Summary

Table of Content

Electronic Toll Collection (ETC) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Electronic Toll Collection Market Size

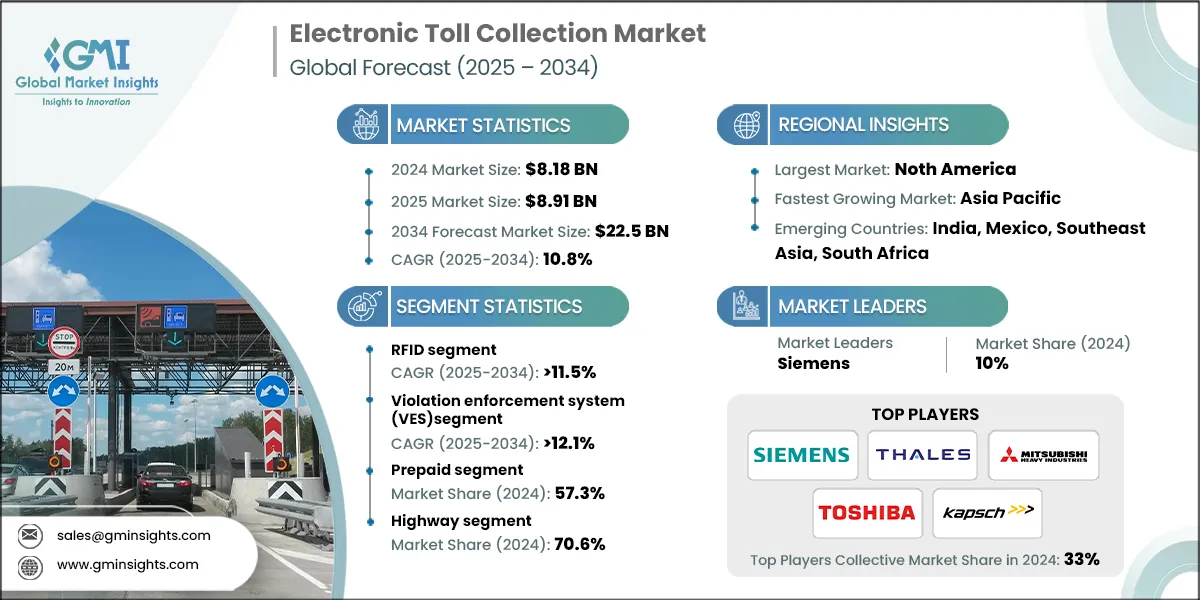

The global electronic toll collection (ETC) market size was estimated at USD 8.18 billion in 2024. The market is expected to grow from USD 8.91 billion in 2025 to USD 22.5 billion in 2034, at a CAGR of 10.8%, according to latest report published by Global Market Insights Inc.

To get key market trends

The increase in urbanization and vehicle ownership has led to excessive traffic congestion, mainly on highways and toll roads and urban areas. Electronic toll collection (ETC) reduces stop-and-go delays at toll booths by automating vehicle payments, increasing the throughput on toll roads, and decreasing delays on toll plazas.

Governments around the world are mandating cashless tolling and standards for interoperability as part of their modernization of transportation infrastructure. For instance, technology advances like E-ZPass in the United States and FASTag in India are changing the nature of adoption significantly faster.

Electronic Toll Collection (ETC) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.18 Billion |

| Market Size in 2025 | USD 8.91 Billion |

| Forecast Period 2025 - 2034 CAGR | 10.8% |

| Market Size in 2034 | USD 22.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing Traffic Congestion | Rising vehicle numbers and urbanization increase highway congestion. ETC reduces stop-and-go delays, shortens travel time, and improves traffic flow, enhancing driver convenience while reducing fuel consumption and emissions. |

| Government Policies & Regulations | Mandates for cashless tolling and interoperable systems push ETC adoption. These policies improve revenue collection, ensure compliance, and accelerate digital infrastructure development, making highways safer and more efficient. |

| Technological Advancements | RFID, ANPR, and AI enhance toll accuracy and automation. Advanced analytics reduce errors and fraud, while integration with mobile payments increases user convenience, driving wider adoption and operational efficiency. |

| Environmental Sustainability Goals | ETC reduces vehicle idling at tolls, cutting emissions and fuel usage. It supports green mobility initiatives, helping governments and operators meet climate goals while promoting cleaner, more sustainable road transportation. |

| Rising Demand for Seamless Travel | Modern drivers prefer uninterrupted journeys without stopping at toll booths. ETC meets this demand by enabling automatic payments, reducing delays, and enhancing travel convenience. This improves overall road efficiency, user satisfaction, and encourages adoption of digital tolling systems. |

