Summary

Table of Content

Endotherapy Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Endotherapy Devices Market Size

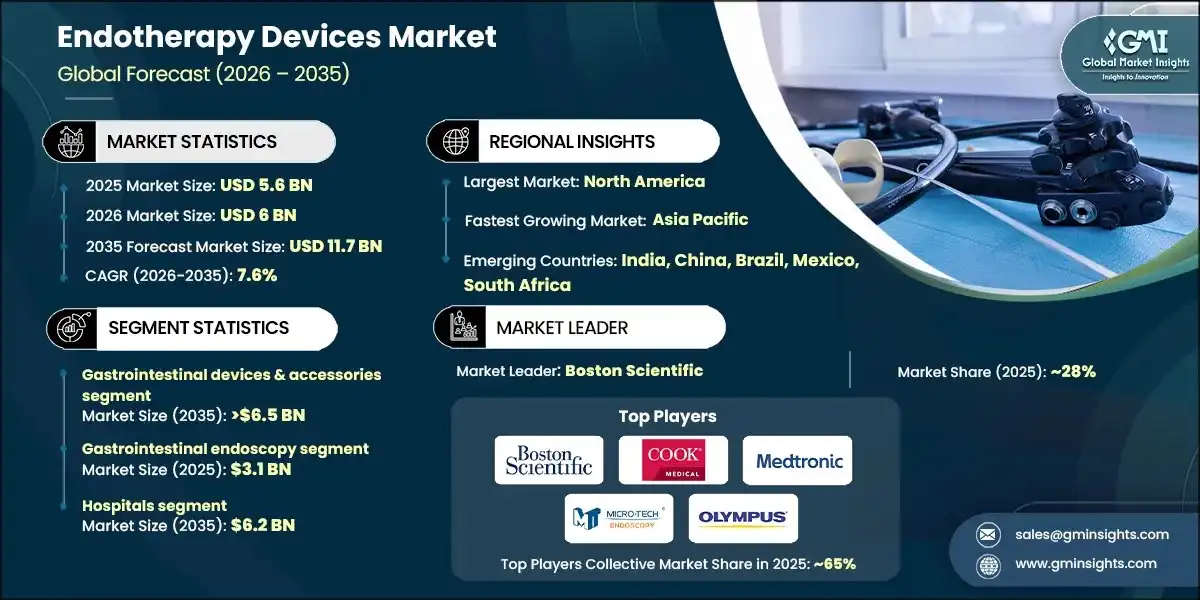

The global endotherapy devices market was valued at USD 5.6 billion in 2025. The market is expected to reach from USD 6 billion in 2026 to USD 11.7 billion in 2035, growing at a CAGR of 7.6% during the forecast period, according to the latest report published by Global Market Insights Inc. The high market growth is attributed to the rising preference for minimally invasive procedures, technological advancements in endoscopic and therapeutic devices, and expansion of ambulatory surgical centers (ASCs), among other contributing factors.

To get key market trends

Endotherapy devices are surgical instruments used in endoscopic treatments that use small incisions or natural body holes to detect and cure inside disorders. They make it possible to perform minimally invasive therapeutic procedures such ablation, dilation, hemostasis, tissue removal, and stenting.

The major players in the global endotherapy devices market are Boston Scientific, Cook Medical, Medtronic, MICRO-TECH, and OLYMPUS. These companies maintain their competitive position through ongoing product innovation, global market presence, and substantial investment in research and development.

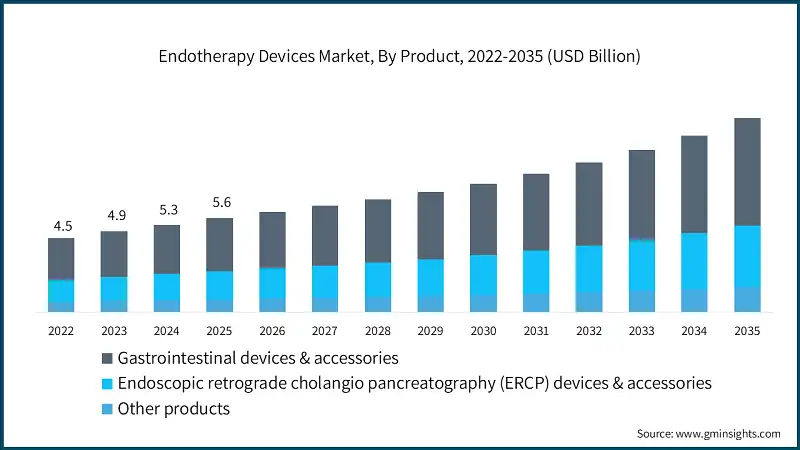

The market has increased from USD 4.5 billion in 2022 and reached USD 5.3 billion in 2024, with the historic growth rate of 8.7%. The market growth was driven by the expansion of therapeutic endoscopy beyond diagnostics, increasing hospital and ambulatory surgical center investments in advanced endoscopic infrastructure, rising procedural volumes supported by favourable clinical outcomes, and improved physician preference for endoscopic interventions over open surgeries.

