Summary

Table of Content

Europe Wooden Furniture Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Europe Wooden Furniture Market Size

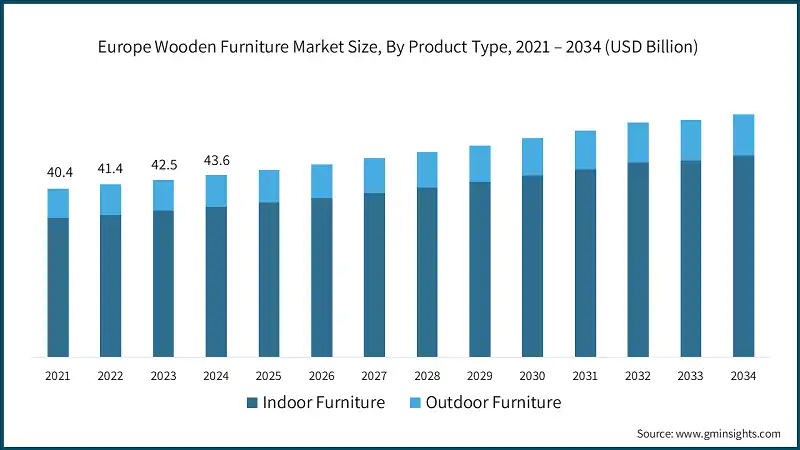

The Europe wooden furniture market size was estimated at USD 43.64 billion in 2024. The market is expected to grow from USD 44.88 billion in 2025 to USD 58.22 billion in 2034 at a CAGR of 3.5%. The rising demand for wooden furniture across residential areas and increased spending on home improvement projects drives the Europe market growth. According to Eurostat, spending on home improvement in the European Union reached €300 billion in 2023, showing a significant increase from previous years. Homeowners are spending more on renovations due to high interest rates and persistent inflation, covering costs from flooring to furnishings.

To get key market trends

In addition, urbanization and the surge in new housing projects are driving up the demand for furniture, especially wooden furniture, as an increasing number of homes and apartments need furnishing. This demand is especially pronounced in swiftly expanding urban locales, where new residential projects are the norm. According to Eurostat, the urban population in the European Union increased by 2.4% from 2015 to 2020, further fueling the need for residential furnishings.

Europe Wooden Furniture Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 43.64 Billion |

| Forecast Period 2025 – 2034 CAGR | 3.5% |

| Market Size in 2034 | USD 58.22 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Furthermore, rising disposable incomes allow consumers to buy premium and designer wooden furniture, improving their living spaces with high-quality, attractive pieces. Government initiatives and regulations also support market growth by promoting sustainable forestry and eco-friendly manufacturing. For example, the European Green Deal aims to make Europe climate-neutral by 2050, encouraging eco-friendly practices. Consumer preferences in the wooden furniture manufacturing industry are changing rapidly, creating challenges for manufacturers. Consumers prefer products that match their specific needs, which can change quickly, making it hard for manufacturers to keep up with trends.

Europe Wooden Furniture Market Trends

- New woodworking technology has improved the quality and design of wooden furniture, making it more attractive to buyers. These improvements allow for precise work, creative designs, and strong, high-quality pieces. Also, the trend of custom and personalized furniture is boosting demand for unique wooden pieces made to fit individual tastes and needs. Moreover, consumers prefer unique, custom pieces that show their personal style and fit well in their homes, driving market growth. A survey by Furniture Today found that 60% of consumers are willing to pay more for customized furniture, further validating this trend.

- While the European wooden furniture market reflects the shift towards sustainability, customization, and technological innovations, sustainability is a major trend. Customers preference is transitioning towards eco-friendly products and thereby forcing manufacturers to embrace greener practices such as the use of sustainably sourced wood, eco-certifications such as FSC (Forest Stewardship Council), and reducing carbon footprints via production processes.

- Increased awareness of the environmental consequences of the furniture industry prompts consumers to prefer brands that embrace responsible sourcing and transparent supply chains. This trend corresponds to the European sustainable development goals, thus creating demand for eco-friendly and durable furniture.

- Additionally, e-commerce has transformed the market for wooden furniture in Europe. The vast online retail stores provide consumer access in comfort to diverse ranges of styles, materials, and prices. Online platforms also give the small & niche brands a wider reach, fueling competition and innovation in the market. However, the transition brings some challenges like those for some traditional brick-and-mortar stores which would be forced to adopt as the online preference grows.

Europe Wooden Furniture Market Analysis

Learn more about the key segments shaping this market

Based on product type, the Europe market can be segmented into indoor furniture and outdoor furniture. In 2024, the indoor furniture segment dominated the market, accounting for USD 35.9 billion and is expected to grow at a CAGR of 3.4% during the forecast period of 2025-2034.

- Urbanization is leading to more apartment and house constructions, increasing the demand for indoor furniture. According to Eurostat, the number of building permits issued for residential buildings in the European Union increased by 5.2% in 2023. Items like sofas, beds, dining tables, and wardrobes are essential for these new homes. Indoor furniture also offers many functional and versatile options, such as storage solutions, multi-purpose furniture, and space-saving designs. This versatility makes indoor furniture popular with consumers, as it improves both the functionality and look of their living spaces.

