Home > Semiconductors & Electronics > Telecom and Networking > Telecom Hardware > Enterprise Networking Market

Enterprise Networking Market Analysis

- Report ID: GMI2978

- Published Date: Dec 2018

- Report Format: PDF

Enterprise Networking Market Analysis

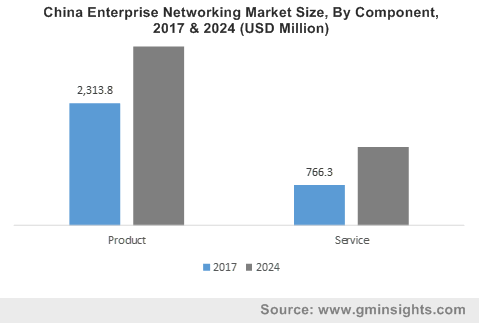

The product segment is expected to grow at a CAGR of above 2% over the forecast timeline due to a surge in the demand for networking products including switches, routers, and network management & security hardware components. In this segment, the switch segment is expected to hold a major market share of over 25% by 2024 as they are widely used to connect devices and networks, resulting in a single network of shared resources. Organizations are increasingly using managed network switches as they enable higher network flexibility and offer security to support greater network control.

The services segment is projected to have an accelerated growth rate of over 5% from 2018 to 2024 due to the growing need for services such as training & consulting, integration & maintenance, and managed services. The integration & maintenance services segment will hold a major portion of the market share as these services help service providers and enterprise customers to update, consolidate, and build dynamic networks for cloud NFV environments. As enterprise networks are becoming more complex, the need for system integration services will fuel interoperability in multi-vendor and multi-network environments.

The on-premise deployment model held a major portion of the enterprise networking market share in 2017 and is projected to dominate the market by 2024 with a share of over 65%. To effectively deploy network monitoring & management solutions, enterprises are adopting the on-premise deployment approach, providing better control over network resources and better security. Enterprises prefer keeping their data local to avoid cyber-attacks and data theft, supporting the adoption of on-premise network solutions.

The BFSI application segment is estimated to hold a market share of above 15% by 2024 due to the growing adoption of digital platforms and the rising number of hyper-connected networks. As the sector is witnessing a rapid transformation due to the increasing popularity of cloud computing and network virtualization technologies, the demand for network management & monitoring solutions has increased significantly to keep a track on data and device security. Banks and financial institutions are hence trying to implement cyber-security policies, making an appropriate network security approach to challenge cyber threats.

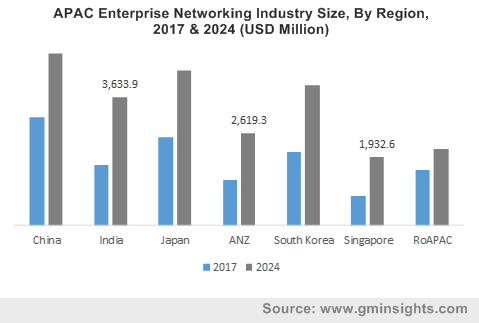

The Asia Pacific enterprise networking market is expected to grow at a CAGR of over 8% from 2017 to 2024 due to the increasing number of small-scale businesses embracing digital platforms, cloud computing, BYOD, and other networking technologies. For instance, in October 2017, China Unicom extended its partnership with Alibaba in cloud computing services in China. The adoption of cloud computing platforms has also enabled disparate network architectures that add on to the operational burden on enterprises. This will facilitate the need for network management solutions to improve network agility and flexibility. The growing adoption of digital technology by SME has also surged the demand for network security solutions to detect and prevent cyber threats. They are implementing measures, such as address system security flaws, in a timely manner by installing security devices to secure system connections.