Summary

Table of Content

Electric Construction Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Electric Construction Equipment Market Size

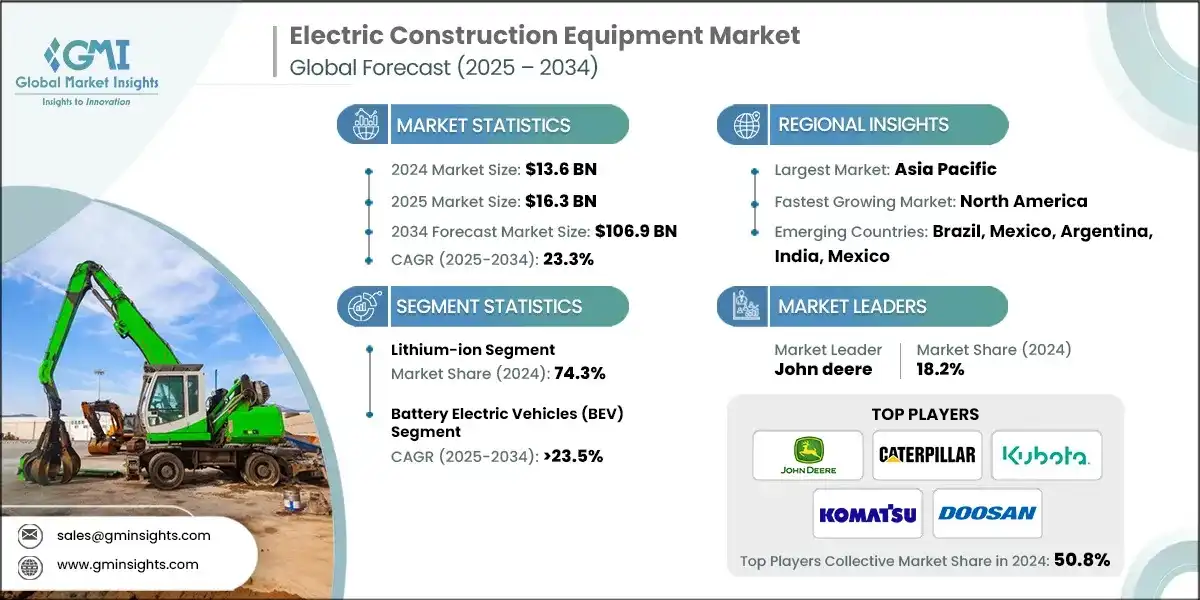

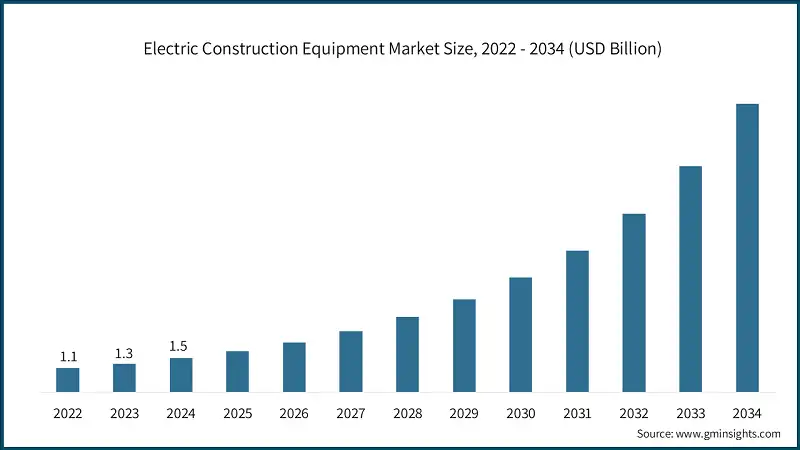

The global electric construction equipment market was valued at USD 13.6 billion in 2024. The market is expected to grow from USD 16.3 billion in 2025 to USD 106.9 billion in 2034 at a CAGR of 23.3%, according to latest report published by Global Market Insights Inc. This growth is attributed to the rising global demand for sustainable and low-emission construction machinery, increasing investments in infrastructure and smart city projects, and the expansion of electrified fleets in commercial and municipal construction

To get key market trends

- The electric construction equipment market is experiencing strong growth due to the increasing integration of battery-electric drivetrains, AI-powered telematics, mobile-first fleet control interfaces, and advanced data analytics for predictive maintenance. Rising concerns over diesel emissions, noise pollution, and regulatory restrictions in urban zones, combined with OEM demand for lower total cost of ownership (TCO), will continue to spur adoption of technologies such as fast-charging systems, swappable batteries, IoT-based remote monitoring, and autonomous operation support.

