Summary

Table of Content

E-Gasoline Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

E-Gasoline Market Size

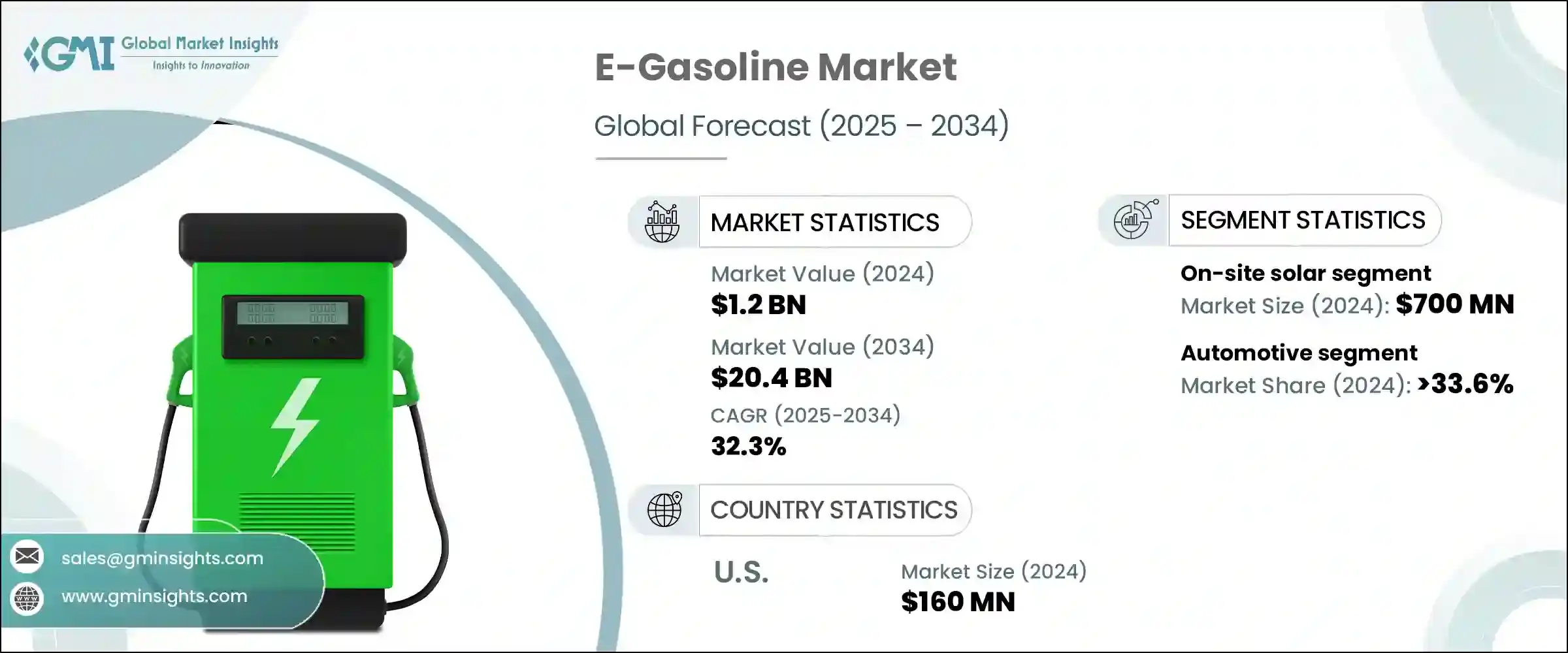

The global E-gasoline market was valued at USD 1.2 billion in 2024 and is estimated to reach USD 20.4 billion by 2034, growing at a CAGR of 32.3% from 2025 to 2034. Governments are introducing stricter emission laws to reduce pollution's impact on health and the environment. These rules often push industries to use cleaner technologies and practices to meet the standards.

