Summary

Table of Content

Domestic Booster Pump Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Domestic Booster Pump Market Size

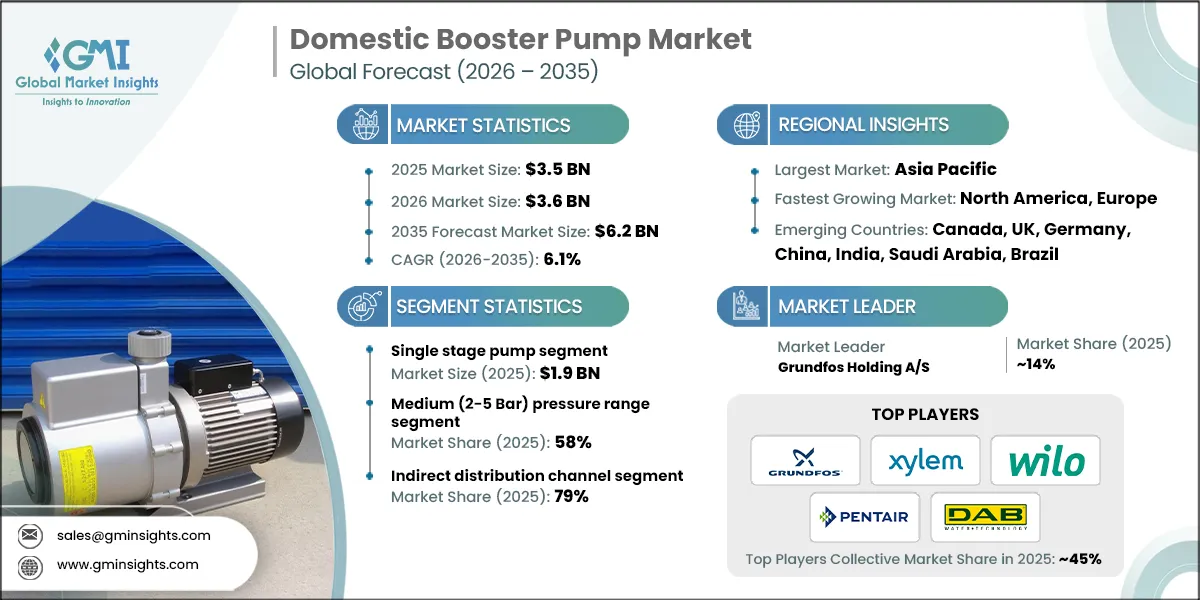

The global domestic booster pump market was estimated at USD 3.5 billion in 2025. The market is expected to grow from USD 3.6 billion in 2026 to USD 6.2 billion in 2035, at a CAGR of 6.1%, according to latest report published by Global Market Insights Inc.

To get key market trends

- As cities around the world - whether developed or undeveloped - are experiencing increasing densities (growing populations) and rapid urbanization, the domestic booster pump market is also seeing significant growth. The increasing number of multi-story apartments, gated communities, and tall high-rise residential buildings is significantly threatening the capacity of municipal water systems.

- This has created an increase in the installation of domestic booster pumps in building projects to maintain consistent water pressure throughout all floors or outlets of buildings. According to the UN, 56.2% of the global population lived in urban areas in 2020 and the projection is that by 2050, that will increase to 68%. Urbanization, combined with large-scale housing programs and urban redevelopment programs, will all contribute to the continued demand for booster pumps in newly constructed and/or renovated homes.

- Declining municipal pressure, because of an aging water supply system, is another contributing factor to the growth of the market. Many municipalities have experienced decreased pipeline efficiency due to aging distribution systems, which causes a significant amount of leakage and long-distance water transport and creates uneven supply throughout peak usage times. Many municipalities have therefore created a low-pressure environment in many residences, especially those located on upper floors.

- The American Society of Civil Engineers (ASCE) reported in the 2021 report titled "Infrastructure Report Card," that an estimated six billion gallons of treated water is lost every day in the United States due to pipeline leaks. Homeowners have begun to install domestic booster pumps as a less expensive option to permanently fix this problem, rather than relying completely on upgrades to municipal infrastructure. The trend is visible in both established and developing markets.

