Summary

Table of Content

Europe Sportswear Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Europe Sportswear Market Analysis

The Europe sportswear market size was estimated at USD 89.88 billion in 2024. The market is expected to grow from USD 94.88 billion in 2025 to USD 163.15 billion in 2034 at a CAGR of 6.2%. In Europe, the population is shifting towards awareness of health and wellness, which is a key driver fueling the growth of the sportswear market.

To get key market trends

Over 60% of Europeans consumers engage in physical activity at least once a week, reflecting a significant shift towards active lifestyles which focuses on health and wellness, according to the European Commission. High-performance sportswear. Manufacturers are engaged in continuously innovating new, trendy and stylish sportswear to cater the demand of high-performance sportswear for different age group, especially for women.

Europe Sportswear Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 89.88 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.2% |

| Market Size in 2034 | USD 163.15 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The rise in athleisure has shifted sportswear into fashion trend. Increased numbers of people who engage in physical activity increase the demand for sportswear. Furthermore, government and corporations engage in activities which focus on promoting health and fitness awareness drives greater participation in sports and outdoor activities. This further results in increased demand for sportswear.

Manufacturers collaborate with celebrity endorsement to create a competitive edge in competitive markets. Focused advertisement and influence of celebrities helps manufacturers to target audience. Influencers and health advocates are boosting this trend by endorsing brands that reflect their values. Innovations in fabric technology and sustainable manufacturing are meeting consumer demands for performance and eco-friendliness. Consequently, the European sportswear market is on a robust growth path, fueled by health consciousness and the mainstreaming of fitness.

Europe Sportswear Market Trends

The Europe market has shown significant growth in recent years, this growth is driven by the several factors. Growing engagement in physical activities driving the market in Europe. Modern lifestyle involves awareness of health and wellness. Now a days, consumers are increasingly looking for sportwear that are made from biodegradable materials, recycled fabrics. As sustainability becomes a key purchasing factor, leading brands are focusing on ethical manufacturing to reduce carbon footprints, which helps them to attract consumers.

Smart integration in sportswear includes built-in sensors, temperature regulation, UV protection and posture correction, becoming a popular choice for consumers as it enhances the appeal of product. Stylish and comfortable sportswear are in high demand, driven by the rising athleisure trend. Products that are versatile combine performance, breathability, stretchy and stylish attract customers. This shift is making fashion-driven sportswear a lifestyle staple, emphasizing both comfort and aesthetics.

Leading brands provide virtual try-on and 3D body scanning, these AI-driven shopping experiences enhance the shopping experience and boost conversion rate. With rise in E-commerce, more products are available on online platforms further increases the awareness of good sportswear products.

Europe Sportswear Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is divided into apparel, footwear and accessories. In 2024, the footwear segment accounted for a revenue of USD 40.55 billion and is expected to reach 75.54 billion by 2034.

The footwear segment that dominates the market is due to consumers preferring sneakers and aesthetic shoes for various activities like running, gym workout and casual wear. Shoes with advanced features attract customers for their comfort. Leading companies like Adidas and Puma invest in performance-enhancing innovations such as the use of breathable material, lightweight material and energy-return soles, making footwear that are essential for both athletes and casual wearers. The growing sneaker culture and celebrity collaborations have further boosted demand for footwear. Unlike apparel and accessories, footwear has short replacement cycle, resulting in consistent market growth.

Learn more about the key segments shaping this market

Based on consumer group, the Europe sportswear market is categorized into men, women and unisex. In 2024, the women consumers segment has accounted market share of 49.1% and is anticipated to grow at a CAGR of 6.4% in forecast period.

The women’s segment dominated the market due to several reasons that differentiate it from men’s and unisex segments. Rising awareness of health and fitness gives rise to activities like yoga, gym workouts, running, cycling and other activities which fueled the demand of specialized athletic wear. Major brands focus on targeting female consumers with exclusive product lines and collaboration with celebrity endorsement enhance brand engagement. Women’s sportswear has a high growth rate due to evolving fashion trends and increasing disposable income.

Based on distribution channel, the Europe sportswear market is categorized as online and offline. In 2024, the offline segment accounted for a market share of 65.3% and is anticipated to grow at a CAGR of 6.1%.

