Summary

Table of Content

Europe Automotive Start-Stop Battery Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Europe Automotive Start-Stop Battery Market Size

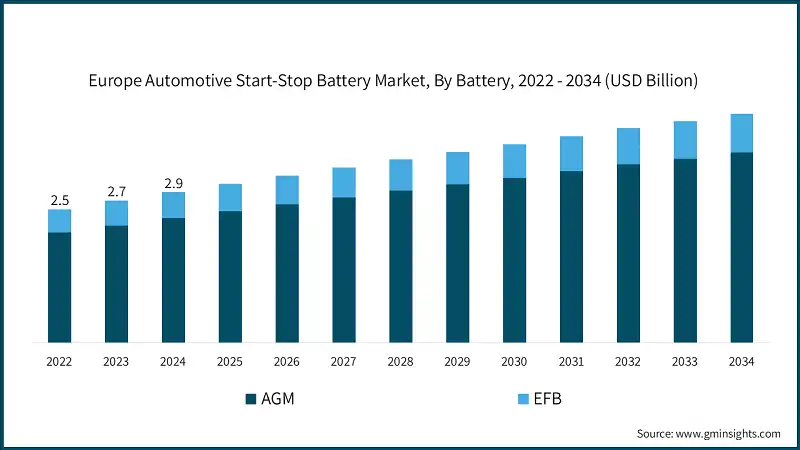

The Europe automotive start-stop battery market was valued at USD 2.9 billion in 2024. The market is expected to grow from USD 3 billion in 2025 to USD 4.4 billion by 2034, at a CAGR of 4.1%.

To get key market trends

- Europe’s automotive start-stop battery market is fueled by the acceleration of new battery electric vehicle (BEV) sales. According to the European Alternative Fuels Observatory (EAFO), new BEV Sales increased 34% in the first half of 2025, driven by strong policy support, infrastructure investment, and enduring consumer faith in electrified mobility. The EAFO notes that BEVs is important to Europe's zero-emissions transport aspirations and demand for energy-efficient battery systems, including start-stop technologies.

- Germany is celebrating the most robust EV market in Europe with continued government incentives and a diverse array of full BEV models on the market. The EAFO has commented on the leading role that Germany's policy support and charging infrastructure have played in the advancement of the BEV uptake. The improved potential for market development is driving demand for smart battery systems, including start-stop systems that enhance fuel efficiency in hybrid and plug-in EVs.

- The UK's automotive start-stop battery market is driven by the USD 3.3 billion DRIVE35 programme which was launched in July 2023 and is meant to assist with zero-emission vehicle manufacturing. The DRIVE35 programme funds gigafactories, and advanced battery research & development to ensure long-term funding for battery development. For example, the UK government has dedicated USD 405 million to auto projects, reaffirming the UK's dominance in EV technology.

- The start-stop battery market in Russia is developing as a result of the increasing battery needs for electric vehicles powered by a ramped up electrification of transport. The IEA noted that Europe, including the country of Russia, experienced a 25% increase in electric truck battery consumption in 2024, which represents the widespread adoption of electrified commercial fleets; which affirms the value of resilient battery systems that leverage start-stop technology to minimize energy usage.

- France's market is driven by increasing EV infrastructure and public awareness. As per EAFO, there was strong BEV growth in France, during H1 2025, driven by policy incentives and gradual build-out of their charging network. The transition from conventional to electrified mobility has significant implications for demand in start-stop batteries as they improve energy efficiency for hybrid and plug-in vehicles.

- Spain's start-stop battery industry stands to gain from broad EU industrial strategies. The European Commission's Action plan for 2025 indicates that Spain is one of the countries making significant forward momentum with clean mobility and battery innovation. Spain has seen increased BEV registrations and has recent explicit strategies to support domestic supply chains for batteries. This presents an opportunity for the automotive battery industry in Spain, particularly around start-stop batteries.

