Summary

Table of Content

Europe Biofuel Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Europe Biofuel Market Size

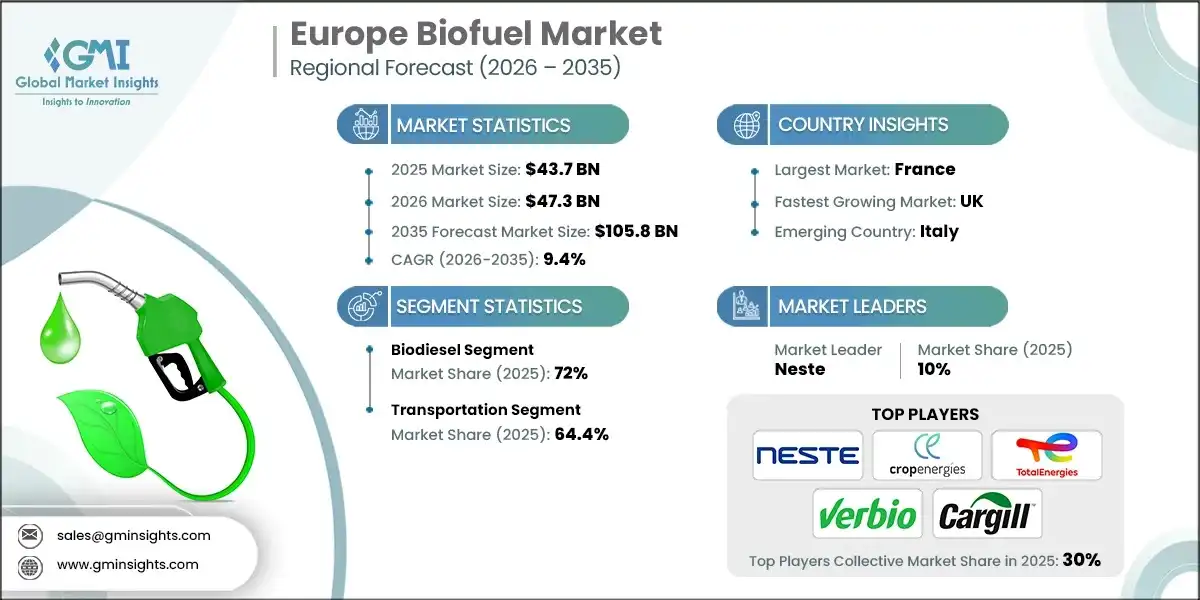

According to a recent study by Global Market Insights Inc., the Europe biofuel market was estimated at USD 43.7 billion in 2025. The market is expected to grow from USD 47.3 billion in 2026 to USD 105.8 billion in 2035, at a CAGR of 9.4%.

To get key market trends

- The EU’s revised Renewable Energy Directive (RED III) is a structural driver for biofuels across Europe. It lifts transport renewable energy ambition while giving Member States two compliance pathways (either a 29% renewables-in-transport share or a 14.5% GHG-intensity reduction by 2030) and strengthens sustainability verification.

- The directive prioritizes advanced biofuels in Annex IX Part A and RFNBOs (renewable fuels of non-biological origin), narrows room for conventional crop-based fuels, and hardens lifecycle GHG thresholds. For producers, the clear legal architecture catalyzes investments in efficient pathways and auditable supply chains, nudging portfolios towards waste- and residue-derived feedstocks and co-processing routes that meet the stricter criteria.

- For instance, in May 2024, the legally binding framework and transport targets are codified in Directive (EU) 2023/2413 (RED III), with additional feedstocks added via Commission Delegated Directive (EU) 2024/1405 published in the Official Journal, reinforcing advanced feedstock availability and compliance routes for 2030 targets.

- Increasing decarbonization initiatives spurred by favorable policy adoption for sustainable fuel is bolstering the market landscape. ReFuelEU Aviation introduces mandatory Sustainable Aviation Fuel (SAF) blending at EU airports, starting at 2% in 2025 and ramping through the 2030s, backed by reporting, penalties and a refueling obligation to curb tankering.