| Pitfalls & Challenges | Impact |

| High Implementation Costs | Setting up ETC infrastructure RFID readers, cameras, and backend systems requires significant investment. This can slow adoption, especially in developing regions, and may deter smaller operators from transitioning from manual toll collection. |

| Privacy and Data Security Concerns | ETC systems collect vehicle and user data, raising privacy issues. Cybersecurity threats and potential misuse of personal information can limit public acceptance and affect trust in digital tolling solutions. |

| Opportunities: | Impact |

| Expansion in Emerging Markets | Rapid urbanization and growing vehicle ownership in Asia-Pacific, Africa, and Latin America create vast opportunities for ETC deployment, improving road efficiency and modernizing toll operations. |

| Integration with Smart Mobility & ITS | Linking ETC with Intelligent Transport Systems, traffic management, and smart city initiatives allows dynamic tolling, predictive congestion management, and better infrastructure planning, enhancing overall mobility. |

| Adoption of AI and Analytics | AI-driven vehicle recognition, fraud detection, and predictive traffic analysis can improve accuracy, reduce costs, and enable more intelligent, adaptive tolling systems. |

| Environmental & Sustainability Initiatives | Governments push for greener transport solutions positions ETC as a key tool to reduce vehicle idling, fuel consumption, and emissions, supporting eco-friendly infrastructure and climate goals. |

| Market Leaders (2024) | |

| Market Leaders |

Top company hold 10% market share |

| Top Players |

Collective market share in 2024 is 33% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Mexico, Southeast Asia, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Developments in RFID, ANPR, cloud computing, and AI are driving the next generation of ETC systems. These technologies enhance accuracy, mitigate fraud, and lower asset costs to make toll collection more scalable. The emergence of mobile wallets and digital payment platforms improves user convenience.

ETC contributes to sustainability by reducing idling of motor vehicles and the amount of fuel at a toll plaza. This translates into lower carbon emissions and better air quality. With all levels of government and organizations announcing and enacting progressive climate and associated goals, ETC is significant to the case for greener mobility.

In January 2025, TransCore unveiled its upgraded Infinity Digital Lane System on the West Virginia Turnpike, providing the latest generation of electronic toll collection on the highway. Featuring enhanced E-ZPass services, the upgraded system also provides toll-by-plate processing at each of the four plazas, giving drivers without transponders the ability to pay their toll without delays. This is in line with the trend developing throughout the US in moving to cashless and digital tolling solutions, which offer a greater level of drive convenience and allow smarter and sustainable operation of the regional highways.

North America leads in the development of ETC with wide rolling networks of E-ZPass and interoperability in state development driving the early adoption. Tolling has a way to go totally electronic and cashless and toll-by-plate and License plate identification systems are offering further access to drivers without tags. Enhanced digital lane systems and integration into intelligent transport networks drive efficiency.

The Asia Pacific market is the most rapidly expanding ETF market due to accelerated urbanization, vehicles ownership and government sponsored programs such as Fastag in India and digitization of current toll roads in China. Nations are spending money on the implementation of RFID, ANPR, and AI technology in managing traffic and reducing congestion.

Electronic Toll Collection Market Trends

The ETC systems that utilize RFID, NFC, and mobile wallets abolish cash transactions altogether with toll payment, creating a seamless customer experience. It reduces waiting time in queues, and allows for a faster travel time, all the while being much more convenient for the driver. In addition, it improves transparency in the collections of revenue and is aligned with the existing trends for cashless, digital economies throughout the world.

Free-flow tolling systems that utilize a combination of sensors and ANPR technology allow vehicles to automatically pay without ever stopping or slowing down. This application reduces congestion, increases the throughput for the toll plaza and significantly reduces toll collection operating expense. The operations are safer for motorists and allow transportation and traffic to move more efficiently over large distances on urban expressways and inter-urban highways.

ETC is utilized in conjunction with Intelligent Transport Systems (ITS) technology as well as smart city platforms to create dynamic pricing, real-time congestion management, and predictive maintenance. These trends create an efficient planning of traffic management, and travel system, while improving traveller experience, and ensure that toll systems contribute to larger urban mobility and sustainability objectives.

Technology-based electronic toll collection (ETC) solutions provide additional accuracy by minimizing accuracy in vehicle identification and toll collection functions, while providing data analytics for fraud detection, predictive traffic analytics, and optimal toll rates using trend data. In addition to improved accuracy, this trend reduces costs for operators while facilitating smarter, more adaptive tolling systems that respond to real-time traffic.

ETC is a robust contributor to sustainability by reducing fuel waste and emissions from idling vehicles. Governments are adopting ETC under eco-friendly transport policies, while this trend encourages travel without contact and smooth travel experiences through tolling. This trend leads to lower carbon emissions and specifically aligns road operators to address international carbon emissions reductions and climate action more broadly.

