Summary

Table of Content

Electric Vehicle Communication Controller Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Electric Vehicle Communication Controller Market Size

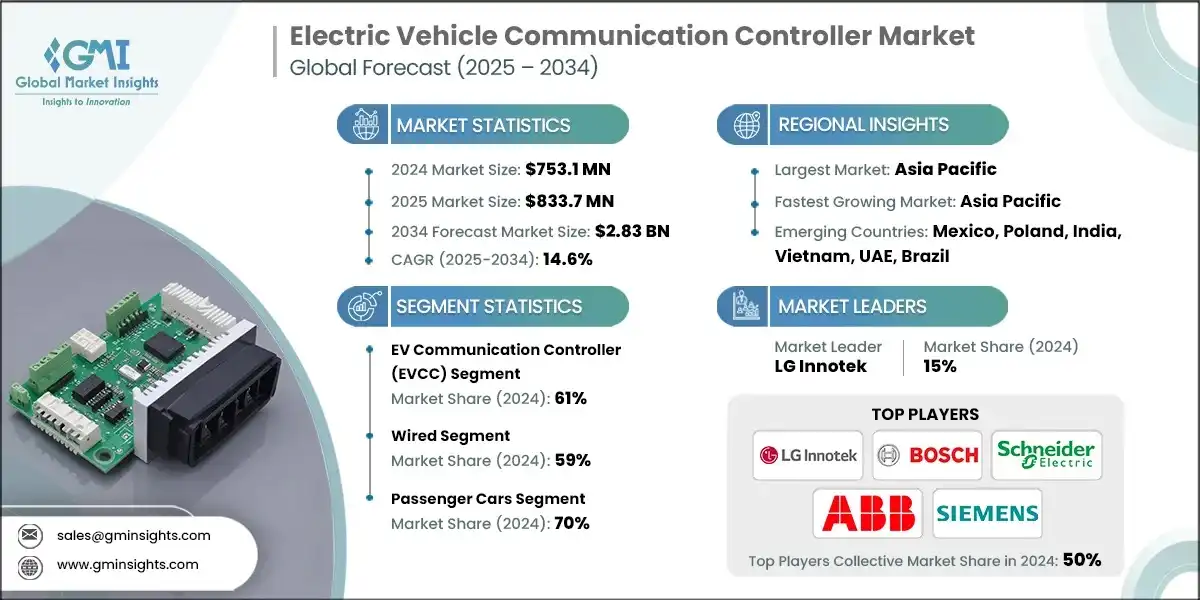

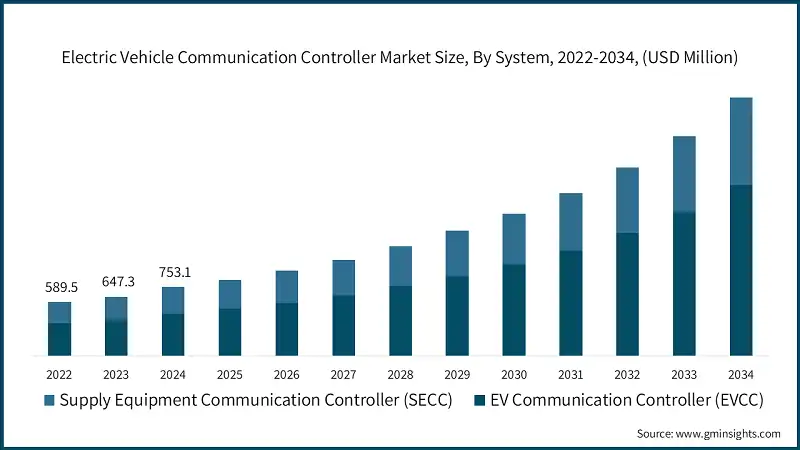

The global electric vehicle communication controller market size was valued at USD 753.1 million in 2024. The market is expected to grow from USD 833.7 million in 2025 to USD 2.83 billion in 2034 at a CAGR of 14.6%, according to latest report published by Global Market Insights Inc.

To get key market trends

The market for electric vehicle communication controllers (EVCCs) is growing rapidly with the worldwide growth of electric mobility, along with rapid developments in charging infrastructure, communication standards and smart grid. EVCCs are an important interface between electric vehicles (EVs) and charging equipment that enable secure, efficient, and communicative standards for charging and grid services. This technology ensures ease of interoperability among EVs, charging stations, and backend systems, further fostering a rapid transition to connected, intelligent, and energy optimized transportation ecosystems.