Europe Automotive Start-Stop Battery Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.1% |

| Market Size in 2034 | USD 4.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Resurgent growth across the automotive industry | Resurgent growth across the automotive industry boosts demand for start-stop batteries by increasing vehicle production, especially hybrids and mild electrics, which rely on efficient energy management systems to meet fuel economy and emission standards. |

| Increasing adoption of energy-efficient & advanced vehicle technologies | Increasing adoption of energy-efficient and advanced vehicle technologies drives demand for start-stop batteries, as these systems enhance fuel economy and reduce emissions by minimizing engine idling, aligning with global sustainability goals and stricter automotive efficiency standards. |

| Pitfalls & Challenges | Impact |

| Stringent government regulations pertaining to battery recycling | Stringent government regulations on battery recycling pose a pitfall for the automotive start-stop battery market by increasing compliance costs and operational complexity. Manufacturers must invest in eco-friendly designs and recycling infrastructure, potentially slowing innovation and raising product prices. |

| Opportunities: | Impact |

| Expansion of Hybrid Vehicle Segment | The growing popularity of hybrid vehicles in Europe presents a major opportunity, as start-stop batteries are integral to their energy systems. This trend boosts demand for reliable, efficient batteries that support fuel savings and lower emissions. |

| EU Funding for Green Mobility Innovation | European Union funding programs for sustainable transport and battery innovation encourage R&D and manufacturing of advanced start-stop systems. These incentives help companies scale production, improve technology, and meet environmental goals, strengthening market competitiveness and growth. |

| Market Leaders (2024) | |

| Market Leader |

|

| Top Players |

Collective market share in 2024 is 40% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Germany |

| Fastest Growing Market | Spain |

| Emerging Country | Germany, UK, France, Italy, Russia, Spain, Belgium, Netherlands, Poland, Switzerland |

| Future outlook |

|

What are the growth opportunities in this market?

Europe Automotive Start-Stop Battery Market Trends

- The EU is prioritizing battery self-sufficiency to reduce reliance on imports and strengthen its industrial base. According to the European Parliamentary Research Service, the EU is injecting strategic impetus into battery production through funding, regulation, and stakeholder coordination. This push is reshaping the start-stop battery landscape by encouraging local manufacturing, innovation, and circular economy practices.

- The EU battery sector faces challenges from high energy costs, raw material dependencies, and delayed gigafactory projects. The collapse of Northvolt, once a flagship battery manufacturer, raised concerns about Europe’s ability to meet future battery demand. These disruptions affect the availability and pricing of start-stop batteries, prompting manufacturers to diversify sourcing and invest in resilient supply chains.

- According to the IEA, electric truck battery demand in Europe rose by 25% in 2024, reflecting a shift toward electrified logistics. This trend is influencing the start-stop battery market, as commercial vehicles increasingly require robust energy systems for frequent engine cycling and auxiliary power. Manufacturers are adapting start-stop technologies to meet the durability and performance needs of fleet operators.

- The IEA notes that the battery industry is entering a phase of global standardization, replacing fragmented regional approaches. This trend benefits the start-stop battery market by enabling economies of scale, reducing production costs, and simplifying integration across vehicle platforms. European manufacturers are aligning with global standards to remain competitive and ensure interoperability in international automotive supply chains.

- The IEA highlights that battery demand is driving up the need for lithium, cobalt, and nickel. As start-stop batteries evolve to support more advanced vehicle systems, their material requirements grow. This intensifies competition for resources and pressures manufacturers to innovate with alternative chemistries or recycling strategies to ensure long-term supply security.

- The EU’s Circular Economy Action Plan emphasizes battery recyclability and eco-design. This regulatory focus is prompting start-stop battery manufacturers to adopt sustainable materials and closed-loop production models. These changes not only reduce environmental impact but also align with consumer expectations and future compliance requirements.

Europe Automotive Start-Stop Battery Market Analysis

Learn more about the key segments shaping this market

- Based on battery, the market is segmented into AGM and EFB. The AGM battery market dominated the overall industry accounting for 82.7% share in 2024 and will grow at a CAGR of 4.2% till 2034. AGM batteries are increasingly favored in urban environments due to their superior cycling durability. As cities expand low-emission zones, vehicles with frequent stop-start cycles require batteries that can handle repeated engine restarts. The IEA notes that battery demand is shifting toward technologies that support high-frequency usage, especially in dense European cities where electrified and hybrid vehicles dominate1. This trend is accelerating AGM adoption in both OEM and aftermarket segments.