Physical stores provide a hands-on shopping experience which allows consumers to try on products for the right fit, comfort and to check material quality. This is the key factor that gives edge to offline sales over online sale of sportswear. Additionally, brand-exclusive stores and multi-brand outlets create a strong retail presence, offer personalized customer service and immediate deliveries. These stores are also engaged with loyalty programs, in-store promotion and premium shopping experience which make offline shopping preferred choice of customers.

Looking for region specific data?

Europe region accounted for a revenue of USD 89.88 billion in the year 2024 and is anticipated to grow at a CAGR of 6.2% during the forecasted period.

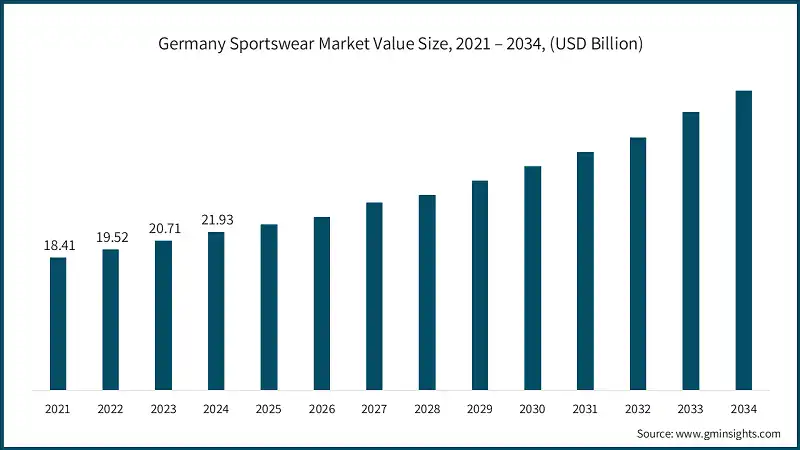

In 2024, Germany sportswear market accounted for a revenue of USD 21.93 billion and is anticipated to grow at a highest CAGR of 6.6% during the forecasted period in the European market. Germany population shows strong sports participation specifically focus on football, running and outdoor activities. According to Statista, there were around 86,000 sports clubs across Germany in 2024. Growing attention to sports gives rise to the sportswear market in Europe. Manufacture offers stylish and eco-friendly sportswear products to meet the functional yet stylish sportswear demand of consumers.

The UK accounted for a revenue of USD 14.91 billion in the year 2024 and is anticipated to grow at a CAGR of 6.1% during the forecasted period. The UK has a booming fitness culture, which includes HIIT workout and yoga, drives the demand for high-performance and stylish sportswear. Football clubs, cricket and tennis contribute to diverse sportswear preferences. Additionally, Uk market has strong shift towards luxury sportswear products. Strong e-commerce and direct-to-consumer (DTC) sales further drive the market of sportswear in the UK.

France accounted for a revenue of USD 10.76 in 2024 billion and is anticipated to grow at a highest CAGR of 5.9% during the forecasted period in the European sportswear market. Paris is a global fashion hub which drives stylish, high-end sportwear demand. Customers show interest in premium brands which blend fashion and functionality. Additionally, health and fitness awareness and government initiatives to promote exercise for public health, result in increased demand of sportswear in France.

Europe Sportswear Market Share

The top 5 companies in the Europe market include Adidas AG, Puma SE, Kappa S.p.A., Fila S.p.A. and Lotto sport Italia S.p.A., they collectively hold a share of 5-10% in the market. The Europe sportwear market is highly fragmented, but the market is competitive in nature due to the presence of local and global players across the globe.

- Adidas AG executes their ‘Own the Game’ strategy which focuses on brand credibility which strengthen reputation, consumer experience and sustainability. Adidas continues in investing sustainable sportswear such as Futurecraft Loop initiative, which focuses on 100% recyclable running shoes. Their strong digital presence resulted in maximum market share.

- Puma SE engaged in strategic partnerships with athletes and sports events, which enhanced their market presence. They focus on creating high-performance sportswear and improving retail & e-commerce to enhance distribution networks. Additionally, puma invests in advanced performance fabrics and footwear technology such as Nitro Foam midsole attract customers as it enhances cushioning in running shoes.

