Summary

Table of Content

Dolomite Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Dolomite Market Size

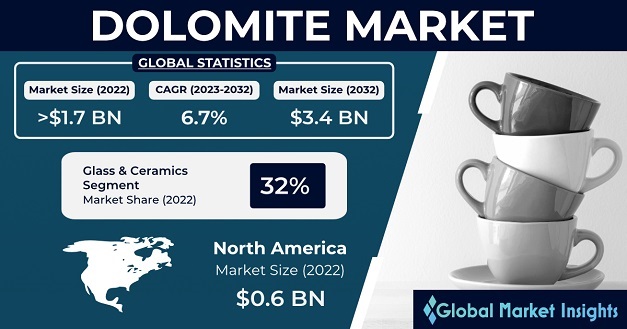

Dolomite Market size was worth over USD 1.7 billion in 2022 and is poised to grow significantly at 6.7% CAGR from 2023 to 2032 driven by the increasing steel production globally.

To get key market trends

Dolomite is a critical fluxing agent used in steelmaking that helps remove impurities and enhances the quality of steel. The surging demand for steel across various industries, such as construction, automotive, and manufacturing is driving the need for dolomite to cater to the rising flux demand. The rapid industrialization and infrastructure development in several emerging economies has further bolstered steel production, driving the need for dolomite. For instance, the World Steel Association reported that the world's crude steel production reached 1.87 billion tons in 2022.

Dolomite Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2022 |

| Market Size in 2022 | USD 1.75 Billion |

| Forecast Period 2023 to 2032 CAGR | 6.7% |

| Market Size in 2032 | USD 3.4 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Dolomite Market Growth Drivers and Restraints

Dolomite industry is poised to record substantial growth attributed to increasing application in concrete and asphalt production as construction aggregates. The increase in cement manufacturing driven by the rising infrastructure projects and urbanization is driving the demand for dolomite in the construction industry. However, competition arising from the use of alternate products, such as limestone and magnesite, for offering similar properties and applications, can negatively impact the market growth.

COVID-19 Impact

The COVID-19 pandemic had neutral impact on the product demand. During the initial stages, the market experienced production and supply chain disruptions due to lockdowns and restrictions. Reduced construction activities and industrial shutdowns also affected the adoption of dolomite in various sectors. However, with several government-initiated stimulus packages and infrastructure projects helping to revive the economies, the usage of dolomite in the construction and steel industries has rebounded. The higher focus on sustainable agriculture and food security during the pandemic also influenced the need for dolomite in the agriculture sector.

Dolomite Market Trends

The increasing focus on sustainable agriculture practices will anchor the demand for dolomite as a vital component in agricultural applications. The rising awareness of soil conditioners to neutralize acidic soils in order to provide essential nutrients, such as calcium and magnesium to crops has spurred higher product adoption across major agricultural countries, including India, China, and Brazil, among others. The intensifying focus on sustainable agricultural practices and increasing crop yields among farmers and agricultural industries worldwide will also contribute to considerable market growth.

Dolomite Market Analysis

Learn more about the key segments shaping this market

Calcined dolomite market gained notable traction in 2022 and is anticipated to grow considerably between 2023 and 2032. Calcined dolomite is produced by heating dolomite to a high temperature, resulting in the release of carbon dioxide and transforming the mineral into a more reactive and pure form of magnesium oxide and calcium oxide. This processed dolomite finds extensive applications in steelmaking to remove impurities and improve the quality of steel. In the automotive sector, the consumption of steel products during 2021-2022 grew by 3.3%. To that end, the growing demand for steel in various industries, including construction and automotive will fuel the segment expansion.

Learn more about the key segments shaping this market

The glass and ceramics segment held around 32% revenue share of the dolomite market and is set to witness substantial growth through 2032. This can be attributed to the rising adoption of dolomite as a crucial raw material in glass and ceramics manufacturing due to its unique properties, such as high magnesium and calcium content to offer improved product quality and durability. According to the Glass Packaging Institute of America, the domestic glass container sector sold 16.2 billion bottles and jars to several brands and comparable end markets through the third quarter in 2022. The increasing demand for glassware, ceramics, and other related products will thereby propel the segment growth.

Looking for region specific data?

North America held sizable share of the global dolomite market, accounting for USD 0.6 billion in 2022 and is set to record considerable growth between 2023 and 2032. The presence of robust construction industry in the region is driving the demand for dolomite in road construction, concrete, and asphalt production. The increasing steel production and the emphasis on sustainable agricultural practices in North America have boosted the demand for dolomite. Furthermore, the presence of key players along with continuous technological advancements in dolomite extraction and processing will contribute to regional market expansion.

Dolomite Market Share

The competitive landscape of the dolomite market includes top companies, such as:

- Carmeuse

- JFE Mineral & Alloy Company, Ltd.

- Calcinor

- Arij Global Trading

- Dillon

- Imerys

- Lhoist

- Omya AG

- Rawedge

- Nordkalk Corporation

- Beihei Group,

- Sibelco.

Dolomite Industry News

- In 2022, RHI Magnesita inaugurated the Dolomite Hub in Austria, after two years of development with an investment of more than USD 50.6 million. The new dolomite center boosts plant productivity while making substantial contribution to environmental preservation.

- In March 2023, Refractarios Kelsen S.A., (Calcinor), a well-known manufacturer of dolomite bricks and mixes, established a new fired brick facility with a footprint of over 6,000 m2 for business expansion in Aduna.

Dolomite market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD Billion & Units from 2018 to 2032, for the following segments:

By material type

- Calcined Dolomite

- Agglomerated Dolomite

- Sintered Dolomite

By End use

- Agrochemicals

- Pharma & Healthcare

- Glass & Ceramics

- Animal Feed

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

Frequently Asked Question(FAQ) :

Which are the major dolomite business players?

Carmeuse, JFE Mineral & Alloy Company, Ltd., Calcinor, Arij Global Trading, Dillon, Imerys, Lhoist, Omya AG, Rawedge, Nordkalk Corporation, Beihei Group, and Sibelco are among the top companies operating in the global dolomite market.

How big is the North America dolomite market?

North America dolomite industry accounted for USD 0.6 billion in 2022 and is set to witness considerable growth from 2023-2032 owing to the presence of robust construction industry and the higher emphasis on sustainable agricultural practices.

What is the dolomite market worth?

Market size for dolomite was valued at over USD 1.7 billion in 2022 and is estimated to witness significant growth at 6.7% CAGR from 2023 to 2032 owing to increasing usage in steel production.

Why is the demand for calcined dolomite gaining traction?

Calcined dolomite industry gained notable traction in 2022 and is anticipated to grow considerably through 2032 attributed to its extensive application in steelmaking to remove impurities and improve the quality of steel.

Dolomite Market Scope

Related Reports