In May 2025, the Transport Ministry of Vietnam and Viettel have established ETC systems at 35 more toll stations, for a total of 91 of 116 stations. This last roll-out signifies the end of the second roll-out stage in the project of non-stop toll collection, easing stop-and-go traffic, travel time, and convenience for drivers.

Electronic Toll Collection Market Analysis

Learn more about the key segments shaping this market

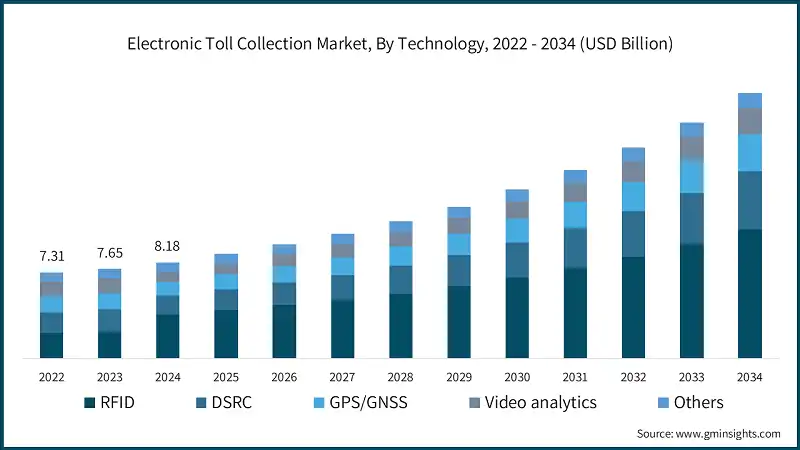

Based on technology, the electronic toll collection market is segmented as RFID, DSRC, GPS/GNSS, video analytics, and others. The RFID segment dominated the market, accounting for 46% in 2024 and is expected to grow at a CAGR of over 11.5% through 2034.

- RFID systems are the most far-reaching technology and product in the ecosystem of ETC systems, as they are inexpensive, straightforward to utilize, and widely accepted by the marketplace, especially in Asia. DSRC systems are still relevant in Japan, South Korea, and Europe, with regards to open-road tolling at high speeds and V2X integration. The dominance of RFID continues, while DSRC finds its place in regional niches.

- The highways remain the main area of application for ETC systems because of processing vehicles on interchange or highway speed and offering a convenient system for freight and passenger vehicles. However, that application area is being surpassed in growth with urban tolling zones, congestion charges, and low-emission tolling stacks will still grow substantially. Smart city devices world-wide are also contributing in favor of the role of ETC (perhaps advanced capabilities) in the city (beyond highways), especially in Europe and Asia-Pacific.

- The solutions for ETC systems are evolving from tags and readers towards an intelligent platform. Vendors are integrating descriptions like AI and video analytics for vehicle classification, fraud detection and violation enforcement. Likewise, the back-office systems, while solved with multi-lane, are opening up such sizable opportunities for interoperability and digital payments within a system to cross state and municipal systems with a service to tie them together, facilitates these options in a more advanced and scalable service. This all serves the convergence to accuracy, efficient processing, and convenience for customers, around the world.

- In 2025, Neology presented the neoRead 7204, an advanced RFID tag reader that supports both OmniAir and E-ZPass protocols. The neoRead works to increase read accuracy and reliability at highway speeds, in addition to providing real-time error correction. This innovation exemplifies the continuous technological upgrades in ETC hardware to provide higher efficiency, interoperability, and reduced toll collection errors.

Learn more about the key segments shaping this market

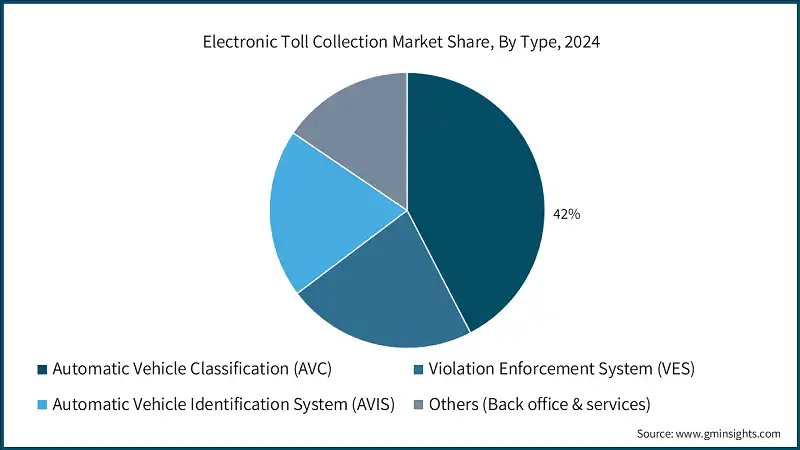

Based on type, the electronic toll collection market is bifurcated into automatic vehicle classification (AVC), violation enforcement system (VES), automatic vehicle identification system (AVIS), and others. The violation enforcement system (VES) is expected as the fastest growing segment as governments and highway operators are shifting from traditional toll booths to cashless, open-road systems. The segment is expected to grow at a CAGR of over 12.1% from 2025 to 2034.