- For biofuel suppliers (HEFA/advanced SAF today; e-SAF from 2030), this creates predictable offtake and encourages capacity scale-up, logistics readiness, and long-term contracts. Airports and airlines are investing in supply infrastructure and procurement strategies, pushing SAF beyond pilots into regular operations, and anchoring biofuel’s role in Europe’s aviation energy mix.

- For reference, in October 2025, European Union Aviation Safety Agency (EASA) published its first annual ReFuelEU report showing 2024 SAF uptake concentrated in 12 Member States, with most volumes from UCO and animal-fat pathways and infrastructure readiness improving ahead of the 2025 2% mandate.

- Traceability is becoming a competitive differentiator, in turn fueling market growth. The Commission’s Union Database for Biofuels (UDB) is rolling out to provide end-to-end chain-of-custody visibility, tracking consignments from raw material origin to market placement, mitigating irregularities, preventing double counting and improving market integrity.

- This elevates confidence in sustainability claims, enabling financiers and obligated parties to rely on standardized verification while encouraging cross-border trade in compliant consignments. For operators, early integration with the UDB will reduce compliance risk and ease audits, a clear commercial benefit as mandates tighten.

- For illustration, the European Commission confirms the UDB has been functional since November 2024, with a legal proposal to extend traceability upstream in 2025; the UDB is designed to support RED objectives and ensure transparency across liquid and gaseous renewable fuels supply chains.

Europe Biofuel Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 43.7 Billion |

| Market Size in 2026 | USD 47.3 Billion |

| Forecast Period 2026-2035 CAGR | 9.4% |

| Market Size in 2035 | USD 105.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing popularity as an eco-friendly fuel for road transportation | Rising adoption of biodiesel and HVO in heavy-duty fleets as a sustainable alternative to fossil diesel. |

| Growing emphasis on reducing greenhouse gas emissions | EU climate targets and RED III mandates are accelerating demand for low-carbon fuels across transport sectors. |

| Government initiative for research endeavours and favourable regulatory measures | National and EU-level funding programs and mandates are fostering innovation in advanced biofuels and SAF production. |

| Pitfalls & Challenges | Impact |

| High feedstock cost | Volatility in waste oil and residue availability drives up production costs, impacting margins and scalability for biofuel producers. |

| Opportunities: | Impact |

| Expansion of Sustainable Aviation Fuel (SAF) | Rising mandates under ReFuelEU Aviation create a strong opportunity for producers to scale SAF capacity and secure long-term airline offtake agreements. |

| Advanced biofuels from waste and residues | Increasing regulatory preference for Annex IX feedstocks opens avenues for investment in lignocellulosic ethanol and waste-based HVO production. |

| Market Leaders (2025) | |

| Market Leaders |

10% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | France |

| Fastest Growing Market | UK |

| Emerging Country | Italy |

| Future Outlook |

|

What are the growth opportunities in this market?

Europe Biofuel Market Trends

- National mandates and certification schemes are accelerating transport decarbonization, which in turn is fueling the market outlook across the region. Member States are translating EU rules into national obligations, certificate systems and penalties that create durable demand for biofuels in road, rail, maritime and aviation. These mechanisms reward advanced feedstocks, enable double counting for certain wastes, and integrate biomethane and RFNBOs.

- The result is a more diversified set of renewable transport fuels, with clearer compliance mechanics and price signals for obligated suppliers. As countries tighten rules, suppliers must optimize blends, documentation, and GHG performance to maintain margin and eligibility.

- Since July 2024, Spain’s Order TED/728/2024 updates the renewable transport obligation with certificates, advanced sub-targets, and penalties; in July 2025, MITECO opened consultation on a Royal Decree to transpose RED III, shifting calculation to GHG-reduction and reinforcing traceability and sanctions.