Moreover, procedural volumes are surging, fuelled by the rising incidence of GI cancers, kidney stones, benign prostatic hyperplasia, and chronic respiratory diseases. For instance, according to the World Health Organization (WHO), gastrointestinal cancers accounted for approximately 26% of global cancer cases in 2021, with a projected annual increase of 2.4% through 2025.

Similarly, the National Kidney Foundation reported that over 500,000 people in the U.S. were visited the emergency room for kidney stones in 2022, with cases expected to rise due to dietary and lifestyle factors. In addressing these ailments, endotherapy devices play a pivotal role in both diagnosis and treatment.

Furthermore, continuous innovation in high-definition imaging, flexible endoscopes, robotic-assisted systems, and advanced energy-based tools is improving precision and safety. These advancements expand the therapeutic scope of endotherapy, allowing complex interventions that previously required open surgery. Technology-driven upgrades also stimulate replacement demand.

Endotherapy Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 5.6 Billion |

| Market Size in 2026 | USD 6 Billion |

| Forecast Period 2026-2035 CAGR | 7.6% |

| Market Size in 2035 | USD 11.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising prevalence of gastrointestinal disorders | This factor is significantly increasing procedural demand for therapeutic endoscopy, directly boosting utilization of endotherapy devices across hospitals and specialty GI centers. |

| Growing demand for minimally invasive procedures | Preference for minimally invasive interventions is accelerating adoption of endotherapy devices due to shorter recovery times, lower complication rates, and reduced healthcare costs. |

| High volume of endoscopic procedures | The consistently rising number of diagnostic and therapeutic endoscopies is sustaining steady sales of endotherapy accessories and consumables, supporting recurring market revenue. |

| Technological advancements in endoscopic devices | Ongoing innovations in precision, safety, and device functionality are expanding clinical applications and encouraging healthcare providers to upgrade to advanced endotherapy systems. |

| Pitfalls & Challenges | Impact |

| High cost of advanced endotherapy devices | Elevated capital and consumable costs are limiting adoption among cost-sensitive healthcare facilities, particularly in emerging and underfunded markets. |

| Risk of procedure-related complications | Concerns around bleeding, perforation, and infection continue to restrict wider procedural adoption and necessitate skilled operators, moderating overall market growth. |

| Opportunities: | Impact |

| Increasing adoption of single-use endotherapy devices | This trend is expected to drive future market growth by reducing cross-contamination risks, lowering reprocessing costs, and increasing acceptance across hospitals and ambulatory surgical centers. |

| Integration of robotics and AI in endotherapy | The incorporation of robotics and AI is projected to enhance procedural precision, clinical outcomes, and workflow efficiency, accelerating adoption of advanced endotherapy solutions and expanding their therapeutic scope. |

| Market Leaders (2025) | |

| Market Leaders |

~ 28% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, China, Brazil, Mexico, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Endotherapy Devices Market Trends

The market is growing considerably with the integration of advanced imaging technologies, adoption of robotic and AI-assisted endotherapy, and rise in single-use and disposable endoscopic devices, among other factors collectively driving industry growth.

- Endotherapy systems are becoming more advanced with high-resolution imaging, narrow-band imaging (NBI), and increased visualization features. These enhancements enable clinicians to spot lesions and deliver precise therapeutic interventions. Enhanced imaging improves patient outcomes and diagnostic confidence.

- Single-use endotherapy instruments are gaining popularity due to infection control and sterilization issues with reusable devices. These disposables help to reduce cross-contamination and turnaround time between procedures. Although the cost per procedure may increase, safety benefits promote adoption in many hospital settings.

- Furthermore, endotherapy is extending into urology, pulmonology, and cardiovascular interventions, broadening its clinical footprint. Devices are now optimized for treatments like stone extraction, tumor ablation, and airway management. This cross-specialty adoption increases device demand and market diversity, thereby sustaining market growth.

