Summary

Table of Content

Endoscope Reprocessing Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Endoscope Reprocessing Market Size

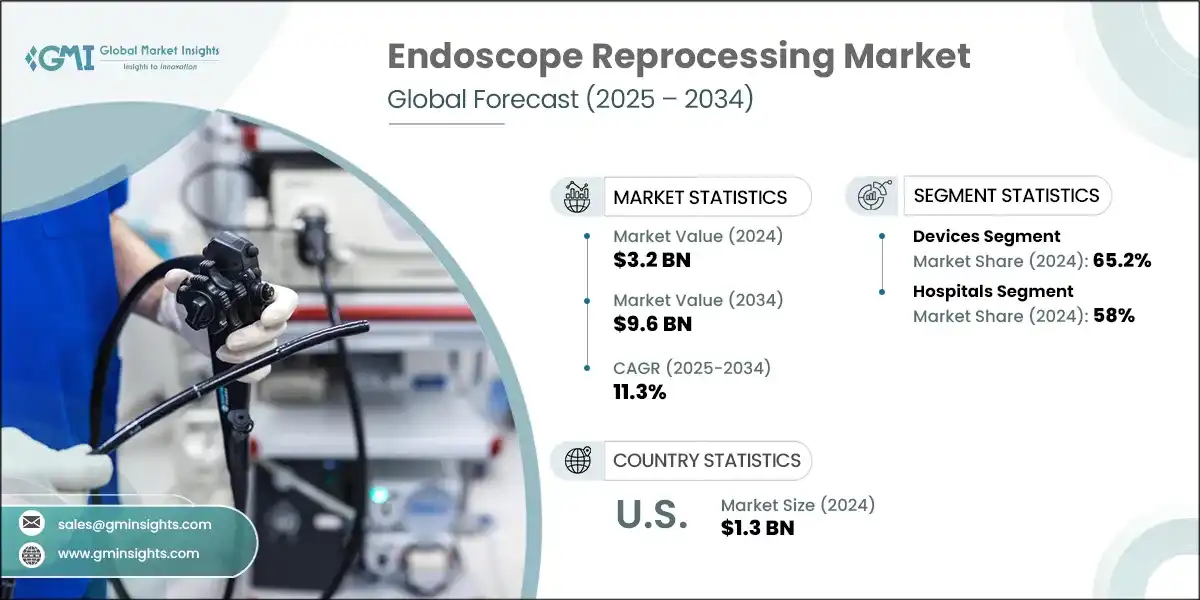

The global endoscope reprocessing market was estimated at USD 3.2 billion in 2024. The market is expected to grow from USD 3.7 billion in 2025 to USD 9.6 billion in 2034, growing at a CAGR of 11.3%. This high growth is attributed to several factors, including rising preferences for minimally invasive procedures, and increasing prevalence of GI disorders, cancer, and increasing demand for endoscopy procedures.

To get key market trends

Endoscope reprocessing is the detailed procedure used to clean and disinfect reusable endoscopes after each patient use to ensure they are safe for the next procedure. The key players in the market are CONMED Corporation, STERIS, Steelco, Ecolab, and Getinge.

The market grew from USD 2.4 billion in 2021 to USD 2.9 billion in 2023. This growth was primarily driven by several transformative trends. The increasing reliance on minimally invasive techniques has played a major role in boosting the use of endoscopes across various medical procedures. This shift, coupled with the growing popularity of outpatient care and the rise of ambulatory surgical centers, has created a pressing need for dependable systems that can clean and prepare endoscopic equipment quickly and thoroughly.

The growing incidence of gastrointestinal disorders, cancer, and other health conditions that require diagnostic and therapeutic endoscopic procedures is a key factor fueling the expansion of the endoscope reprocessing market. For instance, a 2024 report by the American Society of Anesthesiologists noted that around 6.1 million upper endoscopies are conducted each year in the U.S. As endoscopic procedures become more common for both diagnostic and interventional purposes, the need for effective and efficient reprocessing of endoscopes and accessories also increases.

