Summary

Table of Content

EV Low Voltage Drive System Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

EV Low Voltage Drive System Market Size

The global EV low voltage drive system market size was valued at USD 736.1 million in 2024 and is projected to grow at a CAGR of 7.3% between 2025 and 2034. Technological advancements in power electronics have significantly increased the demand for EV low voltage drive systems. Key components such as inverters, motor controllers, and battery management systems (BMS) have seen substantial improvements. These advancements have led to more efficient, compact, and cost-effective solutions for EVs.

To get key market trends

Enhanced control over energy conversion and distribution in low-voltage drive systems has improved overall vehicle performance and energy efficiency. Consequently, EV manufacturers can now offer vehicles with extended driving ranges, improved battery life, and reduced energy consumption, all of which are crucial factors driving consumer adoption.

EV Low Voltage Drive System Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 736.1 Million |

| Forecast Period 2025 - 2034 CAGR | 7.3% |

| Market Size in 2034 | USD 1.5 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

For instance, in July 2024, Danfoss Power Solutions launched the ePanda eDrive, an advanced integrated power system designed specifically for low-voltage applications. This new solution is particularly aimed at mobile elevating work platforms, enhancing efficiency, reliability, and safety in operation. The ePanda eDrive combines an electric motor, microcontroller unit, and reduction gearbox into a compact system. This integration simplifies installation and reduces the number of components required, ultimately lowering labor costs and installation time.

The increasing adoption of EVs is also significantly driving the growth of the EV low voltage drive systems market. As global demand for EVs rises due to environmental concerns, government incentives, and advancements in technology, low-voltage drive systems have become essential components of this transition. These systems are particularly suitable for smaller electric vehicles, such as electric two-wheelers, e-bikes, compact cars, and hybrid electric vehicles (HEVs), which are experiencing rapid growth in both developed and emerging markets.

EV Low Voltage Drive System Market Trends

An emerging trend is the growing demand for affordable and efficient electric vehicles. As consumer interest in electric mobility increases, there is a significant push for cost-effective solutions that provide adequate power while maintaining energy efficiency. Low-voltage drive systems, typically more affordable than high-voltage alternatives, are ideal for smaller electric vehicles such as electric bikes, compact cars, and hybrid vehicles. This trend is particularly notable in emerging markets, where cost-sensitive consumers are adopting smaller EVs that utilize low-voltage systems to remain competitively priced without compromising performance.

The integration of autonomous driving technologies and smart grid solutions is becoming a significant trend in the EV low voltage drive system market. As the automotive industry advances towards autonomous driving, low-voltage systems are increasingly utilized to power auxiliary systems such as sensors, control units, and communication devices in electric vehicles. Additionally, the growth of vehicle-to-grid (V2G) technologies and smart charging is driving the demand for more sophisticated power management systems. These systems, including low-voltage drive systems, must integrate seamlessly with grid networks to enable energy-efficient operations.

The lack of consumer awareness significantly impedes the growth of the EV low voltage drive systems market. Despite the increasing adoption of EVs, many consumers remain unfamiliar with the technical aspects of EV powertrains, including the distinctions between low-voltage and high-voltage systems. Consequently, the benefits of low-voltage systems, such as cost-effectiveness, energy efficiency, and suitability for smaller, more affordable vehicles like electric two-wheelers and compact cars, often go unrecognized.

EV Low Voltage Drive System Market Analysis

Learn more about the key segments shaping this market

Based on voltage, the market is segmented below 48V, 48V to 60V, and above 60V. In 2024, the below 48V segment held a market share of over 57% and is expected to exceed USD 800 million by 2034. The below 48V segment commands a significant share in the EV low voltage drive systems market, attributed to its widespread adoption as a cost-effective solution for various, particularly two-wheelers and mild hybrid vehicles.

This segment's dominance is largely due to the extensive use of 48V systems in electric two-wheelers, such as e-scooters, e-bikes, and light electric vehicles. These vehicles, designed for short-distance urban mobility, require relatively lower power, making the 48V system an ideal choice for achieving a balance between cost and performance.

