Summary

Table of Content

Drone Cybersecurity Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Drone Cybersecurity Market Size

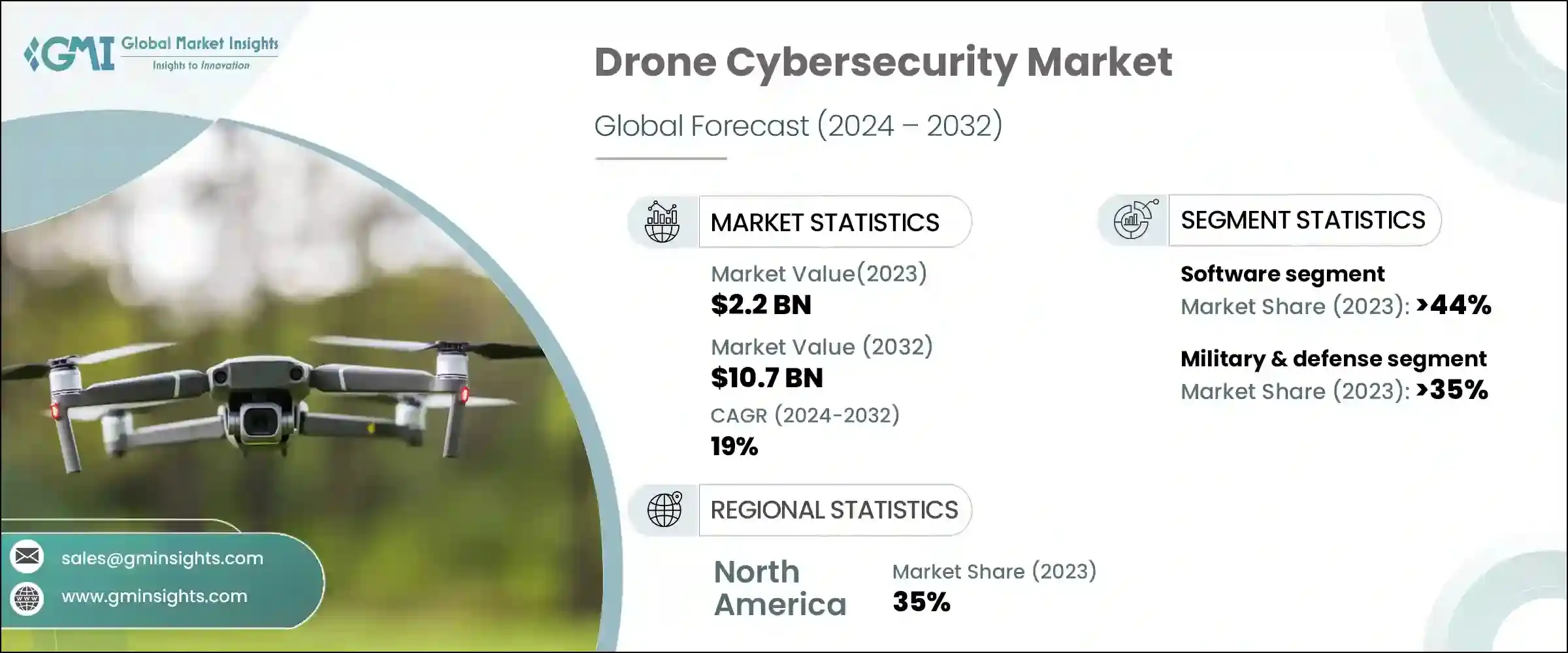

Drone Cybersecurity Market was valued at USD 2.2 billion in 2023 and is estimated to register a CAGR of over 19% between 2024 and 2032. With the growing adoption of drones in sectors such as agriculture, defense, and logistics, the demand for robust cybersecurity measures is intensifying. This is driven by the increased need to protect sensitive data, ensure operational safety, and comply with stringent regulatory standards, leading to increased investments in advanced security technologies and solutions.

To get key market trends

Moreover, efforts to combat unauthorized and malicious drones focus on advanced detection systems, anti-drone technologies, and regulatory frameworks to enhance security and safeguard critical infrastructure. For instance, in June 2024, Dedrone launches dedrone-on-the-move to fight against unauthorized and malicious drones. This solution expands Dedrone’s suite of offerings for agile, modular, adaptable, battle-proven counter-drone defense for expeditionary forces deployed in volatile or high-risk environments.