Moreover, the focus on effective reprocessing of endoscopes is driven by the need to enhance patient safety and reduce the risk of healthcare-acquired infections (HAIs). Regulatory bodies and organizations issue stringent guidelines to ensure the reliability of reprocessing procedures. With the rise of multidrug-resistant pathogens and increased scrutiny on infection control, thorough cleaning, disinfection, and validation processes are essential.

Endoscope reprocessing refers to the endoscopy devices that are intended to be inserted into the body during minimally invasive endoscopic procedures for examination, diagnosis, or therapeutic purposes.

Endoscope Reprocessing Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.2 Billion |

| Forecast Period 2025 – 2034 CAGR | 11.3% |

| Market Size in 2034 | USD 9.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for endoscopy procedures | Boosts the need for efficient and scalable endoscope reprocessing solutions to meet rising procedural volumes |

| Technological advancements in endoscope reprocessing | Drives innovation in automated and high-level disinfection systems, improving safety and compliance |

| Rising preferences for minimally invasive procedures | Elevates the frequency of endoscope use, intensifying demand for reliable and rapid reprocessing methods. |

| Increasing prevalence of GI disorders, cancer, and other chronic ailments | Expands the patient pool requiring endoscopic diagnostics, thereby increasing the load on reprocessing infrastructure. |

| Pitfalls & Challenges | Impact |

| Adverse effects of chemical disinfectants | Raises safety concerns for healthcare workers and patients, prompting demand for safer, eco-friendly alternatives. |

| High cost of endoscope reprocessing devices | Limits adoption in low-resource settings, hindering market penetration and scalability. |

| Opportunities: | Impact |

| Rising awareness of infection control | Drives demand for advanced reprocessing systems to ensure patient safety and regulatory compliance. |

| Growth in healthcare infrastructure | Expands market potential by increasing the installation of endoscopy units and associated reprocessing facilities. |

| Market Leaders (2024) | |

| Market Leaders |

21% market share |

| Top Players |

Collective Market Share in 2024 is 48% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, Indonesia, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Endoscope Reprocessing Market Trends

In recent years, there have been major breakthroughs in how endoscopes are cleaned, sterilized, and maintained, owing to evolving technologies that have completely reshaped the reprocessing process.

- Automated endoscope reprocessors (AERs) delivers consistent and reliable decontamination. These systems reduce the risk of human error by using a standardized process that combines strong disinfectants with mechanical operations. For instance, ASP AEROFLEX AER, which stands out for its rapid cycle time and ability to disinfect flexible semi-critical endoscopes efficiently.

- Additionally, these systems boosts productivity and supports compliance with safety standards. One of its key features is the AUROSURE MRC monitor, which automatically checks the minimum required concentration of disinfectant and provides clear pass/fail results, removing the need for manual checks. These innovations not only raise safety and regulatory standards but also simplify the reprocessing workflow.

- Additionally, the introduction of endoscope drying and storage cabinets has addressed the issue of moisture, which serves as a breeding ground for microbes. Products such as the EDC Plus drying and storage cabinet by Olympus incorporate advanced features such as HEPA filter air circulation systems. These cabinets provide controlled environments that ensure thorough drying of endoscopes, preventing microbial growth associated with residual moisture. They also offer secure storage conditions that maintain endoscope sterility until the next use. The use of these cabinets reduces the risk of contamination, enhances operational efficiency, and extends the lifespan of the endoscopes, making them a valuable addition to the reprocessing workflow.

- Furthermore, modern endoscope reprocessing equipment can integrate with hospital information system (HIS). This integration allows for seamless data transfer, improving tracking, scheduling, and inventory management. Enhanced connectivity and interoperability streamline operations and improve the overall efficiency of endoscope reprocessing departments. As technology continues to advance, it is expected to play an increasingly important role in shaping the future of endoscope reprocessing.

