Summary

Table of Content

E-cigarette Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

E-cigarette Market Size

The global e-cigarette market was estimated at USD 13.4 billion in 2024. The market is expected to grow from USD 15.9 billion in 2025 to USD 61.6 billion in 2034, at a CAGR of 16.2% according to latest report published by Global Market Insights Inc.

To get key market trends

The e-cigarette market has experienced remarkable growth during the past decade, becoming a significant portion of the tobacco and de-vaping market. E-cigarettes also referred to as vaping devices, were originally designed as substitutes for traditional cigarettes and have received users among adult smokers who desire a less harmful alternative to smoking.

There are also younger consumers entering the market through flavored products and technological advancements. Market growth is stimulated by a greater understanding and awareness of the health consequences of smoking, a favorable regulatory environment in some jurisdictions, and ongoing product innovation and development.

The market consists of a variety of product categories including rechargeable e-cigarettes, disposable e-cigarettes, and pod systems. Established tobacco companies have expanded their presence in the market through acquisitions and product launches, while independent manufacturers have continued to modify and introduce advancements in technology. Distribution typically occurs through traditional retail, vape shops, or online.

Market patterns consist of increased access to disposable e-cigarettes, a growing focus on sustainable products, and an increase in demand for nicotine salts. Moreover, COVID-19 has impacted on consumer behavioral shift and distribution models that have made online sales more prevalent. The market is maturing, and manufacturers are committing to research and development to address health and safety issues and shifting consumer behaviors.

E-cigarette Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 13.4 Billion |

| Market Size in 2025 | USD 15.9 Billion |

| Forecast Period 2025 – 2034 CAGR | 16.2% |

| Market Size in 2034 | USD 61.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing health awareness and smoking alternatives | Consumers are becoming more aware of e-cigarettes as a potentially healthier alternative to smoking tobacco. |

| Technological advancements and product innovation | Advancements such as the ability to come with smart pods, longer battery life, nicotine salt formulations, etc. help improve the experience and the appropriation. |

| Rise in demand for flavored e-cigarettes | The wide variety of flavors to choose from caters to every type of consumer, especially younger consumers. |

| Pitfalls & Challenges | Impact |

| Negative impact on health owing to high addiction of nicotine | The pod has the capacity to hold a substantial amount of nicotine and addiction is a potential problem of using vape products. |

| Implementation of stringent government regulations on consumption and import | The government has acted against the selling of, promoting of, and importing of vape products, which has affected product availability and new growth of the industry. |

| Opportunities: | Impact |

| Expansion into emerging markets | There are potential areas for growth in geographical locations increasingly urbanizing and becoming familiar with alternatives (Southeast Asia and Latin America). |

| Integration with digital health platforms | Smart pod systems that record consumption and provide cessation programs appeal to health-oriented consumers and allow for some potential integration with wellness apps. |

| Market Leaders (2024) | |

| Market Leaders |

10% market share |

| Top Players |

Collective market share in 2024 is The collective Market Share is 35% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia-Pacific |

| Emerging countries | Costa Rica, Spain, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

E-cigarette Market Trends

The market is shifting due to regulations, technological innovation, and diverse consumer preferences.

- Flavor Innovation and Localization: While there are regulatory concerns, flavor innovation continues to be an important driver in the market, with new brands working on fruit, beverage, and dessert blends that accommodate local markets where flavor is still allowed.

- Development of Pod Systems with Changeable Coils: In some markets, there has been interest in the adoption of pod-type devices that enable users to change coils and refill their e-liquid, a hybrid between disposable and complex open systems. Compared to pre-filled pods, pod systems may offer more personalization and better value.

- E-Liquid Formulations of the Future: The trend continues of smokers switching to nicotine salts, which provide a smoother throat hit as well as increased nicotine delivery efficiency as compared to freebase nicotine. The research and development on new products now are on flavor stability and the development of synthetic nicotine to avoid or mitigate some regulatory frameworks.

- Coiling and Wicking Technology: The industry leader was shift away from wire coils in favor of mesh coiling, for better flavor production, more rapid heating of the coil, and longer total life of the coil. Increasingly more innovation about ceramic coils and wicking material has progressed, further enhancing coil performance and leak prevention possibilities.

