Summary

Table of Content

Electronic Parking Brake (EPB) System Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Electronic Parking Brake System Market Size

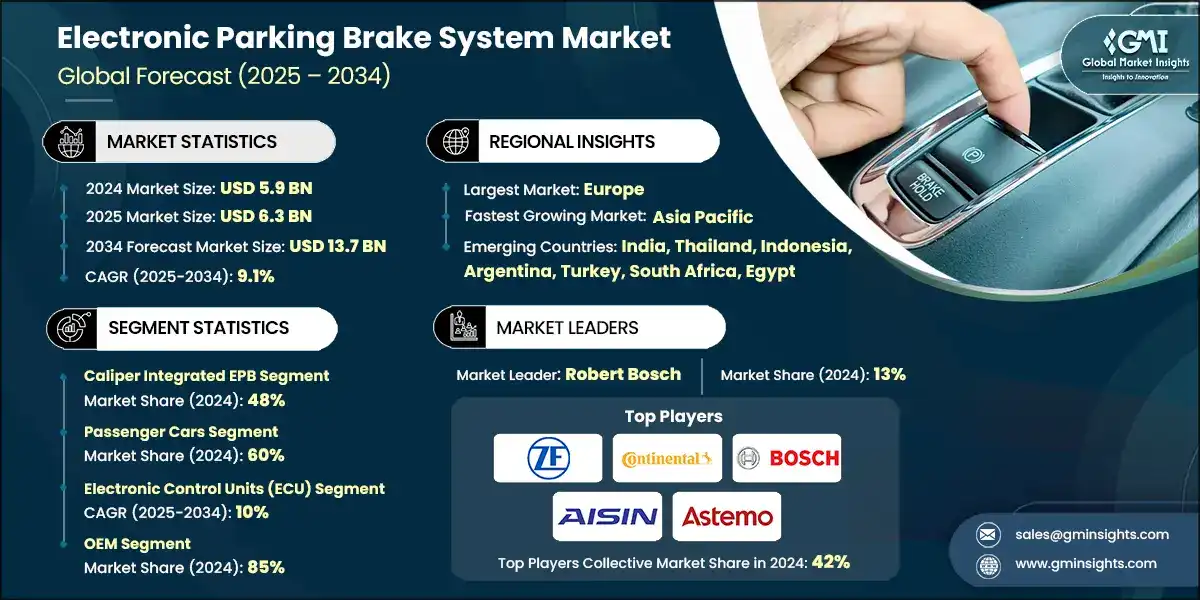

The global electronic parking brake (EPB) system market size was estimated at USD 5.9 billion in 2024. The market is expected to grow from USD 6.3 billion in 2025 to USD 13.7 billion in 2034, at a CAGR of 9.1% according to latest report published by Global Market Insights Inc.

To get key market trends

The electronic parking brake system market is advancing with the growing focus on vehicle safety, automation, and electrification. EPB systems are replacing traditional handbrakes, offering better control, space efficiency, and compatibility with advanced driver assistance systems (ADAS).

Rising regulatory mandates and demand for automated safety features are driving EPB adoption in passenger cars, SUVs, and electric vehicles. OEMs are integrating EPBs to provide auto-hold, incline detection, and electronic emergency braking for smoother braking experiences.

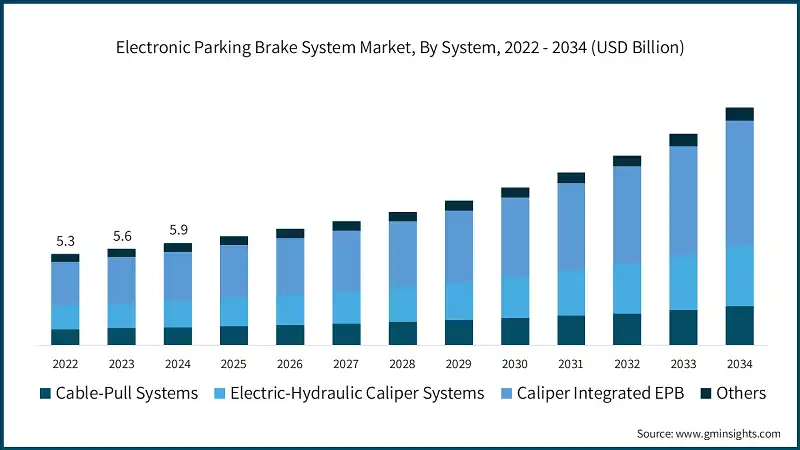

The electronic parking brake (EPB) system market was valued at USD 5.3 billion in 2022 and is projected to exceed USD 11 billion by 2032, driven by lightweight vehicle structures and electrification trends.