- Automated Vehicle Classification (AVC) Systems facilitate differentiating vehicle categorization by number of axles, size, or weight for differentiated tolling. AVC forms a major part of highway and commercial vehicle tolling. AVC systems enhance precise classification of vehicles and reduction in human error, as well as proper tolling. Growth in logistics and freight operations has resulted in a higher demand of AVC especially in Europe and Asia-Pacific.

- Vehicle Enforcement Systems (VES) use cameras, Automatic Number Plate Recognition (ANPR) and sensors to identify and issue lines to tort evaders. VES eliminates revenue leakage resulting from an inability to force motorists to pay their tolls and automates tolling compliance with state or federal traffic laws as these laws apply to tolling. With cashless and open-road tolling becoming increasingly ubiquitous, VES is experiencing rapid adoption. Advanced analytics, including segmentation and artificial intelligence, improve VES detection accuracy and reliability which distinguishes the role of VES in modern tolling.

- Automated Vehicle Identification (AVID) systems employ RFID tags, Dedicated Short Range Communication (DSRC), or license plate recognition to detect vehicles and link them to accounts for seamless tolling. AVIS is at the heart of electronic toll collection (ETC) activity and offers the key to the fast, precise, and reliable collection of the tolls, and does not overload the routes and decrease the delays. The current technological and innovation development still helps AVIS to remain the largest segment of functions of the toll systems in the world.

- In September 2025, Mastercard declared the launch of in-car payment technology that allows cars to automatically pay at the tolls, parking, and charging services charged directly into the infotainment system of the car. Technology will enhance the experience of the driver in terms of being able to make payments without any hassle, and it will bring faster urban mobility in the future.

Based on payment method, the electronic toll collection market is bifurcated into prepaid, hybrid and postpaid. The prepaid segment held a share of 57.3% in 2024, and it dominates the market as they are cheaper to manage, as they minimize administrative overhead associated with invoicing, debt collection, or violation enforcement, compared to postpaid or hybrid systems.

- The Prepaid models require users to load money into their account for toll usage. The prepaid systems provide complete spending control, less potential for overspending, and a quicker processing time at the toll. This system continues to gain traction in developing markets and infrequent users, as the prepaid toll model tends to be more straightforward, manageable, and provides more predictable means of disposal and toll payment, respectively. Prepaid models have also become widely used across highways and urban corridors.

- The Hybrid ETC payment models encompass prepaid modules and postpaid features, which allow for preloading funds for future transactions or automatic billing based on usage. The hybrid model offers flexibility to users by supporting a wide diversity, including commuters and casual travelers, regardless of the frequency of toll-use. The hybrid model will also continue to be embraced in urban areas and related smart city initiatives by offering multiple payment transaction capabilities.

- Governments worldwide are encouraging digital toll payments to decrease cash management, increase collection efficiency, and aid congestion management. Programmatic incentives for compliance, such as discounts for prepaid and/or hybrid users, can also motivate compliance. Compliance frameworks increasingly require interoperable payment options, thereby supporting clear advances in the acceptance and adoption of electronic toll collection (ETC) payment systems, particularly in developing economies and areas with high traffic congestion.

- India's NHAI inaugurated its inaugural Multi-Lane Free Flow (MLFF) tolling system in Gujarat in August 2025 using a hybrid ETC payment method that had options for prepayment and post-payment. This advance will allow for faster (cashless) tolling and will help reduce congestion on toll roads. It will support mobile payments and use new tools to improve smart city mobility, making a major advancement in progresses toward modernizing urban toll infrastructure.

Based on application, the electronic toll collection market is bifurcated into urban zones and highways. Highway segment held 70.6% and is anticipated to grow at a CAGR of 10.4% between 2025 and 2034.

- Cities are embracing autonomous electric microbuses and shuttle services to create flexible transport solutions. These cars will support the last-mile connectivity, lessen the congestion, and interlink with smart city solutions over urban networks. Pilot projects across Europe and Asia have shown their ability to facilitate efficiency and safety in high traffic conditions in urban settings.