- Battery Performance: The industry standardization on USB-C for charging is a faster and more user-friendly charging solution than existed before. The R&D currently being conducted is focused on maximizing battery density, to provide longer battery life, in smaller devices. This is an important selling feature for disposables and pods.

E-cigarette Market Analysis

Learn more about the key segments shaping this market

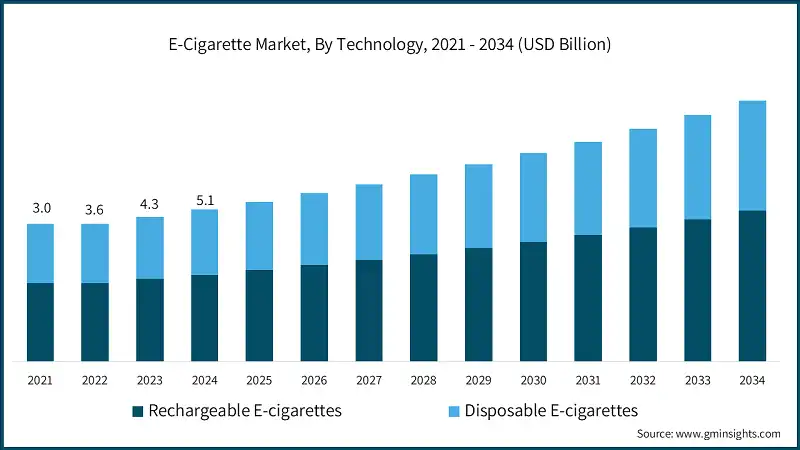

Based on technology, the e-cigarette market is divided into disposable e-cigarettes and rechargeable e-cigarettes. The rechargeable segment dominated the market, accounting for around 62% in 2024 and is expected to grow at a CAGR of over 19.1% through 2034.

- The global e-cigarette industry is growing rapidly, with rechargeable devices poised to take the lead in market share. Rechargeable devices hold the market because they cost less to operate and can provide consumers with convenience. Users can refill and re-charge the device; this reduces the costs associated with long-term e-cigarette use and reduces waste. The preference for rechargeable e-cigarettes can be attributed to their durability over disposable devices, as well as being able to customize the low-cost options.

- Rechargeable e-cigarettes have useful features, such as more power output, more choice of flavors to use in the device, and more life (in terms of battery) before needing to be recharged. Rechargeable e-cigarettes remain the preferred option among consumers because they offer customization options and are more durable than disposable e-cigarettes. This, along with advancements in technology related to battery life and vapor production, is providing consumers with better experience overall.

- There is an increase in consumers wanting rechargeable devices, especially among habitual users who consider the price of e-cigarettes and the sustainable benefit from using them. Manufacturers are responding to feedback and refocusing their research and development efforts and funding into rechargeable e-cigarettes and expanding their product lines to account for different consumer preferences.

Learn more about the key segments shaping this market

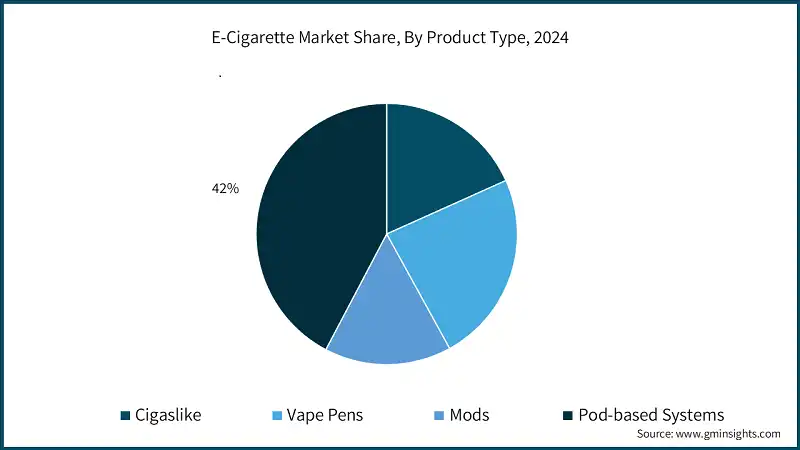

Based on product type, the e-cigarette market is divided into cigalikes, vape pens, pod vapes, and box mods. The pod vapes segment dominated the market, accounting for around 41% in 2024 and is expected to grow at a CAGR of over 21.1% through 2034.