Endoscope Reprocessing Market Analysis

Learn more about the key segments shaping this market

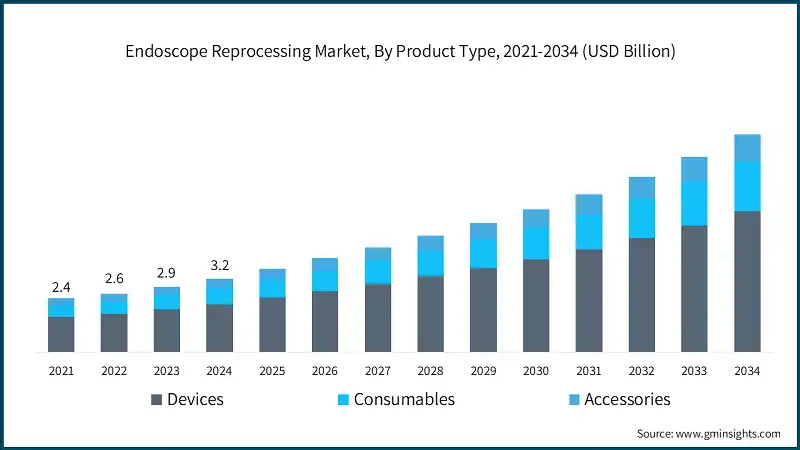

The global market was valued at USD 2.4 billion in 2021. The market size reached USD 2.9 billion in 2023, from USD 2.6 billion in 2022.

Based on the product type, the endoscope reprocessing market is segmented into devices, consumables, and accessories. The devices segment accounted for 65.2% of the market in 2024 due to its high utility, technological innovation, and ability to support complex endoscope reprocessing. The segment is expected to exceed USD 6.2 billion by 2034, growing at a CAGR of 11.2% during the forecast period. On the other hand, the consumables segment is expected to grow with a CAGR of 11.7%. The growth of this segment can be attributed to increasing demand for specialized tools and components that support endoscopic procedures. Similarly, the accessories segment is expected to grow at a CAGR of 10.9% over the forecast timeframe.

- Continuous innovation and advancements in endoscope reprocessing devices drive market growth by improving efficiency, efficacy, and safety. Manufacturers invest in research and development to introduce new technologies, features, and functionalities that enhance cleaning performance, automate reprocessing workflows, and ensure compliance with regulatory standards.

- Furthermore, the push toward automation and robotics in endoscope reprocessing is steadily gaining momentum. Automated endoscope reprocessors (AERs) are becoming increasingly popular because they help standardize cleaning and disinfection, reduce the chances of human error, and enhance overall efficiency.

- Moreover, manufacturers are actively introducing new products with advanced features to remain competitive and uphold stringent standards of patient safety. For instance, in June 2023, Olympus unveiled its latest innovation, the ETD washer-disinfector. Representing the newest addition to the company's infection prevention portfolio, the ETD Basic and ETD Premium models were designed to enhance cleaning and disinfection outcomes while promoting sustainability and operational efficiency in endoscope reprocessing.

Learn more about the key segments shaping this market

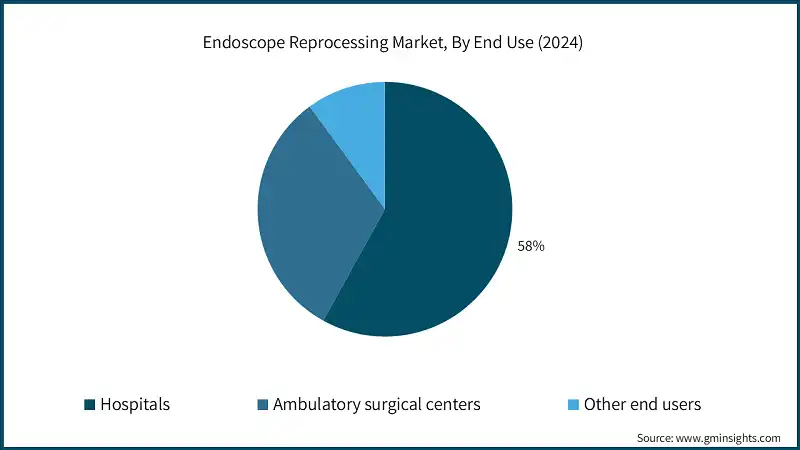

Based on the end use, the endoscope reprocessing market is segmented into hospitals, ambulatory surgical centers, and other end users. The hospitals segment accounted for the highest market share of 58% in 2024, owing to their high patient volumes and the growing need for advanced medical equipment and infection control measures.