- Electric construction equipment is becoming much more prevalent with changes in markets, regulations and the various forces of modernization around the world. For instance, in March 2024 the European Union strengthened their Green Deal mandates on construction emissions which put even stricter CO2 reduction targets into motion, while providing incentives to adopt zero-emission machinery.

- Initially the adoption and uptake of electric construction equipment had negative market forces from supply chain disruptions and battery raw material shortages when the supply and demand were initially disrupted throughout the year 2020. However, in 2021 demand grew quickly since many contractors, rental companies, and enhanced government backed infrastructure projects sought zero-noise emission options from both instrumented machines with proven domestic low-noise benefits that significantly while engaging mission-informed sustainability goals.

- Fleet operators quickly expanded their investment in equipment which provided advanced telematics for geo-fencing, predictive battery-health alerts and over-the-air (OTA) performance updates to proactively mitigate downtime and enhance remote asset management.

- Due to rapid infrastructure expansion, government decarbonization mandates, and growing smart city initiatives, the Asia-Pacific region is currently the leading region for the electric construction equipment market. China, Japan, and South Korea are more advanced than other regions and have taken the lead with the successful implementation of battery-electric excavators which is being championed by local domestic innovations and state-supported subsidies across battery-electric excavators, loaders, cranes and telehandlers.

Electric Construction Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 13.6 Billion |

| Market Size in 2025 | USD 16.3 Billion |

| Forecast Period 2025 - 2034 CAGR | 23.3% |

| Market Size in 2034 | USD 106.9 billion |

| Key Market Trends | |

| Drivers | Impact |

| Stringent emission regulations | Governments worldwide are mandating carbon reduction and phasing out diesel-based construction machinery (e.g., EU Fit for 55, U.S. EPA non-road diesel rules, Chinas subsidy programs) |

| Urbanization & smart city projects | Rapid infrastructure expansion in Asia-Pacific and Europe is fueling demand for low-emission, quiet, compact electric equipment suitable for urban zones. |

| Cost savings & efficiency | Lower operating costs, reduced fuel dependency, and fewer maintenance needs compared to diesel equipment are attracting contractors and rental operators. |

| OEM and rental adoption | Equipment-as-a-service (EaaS) models and rental company initiatives accelerate deployment by lowering upfront costs for end-users. |

| Pitfalls & Challenges | Impact |

| High upfront costs | Electric machines typically have higher purchase prices due to battery and powertrain costs, creating adoption barriers for smaller contractors. |

| Charging infrastructure gaps | Lack of standardized charging stations and mobile charging solutions hinders widespread deployment, especially on remote job sites. |

| Opportunities: | Impact |

| Government incentives & subsidies | Financial support programs in Europe, China, India, and the U.S. provide strong tailwinds for electric fleet adoption. |

| Advancements in battery tech | Next-gen lithium-ion, solid-state, and hydrogen-electric hybrid systems can extend runtime, improve performance, and reduce charging bottlenecks. |

| Smart jobsite integration | Combining electric machines with digital twins, predictive analytics, and 5G connectivity can optimize efficiency and safety in large-scale projects. |

| Green infrastructure projects | Decarbonization targets, zero-emission zones, and sustainable construction initiatives open large procurement opportunities for electric fleets. |

| Market Leaders (2024) | |

| Market Leaders |

Holds 18.2% market share |

| Top Players |

Collective market share in 2024 is 50.8% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Emerging Country | Brazil, Mexico, Argentina, India, Mexico |

| Future Outlook |

|

What are the growth opportunities in this market?

Electric Construction Equipment Market Trends

- AI-powered predictive maintenance and operational analytics are altering the electric construction equipment industry to allow real-time inspection and monitoring of machine performance with alerts prior to component failures and analysis regarding improving uptime based on equipment performance. For example, in February 2025, Komatsu released and AI-enabled predictive maintenance suite, which included real-time diagnostic, over-the-air updates, and cloud-enabled health monitoring of heavy electric machinery.

