Summary

Table of Content

Drone Analytics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Drone Analytics Market Size

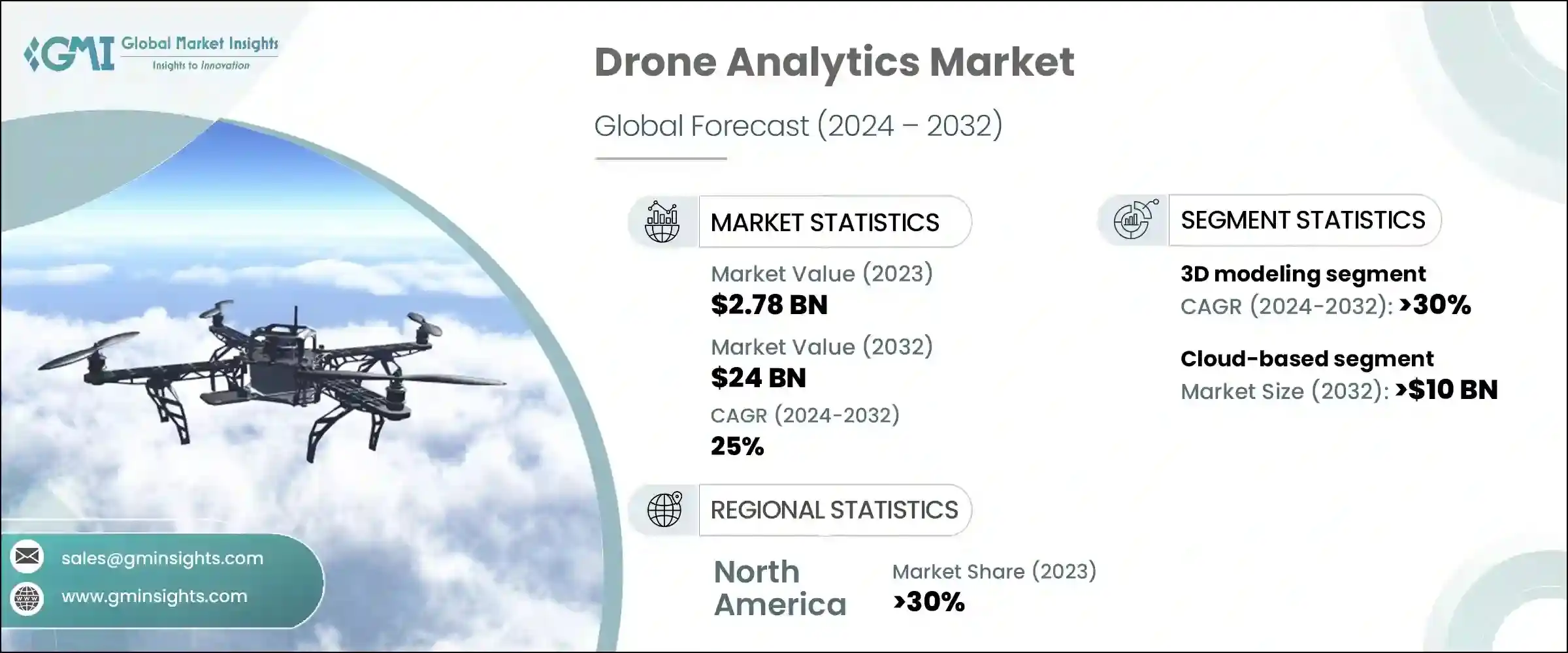

Drone Analytics Market was valued at USD 2.78 billion in 2023 and is anticipated to grow at a CAGR of over 25% between 2024 and 2032. The expansion of the market is driven by significant advancements in drone technology, specifically in sensor & imaging capabilities, which allow for more precise & comprehensive data gathering.

To get key market trends

For instance, in May 2024, ideaForge Technology Limited launched flight Cloud, a groundbreaking platform in drone data analytics. By simplifying workflows and maximizing efficiency through seamless integration with its drones, flight Cloud aims to revolutionize business utilization of aerial data, offering a streamlined & subscription-based solution that bypasses traditional complexities.

