven by the rising demand for transition metals like copper, nickel, and lithium.

Explosives & Pyrotechnics Market Scope

Related Reports