To get key market trends

The policies also reduce the use of fossil fuels, encouraging automakers and energy companies to switch to cleaner options, including e-gasoline. For instance, an EU directive from 2023 requires that by end of 2025, at least 2.6% of transport energy must come from renewable fuels not derived from biological sources. This rule requires EU countries to include scalable e-gasoline in their fuel supplies to meet these goals.

E-Gasoline Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.2 Billion |

| Forecast Period 2025 – 2034 CAGR | 32.3% |

| Market Size in 2034 | USD 20.4 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Consumers are increasingly seeking sustainable options, which is driving companies to focus on eco-friendly practices and products. Concerns about climate change are making consumers more willing to choose low-carbon fuels, including e-gasoline, even if they cost more. For instance, in 2023, Ireland’s Department of Transport held discussions with the public and stakeholders about new fuel regulations. This showed public support for addressing climate issues and led to the introduction of mandatory E10 gasoline by July 1, 2023, despite expected price increases.

New technologies are lowering production costs and improving efficiency, making e-gasoline a more realistic choice for consumers and businesses aiming to reduce emissions. Advances in synthetic fuel production have made e-gasoline easier to scale, attracting major investments from energy companies. For instance, in 2024, the U.S. Department of Energy launched the Clean Fuels & Products Shot initiative to speed up research in fuel production methods and make e-gasoline more affordable and accessible.

Automotive and energy companies are working together to create e-gasoline infrastructure and distribution networks, ensuring it is widely available. These partnerships promote resource sharing and innovation, helping to improve e-gasoline technology. Joint efforts are speeding up adoption and aligning with global goals to cut emissions. For instance, in 2024, the U.S. government launched the Sustainable Aviation Fuel Grand Challenge, bringing together public and private organizations to build supply chains and infrastructure for e-gasoline in line with national decarbonization plans.

In April 2025, President Trump implemented tariff on all e-gasoline imports, with even higher rates imposed on certain countries. These tariffs increased the cost of essential materials including catalysts, electrolyze components, and carbon feedstocks, which are crucial for production. As manufacturers depend on global supply chains for these inputs, they face the challenge of either absorbing the additional costs or passing them on to consumers, potentially hindering the adoption of synthetic gasoline in the market.

E-Gasoline Market Trends

Companies are rapidly constructing e-gasoline plants to address the rising demand for sustainable fuel alternatives. Scaling up production capacity is vital to support the transition to an eco-friendlier transportation sector. For instance, in 2024, the European Commission approved a USD 397 million German state aid package for Concrete Chemicals’ PtL-kerosene plant in Rüdersdorf, with a 30,000 t/yr capacity. This move underscores the growing momentum behind large-scale synthetic fuel facilities across the EU.

Automakers are collaborating with energy companies to ensure the availability of vehicles compatible with e-gasoline and to promote the adoption of this sustainable fuel. These alliances are pivotal in driving the shift towards cleaner transportation and reducing long-term carbon emissions. For instance, the U.S. DRIVE partnership, a DOE-led consortium active through 2024, unites the DOE with major automakers, to co-develop and test synthetic and hydrogen fuels in internal combustion engines, fostering joint validation of e-fuel blends.

Governments are funding green fuel initiatives to expedite the shift to sustainable energy and reduce dependence on fossil fuels. These incentives stimulate research and development investments, spurring innovation in renewable energy. Tax breaks and subsidies are making e-gasoline more cost-competitive with traditional fuels. For instance, in 2024, the Treasury and IRS issued Notice 2024-49, establishing the Section 45Z Clean Fuel Production Credit, effective January 1, 2025.

Consumers are increasingly opting for eco-friendly alternatives, driving demand for e-gasoline as a cleaner substitute for traditional gasoline. This shift in consumer preferences further motivates companies to invest in sustainable energy solutions. Even higher prices have not deterred demand, as climate-conscious buyers prioritize sustainable options. For instance, the European Commission’s 2024 Citizen Support survey revealed that 93% of Europeans have taken concrete eco-friendly actions, while 70% support reducing fossil fuel dependence.