Post-pandemic, the automotive industry is focusing on intelligent braking systems for efficiency. By 2025, OEMs plan to standardize EPBs in mid-range and premium segments with integrated safety features.

Post-pandemic, energy-efficient and low-emission mobility solutions have gained traction. By 2025, car manufacturers aim to introduce EVPs compatible with brake systems, regenerative braking, and ECUs to enhance safety and performance.

Innovation in the EPB market is driven by companies like ADVICS, AISIN, Continental, Hyundai Mobis, and Mando, focusing on compact actuators, software-driven modules, and wireless systems for better efficiency and integration. For instance, in November 2023, ADVICS launched new EPB actuator kits for easier installation, now used in over eight million vehicles globally and distributed by AISIN World Corp. of America.

Europe dominates the EPB system market due to strict EU regulations, ADAS adoption, and a strong OEM network, with Germany and France leading implementation in premium and mid-range cars. For instance, In April 2025, ADVICS partnered with a German manufacturer to launch a next-gen EPB actuator with auto-hold, wireless control, and ECU integration for improved braking and automation.

Asia-Pacific is the fastest-growing EPB market, driven by electrification, rising vehicle numbers, and safety demands. For instance, in March 2025, Hyundai Mobis launched a compact EPB module in South Korea for lightweight EVs with advanced features.

Electronic Parking Brake (EPB) System Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 5.9 Billion |

| Market Size in 2025 | USD 6.3 Billion |

| Forecast Period 2025 - 2034 CAGR | 9.1% |

| Market Size in 2034 | USD 13.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Shifts toward vehicle automation and ADAS | EPBs enable key safety features like auto-hold, hill-start assistance, and electronic emergency braking. |

| Electrification of vehicle platforms (EVs, HEVs) | EPBs integrate with electric architectures, replacing mechanical linkages. |

| OEM push for lightweight and modular brake systems | EPBs simplify mechanics and reduce weight, aiding fuel efficiency and design flexibility. |

| Consumer demand for convenience and safety | Drivers in urban areas prefer intuitive braking, boosting EPB adoption in mid-range and premium segments. |

| Regulatory mandates for brake-by-wire systems | Governments are enforcing stricter regulations, driving OEMs to adopt EPBs for compliance. |

| Pitfalls & Challenges | Impact |

| Electronic reliability under extreme conditions | EPB systems must perform reliably under extreme temperatures, humidity, and vibration. |

| Integration complexity with ADAS and ECUs | Integrating EPB modules, control units, and ADAS platforms extends development cycles. |

| Opportunities: | Impact |

| Integration with electric and hybrid powertrains | EPBs replace mechanical linkages, enabling efficient braking and regenerative support in EVs and HEVs. |

| Advancements in actuator and ECU technologies | Intelligent actuators and software-driven ECUs enhance braking precision and support ADAS features. |

| Expansion of ADAS and brake-by-wire platforms | EPBs enhance next-gen safety systems with features like auto-hold and electronic emergency braking. |

| Rising demand in emerging markets and mid-range vehicles | EPBs are increasingly adopted in mass-market vehicles, especially in Asia-Pacific and LATAM. |

| Market Leaders (2024) | |

| Market Leaders |

13% Market Share |

| Top Players |

Collective market share in 2024 is Collective Market Share is 42% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Emerging countries | India, Thailand, Indonesia, Argentina, Turkey, South Africa, Egypt |

| Future outlook |

|

What are the growth opportunities in this market?

Electronic Parking Brake System Market Trends

- In 2025, ZF Friedrichshafen, Bosch, and Continental introduced advanced EPB systems with smart actuator control, auto-hold intelligence, and real-time diagnostics to enhance braking and ADAS integration.

- OEMs and Tier-1 suppliers are adopting EPBs with advanced features like interconnected ECUs and remote calibration, reducing maintenance costs and improving vehicle uptime.