- Europe’s large diesel fleet makes HVO, a pragmatic decarbonization lever. OEM endorsements and plant logistics pilots are expanding usage, while suppliers scale feedstocks (UCO, residues) and distribution. For biofuel producers, HVO provides near-term volume growth and a bridge to advanced pathways, especially where electrification is slower in heavy-duty segments.

- For illustration, in August 2024, Germany’s Federal Ministry of Transport published technical guidance on HVO100 environmental performance, and BMW Group announced January 2025 initial-fill HVO100 for all diesels made in Germany, following the approval of HVO100 sales at filling stations.

- European industrial policy and state aid are catalyzing biofuel projects, particularly advanced biofuels and SAF, by de-risking capital expenditure and supporting scale. Grants, green financing and temporary frameworks are steering investment towards waste- and residue-based pathways, RFNBO integration, and biorefinery conversions.

- For instance, in March 2024, the European Commission approved over USD 900 million French scheme to support production of energy and fuels from biomass and renewable hydrogen, aligned to the Green Deal Industrial Plan and REPowerEU, covering direct grants for new and scaled projects to be operational within 36 months. This deepens regional supply chains and supports domestic resilience, while crowding-in private financing and accelerating FID timelines.

- Integrated energy companies are converting legacy refineries into biorefineries, leveraging proprietary technologies, logistics and market access to produce HVO, bio-naptha, bio-LPG, and prepare for SAF. These conversions anchor feedstock pre-treatment capabilities and co-processing flexibility, creating credible volume ramps and diversified outlets (road, marine, aviation).

- For reference, in January 2024, Eni announced to convert its Livorno into a biorefinery (500,000 t/yr Ecofining unit; completion by 2026), expanding HVO/SAF-ready output; Eni outlines broader European biorefinery growth and HVO distribution under Enilive on its site.

Europe Biofuel Market Analysis

Learn more about the key segments shaping this market

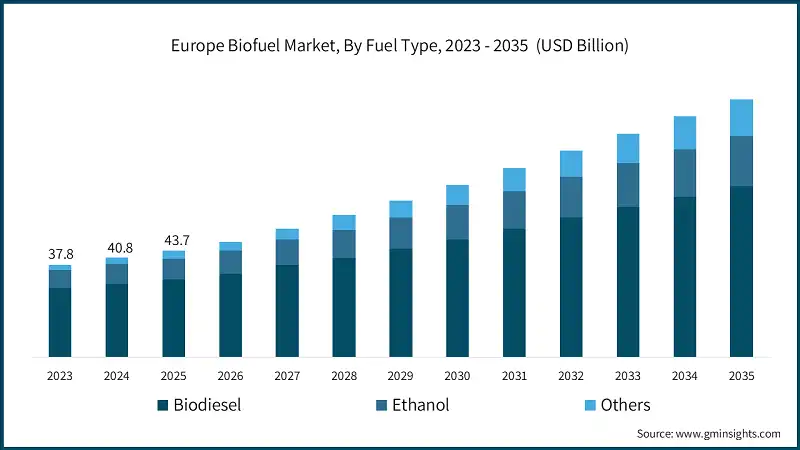

- Based on fuel type, the market is segmented into biodiesel, ethanol, among others. Europe biodiesel industry dominated with 72% of the market share in 2025 and is set to grow at a CAGR of 8.3% by 2035. Biodiesel remains the dominant renewable fuel in Europe’s transport sector, driven by its compatibility with existing diesel engines and infrastructure.

- The trend is shifting from conventional FAME biodiesel toward Hydrotreated Vegetable Oil (HVO), which offers superior performance, lower emissions, and drop-in capability. Regulatory frameworks such as RED III and national mandates prioritize advanced feedstocks like used cooking oil (UCO) and animal fats, reducing reliance on crop-based oils.

- OEM endorsements and retail approvals for HVO100 in countries including Germany and Sweden are accelerating adoption, particularly in heavy-duty fleets and logistics. Investments in biorefineries by energy majors further strengthen HVO’s position as a strategic decarbonization tool.