As national governments and automotive OEMs escalate their pledges for carbon neutrality, the growth of public and private EV charging networks continues to flourish and provides support for EVCC adoption at home, in businesses, and in fleets. In addition, standardized communication protocols such as ISO 15118, OCPP, and CHAdeMO are establishing interoperability and expanding vehicle-to-grid (V2G) capabilities, allowing bidirectional energy flow, smart charging and dynamic load management. This enhances grid stability and creates new revenue-generating opportunities for EV owners and utilities which will further solidify and increase EVCC demand.

Ongoing development in EVCC technology is resulting in smarter, faster and more reliable communication solutions. Leading manufacturers such as LG Innotek, Bosch, Siemens, and BYD are providing enhanced capabilities like cybersecurity modules, powerline communication, and real-time data analytics to EVCCs. Software-defined architectures and cloud-based management will facilitate over-the-air (OTA) updates, predictive maintenance, and adaptive load control. These "smart" EVCCs will enable improved charging efficiencies, improved latency, and the possibility of next-generation applications such as wireless charging and autonomous vehicle connectivity. Technological evolution supports performance improvements in EVCCs along with the adoption of EVCCs across diverse ecosystems.

Government policies and large-scale investments in e-mobility infrastructure are huge drivers of the EVCC market. Incentives including subsidies, tax credits and zero-emission obligations are encouraging automakers and charging providers to work faster on deploying the electric vehicle ecosystem. Leading EV markets in Europe and North America are attempting to drive EV deployment because of policy changes, while regions in Asia Pacific are focusing on growing charging infrastructure, incentivized by their government initiatives, such as in China, India, and South Korea.

In May 2024, The European Automobile Manufacturers Association (ACEA) released its report “Electric cars - Tax benefits and incentives (2024)” which indicates that all EU member states offer some sort of fiscal support (acquisition or ownership) for electric vehicles, and that five member states were offering incentives for charging-infrastructure by the same date.

Electric Vehicle Communication Controller Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 753.1 Million |

| Market Size in 2025 | USD 833.7 Million |

| Forecast Period 2025 - 2034 CAGR | 14.6% |

| Market Size in 2034 | USD 2.83 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising EV adoption and expansion of charging infrastructure | Accelerates demand for EVCCs to ensure efficient and interoperable charging. |

| Integration of standardized communication protocols and V2G capabilities | Enables seamless vehicle-grid interaction and smart energy management. |

| Technological advancements in intelligent and secure EVCC solutions | Enhances charging efficiency, reliability, and future-ready connectivity. |

| Government policies and regional investments driving e-mobility ecosystems | Stimulates market expansion through incentives, infrastructure funding, and regulatory support. |

| Pitfalls & Challenges | Impact |

| High cost and complexity of advanced EVCC integration | Slows adoption due to higher implementation and maintenance expenses. |

| Cybersecurity and data privacy risks | Poses adoption risks and operational challenges due to potential breaches. |

| Opportunities: | Impact |

| Expansion of vehicle-to-grid (V2G) and smart charging ecosystems | Creates new revenue streams and supports grid optimization. |

| Growth of fast and ultra-fast charging networks | Increases need for high-performance EVCCs for rapid, safe charging. |

| Integration with smart cities and IoT infrastructure | Unlocks advanced mobility services and intelligent energy management. |

| Software-defined and cloud-based EVCC solutions | Improves scalability, remote management, and operational efficiency. |

| Market Leaders (2024) | |

| Market Leaders |

15% market share |

| Top Players |

Collective market share in 2024 is 50% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | Mexico, Poland, India, Vietnam, UAE, Brazil |

| Future Outlook |

|

What are the growth opportunities in this market?

Electric Vehicle Communication Controller Market Trends

V2G (Vehicle-to-Grid) technology is surfacing as an important trend in the EVCC market, permitting EVs to return excess energy to the grid. In these elements of EVCCs serving as the communication backbone exchanging real-time data from EVs to the charger to the utility operator, which couplings EVCC to optimizing energy usage, dynamic load balancing peak shaving and grid stabilization by different actors in the energy ecosystem. Government entities in Europe, Japan and North America are initiating V2G projects with a focus on incentivizing adoption.

The proliferation of fast and ultra-fast DC charging stations is shaping EVCC requirements, these networks demand high-speed, secure, and reliable communication between EVs and chargers. EVCC's allow energy consumers, through a network of chargers and EVs, to manage large power flows, energy efficiency and facilitate user authentication and billing processes. This need for fast and ultra-fast chargers is very pronounced along highway corridors, station depots, and urban hubs where fast turnaround is critical.

Manufacturers such as ABB, Siemens and LG Innotek have been developing EVCC solutions that can manage ultra-fast charging while providing sufficient safety, interoperability, and scalability standards, for V2G capability to ensure a sustainable and equitable EV ecosystem.