- EPBs are replacing mechanical handbrakes in EVs, HEVs, and PHEVs, enabling integration with regenerative breaking and energy management systems.

- Next-gen EPBs feature wireless control units and smaller actuator systems. With built-in fail-safe redundancy, they can be installed on lightweight systems and support modular vehicle designs.

- Manufacturers are focusing on the software-based braking systems, which are integrated with ADAS, hill-start assistance, and electronic emergency braking and make EPBs smart safety elements, instead of a hardware one.

- In the developing economies such as India, Mexico and Turkey, EPBs are making inroads into mid-range and compact cars due to the increasing safety consciousness, urbanization and standardization of digital braking systems by the OEMs.

- The trend of sustainability and recyclability is affecting EPB design, and manufacturers are considering low-energy actuators, environmentally friendly materials, and modular components to meet the objectives of green mobility.

- Collaboration among OEMs, startups, and brake suppliers is driving innovation, with AI, IoT, and cloud-based features shaping smart braking systems.

- With the shift to electrification and autopilot capabilities, Electronic Parking Brakes (EPBs) are integral to intelligent mobility, enabling real-time performance monitoring and fault prevention to enhance safety and reduce downtime.

- By 2026, global standardization in brake-by-wire systems and safety protocols is driving EPB adoption in next-gen vehicles, enabling modular design and energy-efficient mobility.

Electronic Parking Brake System Market Analysis

Learn more about the key segments shaping this market

Based on system, electronic parking brake system market is segmented into cable-pull systems, electric-hydraulic caliper systems, caliper integrated EPB and Others. The caliper integrated EPB segment dominates the market with 48% share in 2024, and the segment is expected to grow at a CAGR of 10% from 2025 to 2034.

- In 2024, the Caliper integrated EPB segment is poised to command nearly half of the total market share, solidifying its status as the leading type of electronic parking brake system. This dominance stems from its ability to reduce weight, simplify installation, and enhance efficiency compared to traditional cable-pull and hydraulic systems.

- For instance, in March 2024, Continental AG unveiled a next-gen caliper-integrated EPB system tailored for compact electric vehicles in Europe, underscoring the technology's growing adoption among OEMs.

- The adoption of caliper-integrated EPBs is rising in electric and hybrid vehicles due to their compact and lightweight design. In July 2023, ZF Friedrichshafen AG introduced a caliper-based EPB system for SUVs, enhancing cabin space by removing mechanical handbrakes.

- Safety regulations mandating advanced brake systems, coupled with a rising consumer preference for premium features in mid-range vehicles, are poised to drive this growth.

- For instance, in January 2025, Hyundai Mobis unveiled its caliper-based EPB in its mass-market sedan lineup in the Asia-Pacific. This strategic move aims to capitalize on the burgeoning automotive markets of China and India.

- Once a standard in the industry, the cable-pull EPB systems segment is now witnessing a gradual decline in market share with a CAGR of 8.1% from 2025 to 2034. Utilizing motor-driven cables to mimic mechanical handbrakes, these systems offer a cost-effective transitional technology. However, their application is now limited to low-end vehicles.

- Electric-hydraulic caliper systems remain popular in high-performance and larger automobiles due to their precise braking and enhanced safety redundancy.

- The category of Others which comprises emerging EPB technologies like wheel hub incorporated braking systems and sophisticated mechatronic systems is slowly taking hold.

- For instance, in November 2024, Bosch introduced a distributed EPB prototype at the Tokyo Mobility Show, aimed at autonomous vehicle platforms. This innovation is expected to influence next generation braking systems beyond 2030.