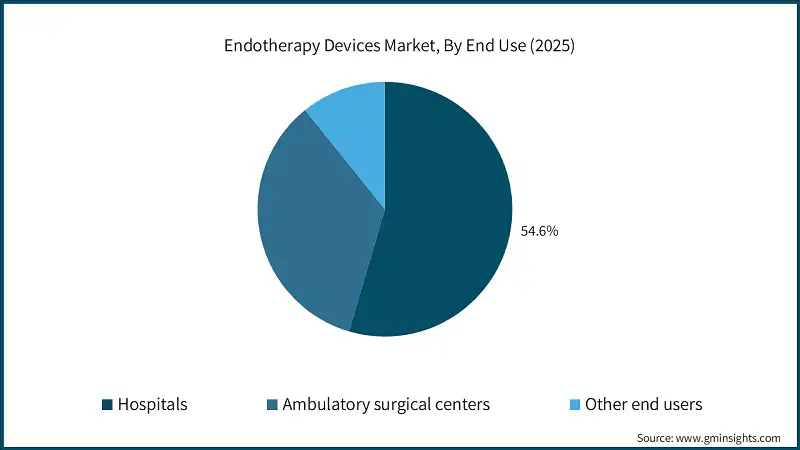

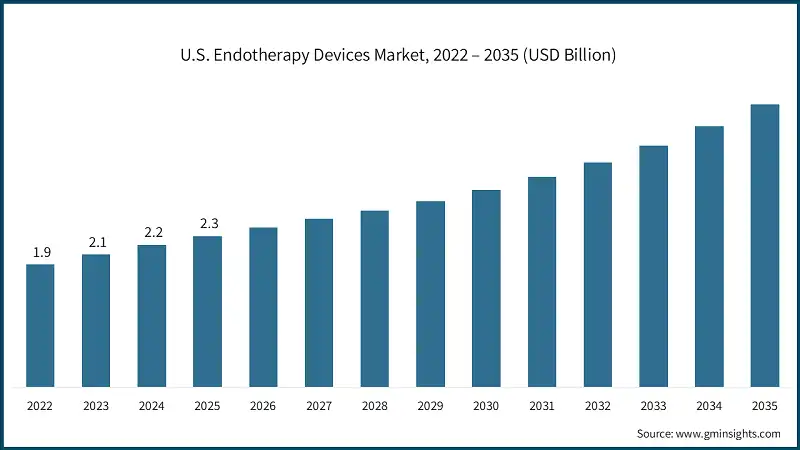

Endotherapy Devices Market Analysis Based on product, the endotherapy devices market is segmented into gastrointestinal devices & accessories, endoscopic retrograde cholangiopancreatography (ERCP) devices & accessories, and other products. The gastrointestinal devices & accessories segment has asserted its dominance in the market by securing a significant market share of 56.4% in 2025 owing to the high volume of GI endoscopic procedures, widespread use of therapeutic accessories in routine interventions, and the rising prevalence of gastrointestinal disorders globally. The segment is expected to exceed USD 6.5 billion by 2035, growing at a CAGR of 7.4% during the forecast period. On the other hand, the endoscopic retrograde cholangiopancreatography (ERCP) devices & accessories segment is expected to grow with a CAGR of 8.3%. The growth of this segment is driven by the increasing incidence of biliary and pancreatic disorders, rising preference for minimally invasive ERCP procedures over surgical alternatives, and continuous advancements in stents, guidewires, and sphincterotomy devices. Based on application, the endotherapy devices market is segmented into gastrointestinal endoscopy, laparoscopy, arthroscopy, urology endotherapy, bronchoscopy, and other applications. The gastrointestinal endoscopy segment dominated the market in 2025, accounting for USD 3.1 billion and is anticipated to grow at a CAGR of 7.9% during the forecast period. Based on end use, the endotherapy devices market is classified into hospitals, ambulatory surgical centers, and other end users. The hospitals segment dominated the market with a revenue share of 54.6% in 2025 and is expected to reach USD 6.2 billion within the forecast period. North America dominated the global market with the highest market share of 43.9% in 2025. Europe market accounted for USD 1.3 billion in 2025 and is anticipated to show lucrative growth over the forecast period. The Asia Pacific market is anticipated to grow at the highest CAGR of 9% during the analysis timeframe. The Latin America market is experiencing robust growth over the analysis timeframe. The Middle East & Africa market is experiencing robust growth over the analysis timeframe. The global market is moderately consolidated, characterized by the presence of large multinational medical device companies alongside a growing number of regional and niche players. Leading companies compete on the basis of broad product portfolios, technological innovation, global distribution networks, and strong relationships with hospitals and physicians. Continuous investment in R&D and clinical validation remains a critical factor for sustaining competitive advantage. Key players include Boston Scientific, Cook Medical, Medtronic, MICRO-TECH, and OLYMPUS, collectively accounting for ~65% of the total market share. These companies focus on expanding their therapeutic endoscopy offerings through new product launches, portfolio expansions, and regulatory approvals. Strategic initiatives such as mergers, acquisitions, partnerships, and geographic expansion particularly in Asia Pacific and emerging markets are intensifying competition. Smaller players compete by offering cost-effective solutions, single-use accessories, and specialized devices tailored to specific clinical applications, increasing overall market dynamism. A few of the prominent players operating in the endotherapy devices industry include: Its comprehensive endotherapy portfolio spanning GI, biliary, and urology therapeutic solutions, backed by strong clinical evidence and dedicated physician training programs. Their focus on innovation and procedural efficiency enhances clinical outcomes and reinforces long-term customer loyalty globally. OLYMPUS stands out with its market-leading imaging systems and integrated endoscopy platforms that deliver superior visualization and precision, strengthening the performance of endotherapy devices. Extensive global sales and service networks further ensure strong after-sales support and widespread clinical adoption. Cook Medical’s deep expertise in minimally invasive technologies, particularly in niche segments like ERCP, biliary stenting, and therapeutic accessories that combine reliability with procedural versatility. Their emphasis on customizable solutions and long-standing clinician partnerships supports strong penetration in specialized endotherapy applications. Learn more about the key segments shaping this market