Cities are moving toward smart mobility and IoT-based urban planning, with this the upgrade of EVCCs into broader digital ecosystems increases. EVCCs harness the power of connectivity to enable predictive analytics, streamline automated billing, improve energy efficiency, and inform fleet management based on data from traffic management systems, energy grids, and cloud. Smart city initiatives in regions, such as Asia Pacific, Europe, and North America, are relying on systems with EVCCs that facilitate coordination of EV fleets, manage energy loads, and directly eliminate emissions.

The shift toward software-defined EV architectures and cloud-managed charging platforms is forming the EVCC landscape. Modern EVCCs support over-the-air (OTA) updates, remote diagnostics, and cybersecurity monitoring, reducing maintenance costs while improving scalability. Fleet operators and utilities are managing multiple chargers as well as optimizing schedules with cloud-based systems, all while applying real-time dynamic pricing.

This growing viability is also leading to the development of interoperable, modular EVCC products to support a variety of EV and charger models. As software-defined EVCCs become more ubiquitous, experts expect to see acceleration of innovation for connected EV infrastructure and better integration between different autonomous, shared, and electrified mobility services globally.

Electric Vehicle Communication Controller Market Analysis

Learn more about the key segments shaping this market

Based on system, the electric vehicle communication controller market is divided into EV communication controller (EVCC) and supply equipment communication controller (SECC). The EV communication controller (EVCC) segment dominated the market with 61% share in 2024, due to the growing demand for physical network devices such as switches, routers, and gateways that support VXLAN encapsulation and overlay networking.

- EVCCs are gradually allowing vehicle-to-grid (V2G) operation, which facilitates bidirectional energy flow and real-time communication to the grid to enable dynamic load management, peak shaving, and smart charging for residential, commercial and fleet EVs to make best use of the energy consumed, optimize the grid and provide new revenue opportunities in a connected and sustainable transportation ecosystem.

- Modern EVCCs are starting to use cloud platforms and software defined architectures, which enable over-the-air updates, remote diagnostics, and predictive maintenance. This shift promotes efficient management of multiple EVs by fleet operators and OEMs, enhances interoperability and reduces operational costs, while establishing a connected EV infrastructure that is scalable, flexible and ready for the future.

- SECCs are in development to enable safe, efficient, and secure communication with EVs as they service high-speed, high-power charging stations. The rapid deployment of DC fast chargers along highways, at commercial hubs, and in urban environments increases the need for intelligent SECCs that allow real-time monitoring, billing, and load management across many chargers and networks.

- Within the development of SECCs there is a common theme of compliance with global standards such as ISO 15118 and OCPP to enable seamless interoperability among all forms of EVs, chargers, and the grid. Once established SECCs allow the effective integration of smart grids, support V2G operations, and improve user experience across public and private charging infrastructure.

Learn more about the key segments shaping this market

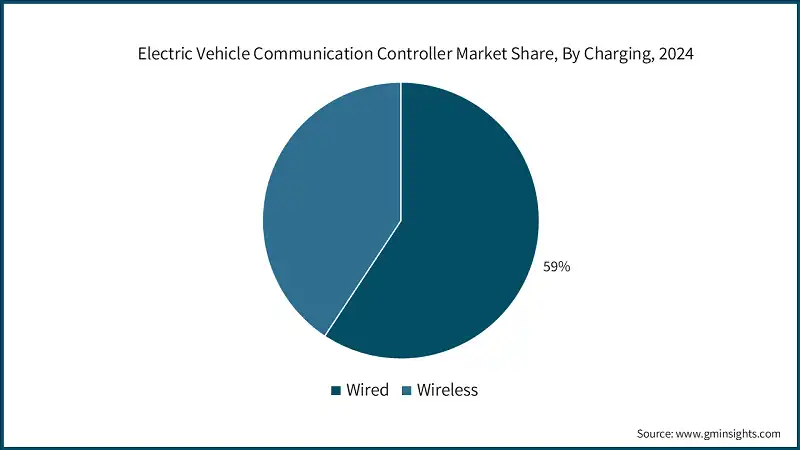

Based on charging, the electric vehicle communication controller market is segmented into wired and wireless. The wired segment dominates the market with 59% share in 2024 due to its superior reliability, low latency, and secure data transfer.

- The wired segment is dominating the market, with automakers utilizing automotive ethernet particularly in EV applications, to provide higher capacity data transfer between EV components. Increased bandwidths allow for improved real-time diagnostics and charging control and facilitate the smarter use of V2X communication protocols. This shift is driving the use of advanced wired communication controllers in modern EV architecture.

- As a result of the increased need for reliable data-transmission performance in automotive applications and safety compliance, many manufacturers have also advanced shielded wired communication solutions. Innovative connectors and harness assemblies have been developed with enhanced electromagnetic interference (EMI) shielding, performance, and compliance with ISO and IEC standards in relation to the high-voltage EV environment.

