Summary

Table of Content

Ethanolamines Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Ethanolamines Market Size

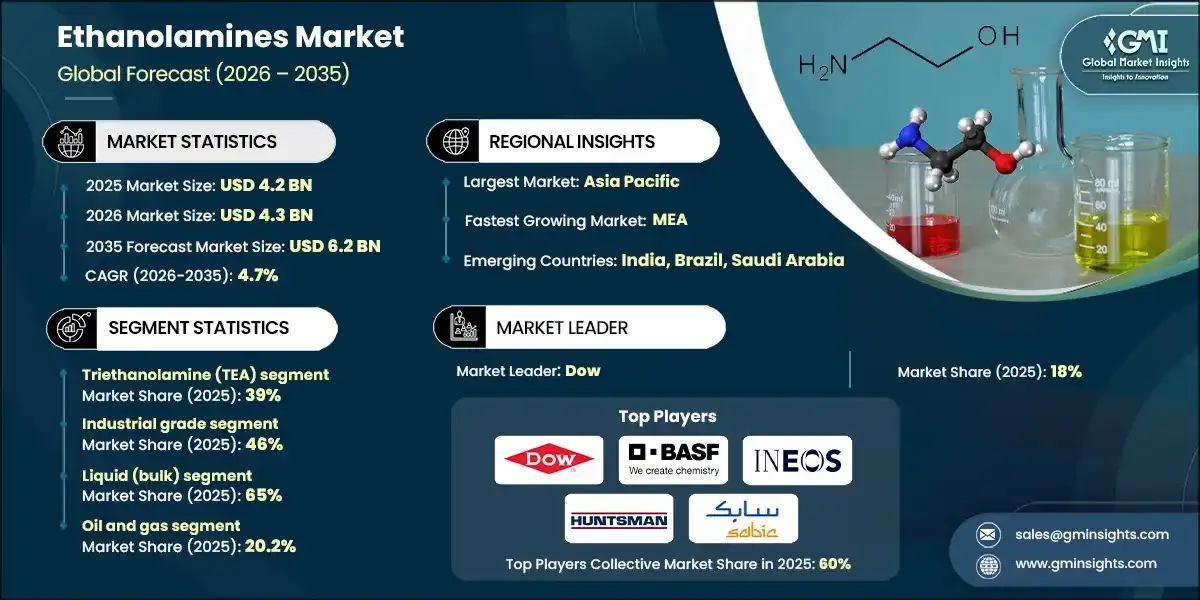

The global ethanolamines market was valued at USD 4.2 billion in 2025. The market is expected to grow from USD 4.3 billion in 2026 to USD 6.2 billion in 2035, at a CAGR of 4.7%, according to latest report published by Global Market Insights Inc.

To get key market trends

- As a result of growth in post-COVID construction chemicals, detergents, and gas treatment, the last four years have seen a continuous growth in ethanolamines. Chemical production increased globally from 2021 to 2025, and the International Energy Agency along with a number of other industry associations remarked a growth in the expulsion of and demand for cleaning chemicals, which are MEA, DEA, and TEA’s most important markets.

- The steady growth of the chemical production industry was in large part due to the production of surfactants and detergents. Because of the pandemic, demand for these cleaning products increased, and after the pandemic, demand for these products remained at high levels. Ethanolamines are a crucial component of the production of non-ionic and anionic surfactants which are utilized in the production of hospitality detergents, detergents for industrial and institutional use, and personal care products.

- During the 2021 to 2025 period, demand for ethanolamines in gas treating and refinery applications also increased. Ethanolamines are utilized in amine gas treatment tools for the removal of CO2 and H2S from natural gas and refinery streams. In the years 2021 to 2025, the volumes of gas in power and petrochemicals as well as the refineries in Asia and the Middle East allowed for an increased demand for gas even with the disruption in the energy markets.

- Fertilizers, cement, coatings, and cleaners have resulted in expanding capacity and downstream demand in China, India, and Southeast Asia. Thus, regionally, the Asia Pacific ethanolamines market had the most and the fastest growing economies. Environmental regulations and energy-transition policies in North America and Europe were modest, leading to efficiency-driven growth. In the oil and gas industry, construction, and industrial cleaning minority ethanolamine-based gas treatment and specialty formulations were used, but the growth was not significant, leading to a gap in the market.