- Pod-based systems are the most popular type of e-cigarette, primarily because they are lightweight, portable, and easy to use. The e-cigarette systems are small, light, and usually prefilled, making them attractive to beginner and casual users. As they are simple to use and require no complex maintenance like coil replacement or flare refilling. Majority of pod-based systems use nicotine salts to provide a smooth inhale and deliver nicotine to the user more quickly - much like traditional cigarettes.

- The business model for pod-based systems generates revenue by requiring their customers to purchase brand-specific cartridges. Various companies in the market have developed their own pod systems that require consumers to buy their branded replacement. This concept is referred to as a closed system and allows the company to maintain control of product quality, while still allowing the manufacturer to maintain control of the user experience and the price of the replacement products. Pod-based systems provide convenience due to their small size and limited vapor. We can see this convenience appeals to the interest of young adult and urban consumer preferences. The market will continue to grow as manufacturers continue product development and compliance with new regulations, while still providing the compact simplicity that users are looking for in their devices.

Based on price, the E-cigarette market is segmented into low, medium and high.

- E-cigarettes in the medium-price category are ubiquitous across many markets because they bridge affordability with advanced features. Common devices marketed in this category, including pod systems and vape pens, provide additional convenience over disposable devices or simple starter kits while also being more versatile. Increased wholesale sales in this price category are fueled by consumers becoming more familiar with quality, safety, and performance, along with the growing consumer desire for products to allow longer use times and greater e-liquids options.

- Companies are placing stronger emphasis on safety, quality control, and regulatory compliance due to heightened consumer awareness about vaping practices. The medium-price point segment of consumers includes new users who are switching from traditional cigarettes, in addition to more experienced vapers who want reliable performance without a premium price. Companies offer product enhancements, and continue to innovate new products, incorporating devices' prior premium products with lower prices. The strategic competition has developed positive marketplace activity and has increased consumer adoption across several global marketplaces.

Looking for region specific data?

North America E-cigarette Market Analysis

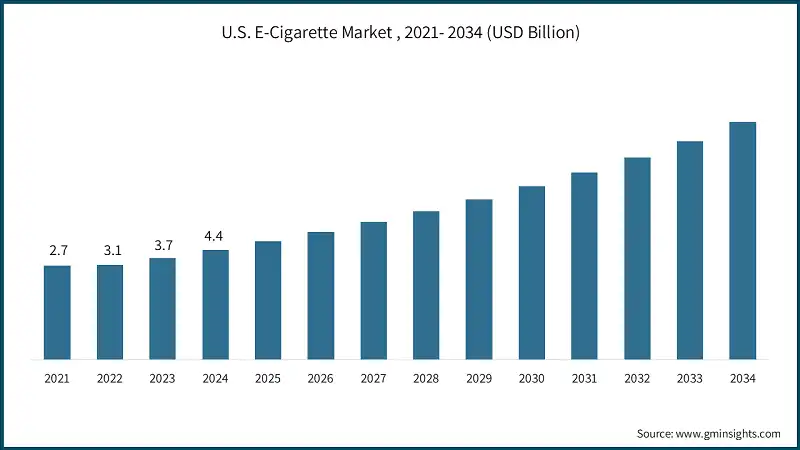

In 2024, the U.S contributed significantly to the market, generating revenue of USD 4.4 billion.

- In North America, especially in the United States, pod-based systems gained share with early market leaders. Company’s revolutionized the category prior to accountability, scrutiny, and regulation when it marketed its pod systems, designed as compact cigarette alternatives, with its patented nicotine salt formulations that allow for higher nicotine concentrations and less throat irritation than traditional liquid-based vaping. These factors also appealed to sub-groups other than adult cigarette smoking adults.

- Distribution networks, with established market share from the traditional cigarette segment, have an advantage to support the appeal of pod systems in the United States because everything would be in-flux through regulators and brand marketing disruption.

Europe E-cigarette Market Analysis

Europe market holds significant share in 2024 and is expected to grow at 19.3% during the forecast period.