- Wireless controllers have also been designed to support features that enable Vehicle-to-Everything (V2X) use cases to allow the EV to share data between itself, infrastructure, and the grid. V2X has the potential to expedite the rollout of smart charging, predictive maintenance, and connected driving possibilities, especially for autonomous and fleet-based EV applications.

Based on vehicle, the electric vehicle communication controller market is segmented into passenger cars and commercial vehicles. The passenger cars segment is expected to dominate the market and hold 70% share in 2024.

- Passenger car segment dominates the market due to the rapid adoption of electric vehicles, increasing consumer demand for advanced connectivity features, and large-scale integration of smart communication controllers to enhance vehicle efficiency, safety, and real-time performance monitoring.

- The rise in passenger car use is indicative of the consumer-centric nature of electric car adoption, bolstered by a greater array of available vehicles, repeat development of battery technology, and significant investments in charging infrastructure. This segment also benefits from regulatory requirements in major markets, such as California's Advanced Clean Cars II, which mandates 100% sales of zero emission vehicles to achieve compliance with the California Air Resources Board's directive by 2035, and the European Union's impending phase-out of sales of internal combustion engines, also by 2035, as indicated by the European Commission.

- Heavy-duty commercial vehicles are progressing most rapidly due to their distinct total cost of ownership advantages, regulatory pressures, and commitments to corporate sustainability. Fleet operators are starting to see the outstanding operational advantages of electric commercial vehicles such as fuel cost savings, lower maintenance costs, and access to low emissions zones in urban center. The higher growth segment can capture growth rates that are higher than the light vehicle sales because most commercial vehicle purchases are centralized, and fleet managers are able to justify a higher acquisition cost because of operational savings and regulatory compliance benefits.

- The commercial vehicle segment necessitates more complex communication controllers to account for high powered charging, longer hours of operation and fleet management integration. It is common for electric commercial vehicle applications to require communication controllers that can handle multiple charging sessions at once, interface with other fleet management systems, and contain models of payment and billing for many operators and vehicles.

Based on current, the electric vehicle communication controller market is segmented into alternating current (AC) and direct current (DC). The alternating current (AC) segment is expected to dominate the market, due to widespread use in residential and commercial charging, lower infrastructure costs, compatibility with existing electrical systems, and ease of installation and maintenance.

- AC charging dominance indicates that AC charging is more extensively deployed in home and commercial applications, where lower power levels and longer charging times better align with daily patterns of usage. They provide an expected operating range of power between 3.7kW-22kW, making AC charging more suitable to situations such as overnight charging or longer duration parking. The communication controllers for AC charging are focused on safety monitoring, load management, and smart charging capabilities to gravitate down grid usage or electricity bills.

- DC charging is notably the higher growth segment, which is expected as new fast charging networks ramp up and demand for ultra-fast charging for more than daily driving needs is needed to accommodate job-related driving or long-distance driving. Power levels will be between 50kW -350+, but the facility of management with communication controllers for better thermal management and safety. This segment also includes further investment of infrastructure; the U.S. NEVI program relies on increasing ability to develop DC fast charging corridors to the Department of Transportation.

- The growth in the DC charging segment is supported technologically through existing battery technology to research a new science but working on new thermal or temperature monitoring to support faster charging in battery chemistry and time. Communication controllers for DC charging are expected to coordinate more variable and complex profiles for power delivery and charging strategies and buffer the connection service to the battery management system.

Looking for region specific data?

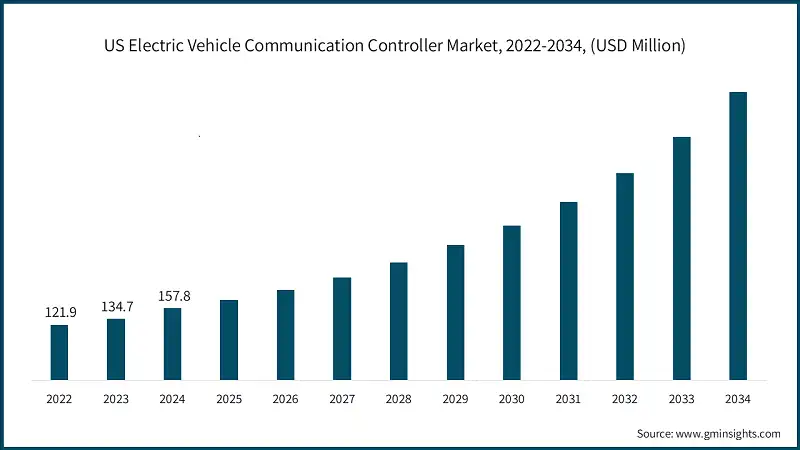

The US electric vehicle communication controller market reached USD 157.8 million in 2024, growing from USD 134.7 million in 2023.