- The trend for new home design and construction is indicative of increasing reliance on water pressure enhancement devices. Newer homes are being built and designed to meet the needs of multiple people living together, with many homes today having several bathrooms. Many modern bathrooms have additional water appliances installed in them today than ever before: showers, washing machines and dishwashers; all of which will at times be used simultaneously. Homeowners expect consistent delivery of medium pressure water to all of their bathroom fixtures, thereby making domestic booster pumps necessary for all of the homes they build. The increased anticipation of constant water to every faucet is progressing domestic booster pumps from being optional upgrades to a 'must-have' system in residential homes.

- The advancement of smart home technologies is also providing new avenues for revenue growth in the domestic booster pump industry. With more people adopting smart home technologies, there is an increasing expectation for domestic booster pumps to be designed with enhanced capabilities, including sensor-based, variable speed drives and IoT (Internet of Things) based controls. By enabling users to monitor in real-time the amount of water they consume, as well as how efficiently they are using their electricity, the smart home technology can help consumers save money on utility bills.

- The International Energy Agency (IEA) expects that smart home technologies will contribute to a decrease in global energy consumption of approx. 10% by 2040. When considering modern domestic booster pumps in a larger scheme of smart home technology and building control systems, these pumps will be significant contributors to the energy efficiency of residential homes.

Domestic Booster Pump Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 3.5 Billion |

| Market Size in 2026 | USD 3.6 Billion |

| Forecast Period 2026-2035 CAGR | 6.1% |

| Market Size in 2035 | USD 6.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rapid urbanization and residential construction | These drives sustained demand for domestic booster pumps as high rise apartments and dense housing developments require consistent water pressure across multiple floors, increasing installations in new builds. |

| Inadequate municipal water pressure and aging water supply infrastructure | Pressure losses from old or overburdened water networks elevate reliance on domestic booster pumps as a practical household solution, supporting steady replacement and retrofit demand. |

| Growth in multi-bathroom and modern housing designs | Rising use of simultaneous water outlets increases pressure requirements, pushing booster pumps from optional upgrades to essential components of modern residential plumbing systems. |

| Expansion of smart homes and building automation | This accelerates adoption of intelligent and variable speed booster pumps, enhancing market value through higher margin smart and energy efficient product offerings. |

| Pitfalls & Challenges | Impact |

| High initial installation and replacement costs | Upfront equipment and installation expenses can limit adoption in price sensitive markets, slowing penetration among low income households and older residential buildings. |

| Maintenance requirements and after-sales dependence | Ongoing servicing needs and reliance on skilled technicians can reduce user confidence in some regions, impacting long term ownership perception and adoption rates. |

| Opportunities: | Impact |

| Retrofitting of aging residential infrastructure | Modernization of old homes and apartment complexes creates strong demand for compact, energy efficient booster pumps designed for easy replacement and system upgrades. |

| Rising adoption of energy‑efficient and smart pumps | This shifts market growth toward premium segments, increasing revenue per unit while aligning domestic booster pumps with sustainability and smart living trends. |

| Market Leaders (2025) | |

| Market Leader |

Market share of ~14% |

| Top Players |

Collective market share of ~45% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America, Europe |

| Emerging countries | Canada, UK, Germany, China, India, Saudi Arabia, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Domestic Booster Pump Market Trends

- In the domestic booster pump market, one of the biggest trends currently being experienced is the uptake of Energy Efficient Variable Speed Pumps. This is being driven by a growing awareness of how much energy is consumed, and how much it costs to run a household daily overall. By newer advanced motor technology, such as permanent magnet motors and variable frequency drives (VFD), variable speed pumps automatically adjust their performance in response to changes in water demand as they occur in real-time.

- This feature allows for decreased mechanical wear and tear on the motors, reduced energy consumption, reduced noise and vibration levels, and the minimization of pressure fluctuations. As energy saving government regulations continue to become clearer and green building codes become more commonplace, homeowners and developers alike will continue to take advantage of booster pump appliances that both optimize pressure while delivering ongoing savings in electricity through energy efficient options for long-term, responsible use of energy resources.