- Pod-based devices are becoming more accepted in Europe due to the overall trend to harm reduction and smoking cessation. The UK is actively promoting vaping as a less harmful alternative to smoking, which has allowed pod-based devices to become a more mainstream option.

- Generally, European consumers value quality, safety, and compliance with regulations which make closed-system pods to deliver nicotine consistently and cannot be tampered with more desirable to the consumer.

- Although the European Union (EU) Tobacco Products Directive imposes restrictions on maximum nicotine concentration as well as advertising restrictions, pod systems have been able to reformulate their product to comply with these restrictions while keeping a sleek, minimalistic aesthetic that fits Eurocentric sensibilities.

Asia-Pacific E-cigarette Market Analysis

Asia Pacific is both dominant and the fastest growing region and is expected to grow at 19.4% during the forecast period.

- In the APAC region, the rapid adoption of pod-based e-cigarette systems has occurred due to urbanization, rising disposable income, and increasing population of youth attracted to better looking, tech-based products.

- Countries such as China, South Korea, and Malaysia became major consumption and manufacturing markets in the region with local brands leading the focus on affordable pod systems designed for people living in those markets. Pods, due to their discreetness, also matched cultural norms about smoking in public even while being easy to use making them very welcoming for a first-time user.

- Regulatory differences across the APAC region vary greatly; however, in markets that place few restrictions on vaping, pod systems have experienced rapid growth due to aggressive online and retail-marketing strategies.

E-cigarette Market Share

- The top 5 companies in the market are Philip Morris International, RELX International, British American Tobacco, Shenzhen Smoore Technology, and Japan Tobacco International contributing around 35% of the market in 2024.

- PMI is a top tobacco company which has made sizeable investments in various innovations where traditional tobacco products were once the primary mode of delivering nicotine, specifically in heated tobacco (with IQOS being their key product) and e-cigarettes. Their size and global distribution reach give them the ability to expand in e-cigarettes and heated tobacco more rapidly than other brands. Therefore, a shift away from traditional cigarettes towards heated and even smokeless variants makes them a primary player in the realm of alternative nicotine delivery.

- RELX International, a rapidly growing e-cigarette brand, is known for its closed-pod systems with a modernized look and feel. Its innovation and user experience have allowed it to acquire a substantial market share, particularly in Asia. RELX International has a powerful brand presence and continues to develop its product line as a key player in the expanding vaping industry.

- BAT is acknowledged as one of the largest tobacco companies in the world. Like PMI, BAT has significant investments in the full-scale breadth of tobacco from traditional cigarettes to various oral nicotine products, to a significant presence in the e-cigarette market.

- Smoore is the biggest manufacturer of vaping devices in the world and operates primarily as a business-to-business (B2B) supplier and develops innovative atomization technology and produces vaping components for many of the top e-cigarette brands.

- JTI is one of the largest tobacco companies globally and notably produces a variety of reduced-risk products, namely e-cigarette brands and heated tobacco products (Ploom). JTI's long-established tobacco infrastructure and investment in next-generation products make them an effective competitive force in the market. JTI's size, global reach, and product innovative prowess certainly help cement their position in the ever-evolving market.

E-cigarette Market Companies

Major players operating in the e-cigarette industry are:

- Philip Morris International

- RELX International

- British American Tobacco

- Japan Tobacco International

- Shenzhen Smoore Technology

- Imperial Brands PLC

- KT&G Corporation

- MOTI International

- Voopoo Technology

- Shenzhen IVPS Technology

- Aspire (Eigate)

- Innokin Technology

- Geekvape

- Altria Group

- Elf Bar (iMiracle Shenzhen)

- KT&G is the largest South Korean tobacco company with a strong influence in the global heat-not-burn (HnB) e-cigarette space, with its "Lil" series. KT & G is rapidly expanding its global reach with a landmark partnership with Philip Morris International to discover the "lil" devices abroad.

- MOTI International is a top Chinese brand specializing in e-cigarettes, dedicating itself to the design and manufacturing of uniquely designed e-vape products, such as pod systems and disposables. MOTI's focus on user experience means they were actively looking to partner with companies, e.g. Smoore. MOTI has developed a strong international presence with a customer base of over sixty countries and over one hundred thousand retail locations and also leads in market share by continuously developing an international footprint.