Learn more about the key segments shaping this market

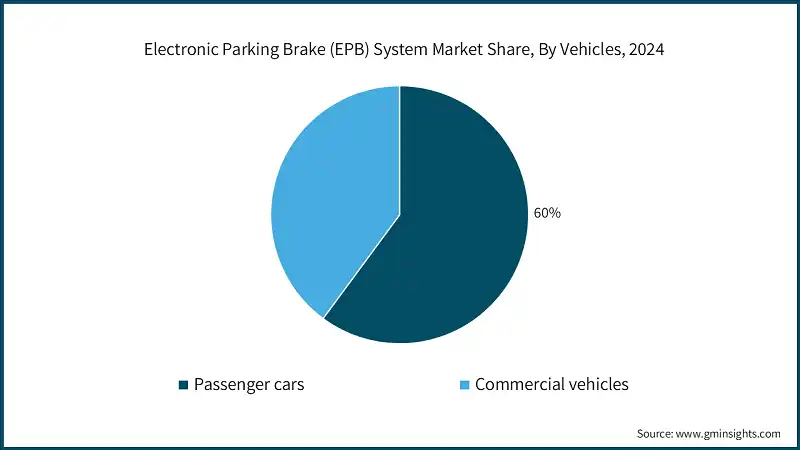

Based on vehicles, electronic parking brake system market is divided into passenger cars, commercial vehicles and electric vehicles. Passenger cars segment dominated the market, accounting for around 60% in 2024 and is expected to grow at a CAGR of 9.4% from 2025 to 2034.

- In 2024, The passenger cars segment leads the EPB system market due to increasing adoption in compact cars, sedans, and SUVs, offering enhanced safety, comfort, and integration with ADAS.

- Regulatory pressures in Europe, the US, and Asia-Pacific are driving the adoption of Electronic Parking Brakes (EPBs) in passenger vehicles. Automakers value EPBs for their cost-effectiveness, adaptability, and compatibility with various vehicle types.

- For instance, in April 2025, Bosch launched its next-gen EPB system in Germany, featuring enhanced caliper integration, improved durability, and connectivity to vehicle data platforms, aligning with the global shift toward intelligent braking systems.

- The EPB system market will primarily rely on passenger cars due to high production volumes and demand for advanced safety features. Commercial vehicles will also contribute to growth, especially in logistics-driven regions like North America and Europe.

- The commercial vehicle division of the EPB market is growing steadily due to rising demand for trucks, buses, and light-duty vans. Advanced features like automatic hill-hold and load stability make EPB systems highly desirable in delivery, logistics, and urban transport sectors.

- The commercial vehicle segment is projected to grow at a CAGR of 8.5% from 2025 to 2034, driven by fuel efficiency needs, stricter emission regulations, and fleet management adoption. EPBs are increasingly popular in LCVs and hybrid trucks for reducing driver fatigue and improving safety in urban traffic.

- For instance, in June 2024, ZF Friedrichshafen AG launched an upgraded EPB system for medium-duty trucks in North America, featuring predictive braking control and telematics integration to meet commercial logistics needs.

Based on component, the electronic parking brake system market is segmented into electronic control units (ECU), actuators, sensors, switches & wiring harnesses and others. The electronic control units (ECU) segment is expected to dominate the market owing to its high reliability, compact design, and consistent performance.

- The electronic control units (ECU) segment is expected to dominate the EPB system market with a CAGR of around 10% from 2025 to 2034, driven by its reliability, compact size, and compatibility with internal combustion, hybrid, and mild-hybrid platforms.

- OEMs prefer ECU-based ECU-EPB systems for their safety, efficiency, and compatibility with ADAS and vehicle connectivity platforms, enhancing performance in various driving conditions.

- For instance, in early 2025, Bosch introduced its second-generation EPB ECU in Germany, featuring improved processing power, adaptive control logic, and compatibility with connected vehicle platforms.

- Actuators are increasingly used in EPB systems for precise breaking and rapid response. In June 2024, Mando Corporation launched compact EPB actuators for hatchbacks and SUVs, focusing on lightweight design and low power consumption.

- Sensors are critical to EPB adoption, providing data on braking force, wheel speed, and position to enhance safety and efficiency. For instance, in January 2025, Bosch introduced EPB-specific sensors enabling predictive diagnostics for high-end sedans and SUVs.

- Switches and wiring harnesses, though less dominant than ECUs, ensure system durability and enable efficient power and communication between the ECU, sensors, and actuators.

- For instance, in September 2024, Lear Corporation released modular wiring harnesses designed to fit EPB systems that make assembly of OEMs easier and lower the production cost.

Based on sales channel, the electronic parking brake system market is divided into OEM and aftermarket. OEM segment dominated the market accounting around 85% in 2024 and is expected to grow at a CAGR of 9.3% from 2025 to 2034.

- OEMs dominate the EPB system market as strict regulations in Europe, North America, and Asia-Pacific drive automakers to adopt these systems, ensuring safety compliance and advanced braking performance.