- The combined growth of mobile and IoT platforms is accelerating faster than we have seen in a long time, and many documentation OEMs are using smartphone-based fleet management and GPS tracking as part of their daily toolkit for managing mobile production equipment and controlling mobile equipment remotely. For example, in April 2025, John Deere introduced a mobile-first connected platform in North America that gave operators the ability to monitor machine health, schedule and track maintenance events, and confirm operational status in real-time.

- Autonomous and semi-autonomous operational systems are maturing to include a suite of sensors, AI-assisted navigation, and collision avoidance, which are now commonplace in electric loaders, excavators, and cranes. For example, in January 2025, Caterpillar introduced enhanced autonomous operation modules in Japan that supported both OEM-based deployments as well as rental fleet management, adding another layer of operational safety and efficiency on the jobsite.

- People are making a conscious effort to prioritize sustainability and energy efficiency when designing new products. Suppliers now look to incorporate low-power control chips, highly efficient battery management systems, and eco-friendly materials. In March 2025, Kubota launched their energy-efficient compact electric loader for the European market. This loader can manage the battery better and has a reduced amount of energy consumption while still providing the same amount of performance.

- Compliance and safety shifted their role as product design factors, as regulators have mandated governments around the world to reduce emissions, electrify their equipment and wrap them into a standard, safe operating protocol. The European Union updated their Non-Road Mobile Machinery (NRMM) regulations in 2025, and new electric construction equipment must comply with energy efficiency, safety, and digital reporting standards.

Electric Construction Equipment Market Analysis

Learn more about the key segments shaping this market

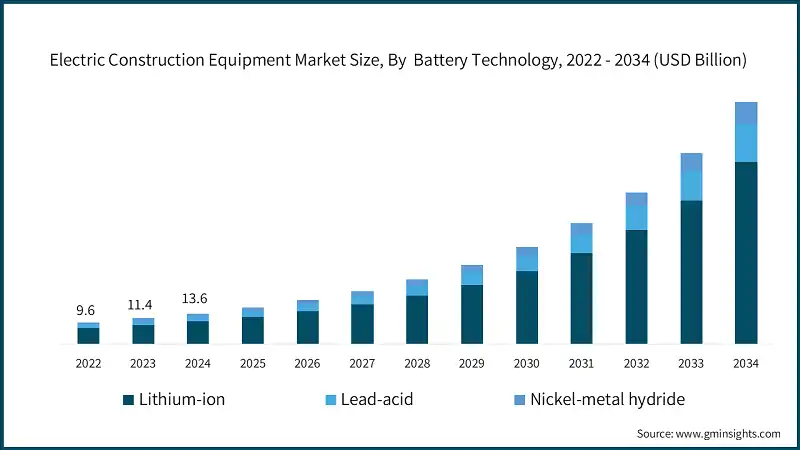

Based on battery technology, the market is divided into lead-acid, lithium-ion and nickel-metal hydride. The lithium-ion segment dominated around 74.3% share in 2024 and is expected to grow at a CAGR of over 23.4% through 2034.

- The lithium-ion battery segment is emerging as the largest segment of the electric construction equipment industry due to increasing demand for improved energy density, shortening charge times, extended lifecycle, and higher performance in heavy-duty and compact electric machines in the fast-growing regions of Asia-Pacific and Europe.

- Established electric construction equipment OEMs such as John Deere, Caterpillar, Komatsu, and Kubota are in constant improvement modes with lithium-ion batteries. They are continually improving the advances in battery management systems, modular battery packs, and AI-enabled predictive diagnostics. OEMs are developing fast-charging solutions, OTA (over the air) software updates to optimize battery life per charge, and IoT-based remote monitoring tools, to be deployed on existing equipment platforms, which works in synchronization with the existing capabilities of the lithium-ion segment. For example, in February 2025, Komatsu launched the next-gen, AI-enabled, solid-state lithium-ion excavator, in Europe, which contains goods monitoring of battery health and cloud-based performance monitoring.

- The lead-acid and nickel-metal hydride segments, while smaller, are gradually gaining traction in niche applications such as compact loaders, mini excavators, and low-cost rental fleets. Lithium-ion batteries’ higher upfront costs and infrastructure requirements continue to drive OEMs and rental operators to offer hybrid solutions combining battery types, while innovations in charging stations and modular battery swapping are helping to expand adoption across commercial and urban construction projects worldwide.