- Artificial Intelligence is being used to observe and forecast traffic movements in the urban environment. Artificial intelligence can also enhance signal timing, congestion management, and travel time. In the use of sensors and vehicles when connected, real-time information is gathered on vehicular movements. City planners can use such information to deal proactively with accidents, enhance safety and efficiency to drivers, cyclists, and pedestrians.

- Electric vehicle charging points are being installed more on the highways to support more EVs. To enable long-distance travel, facilitate the adoption of the green mobility movement, and complement government efforts in reducing transportation and freight and passenger movement emissions, fast-charging points are installed along major travel routes.

- In July 2024, Germany expanded its truck tolling scheme to encompass vehicles weighing between 3.5 and 7.5 tons. The legislative reform modified fee structures to include Carbon-di-oxide based pricing and an increased toll for vehicles that result in increased emissions. Additionally, trucks with zero emissions will continue to remain toll-free until December 31, 2025, after which they will be subject to a 75% toll reduction starting January 1, 2026.

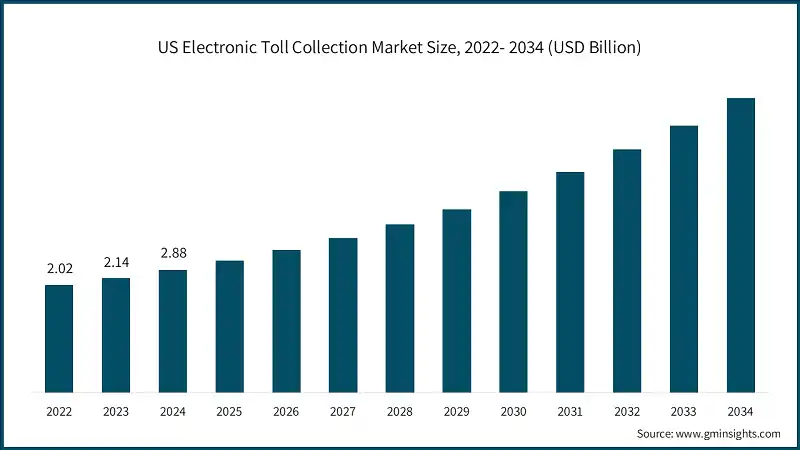

North America dominated the electronic toll collection (ETC) market with around 40.3% share and generated USD 3,296.3 million in 2024. Extensive highway networks and high vehicle usage in the region create consistent demand for ETC solutions. Operators prioritize automation to reduce congestion, improve safety, and optimize toll revenue.

- A few decades ago, electronic toll collection was implemented in the US and Canada, establishing a robust infrastructure and broad acceptance by users. Established models like E-ZPass, established decades ago, continue to set standards for interoperability and efficiency, and reliability across North America.

- ETC systems of the North American nature are developed based on RFID, DSRC, GPS/GNSS and video analytics and AI to conduct enforcement and traffic management. This advanced technology facilitates quicker and more precise toll collection and can be multi-state and multi-protocol in nature with the requirement of seamless and correct communications.

- In November 2024, 407 ETR introduced updated toll rates that added additional toll zones and vehicle classifications. The updated cash toll rates and classifications allow for a more equitable distribution of tolls and links tolls observed traffic patterns, which will also help improve efficiency on the highway and support future innovations with ETC infrastructure that can better allocate high volume traffic flow on this important freeway in Ontario.

Looking for region specific data?

The electronic toll collection market in US is expected to hold a share of 87.4% in 2024 and experience robust growth from 2025 to 2034.

- In the United States, the use of the All-Electronic Tolling (AET) systems is becoming popular now, and cash transactions no longer take place at the toll plazas to enhance traffic flow, congestion, and lower the operating expenses. For example, Richmond, Virginia, implemented a cashless tolling system in 2025, indicating an increased adoption of AET systems.

- Dynamic pricing models across toll systems are also a response to trafficking congestion while optimizing toll revenues. Toll rates are changeable and responsive to real-time traffic conditions to influence travel behavior, inciting off-peak travel and a higher level of traffic flow. This type of pricing model is becoming more common, as well.

- In October 2024, Emovis is improving tolling infrastructure on the A-25 highway in Quebec, which runs from Montreal to Laval, including the toll bridge. The project entails deploying new all-electronic tolling equipment in 2025 which will enhance operational performance and user experience.

The electronic toll collection (ETC) market in Europe is expected to grow at a CAGR of 9.3%.

- Europe is expected to experience significant and promising growth in the ETC market due to strong regulatory support, rapid adoption of interoperable EETS systems, implementation of Carbon di oxide-based toll, and large-scale investments in free-flow, digitalized toll infrastructure across highways and urban mobility networks.