Learn more about the key segments shaping this market

Based on the vehicle, the EV low voltage drive system market is divided into passenger cars, commercial vehicles, two wheelers, and off-highway vehicles. The two wheelers segment held around 42% of the market share in 2024, driven by the rising adoption of electric two-wheelers such as e-scooters and e-bikes. This growth is primarily attributed to the demand for cost-effective, eco-friendly, and convenient urban transportation solutions.

In many emerging markets, particularly in Asia and parts of Europe, two-wheelers already serve as a dominant mode of transport. The transition to electric-powered models is accelerating as cities endeavor to reduce pollution and traffic congestion.

Looking for region specific data?

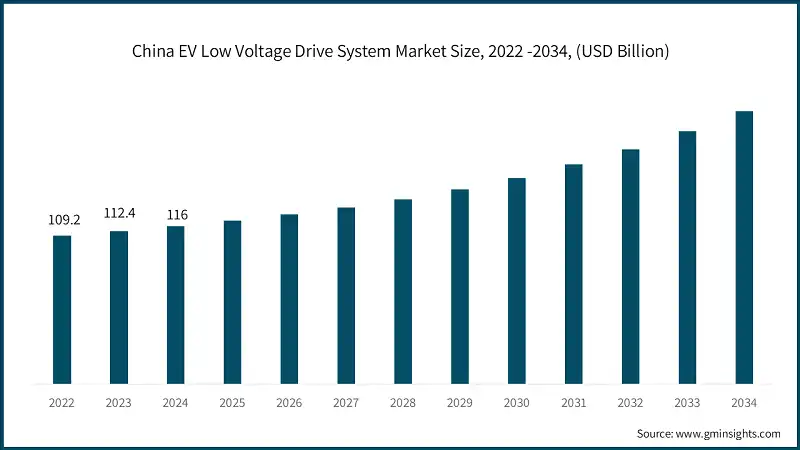

Asia Pacific EV low voltage drive system market accounted for 32% of the revenue share in 2024, owing to its leadership in electric vehicle (EV) adoption and production, particularly in electric two-wheelers and small EVs. The country has been at the forefront of the electric mobility revolution, driven by government policies and consumer demand for affordable, sustainable transportation solutions. China also hosts the world’s largest market for electric two-wheelers, such as e-scooters and e-bikes, which predominantly utilize low-voltage drive systems, typically below the 48V range, contributing to its dominant position.

The demand for EV low voltage drive systems in Europe is increasing rapidly due to regulatory pressures and evolving consumer preferences for sustainable mobility solutions. Europe has been a leader in adopting green technologies, with governments in countries such as Germany, France, and the Netherlands setting ambitious targets for carbon neutrality and electric vehicle adoption.

A primary driver is the region’s commitment to reducing greenhouse gas emissions and the push to phase out internal combustion engine (ICE) vehicles. To achieve these goals, European countries have introduced incentives, subsidies, and tax benefits for electric vehicles, significantly boosting the adoption of electric two-wheelers, electric cars, and mild hybrid vehicles that require low-voltage drive systems.

The demand for EV low voltage drive systems market in North America is increasing due to rising consumer adoption of electric vehicles (EVs), supportive government policies, and a shift towards sustainable mobility solutions. The United States, in particular, has experienced significant growth in the popularity of electric passenger vehicles, mild hybrid vehicles, and electric two-wheelers, all of which require low-voltage drive systems.

A key driver of this trend is the growing consumer awareness of the environmental impact of traditional internal combustion engine (ICE) vehicles and the increasing adoption of EVs as a cleaner alternative. As concerns over fuel efficiency and carbon emissions persist, more consumers are opting for electric alternatives, including affordable small EVs, electric scooters, and e-bikes, which typically operate with low-voltage systems.