Learn more about the key segments shaping this market

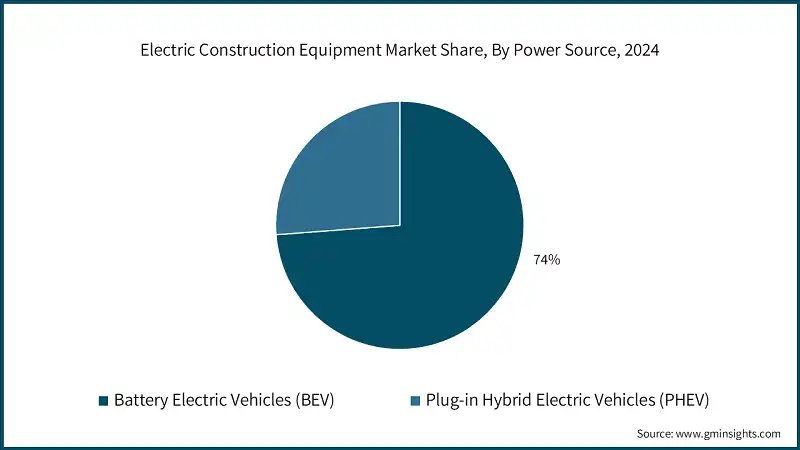

Based on power sources, the electric construction equipment market is segmented into battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV). The battery electric vehicles (BEV) segment dominates the market with 74% share in 2024 and is expected to grow at a CAGR of over 23.5% from 2025 to 2034.

- Battery electric vehicles (BEV) segment dominates the market because of the increasingly demanding specifications for zero-emissions, lower operating costs; and increased efficiency, particularly with urban construction and large-scale construction projects - that are mostly found in Asia-Pacific and Europe.

- There is a large group of original equipment manufacturers (OEMs), like Caterpillar, John Deere, Komatsu, Kubota, and Doosan Infracore, that are competitively evolving BEV products with advanced battery management systems, charging capabilities, or predictive maintenance based in artificial intelligence (AI). New products based on the evolution of BEV designs include cloud connected fleet tracking, over-the-air (OTA) software updates, and IoT-specific machine control and functionality, which also entrench the BEV segment in continued dominant status. One of these such products is the John Deere BEV compact loader introduced in March 2025, in Europe, which has predictive battery diagnostics and remote fleet tracking features.

- The plug-in hybrid electric vehicle (PHEV) segment is also growing; however, it is focused on applications that typically require heavy-duty or longer runtimes. Hybrid solutions using battery and diesel, or hydrogen-electric drivetrains, will always be sought after usage within sectors focused on operational runtime limits and short-charging windows. The growing prevalence of even more fast-charging stations, as well as modular energy storage solutions, are also on their way to helping further secure PHEV usage in commercial construction fleets worldwide.

Based on equipment, the market is segmented into excavators, loaders, bulldozers, cranes, dump trucks, rollers and others. The excavator’s segment is expected to dominate the market throughout the forecast period.

- The excavators segment is expected to take the lead in the electric construction equipment market because there is strong demand for versatile, zero-emission machines that can perform heavy-duty digging, lifting and material handling. Growth, particularly in the Asia-Pacific and Europe, is strong due to low noise and environmentally friendly construction equipment requirements for infrastructure and urban construction.

- Also, with leading OEMs like Komatsu, Caterpillar, John Deere, Kubota and Doosan Infracore continually improving electric excavator offerings with more sophisticated battery management systems, AI-enabled predictive maintenance capabilities, telematics and IoT-based remote monitoring, developments such as fast-charging capabilities, autonomous or semi-autonomous operation, and cloud-connected fleet management will add to excavators globally overtaking the other segments. For example, in April 2025, Komatsu began selling a next-gen electric excavator in Japan including AI-powered diagnostics capabilities, remote monitoring and predictive maintenance.

- The loaders, bulldozers, cranes, dump trucks, rollers and other segments, while smaller, are slowly beginning to see adoption, especially in urban construction, rental fleets and niche applications. OEM’s are successfully adding hybrid and fully electric versions of their machines with modular battery packs and connected fleet management to facility wider spread adoption in municipal and commercial construction projects.

Based on battery capacity, the market is segmented into less than 50 kWh, 50 kWh to 200 kWh and more than 200 kWh. The 50 kWh to 200 kWh segment dominates the market.

- The 50 kWh to 200 kWh battery capacity segment dominates the electric construction equipment market due to its optimal balance of power, runtime, and cost-efficiency, making it suitable for a wide range of machinery such as excavators, loaders, and compact cranes. Demand is particularly strong in Asia-Pacific and Europe, where urban construction projects and infrastructure development prioritize zero-emission, high-performance equipment.

