Summary

Table of Content

Erythritol Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Erythritol Market Size

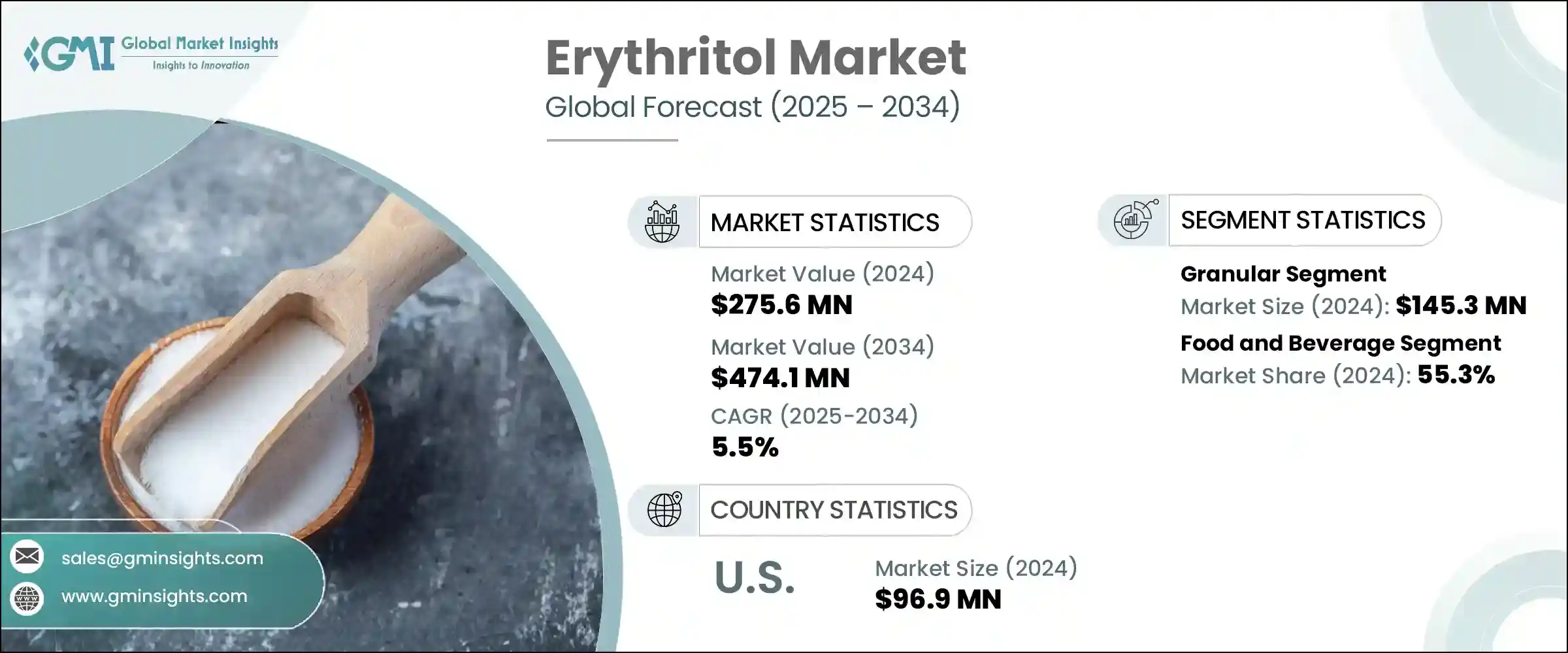

The global erythritol market size was estimated at USD 275.6 million in 2024. The market is expected to grow from USD 293.4 million in 2025 to USD 474.1 million by 2034, growing at a CAGR of 5.5%.

To get key market trends

The increasing global health awareness of consumers has led to a greater demand for low-calorie and sugar-free food products, and the market has seen significant growth in recent years as a result. Its widespread usage as a sugar substitute in foods and beverages, including baked goods, beverages, confectionery and many others, has increased its demand causing the market to grow immensely.