- OEMs are increasingly using EPB systems in hybrid and electric vehicles for regenerative breaking, energy recovery, and stability. These systems also integrate seamlessly with connected and autonomous vehicle platforms.

- For instance, in March 2025, Bosch partnered with a leading European EV manufacturer to develop a next-gen EPB solution featuring adaptive actuation, predictive diagnostics, and 48V mild-hybrid integration, enhancing safety and energy efficiency.

- The aftermarket segment is projected to grow at a CAGR of approximately 8% from 2025 to 2034, driven by retrofitting EPB systems in older ICE, hybrid, and EV vehicles to improve reliability, safety, and efficiency.

- Advancements in the aftermarket are driven by modular EPB designs, plug-and-play packages, and universal controllers, simplifying installation and addressing wiring complexities with universal modules and clear guides.

- For instance, in September 2024, Continental AG launched a retrofit EPB kit in Asia-Pacific, targeting budget fleets and mid-tier passenger vehicles to expand aftermarket adoption beyond factory-fitting systems.

Looking for region specific data?

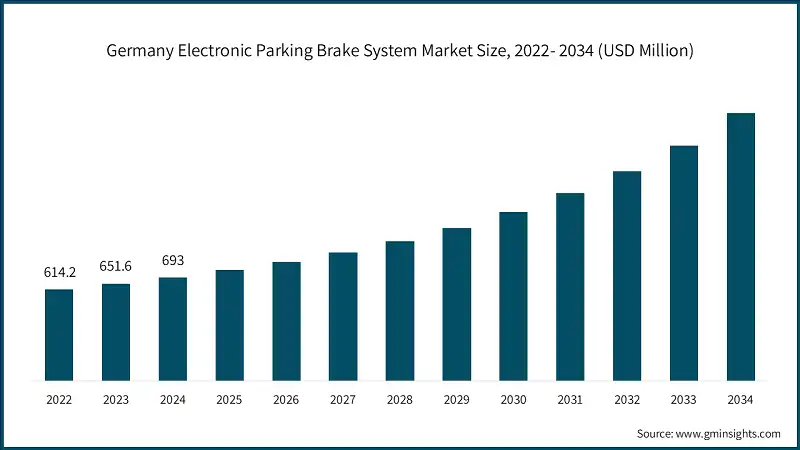

Europe region dominated the electronic parking brake (EPB) system market with a market share of 35% in 2024.

- In 2024, Europe's EPB system market grew due to strict safety policies and the adoption of advanced braking systems in premium cars to meet Euro NCAP standards.

- Europe has positioned itself as a technological leader in the EPB market, facilitated by the intensive level of R&D, stringent regulatory provisions, and well-developed automotive supply chain. The shift toward autonomous driving, connected mobility, and electrification is boosting the adoption of electronic braking systems in vehicles.

- Germany, the largest car market in the region, is driving growth with innovations in caliper-integrated EPB systems.

- For instance, in February 2024, ZF Friedrichshafen AG unveiled its updated EPB platform for electric SUVs and luxury sedans.

- Supportive government policies in Europe are driving safety improvements and electrification. Countries like France and the UK are boosting EPB demand through ADAS advancements and EV adoption, relying on high-quality braking technologies.

- In July 2024, Bosch increased EPB installations in mid-range passenger cars to meet rising demand for safety systems, previously limited to high-end vehicles. This reflects Europe's growing focus on driver safety, efficiency, and sustainability.

The Germany electronic parking brake (EPB) system market was valued at USD 581.5 million and 614.2 million in 2021 and 2022, respectively. The market size reached USD 693 million in 2024, growing from USD 651.6 million in 2023.

- Germany's Electronic Parking Brake (EPB) systems market is growing steadily, driven by advanced automotive engineering, luxury vehicle manufacturing, and rapid ADAS adoption. Leading OEMs like BMW, Mercedes-Benz, Volkswagen, and Audi ensure sustained demand for EPB systems.

- Strict EU safety regulations and consumer demand for automation drive German manufacturers to adopt EPB systems, enhancing safety, space efficiency, and autonomous driving capabilities.

- For instance, in 2024, a major German automaker introduced vehicles with integrated EPB and brake-by-wire systems, highlighting the growing use of electronic braking in premium and mid-tier segments.

