Summary

Table of Content

Ethylene Propylene Diene Monomer (EPDM) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Ethylene Propylene Diene Monomer Market Size

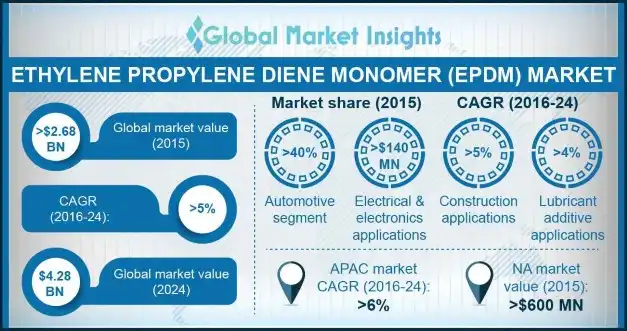

Ethylene Propylene Diene Monomer (EPDM) Market size was valued over $2.68 billion in 2015 and is expected to witness a CAGR of 5% through 2024. The industry is mainly driven by growing automotive and construction sector. Asia Pacific was largest regional market in 2015 owing to the expansion of end use industries particularly in China and India.

To get key market trends

Growing automotive industry, accompanied with increasing range of applications within the domain is anticipated to propel the market growth over the forecast timeframe. Global commercial and personal vehicle production was over 220 billion units & 680 billion units respectively in 2015. Rapid automotive sales in the coming years are anticipated to complement growth.

Also, increasing per capita spending results in drifting consumer focus towards functional as well as luxurious cars is another factor likely to propel the ethylene propylene diene monomer.

Plastic plays a vital role in various end user industries. It is one of the major raw materials used in plastic modification application, and is primarily employed in the polymer modification process for olefinic thermoplastic elastomers such as thermoplastic olefin (TPO) and thermoplastic vulcanizates (TPV).

Ethylene Propylene Diene Monomer (EPDM) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2015 |

| Market Size in 2015 | 2.68 Billion (USD) |

| Forecast Period 2016 - 2024 CAGR | 5% |

| Market Size in 2024 | 4.28 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Global thermoplastic olefin sector was more than 950 kilo tons in 2015 and is projected to surpass 1500 kilo tons by 2024. TPVs are polymeric compounds that demonstrate elastomeric properties over a wide temperature range and thermoplastic behavior at the melt temperature.

In addition, TPV is used in a wide range of automotive applications primarily due to its excellent UV and ozone resistance, low part weight; and high chemical and weathering resistance. It is employed in under-the-hood applications, tubing, air ducts, suspension bellows, plugs, molded seals, and cable jacketing.

TPO is an olefinic elastomer that typically consists of thermoplastic, elastomer, and filler. It is used in the range of 5% to 20% in the formulation of TPOs. Increasing polymer application in end user industries such as automotive and construction will positively influence ethylene propylene diene monomer market from 2016 to 2024.

Construction industry in Asia Pacific, particularly led by China, India, and Japan, is witnessing gains and is likely grow exponentially in the near future. China construction spending was over USD 1.7 trillion in 2015. Increasing polymer use in construction for roofing purposes will drive the EPDM market up to 2024.

Significant capacity addition by major industry players has resulted in product oversupply, which may hamper EPDM market price. Also, the global synthetic rubber market has been witnessing a change in the demand-supply dynamics. This is likely to further negatively influence industry growth.

The market is also influenced by oscillating crude oil prices as raw materials used in manufacturing process are petroleum products, making the outcome non-biodegradable. However, introduction of bio-based EPDM products with sugarcane and other bio based raw materials is anticipated to boost growth.

Ethylene Propylene Diene Monomer Market Analysis

Learn more about the key segments shaping this market

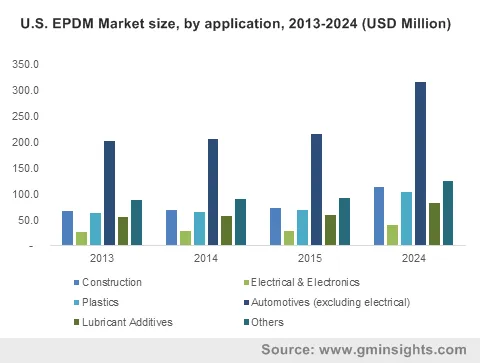

Automotive segment was valued at over $1.07 billion in 2015. Apart from steel, aluminum and other synthetic rubbers, it is one of the key raw materials used in automotive component production. It is primarily used in rear lamp gaskets, inner tire tubes, hoses, tire sidewalls, front & rear bumpers, belt drives, braking systems, door seals, and interior panels of cars. The broad application scope of the product in automotive industry is expected to boost growth of ethylene propylene diene monomer market over the forecast timeframe.