Ethanolamines Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 4.2 Billion |

| Market Size in 2026 | USD 4.3 Billion |

| Forecast Period 2026-2035 CAGR | 4.7% |

| Market Size in 2035 | USD 6.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing gas treating demand in natural gas processing | Sustains MEA and DEA consumption in amine gas units |

| Rising surfactant uses in cleaning and personal care | Drives TEA and DEA volumes in detergent formulations |

| Infrastructure and construction growth in Asia Pacific | Boosts ethanolamine use in cement and coatings additives |

| Pitfalls & Challenges | Impact |

| Volatile ethylene and ammonia feedstock prices | Squeeze producer margins and complicate long-term contracts |

| Environmental and health concerns around DEA usage | Trigger reformulation toward MEA, TEA and alternatives |

| Opportunities: | Impact |

| Expansion of gas projects in Middle East and Asia | Opens new long-term off-take for gas treating amines |

| Development of bio-based and low-VOC formulations | Enables differentiation in sustainable coatings and cleaners |

| Market Leaders (2025) | |

| Market Leaders |

18% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | MEA |

| Emerging Country | India, Brazil, Saudi Arabia |

| Future Outlook |

|

What are the growth opportunities in this market?

Ethanolamines Market Trends

- Producers are evolving from commodity ethanolamines to customizing their offerings to specific applications and developing specialized solutions. Major players such as Dow, BASF, and Huntsman are offering packaged formulations of amines for gas treating, cement grinding aids and surfactants, combining technical service, and process design. This lessens pure price competition and secures long-term contracts with oil, gas, and construction clients.

- There is regulatory and toxicological scrutiny on certain ethanolamines, especially DEA in cosmetics and some cleaners, resulting in needing to reformulate. The European Commission’s restrictions on DEA in cosmetics and the growing low-nitrosamine systems preference pushes the customers to MEA, TEA, or other alternative chemicals. The suppliers are offering low-nitrosamine grades, safer product blends, and increased regulatory transparency for formulators.

- In Asia Pacific region, ethanolamines consumption is driven by gas processing and the production of detergents, agrochemicals, and construction chemicals. Ethanolamines are in high demand due to China and India’s expansions of infrastructure for natural gas, cement production, and fertilizer production. The region’s chemical clusters incorporating ethanolamines within surfactants, amines, and specialty chemicals to provide the region with increased self-sufficiency and the ability to export.

- The steams of decarbonization and transitioning energy policy continue to spawn demand for amine-gas treating which includes the capturing of CO2 in gas and refining. Customers, however, look for systems with lower energy consumption, longer solvent lifespans, and slower solvent degradation. In cleaners and coatings, the rising of low-VOC, bio-based, and eco-label compliant products encourage the development of not only more efficient application systems, but also greener ethanolamine derivatives.