- In North America, US currently leads the market driven by its early adoption of electric power technologies, EV infrastructure investment, and government incentives for clean commuting. Several large EV manufacturers, including Tesla, Ford, and General Motors, are putting in place expensive EVCC systems as a mechanism for supporting efficacious communication for charging technology across networks.

- The US market leads because of its healthy ecosystem for EVs, charging infrastructure, and collaborative partnerships between companies that are vested in integrated vehicle solutions including manufacturers, utilities, and technology companies. EVCCs connected with Vehicle-to-Grid (V2G), smart grids, and cloud-based management systems supports seamless communication between vehicles and charging stations.

- In particular, the US market for EVCCs has significant potential for growth with rising investment in fast-charging and wireless charging, and with growing demand for bi-directional power flow technologies. To support the increased manufacturing of EVs, improved mobility, and increased modernized grids, there is substantial investment taking place to help deliver intelligent and standardized controllers to support safe, efficient, and interoperable charging experiences across the US.

The North America market dominated the electric vehicle communication controller market with a market share of 23.1% in 2024.

- The electric vehicle communication controller (EVCC) market in North America is experiencing strong growth rates driven by the increasing adoption of electric vehicles (EVs), increased connectivity over smart charging infrastructure, and strong government incentives to purchase EVs. Automakers, utilities, and technology vendors are all investing more into their EVCC offerings to provide reliable and efficient communication between the electric vehicle, the charging station, and the electrical grid.

- The United States will be the leader of the regional market because of early investments in EV charging infrastructure, the prominence of top original equipment manufacturers (OEMs) such as Tesla, Ford, General Motors, etc., and the quick implementation of Vehicle-to-Grid (V2G) and ISO 15118 standards. Canada is emerging to be a quick-growing regional market with their of government-backed clean transportation initiatives and the developing supply of public charging networks.

- The EVCC market is also supported by developments in fast charging, wireless charging, and bidirectional communication technologies. The increased use of cloud-based infrastructure with energy management solutions driven by artificial intelligence (AI) and smart grids will help support interoperability, scalability, and automation in the EVCC market. These developments will help North America become the global leader in connected EV charging innovation.

Europe electric vehicle communication controller market accounted for USD 196.7 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- In 2024, Europe was ranked as the second largest electric vehicle communication controller market in the world, following North America, at a CAGR of 13.7%. The region's indirect growth will mostly be driven by rapid cloud growth, data center expansion in the hyperscale and co-location markets, increasing interest in SDN, and enterprise-wide digital transformation in sectors like manufacturing, BFSI and telecom.

- Germany, France, and the UK continue to be the largest markets because of advanced IT infrastructure, strong network virtualization prowess, and continuing interest in hybrid and multi-cloud. Germany will have a data center modernization effort driven by enterprises, the UK will continue to be a leader in SDN integration and the partnerships with cloud, while France is working with secure network overlays and NFV for public sector and telecom deployments.

- In contrast, Central and Eastern Europe are emerging markets with promising market growth trajectories. Countries such as Poland, Hungary, and the Czech Republic are investing in cloud data centers, in enterprise connectivity, and deploying VXLANs with SDN. Central and Eastern Europe are rising due to rapid digital transformation, supported by governments and aided by the growing interest in scalable and cost-effective virtual networks.

Germany dominates the electric vehicle communication controller market, showcasing strong growth potential, with a CAGR of 12.5%.

- Germany is rapidly transitioning to V2G-capable communication controllers allowing for two-way power connectivity between EVs and the grid. This transformation helps to optimize energy use, maintain grid stability, and use renewable energy, which is consistent with Germany’s Energiewende policy to further a more sustainable and decentralized energy system.

- Germany's adoption of ISO 15118 and Combined Charging System (CCS) standards is accelerating to provide interoperability, secure communication, and plug-and-charge functionality. These further drives collaboration between automakers, charging network operators, and utilities to create a uniform and efficient EV charging ecosystem in Europe.

- Germany is fueling demand with a focus on high-power charging infrastructures in for advanced EV communications controllers (EVCCs) that can manage electric-vehicle-to-grid (V2G) communication at high voltage. This activity supports long-distance EV travel and reduced charging time, with increased installations along highways and in urban areas under initiatives like the National Charging Infrastructure Plan.

The Asia Pacific electric vehicle communication controller market is anticipated to grow at the highest CAGR of 15.6% and generated USD 285.9 million of revenue in 2024, during the analysis timeframe.