EV Low Voltage Drive System Market Share

Continental AG and Infineon collectively held a substantial market share of over 13% in the EV low voltage drive system industry in 2024. Continental AG and Infineon Technologies possess a substantial share in the EV low voltage drive systems industry, attributed to their advanced technological capabilities, comprehensive product portfolios, and significant contributions to the development of sophisticated power electronics and drive systems for electric vehicles.

Continental AG, a global leader in automotive solutions, maintains a strong presence in the EV market by providing critical electronic components such as motor controllers, inverters, and battery management systems, which are essential to low-voltage drive systems.

Infineon is a prominent entity in the semiconductor industry, providing essential components such as power semiconductors and microcontrollers, which are integral to low-voltage drive systems. Infineon's proficiency in energy-efficient power electronics, particularly for 48V and sub-48V systems, establishes it as a crucial supplier for automakers and electric vehicle manufacturers. These manufacturers seek to enhance performance while reducing energy consumption and costs.

Valeo and ZF are strategically enhancing their positions in the EV low voltage drive systems market. Valeo is expanding its portfolio of electrification solutions, focusing on 48V systems and power electronics, to address the increasing demand for sustainable mobility. Similarly, ZF is strengthening its market presence by developing innovative low-voltage drive systems for mild hybrid and electric vehicles, while also expanding its global footprint through acquisitions and collaborations.

EV Low Voltage Drive System Market Companies

Major players operating in the EV low voltage drive system industry are:

- ABB

- Allegro Microsystems

- Analog Devices

- Borgwarner

- Continental

- Delphi Technologies

- Eaton

- Infineon

- Lear

- Mahle

EV Low Voltage Drive System Industry News

- In July 2024, BorgWarner officially opened a new high-voltage (HV) testing facility at its India Propulsion Engineering Centre (IPEC) in Bengaluru. This state-of-the-art laboratory is designed to enhance the development and testing capabilities of electric propulsion systems, including high-voltage traction motors, inverters, and DC-DC converters. The lab will facilitate functional testing and verification for both high-voltage and low-voltage electric drive components. This includes a 350 kW eDyno capable of supporting integrated motor and inverter systems, as well as provisions for testing auxiliary components like pump motors and clutch actuators

The EV low voltage drive system market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Bn) and volume (Units) from 2021 to 2034, for the following segments:

Market, By Voltage

- Below 48V

- 48V to 60V

- Above 60V

Market, By Vehicle

- Passenger cars

- Hatchback

- Sedan

- SUV

- Commercial vehicle

- LCV

- HCV

- Two wheeler

- Off-highway vehicles

Market, By Component

- Inverter

- Battery management system

- DC-DC Converters

- Voltage Regulators

- Power electronics

- Others

Market, By Propulsion

- Battery electric vehicles (BEV)

- Plug-in hybrid electric vehicles (PHEV)

- Hybrid electric vehicles (HEV)

- Fuel cell electric vehicles (FCEV)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Nordics

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Southeast Asia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

Who are the major players in the EV low voltage drive system industry?

The key players in the industry include ABB, Allegro Microsystems, Analog Devices, Borgwarner, Continental, Delphi Technologies, Eaton, Infineon, Lear, and Mahle.

How much is the Asia Pacific EV low voltage drive system market worth?

The Asia Pacific region accounted for 32% of the market share in 2024, led by its leadership in EV adoption and production, particularly in electric two-wheelers and small EVs.

Why is the below 48V segment significant in the EV low voltage drive system industry?

The below 48V segment held over 57% of the market share in 2024 and is expected to exceed USD 800 million by 2034 due to its widespread adoption as a cost-effective solution for two-wheelers and mild hybrid vehicles.

How big is the EV low voltage drive system market?

The market size of EV low voltage drive system reached USD 736.1 million in 2024 and is set to grow at a 7.3% CAGR from 2025 to 2034, driven by technological advancements in power electronics.

EV Low Voltage Drive System Market Scope

Related Reports