- For reference, in December 2025, The German cabinet has formally endorsed legislation to transpose the European Union’s Renewable Energy Directive (RED III) into national law, marking a pivotal move toward harmonizing Germany’s energy and climate framework with the latest EU requirements.

- Ethanol industry will grow at a CAGR of 9% by 2035, as the product play a critical role in Europe’s gasoline pool, primarily through blending mandates under the Fuel Quality Directive and RED III. The trend is toward higher blends (E10 and E85) and increased use of advanced ethanol from lignocellulosic biomass to meet sustainability criteria.

- Ethanol’s role is reinforced by its cost-effectiveness and compatibility with existing vehicle fleets, making it a practical solution for reducing GHG emissions in light-duty transport. Several Member States are expanding E10 availability, while advanced ethanol projects are scaling up to comply with Annex IX feedstock requirements.

- Ethanol also benefits from strong certification systems ensuring traceability and compliance. For instance, in 2024, the French Ministry for Ecological Transition confirmed that transport energy report that E10 gasoline now accounts for over 60% of petrol sales, reflecting consumer acceptance and regulatory support for higher ethanol blends.

- Europe is witnessing rapid growth in advanced biofuels and Sustainable Aviation Fuel (SAF), driven by mandates like ReFuelEU Aviation and FuelEU Maritime. These fuels, derived from waste, residues, and renewable electricity (RFNBOs), are essential for decarbonizing hard-to-abate sectors such as aviation and shipping.

- SAF blending obligations starting in 2025 create a guaranteed market, while biomethane and e-fuels gain traction in heavy transport and maritime applications. Energy companies are converting refineries into biorefineries to produce HVO and SAF on a scale, and governments are offering subsidies and state aid to accelerate deployment. This diversification strengthens Europe’s energy security and climate resilience.

Learn more about the key segments shaping this market

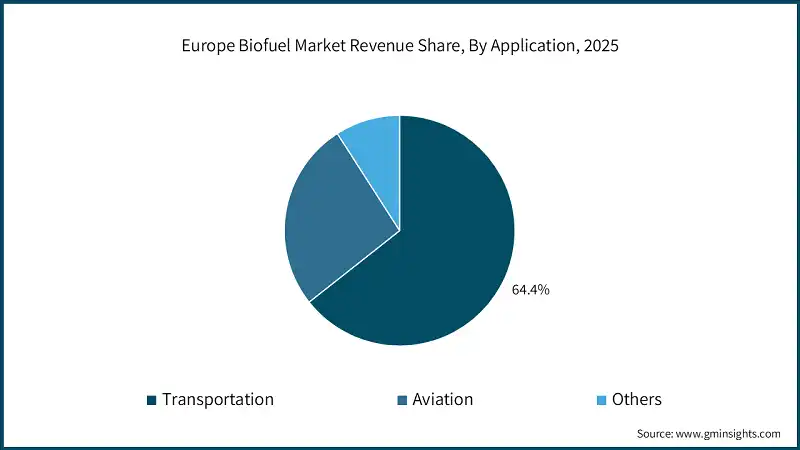

- Based on application, the market is segmented into transportation, aviation, and others. The transport application held a market share of 64.4% in 2025 and will grow at a CAGR of 9.3% by 2035. Biofuels continue to play a central role in decarbonizing Europe’s road transport sector, particularly for heavy-duty vehicles and fleets where electrification faces cost and infrastructure barriers.

- The trend is toward higher blends of biodiesel (including HVO) and ethanol, supported by RED III mandates and national blending obligations. Countries are expanding retail availability of renewable fuels, and OEMs are endorsing compatibility with advanced biofuels.

- Additionally, logistics operators and public transport fleets are increasingly adopting HVO100 and E85 to meet corporate sustainability targets. This shift is reinforced by government incentives and certification systems that ensure compliance with GHG reduction goals.