Drone Analytics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 2.78 Billion |

| Forecast Period 2024 – 2032 CAGR | 25% |

| Market Size in 2032 | USD 24 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Regulatory support and frameworks favoring commercial drone operations play a pivotal role in this industry. These regulations reduce legal barriers and promote broader adoption of drone analytics solutions across global markets. Additionally, the increasing demand for real-time data analysis in sectors such as emergency response and environmental monitoring further accelerates market growth. As industries seek efficient & cost-effective solutions for complex data challenges, the integration of Artificial Intelligence (AI) & Machine Learning (ML) algorithms with drone analytics emerges as a critical driver, enabling rapid decision-making and operational efficiencies.

Cost efficiency and operational benefits associated with drone data analytics are the key drivers of market growth. As compared to traditional methods, drones offer cost-effective & agile alternatives for data collection & analysis, especially in remote/hazardous environments. By providing actionable insights quickly & accurately, drone analytics solutions help businesses make informed decisions that optimize resources and improve productivity.

Security & privacy concerns loom large as drones increasingly handle sensitive data. Safeguarding against unauthorized access and data breaches remains critical, necessitating robust encryption protocols & adherence to stringent privacy regulations. Moreover, integrating drone data analytics into existing IT infrastructures can be complex, requiring compatibility with diverse systems and workflows. This integration challenge spans hardware, software, and data management protocols, often demanding tailored solutions to ensure seamless operation & optimal efficiency.

Technological limitations persist in drone capabilities, such as battery life constraints and payload capacities. These constraints can limit the operational range and efficiency of drones, impacting their effectiveness in long-duration missions/heavy payload tasks. Overcoming these challenges requires continuous innovations in drone hardware and software, alongside strategic investments in Research & Development (R&D) to address these technical barriers effectively. As the industry strives to enhance drone performance and operational reliability, overcoming these challenges will be crucial in unlocking the full potential of drone data analytics across various sectors.

Drone Analytics Market Trends

The drone analytics industry is witnessing several compelling trends that are reshaping its landscape. One prominent trend is the integration of artificial AI and ML algorithms into drone analytics platforms. These technologies enable drones to autonomously collect, process, and analyze vast amounts of data in real-time, enhancing their ability to deliver actionable insights swiftly & accurately. This trend not only improves operational efficiencies across industries, but also opens new possibilities for predictive analytics and proactive decision-making based on continuous data streams.

For instance, in May 2024, Chungnam Province in South Korea unveiled its AI-driven drone analysis system for enhanced social disaster management. By integrating advanced AI capabilities, the system aims to automatically assess fire origins, structural damages, and crowd management, marking significant advancements in disaster response capabilities within the region.

Drone Analytics Market Analysis

Learn more about the key segments shaping this market

Based on deployment mode, the market is divided into cloud-based and on-premises. The cloud-based segment is expected to reach a value over USD 10 billion by 2032.

- Cloud-based solutions allow organizations to scale their drone data analytics capabilities more easily. As the volume of data from drones increases, cloud platforms can quickly expand storage & processing capacities without the need for significant upfront investments in hardware.

- Cloud-based solutions often operate on a subscription/pay-as-you-go model, reducing initial capital expenditures. This pricing structure appeals to businesses seeking to manage costs effectively, while benefiting from advanced analytics capabilities.

- Cloud platforms enable real-time access to drone data and analytics from anywhere with internet connectivity. This accessibility fosters collaborations among geographically dispersed teams & stakeholders, enhancing decision-making speed and agility.

Learn more about the key segments shaping this market

Based on application, the drone analytics market is divided into geolocation tagging, aerial monitoring, thermal detection, ground exploration,3D modeling, and others. The 3D modeling segment is the fastest growing segment with a CAGR of over 30% between 2024 and 2032.

- 3D modeling using drone data has diverse applications across industries such as construction, architecture, urban planning, and infrastructure development. Drones equipped with high-resolution cameras and Light Detection and Ranging (LiDAR) sensors can capture detailed aerial imagery & topographical data, which is essential for creating accurate 3D models of landscapes, buildings, and structures.

- Drones enable precise data collection from multiple angles and elevations, allowing for the creation of highly accurate 3D models. These models provide detailed spatial information that is crucial for project planning, design validation, and resource management, leading to improved operational efficiencies & cost savings.

Looking for region specific data?

North America dominated the global drone analytics market in 2023, accounting for a share of over 30%. North America, particularly the U.S., is at the forefront of technological innovations in drone technology, sensors, and data analytics. The region benefits from a strong ecosystem of technology companies, research institutions, and government initiatives that drive advancements in drone capabilities & applications.