Erythritol Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 275.6 Million |

| Forecast Period 2025 – 2034 CAGR | 5.5% |

| Market Size in 2034 | USD 474.1 Million |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

In the previous decade, the erythritol market was on a steep rise as consumers were increasingly looking for healthier substitutions for sugar. The COVID-19 pandemic caused a major change in people’s thought processes, there was an increased consumption of erythritol due to the heightening awareness of obesity, diabetes, and various cardiovascular diseases.

Adopting erythritol as a non-caloric sweetener was especially noticed in Europe and North America where the consumers’ diversion towards sugar substitutes has aided the economy greatly.

Increasing utilization of erythritol in the emerging economies of Asia-Pacific and Latin America is expected to aid in the continuous growth of the market as these regions are expected to drive expansion over the coming years.

Therefore, the growth potential remains in view as it is expected for the market value increase to remain at a constant over the provided timeframe.

An increase in both natural and plant-based food components is additionally contributing to the growth of the erythritol market. Because erythritol is a naturally existing sugar alcohol which is contained in fruits, its employment by producers attempting to substitute natural for artificial sweeteners increases. Furthermore, the market for low calorie sugar sweeteners such as erythritol is greatly aided by the increasing popularity of ketogenic and low carbohydrate diets.

Erythritol Market Trends

Erythritol is a naturally existing sugar alcohol that is used as a low-calorie sugar substitute in several food and beverage products. This is great for health-conscious individuals striving to reduce their calorie intake because it offers sweetness without any calories.

Increasing demand for low-calorie and sugar-free food products: The erythritol market is experiencing strong growth due to rising demand for low-calorie and sugar-free alternatives, particularly in the food and beverage sector. The caloric and glycemic lags which are linked with traditional sugars make erythritol’s application in these succors effortless as it is a sugar alcohol with almost zero calories sweetening value. It is increasingly in use for beverages, confectionery, baked goods and even dairy products where taste and mouthfeel are essential.

Rising health consciousness among consumers: With the growing understanding of the relation of diet with chronic problems such as obesity, diabetes, and heart diseases, consumers are very careful about their nutritional choices. This has directly increased the need for functional ingredients like erythritol which provides the sweetness of sugar without the health issues that come with it. Unlike many other sugar substitutes, erythritol does not increase blood glucose or insulin levels, which is ideal for health-conscious individuals and the diabetic population.

Growth of plant-based and natural food ingredient trends: Another significant factor that propels the erythritol industry is the shift to plant-based and natural food products. Naturally sourced ingredients tend to attract consumers more than synthetic ones, as seen in the rejection of aspartame and saccharin sweeteners. Erythritol, which can be obtained through gluconic fermentation, fits this requirement perfectly. It is routinely combined with stevia or monk fruit to provide a completely natural sweetening system. The trend is quite visible in premium and organic products since they are more likely to use erythritol due to their pleasant taste and clean appeal.

Trade Impact

The erythritol market was notably affected by the Trump tariffs, especially the ones involving Chinese products under the Section 301 trade actions. Tariffs on imports of erythritol, a low-calorie sweetener China produces, increased in the U.S., making it costlier for American businesses. This lessened the competitiveness of Chinese products in the U.S. market and incentivized the boost in domestic production and increased imports from other countries like Indonesia and India. China’s decreased demand from the U.S. allowed to focus on other markets like India, EU, and Southeast Asia which resulted in increased global competition and lesser prices.

Domestic suppliers led to increase in costs of basic inputs leading to an increase in the cost of food products for those who manufactured using erythritol. Sourcing diversification was seen with importers, and some U.S. firms aggressively sought tariff exemptions. Untargeted by the tariffs India had a free reign to increase her exports to the U.S. and gain exports redirected from China which led to tough price competition for local producers as these imports were cheaper.