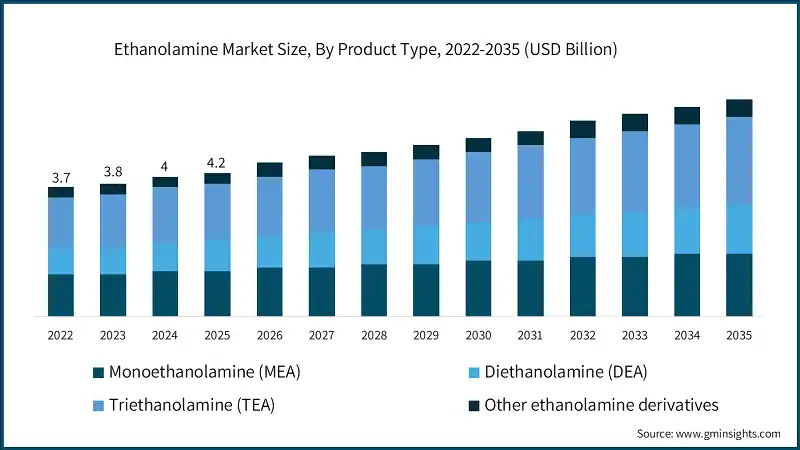

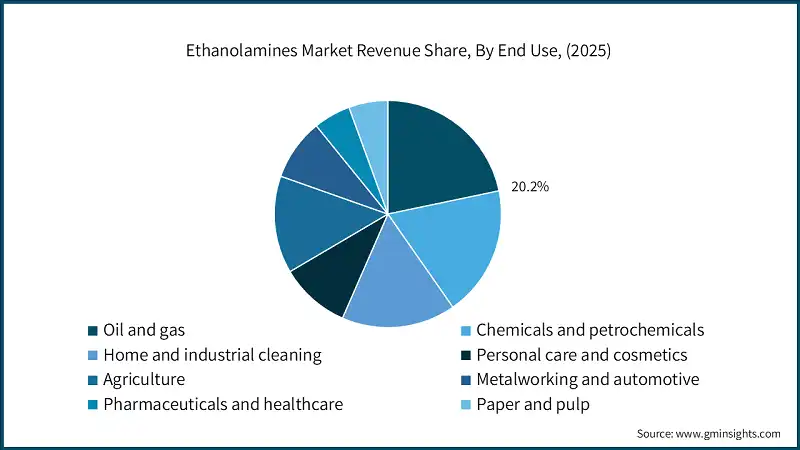

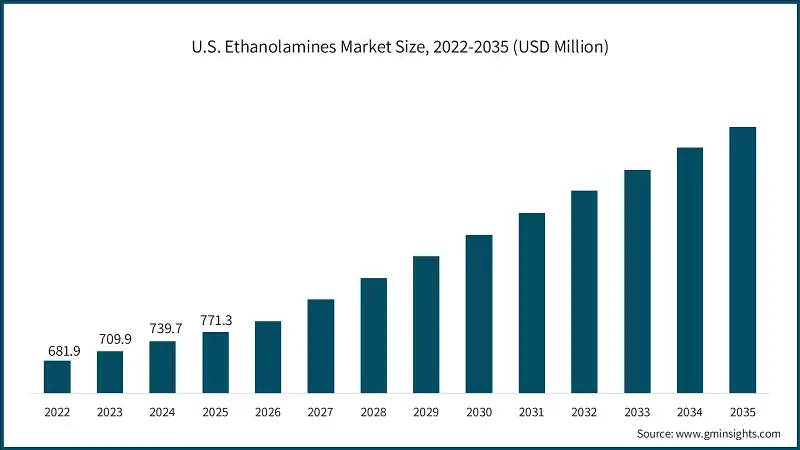

Ethanolamines Market Analysis Based on product type, the market is segmented into monoethanolamide (MEA), diethanolamine (DEA), triethanolamine (TEA), and other ethanolamine derivatives. Triethanolamine (TEA) dominated the category with an approximate market share of 39% in 2025 and is expected to grow with a CAGR of 4.3% by 2035. Based on grade, the ethanolamines market is segmented into technical grade, industrial grade, high-purity grade, specialty / customized formulations. Industrial grade held the largest market share of 46% in 2025 and is expected to grow at a CAGR of 4.8% during 2026-2035. Based on form, the ethanolamines market is segmented into liquid (bulk), solution / aqueous blends, solid / flakes (where applicable). Liquid (bulk) segment dominated the market with an approximate market share of 65% in 2025 and is anticipated to grow with the CAGR of 4.6% by 2035. Based on end-use, the ethanolamines market is segmented into oil and gas, chemicals and petrochemicals, home and industrial cleaning, personal care and cosmetics, agriculture, metalworking and automotive, pharmaceuticals and healthcare, paper and pulp, other industrial and specialty end uses. Oil and gas segments dominated the category with an approximate market share of 20.2% in 2025 and is expected to grow with the CAGR of 4.8% by 2035. North America contributes a significant share to the global ethanolamines market, rising from USD 921 million in 2025 to USD 1.3 billion in 2035, mainly driven by gas treating, detergents and downstream chemical uses. The region benefits from established gas processing infrastructure, mature home and industrial cleaning markets, and stringent product-performance standards that support steady consumption of MEA, DEA and TEA. Europe remains a sizeable, gradually expanding ethanolamines market, increasing from USD 1 billion in 2025 to USD 1.5 billion in 2035, driven by specialty chemicals, detergents and industrial applications. Stricter environmental, health and safety regulations encourage higher-spec grades and reformulation away from more scrutinized amines, sustaining value growth even as energy and feedstock costs remain volatile. Asia Pacific ethanolamines market is the largest ethanolamines region, growing from USD 1.7 billion in 2025 to USD 2.6 billion in 2035 at around 4.2% CAGR, driven by industrialization, construction and energy. China, India and Southeast Asia expand use in gas treating, agrochemicals, detergents and construction chemicals, with regional producers increasingly integrating ethanolamines into broader surfactant and specialty-chemical value chains. Latin America is a smaller but steadily growing ethanolamines market, rising from USD 252 million in 2025 to USD 353 million in 2035, led by construction, agriculture and basic chemicals. Brazil and other regional economies consume ethanolamines in fertilizers, herbicides, cement additives and detergents, with demand linked to infrastructure cycles and crop-intensity trends. Middle East and Africa is the smallest but fastest-growing ethanolamines regions, increasing from USD 257 million in 2025 to USD 384 million in 2035 at about 4.3% CAGR. Growth is fueled by expanding gas processing, refining, and petrochemical complexes, particularly in Gulf states, alongside rising demand for detergents and construction chemicals. The global market is moderately consolidated at the top 5, with Dow, BASF, INEOS, Huntsman and SABIC together representing 60% share of global capacity and revenue. These players benefit from integration into ethylene and ammonia chains, large-scale units in North America, Europe, and the Middle East, and deep relationships with oil and gas, detergents, agrochemicals and construction-chemicals customers, while the remaining market is fragmented among regional and niche producers. Major players operating in the ethanolamines industry include: Learn more about the key segments shaping this market