The drone data analytics market in China is experiencing rapid growth, driven by extensive government support and investments in drone technology. China's focus on technological innovation and its large-scale deployment of drones across various sectors such as agriculture, logistics, and surveillance contribute significantly to the market expansion. Government initiatives aimed at integrating drones into smart city projects and infrastructure development further bolster growth, supported by a robust ecosystem of technology companies & research institutions that advance drone capabilities.

In South Korea, the drone analytics market is growing steadily, propelled by advancements in drone technology and supportive regulatory frameworks. South Korea's emphasis on technology-driven industries and its proactive approach to integrating drones into public safety, agriculture, and environmental monitoring sectors drive market adoption. Government initiatives promoting R&D in drone technology foster innovations, while partnerships between industry players and academic institutions contribute to expanding applications & market opportunities.

Japan's market is expanding with a focus on precision agriculture, disaster response, and infrastructure inspection. The country's aging population & geographical challenges have spurred interest in drone technology for remote monitoring and data collection. Japan's regulatory environment supports safe drone operations, facilitating wide adoption in industries such as construction, utilities, and transportation. Investments in R&D to enhance drone capabilities and promote commercial applications underscore Japan's commitment to driving growth in the drone analytics sector.

Drone Analytics Market Share

Dà-Jing Innovations Science and Technology Co., Ltd., also known as DJI, and PrecisionHawk. hold a significant share in the drone analytics industry. DJI stands out as a global leader in drone technology, known for its extensive range of consumer and commercial drone solutions. The company's dominance stems from its robust lineup of drones equipped with advanced sensors & imaging technologies, tailored for diverse applications including aerial photography, videography, surveying, and mapping. PrecisionHawk's strength lies in its advanced analytics software, which utilizes AI and ML to extract actionable insights from drone-collected data. By offering comprehensive services from flight planning to data analysis, PrecisionHawk enables businesses to optimize operations, enhance decision-making, and achieve operational efficiencies.

Some other major players in the market are Skycatch, Sentera, Delair, SlantRange, Trimble Inc., Orbital Insight, and Skyward (a Verizon company).

Drone Analytics Market Companies

Major players operating in the drone analytics industry are:

- AgEagle Aerial Systems Inc.

- Airware

- DJI

- DroneDeploy

- Kespry

- PrecisionHawk

- senseFl

Drone Analytics Industry News

- In April 2024, Ohio Department of Transportation (ODOT) pioneered a state-level Unmanned Traffic Management (UTM) system, marking significant advancements in drone airspace management. Developed in collaboration with CAL Analytics, the system operates on a peer-to-peer model, enhancing safety by preventing conflicts in shared airspace and supporting various public & private sector applications.

- In October 2023, D-Fend Solutions launched EnforceAir Version 23.08, a significant upgrade to its EnforceAir software. This update enhances D-Fend's RF-based counter-drone technology with improved cyber detection & mitigation capabilities, advanced data analytics, and a streamlined user experience. By continually updating its system, D-Fend aims to provide comprehensive coverage against the evolving drone threats, positioning itself at the forefront of the dynamic drone security market with state-of-the-art capabilities.

The drone analytics market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD million) from 2021 to 2032, for the following segments:

Market, By Deployment Mode

- Cloud-based

- On-premises

Market, By Application

- Geolocation tagging

- Aerial monitoring

- Thermal detection

- Ground exploration

- 3D modeling

- Others

Market, By End Use

- Agriculture

- Construction

- Mining and quarrying

- Insurance

- Utility

- Telecommunication

- Oil & gas

- Defense & security

- Healthcare

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Frequently Asked Question(FAQ) :

Who are the major drone analytics industry players?

AgEagle Aerial Systems Inc., Airware, DJI, DroneDeploy, Kespry, PrecisionHawk, and senseFly

What is the size of the North America drone analytics market?

North America industry recorded over 30% share in 2023 led by the strong ecosystem of technology companies, research institutions, and government initiatives that drive advancements in drone capabilities & applications.

How big is the drone analytics market?

The industry size for drone analytics was valued at USD 2.78 billion in 2023 and is anticipated to grow at over 25% CAGR between 2024 and 2032 driven by significant advancements in drone technology, specifically in sensor & imaging capabilities for more precise & comprehensive data gathering.

Why is the demand for cloud-based drone analytics growing?

The cloud-based deployment mode segment in the drone analytics industry is expected to exceed USD 10 billion by 2032 as they allow organizations to scale their drone data analytics capabilities more easily

Drone Analytics Market Scope

Related Reports