The 25% tariffs on imports from Canada and Mexico raised concerns on sweetener industry. However, most people thought that the ramifications for the sugar industry would most likely be negligible. The suspension agreements which govern trade between the U.S. and Mexico are sugar’s most important import Mexico’s trade agreement with Canada and the U.S., The U.S. corn syrup sweetener imports would be subject to some form of tariff, but that the sugar needs of the economy would cover the expected surplus.

As an example, China placed retaliatory tariffs on agricultural goods from the United States directly impacting the supplied goods for intermediaries such as corn severely disrupting the erythritol supply chain. Domestically and internationally, other countries countered measures on American products such as Canada and members of the EU not specifically targeting erythritol. All in all, the tariffs added expenses, changed trading and sourcing patterns, and altered the strategy across the crucial market areas.

Erythritol Market Analysis

The erythritol industry is undergoing multiple global trends and issues which are critical for its growth. A trend worth noting is the innovation in erythritol-based products as the manufacturer puts it into an increasing number of food and beverage products including but not limited to snacks, dairy, and spreading materials.

This broadening of the scope stems from the need of consumers to seek better and easier substitutes for sugars. Moreover, there is an increasing focus on clean label products where consumers prefer recognizable and natural ingredients, which also increases the appeal of erythritol since it comes from natural sources. One more important trend is the increases in investment towards research and development to increase the efficiency and ease of production of erythritol, thus making it more economically viable when compared to other sweeteners.

As consumers increasingly seek out products with lesser artificial additives and preservatives, the appeal of erythritol as a constituent of clean and natural ingredients is gaining prominence. Last but not the least, the use of sweeteners like erythritol is being encouraged by the governing bodies of different regions which further augments acceptance by the market.

Learn more about the key segments shaping this market

The erythritol market from granular segment was valued at USD 145.3 million in 2024, and it is anticipated to expand 5.6% of CAGR during 2025-2034.

Due to its flexibility and simplicity in a range of uses. In the food and beverage sector, granular erythritol is highly preferred because, like sugar, it has the same consistency and looks like sugar, qualifying its use as a sweetener in baked goods, beverages, and confectionery items. It stands to reason that this form is common in residential uses because it is readily measurable and mixable in recipes.

In addition, its undisclosed widespread acceptance in bulk manufacturing of low-calorie, sugar-free food items is very likely to have single handedly claimed the market. Erythritol's appeal is further enhanced by its adaptability as a granular bulk in diverse formulations: from powdered sweeteners to cook and bake sugar substitutes. Its primary and overwhelming ease of use is being thermally stabilized to a higher degree, which makes the product suitable for cooking and baking. This is the major reason why erythritol market will leads in the future.

Learn more about the key segments shaping this market

The food and beverage segment was valued at USD 152.4 million in 2024 and gained 5.7% CAGR from 2025 to 2034 with a market share of 55.3%.

In 2024, the erythritol market’s highest revenue comes from the food and beverage segment. This segment leads due to increasing sales of erythritol products stemming from the health-conscious and sugar-free treatment options offered. Erythritol sweeteners continue excelling in this category because of their sugar-like flavor, low glycemic index, and suitability for heat-intensive processes such as baking. Erythritol’s caloric stability under extreme conditions allows for cookies, cakes, and pastries, while its non-hygroscopic character helps retain textural moisture and prolong shelf-life.

Within confectionery, erythritol is commonplace in sugar-free polyols utilized in mints and gums along with chocolate, while also providing a gratifying cooling bonus that eases extra calories. Dairy manufacturers are subsequently increasingly adopting erythritol in flavored yogurts, puddings, and in ice creams as these products evolve to accommodate a calorie-controlled diet. As such, the clean-label shift alongside policy initiatives aimed at boosting the reduction of added sugars further enforces these constituents.

Moreover, manufacturers frequently incorporate erythritol into sweeteners like stevia to cover bitterness and improve taste without adding calories. The increase in the population of health-minded and diabetic consumers in both developed and emerging markets is fueling innovation with erythritol. Europe and North America continue to be primary markets for erythritol due to advanced demographic health trends, while the Asia-Pacific region is accelerating due to urban growth and shifts in eating patterns. In any case, this segment is expected to sustain leadership in the erythritol market both in volume and value for the next few years.