- Voopoo Technology is a Chinese manufacturer who is highly regarded for their unique designs and high-quality products and popular line of products, most notably the DRAG series, and GENE chips that are implemented into their devices. VOOPOO has already established a strong brand within the global vaping market and continues to build their distribution network in North America and Europe.

E-cigarette Industry News

- In March 2025, Geek Bar was awarded the coveted International Forum (iF) Design Award 2025 for its concept e-cigarettes Sugar Cube modular e-cigarette and Minimore sustainable disposable device. This will provide the company with an opportunity to position itself as a design leader, add to brand premium positioning, and stimulate the adoption of its innovation among competitive offerings.

- In May 2025, JT International announced it has now completed the acquisition of Flavour Warehouse, a large distributor of e-liquids and vaping products, as part of its broad strategy to increase its position in the alternative nicotine product category. It will enhance the company’s goals with its distribution capability, add diversity to its product portfolio, and increase its speed to market in vaping.

- In October 2024, British American Tobacco (BAT) launched a new line of synthetic nicotine pouches, in what would be seen as a significant technological advancement in the oral nicotine segment. This will allow the company to differentiate its products using advanced formulation technology, simplify regulations, and take market share in the premium oral nicotine category.

- In July 2024, Philip Morris International (PMI) announced a new manufacturing facility which they would be developing in Aurora, Colorado. This facility would produce Zyn nicotine pouches. PMI expressed their intent to invest USD 600 Million into this facility, which will run full production at the end of 2025. The development will provide meaningful acquisition of production capacity and relieve supply limitations related to increasing demand for oral nicotine.

The e-cigarette market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and Volume (Thousand Units) from 2021 to 2034, for full diversification.

Market, By Product type

- Cigalikes

- Vape Pens

- Pod vapes

- Box mods

Market, By System type

- Open

- Close

Market, By Usage model

- Disposable

- Rechargeable

Market, By Flavor

- Tobacco-Based

- Menthol/Mint

- Fruit-Based

- Sweet/Dessert

- Beverage-Inspired

- Botanical/Spice

- Unflavoured/Neutral

- Others (Experimental flavors, coded flavors, custom blends)

Market, By Mode of operation

- Manual

- Automatic

Market, By Price

- Low

- Medium

- High

Market, By Use

- Men

- Women

Market, By Distribution channel

- Online

- E-commerce websites

- Company-owned websites

- Offline

- Supermarkets/hypermarket

- Specialty vape/tobacco shops

- Convenience stores and gas stations

- Others (Vending machines, direct sales, duty-free shops)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- Indonesia

- Philippines

- South Korea

- Malaysia

- Latin America

- Chile

- Colombia

- Costa Rica

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Which region leads the e-cigarette market?

The United States led the market in 2024, contributing USD 4.4 billion in revenue, driven by strong consumer demand and favorable market dynamics.

Who are the key players in the e-cigarette market?

Key players include Philip Morris International, RELX International, British American Tobacco, Japan Tobacco International, Shenzhen Smoore Technology, Imperial Brands PLC, KT&G Corporation, and MOTI International.

What are the upcoming trends in the e-cigarette industry?

Key trends include flavor innovation tailored to local markets, the development of pod systems with changeable coils, and a shift toward rechargeable devices offering greater personalization and value.

What was the valuation of the pod vapes segment?

The pod vapes segment held a 41% market share in 2024 and is expected to grow at a CAGR of over 21.1% through 2034.

What is the projected size of the e-cigarette market in 2025?

The market is expected to reach USD 15.9 billion in 2025.

How much revenue did the rechargeable e-cigarette segment generate?

The rechargeable e-cigarette segment generated 62% of the market share in 2024 and is projected to grow at a CAGR of over 19.1% through 2034.

What is the projected value of the e-cigarette market by 2034?

The market is expected to reach USD 61.6 billion by 2034, fueled by innovations in flavor profiles, the development of pod systems, and increasing adoption of rechargeable devices.

What is the market size of the e-cigarette in 2024?

The market size was USD 13.4 billion in 2024, with a CAGR of 16.2% expected through 2034, driven by technological advancements, regulatory shifts, and evolving consumer preferences.

E-cigarette Market Scope

Related Reports