- Manufacturers are designing compact, efficient systems for both new installations and replacement applications. New energy-efficient booster pump designs feature improved hydraulic efficiencies, innovative pressure control systems, and reduced standby power usage. These pumps are especially well-suited to new urban apartment and modern home construction, as space limitations and low noise levels tend to be important factors for these types of installations. With rising electricity prices in many countries, there is a significant market opportunity associated with increased adoption of energy-efficient pumps that benefit the end-user with a reduced total cost of ownership.

- Additionally, the evolution of Smart and IoT enabled domestic booster pump systems is being influenced by the rapid emergence of smart homes and connected homes, as more households install smart home devices, connects their devices into a complete, integrated building automation system. The smart booster pump is a device that provides a built-in monitoring feature and sends alerts to the homeowner via their mobile device or home automation system.

- This provides ease of use, reduces maintenance requirements, increases the trusted performance of the pump and provides the homeowner with peace of mind. With homeowners now seeking to improve the convenience of their homes using smart and automated devices that connect seamlessly with the overall total building management system, smart booster pumps are proving to be a very important growth opportunity for the domestic booster pump sector.

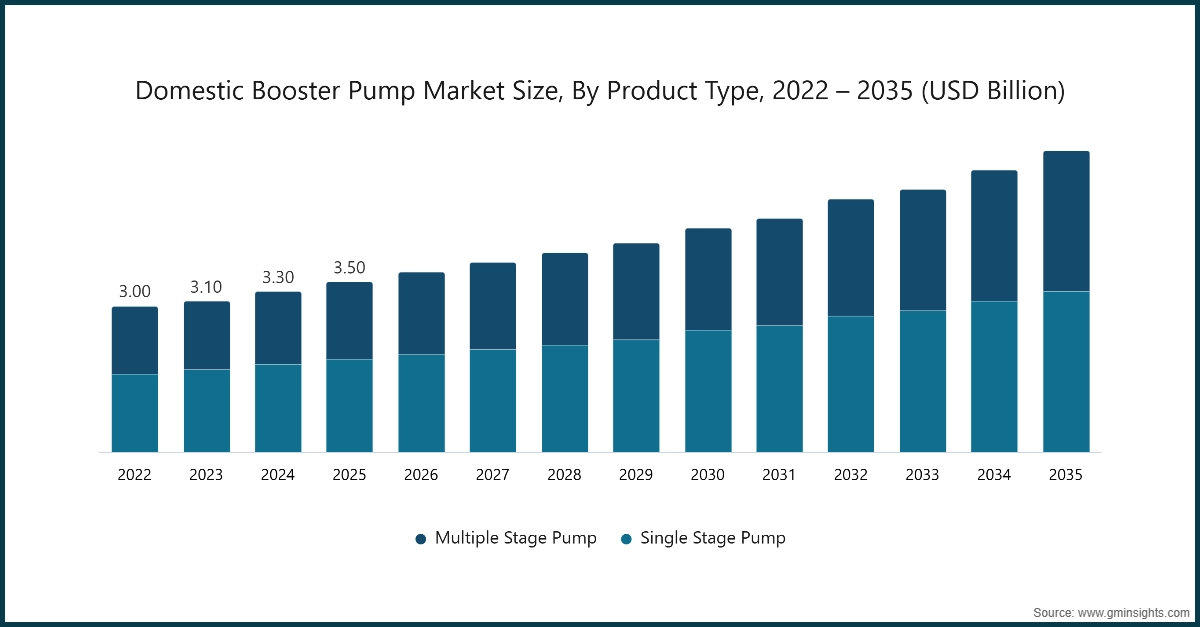

Domestic Booster Pump Market Analysis

Learn more about the key segments shaping this market

Based on product type, the domestic booster pump market is categorized into single stage pump and multiple stage pump. The single stage pump accounted for revenue of around USD 1.9 billion in 2025 and is anticipated to grow at a CAGR of 6% from 2026 to 2035.

- The growth is primarily attributed to their cost-effectiveness, simple design, ease of installation, and suitability for low to medium-pressure residential applications, which account for most of the household water-pressure requirements. Single-stage booster pumps are widely preferred in single-family homes, low-rise buildings, villas, and small apartment blocks, where the required head and flow rates can be efficiently achieved with a single impeller configuration.