Looking for region specific data?

U.S. erythritol market was valued at USD 96.9 million in 2024 and expected to grow at a 5.5% CAGR from 2025-2034. Motivated by emerging customer interest regarding low-calorie and sugar-free consumables, an increased use of erythritol as a replacement for sugar especially in savory and dairy products. Furthermore, the realization of health risks related to sugar intake among the population, particularly regarding the use of erythritol, can be attributed to the augmentation of the sugar alternate industry.

In the United States, the largest country within North America, erythritol market share is driven by the regions of Northeast and West, due to their bulk purchasing power. The use of erythritol, especially in beverages, snacks, and processed foods, coupled with the already established demand caused by the region’s strong adoption of low-carb and ketogenic diets, contributes to expanding market growth. The North American region makes the most use of erythritol products which triggers more adjacent countries to progress in the sugar-free product market.

- For instance, the FDA began implementing reorganizations affecting various parts of the agency. The FDA reviewed a scientific paper on the cardiovascular effects of erythritol in 2023 and concluded that the observational studies did not establish a causal link between erythritol consumption and the observed effects. The FDA will continue to monitor and review new information on erythritol and other sweeteners as it becomes available.

Erythritol Market Share

The erythritol industry is fuelled by global participants including Cargill with a revenue of USD 160 billion in 2024, Tate & Lyle with a revenue of USD 2.2 billion, Jungbunzlauer Suisse AG with a revenue of USD 292.3 million, Foodchem International Corporation, Shandong Sanyuan Biotechnology with a revenue of USD 6.4 million in 2024. Each firm contributes their part towards the growth of the regional business.

In the context of the competitive landscape of the global erythritol market, Cargill and Tate & Lyle are some of the leading industry players which are in competition with each other and focus on a few parameters which should be strategically managed.

The price of the products offered remains a competitive factor, especially with consumers and manufacturers wanting to pay less for sweeteners without compromising on quality. These two companies take advantage of their broad supply chains because of economies of scale, enabling them to set lower prices.

Another important factor is product differentiation. Cargill and Tate and Lyle put a lot of their resources into R&D so that they could provide innovation and offer erythritol in different versions such as granulated or powdered erythritol or blends with other sweeteners. In addition, both companies focus on clean-label and wholesome markets which caters the healthier and clean labeled products.

- For instance, Tate and Lyle have commenced offering ERYTESSE Erythritol as sweeteners, following a strategic partnership with a major supplier. This initiative has been put in place to meet the growing demand for low sugar and low caloric products. Just like other products in the same category, Erythritol has a caloric value of zero, and is practically useable in all beverages, dairy products, baked goods and confectioneries as it is 70% as sweet as sucrose.

- Moreover, erythritol has a clean taste with bulking properties useful to many companies in preserving taste and texture during reformulation of products. This shifts market expectations to being more health-conscious and further reinforces Tate and Lyle's brand image in the competitive market of low-calorie sweeteners.

Distribution and availability are especially important in competition. Cargill, Tate, and Lyle set big global distribution networks. These networks cover North America, Europe, and Asia by reaching key markets. These two corporations additionally partner with food manufacturers, beverage companies, and retailers to access more markets for their erythritol products.

Erythritol Market Companies

Major players operating in the erythritol industry are:

- Cargill: Cargill has been recognized as one of the global leaders in erythritol and carotenoids business, marketing non-GMO, high purity erythritol under the brand Zerose. Using its solid distribution and R&D capabilities, the firm attends to food and beverage makers on a global scale.

- Tate & Lyle: Tate & Lyle North America markets erythritol as part of its sugar-reduction specialty sweetener line. The firm caters to the health and wellness trends in Europe, North America, and Asia by providing clean-labels solutions and supports them with tailored innovations.