- For instance, in January 2025, the Swedish Energy Agency (Energimyndigheten) announced updated reduction mandate levels for transport fuels, requiring higher shares of bio-based components in diesel and gasoline blends to meet national climate targets under RED III.

- Aviation industry will grow at a CAGR of 9.6% by 2035, driven by the implementation of ReFuelEU Aviation, which mandates SAF blending at EU airports starting in 2025. Airlines and airports are investing in SAF supply chains, while energy companies are scaling production through biorefinery conversions and partnerships.

- The trend is toward HEFA-based SAF today, with increasing focus on synthetic e-SAF and advanced pathways post-2030. Corporate offtake agreements and government-backed incentives are creating strong market signals, ensuring that SAF adoption moves beyond pilot programs into mainstream operations.

- For illustration, in February 2025, Avinor, Norway’s state-owned airport operator, confirmed that all domestic flights now comply with the country’s SAF mandate, which requires a minimum blend of sustainable aviation fuel in jet fuel sold at Norwegian airports.

- Biofuels are gaining traction in maritime transport, rail, and stationary power generation. The FuelEU Maritime regulation, effective from 2025, incentivizes renewable fuels, including advanced biofuels and e-fuels, for ships calling at EU ports. Rail operators are piloting HVO and biomethane to decarbonize non-electrified routes, while utilities are co-firing biofuels in power plants to reduce emissions.

- For reference, in December 2024, the Danish Energy Agency launched a national Power-to-X and green fuels roadmap, highlighting advanced biofuels as a key solution for maritime and industrial applications, with funding allocated for pilot projects starting in 2025. These applications reflect Europe’s broader strategy to integrate renewable fuels into hard-to-abate sectors, supported by lifecycle GHG accounting and sustainability certification frameworks.

Looking for region specific data?

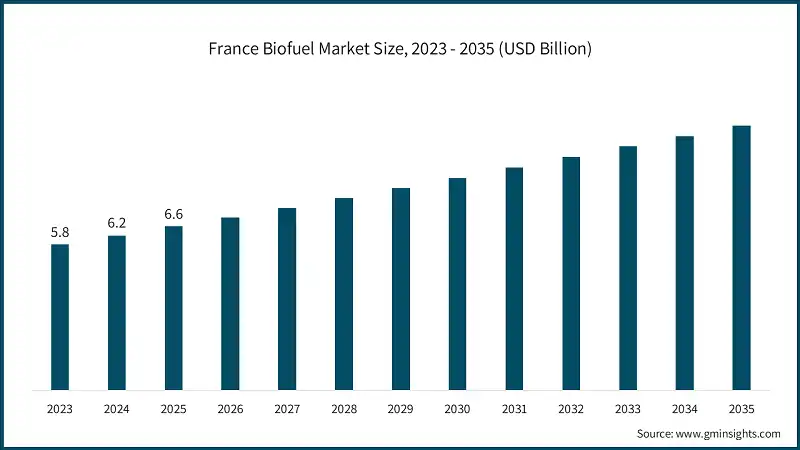

- France dominated the Europe biofuel market with around 15% share in 2025 and generated USD 6.6 billion in revenue. France’s 2025 approach places biofuels within a broader hydrogen and e-fuels industrial strategy while it reshapes transport compliance under RED-III. Ongoing state-aid framework for biomass-based fuels and hydrogen and a planned shift from the historical TIRUERT system toward an IRICC (GHG-intensity) mandate architecture is further boosting the market growth.

- For reference, in April-2025, France Hydrogène welcomes the revised National Hydrogen Strategy highlighting updated targets (e.g., 4.5 GW electrolysis by 2030), calls for hydrogen mobility, and backing for synthetic aviation fuel projects, linking hydrogen policy to transport fuels and SAF industrialization.

- Germany biofuel market will grow at a CAGR of 9.8% by 2035, driven by tighter national implementation of RED-III that shifts compliance from “volumes blended” to measured greenhouse-gas intensity reduction across all transport modes and a practical pivot toward high-integrity supply chains and drop-in renewable fuels to decarbonize heavy transport quickly.