- Leading OEMs such as Komatsu, Caterpillar, John Deere, Kubota, and Doosan Infracore are continuously enhancing machinery in this battery range with advanced battery management systems, AI-enabled predictive maintenance, fast-charging capabilities, and IoT-based remote monitoring. In February 2025, Caterpillar launched a 120 kWh electric excavator in Europe, integrating cloud-connected fleet management and predictive battery diagnostics, further reinforcing the dominance of this segment.

- The less than 50 kWh segment, typically used in compact or mini equipment, and the more than 200 kWh segment, designed for ultra-heavy-duty machines, are smaller but gradually growing. Innovations in modular battery packs, hybrid configurations, and fast-charging infrastructure are supporting wider adoption of these capacities, particularly in specialized or high-performance applications.

Based on end use, the market is segmented into construction, mining, material handling, agriculture and others. The construction segment dominates the market.

- The construction segment dominates the electric construction equipment market due to high demand for versatile, zero-emission machinery such as excavators, loaders, bulldozers, and cranes in urban infrastructure, commercial, and residential projects. Growth is particularly strong in Asia-Pacific and Europe, driven by smart city initiatives, emission regulations, and rapid infrastructure development.

- Leading OEMs such as Caterpillar, Komatsu, John Deere, Kubota, and Doosan Infracore are continuously enhancing electric machinery for construction applications with advanced battery management systems, AI-enabled predictive maintenance, telematics, and IoT-based fleet monitoring. For example, in March 2025, Komatsu launched a next-generation electric excavator for construction projects in Europe, featuring predictive diagnostics, cloud-connected fleet management, and fast-charging capabilities.

- Mining, material handling, agriculture, and other segments, while smaller, are witnessing gradual adoption. Electric loaders, compact excavators, and hybrid machinery are being deployed in mining and agriculture, while innovations in battery packs, hybrid systems, and connected fleet solutions support wider adoption across niche applications.

Looking for region specific data?

Asia Pacific Electric Construction Equipment Market

Asia Pacific region dominated the global market with a share of 32.8% in 2024, driven by rapid infrastructure development, urbanization, and increasing adoption of sustainable and low-emission construction machinery. Countries such as China, India, Japan, and South Korea are leading the deployment of electric excavators, loaders, and compact machinery.

- Moreover, Asia-Pacific has been at the forefront of smart construction technology adoption, integrating AI-enabled predictive maintenance, IoT-based fleet monitoring, and cloud-connected equipment management. Key OEMs such as Komatsu, Caterpillar, and Hitachi are expanding their electric machinery offerings in the region, driving demand for battery-electric and hybrid machines.

- In addition, governments across the region are introducing stringent emission standards, urban sustainability initiatives, and incentives for electric machinery adoption, enabling faster deployment of next-generation equipment such as autonomous or semi-autonomous loaders, excavators, and cranes. These policies make Asia-Pacific a key hub for innovation and early adoption of electric construction equipment.

The China electric construction equipment was valued at USD 954.5 million and USD 1.10 billion in 2021 and 2022, respectively. The market size reached USD 1.53 billion in 2024, growing from USD 1.3 billion in 2023.

- China is the largest market for electric construction equipment in the Asia-Pacific region, largely due to rapid infrastructure development, urbanization, and broader acceptance of sustainable construction practices. Growing investment in develops smart construction sites; buy automated machinery; and electrify OEM fleets which has rapidly increased the implementation of electric excavators, loaders, and compact equipment today. In February 2025, Komatsu also launched a cloud-connected electric excavator in Shanghai with features to provide predictive-maintenance, Artificial Intelligence-enabled performance monitoring, and remote fleet management for OEMs and rental operators.

- Companies significantly investing in the Chinese market include some big names, like Komatsu, Caterpillar, John Deere, and Doosan Infracore. They are investing in China due to high demand for high-performing, lower-emission construction machinery with potential for integrating IoT-based monitoring with operational efficiency and operational safety solutions on urban and large-scale infrastructure projects.

- Other notable Asia-Pacific market players doing noteworthy growth in electric construction equipment include India, Japan, and South Korea. Its mainly government backed electrification efforts; smart city initiatives; and growing contractor and rental fleet-based adoption of digitized, low-emission machinery.