- Multiple nations in Europe are putting toll charges in place that charge fees depending on vehicle emissions class. Vehicles that produce lower emissions receive a discount. These strategies, in tandem with Member States climate targets and the EU green policy, is leading the toll appoints to use ETC systems to collect emissions information and use it to classify and differentiate toll pricing.

- Europe is converting from traditional toll plazas to Multi-Lane Free Flow (MLFF) / All Electronic Tolling (AET) systems. Moreover, onboard units are being upgraded (e.g., upgrading to 4G, replacing 2G), increase use of ANPR, DSRC, and GNSS from different locations to facilitate contactless, faster, and more accurate toll collection.

- In March 2025, Toll4Europe and Telepass signed contracts with the Dutch Vehicle Authority (RDW) to provide EETS-compliant services before the distance-based truck toll system begins in the middle of 2026. Trucks over 3.5 tons will require OBUs, with a charging system depending on the emission class of the trailer.

The ETC market in Germany is expected to hold 21% market share in 2024.

- Germany is progressively linking toll rates for heavy-goods vehicles with their CO2 emission class. Trucks powered by diesel and lower-emission vehicles are billed with different fees based on their emissions classification. Zero emission vehicles are exempt from toll fees until the end of 2025. This initiative encourages fleet operators to replace their vehicles with technologically cleaner vehicles while making the weighting of toll fees consistent with Germany's climate and environmental objectives.

- Germany is upgrading its existing ETC systems with improved GPS tracking for trucks, ANPR (automatic number-plate recognition) systems for enforcement, and “toll enforcement towers” that verify vehicle weight classes and compliance vehicles with toll payment requirements. This infrastructure will, as part of digital integration, provide better methods of monitoring, automated violation detection, and more accurate toll billing.

- In September 2024, SkyToll and TollNet won the contract to provide a new ETS on the highways of Croatia to the value of 80 million Euros. The system will comprise of automatic license-plate recognition with DSRC, extend ability to charge tolls based on distance both in passenger and commercial vehicles, and be compatible with EETS.

The electronic toll collection market in Asia Pacific held a market share of 21.4% in 2024 and is expected to grow at a CAGR of 12.5% from 2025 to 2034 owing to rapid digital transformation and IoT expansion.

- The region is experiencing a surge in mobile payments, digital wallets, and fintech solutions. Integrating ETC with these platforms enables prepaid, hybrid, and cashless tolling. Combined with government support for contactless, technology-driven solutions, this accelerates the pace of ETC adoption across APAC.

- As trade increases among countries and travel also resumes more so regionally, there will be an even greater demand for tolling systems that work seamlessly across borders. Countries in APAC are moving toward interoperable ETC tags with unified standards and a common Clearinghouse platform that will reduce friction for commercial vehicles and personal vehicles operating in multiple countries.

- Across the region of APAC, consumer adoption of mobile wallets, QR-codes, and super-apps is rapidly increasing. Governments/toll operators are starting to make ETC payment facilities available to these platforms, which offers greater convenience of use and creates more chances of ubiquity. With the continued enhancement of digital payment infrastructure over time, prepaid and hybrid models of ETF based on mobile payments gain momentum.

- The governments of APAC are implementing the sophisticated system of detection and enforcement: ANPR cameras, GPS/GNSS system to monitor commercial vehicles, vibration sensors, artificial intelligence to enforce violations, and real-time data analysis. These advanced systems support accurate tolerance, minimal toll leakage, and modern traffic management.

- In Q1 of FY 2025–26, FASTag-based toll collection in India has increased by approximately 20% to INR 21,000 crore from INR 17,280 crore over the same period last year. The collection increase indicates the accelerated adoption of electronic tolling, less congestion, and efficiency of transport on the national highways and it upholds the government plans of cashless transport.

The ETC market in China is estimated to hold market revenue of USD 705.4 million in 2024 and is expected to experience strong growth from 2025 to 2034.

- China has significant government support for implementing smart infrastructure, such as automating collection on highways and expressways. Expect an increase in ETC installations, reduction of cash, and greater use of technologies such as ANPR, mobile payments, and AI for enforcement.

- China's rapid adoption of EV, investments in connected and autonomous driving, and the likely integrations of ETC and payment services with in-vehicle systems, connected vehicle networks, and mobility apps can support vehicle identification, dynamic tolling, and possibly even V2X-enabled tolling interactions.

- China has consolidated its ETC system in 29 of its 34 provinces and implemented approximately 100,000 edge nodes and over 500,000 applications. This system collects over 300 million data records each day and increases toll station traffic efficiency by a multiple of ten. The goal of this scheme was to improve toll collection, as well as road safety.

The Latin American electronic toll collection (ETC) market is projected to grow at a CAGR of 10.4% from 2025 to 2034. This growth is driven by the need to optimize urban traffic flow, reduce congestion, and enhance public safety through smart infrastructure.