- For reference, BMW Group confirms operational rollout from January-2025, all diesel models produced in Germany receive HVO100 initial fill (Neste MY Renewable Diesel) across Munich, Dingolfing, Regensburg, Leipzig, an OEM signal that drop-in renewable diesel is ready for mainstream use.

- Spain biofuel market stood at USD 3.3 billion in 2025. The country is consolidating biofuels within a comprehensive RED-III transposition that prioritizes GHG-based accounting, stronger traceability, and integration of biogas/biomethane and RFNBOs.

- In 2025, the Ministry for the Ecological Transition (MITECO) advanced a Royal Decree consultation to set supplier obligations that align with the PNIEC’s targeted transport emissions reduction and to introduce e-credits that reward higher-efficiency renewable options (including domestic biomethane and RFNBOs).

- UK biofuel industry will reach USD 12 billion by 2035, driven by product’s demand creation along with supplyside bankability for sustainable fuels. The SAF Mandate (in force from January 2025) sets a legally binding ramp (2% in 2025; 10% by 2030; 22% by 2040), enforced through tradable SAF certificates tied to lifecycle GHG savings.

- In addition, with the Advanced Fuels Fund (additional over USD 63 million announced in 2025), this policy stack is intended to catalyze UK projects in advanced SAF pathways (waste-to-jet, alcohol-to-jet, PtL), complementing existing RTFO structures for ground transport.

- Italy biofuel market will grow at a CAGR of 8.5% through 2035, augmented by aggressive biorefinery scaling and SAF commercialization led by national champions. Moreover, industrial build-out strengthens Italy’s role in European HVO/SAF capacity and aligns with national energy-security and circular-feedstock strategies, while supporting broader maritime and on-road renewable fuel applications.

Europe Biofuel Market Share

- The top 5 companies in Europe biofuel industry including Neste, CropEnergies AG, TotalEnergies, VERBIO AG, and Cargill collectively accounted for over 30% of market share in 2025. Neste has established itself as a global player in renewable fuels, with Europe serving as a cornerstone of its strategy.

- The company’s competitive edge lies in its large-scale production of hydrotreated vegetable oil (HVO) and sustainable aviation fuel (SAF), supported by advanced proprietary technologies and strong feedstock sourcing capabilities. CropEnergies is Europe’s another ethanol producer, with a well-integrated network of plants across Germany, Belgium, France, and the UK.

- Its strategic advantage stems from its specialization in fuel ethanol, a segment that remains critical for meeting RED III transport targets and national blending mandates. In addition, TotalEnergies leverages its integrated energy model to drive biofuel growth, particularly in renewable diesel and SAF. The company’s La Mède biorefinery in France exemplifies its pivot toward low-carbon fuels, with significant capacity dedicated to HVO and co-processing for SAF.

Europe Biofuel Market Companies

Major players operating in the Europe biofuel industry are:

- ADM

- BP

- Borregaard AS

- BTG International Ltd

- Cargill

- Chevron Corporation

- CLARIANT

- COFCO

- CropEnergies AG

- FutureFuel Corporation

- Green Joules

- Münzer Bioindustrie GmbH

- My Eco Energy

- Neste

- POET, LLC

- The Andersons, Inc.

- TotalEnergies

- UPM

- VERBIO AG

- Wilmar International Ltd

- Neste, headquartered in Finland, reported strong performance in its Renewable Products segment, which accounted for a significant share of its USD 24.7 billion revenue in 2024. With operations across Europe, North America, and Asia, Neste continues to expand its renewable diesel and sustainable aviation fuel (SAF) capacity, including major investments in its Rotterdam and Porvoo facilities.

- TotalEnergies, headquartered France, achieved revenues of USD 237 billion in 2024, supported by its integrated energy portfolio and growing renewable fuels business. The company operates the La Mède biorefinery in France, producing hydrotreated vegetable oil (HVO) and co-processing sustainable aviation fuel (SAF) to meet EU mandates.