- Governments and public-private partnerships are actively deploying EV charging networks across the Asia-Pacific with major expansions supported by incentives, and these initiatives are being augmented by total fast charging and smart grid investments across the region. The growing demand for communication controllers is being driven by the demand for managed data exchanges, real-time telematics, and energy management across a variety of charging platforms.

- EV production increases in China, Japan, South Korea, and India combined with government support for local supply chains and component standardization, are driving local OEM need for more locally manufactured EV communication controllers. Vehicle manufacturers developing low-cost, interoperable, and regionally compatible EVCC systems are also seeing government support on passenger vehicle and commercial platforms.

- As Asia Pacific markets continue development, charging networks partnered with Vehicle to Grid (V2G) and IoT-enabled EVCC systems are evolving as mobility ecosystems become more connected. These systems in the hybrid charging market allow real-time data communication between the EV, charging system, and grid data while optimizing power distribution for predictive maintenance and distribution load balancing to support the region's initiatives toward intelligent and data-driven mobility infrastructures.

China dominates the market in Asia Pacific and is estimated to grow at a CAGR of 16.1% between 2025 and 2034.

- China's electric vehicle communication controllers (EVCC) market is driven by proactive government initiatives, subsidies and extensive charging networks. The increasing investments into smart and ultra-fast charging stations create, a need for advanced communication controllers that facilitate multi-channel communication and provide interoperability, secure data transfer, and efficient charging management for vehicle-to-grid (V2G) operations with passenger and commercial electric vehicles (EVs).

- China's automotive manufacturers and technology providers have embraced standardized communication protocols, such as GB/T and ISO 15118, to create a wider level of compatibility across domestic EVs and charging stations. The localizing EVCC manufacturing brings down costs, expedites rollout, and secures the supply chain to help China accelerate its growth to be at the forefront of the global electric mobility space.

- China is also progressively moving towards the implementation of V2G and intelligent communication controllers that are enabled for smart grid and device communications. These systems enable real-time energy management, load balancing and bidirectional energy transfer between the EV battery and the power grid that increases operational efficiency and supports the country's renewable energy objectives and intelligent mobility agendas.

Latin America electric vehicle communication controller market accounted for USD 57.8 million in 2024 and is anticipated to show lucrative growth over the forecast period with a CAGR of 12.1%.

- Electric vehicle communication controller market in Latin America region is driven by rapid digital transformation with increased cloud adoption and modern EV charging networks are implemented. Rising demand for smart, interoperable and scalable EVCC solutions supports efficiency, security and grid integration in other sectors.

- EVCC growth is driven by Mexico’s strong industrial base, investments in EV infrastructure and uptake of smart charging networks. In Argentina, digital and EV ecosystems are being modernized through standards, with investments providing network automation and charging connectivity solutions supporting efficient communication between vehicles, charging stations and energy management systems

- Emerging countries in Latin America exhibit high EVCC growth opportunity due to rapid urbanization, SME uptake of EVs and digital government initiatives. Hybrid and cloud-connected EV charging networks are growing within emerging markets delivering scalable, secure communication and workload management across distributed EV infrastructure.

Brazil is estimated to grow with a CAGR of 10.4%, in the Latin America electric vehicle communication controller market.

- In Brazil, the electric vehicle communication controller (EVCC) market is increasing as automotive manufacturers and energy providers implement hybrid and multi-cloud architectures. These architectures allow for secure, scalable and real-time collection for efficient communication between EVs, charging stations and grid management platforms across transportation and industrial applications.

- Firms are also using lakehouse architectures for AI and predictive analytics to EVCC systems. The combination of technologies enables real-time monitoring, performance improvements, and a personalized experience for EV users. Various automotive manufacturers receive optimized connected vehicle systems, effectively integrated supply chains and optimized workflows across energy management and production.

- The uptake of EVCC in Brazil is also supported through partnerships between OEMs, cloud hyperscale’s, and IT service providers. Managed services and AI-enabled products improve the efficiency of the infrastructure, promote decision-making in real-time, and optimize communication between the vehicle and grid.

The Middle East and Africa accounted for USD 38.4 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- The MEA electric vehicle communication controller market represented 5% of the market in 2024, fueled by governments developing electric vehicle (EV) charging infrastructure, such as public and private networks. This expansion is generating a requirement for more sophisticated EV charging stations (EVCCs) that can provide secure communication, provide better charging management, and facilitate interoperability from vehicles to the grid.

- Countries in the region are beginning to connect EVCCs to smart grids and renewable generation. Using vehicle-to-grid (V2G) capabilities and energy management in real time, V2G helps manage the load while better facilitating clean energy adoption and grid reliability.

- The regulatory environment and incentives surrounding EV adoption have fastened the roll-out of connected charging infrastructure. Policies promoting standardization, safety and interoperability of technology help meet regulatory compliance with intelligent EVCCs, while also providing operational efficiencies in the region.

