Summary

Table of Content

Enterprise Networking Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Enterprise Networking Market Size

Enterprise Networking Market size estimated at over USD 62 billion in 2017, growing at a CAGR of 6% from 2018 to 2024.

To get key market trends

To get key market trends

The demand for enterprise networking market is expected to accelerate over the forecast timeline as enterprise networks are the backbones of all communications, improving data management. As organizations are rapidly embracing networking technologies, such as Software-Defined Networking (SDN), network virtualization, and cloud computing, the demand for these solutions will increase to ensure effective management of fixed & wireless devices and their security. The increasing proliferation of connected devices and the rising cyberattacks on networks are also driving the demand for robust network security solutions, enabling secure real-time communication. To ensure higher levels of network security, enterprises are adopting network security solutions including firewalls, intrusion detection systems, and anti-malware. The rise in smartphone adoption, the BYOD trend, and various government initiatives to speed up the digital transformation have accelerated the need for wired and wireless networking devices including switches, wireless routers, and secure web gateways.

Enterprise Networking Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2017 |

| Market Size in 2017 | 62 Billion (USD) |

| Forecast Period 2018 - 2024 CAGR | 6% |

| Market Size in 2024 | 90 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Enterprise Networking Market Analysis

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

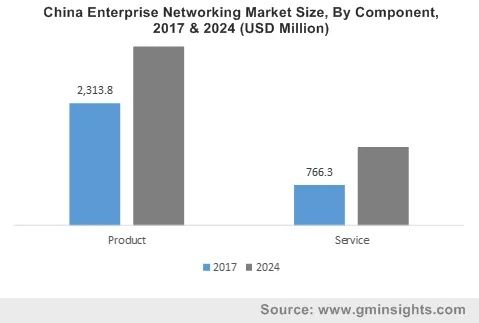

The product segment is expected to grow at a CAGR of above 2% over the forecast timeline due to a surge in the demand for networking products including switches, routers, and network management & security hardware components. In this segment, the switch segment is expected to hold a major market share of over 25% by 2024 as they are widely used to connect devices and networks, resulting in a single network of shared resources. Organizations are increasingly using managed network switches as they enable higher network flexibility and offer security to support greater network control.

The services segment is projected to have an accelerated growth rate of over 5% from 2018 to 2024 due to the growing need for services such as training & consulting, integration & maintenance, and managed services. The integration & maintenance services segment will hold a major portion of the market share as these services help service providers and enterprise customers to update, consolidate, and build dynamic networks for cloud NFV environments. As enterprise networks are becoming more complex, the need for system integration services will fuel interoperability in multi-vendor and multi-network environments.

The on-premise deployment model held a major portion of the enterprise networking market share in 2017 and is projected to dominate the market by 2024 with a share of over 65%. To effectively deploy network monitoring & management solutions, enterprises are adopting the on-premise deployment approach, providing better control over network resources and better security. Enterprises prefer keeping their data local to avoid cyber-attacks and data theft, supporting the adoption of on-premise network solutions.

The BFSI application segment is estimated to hold a market share of above 15% by 2024 due to the growing adoption of digital platforms and the rising number of hyper-connected networks. As the sector is witnessing a rapid transformation due to the increasing popularity of cloud computing and network virtualization technologies, the demand for network management & monitoring solutions has increased significantly to keep a track on data and device security. Banks and financial institutions are hence trying to implement cyber-security policies, making an appropriate network security approach to challenge cyber threats.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

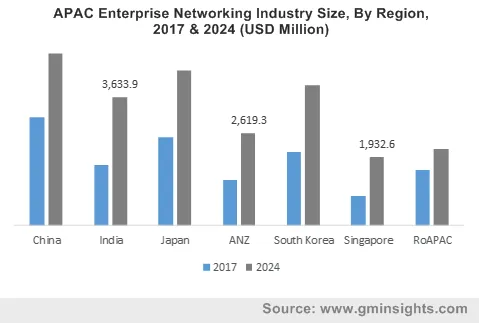

The Asia Pacific enterprise networking market is expected to grow at a CAGR of over 8% from 2017 to 2024 due to the increasing number of small-scale businesses embracing digital platforms, cloud computing, BYOD, and other networking technologies. For instance, in October 2017, China Unicom extended its partnership with Alibaba in cloud computing services in China. The adoption of cloud computing platforms has also enabled disparate network architectures that add on to the operational burden on enterprises. This will facilitate the need for network management solutions to improve network agility and flexibility. The growing adoption of digital technology by SME has also surged the demand for network security solutions to detect and prevent cyber threats. They are implementing measures, such as address system security flaws, in a timely manner by installing security devices to secure system connections.

Enterprise Networking Market Share

Some of the companies present in the market are involved in strategic partnerships to deliver new solutions to grab a major portion of the market share. In February 2017, Cisco and Ericsson extended their relationship to offer new NFV and cloud-based security services to service providers. It enabled their business customers to detect, protect, and respond faster to cyberattacks.

The companies are also involved in making continuous innovations in their existing offerings to deliver new & improved storage and networking solutions. This enables them to serve a much broader customer base. For instance, in April 2017, Broadcom introduced a new 100G ethernet multi-host controller to accelerate NFV, machine learning, and enterprise & cloud storage. The new BCM57454 NetXtreme E-Series combines a high bandwidth ethernet controller with hardware acceleration engines to improve network performance.

Some of the major companies operating in the enterprise networking market are

- Trend Micro

- Arista

- Broadcom

- Dell Technologies

- Netscout

- Extreme Networks

- F5 Networks

- FireEye

- Fortinet

- Cisco

- HPE

- Huawei

- Riverbed

- Juniper

- McAfee

- Checkpoint

- Palo Alto

- Symantec

- VMWare

Industry Background

The adoption of digital technologies has compelled organizations to keep pace with the changing business needs. Without an adaptable infrastructure, they are not able to manage their large and complex networks. This facilitated the adoption of enterprise networking solutions to realize the value of investments in networking systems and IT infrastructure. The proliferation of cloud computing and network virtualization technologies will also fuel the demand for such solutions to effectively manage heterogeneous enterprise networks.

Frequently Asked Question(FAQ) :

Which are the key players operating in the enterprise networking landscape?

Some of the major companies in the market are Trend Micro, Arista, Broadcom, Dell Technologies, Netscout, Extreme Networks, F5 Networks, FireEye, Fortinet, Cisco, HPE, Huawei, Riverbed, Juniper, McAfee, Checkpoint, Palo Alto, Symantec, and VMWare.

How will BFSI sector fare in the enterprise networking industry during the forecast period?

The BFSI application segment is estimated to hold a market share of above 15% by 2024 owing to increasing deployment of digital platforms and growing number of hyper-connected networks in the BFSI sector.

What are the growth forecasts for Asia Pacific enterprise networking market?

The Asia Pacific market is expected to grow at a CAGR of over 8% from 2017 to 2024 due to increasing number of small-scale businesses embracing digital platforms, cloud computing, BYOD, and other networking technologies.

What was the estimated global enterprise networking market size in 2017?

The market size of enterprise networking estimated at over USD 62 billion in 2017.

What is the anticipated growth for the enterprise networking industry share during the forecast period?

The industry share of enterprise networking is estimated to grow at a CAGR of 6% to 2024.

Enterprise Networking Market Scope

Related Reports