- EFB batteries are gaining traction in light commercial vehicles and delivery fleets, which require cost-effective solutions for moderate cycling performance. The IEA reports that electric truck battery demand in Europe rose by 25% in 2024, reflecting a broader shift toward electrified logistics. EFB batteries offer a balance of performance and affordability, making them ideal for fleet operators transitioning to low-emission vehicles with start-stop systems.

- The rise of PHEVs in Europe is boosting demand for AGM batteries, which support the complex energy needs of dual powertrains. According to the European Alternative Fuels Observatory, PHEVs maintained a significant share of new registrations in 2025, especially in markets like France and the Netherlands. AGM batteries are preferred in these vehicles for their deep discharge capabilities and resilience under variable load conditions.

- EU regulations are increasingly emphasizing battery performance, safety, and recyclability. AGM and EFB batteries are being engineered to meet these evolving standards. The IEA highlights that battery technologies are undergoing rapid innovation to align with stricter EU directives on energy efficiency and lifecycle impact. This regulatory environment is encouraging automakers to adopt advanced battery types that ensure compliance and long-term reliability.

- Automakers are integrating smart battery management systems (BMS) into vehicles, which work more effectively with AGM and EFB batteries. These systems optimize charging, monitor health, and extend battery life. The IEA’s Global EV Outlook 2025 emphasizes the role of digitalization in battery performance optimization. AGM and EFB batteries are increasingly designed to be BMS-compatible, making them more attractive for modern vehicle platforms.

- To reduce supply chain risks, Europe is investing in local battery production. AGM and EFB batteries, which are less resource-intensive than lithium-ion types, are benefiting from this shift. The European Commission’s industrial strategy supports regional battery ecosystems, encouraging manufacturers to scale up production of advanced lead-acid batteries for start-stop applications. This localization trend enhances supply security and reduces costs for European automakers.

Learn more about the key segments shaping this market

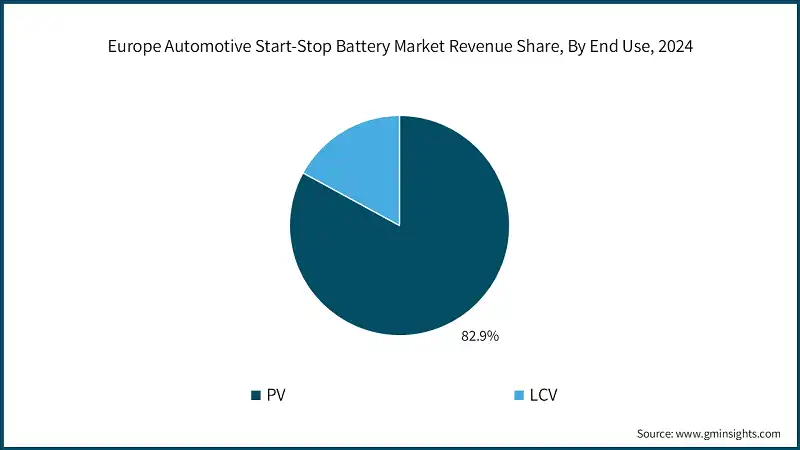

- Based on end use, the market is segmented into Personal Vehicle (PV) and Light Commercial Vehicle (LCV). The PV industry catered for a share of 82.9% in 2024 and is estimated to grow at a CAGR of 4% through 2034.

- Urbanization across Europe is intensifying traffic congestion, especially in metropolitan areas. Passenger vehicles operating in stop-and-go conditions benefit significantly from start-stop systems that reduce fuel consumption and emissions. This driving pattern makes start-stop batteries essential for urban mobility. As cities expand and traffic density rises, automakers are prioritizing energy-efficient solutions for passenger cars, with start-stop batteries playing a central role in meeting both consumer and regulatory expectations for cleaner transport.

- Local governments and utility providers across Europe are transitioning their light commercial fleets to electrified platforms. These vehicles, often used for maintenance, public services, and deliveries, require reliable start-stop batteries to support frequent engine cycling and auxiliary loads. The European Commission’s Clean Vehicles Directive encourages public sector fleet electrification, indirectly boosting demand for start-stop systems in LCVs. This policy-driven shift is creating long-term opportunities for battery manufacturers targeting municipal and service-oriented vehicle segments.