Learn more about the key segments shaping this market Learn more about the key segments shaping this market

Learn more about the key segments shaping this market Looking for region specific data?

Looking for region specific data?North America Endotherapy Devices Market

Europe Endotherapy Devices Market

Asia Pacific Endotherapy Devices Market

Latin America Endotherapy Devices Market

Middle East & Africa Endotherapy Devices Market

Endotherapy Devices Market Share

Endotherapy Devices Market Companies

Endotherapy Devices Industry News:

The endotherapy devices market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 – 2035 for the following segments:

Market, By Product

- Gastrointestinal devices & accessories

- Biopsy forceps

- Single-use biopsy forceps

- Reusable biopsy forceps

- Hot biopsy forceps

- Injection needles

- EUS-guided FNA (fine needle aspiration) needles

- EUS-guided FNB (fine needle biopsy) needles

- Other injection needles

- Endoscopic submucosal dissection (ESD) knives

- Needle-tipped knives

- Insulation-tipped knives

- Polypectomy snares

- Hemoclips

- Graspers

- Hemostasis forceps

- Sclerotherapy needles

- Other gastrointestinal devices & accessories

- Biopsy forceps

- Endoscopic retrograde cholangiopancreatography (ERCP) devices & accessories

- Metal stents

- Sphincterotome

- Guide wire

- Catheter

- Guiding catheter

- Dilation catheter

- Drainage catheter

- Other catheters

- Plastic stents

- Balloon dilation

- Extraction basket

- Extraction balloon

- Other ERCP devices & accessories

- Other products

Market, By Application

- Gastrointestinal endoscopy

- Laparoscopy

- Arthroscopy

- Urology endotherapy

- Bronchoscopy

- Other applications

Market, By End Use

- Hospitals

- Ambulatory surgical centers

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the global endotherapy devices market?

Prominent players include B. Braun, Boston Scientific, CONMED, Cook Medical, Endo-Med, FUJIFILM, Johnson & Johnson, KARL STORZ, and M.I. Tech.

Which end-use segment dominated the global endotherapy devices market in 2025?

The hospitals segment dominated the market with a revenue share of 54.6% in 2025 and is expected to reach USD 6.2 billion during the forecast period.

Which region led the global endotherapy devices market in 2025?

North America led the market with the highest share of 43.9% in 2025, driven by advanced healthcare infrastructure and high adoption of innovative technologies.

What are the key trends in the global endotherapy devices industry?

Key trends include the integration of advanced imaging technologies, adoption of robotic and AI-assisted endotherapy, and the increasing use of single-use and disposable endoscopic devices to address infection control concerns.

What is the projected size of the endotherapy devices market in 2026?

The market is projected to reach USD 6 billion in 2026, continuing its growth trajectory.

What was the market share of the gastrointestinal devices & accessories segment in 2025?

The gastrointestinal devices & accessories segment held a significant market share of 56.4% in 2025, driven by the high volume of GI endoscopic procedures and the rising prevalence of gastrointestinal disorders globally.

What was the valuation of the gastrointestinal endoscopy application segment in 2025?

The gastrointestinal endoscopy segment was valued at USD 3.1 billion in 2025 and is anticipated to grow at a CAGR of 7.9% during the forecast period.

What is the projected value of the endotherapy devices market by 2035?

The market is expected to reach USD 11.7 billion by 2035, fueled by advancements in imaging technologies, adoption of robotic and AI-assisted endotherapy, and increasing demand for single-use devices.

What was the market size of the endotherapy devices market in 2025?

The market size was valued at USD 5.6 billion in 2025, with a CAGR of 7.6% expected during the forecast period, driven by the rising preference for minimally invasive procedures, technological advancements, and the expansion of ambulatory surgical centers (ASCs).

Endotherapy Devices Market Scope

Related Reports