- Germany remains a key market for EPB systems in Europe, driven by its strong R&D ecosystem, robust automotive supply chain, and government focus on smarter mobility. Continued innovative investments will help maintain its leadership in EPB technology.

- In Germany, collaboration between car manufacturers and Tier-1 suppliers is accelerating the adoption of Electronic Parking Brakes (EPB), driven by the demand for better braking, optimized interior space, and advanced safety features.

Asia Pacific electronic parking brake system market accounted for USD 1.8 billion in 2024 and is anticipated to show lucrative growth of 9.2% CAGR over the forecast period.

- The Asia Pacific Electronic Parking Brake (EPB) market is growing rapidly, driven by rising vehicle production, passenger car demand, and advanced safety system adoption in key countries like China, Japan, South Korea, and India.

- The regulatory measures of vehicle safety by the government and the incentives of smart and connected automotive technologies are pushing the manufacturers in the region into implementing the EPB systems.

- With a vast automotive consumer base, supportive policies, and rapid advancements in vehicle electrification, the Asia Pacific is poised to lead the global adoption of Electronic Parking Brakes (EPB).

- For instance, in early 2024, a leading supplier from Japan unveiled next-generation EPB systems tailored for both domestic and international markets, underscoring Asia Pacific's pivotal role in EPB innovation.

China dominates the Asia Pacific electronic parking brake (EPB) system market, showcasing strong growth potential, with a CAGR of 9.5% from 2025 to 2034.

- China dominates the Asia Pacific Electronic Parking Brake (EPB) system market due to its large automotive manufacturing capacity, rapid adoption of advanced safety features, and supportive government regulations.

- Government incentives and rising demand for quality passenger vehicles are boosting EPB adoption, as automakers integrate these systems to meet safety and comfort standards.

- China leads the EPB region, driven by its strong industrial base, technological advancements, and focus on electrification and automation.

- For instance, in May 2024, a Chinese motor parts supplier unveiled an intelligent EPB system tailored for hybrid and electric vehicles, aiming to boost vehicle control, safety, and efficiency in both local and global markets.

- In China, a growing focus on driver safety and comfort is driving EPB integration, with automakers and tech suppliers collaborating to deliver reliable and intelligent braking systems.

The North America electronic parking brake system market is anticipated to grow at a CAGR of 8.9% during the analysis timeframe.

- The North American automotive electronic parking brake (EPB) system market is growing steadily, driven by rising adoption of ADAS, hybrid and electric vehicles, and consumer demand for safety and convenience. Automakers in the US and Canada are using EPB systems to meet safety standards and differentiate vehicle segments.

- Technological advancement and innovation of products contribute to further market expansion. Suppliers are prioritizing compact, lightweight, software-based EPBs to enhance braking, support autonomous driving, and lower maintenance costs.

- OEMs and technology providers are driving the market through strategic alliances. For instance, in August 2024, a US automotive supplier partnered with a global OEM to develop an intelligent EPB solution with predictive diagnostics.

- Government safety mandates, increasing EV adoption, and consumer demand for advanced safety features are driving the growth of EPB systems in North America.

- The US leads the North American EPB market with a strong automotive industry and high EV adoption. Canada benefits from incentives and safety regulations, while Mexico is becoming a production hub for EPB-equipped vehicles.

The electronic parking brake (EPB) system market in US is expected to experience significant and promising growth from 2025 to 2034.

- Hybrid, electric, and premium vehicles dominate the Us automotive EPB system market, driven by strict safety regulations and rising demand for advanced braking integrated with ADAS.

- US and international OEM suppliers are developing compact, lightweight, software-driven EPB solutions, compatible with both traditional ICE vehicles and today's EVs, highlighting the market's technological focus.

- Favorable safety regulations and federal Motor Vehicle Safety Standards (FMVSS) standards, along with consumer demand, are driving OEMs to adopt EPB features, including automatic braking and driver support systems.

- The US EPB market is set for rapid growth, driven by EV adoption, autonomous driving advancements, and demand for smart safety systems, supported by regulatory pressures and a strong innovation ecosystem.

Brazil leads the Latin American electronic parking brake system market, exhibiting remarkable growth of 6.8% during the forecast period of 2025 to 2034.

