Home > Packaging > Consumer Goods Packaging > Food Packaging > Europe Beverage Container Market

Europe Beverage Container Market Size

- Report ID: GMI4751

- Published Date: Jun 2020

- Report Format: PDF

Europe Beverage Container Market Size

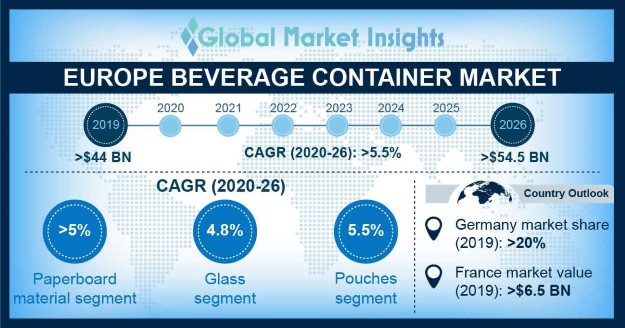

Europe beverage container market size exceeded USD 44 Billion, globally in 2019 and is estimated to grow at over 5.5% CAGR between 2020 and 2026. Growing demand for aseptic packaging to improve the product shelf life is propelling the industry advancement during the study timeframe.

Positive outlook for the beverage sector accompanied by growing export potential of European alcoholic and non-alcoholic beverages is propelling the Europe beverage container market growth. The food & beverage industry accounts for nearly 15% of Europe’s manufacturing industry owing to rise in local demand along with favorable trade policies. Intra-EU exports contribute to around 25% of the regional F&B industry turnover. Whereas, intra-EU beverage exports is nearly equal to exports to other countries.

| Report Attribute | Details |

|---|---|

| Base Year: | 2019 |

| Europe Beverage Container Market Size in 2019: | 44.7 Billion (USD) |

| Forecast Period: | 2020 to 2026 |

| Forecast Period 2020 to 2026 CAGR: | 5.5% |

| 2026 Value Projection: | 54.5 Billion (USD) |

| Historical Data for: | 2015 to 2018 |

| No. of Pages: | 340 |

| Tables, Charts & Figures: | 298 |

| Segments covered: | Material, Type, Application, Country |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Increasing competitiveness in the beverage industry driven by product innovation in categories such as dairy alternatives, organic beverages, and kombucha accompanied by consumer preference towards new & healthy beverages will generate new growth opportunities. The outbreak of COVID-19 is projected to shift the consumer presence towards products with high fiber, vitamin & minerals for health improvement.

Positive economic outlook, availability of extensive range of beverages, along with penetration of e-commerce distribution network has supported the Europe beverage container market expansion even in times of COVID-19.

Increasing demand for see-through cans & bottles for enhancing the aesthetic appeal of fruit juices, enhanced water, dairy products, and sports & energy drinks will support the Europe beverage container market growth. Technological advancements towards improved heat resistance, acid resistance, and greater shelf life of products will drive the see-through packaging demand over the projected timeframe. Manufacturers are working closely with beverage processors to provide the customized design as per their requirements, thereby enhancing their bargaining power.

Improved raw material recycling rates particularly for glass, plastic, and aluminum owing to supporting schemes by the government has changed the industry dynamics. Government initiatives such as the deposit-return system (DRS) where a surcharge is levied on a product when purchased and a rebate when it is returned, by the European Union has positively influenced the Europe beverage container market.

Manufacturers have been able to reduce their raw material processing costs and gain competitive advantage. However, the revenues for large scale alcoholic and non-alcoholic beverage producers is expected to fall in 2020 owing to lowered exports and supply chain disruptions.