- Brazil and Mexico are increasingly implementing RFID-based systems for toll collection. The new technology aids toll collection to occur faster and more efficiently, contributing to less congestion and a smoother traffic flow on major highways. The move to RFID is part of a general shift to modern digital infrastructure in the region.

- Substantial investment is being made to upgrade tolling infrastructure throughout the region. Upgrades include the installation of state-of-the-art tolling equipment and improvements to existing toll booths to install the new technologies and systems for a more reliable and efficient toll collection effort.

- Cities of Latin America are progressively linking ETC systems with smart mobility platforms, which provide traffic monitoring, dynamic pricing, and improved traffic management in real-time. The use of data analytics and IoT technology is collectively intended to improve urban mobility and reduce congestion.

- In June 2025, Actis announced a new platform for toll roads in Latin America after acquiring a portfolio of 416 km of toll roads in Colombia. This investment and interest in toll road infrastructure is increasing on a regional level as the region aims to increase connectivity to drive economic growth.

The MEA electronic toll collection market is projected to grow at a CAGR of 9.2% from 2025 to 2034.

- Countries in the MEA region are integrating electronic toll collection (ETC) systems in broader smart city frameworks. These advancement aids in real-time monitoring of traffic, dynamic pricing, and improved traffic management are contributing to better urban mobility and less congestion. Governments are now using data analytics and Internet of Things (IoT) technology to optimize transportation infrastructure.

- The commercialization of GPS and GNSS technology has allowed the MEA region to adopt satellite-based tolling systems. These systems avoid the use of traditional toll booths and allow for toll collection based on vehicle location and usage. This approach increases efficiency and lowers infrastructure costs.

- In August 2025, Jordan declared that Salik Jordan would be introduced as the first national toll road system later that year. This system aims to modernize infrastructure and alleviate congestion, drawing upon successful models implemented in the UAE, Egypt, and Morocco.

- Cities in the MEA region are employing ETC systems in smart mobility platforms. Such integration allows for real-time traffic monitoring, dynamic pricing, and real-time traffic management. With application of technologies such as data analytics and IoT, these systems will seek to improve urban mobility and reduce congestion.

Electronic Toll Collection Market Share

- The top 7 companies in the electronic toll collection (ETC) industry are Siemens, Thales, Mitsubishi Heavy Industries, Toshiba, Kapsch TrafficCom, TransCore / ST Engineering, and Conduent contributing around 42.9% of the market in 2024.

- Siemens has a market lead with its full portfolio of tolling solutions, smart city infrastructure integration, and relevant global scale. Siemens can offer end-to-end ETCS (hardware, software, and analytics) in its entirety, positioning it for highway and tolling programs at scale, both rural and urban.

- Thales is a pioneer in smart technologies such as RFID, DSRC, and GNSS-based solutions. Governments and operators leverage their expertise in safe digital payments and smart transportation systems to implement effective, safe, and interoperable tolling systems quickly on territories.

- Mitsubishi Heavy Industries deploys decades of infrastructure engineering core capability, producing high-quality tolling machines. Its reputation for reliability and toughness in hostile environments qualifies Mitsubishi Heavy Industries for huge National and Regional ETC deployments.

- Toshiba offers market power through its pioneering tolling technology, including automated vehicle identification and payment processing solutions. Toshiba's commitment to integration of smart systems and general high level of operational efficiency results in faster and more precise collections of tolls, drawing larger contracts around the world.

- Kapsch TrafficCom is a leader in the market because of its end-to-end electronic toll collection (ETC) solutions, global deployment expertise, and customization for city, highway, and cross-border applications. The confidence is further boosted with Kapsch TrafficCom since Kapsch has initiated and finished successful big-size international projects.

Electronic Toll Collection Market Companies

Major players operating in the electronic toll collection (ETC) industry are:

- Siemens

- Thales

- Mitsubishi Heavy Industries

- Toshiba

- Kapsch TrafficCom

- TransCore / ST Engineering

- Conduent

- Cubic

- EFKON

- Neology

- Siemens has a complete range of ETC products, including vehicle detection and classification systems, DSRC and RFID transponders, and back-office software for integrated transaction processing, enforcement, and reporting. Its end-to-end tolling solutions cover highways, city roads, and smart city projects around the world to collect tolls efficiently, automatically, and reliably.

- Thales provides innovative ETC solutions such as DSRC and RFID tag systems, AVI, and interoperable onboard units within cross-border countries in compliance with EETS. Its smart back-office platforms manage billing, enforcement, and analytics to allow operators to implement secure, scalable, and seamless tolling systems integrated into national and international mobility networks.