- Brazil's electronic parking brake (EPB) system market leads in Latin America, driven by a strong automotive industry and growing hybrid and electric vehicle adoption. Automakers are rapidly integrating EPB systems to enhance safety and meet stringent regulations.

- Government support for clean mobility, including EV incentives and infrastructure, is driving advanced automotive component development, establishing Brazil as a key EPB innovation hub.

- Brazil is leading Latin America's shift to advanced braking technologies, with OEMs and tier-1 suppliers establishing local facilities. This has attracted EPB system investments, strengthening its supply chain and technology base.

- For instance, in May 2025, a leading brake system manufacturer announced plans to expand its EPB facility in San Paulo, highlighting Brazil's growing market potential for compact and SUV cars with EPB.

- Brazil is expected to remain a regional leader, driven by innovation, favorable policies, and a supportive consumer market, with vehicle electrification and automation boosting its role in automotive technology.

UAE to experience substantial growth in the Middle East and Africa electronic parking brake (EPB) system market in 2024.

- The UAE is focusing on EVs and smart mobility, with automatic parking brakes (EPBs) being a key area. For instance, in February 2025, it announced a $100 million investment in smart vehicle technologies, aiming for EVs and autonomous vehicles by 2035, driving demand for advanced safety systems like EPBs.

- Tesla, Hyundai, and BYD are expanding their EV and hybrid offerings in the UAE's luxury SUV and premium passenger car market, integrating EPB systems to enhance safety, enable ADAS, and save road space.

- The UAE government plans to introduce reduced import tariffs and tax exemptions for EVs and hybrids. A 2026 regulation mandating advanced brake systems in new passenger cars is expected to boost EPB adoption.

- Dubai's Green Mobility Strategy, targeting over 1,000 charging stations by 2027, is driving EPB market growth. Rising demand for EPB-equipped models among luxury car dealerships in Dubai and Abu Dhabi highlights its premium appeal.

- The UAE's EPB industry is set for growth, driven by government sustainability initiatives, foreign automaker inflows, and rising demand for advanced vehicles, positioning it as a key hub for braking technologies in the Middle East.

Electronic Parking Brake System Market Share

- The top 7 companies in the electronic parking brake (EPB) system industry are ZF Friedrichshafen, Continental, Robert Bosch, Aisin Seiki, Hitachi Astemo, Hyundai Mobis and Mando contributed around 47% of the market in 2024.

- ZF Friedrichshafen, through its TRW and ZF brands, offers advanced electronic parking brake (EPB) solutions with modular design, ADAS integration, and predictive diagnostics, catering to high-end and commercial automotive sectors globally.

- Continental offers smart EPB systems compatible with automobile control units, electric motors, and advanced driver assistance systems, with a strong presence in Europe, Asia, and North America.

- Robert Bosch dominates the EPB market with energy-efficient and precise braking solutions, widely adopted across passenger cars, commercial vehicles, and electric mobility platforms.

- Aisin Seiki provides caliper-based and cable-pull EPB systems, offering durable, lightweight, and space-saving solutions compatible with hybrid and EV platforms, making it a preferred partner for OEMs in Asia and Europe.

- Hitachi Astemo offers reliable, low-noise, and efficient EPB and brake-by-wire systems, focusing on safety, modularity, and energy efficiency for OEM and electric vehicle platforms.

- Hyundai Mobis provides EPB solutions that focus on integration with ADAS, hybrid, and EV architecture. Mobis, a pioneer in its design of caliper-based electronic actuators, is extremely reliable, small and able to provide supplies to Hyundai and Kia, among other customers in the global OEM industry.

- Mando manufactures EPB systems with high precision, quick response actuation, and seamless ECU integration, focusing on durability and energy efficiency in the Asia-Pacific and emerging EV markets.

Electronic Parking Brake System Market Companies

Major players operating in the electronic parking brake (EPB) system industry are:

- Aisin Seiki

- Akebono Brake Industry

- Brembo

- Continental

- Hitachi Astemo

- Hyundai Mobis

- Knorr-Bremse

- Mando

- Robert Bosch

- ZF Friedrichshafen

- Aisin Seiki, Akebono Brake Industry, and Brembo lead EPB innovation with energy-efficient systems for various vehicles, low-noise actuators for hybrid and electric platforms, and high-performance solutions for luxury and sports cars.