- The rise of ride-sharing platforms and MaaS models in Europe is increasing the utilization rates of passenger vehicles. These vehicles experience more frequent stops and engine restarts, making start-stop batteries critical for operational efficiency and fuel savings. As urban mobility shifts from ownership to shared use, the demand for durable and high-performance batteries grows. This trend supports the integration of start-stop systems in fleet-managed PVs, especially in cities promoting sustainable transport alternatives.

- The boom in e-commerce across Europe has led to a surge in last-mile delivery services using light commercial vehicles. These vehicles operate in dense urban areas with frequent stops, making start-stop batteries vital for fuel efficiency and reduced emissions. The European Investment Bank has supported logistics electrification projects, indirectly stimulating demand for energy-efficient battery systems in LCVs. This commercial shift is reshaping battery specifications to meet the needs of high-frequency delivery operations.

- European consumers are increasingly choosing low-emission vehicles, including hybrids and mild hybrids, which rely on start-stop systems to optimize fuel use. This preference is driven by rising environmental awareness and access to green incentives. Automakers are responding by equipping more PV models with start-stop technology, boosting demand for compatible batteries. The trend reflects a broader cultural shift toward sustainable mobility, where battery performance and reliability are key differentiators in consumer decision-making.

- Many European countries have set fleet electrification targets for commercial transport, including LCVs. These targets encourage businesses to adopt vehicles with energy-saving technologies like start-stop systems. The EU’s Fit for 55 package outlines emissions reduction goals that indirectly promote battery innovation in commercial fleets. As companies align with these targets, demand for start-stop batteries tailored to LCVs is expected to grow, especially in sectors like retail, logistics, and field services.

Looking for region specific data?

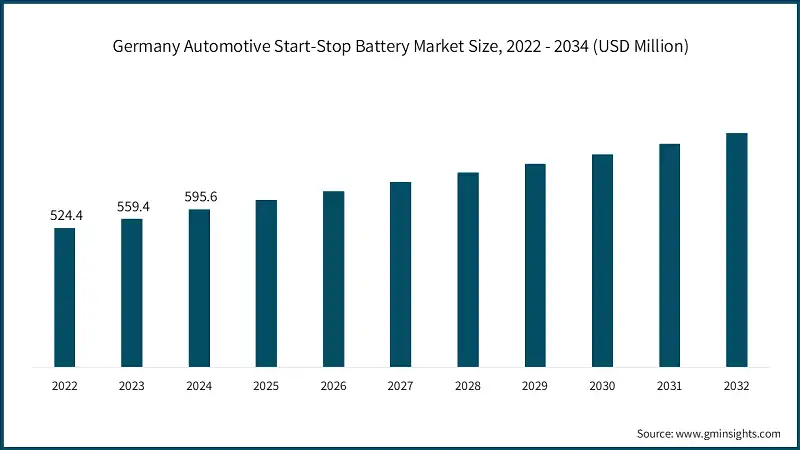

- The Germany dominated the Europe automotive start-stop battery market with 20.5% share in 2024 and generated a revenue of USD 595.6 million in 2024. Germany’s automotive start-stop battery market is driven by its National Platform for Electric Mobility, which promotes technological neutrality and systemic innovation. The platform encourages development of efficient internal combustion engines alongside electrification, supporting start-stop systems as a transitional technology. This approach aligns with Germany’s goal to become a lead market for sustainable mobility.

- The UK start stop battery market is poised to grow at over USD 490 million by 2034. The UK’s battery strategy outlines a USD 2.5 billion commitment to scale up battery manufacturing and innovation through 2030. This includes support for start-stop battery technologies as part of the broader zero-emission vehicle transition. The strategy emphasizes sustainable design, recycling, and supply chain resilience, positioning the UK as a global leader in battery development.

- France automotive start-stop battery market was valued at USD 461 million in 2024. France’s national strategy for automated and connected mobility includes USD 250 million in funding for sustainable automotive technologies. This investment supports innovation in energy-efficient systems, including start-stop batteries, which are essential for hybrid and connected vehicles. The strategy aims to modernize mobility services and reduce emissions across transport sectors.