UAE to experience substantial growth in the Middle East and Africa electric vehicle communication controller market in 2024 with a CAGR of 9.7%.

- The United Arab Emirates (UAE) is rapidly deploying charging infrastructure in urban centers like Dubai and along major highways throughout the country. EVCCs seemed to be vital to support seamless interoperable communication with EVs, the charging stations, and grid operators, while the nation formulates ways to encourage EV adoption.

- The smart city projects in the UAE will employ EVCC technologies that will allow for connected vehicle systems, and predictive maintenance for real-time energy optimization, that align with adjacent digital transformation, and sustainable mobility strategies.

- The UAE is developing standardized communication protocols for EVs and charging stations that will support secure plug-and-charge. This advancement allows for better scaled infrastructure and for cross-network communication with many different service providers.

Electric Vehicle Communication Controller Market Share

The top 7 companies in the electric vehicle communication controller industry are LG Innotek, Robert Bosch, Schneider Electric, ABB, Siemens, Tesla and BYD, contributing 60% of the market in 2024.

- LG Innotek holds the top position in the market, with a 14.9% market share. The company is well established player in automotive electronics and has secured important strategic partnerships with leading manufacturers of electric vehicles. LG Innotek's market leadership is attributable to its comprehensive product offerings of electric vehicle charging controllers (EVCC) and smart electric vehicle control (SECC) technologies, as well as its full-scale manufacturing capabilities and strong customer relationships with automotive OEMs General Motors, Ford, and Stellantis.

- Robert Bosch has built on its extensive role as a technology solutions provider in the automotive industry with a robust global manufacturing footprint. Bosch's competitive strengths lie in its system-level strategy to develop components for electric vehicles, providing an integrated solution offering communication controllers, power electronics, thermal management, and safety systems.

- Schneider Electric retains a competitive position in the charging equipment segment by emphasizing its capabilities in energy management and electrical infrastructure technologies, allowing for holistic charging solutions. Schneider Electric differentiates itself from competitors by virtue of its ability to leverage communication controllers with energy management systems capable of value-added demand response, load balancing and renewable energy integration functionality. Schneider Electric is focused on parts of the market comprising commercial, fleet and utility programs to ensure high-value segments of the market with longer replacement cycles and profit margins.

- ABB is positioning itself as a leading firm in power and automation technologies to provide high-performance communication controllers for fast charging applications. ABB excels in DC fast charging infrastructure, such as the Terra series of charging stations, creating integrated market opportunities for communication controllers with charging hardware. ABB's competitive advantages can also infect commercial and public charging segments from both a service network and established relationships with utility companies.

- Siemens rounds out the top five companies with approximately 6.2% market share, with a focus on smart charging solutions that connect with wider smart city and industrial automation initiatives. Siemens' competitive focus is on cybersecurity, grid integration and reliability at the industrial level, which distinctly appeals to utility companies and larger fleet operators that consider system safety and operational resiliency a priority.

- Tesla is primarily serving its own vehicles and Supercharger network ecosystem. With the vertical integration strategy focuses on in-house developed communication controllers, specifically for its own protocols and vehicle architecture. Furthermore, the recent decision by Tesla to open its Supercharger network to other manufacturers is an opportunity for market expansion for its communication controller technology.

- BYD Company is focused mainly in China where they are positioned as a leading electric vehicle manufacturer. BYD uses vehicle production and charging infrastructure developments as a packaged approach to create synergies that reduce costs while improving the optimization of the system. The company's expansion to international markets such as Europe and North America provides opportunities for growth for its communication controller business.

Electric Vehicle Communication Controller Market Companies

Major players operating in the electric vehicle communication controller industry are:

- ABB

- BYD

- Efacec Power Solutions (or Efacec)

- Ficosa Internacional

- LG Innotek

- Mitsubishi Electric

- Robert Bosch

- Schneider Electric

- Tesla

- Vector Informatik

- ABB is a prominent supplier of electric vehicle (EV) chargers and communication controllers, providing scalable, high-performance solutions for fast and reliable vehicle-grid integration. BYD focuses on its electric mobility expertise to support in transportation and commercial vehicles with a built-in electric vehicle communication controller (EVCC) to improve battery monitoring and management, obtain charging efficiency and guaranteed integrated communication across different charging networks.

- Efacec Power Solutions is focused on advancing electric vehicle charging infrastructure and intelligent communication controllers, providing energy management and connecting smart grids. Ficosa Internacional is focused on vehicle electronics with an EVCC system that provides secure real-time communication between electric vehicles (EV), EV charging stations, and EV subsystems for better performance.