- Continental, Hitachi Astemo, and Hyundai Mobis provide advanced EPB solutions, focusing on intelligent diagnostics, compact actuators, and innovative designs compatible with hybrid and electric vehicles.

- Knorr-Bremse, Mando, and Robert Bosch provide reliable EPB systems for passenger and commercial vehicles. Knorr-Bremse focuses on heavy-duty applications, Mando offers cost-effective systems with stability features, and Bosch delivers compact, energy-efficient EPBs compatible with ADAS functions.

- ZF Friedrichshafen excels in integrating electronic chassis, brake systems, and EPB. Its TRW solutions ensure safe and efficient braking with predictive diagnostics and autonomous driving integration.

Electronic Parking Brake System Industry News

- In April 2025, Hitachi Astemo introduced a compact EPB module for hybrid and electric vehicles, featuring advanced controls and predictive diagnostics for automated braking and autonomous driving.

- In February 2025, Knorr-Bremse introduced an upgraded EPB system for heavy-duty trucks and buses, enhancing actuator reliability and integration with braking and stability control systems for fleets in Europe and North America.

- In December 2024, Robert Bosch launched its new EPB series, boasting improved energy efficiency and integration features tailored for hybrid and electric vehicles. This system, equipped with compact actuators and sophisticated diagnostics, aids OEMs in adhering to worldwide electrification and safety benchmarks.

- In November 2024, ZF Friedrichshafen unveiled its next-gen TRW EPB solution, boasting predictive diagnostics and an advanced actuator design tailored for autonomous and electric vehicles. This system not only ensures precise braking control but also integrates effortlessly with electronic chassis and brake control systems.

The electronic parking brake (EPB) system market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Mn) and volume (Units) from 2021 to 2034, for the following segments:

Market, By System

- Cable-pull systems

- Electric-hydraulic caliper systems

- Caliper integrated EPB

- Others

Market, By Vehicles

- Passenger cars

- Hatchbacks

- Sedans

- SUVS

- Commercial vehicles

- Light commercial vehicles

- Medium commercial vehicles

- Heavy commercial vehicles

Market, By Component

- Electronic control unit (ECU)

- Actuators

- Sensors

- Switches & wiring harnesses

- Others

Market, By Sales Channel

- OEM

- Aftermarket

Market, By Propulsion

- Internal combustion engine (ICE)

- Hybrid electric vehicle (HEV / PHEV)

- Battery electric vehicle (BEV)

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Portugal

- Croatia

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Singapore

- Thailand

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Egypt

Frequently Asked Question(FAQ) :

What are the upcoming trends in the electronic parking brake system market?

Trends include wireless control units, software-based braking, ADAS integration, regenerative braking for EVs, and eco-friendly, energy-efficient designs.

What was the market share of the OEM segment in 2024?

The OEM segment dominated the market with around 85% share in 2024 and is anticipated to showcase around 9.3% CAGR up to 2034.

Who are the key players in the electronic parking brake (EPB) system industry?

Key players include Aisin Seiki, Akebono Brake Industry, Brembo, Continental, Hitachi Astemo, Hyundai Mobis, Knorr-Bremse, Mando, Robert Bosch, and ZF Friedrichshafen.

Which region leads the electronic parking brake (EPB) system sector?

Europe leads the market with a 35% share in 2024, led by stringent safety regulations, advanced braking systems in premium vehicles, and a strong automotive supply chain.

What was the market share of the passenger cars segment in 2024?

The passenger cars segment accounted for approximately 60% of the market in 2024 and is set to expand at a CAGR of 9.4% through 2034.

What was the market share of the caliper integrated EPB segment in 2024?

The caliper integrated EPB segment dominated the market with a 48% share in 2024 and is expected to witness over 10% CAGR till 2034.

What is the market size of the electronic parking brake (EPB) system in 2024?

The market size was USD 5.9 billion in 2024, with a CAGR of 9.1% expected through 2034. The market is driven by increasing focus on vehicle safety, automation, and electrification.

What is the projected value of the electronic parking brake system market by 2034?

The market is poised to reach USD 13.7 billion by 2034, fueled by advancements in ADAS integration, electrification, and smart braking systems.

What is the expected size of the EPB system market in 2025?

The market size is projected to reach USD 6.3 billion in 2025.

Electronic Parking Brake (EPB) System Market Scope

Related Reports