- Kappa is expanding in the European market with widely recognized “Omni” logo. Kappa differentiated themselves from other brands created competitive edge by offering affordable and stylish sportwear that appeals to young consumers. They are engaged in collaboration to blend sportswear with streetwear aesthetics.

- Fila S.p.A. focuses on expanding-on-expanding portfolio by retro style designs and marketing leadership to strengthen brand identity. They engaged with fashion and sports collaborations to target lifestyle segment.

- Lotto sport Italia S.p.A. prioritizes cutting-edge sports technology in their footwear and apparel particularly in football and tennis. Their focus on comfort, durability and affordability creates a competitive edge in the market.

Europe Sportswear Market Companies

Major players operating in the Europe sportswear industry include:

- Adidas AG

- ASICS Corporation

- Errea Sport S.p.A.

- Fila S.p.A.

- Hummel International Sport & Leisure A/S

- Kappa S.p.A.

- Le Coq Sportif S.A.S.

- Lotto Sport Italia S.p.A.

- New Balance Athletics, Inc.

- Nike, Inc.

- Puma SE

- Reebok International Ltd.

- Salomon S.A.

- Uhlsport GmbH

- Under Armour, Inc.

These industry leaders are actively engaged in strategic initiatives such as mergers & acquisitions, partnerships, expansions to broaden their product portfolios, reach a wider customer base and strengthen their market presence. These companies invest in R&D to innovate new products with advanced materials and sustainable fabrics, that allow brands to keep ahead of competitors. Companies emphasize sustainable sourcing, recycled materials and carbon neutral operations in the manufacturing process to reduce carbon footprint, which helps companies to attract customers who are concerned about the environment. Additionally, companies provide customization and personalization in sportswear like customized design in shoes, jerseys and activewear.

Europe Sportswear Industry News

- In July 2024, Kappa France unveiled the Stade Malherbe Caen Kombat™ Away jersey for the 2024-2025 football season on social media. This boosts brand visibility and customer engagement which enhance the position of Kappa France in Europe market.

- In January 2024, the brand made a strategic move by enlisting Lev Tanju, the visionary behind the skate wear label Palace, to spearhead the creative direction of fila+. This new line not only pays homage to Fila's rich archives but also reimagines timeless designs. The collection marries artisanal craftsmanship with an authentic touch, catering to contemporary tastes and everyday wear.

- In April 2024, PUMA has launched its first worldwide brand campaign in 10 years “FOREVER. FASTER. - See The Game Like We Do” with the objective to strengthen PUMA’s positioning as the Fastest Sports Brand in the world. The campaign conveys the brand’s unique connection with speed and invites everyone.

The Europe sportswear market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Million Units) from 2018 to 2034, for the following segments:

Market, by product type

- Apparel

- Footwear

- Accessories

Market, by Price range

- Low

- Medium

- High

Market, by Consumer Group

- Men

- Women

- Unisex

Market, by Distribution channel

- Online

- E-commerce

- Company website

- Offline

- Department stores

- Specialty stores

- Other retail outlets

The above information is provided for the following countries:

- Europe

- UK

- Germany

- France

- Italy

- Spain

Frequently Asked Question(FAQ) :

Who are some of the prominent players in the Europe sportswear market?

Major players in the Europe sportswear industry include Adidas AG, ASICS Corporation, Errea Sport S.p.A., Fila S.p.A., Hummel International Sport & Leisure A/S, Kappa S.p.A., Le Coq Sportif S.A.S., Lotto Sport Italia S.p.A., New Balance Athletics, Inc., Nike, Inc., Puma SE, Reebok International Ltd., Salomon S.A., Uhlsport GmbH, and Under Armour, Inc.

How big is the Europe sportswear market?

The Europe market size for sportswear was estimated at USD 89.88 billion in 2024 and is expected to grow to USD 163.15 billion by 2034, at a CAGR of 6.2%.

What is the size of the footwear segment in the Europe sportswear industry?

In 2024, the footwear segment accounted for a revenue of USD 40.55 billion and is expected to reach USD 75.54 billion by 2034.

How much is the Germany sportswear market worth?

In 2024, the Germany sportswear market accounted for a revenue of USD 21.93 billion and is anticipated to grow at the highest CAGR of 6.6% during the forecast period in the European market.

Europe Sportswear Market Scope

Related Reports