- Compared to multi-stage pumps, single-stage pumps offer lower upfront costs, reduced maintenance complexity, and easier servicing, making them particularly attractive for price sensitive residential consumers and retrofit applications. Their compact size and straightforward operation also enable easy integration into existing plumbing systems without extensive modifications.

Based on pressure range of domestic booster pump market consists of low (Up to 2 Bar), medium (2-5 Bar) and high (Above 5 Bar). The medium (2-5 Bar) pressure range emerged as leader and held 58% of the total market share in 2025 and is anticipated to grow at a CAGR of 6% from 2026 to 2035.

- Medium-pressure booster pumps effectively serve multi-bathroom homes, low to mid-rise apartment buildings, and modern residential complexes, providing sufficient pressure to ensure consistent water flow across multiple outlets such as showers, faucets, washing machines, and dishwashers without the excessive energy consumption associated with high-pressure systems. As urban housing increasingly shifts toward multi-storey living and compact residential layouts, especially in developing and urbanizing regions, the 2–5 bar range meets typical regulatory and plumbing code requirements while avoiding risks such as pipe stress, leakage, or increased maintenance costs.

Additionally, medium-pressure pumps are highly compatible with variable speed drives and smart pressure control technologies, enabling homeowners to optimize energy usage while maintaining comfort. From a cost perspective, they offer a favorable trade-off between initial investment and long-term operating efficiency, making them attractive for both new installations and retrofit projects.

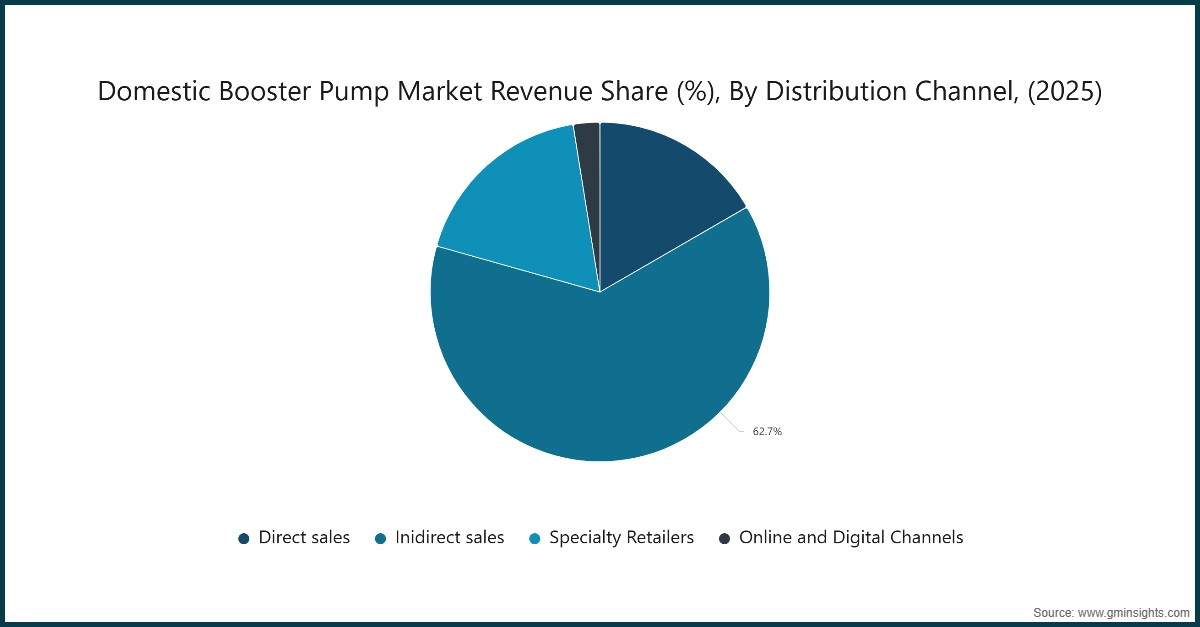

Learn more about the key segments shaping this market

Based on distribution channel of domestic booster pump market consists of direct and indirect. The indirect distribution channel emerged as leader and held 79% of the total market share in 2025 and is anticipated to grow at a CAGR of 5.9% from 2026 to 2035.