North America Electric Construction Equipment Market

North America accounted for USD 3.72 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- North America plays a critical role in the global market, supported by advanced infrastructure, high adoption of construction technology, and strong government incentives for low-emission and sustainable machinery.

- Moreover, the region is a leader in smart construction and fleet management, where technologies such as AI-enabled predictive maintenance, IoT-based equipment monitoring, and telematics platforms are increasingly integrated into electric excavators, loaders, and compact machinery to optimize jobsite efficiency.

- In addition, the growing focus on operational efficiency, sustainability, and regulatory compliance encourages rapid adoption of autonomous or semi-autonomous electric machinery, modular battery systems, and cloud-connected fleet solutions across commercial, municipal, and industrial projects.

- North America is at the forefront of construction technology innovation, with key OEMs such as Caterpillar, John Deere, and Komatsu developing advanced electric and hybrid equipment, driving the demand for next-generation electric construction machinery and accelerating market growth.

US dominates the North America electric construction equipment market, showcasing strong growth potential.

- The market in the U.S. is expected to experience significant and promising growth, driven by rising investments in infrastructure, clean energy projects, and sustainable urban development. For example, in March 2025, Caterpillar launched a battery-electric compact loader in California, featuring cloud-connected fleet monitoring and predictive battery diagnostics, supporting both commercial contractors and rental operators.

- Key players investing heavily in the U.S. include Caterpillar, John Deere, Komatsu, and Doosan Infracore, motivated by strong demand for low-emission, high-efficiency equipment and government incentives supporting electrification.

- Growth is particularly driven by state-level initiatives such as zero-emission construction zones in California and New York, the Infrastructure Investment and Jobs Act, and corporate ESG commitments by major contractors. These initiatives encourage the adoption of electric excavators, loaders, bulldozers, and other machinery across municipal, commercial, and industrial projects.

Europe Electric Construction Equipment Market

The European market for electric construction equipment is anticipated to grow at a strong CAGR of 23.1% during the forecast period.

- Europe accounts for a significant share of global construction and infrastructure development, led by Germany, France, the UK, and the Nordics. Increasing investments in urban infrastructure, green construction projects, and sustainable mobility initiatives are driving demand for electric excavators, loaders, cranes, and compact machinery. In addition, tightening EU emission standards and decarbonization policies further accelerate adoption of low-emission electric machinery, contributing to market growth.

- Moreover, Europe is a hotspot for smart construction technology adoption, including AI-enabled predictive maintenance, IoT-based fleet monitoring, and telematics solutions. Government incentives, urban sustainability initiatives, and corporate ESG commitments encourage widespread deployment of electric construction equipment across commercial, municipal, and industrial projects, spurring market expansion.

UK is estimated to grow with a significant CAGR, in the European market.

- The electric construction equipment market in the U.K. is expected to experience strong growth, driven by increasing government initiatives toward carbon neutrality, stricter emission regulations, and growing adoption of low-emission machinery in urban construction and infrastructure projects. Electric excavators, loaders, and compact equipment are increasingly being deployed in cities with zero-emission construction zones and sustainable development mandates. For example, in April 2025, JCB launched an electric mini-excavator in London, featuring AI-enabled predictive maintenance, IoT-based fleet monitoring, and cloud-connected performance analytics.

- Major players investing in the U.K. include Caterpillar, John Deere, Komatsu, and Doosan Infracore, motivated by strong demand for high-efficiency, environmentally friendly construction equipment and the expansion of rental fleets with electric machinery.

- Growth is further supported by initiatives such as the U.K. Green Construction Board, government incentives for low-emission machinery, and increasing corporate ESG commitments. Contractors and rental operators are adopting electric fleets to reduce operational costs, comply with emission standards, and improve productivity across commercial, municipal, and residential projects.

Latin American Electric Construction Equipment Market

Brazil leads the Latin American electric construction equipment market, exhibiting remarkable growth during the forecast period.

- The Brazil market is expected to experience high growth, driven by rising urban infrastructure development, renewable energy projects, and growing awareness of sustainable construction practices. Increasing adoption of electric excavators, loaders, and compact machinery is being supported by government incentives, pilot electrification projects, and private-sector investment in green construction technologies.

- Major players investing in Brazil include Caterpillar, Komatsu, John Deere, and Doosan Infracore, motivated by strong demand for low-emission, cost-efficient machinery and the growing rental market for construction fleets.