- Mitsubishi Heavy Industries dominates in toll collection automation and hardware. They produce automatic vehicle classification (AVC) sensors, DSRC toll collection hardware, and toll plaza automation. These products and services ensure accurate lane-based detection, a high-performance toll collection solution, and provide service in adverse conditions through full maintenance and operating service for both national and regional highways.

- Toshiba's ETC suite includes automatic vehicle identification and license plate recognition (ANPR/LPR), RFID tag readers, and toll management software for invoicing, reporting, and violation enforcement. The hybrid systems include ANPR RFID and video analytics to provide flexible, high speed toll collection appropriate for the free-flow toll lane, urban roads, and large highway systems.

- Kapsch TrafficCom offers RFID and DSRC transponders, automatic vehicle classification (AVC) technology, and back-office processing platforms for billing, customer service, and enforcement. Its Electronic Toll Collection (ETC) solutions support multi-lane free-flow tolling and are integrated with smart mobility and traffic management systems, allowing operators to install scalable, secure, and technologically advanced toll infrastructure.

Electronic Toll Collection Industry News

- In March 2025, Mitsubishi Heavy Industries came up with a Merging Support Information System, which is a sensing and communication technology of their toll collection and ETC systems. Technology will promote autonomous driving infrastructure by delivering real-time information to the cars that join highways to improve the flow of traffic and their safety.

- Toshiba announced 650 V 3rd-generation SiC MOSFETs in TOLL Package in August 2025. The devices are aimed at enhancing the effectiveness and performance of electronic toll collection systems, optimized power conversion and thermal management, which enable the development of more energy efficient and cost-effective solutions to toll collection.

- In July 2025, Kapsch TrafficCom introduced its new generation of V2X tolling technology, which incorporates vehicles to everything communication, to provide smooth tolling experience. It also initiated a nation-wide HGV toll system in Denmark, which is built on GNSS and RFID to be used in dynamic tolling applications, showing its inclinations to innovations in the sphere of tolling.

- In July 2024 Conduent replenished the open-road E-ZPass tolling and a gated exit system with Automated Toll Payment Machines in Ohio Turnpike. The upgrade will enhance the experience of the driver by minimizing the congestion and streamlining the toll collection process.

The electronic toll collection (ETC) market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Bn) from 2021 to 2034, for the following segments:

Market, By Technology

- RFID

- DSRC

- GPS/GNSS

- Video analytics

- Others

Market, By Type

- Automatic Vehicle Classification (AVC)

- Violation Enforcement System (VES)

- Automatic Vehicle Identification System (AVIS)

- Others (Back office & services)

Market, By Payment method

- Prepaid

- Hybrid

- Postpaid

Market, By Application

- Urban zones

- Highways

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Southeast Asia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What was the market share of the prepaid segment in 2024?

The prepaid segment held a 57.3% market share in 2024, dominating due to its cost-effectiveness and reduced administrative overhead compared to postpaid or hybrid systems.

Who are the key players in the electronic toll collection industry?

Key players include Siemens, Thales, Mitsubishi Heavy Industries, Toshiba, Kapsch TrafficCom, TransCore / ST Engineering, Conduent, Cubic, EFKON, and Neology.

What are the upcoming trends in the electronic toll collection (ETC) market?

Trends include ETC-ITS integration, ANPR-based free-flow tolling, dynamic pricing, real-time congestion management, and sustainability measures.

Which region leads the electronic toll collection sector?

The United States leads the market, holding an 87.4% share in 2024. The adoption of All-Electronic Tolling (AET) systems, such as the cashless tolling system implemented in Richmond, Virginia, in 2025, is driving growth.

What was the market share of the RFID segment in 2024?

The RFID segment accounted for 46% of the market in 2024 and is expected to witness over 11.5% CAGR through 2034.

What is the growth outlook for the violation enforcement system (VES) segment from 2025 to 2034?

The violation enforcement system (VES) segment is set to expand at a CAGR of over 12.1% till 2034, as governments and highway operators transition to cashless, open-road tolling systems.

What is the market size of the electronic toll collection in 2024?

The market size was estimated at USD 8.18 billion in 2024, with a CAGR of 10.8% expected through 2034. Increasing urbanization and vehicle ownership, coupled with the need to reduce traffic congestion, are driving market growth.

What is the expected size of the electronic toll collection (ETC) market in 2025?

The market size is projected to reach USD 8.91 billion in 2025.

What is the projected value of the electronic toll collection market by 2034?

The ETC market is projected to reach USD 22.5 billion by 2034, driven by advancements in RFID, NFC, and ANPR technologies, as well as the adoption of cashless tolling systems.

Electronic Toll Collection (ETC) Market Scope

Related Reports