E-Gasoline Market Analysis

Learn more about the key segments shaping this market

- The global market for e-gasoline was valued at USD 900 million, USD 1 billion, and USD 1.2 billion in 2022, 2023 and 2024, respectively. The renewable source segments include on-site solar and wind. On-site solar segment was valued at USD 700 million in 2024. The transition to renewable energy sources is fuelled by environmental concerns, economic benefits, and the pursuit of long-term sustainability goals.

- Decreasing technology costs and the goal of energy independence are reducing grid dependence and operational expenses. For instance, small-scale solar capacity grew from 44 GW in June 2023 to a projected 55 GW by December 2024, spurred by a 30% drop in module prices and a 26% federal Investment Tax Credit.

- The wind segment is estimated to grow at over 33% CAGR till 2034. The conversion to renewables allows for a great opportunity to mitigate climate change at a good cost and to enhance operational efficiencies for businesses and communities. Government incentive programs and corporate commitments towards clean energy fast-track the deployment of large-scale turbines that produce more renewable energy. For instance, in 2023, U.S. wind capacity reached 147.5 GW, with an added 7.1 GW of new projects expected in 2024.

Learn more about the key segments shaping this market

- Based on applications, the e-gasoline market is segmented into automotive, marine, aviation, industrial, and others. The automotive segment has a market revenue share of over 33.6% in 2024. E-gasoline offers an eco-friendly alternative to traditional fuels, significantly reducing greenhouse gas emissions.

- As stricter emission standards and consumer demand for cleaner energy grow, automakers increasingly adopt synthetic fuels. For instance, the EU RED II Delegated Act 2023/2413 mandates a 1.7% RFNBO sub-target by 2030. In 2023, member states reported 0.95 PJ of RFNBO consumption, with early e-gasoline adoption seen in Germany and Sweden.

- The marine segment is estimated to grow at a CAGR of 32% over till 2034. The maritime industry is turning to low-carbon fuels including hydrogen, ammonia, and e-gasoline to meet tightening environmental regulations and global decarbonization goals. Port rules and initiatives, including the FuelEU Maritime Regulation (EU 2023/1805), drive these changes, requiring a 2% GHG intensity reduction by 2024 (equivalent to 2.8 PJ of renewable energy onboard ships over 5,000 GT), increasing to 6% (8.4 PJ) by 2030.

- The aviation segment crossed USD 145 million in 2024. Aviation is also exploring e-gasoline for sustainable fuel integration, aiming for carbon-neutral flights. These alternative fuels offer a promising solution to reduce emissions in the transportation sector and contribute to a more sustainable future. For instance, under ReFuelEU Aviation (Reg 2023/1563), 2% of jet fuel must be SAF by 2025, with up to 10% synthetic RFNBO e-gasoline, rising to 6% by 2030.

- Industrial segment is estimated to have a revenue share of over 20% in 2034. Factories are incorporating e-gasoline in machinery and transport to lower emissions and align with sustainability targets. By diversifying fuel sources and investing in sustainable solutions, industries are taking proactive steps towards a cleaner and greener future. For instance, in 2023, EU ETS MRR Guidance zero-rated RFNBO combustion reported 18 installations of e-gasoline using 1,050 TJ of RFNBO, exempt from added ETS liabilities.

Looking for region specific data?

- The U.S. e-gasoline market in 2022, 2023 and 2024 was valued at USD 110 million, USD 120 million, and USD 160 million, respectively. Governments and corporations are increasingly prioritizing synthetic fuels to achieve climate goals and lessen dependence on traditional gasoline. For instance, California’s updated Low Carbon Fuel Standard (LCFS) in 2024 replaced over 3 billion gallons of conventional diesel with renewable and synthetic fuels, including pilot e-gasoline blends.