- Growth is further fueled by government programs and urban sustainability initiatives, alongside corporate ESG commitments by contractors adopting electric machinery to reduce emissions, improve operational efficiency, and comply with emerging environmental regulations across municipal, commercial, and industrial projects.

Middle East and Africa Electric Construction Equipment Market

UAE to experience substantial growth in the Middle East and Africa market in 2024.

- The global market for electric construction equipment across the UAE is expected to experience strong growth, driven by rapid infrastructure development, smart city projects, and government initiatives promoting sustainability and low-emission construction. Electric excavators, loaders, and compact machinery are increasingly being deployed in urban mega-projects and renewable energy construction sites. For example, in April 2025, Doosan Infracore launched an electric excavator in Dubai, featuring AI-enabled predictive maintenance, IoT-based fleet monitoring, and cloud-connected performance analytics.

- Major players investing in the UAE include Komatsu, Caterpillar, John Deere, and Doosan Infracore, motivated by strong demand for high-efficiency, eco-friendly construction machinery and growing adoption of rental fleets equipped with electric equipment.

- Growth is further supported by government-led sustainable infrastructure initiatives, including smart city developments, emission-reduction targets, and corporate ESG programs. Contractors and developers are adopting electric machinery to improve operational efficiency, reduce emissions, and comply with emerging environmental standards across commercial, municipal, and industrial projects.

Electric Construction Equipment Market Share

The electric construction equipment (ECE) market is shaped by a mix of established global leaders and emerging innovators, creating a dynamic and moderately consolidated competitive landscape. Key players such as Caterpillar, John Deere, Kubota, Komatsu, Doosan Infracore, Hitachi Construction, and Liebherr collectively account for a significant portion of the market share, estimated at around 45%. These companies maintain their dominance through strategic investments in electric machinery development, AI/IoT-enabled fleet management, and global expansion, while tailoring solutions to meet the evolving needs of sustainable and smart construction equipment.

To strengthen their market positions, leading firms are adopting multi-pronged strategies including product innovation, strategic partnerships, and regional expansion. These efforts aim to make electric construction machinery more efficient, cost-effective, and adaptable to varying construction and infrastructure projects.

In addition to these dominant players, other manufacturers and regional OEMs are contributing to market growth through advanced battery technologies, modular electric drivetrains, and localized deployment strategies. Their presence is particularly notable in Asia-Pacific and Europe, where rising demand for sustainable construction solutions and government incentives are driving increased adoption of electric equipment.

Overall, the market is witnessing intensified competition and greater diversity, as both established and emerging players continue to evolve their offerings and strategies to meet the global demand for efficient, low-emission, and technologically advanced construction machinery.

Electric Construction Equipment Market Companies

Major players operating in the electric construction equipment industry are:

- Caterpillar

- Doosan Infracore

- Hitachi Construction

- John deere

- Komatsu

- Kubota

- Liebherr

- LiuGong Machinery

- Manitou

- Mecalac

- John Deere

John Deere leads the electric construction equipment industry with a share of 18.2% in 2024, offering a comprehensive portfolio of battery-electric and hybrid loaders, excavators, and compact machinery. Its strength lies in AI-enabled predictive maintenance, IoT-based fleet monitoring, and telematics-driven operational efficiency, enabling contractors and fleet operators to maximize uptime and productivity. John Deere emphasizes sustainability, energy-efficient designs, and modular battery systems, driving adoption across commercial, municipal, and industrial construction projects.

- Caterpillar

Caterpillar stands out for its expertise in heavy-duty electric and hybrid construction machinery. Its portfolio includes electric loaders, excavators, and compact equipment integrated with AI-enabled predictive maintenance, telematics, and cloud-connected fleet management. Caterpillar’s global manufacturing footprint and reliability in durable, energy-efficient machinery make it a trusted name in sustainable construction operations.

- Kubota

Kubota specializes in compact electric construction equipment, including mini-excavators, loaders, and utility vehicles designed for urban and residential projects. Its focus on eco-friendly designs, modular battery systems, and IoT-enabled monitoring ensures efficient, quiet, and sustainable operations. Kubota’s expertise in compact machinery and emphasis on zero-emission solutions make it a preferred choice for small-scale and urban construction applications.