Learn more about the key segments shaping this market

Based on wood type, the Europe wooden furniture market can be segmented into hardwood and softwood. Hardwood dominated the market with 75.8% of the market share in 2024 and is expected to grow at a CAGR of over 3.4% during the forecast period of 2025-2034.

- Hardwoods are attractive options to homeowners as they come in diverse colors and grain patterns. Furthermore, due to their scarcity in the past few years, hardwood can be expensive. The rich, chocolate-colored grain makes it perfect for veneers, and it is highly prized in the high-end furniture industry. It is renowned for its strength and for the variety of colors that can appear in its straight grain.

- The growing trend of urbanization and the construction of various residential and commercial facilities in various regions of Europe are advantageous for hardwood furniture demand. Hardwood is the significantly used in in furnishing new homes, offices, and hospitality settings due to the durability and beauty of this wood.

Looking for region specific data?

- In the Europe wooden furniture market, Germany accounted for the largest market share of USD 9.2 billion in 2024. It is projected to reach USD 13.2 billion by the end of 2034. This growth can be attributed to Germany's strong tradition of craftsmanship, high demand for quality furniture, and the country's robust economy, which supports consumer spending on premium and designer wooden furniture. Additionally, Germany's commitment to sustainability and innovation in woodworking technology further propels the market's expansion.

Europe Wooden Furniture Market Shares

The top companies in the Europe market include Jogn Lewis & Partners, Wren Kitchens, Laura Ashley, Hammonds Furniture, collectively hold a share of 5-10% in the market. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broader customer base, and strengthen their market position.

Europe Wooden Furniture Market Companies

Major players operating in the wooden furniture industry are:

- B&B Italia S.p.A.

- BoConcept A/S

- Conforama

- Herman Miller, Inc.

- Hülsta-Werke Hüls GmbH & Co. KG

- IKEA Group

- JYSK Holding A/S

- Ligne Roset (Société Roset)

- Natuzzi S.p.A.

- Nobia AB

- Poltrona Frau Group (Haworth Inc.)

- Roche Bobois S.A.

- Rolf Benz AG & Co. KG

- Steinhoff International Holdings N.V.

- Vitra AG

IKEA, headquartered in the Netherlands, marks a significant global presence in the furniture market. The company has a robust supply chain management system and cost-efficient production processes, that has led to the company to maintain competitive edge in the wooden furniture market. In December 2024, IKEA announced the acquisition of the IKEA retail operations in Estonia, Latvia, and Lithuania (Europe). The acquisition includes three full-size IKEA stores, five additional smaller customer meeting facilities, e-commerce, and the digital retail development company.

Vitra AG, headquartered in Switzerland, offers high-end and premium wooden furniture. The company strategically collaborates with the designers to develop and produce unique wooden furniture. The company has a strong brand identity and commitment to producing durable products for customers across the globe.

Europe Wooden Furniture Industry News

- In February 2024, Restoration Hardware (RH) introduced 18 outdoor collections for 2024. Ranging from streamlined and Spanish-inspired to mountain vibes and contemporary, the launch includes two brand-new collaborations. The collection, which includes lounge, dining, and pool seating, features curved backs constructed of all-weather wicker and rounded legs with a slight taper.

- In March 2024, Ashley Home, Inc. acquired Resident Home Inc., which operates its business in Direct-to-consumer (DTC) brands in the home furnishings industry with an opportunity to expand its home furnishings assortment and G footprint.

The Europe wooden furniture market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Indoor furniture

- Outdoor furniture

Market, By Price Range

- Low

- Medium

- High

Market, By Wood Type

- Hardwood

- Softwood

Market, By Application

- Residential

- Upholstered furniture

- Non-upholstered furniture

- Bedroom

- Kitchen cabinet

- Dining room

- Blinds & shades

- Mattresses

- Others

- Commercial

- Business/office

- Educational

- Healthcare

- Hospitality

- Others

Market, By Distribution Channel

- Online

- Company website

- E-commerce

- Offline

- Specialty stores

- Mega retail stores

- Others (individual stores, etc.)

The above information is provided for the following regions and countries:

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

- Nordic countries

- Denmark

- Sweden

- Norway

- Rest of Nordic countries

Frequently Asked Question(FAQ) :

How much is the Germany wooden furniture market worth?

In 2024, Germany accounted for the largest market share in the Europe wooden furniture industry, with USD 9.2 billion.

Who are some of the prominent players in the Europe wooden furniture market?

Major players in the Europe wooden furniture industry include B&B Italia S.p.A., BoConcept A/S, Conforama, Herman Miller, Inc., Hülsta-Werke Hüls GmbH & Co. KG, IKEA Group, JYSK Holding A/S, Ligne Roset (Société Roset), Natuzzi S.p.A., Nobia AB, Poltrona Frau Group (Haworth Inc.), Roche Bobois S.A., Rolf Benz AG & Co. KG, Steinhoff International Holdings N.V., and Vitra AG.

What is the size of the indoor furniture segment in the Europe wooden furniture industry?

In 2024, the indoor furniture segment dominated the market, accounting for USD 35.9 billion and is expected to grow at a CAGR of 3.4% during the forecast period of 2025-2034.

How big is the Europe wooden furniture market?

The Europe market size for wooden furniture was estimated at USD 43.64 billion in 2024 and is expected to grow to USD 58.22 billion by 2034, at a CAGR of 3.5%.

Europe Wooden Furniture Market Scope

Related Reports