Further, stringent regulations and guidelines from governments and international bodies require drone operators to implement comprehensive cybersecurity measures. Compliance with these regulations ensures the protection of critical infrastructure and sensitive data, driving the demand for cybersecurity solutions. Innovations in drone technology, such as improved automation and AI capabilities, have expanded the application of drones, necessitating advanced cybersecurity solutions to protect these sophisticated systems from potential cyber-attacks.

Drone Cybersecurity Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 2.2 Billion |

| Forecast Period 2024 to 2032 CAGR | 19% |

| Market Size in 2032 | USD 10.7 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

For instance, in May 2024, DroneShield announced the release of Version 10.0 for its DroneSentry-C2 platform, which includes substantial updates to the user interface, AI capabilities, and detection functionalities within the C-UAS Command-and-Control software industry.

The market faces numerous challenges such as limited focus on security during development, rapid evolution of drone technology, and standardization issues. Various drone manufacturers prioritize functionality and cost-effectiveness during the design phase, often neglecting robust security measures. Also, various innovations are being reported in the drone industry, with new features and functionalities being introduced frequently. The management and regular updates of cybersecurity solutions with these advancements is considered challenging in several situations. Furthermore, the lack of standardized protocols and communication methods within the drone industry makes it difficult to develop interoperable cybersecurity solutions, thus restricting the market adoption

Drone Cybersecurity Market Trends

The market is witnessing a rise in solutions that address new and sophisticated cyber threats, such as zero-day attacks and exploitation of vulnerabilities in autonomous drones. The development of integrated solutions and counter-drone technologies that combine anti-drone detection and jamming systems with traditional cybersecurity software has been a growing trend in recent years. Further, with the increasing adoption of drones for data collection, there is a growing emphasis on drone cybersecurity solutions that ensure data encryption, access control, and compliance with data privacy regulations.

Moreover, integration with existing air traffic control systems and infrastructure has become a crucial aspect of comprehensive drone cybersecurity solutions. Various organizations are shifting from reactive solutions to proactive measures. It helps them prevent attacks from happening in the first place rather than addressing incidents. This includes vulnerability assessments, penetration testing, and continuous monitoring of drone systems for suspicious activity. Furthermore, cloud-based platforms are gaining popularity that can provide real-time threat intelligence, remote security management, and centralized data storage for drone operators.

Drone Cybersecurity Market Analysis

Learn more about the key segments shaping this market

Based on component, the market is divided into software, hardware, and services. In 2023, the software segment accounted for a market share of over 44%. As drones are increasingly used in sensitive and critical operations across various industries, the demand for robust cybersecurity measures has grown in recent years. Software solutions are essential for protecting data and ensuring secure communication between drones and control systems.

The rapid development of advanced encryption technologies, machine learning, and data analytics enhances the capabilities of drone software, making it more effective in threat detection and mitigation. This innovation drives the adoption of sophisticated cybersecurity solutions. For instance, in November 2023, Thales announced the development of a new suite of cyber protection tools for unmanned aerial systems. These tools include advanced encryption, machine learning, data analytics, and secure communication protocols designed to enhance the security of drone operations against cyber threats.

Learn more about the key segments shaping this market

Based on application, the drone cybersecurity market is categorized into military & defense, agriculture, logistics & transportation, surveillance & monitoring, and others. In 2023, the military & defense segment accounted for a market share of over 35%. The growth is driven by factors such as the protection of sensitive data and the prevention of unauthorized access. Drones used in military operations collect and transmit a significant amount of sensitive and classified data. It is essential to ensure the cybersecurity of these drones to protect this information from being intercepted or accessed by unauthorized parties.

Furthermore, cybersecurity measures are needed to prevent unauthorized access to drones. Hackers could potentially take control of military drones, which could lead to disastrous consequences, including the use of drones against friendly forces or civilians. Moreover, secure communication channels between drones and their control systems are considered crucial in the current threat landscape. The rise in military contracts is boosting demand for advanced drone cybersecurity solutions, driving innovation, and enhancing security measures for defense applications worldwide. For instance, in October 2023, SkySafe announced its sixth straight military contract in Asia. This contract aimed to provide robust cybersecurity, secure communication channels, and protection of sensitive data.

Looking for region specific data?