- The Europe e-gasoline market is expected to grow at a CAGR of over 30% through 2034. Carbon-neutral mandates are driving the rapid integration of e-gasoline into markets, spurring investment in sustainable transportation R&D. Policies, including the European Green Deal and industry collaborations, are accelerating synthetic fuel production for cars and aviation. The EU’s Directive (2023/2413) sets a binding 29% renewable energy target in transport by 2030, with at least 5.5% advanced biofuels and RFNBOs.

- The Asia Pacific e-gasoline market is estimated to reach USD 3 billion by 2034. Appearing economies, including China, Japan, and India, are embracing e-gasoline to combat pollution and align with global decarbonization trends. For instance, India’s National Green Hydrogen Mission (2023) aims for 5 MMT of green hydrogen annually by 2030, supported by 60–100 GW of electrolyzers, integrating derivatives including green methanol and e-fuels to replace 20% of fossil fuel use in transport.

- The Middle East & Africa e-gasoline market was valued at USD 51 million in 2024. This shift towards e-gasoline and synthetic fuels not only helps in reducing carbon emissions but also ensures long-term economic stability for these nations. Renewable energy projects, including Morocco’s Green Hydrogen Roadmap, target 13 TWh of synthetic fuel exports by 2040, backed by 10 GW of solar and wind energy, advancing transport fuel pilot programs.

- Latin America e-gasoline market is expected to have a market share of over 4.9% by 2034. Renewable energy expansion and biofuel initiatives are bolstering e-gasoline adoption while creating economic opportunities. Brazil’s 2024 ANP Report set a 38.78 million CBIO target under RenovaBio, with 33.1 million CBIOs retired in 2023, incentivizing biofuel and synthetic fuel producers through carbon-credit markets. This transition not only supports sustainability aims but also drives growth in the renewable energy sector.

E-Gasoline Market Share

The top 4 companies dominating the e-gasoline industry are Arcadia eFuels, ExxonMobil, Ballard Power Systems, Inc., and Norsk E-Gasoline, collectively accounting for approximately 30% of the market share. Their leadership stems from groundbreaking projects in synthetic fuel production, strategic alliances with energy and automotive industries, and innovations in power-to-liquid technologies.

Arcadia eFuels stands out with its expertise in power-to-liquid technologies, focusing on large-scale e-gasoline production facilities powered by renewable energy sources, including wind and solar, combined with direct air capture (DAC) for CO2. In 2024, the company made significant progress on its flagship project in Vordingborg, Denmark, which aims to produce 100,000 tons of e-gasoline annually by 2027, catering to both the automotive and aviation sectors.

E-Gasoline Market Companies

ExxonMobil, headquartered in the U.S., reported revenues of USD 339.88 billion for the fiscal year 2024. The company is driving advancements in e-fuel technologies through its Low Carbon Solutions division, focusing on synthetic fuels including e-gasoline to complement its traditional oil and gas operations. In 2024, ExxonMobil collaborated with HIF Global to supply CO2 for e-gasoline production at HIF’s Matagorda facility in Texas, using its ability in carbon capture and storage (CCS).

Porsche, based in Germany, achieved revenues of USD 43.8 billion in 2024. As a leading premium automaker, Porsche is heavily investing in e-fuels to ensure the sustainability of internal combustion engine (ICE) vehicles in a carbon-neutral future. Through its partnership with HIF Global, Porsche co-developed the Haru Oni pilot plant in Chile, which began producing e-gasoline in 2023. In 2024, Porsche further expanded its e-fuel strategy by committing USD 75 million to scale production for its iconic 911 and Cayman models.

Ballard Power Systems, Inc., headquartered in Canada, reported revenues of USD 100 million in 2024. The company specializes in proton exchange membrane (PEM) fuel cells and plays a key role in the clean energy ecosystem that supports e-gasoline development. While primarily focused on hydrogen fuel cells for vehicles and power systems, Ballard’s ability in hydrogen technology aligns with the production of e-gasoline, where hydrogen serves as a critical part.