- The Italian market for start stop batteries will grow at a CAGR of 1.7% till 2034 and is undergoing significant transformation driven by regulatory mandates and rising consumer awareness. Italy’s “Industria 4.0” plan offers tax incentives and super-depreciation for investments in energy-efficient industrial equipment, including automotive battery systems. These fiscal measures encourage adoption of start-stop technologies by reducing the cost of upgrading vehicle manufacturing processes. The plan supports innovation and digitization across Italy’s automotive supply chain.

- Russia's automotive start-stop battery market is growing steadily and will reach USD 300 million by 2034. Russia’s federal initiative on electric and hydrogen vehicles promotes the development of energy-efficient transport systems. The program supports vehicles powered by traction batteries and fuel cells, indirectly boosting demand for start-stop batteries in hybrid platforms. The goal is to achieve 10% production share of alternative energy vehicles by 2030.

Europe Automotive Start-Stop Battery Market Share

The top 4 companies in the market are Clarios, Exide Industries, East Penn Manufacturing Company, GS Yuasa International Ltd. and EnerSys, which collectively account for approximately 40% of the market share in 2024. These firms have consistently invested in AGM and EFB technologies, which are critical for modern fuel-efficient vehicles. Their ability to meet stringent EU performance and sustainability standards has made them preferred suppliers for hybrid and low-emission vehicle platforms.

Additionally, these companies benefit from strong brand recognition and long-standing relationships with automotive manufacturers across Europe. Clarios, for instance, supplies AGM batteries to a majority of new vehicles with start-stop systems, while GS Yuasa and East Penn have expanded their presence through joint ventures and localized production. Their scale allows them to offer competitive pricing, robust warranties, and innovation in battery management systems, reinforcing their dominance in both OEM and aftermarket segments.

Europe Automotive Start-Stop Battery Market Companies

- Clarios, a global leader in advanced energy storage solutions, reported annual revenue exceeding USD 9 billion in 2024. The company dominates the European start-stop battery segment, supplying AGM batteries to over 70% of new vehicles with start-stop systems. Known for its innovation in battery management and sustainability, Clarios leverages strong OEM partnerships and extensive manufacturing capabilities to meet Europe’s evolving mobility and environmental standards.

- Exide Industries, founded in 1947, is a key player in Europe’s automotive battery market, with a strong presence in both OEM and aftermarket segments. In 2024, the company reported revenue of approximately USD 1.5 billion. Exide is recognized for its wide range of lead-acid batteries, including EFB and AGM types, which support start-stop systems in hybrid and fuel-efficient vehicles. Its commitment to recycling and energy-efficient production aligns with EU sustainability goals.

- East Penn Manufacturing Company, established in 1946, is a privately held U.S.-based battery manufacturer with a growing footprint in Europe. Known for its Deka brand, East Penn specializes in high-performance AGM batteries for start-stop applications. With estimated revenue of USD 2 billion in 2024, the company emphasizes closed-loop manufacturing and environmental stewardship, making it a preferred supplier for European automakers focused on clean energy and circular economy practices.

- GS Yuasa International Ltd., headquartered in Japan and operating across Europe, is a leading provider of advanced battery technologies. In 2024, the company reported global revenue of USD 3.2 billion. GS Yuasa offers AGM and lithium-ion solutions tailored for start-stop and hybrid vehicles. Its focus on precision engineering, safety, and long lifecycle performance supports its strong position in Europe’s energy-efficient automotive sector.

- EnerSys, a global energy storage company founded in 2000, reported revenue of USD 3.6 billion in 2024. The company supplies high-performance batteries for automotive, industrial, and military applications. In Europe, EnerSys is known for its Odyssey and Hawker brands, which include AGM batteries optimized for start-stop systems. Its emphasis on innovation, reliability, and sustainability makes it a competitive force in the region’s transition to low-emission mobility.

