Home > Packaging > Consumer Goods Packaging > Food Packaging > Europe Beverage Container Market

Europe Beverage Container Market Analysis

- Report ID: GMI4751

- Published Date: Jun 2020

- Report Format: PDF

Europe Beverage Container Market Analysis

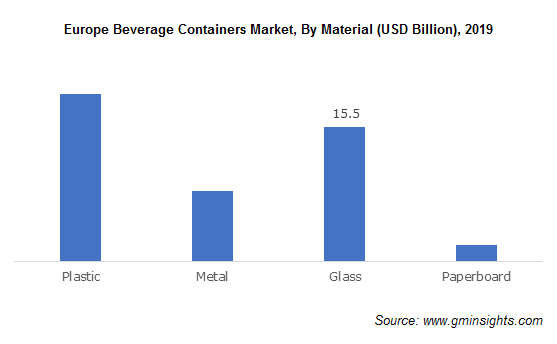

Glass segment is anticipated to witness CAGR of 4.8% between 2020 to 2026. Glass is odorless, chemically inert, and provides resistance to gases and vapors. Glass is considered as an eco-friendly material where the EU glass recycling rates have increased considerably to nearly 73%. Glass containers need no chemical liners and plastic and are alleged as best for taste and for creating premium and special experiences. The capability of glass to preserve strength, aroma, and flavors of beverages and provide a rich aesthetic appeal makes it the most preferred option for the alcoholic beverages industry.

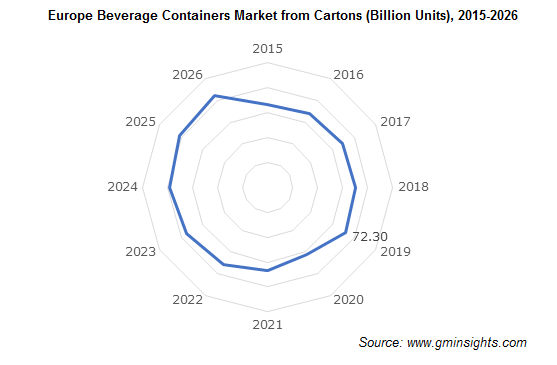

Cartons hold a considerable volume share in the Europe beverage container market in 2019. Cartons enable safe storage and transportation of beverages and provide customized packaging based on the manufacturer’s marketing requirements. Also, factors such as extended shelf life, minimal wastage, convenience, and lower cost drive the product usage in day-to-day low-cost non-alcoholic beverages such as dairy products and fruit juices. Additionally, the European government support for the use of container materials with a low carbon footprint will significantly propel the demand for beverage cartons.

Pouches segment is anticipated to witness a CAGR of 5.5% in terms of revenue from 2020 to 2026. The increasing popularity of pouches due to its flexibility and easy to handle nature will support segment growth. Expansion in the flexible packaging industry owing to improved barrier properties along with innovations in high-speed filling equipment will drive the Europe beverage container market share. Moreover, aspects such as appropriate sealing and heat insulation, capability to act as a barrier against moisture will provide potential growth prospects.

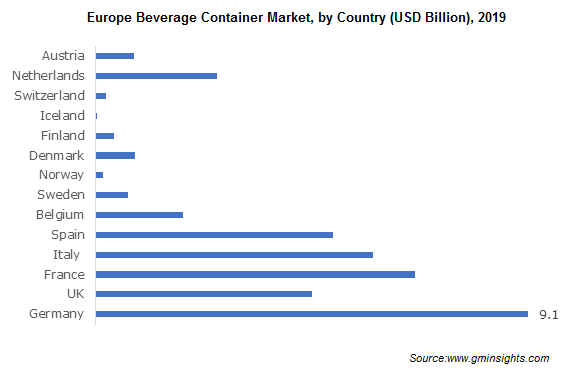

Alcoholic beverages account for a considerable share in the beverage containers production. Europe is the leading wine producing region in the world and holds nearly 27.3% of the global beer production in 2017. Countries including Germany, the UK, Netherlands, and Spain contribute approx. 38% of the regional beer production, whereas, France, Italy, and Spain account for more than 50% of the global wine production. Positive outlook for beverage exports owing to rise in alcoholic beverages demand across developing economies of Asia Pacific will support the Europe beverage container market segment growth.

Europe beverage containers industry share is highly fragmented with several regional and international players including Tetra Pak, Crown Holdings Incorporated, Amcor, Ardagh Group SA, Ball Corporation, Vidrala, CCL Industries Incorporated, Reynolds Group Holdings Limited, Berry Plastics Corporation, and Mondi Group. The top five manufacturers in the global beverage containers business contributed to around 24% of market share in 2019.