Some of the major key players operating across the E-gasoline industry are:

Arcadia eFuels

Archer Daniels Midland Co.

Ballard Power Systems, Inc.

Ceres Power Holding Plc

Climeworks AG

Clean Fuels Alliance America

Electrochaea GmbH

eFuel Pacific Limited

ExxonMobil

FuelCell Energy, Inc.

HIF Global

INFRA Synthetic Fuels, Inc.

Liquid Wind

LanzaJet

MAN Energy Solutions

Norsk E-Gasoline AS

Porsche

Sunfire GmbH

E-Gasoline Industry News

In February 2024, HIF Global announced plans to expand its Matagorda eFuels facility in Texas, with the goal of producing 200,000 tonnes of e-gasoline annually by 2028. Utilizing HIF’s Haru Oni technology, the facility integrates green hydrogen with captured CO₂ to create carbon-neutral e-gasoline for automotive and aviation applications. Supported by a strategic partnership with renewable energy provider AME, this expansion solidifies HIF Global’s leadership in scaling e-gasoline production across North America to meet the growing demand for sustainable fuels.

In April 2024, Norsk E-Gasoline AS unveiled its Heroya project in Norway, aiming to produce 50,000 tonnes of e-gasoline annually by 2026. By employing power-to-liquid (PtL) technology, the project merges renewable electricity with industrial CO₂ to manufacture synthetic gasoline for the European and North American automotive markets. A collaboration with Statkraft ensures a renewable energy supply, enabling low-carbon operations and positioning Norsk E-Gasoline as a key innovator in the e-gasoline market.

In October 2023, Liquid Wind entered a strategic partnership with a global energy firm to develop e-methanol production facilities in Sweden, a vital precursor to e-gasoline. This initiative uses renewable electricity and captures CO₂ to target an annual production of 100,000 tons by 2026. The partnership strengthens Liquid Wind’s role in the e-gasoline market by advancing synthetic fuel infrastructure and supporting Europe’s decarbonization objectives.

In November 2023, Sunfire GmbH joined forces with a leading automotive manufacturer to accelerate advancements in e-fuel technologies, including e-gasoline. The collaboration focuses on scaling Sunfire’s high-temperature electrolysis technology to produce green hydrogen, a crucial element in e-gasoline production. Aimed at commercializing sustainable fuels for passenger vehicles, this partnership enhances Sunfire’s position in the E-gasoline industry by reinforcing the technological foundation for eco-friendly fuel solutions.

This e-gasoline market research report includes an in–depth coverage of the industry with estimates & forecast in terms of revenue in ‘USD Billion’ from 2021 to 2034, for the following segments:

Market, By Renewable Source

- On-site solar

- Wind

Market, By Technology

- Fischer-tropsch

- eRWGS

- Others

Market, By Application

- Automotive

- Marine

- Aviation

- Industrial

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Netherlands

- Aisa Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Latin America

- Brazil

- Argentina

Frequently Asked Question(FAQ) :

Who are the key players in e-gasoline market?

Some of the major players in the e-gasoline industry include eFuel Pacific Limited, ExxonMobil, FuelCell Energy, Inc., HIF Global, INFRA Synthetic Fuels, Inc., Liquid Wind, LanzaJet, MAN Energy Solutions, Norsk E-Gasoline AS.

How much is the U.S. e-gasoline market worth in 2024?

The U.S. e-gasoline market was worth over USD 160 billion in 2024.

What is the size of on-site solar segment in the e-gasoline industry?

The on-site solar segment generated over USD 700 million in 2024.

How big is the e-gasoline market?

The e-gasoline market was valued at USD 1.2 billion in 2024 and is expected to reach around USD 20.4 billion by 2034, growing at 32.3% CAGR through 2034.

E-Gasoline Market Scope

Related Reports