Electric Construction Equipment Industry News

- In April 2025, Caterpillar launched its next-generation battery-electric compact loader with AI-enabled predictive maintenance and cloud-connected fleet monitoring. Initial deployments in California and Texas enhanced operational efficiency, enabling contractors and rental operators to remotely monitor equipment health and optimize machine usage.

- In March 2025, John Deere expanded its electric excavator and loader lineup across Europe and Asia-Pacific. The upgraded platform integrates IoT-based telematics, AI-driven performance analytics, and seamless integration with rental fleet management systems to improve uptime and reduce operational costs.

- In February 2025, Komatsu Ltd. introduced an advanced electric excavator with autonomous operation capabilities and predictive diagnostics. Launched in Shanghai and Tokyo, the solution leverages cloud monitoring and mobile alerts to enhance jobsite safety, energy efficiency, and maintenance scheduling.

- In January 2025, Doosan Infracore, Ltd. unveiled an electric loader series featuring modular battery systems, remote diagnostics, and AI-assisted predictive maintenance. Early deployments in Dubai and Seoul demonstrated improved operational efficiency and reduced downtime for commercial and municipal construction fleets.

- In December 2024, Kubota launched a fleet-focused electric mini-excavator with telematics integration, cloud-connected monitoring, and mobile control dashboards. Initial rollouts in São Paulo and Tokyo showed enhanced productivity and reduced operational costs for compact urban construction projects.

- In November 2024, Hitachi Construction Machinery released an upgraded electric excavator with IoT-based monitoring, predictive maintenance, and energy-optimized operations. Pilots in Japan and Europe indicated higher adoption rates and improved fleet utilization across infrastructure projects.

- In October 2024, Liebherr introduced a next-generation electric crane and loader platform featuring AI-powered performance analytics, cloud-connected fleet management, and predictive diagnostics. Deployed in Germany and the UAE, the solution enabled real-time monitoring, automated maintenance alerts, and improved energy efficiency for heavy-duty construction operations.

The electric construction equipment market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) and Volume (Units) from 2021 to 2034, for the following segments:

Market, By Equipment

- Excavators

- Loaders

- Bulldozers

- Cranes

- Dump Trucks

- Roller

- Others

Market, Battery Capacity

- Less than 50 kWh

- 50 kWh to 200 kWh

- More than 200 kWh

Market, Battery Technology

- Lead-acid

- Lithium-ion

- Nickel-metal hydride

Market, Power Source

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

Market, By End Use

- Construction

- Mining

- Material Handling

- Agriculture

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Nordics

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Southeast Asia

- South America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the electric construction equipment market?

Key players include Caterpillar, Doosan Infracore, Hitachi Construction, John Deere, Komatsu, Kubota, Liebherr, LiuGong Machinery, Manitou, Mecalac.

What are the upcoming trends in the electric construction equipment market?

Key trends include AI-powered predictive maintenance, IoT-based fleet monitoring, autonomous and semi-autonomous operational systems, and Equipment-as-a-Service (EaaS) models for flexible usage.

What is the growth outlook for Europe electric construction equipment market from 2025 to 2034?

Europe electric construction equipment market is anticipated to grow at a strong CAGR of 23.1% during 2025 to 2034, driven by tightening EU emission standards and decarbonization policies.

Which region leads the electric construction equipment market?

Asia Pacific dominated the global electric construction equipment market with a share of 32.8% in 2024. Rapid infrastructure development, urbanization, and government incentives drive the region's dominance.

How much market share does the lithium-ion battery technology segment hold in 2024?

Lithium-ion battery technology dominated the market, accounting for around 74.3% in 2024 and is expected to grow at a CAGR of over 23.4% through 2034.

What is the market size of the electric construction equipment in 2024?

The market size was USD 13.6 billion in 2024, with a CAGR of 23.3% expected through 2034 driven by stringent emission regulations, urbanization & smart city projects, and cost savings & efficiency demands.

What was the market share of the battery electric vehicles (BEV) segment in 2024?

Battery electric vehicles (BEV) segment dominated the market with 74% share in 2024 and is expected to grow at a CAGR of over 23.5% from 2025 to 2034.

What is the current electric construction equipment market size in 2025?

The market size is projected to reach USD 16.3 billion in 2025.

What is the projected value of the electric construction equipment market by 2034?

The electric construction equipment market is expected to reach USD 106.9 billion by 2034, propelled by government incentives, advancements in battery technology, and smart jobsite integration.

Electric Construction Equipment Market Scope

Related Reports