- LG Innotek is creating high guaranteed quality EV communication controllers for fast charging and vehicle to grid applications in order to improve reliability and integration. Mitsubishi Electric Corporation utilizes EVCC technology with its automotive and industrial systems supporting energy efficient charging and predictive diagnostics of electric vehicles, while also capable of real-time connectivity between the electric vehicle and the smart charging grid.

- Robert Bosch is advancing the development of sophisticated EVCCs with a focus for safety, standardized communication, and functionality for vehicle and charging applications. Schneider Electric is focused on the management of smart energy and EV infrastructure through communication controllers that will ensure EVs, charging stations and grid systems communicate with each other to optimize operational efficiency.

- Tesla offers EVCC systems for high-power fueling, vehicle-to-grid capabilities, and introduces updates via over-the-air technology to enhance an electric vehicle's performance and customer experience. Vector Informatik offers automotive software and vehicular communications that will enable electric vehicles (EVs) and charging infrastructure to communicate with security and efficiency.

Electric Vehicle Communication Controller Industry News

- In January 2025, LG Innotek revealed that it has achieved the completion of a USD 1.4 billion automotive electronics manufacturing facility expansion in Michigan, dedicated to manufacturing the next generation of V2G-enabled communication controllers. The new facility features leading-edge automation and quality control systems that will enable the company to satisfy increasing demand from North American automotive manufacturers.

- In December 2024, Robert Bosch announced its new eBike Communication Controller platform that applies its automotive expertise to the rapidly growing electric bike market. The system interacts with smart city infrastructure and includes features like theft protection, optimized routing, and predictive maintenance.

- In November 2024, Schneider Electric acquired charging software company Greenlots, for USD 350 million making Schneider's position in cloud-based charging management systems. Greenlots acquisition excels Schneider's EcoStruxure with analytics and fleet management capabilities.

- In October 2024, ABB confirmed a USD 170 million investment to build electric vehicle (EV) charging manufacturing capacity in South Carolina including the production of Terra series communication controllers. This facility is anticipated to go live in Q3 2025 including 200 jobs for the local economy.

The electric vehicle communication controller market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Mn/Bn) and shipments (units) from 2021 to 2034, for the following segments:

Market, By System

- EV communication controller (EVCC)

- Supply equipment communication controller (SECC)

Market, By Charging

- Wired

- Wireless

Market, By Vehicle

- Passenger cars

- BEV

- PHEV

- FCEV

- Commercial vehicles

- BEV

- PHEV

- FCEV

Market, By Current

- Alternating current (AC)

- Direct current (DC)

Market, By End use

- Electric vehicle manufacturers (OEMs)

- Charging station operators

- Utility providers

- Fleet operators

Market, By Application

- Residential charging

- Commercial charging

- Public charging

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Poland

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Vietnam

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the market share of the passenger cars segment in 2024?

The passenger cars segment is expected to dominate the market with a 70% share in 2024, due to the rapid adoption of electric vehicles, demand for advanced connectivity features.

What are the upcoming trends in the electric vehicle communication controller market?

Key trends include the adoption of V2G technology, the proliferation of fast and ultra-fast DC charging stations, integration with smart city initiatives, software-defined EV architectures, and cloud-managed charging platforms.

What was the valuation of the U.S. electric vehicle communication controller sector?

The U.S. market reached USD 157.8 million in 2024, leading the North American region owing to early adoption of EV technologies, significant EV infrastructure investments, and government incentives for clean commuting.

Who are the key players in the electric vehicle communication controller industry?

Key players include ABB, BYD, Efacec Power Solutions, Ficosa Internacional, LG Innotek, Mitsubishi Electric, Robert Bosch, Schneider Electric, Tesla, and Vector Informatik.

What was the market share of the wired segment in 2024?

The wired segment held a 59% market share in 2024, attributed to its superior reliability, low latency, and secure data transfer capabilities.

What is the expected size of the electric vehicle communication controller industry in 2025?

The market size is expected to reach USD 833.7 million in 2025.

What was the market share of the EV communication controller (EVCC) segment in 2024?

The EVCC segment dominated the market with a 61% share in 2024, led by the demand for network devices like switches, routers, and gateways supporting VXLAN encapsulation and overlay networking.

What is the projected value of the electric vehicle communication controller market by 2034?

The market is poised to reach USD 2.83 billion by 2034, fueled by the increasing demand for secure and efficient EV charging solutions and the integration of V2G technology.

What is the market size of the electric vehicle communication controller in 2024?

The market size was valued at USD 753.1 million in 2024, with a CAGR of 14.6% expected through 2034. The growth is driven by the global adoption of electric mobility, advancements in charging infrastructure, and smart grid developments.

Electric Vehicle Communication Controller Market Scope

Related Reports