Some of the major key players operating across the Europe automotive start-stop battery industry are:

- Accumulators Moura

- Banner Batteries

- Braille Battery

- Clarios

- Crown Battery

- CS Battery

- Discover Battery

- East Penn Manufacturing

- EnerSys

- Erdil Aku

- Exide Technologies

- FIAMM Energy Technology

- GS Yuasa

- Leoch Battery

- MOLL Batteries

- Mutlu Battery

- NorthStar

- Trojan Battery

- U.S. Battery

- XS Power Batteries

- Yigit Aku

Europe Automotive Start-Stop Battery Market News

- In April 2024, Clarios revealed a strategic partnership to supply a major automaker with its advanced Absorbent Glass Mat (AGM) battery technology. This 12V solution is engineered to boost fuel efficiency and lower CO2 emissions, aligning with the automotive sector’s sustainability objectives. Tailored for modern vehicles equipped with start-stop systems and high-power demands, the AGM battery delivers enhanced performance, reliability, and energy efficiency. Its durable, maintenance-free design further reduces environmental impact. This collaboration underscores Clarios’ dedication to sustainable energy storage and reinforces its leadership in automotive battery innovation, driving the future of eco-friendly mobility.

- In April 2022, Enersys entered into a partnership with Orogenic ApS, a Nordic battery distribution specialist, to oversee the distribution and sales of its motive power products across Greenland, the Faroe Islands, Denmark, and Iceland. This alliance aligns with Enersys’ strategic goal of expanding its presence in the Nordic region and reinforcing its position within the European battery market. By tapping into Orogenic ApS’ local expertise, the collaboration aims to grow Enersys’ market share and deliver dependable power solutions throughout the region, further establishing the company’s footprint in Europe.

- In September 2024, GS Yuasa Battery Ltd. unveiled plans to relaunch its ‘ECO.R EC’ battery series for private passenger vehicles starting October 2024. The refreshed lineup includes the high-performance ‘ECO.R HIGH CLASS’ and the reliable ‘ECO.R STANDARD’ models. First introduced in 2001 as the industry’s pioneering automotive battery made with recycled materials, the ECO.R series now features a cohesive design that reinforces its brand identity. With this update, GS Yuasa continues to address the evolving needs of the automotive market, focusing on enhanced safety, reliability, and environmental responsibility.

This Europe automotive start-stop battery market research report includes in-depth coverage of the industry with estimates & forecasts in terms of volume (Million Units) & revenue (USD Million) from 2025 to 2034, for the following segments:

Market, By Battery

- AGM

- EFB

Market, By Vehicle

- Conventional

- HEV

Market, By End Use

- PV

- LCV

The above information has been provided for the following countries:

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Belgium

- Netherlands

- Poland

- Switzerland

Frequently Asked Question(FAQ) :

Which country leads the Europe automotive start-stop battery market?

Germany led the market in 2024 with a 20.5% share and USD 595.6 million in revenue, as its National Platform for Electric Mobility promoting both ICE efficiency and electrification.

What is the projected market size of the UK start-stop battery market by 2034?

The UK market is expected to surpass USD 490 million by 2034, supported by a USD 2.5 billion government battery strategy for scaling up manufacturing and innovation.

What are the upcoming trends shaping the Europe automotive start-stop battery market?

Major trends include rising adoption of energy-efficient vehicles, hybrid sales growth, stricter battery recycling rules, and EU support for green mobility—driving demand for advanced start-stop batteries.

Who are major key players in the Europe automotive start-stop battery market?

Major key players include Discover Battery, East Penn Manufacturing, EnerSys, Erdil Aku, Exide Technologies, FIAMM Energy Technology, GS Yuasa, Leoch Battery, MOLL Batteries, Mutlu Battery, NorthStar, Trojan Battery, U.S. Battery, XS Power Batteries, Yigit Aku.

What is the growth outlook for personal vehicle (PV) end use through 2034?

The PV industry is expected to grow at a 4% CAGR through 2034, driven by urban traffic congestion, where start-stop systems help reduce fuel use and emissions in stop-and-go conditions.

What was the market size of the Europe automotive start-stop battery in 2024?

The market was valued at USD 2.9 billion in 2024, with a CAGR of 4.1% expected through 2034 due to rising BEV sales and growing demand for energy-efficient vehicle technologies.

What share did AGM batteries hold in the Europe market in 2024?

AGM batteries dominated the market with an 82.7% share in 2024, favored for their superior cycling durability and suitability for urban stop-start conditions.

What is the projected value of the Europe automotive start-stop battery market by 2034?

The market is expected to reach USD 4.4 billion by 2034, propelled by the acceleration of new battery electric vehicle (BEV) sales.

Europe Automotive Start-Stop Battery Market Scope

Related Reports