Home > Media & Technology > Information Technology > IT Software > Enterprise Mobility Management Market

Enterprise Mobility Management Market Analysis

- Report ID: GMI352

- Published Date: May 2020

- Report Format: PDF

Enterprise Mobility Management Market Analysis

In Germany, the software component held more than 75% of the enterprise mobility management market share in 2019 and is predicted to exhibit a steady growth through 2026. The reduction in device-leasing costs for enterprises in Germany as their employees work on personal devices has accentuated the demand for enterprise mobility solutions. Mobile Device Management (MDM) is also gaining traction across the country as enterprises are increasingly adopting MDM solutions to secure crucial enterprise data on employee devices and provide streamlined access to enterprise digital resources over residential networks.

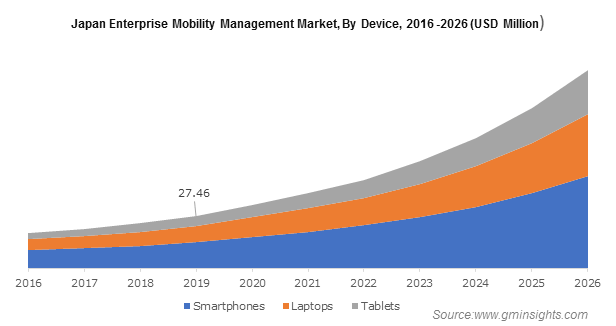

The smartphones segment in Japan captured around 50% of the enterprise mobility market revenues in 2019 led by shifting preference of regional enterprises toward BYOD practices on smartphones. Modern smartphones offer robust computing performance for low-resource intensive tasks and their high portability ensures that employees stay connected anywhere. In March 2020, leading Japanese corporates including Sony and Toyota had already enforced an enterprise-wide BYOD policy to streamline work-from-home.

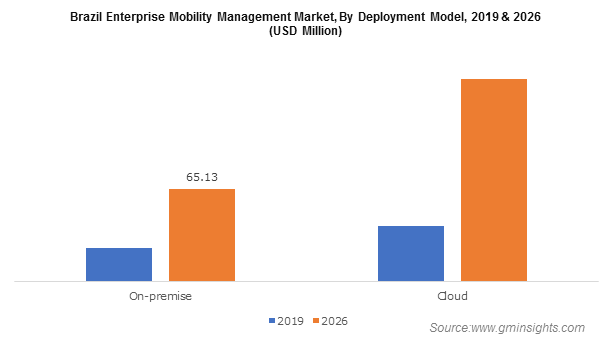

In Brazil, the on-premise segment is set to attain a CAGR of around 15% through 2026 driven by the increasing concern over enterprise data security and strict compliance laws. On-premise solutions securely enable workforce mobility while ensuring that corporate data is secured and in compliance with all industry regulations. Moreover, the increasing use of data-at-rest encryption practices for on-premise data has created new market opportunities.

In the U.S., the IT & telecom application accounted for above 30% of the enterprise mobility management market revenue share in 2019 impelled by the rising awareness of the usage of enterprise mobility tools to complement the capabilities of unified communications and collaboration systems. IT service providers in the U.S. are increasingly shifting toward mobile devices and IP-based instant messenger facilities to counter dynamic market conditions and address evolving customer requirements.

Telecom enterprises are also under considerable pressure to invest in future technologies, with strong emphasis on flexible workforce mobility and better customer service in a competitive market. Enterprise mobility and digital workplace practices are assisting the U.S. telecom enterprises to offer innovative value-added services.

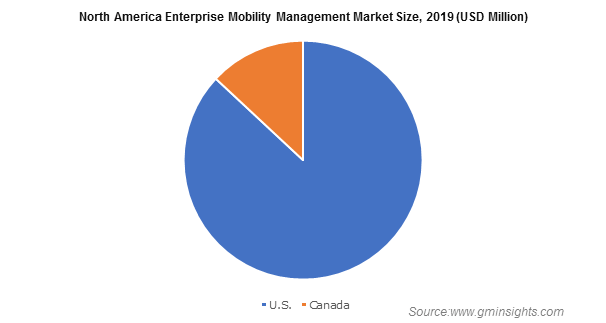

North America enterprise mobility management market size garnered a significant portion with over 35% share in 2019. The regional market is characterized by the presence of major solution providers including IBM, Google, Cisco, Honeywell, and Oracle. However, the growing market penetration of smartphones for business activities in Canada in the wake of COVID-19 situation has accentuated the demand.

SME in North America are rapidly adopting enterprise mobility solutions to reduce the cost of device ownership and to promote flexible working culture for better team collaboration. This is another major factor contributing to the expanding market presence of enterprise mobility technologies in the region.