- The infection risk associated with high-level disinfected endoscopes remains a significant concern for hospitals, necessitating stringent adherence to reprocessing best practices. Hospitals must ensure that their staff are thoroughly trained in general infection control principles and are consistently implementing these practices to minimize the risk of healthcare-associated infections (HAIs).

- Furthermore, to enhance reprocessing reliability and documentation, hospitals are increasingly adopting endoscope tracking systems. These advanced systems utilize RFID technology and artificial intelligence to monitor and document each step of the endoscope reprocessing cycle electronically. By integrating these systems into their workflows, hospitals can ensure that each endoscope is reprocessed correctly before its next use, providing an additional layer of verification.

- The ambulatory surgical centers segment, pulmonary segment, held a market share of 31.9% in 2024. ASCs perform a growing number of outpatient endoscopic procedures due to their cost-effectiveness and convenience. The rising prevalence of minimally invasive surgeries (MIS) and diagnostic procedures requires efficient and reliable endoscope reprocessing solutions to manage the high turnover of equipment between patients.

- Other end users of endoscope reprocessing solutions, including specialty clinics, diagnostic centers, and research institutions, collectively contributed to a growing share of 10.1% in the endoscope reprocessing market in 2024. These facilities often conduct high volumes of specific endoscopic procedures, necessitating reliable and efficient reprocessing solutions to ensure quick turnaround times and maintain high standards of patient safety.

Looking for region specific data?

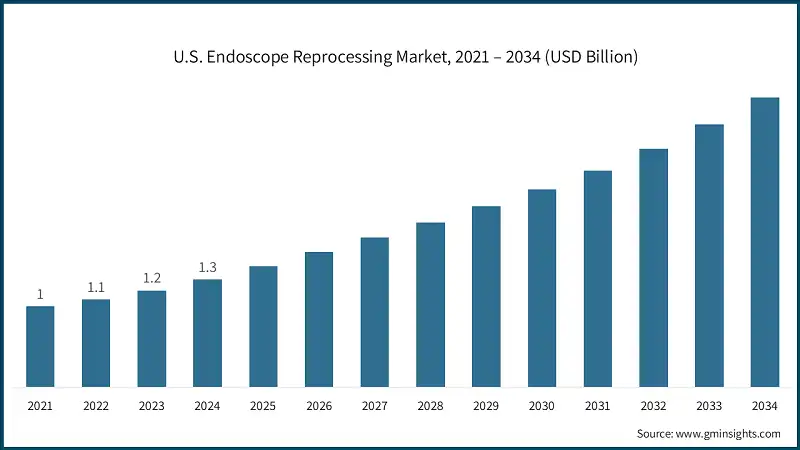

North America dominated the global endoscope reprocessing market with the highest market share of 44.1% in 2024.

- The U.S. market was valued at USD 1 billion and USD 1.1 billion in 2021 and 2022, respectively. In 2024, the market size grew to USD 1.3 billion from USD 1.2 billion in 2023.

- North America’s dominance in the market is driven by several region-specific factors, most notably the high prevalence of chronic diseases that require endoscopic interventions. For instance, according to the Centers for Disease Prevention (CDC), approximately 129 million individuals in the U.S. suffer from at least one major chronic condition.

- Moreover, governments in the region are increasingly prioritizing the improvement of healthcare infrastructure and patient safety. Initiatives and funding directed towards enhancing infection control measures and healthcare quality further bolster the growth of the endoscope reprocessing market.

- Lastly, North America benefits from a robust healthcare system, favorable reimbursement policies, and the presence of leading pharmaceutical and MedTech innovators such as STERIS, Olympus, and ASP. The region is also experiencing increased regulatory support from the FDA for innovative endoscope reprocessing devices.

Europe endoscope reprocessing market accounted for USD 795.8 million in 2024.

- The region’s manufacturers and healthcare providers are increasingly adopting advanced technologies such as automated reprocessors, high-level disinfection systems, and single-use devices.

- These innovations enhance the efficiency, safety, and reliability of endoscope reprocessing, thereby driving market growth. Moreover, key players in this region are focusing on adopting organic growth strategies such as product launches to strengthen their position in the market.