Construction applications are projected to expand at over 5% CAGR in terms of revenue. Owing to its extraordinary resistance to heat, cold, sunlight, and air pollution, this polymer has seen an ever-increasing demand for roofing purposes which is in turn anticipated to boost ethylene propylene diene monomer market share from the construction industry. Moreover, due to its desirable thermal and mechanical characteristics, electrical & electronics applications are forecast to generate revenue of over USD 200 million by 2024.

North America aided by U.S. was valued at over USD 600 million in 2015. High per capita customers spending along with increasing renovation activities in residential and commercial buildings is likely to boost the ethylene propylene diene monomer market in this region.

Asia Pacific is anticipated to witness highest gains and grow over 6% annually through 2024. Growing population has increased infrastructure spending, driving EPDM market in the region, particularly in China and India. Also, growing automotive industry, mainly in Indonesia, will further propel industry growth in future years. Latin America is projected to witness significant gains owing to increasing automotive component manufacturing, particularly in Brazil.

Ethylene Propylene Diene Monomer Market Share Global EPDM market is highly competitive. Major industry includes:

- Petrochina Co. Ltd

- Versalis

- Exxonmobil Chemical Company

- SK Global Chemical Co. Ltd

- and Mitsui Chemicals Inc

- Carlisle Companies Inc

- DOW Elastomers

- John Manville Inc

- JSR Corporation

- Kumho Polychem Co. Ltd

- Lanxess AG

- Lion Copolymer LLC

- OAO Nizhnekamskneftekhim

- Sumitomo Chemical Co. Ltd

The industry is witnessing high degree of forward integration. For instance, Lanxess AG, ExxonMobil Chemical Company, Firestone Building Products Company, and Johns Manville are integrated forward to produce EPDM based products from the raw materials manufactured by the same companies.

Although there is a lot of captive consumption of raw materials, there is also a boost in raw material requirement due to increasing ethylene propylene diene monomer market demand. Along with Chinese companies, the degree of competition is anticipated to remain high over the duration of the forecast period.

Industry Background

Ethylene propylene diene terpolymer is extremely durable synthetic rubber extensively used in automotive parts, construction purposes (roofing), electrical & electronics, plastics, and lubricant additives. Its primary elements, ethylene and propylene, are derived from oil & natural gas. Also, ethylene constitutes around 40% to 80%. The high ethylene content offers enhanced loading possibilities of the polymer, extrusion, and better mixing. Furthermore, they offer superior mechanical, thermal, and insulating property which makes them desirable for widespread application.

Ethylene propylene diene monomer market report includes in-depth coverage of the industry with estimates & forecast in terms of volume in kilo tons & revenue in USD million from 2015 to 2024, for the following segments:

By Application

- Construction

- Electrical & Electronics

- Plastics

- Automotive (excluding electrical)

- Lubricant Additives

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Russia

- Italy

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- MEA

- South Africa

- GCC

Frequently Asked Question(FAQ) :

Which application segment is expected to lead the market during the forecast period?

Based on application, the automotive application segment held the decent share in 2015 and is anticipated to exhibit a remarkable growth rate during the forecast period.

Which are the top companies in the ethylene propylene diene monomer industry?

DOW Elastomers, Carlisle Companies Inc., Mitsui Chemicals Inc., SK Global Chemical Co. Ltd., Exxonmobil Chemical Company, Versalis (Polimeri Europa S.P.A.), Petrochina Co. Ltd., Sumitomo Chemical Co. Ltd., OAO Nizhnekamskneftekhim, Lion Copolymer LLC, Lanxess AG, Kumho Polychem Co. Ltd., JSR Corporation, John Manville Inc., are the top contributors in the industry.

What are the top key factors driving the market?

Increasing demand of EPDM application in automotive and thermoplastic modification are the key factors expected to drive the growth of global market.

What will be the worth of the ethylene propylene diene monomer industry by the end of 2024?

In 2025, the Ethylene Propylene Diene Monomer industry is estimated to record a valuation of 4.28 Billion (USD).

What will be the worth of global ethylene propylene diene monomer market by the end of 2024?

According to the report published by Global Market Insights Inc., the EPDM business is expected to hit at $4.28 billion (USD) by 2024.

What is the growth forecast of the ethylene propylene diene monome market over the anticipated period?

Ethylene propylene diene monome market is likely to depict a crcr of 5% over 2015-2024.

Ethylene Propylene Diene Monomer (EPDM) Market Scope

Related Reports