Summary

Table of Content

Electronic Document Management System (EDMS) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Electronic Document Management System Market Size

Electronic Document Management System Market size exceeded USD 2.12 billion in 2016 and is predicted to grow at over 15.6% CAGR through 2024. Emerging trend of software as a service (SaaS) and cloud computing, coupled with the favourable regulatory scenario is anticipated to escalate industry growth. The growing trend of Bring Your Own Device (BYOD) and integration of document management solution with mobile devices has spur adoption of the technology among enterprises. Government initiatives and mandates on data storage protocols are expected to offer growth opportunities.

To get key market trends

A major factor supporting the industry growth can be attributed to the benefit of a paperless environment created by such solutions. The system reduces the costs and time associated with document management by providing multiple version control and federated searches. The document management software is integrated into the business process thereby allowing organizations to effectively manage their documentation needs. Industry players are focusing on innovation and technological evolution to customization and enhance their product offering. Ease of integration of the system with existing and new technology solutions is expected to drive EDMS market penetration.

The need for software to incorporate services such as social integration, cloud-computing, workflow collaboration and smartphone accessibility is on the rise. However, integration issues with existing applications and data security concerns are factors restraining the EDMS market. The high costs associated with installation, training and maintenance further challenge the industry growth.

Electronic Document Management System Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2016 |

| Market Size in 2016 | 2 Billion (USD) |

| Forecast Period 2017 - 2024 CAGR | 15% |

| Market Size in 2024 | 6 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

COVID19 Impact

The COVID-19 pandemic has positively impacted the electronic document management system market demand with the rising demand in healthcare, enterprises, BFSI, etc. The pandemic has accelerated the adoption of Health Information Management (HIM), Electronic Health Record (EHR), and Picture Archiving and Communication System (PACS) in the medical sector to efficiently manage the increasing number of COVID-19 patients. These integrated EDMS in medical facilities enhances clinical efficiency by improving patient care and meeting the regulatory demand to monitor COVID-19 cases.

Moreover, lockdown imposed in several regions has accelerated the adoption of work-from-home among various enterprises. This will further propel the adoption of electronic document management systems to efficiently manage online training solutions and eliminate storage issues in training procedures.

Electronic Document Management System Market Analysis

The software segment is predicted to cross USD 2,215.8 million valuation by 2024. The software providers offer network / server-based solutions, client’s desktop and cloud-based solutions to manage their business documentation requirements. Many software developers in the market are now targeting the need for customized content and process management. Essential features of the software include compatibly, scalability, ease of use, communication, versioning, mobile device integration, backup, collaboration and security.

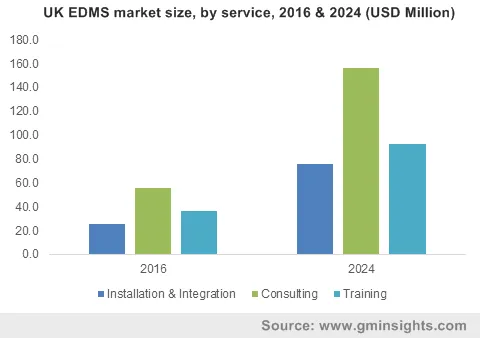

The demand for document management services is anticipated to witness 16.6% CAGR through 2024 owing to the growing need for educating workers on technology usage and demand for consultation services across industries to optimize workflow. Service providers bridge the gap between software developers and end-users.

On-premise electronic document management system market includes an array of desktop-licensed third-party software, that integrates with the organization’s existing IT infrastructure with dedicated on-site servers.

The adoption of cloud-based EDMS is driven on storage space cost, low maintenance and hyper-collaborative tools that allow users to adapt the technology without having to alter their information architecture. In enterprise document management realm, the adoption of cloud-based systems has been comparatively slower and more cautious than standalone software. This can be attributed to the limited bandwidth of cloud computing for large organizations and high risk of data security due to rise in cyber-crimes.

Ease of information access and storage, coupled with low subscription costs of cloud-based solutions is expected to drive growth for cloud-based solutions. Web-based EDMS provide a Graphical User Interface (GUI) and works through portals that are browser based. Such systems allow for scalability, ease of access and reduce costs for small or large organizations.

The global demand for electronic document management system market solutions has been relatively high in the BFSI and government sector. Government application of these solutions can help eliminate need for paper based documentation and streamline workflow for efficient provision of information to citizens. Moreover, it enables governments to provide the transparency and improve efficiency at all levels of government departments. With the growing volumes of paper, the adoption for digital documents can enable staff and constituents to achieve huge cost savings.

Healthcare applications is poised to see sharp growth through 2024 propelled by the growing adoption of HIM, PACS, RIS systems and EMR systems, coupled with the regulatory demand for patient data recording. Integration of EDMS with existing healthcare systems can result in enhanced clinical efficiency and improved patient care. Growth of the IT healthcare market globally, is also driving the demand for advanced patient monitoring systems in hospitals and clinics.

North America and Europe is likely to account for a majority of the electronic document management system market share led by the adoption of such solutions in healthcare and financial industries in these regions. The U.S. market dominated the industry in 2016 on account of the presence of technology giants and high technology penetration. Asia-Pacific region is forecast to register significant growth up to 2024 impelled by favourable government initiatives in countries such as China, Japan and India.

The demand to streamline workflow and improve efficiency has led to increase in adoption of the solution across industry verticals such as medical, government and BFSI. EDMS enable organizations to manage and control the documentation process. Furthermore, it controls the creation, authentication, storage, distribution, centralization, deletion, retrieval and collaboration of the documents. Such systems help organizations to streamline their content and organize their workflow.

Electronic Document Management System Market Share

Some vendors in electronic document management system market comprise :

- eFileCabinet

- DropBox

- Alfresco One

- FileCenter

Key player trends include mergers and acquisitions, new product launches and technological evolution to develop versatile document management software. Regulatory scenario and technologically advanced products are boosting market growth in developed and developing nations. Companies are emphasizing on product innovation and customization to suit diverse application needs and serve as key differentiators among various industries.

This market research report on electronic document management system includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2013 to 2024, for the following segments:

Market, By Solution

- Software

- Service

- Installation & Integration

- Consulting

- Training

Market, By Deployment

- On-premise

- Cloud-based

Market, By Application

- Government

- Medical

- Commercial

- BFSI

- Legal

- Education

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Why is Asia Pacific electronic document management systems industry growing?

APAC electronic document management system industry is pegged to witness significant growth up to 2024 driven by the presence of favorable government initiatives across countries such as China, Japan, and India.

What is the size of electronic document management system market?

The industry share of electronic document management systems was over USD 2.12 billion in 2016 and is expected to rise at a CAGR of 15.6% through 2024 due to the higher adoption of SaaS and cloud computing.

Why are electronic document management software witnessing high demand?

Electronic document management software market size is estimated to exceed USD 2,215.8 million by 2024 owing to the need for scalability, collaboration, better security and, mobile device integration among organizations.

How are healthcare applications driving electronic document management system market trends?

The electronic document management system industry revenue from healthcare applications is slated to rise exponentially through 2024 with the higher adoption of HIM, PACS, RIS systems, and EMR systems.

Electronic Document Management System Market Scope

Related Reports