- Germany is expected to experience significant growth over the forecast period due to its strong manufacturing base, aging population, and increased investment in infection control.

- Furthermore, rising healthcare expenditure often translates into increased investment in healthcare infrastructure, including hospitals, clinics, and outpatient facilities.

- According to Eurostat data from 2021, healthcare expenditure in Europe amounted to around USD 1,895 billion, accounting for approximately 8.1% of the total GDP. This increased healthcare expenditure has enhanced the purchasing capabilities of several hospitals and improved service quality across healthcare facilities.

The Asia Pacific endoscope reprocessing market is anticipated to grow at the highest CAGR of 13% during the analysis timeframe.

- Countries such as India, China, Thailand, and Singapore are emerging as popular destinations for medical tourism. Patients from around the world travel to these countries to access high-quality and affordable healthcare services, including endoscopic procedures. The influx of medical tourists creates additional demand for endoscope reprocessing services in healthcare facilities catering to international patients, thereby stimulating market growth.

- Moreover, the endoscope reprocessing market in China is experiencing growth driven by the expansion of manufacturing facilities by key players. These expansions are crucial for meeting the increasing demand for advanced reprocessing solutions and ensuring the availability of high-quality equipment.

- These developments underscore the region's significant potential for market expansion and the strategic initiatives undertaken by key players to capitalize on emerging opportunities.

Latin America endoscope reprocessing market is anticipated to record robust growth throughout the forecast period.

- Economic growth in several Latin American countries has led to higher disposable incomes and increased healthcare expenditure. As individuals and governments allocate more resources to healthcare, there is a greater demand for advanced medical procedures, including endoscopy, and consequently, an increased need for effective endoscope reprocessing systems.

- Additionally, the rising prevalence of gastrointestinal disorders within the population, coupled with the availability of affordable healthcare solutions, is further stimulating the demand for endoscope reprocessing in the region.

- Furthermore, there is a growing emphasis on training and education for healthcare professionals in the region to ensure proper endoscope reprocessing practices. Professional training programs and workshops on infection control and reprocessing protocols enhance the knowledge and skills of healthcare staff, leading to better implementation of advanced reprocessing technologies and practices.

Middle East and Africa endoscope reprocessing market is anticipated to record significant growth throughout the forecast period.

- This growing burden of disease drives the demand for endoscopic services and, consequently, the need for effective endoscope reprocessing solutions to ensure patient safety and prevent cross-contamination.

- Moreover, the region is experiencing a rise in the number of surgical procedures due to advancements in medical technology and increased access to healthcare services. Many of these procedures involve the use of endoscopes, further driving the demand for efficient reprocessing solutions to ensure the availability of sterile equipment for surgical use, thereby contributing to regional growth.

Endoscope Reprocessing Market Share

Leading companies like Getinge, STERIS, Olympus, Ecolab, and CONMED Corporation together hold between 48% of the market share in the moderately consolidated global market. These companies maintain their leadership through robust product portfolios, strategic partnerships, regulatory approvals, and continuous innovation.

Olympus, for instance, has strengthened its position with the launch of the ETD washer-disinfector series, designed to improve disinfection outcomes while supporting sustainability and operational efficiency. STERIS continues to lead with its Reliance Endoscope Reprocessors, offering advanced automation and compliance features that align with evolving healthcare standards.

Getinge has made strides with its GSS Steam Sterilizers and ED-FLOW AERs, integrating smart technologies to enhance workflow and traceability. Ecolab, known for its infection prevention solutions, leverages its chemistry expertise to deliver high-performance disinfectants and monitoring systems that support consistent reprocessing outcomes.

Endoscope Reprocessing Market Companies

A few of the prominent players operating in the endoscope reprocessing industry include:

- ARC Group of Companies

- ASP

- Belimed

- CONMED Corporation

- Creo Medical

- Ecolab

- Getinge

- Metrex

- Olympus

- Shinva Medical Instrument

- Steelco

- STERIS

- Karl Storz

- Wassenburg Medical

- Getinge

Getinge’s strength lies in its integration of smart technologies and infection control expertise. Its ED-FLOW AER and GSS Steam Sterilizers are designed to optimize workflow efficiency and ensure consistent high-level disinfection. The company’s focus on traceability, automation, and ergonomic design makes its systems ideal for high-throughput hospital environments. Getinge also emphasizes sustainability, offering solutions that reduce water and energy consumption without compromising performance.