Learn more about the key segments shaping this market Learn more about the key segments shaping this market

Learn more about the key segments shaping this market Looking for region specific data?

Looking for region specific data?Ethanolamines Market Share

Ethanolamines Market Companies

Ethanolamines Industry News

This ethanolamines market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Product Type

- Monoethanolamine (MEA)

- Diethanolamine (DEA)

- Triethanolamine (TEA)

- Other ethanolamine derivatives

Market, By Grade

- Technical grade

- Industrial grade

- High-purity grade

- Specialty / customized formulations

Market, By Form

- Liquid (bulk)

- Solution / aqueous blends

- Solid / flakes (where applicable)

Market, By End Use

- Oil and gas

- Chemicals and petrochemicals

- Home and industrial cleaning

- Personal care and cosmetics

- Agriculture

- Metalworking and automotive

- Pharmaceuticals and healthcare

- Paper and pulp

- Other industrial and specialty end uses

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What is the contribution of North America to the global ethanolamines market?

North America contributes a significant share to the global market, with revenues increasing from USD 921 million in 2025 to USD 1.3 billion by 2035. This growth is driven by strong demand from gas treating applications, detergents, and downstream chemical uses.

What are the key trends in the ethanolamines industry?

Key trends include customization of ethanolamine formulations, rising demand for gas treating solvents, and increased focus on low-nitrosamine and low-VOC products due to regulatory scrutiny.

How much market share did the oil and gas end-use segment account for in 2025?

The oil and gas segment held approximately 20.2% market share in 2025, supported by ethanolamine usage in CO₂ and H₂S removal across natural gas processing and refinery operations.

Who are the key players in the ethanolamines market?

Key players operating in the industry include Dow, BASF SE, INEOS Group, Huntsman Corporation, SABIC, Eastman Chemical Company, Nippon Shokubai Co., Ltd., and LyondellBasell Industries.

What is the market size of the ethanolamines industry in 2025?

The market size was USD 4.2 billion in 2025, with a CAGR of 4.7% expected through 2035 driven by growing gas treating demand, surfactant consumption, and construction chemical usage.

What was the market share of liquid (bulk) ethanolamines in 2025?

Liquid (bulk) ethanolamines dominated the ethanolamines industry with around 65% share in 2025, owing to cost-efficient logistics, ease of handling, and large-scale consumption in gas processing and industrial formulations.

What was the market share of the industrial grade segment in 2025?

Industrial grade ethanolamines held 46% share of ethanolamines market in 2025, driven by high-volume demand from detergents, gas treating, cement additives, and standard coatings applications.

How much market share did the triethanolamine (TEA) segment hold in 2025?

Triethanolamine (TEA) accounted for approximately 39% market share in 2025, supported by its widespread use as a neutralizer, emulsifier, and pH regulator in surfactants and personal care formulations.

What is the projected value of the ethanolamines market by 2035?

The ethanolamines industry is expected to reach USD 6.2 billion by 2035, driven by expansion in gas treating applications, cleaning formulations, and infrastructure-led chemical consumption.

What is the current ethanolamines market size in 2026?

The market is projected to reach USD 4.3 billion in 2026 as demand increases from natural gas processing, detergents, and downstream chemical manufacturing.

Ethanolamines Market Scope

Related Reports