In 2023, North America dominated the drone cybersecurity market with around 35% of the market share. The region has been at the forefront of drone adoption across various sectors, including commercial, government, and military applications. The early adoption has driven the need for robust cybersecurity solutions to protect these drone operations across the nations. In addition, North America is known for several leading cybersecurity companies that are actively developing and offering drone cybersecurity solutions. These companies leverage their expertise to cater to the growing demand in the region.

Furthermore, governments in countries such as U.S. and Canada have implemented stricter regulations on drone usage compared to other regions. These regulations often mandate the use of drone cybersecurity measures, creating an opportunistic market for such solutions. For instance, in March 2024, AUVSI firmly opposed a drone ban, advocating instead for the development and implementation of comprehensive cybersecurity standards across the drone industry.

Moreover, the European Aviation Safety Agency (EASA) has developed a comprehensive regulatory framework for drones, promoting safe and secure integration of drones into European airspace. The increased collaboration between public institutions and private companies drives innovation and development in drone cybersecurity. The growing adoption of drones across various industries, including agriculture, logistics, and infrastructure inspection, necessitates robust cybersecurity solutions to protect data and ensure safe operations in the region.

The Asia-Pacific region is witnessing a surge in drone adoption across sectors such as agriculture, defense, and logistics. This has led to a heightened emphasis on cybersecurity solutions to protect critical data and infrastructure. Governments and organizations are investing in advanced technologies and regulatory frameworks to ensure robust security measures and compliance, fostering innovation and growth in the industry.

Drone Cybersecurity Market Share

Thales Group, Fortem Technologies, and Airspace Systems hold a significant market share of 13%. Thales Group is enhancing its portfolio with advanced cybersecurity solutions, leveraging its expertise in defense and aerospace. The company focuses on integrating AI and machine learning for real-time threat detection and mitigation. Its strategic partnerships and continuous R&D investments position it as a leader in securing critical drone operations and protecting sensitive data.

Fortem Technologies and Airspace Systems are pioneering anti-drone technologies with innovative detection and mitigation systems. Fortem's radar-based solutions and AI-powered analytics offer robust protection against unauthorized drones. Airspace Systems emphasizes autonomous security solutions with rapid response capabilities. Both companies' strong emphasis on technological advancement and strategic collaborations enhances their competitive edge in safeguarding drone operations.

Drone Cybersecurity Market Companies

Major players operating in the drone cybersecurity industry are:

- Airspace Systems

- Dedrone

- DroneSec

- Fortem Technologies

- Mobilicom

- Thales Group

- WhiteFox Defense Technologies

Drone Cybersecurity Industry News

- In May 2024, Axon announced the acquisition of Dedrone, aiming to enhance public safety and accelerate the development of advanced drone security solutions.

- In May 2024, BAE Systems launched an advanced drone cybersecurity solution that integrates AI to enhance threat detection and response capabilities for critical infrastructure.

The drone cybersecurity market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue ($Bn) from 2018 to 2032, for the following segments:

Market, By Component

- Software

- Encryption

- Threat detection

- Secure communication

- Authentication

- Others

- Hardware

- Secure onboard computing

- Physical security measures

- Others

- Services

- Consulting and advisory

- Managed security

- Training and education

Market, By Drone Type

- Fixed wing

- Rotary wing

- Hybrid

Market, By Application

- Military & defense

- Agriculture

- Logistics & transportation

- Surveillance & monitoring

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Nordics

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Frequently Asked Question(FAQ) :

Who are the key leaders in the drone cybersecurity industry?

Airspace Systems, Dedrone, DroneSec, Fortem Technologies, Mobilicom, Thales Group, and WhiteFox Defense Technologies, are some of the major drone cybersecurity companies worldwide.

What is the size of the North America drone cybersecurity market?

North America industry held 35% share in 2023 and is expected to register a commendable CAGR from 2024-2032 due to the region being at the forefront of drone adoption across various sectors, including commercial, government, and military applications.

Why is the demand for drone cybersecurity software growing?

Drone cybersecurity industry from the software segment held over 44% share in 2023 and is expected to register an appreciable CAGR from 2024-2032 due to their role in protecting data and ensuring secure communication between drones and control systems.

How big is the drone cybersecurity market?

Market size for drone cybersecurity was USD 2.2 billion in 2023 and is expected to register over 19% CAGR from 2024-2032 owing to the growing adoption of drones in sectors such as agriculture, defense, and logistics, and the rising demand for robust cybersecurity measures worldwide.

Drone Cybersecurity Market Scope

Related Reports