- STERIS

STERIS stands out with its comprehensive portfolio of endoscope reprocessing solutions. Its systems are known for advanced automation, intuitive user interfaces, and compliance with global regulatory standards. STERIS’s strength lies in its ability to deliver end-to-end infection prevention solutions, from cleaning and disinfection to storage and transport, making it a trusted partner for healthcare facilities worldwide.

- Olympus

Olympus combines innovation with deep clinical insight, offering reprocessing systems like the ETD Basic and ETD Premium that enhance cleaning outcomes while promoting sustainability. The company’s infection prevention portfolio is designed to support operational efficiency and regulatory compliance.

- Ecolab

Ecolab leverages its expertise in chemistry and infection control to deliver high-performance disinfectants and monitoring systems for endoscope reprocessing. Its USP lies in providing reliable, science-backed solutions that ensure consistent decontamination. Ecolab’s systems are designed to integrate seamlessly into hospital workflows, with a strong focus on sustainability, safety, and compliance. The company’s global reach and technical support infrastructure further strengthen its position in the market.

Endoscope Reprocessing Industry News:

- In November 2023, Steelco Group and Belimed announced a plan to establish a new joint venture, leveraging their shared values and vision to provide innovative and reliable solutions in the healthcare and life science industries. This collaboration aims to expand the market positioning of both companies and enable a wider customer base.

- In June 2022, Getinge released an updated version of its ED-Flow automated endoscope reprocessor. The new features of this updated version brought a higher level of digital capabilities to the endoscope washer-disinfector. This release enabled the company to solidify its leading position in the endoscopy reprocessing market and expand its customer base.

- In June 2023, Olympus announced the launch of the new Olympus ETD. Introduced in two versions, ETD Basic and ETD Premium. This launch enabled the company to generate revenue and expand its portfolio.

The endoscope reprocessing market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product Type

- Devices

- Automated endoscope reprocessors (AERs)

- By Type

- Single-door AERs

- Double-door AERs

- By Portability

- Standalone AERs

- Portable AERs

- By Type

- Endoscope drying, storage, and transport systems

- Other devices

- Automated endoscope reprocessors (AERs)

- Consumables

- Valves and adaptors

- High level disinfectants

- Bedside kits

- Other consumables

- Accessories

Market, By End Use

- Hospitals

- Ambulatory surgical centers

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Austria

- Switzerland

- CEE

- Poland

- Hungary

- Romania

- Czech Republic

- Bulgaria

- Rest of CEE

- Nordic countries

- Denmark

- Sweden

- Norway

- Rest of Nordic countries

- Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

How much revenue did the devices segment generate?

The devices segment led the market with a 65.2% share.

What was the valuation of the hospitals segment?

The hospitals segment held a 58% market share.

What is the market size of the endoscope reprocessing market in 2024?

The market size was USD 3.2 billion in 2024, with a CAGR of 11.3% expected through 2034, driven by rising demand for minimally invasive procedures and increasing prevalence of GI disorders and cancer.

Who are the key players in the endoscope reprocessing market?

Key players include STERIS, Getinge, Olympus, Ecolab, and CONMED Corporation.

What are the upcoming trends in the endoscope reprocessing industry?

Key trends include the adoption of automated endoscope reprocessors (AERs), integration with hospital information systems, advanced drying and storage cabinets, and the development of eco-friendly disinfectants for enhanced safety and compliance.

Which region leads the endoscope reprocessing market?

North America held a 44.1% share in 2024. Robust healthcare infrastructure, high prevalence of chronic diseases, and regulatory support from the FDA fuel the region's dominance.

What is the projected size of the endoscope reprocessing market in 2025?

The market is expected to reach USD 3.7 billion in 2025.

What is the projected value of the endoscope reprocessing market by 2034?

The market is expected to reach USD 9.6 billion by 2034, driven by technological advancements in automated reprocessing systems and growing awareness of infection control.

Endoscope Reprocessing Market Scope

Related Reports