- Indirect channels including authorized distributors, wholesalers, hardware retailers, building material suppliers, and e-commerce platforms enable manufacturers to penetrate both urban and semi-urban residential markets more efficiently than direct sales models. Domestic booster pumps are typically purchased as part of new home construction, renovation, or emergency replacement, where plumbers, contractors, and system integrators play a critical role in product selection; these professionals overwhelmingly source products through trusted indirect suppliers.

- Additionally, indirect channels offer valued services such as installation support, after-sales service coordination, spare parts availability, and localized technical guidance, which are essential for residential consumers with limited technical knowledge. Competitive pricing, product bundling, flexible financing through retailers, and immediate product availability further strengthen the appeal of indirect channels.

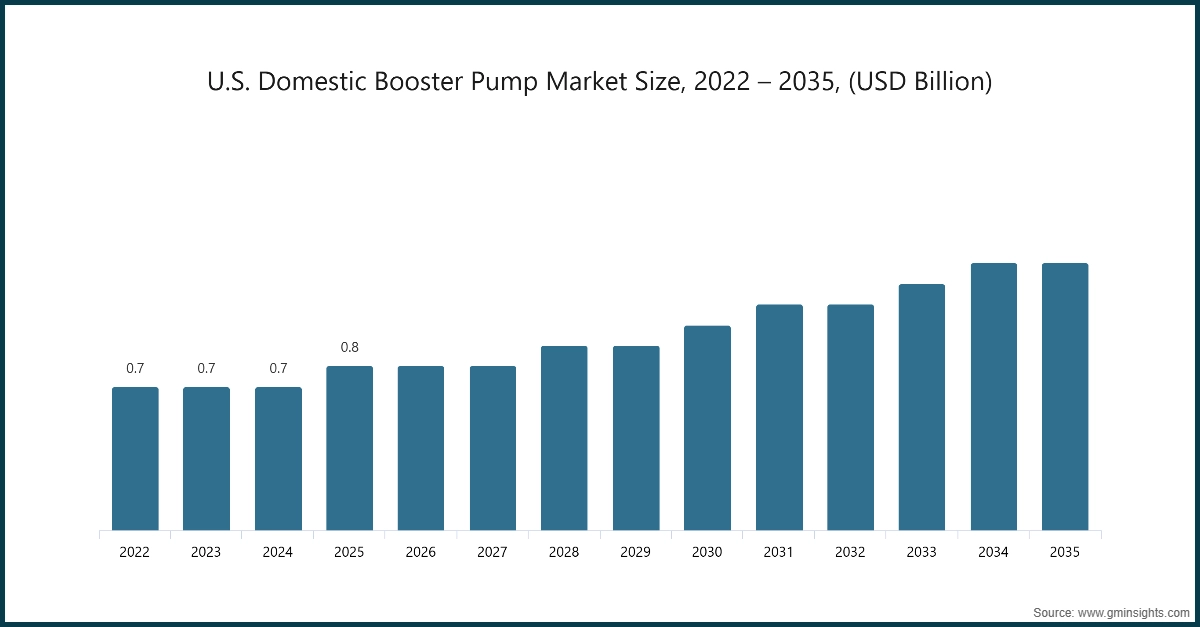

North America Domestic Booster Pump Market

Looking for region specific data?

The U.S. dominates an overall North America domestic booster pump market and valued at USD 0.8 billion in 2025 and is estimated to grow at a CAGR of 5.9% from 2026 to 2035.

- A large proportion of U.S. housing stock particularly multi-story residential buildings, high-rise apartments, and large single-family homes requires booster pumps to maintain adequate water pressure, especially in regions facing pressure loss due to aging municipal water infrastructure or long-distance water transmission.

- Additionally, the U.S. continues to invest heavily in new housing developments, smart buildings, and retrofitting projects, where energy-efficient booster pump systems with variable frequency drives (VFDs) are increasingly preferred to meet sustainability and cost-efficiency goals. Regulatory frameworks promoting water conservation, energy efficiency, and building code compliance, coupled with widespread consumer awareness of water pressure solutions, further encourage adoption.

Europe Domestic Booster Pump Market

In the European market, Germany is expected to experience significant and promising growth from 2026 to 2035.