- VERBIO AG, headquartered Germany, reported revenues of approximately USD 2.05 billion in fiscal year 2024/25, reflecting its strong position in biodiesel, bioethanol, and biomethane production. The company operates multiple plants across Germany and other European countries, focusing on advanced feedstocks and integrated biorefinery concepts.

Europe Biofuel Industry News

- In October 2025, the European Union Aviation Safety Agency (EASA) published its first ReFuelEU Aviation compliance report, confirming that SAF blending obligations of 2% at EU airports are on track, with most volumes sourced from waste-based HEFA pathways.

- In June 2025, UBA’s “Treibhausgas-Projektionen 2025” detailed Germany’s sector pathways, instrument evaluation and sensitivity analyses under the Federal Climate Protection Act and EU ESR, providing the emissions-budget context in which transport biofuels and RFNBOs must scale, in turn promoting product consumption across the country.

- In April 2025, Spain enacted Royal Decree 214/2025, making carbon-footprint calculation and public reduction plans mandatory for defined companies and public bodies, tightening corporate climate governance and improving the data foundation for fuel-policy enforcement, which in turn will create biofuel demand, thereby adding to the market growth down the line.

This Europe biofuel market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) & volume (Mtoe) from 2022 to 2035, for the following segments:

Market, By Fuel Type

- Biodiesel

- Ethanol

- Others

Market, By Feedstock

- Coarse grain

- Sugar crop

- Vegetable oil

- Others

Market, By Application

- Transportation

- Aviation

- Others

The above information has been provided for the following countries:

- Germany

- France

- Spain

- UK

- Italy

Frequently Asked Question(FAQ) :

What are the upcoming trends in the Europe biofuel market?

Key trends include conversion of legacy refineries into biorefineries, expansion of HVO100 retail availability, implementation of Union Database for traceability, and scaling of sustainable aviation fuel (SAF) production capacity.

Who are the key players in the Europe biofuel market?

Key players include Neste, CropEnergies AG, TotalEnergies, VERBIO AG, Cargill, ADM, BP, Borregaard AS, BTG International Ltd, Chevron Corporation, CLARIANT, COFCO, FutureFuel Corporation, Green Joules, Münzer Bioindustrie GmbH, My Eco Energy, POET LLC, The Andersons Inc., UPM, and Wilmar International Ltd.

Which country leads the Europe biofuel market?

France held 15% market share and generated USD 6.6 billion in 2025, driven by its hydrogen and e-fuels industrial strategy and the shift toward GHG-intensity compliance under RED III.

What was the market share of transportation applications in 2025?

Transportation applications held 64.4% market share in 2025, reflecting biofuels' central role in decarbonizing Europe's road transport sector, particularly for heavy-duty vehicles and fleets.

What is the growth outlook for the aviation segment from 2026 to 2035?

The aviation segment is projected to grow at a 9.6% CAGR through 2035, driven by ReFuelEU Aviation mandates requiring SAF blending at EU airports starting at 2% in 2025.

What is the current Europe biofuel market size in 2026?

The market size is projected to reach USD 47.3 billion in 2026.

How much market share did the biodiesel segment hold in 2025?

Biodiesel dominated with 72% market share in 2025, driven by compatibility with existing diesel engines and regulatory frameworks prioritizing advanced feedstocks like UCO and animal fats.

What is the market size of the Europe biofuel in 2025?

The market size was USD 43.7 billion in 2025, with a CAGR of 9.4% expected through 2035 driven by rising adoption of biodiesel and HVO in heavy-duty fleets as a sustainable alternative to fossil diesel.

What is the projected value of the Europe biofuel market by 2035?

The Europe biofuel market is expected to reach USD 105.8 billion by 2035, propelled by RED III mandates, SAF blending obligations, and increasing demand for advanced biofuels from waste and residues.

Europe Biofuel Market Scope

Related Reports