- Jungbunzlauer Suisse AG: Cargill has been recognized as one of the global leaders in the erythritol and carotenoids business, marketing non-GMO, high purity erythritol under the brand Zerose. Using its solid distribution and R&D capabilities, the firm attends to food and beverage makers on a global scale.

- Foodchem International Corporation: Headquartered in China, Foodchem is an important supplier of erythritol for bulk buyers and private label companies. The firm has a foothold in both domestic and export markets and is especially strong in the Asia-Pacific region.

- Shandong Sanyuan Biotechnology: China's primary producers of erythritol, Shandong Sanyuan has a focus on large scale, low-cost production. The firm strongly benefits from increasing domestic and export demand, especially for erythritol used in keto and low sugar diets.

Erythritol Industry News

- In November 2024, Ingredion announced two strategic investments in India to expand its presence in high-value pharmaceutical applications. In the third quarter of 2022, Ingredion acquired Amishi Drugs & Chemicals, and in the fourth quarter, it secured a majority position in Mannitab Pharma Specialities. These investments enhanced Ingredion's specialty pharmaceutical portfolio, including erythritol, super disintegrants, lubricants, and mannitol, to better serve the rapidly growing Indian pharmaceutical market.

- In January 2024, Holiferm Limited and Sasol Chemicals expanded their collaboration to produce and market sustainable surfactants, including rhamnolipids and mannosylerythritol lipids (MELs). This partnership was built upon their March 2022 agreement to develop sophorolipids, using Holiferm’s fermentation technology to reduce carbon footprints in surfactant production. The companies aimed to commercialize these biosurfactants in various industries, including personal care and cleaning products.

- In November 2022, Tate & Lyle PLC introduced ERYTESSETM Erythritol as a new sweetener to its lineup. This addition strengthens Tate & Lyle's position as the global leader in ingredient solutions for healthier food and beverages and increases the company's ability to assist customers in meeting consumer demand for healthier, lower-sugar, and lower-calorie products

- In November 2022, Zhejiang Huakang Pharmaceutical Co. (Huakang Pharma) announced that its erythritol products were under evaluation by major customers, and due to market conditions, it was considering shifting part of its erythritol production capacity. The company also emphasized its focus on technology, product development, and overcoming industry challenges. Huakang Pharma continued to explore new technologies and products, such as crystalline fructose and allulose, while facing technical and regulatory barriers in the functional sugar alcohol industry.

This erythritol market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) & volume (Kilo Tons) from 2021 to 2034, for the following segments:

Market, By Form

- Powder

- Granular

- Liquid

Market, By Purity Level

- High Purity (≥99%)

- Standard Purity (95-98%)

- Others

Market, By Application

- Food and beverages

- Bakery & confectionery

- Beverages

- Dairy products

- Frozen desserts

- Others

- Pharmaceutical

- Tablets & capsules

- Syrups & suspensions

- Others

- Personal care and cosmetics

- Oral care products

- Skin care products

- Others

- Others

- Agricultural applications

- Industrial uses

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Argentina

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in erythritol industry?

Some of the major players in the industry include Baolingbao Biology Co., Ltd., Cargill, Inc., Changzhou Niutang Chemical Plant Co., Ltd., Foodchem International Corporation, Futaste Co., Ltd., Ingredion Incorporated, Jungbunzlauer Suisse AG, Mitsubishi Chemical Group Corporation, Nikken Chemical Co., Ltd., RAJVI ENTERPRISE, Shandong Sanyuan Biotechnology Co., Ltd., Tate & Lyle PLC, Xiwang Group, Zibo ZhongShi GeRui Biotech Co., Ltd.

What is the size of granular segment in the erythritol industry?

The granular segment generated over USD 145.3 million in 2024.

How much is the U.S. erythritol market worth in 2024?

The U.S. market of erythritol was worth over USD 96.9 million in 2024.

How big is the erythritol market?

The market size of erythritol was valued at USD 275.6 million in 2024 and is expected to reach around USD 474.1 million by 2034, growing at 5.5% CAGR through 2034.

Erythritol Market Scope

Related Reports