- The country’s ongoing Energiewende and building modernization initiatives are accelerating the adoption of high-efficiency booster pumps equipped with variable speed drives, as homeowners and housing associations prioritize reduced energy consumption and lower operating costs.

- Additionally, Germany’s strict plumbing codes, water efficiency standards (such as DIN and EU Ecodesign directives), and sustainability mandates encourage the use of advanced pressure management solutions in new residential developments as well as refurbishment projects.

Asia Pacific Domestic Booster Pump Market

In the Asia Pacific market, the China held 32.6% market share in 2025 and is anticipated to grow at a CAGR of 6.4% from 2026 to 2035.

- The country has witnessed sustained growth in high-rise apartment buildings, urban residential complexes, and affordable housing projects, particularly in tier-1 and tier-2 cities, where domestic booster pumps are essential to maintain adequate water pressure across multiple floors.

- In addition, China’s aging municipal water supply networks in many urban and semi-urban areas often result in fluctuating or insufficient water pressure, increasing household reliance on booster pump systems. Government initiatives focused on urban redevelopment, smart city development, and infrastructure modernization further stimulate demand for efficient and compact domestic booster pumps.

Middle East and Africa Domestic Booster Pump Market

In the Middle East and Africa market, Saudi Arabia held 12.4% market share in 2025 promising growth from 2026 to 2035.

- The country’s arid climate and heavy reliance on desalinated and long-distance water transmission systems often result in pressure fluctuations at the point of use, making domestic booster pumps essential for maintaining consistent water flow in villas, apartment buildings, and gated communities. Ongoing housing and urban expansion programs under Vision 2030, including mega-projects, affordable housing initiatives, and new residential cities, are driving steady installation of booster pump systems in both new constructions and retrofitting projects.

- In addition, the proliferation of high-rise residential buildings and vertically expanding urban centers particularly in Riyadh, Jeddah, and the Eastern Province necessitates reliable pressure boosting solutions to ensure adequate water supply across multiple floors. Saudi Arabia’s relatively high household income levels, growing preference for modern home infrastructure, and increasing awareness of water efficiency further support demand.

Domestic Booster Pump Market Share

In 2025, the prominent manufacturers in the market are Grundfos Holding A/S, Xylem Inc., Wilo SE, Pentair plc and DAB Pumps S.p.A. collectively held the market share of ~45%. Grundfos positions its domestic booster pumps as intelligent, integrated water systems, moving beyond the perception of standalone mechanical products. The company emphasizes energy-efficient designs, variable-speed operations, and smart electronic controls directly integrated into compact booster units. Grundfos's innovation strategy prioritizes ease of installation, low noise, system protection, and digital connectivity, empowering both installers and homeowners to easily configure, monitor, and maintain their pumps.

With a focus on sustainability, extended product lifecycles, and ongoing digital upgrades, Grundfos not only defends its premium market position but also aligns with the tightening global standards for energy and water efficiency. Xylem leverages its Lowara brand to highlight features like robust stainless-steel construction, consistent pressure performance, and modular packaged booster systems tailored for residential use. The company's innovations merge pumps with electronic control devices and variable-speed drives, which adjust automatically to changing household demands.

Xylem's offerings stand out with their quiet operation, compact designs, and reliability, making them ideal for apartments and multi-family residences. With strong regional manufacturing and a broad distribution network, Xylem efficiently scales its operations while ensuring consistent product quality, all while being integrated into its broader smart water portfolio.

Domestic Booster Pump Market Companies

Major players operating in the domestic booster pump industry include:

- C.R.I. Pumps Private Limited

- DAB Pumps S.p.A.

- Danfoss A/S

- Davey Water Products Pty Ltd.

- Ebara Corporation

- Franklin Electric Co., Inc.

- Grundfos Holding A/S

- Kirloskar Brothers Limited

- KSB SE & Co. KGaA

- Pedrollo S.p.A.

- Pentair plc

- Shimge Pump Industry Group Co., Ltd.

- Wilo SE

- Xylem Inc.

- Zhejiang Dayuan Pumps Industrial Co., Ltd.

Wilo distinguishes itself in the domestic booster pump arena through its emphasis on advanced electronics, system intelligence, and digital transparency. The company champions high-efficiency motors, intelligent booster systems, and real-time diagnostics that bolster reliability and lessen operational stress. Wilo's innovation strategy underscores user-friendly interfaces, remote monitoring capabilities, and seamless compatibility with contemporary building management systems. By branding its products as highly engineered and future-ready, Wilo carves a niche in premium residential and mixed-use applications, where consistent performance and operational control are paramount.

Pentair carves its niche by offering integrated domestic booster systems that seamlessly merge pumping, pressure control, and electronics into user-friendly units. The company champions true variable-speed operations, ensuring stable pressure delivery and an easy setup, appealing to both installers and homeowners. Its innovation emphasizes intuitive interfaces, intelligent pump responses, durability, and noise reduction. Pentair's unique advantage lies in its ability to integrate booster pumps within its broader residential water management ecosystem, ensuring seamless collaboration with filtration, treatment, and automation products.

Domestic Booster Pump Industry News

- In May 2025, Grundfos announced a significant expansion of its Brookshire, Texas plant. The project aims to enhance production capacity, with the first residential product lines expected to commence operations in the fourth quarter of 2027. The company is focusing on doubling its business operations in the United States by the year 2030.

- In April 2025, Ebara Corporation introduced a new booster series designed for compact residential spaces. This innovative product is tailored to meet the needs of modern housing environments with limited space availability.

- In March 2025, the Saudi Water Partnership Company awarded a major pipeline project to a local consortium. The project, valued at over two billion dollars, will increase water supply capacity by adding six hundred and fifty thousand cubic meters per day to support the development of new housing zones.

- In February 2025, Franklin Electric reported substantial revenue from its water systems business for the year 2024. The company outlined its strategic focus for 2025, emphasizing the development and expansion of residential water solutions.

The domestic booster pump market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Billion) and volume (Million Units) from 2022 to 2035, for the following segments:

Market, By Product Type

- Single stage pump

- Multiple stage pump

Market, By Rated Power

- 10 - 50 W

- 50 - 150 W

- 150 - 300 W

- Above 300 W

Market, By Pressure Range

- Low (Up to 2 Bar)

- Medium (2-5 Bar)

- High (Above 5 Bar)

Market, By End Use

- Residential

- Commercial

- Healthcare

- HoReCa

- Service centres

- Mega retail space

- Industrial

- Others (Government, etc.)

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Which region leads the domestic booster pump market?

The U.S. leads the North American market, valued at USD 0.8 billion in 2025, with a projected CAGR of 5.9% from 2026 to 2035.

What are the upcoming trends in the domestic booster pump industry?

Key trends include the adoption of energy-efficient variable speed pumps, advancements in motor technologies, compact system designs for urban spaces, and increasing focus on reducing energy consumption and total cost of ownership.

Who are the key players in the domestic booster pump market?

Key players include C.R.I. Pumps Private Limited, DAB Pumps S.p.A., Danfoss A/S, Davey Water Products Pty Ltd., Ebara Corporation, Franklin Electric Co., Inc., Grundfos Holding A/S, Kirloskar Brothers Limited, and KSB SE & Co. KGaA.

What is the projected size of the domestic booster pump market in 2026?

The market is expected to reach USD 3.6 billion in 2026.

How much revenue did the single stage pump segment generate?

The single stage pump segment generated USD 1.9 billion in 2025 and is anticipated to grow at a CAGR of 6% from 2026 to 2035.

What was the market share of the medium pressure range segment?

The medium (2-5 Bar) pressure range segment held 58% of the total market share in 2025 and is projected to grow at a CAGR of 6% from 2026 to 2035.

Which distribution channel leads the domestic booster pump market?

The indirect distribution channel dominated the market with a 79% share in 2025 and is expected to grow at a CAGR of 5.9% from 2026 to 2035.

What is the projected value of the domestic booster pump market by 2035?

The market is expected to reach USD 6.2 billion by 2035, fueled by rising electricity prices, green building codes, and demand for compact, efficient systems.

What is the market size of the domestic booster pump market in 2025?

The market size was USD 3.5 billion in 2025, with a CAGR of 6.1% expected through 2035, driven by increasing adoption of energy-efficient pumps and advancements in motor technologies.

Domestic Booster Pump Market Scope

Related Reports